Keep The Right Mix Of Credit

It is important that you keep the right mix of cards, and other credit instruments. A small percentage of your score is calculated by what mix of different kinds of credit you keep. If you are serious about your credit score, it is good to keep a mix of revolving accounts, mortgage, and installment debt, if possible. Its also important that you do not become imbalanced with the kind of credit you are opening/usingfor instance, using too many credit cardsbecause it may hurt your score. Find that delicate balance, try to use only one or two cards with high balances on a regular basis. A strong mix of credit use improves your score.

New Electronic Alerts From Your Bank

Some banks have started sending new electronic alerts to help you manage your day-to-day finances and avoid unnecessary fees.

Your payment history is the most important factor for your credit score.

To improve your payment history:

- always make your payments on time

- make at least the minimum payment if you cant pay the full amount that you owe

- contact the lender right away if you think you’ll have trouble paying a bill

- don’t skip a payment even if a bill is in dispute

Build Your Credit Score As You Save Money

Build your credit score as you save money

©2022 LOQBOX Technology UK Limited Registered in England and Wales, Company Registration number: 07916178.

LOQBOX Technology UK Limited is authorised and regulated by the Financial Conduct Authority, FRN 694919. Registered address: Henleaze Business Centre, Henleaze, Bristol BS9 4PN.

LOQBOX Technology UK Limited is registered with the Information Commissioners Office, registration number Z3176777.

LOQBOX is a trademark of nooli UK Limited and used under license by LOQBOX Technology UK Limited.

LOQBOX Technology UK Limited is a credit broker not a lender, working with selected lenders. LOQBOX credit products are provided by LOQBOX Finance which is the trading name of DDC Financial Solutions Limited. Loans are provided with 0% APR . Lines of credit are provided with 0% APR . You must be 18 years or older to use LOQBOX. Terms and conditions apply.

LOQBOX products provided before 1st April 2021 were provided by LOQBOX Savings Limited, with Company registration number 10583182 and registered address at Henleaze Business Centre, Henleaze, Bristol BS9 4PN. LOQBOX Savings Limited is registered with the Information Commissioners Office, registration number ZA229901. Funds are held for customers of LOQBOX Savings Limited by LOQBOX Trustee UK Limited and LOQBOX Technology UK Limited who manage redemptions.

Also Check: Does Pay For Delete Increase Credit Score

Does Paying Off Collections Boost My Credit Score

Historically, paying off your collections does not improve your credit score because a collection stays on your report for seven years. Newer ways of calculating credit scores no longer count collections against you once they have a zero balance, but it is not possible for you to predict which method your lender will use to calculate your score.

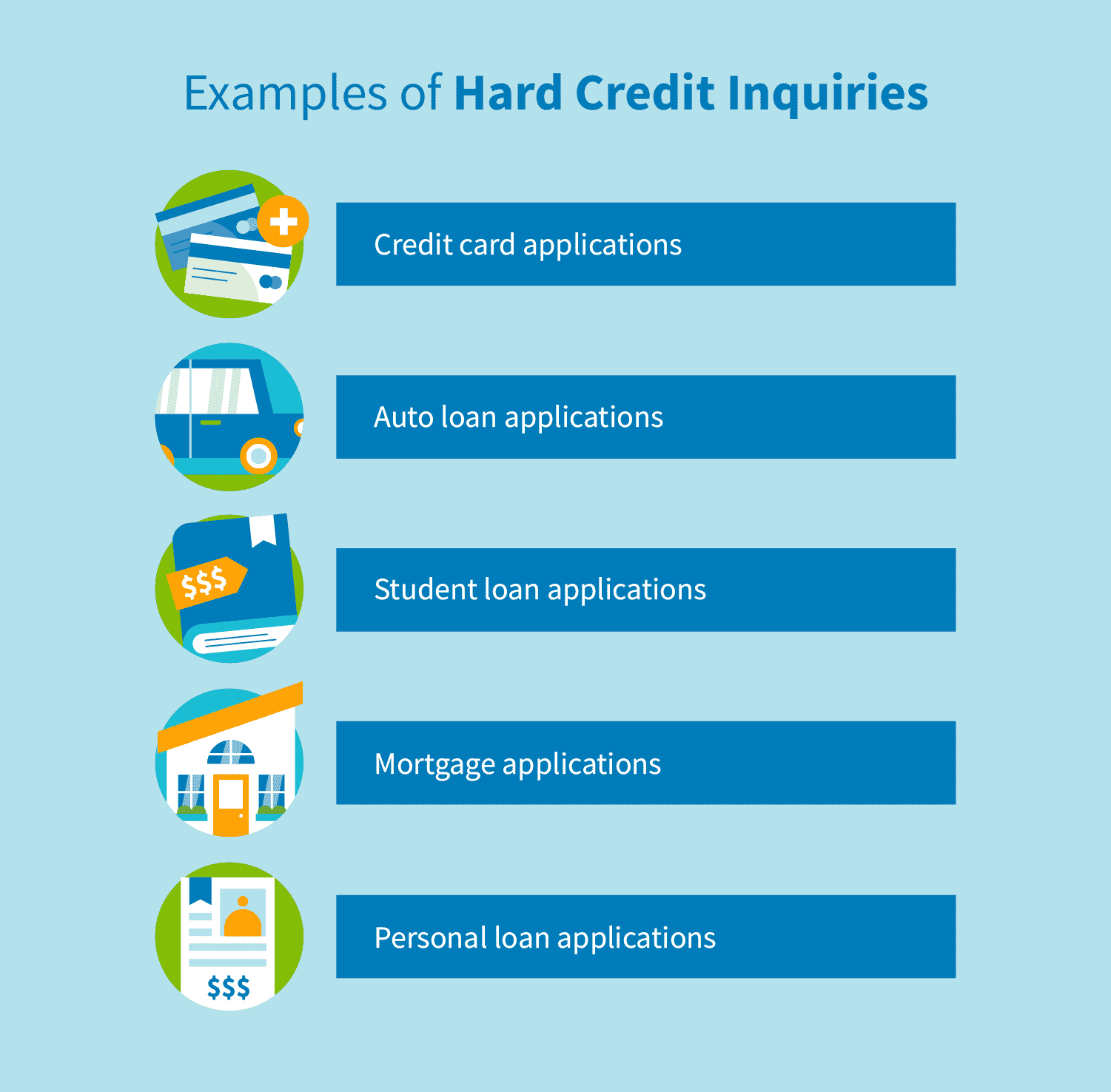

The Difference Between Hard And Soft Credit Inquiries

Its important to understand the difference between a hard credit inquiry, which occurs when you apply for a mortgage or other loans or lines of credit, and a soft credit inquiry.

A hard credit inquiry is when a lender or potential landlord pulls your credit reports and checks your credit score with your permission. Hard credit pulls take place when you apply for a credit card, personal loan, vehicle loan or lease or a mortgage. Landlords may also do a hard credit inquiry.

In most cases, a hard credit inquiry usually reduces your credit score by less than five points. But according to FICO, if you have a short credit history or few accounts it could hurt more. Although inquiries stay on your credit report for up to two years, they only affect your credit score for 12 months.

Of the five factors that make up your credit score, hard credit inquiries make up about 10 percent of your credit score and are calculated as part of the new credit portion of your score.

You May Like: How To Remove Disputes From Credit Report

How Your Credit Score Can Affect Your Loan

If you have a good credit score, you could qualify easily for a personal loan and that too with a lower interest rate. This is because you are seen as a creditworthy borrower who poses a lower risk. Your credit history is evaluated while making a lending decision, and if your payment behavior is consistent with on-time payments, then you will most probably be approved for a loan. You are seen as a trustworthy borrower who is likely to pay back what you borrowed.

How Often Can I Check My Credit Score

The Consumer Financial Protection Bureau suggests checking your credit reports once a year, at a minimum. Credit expert John Ulzheimer suggests a cadence of once a month. Until the end of April 2022, you can get your reports for free every week from the three major credit bureaus by using AnnualCreditReport.com.

Also Check: How To Remove Debt From Credit Report

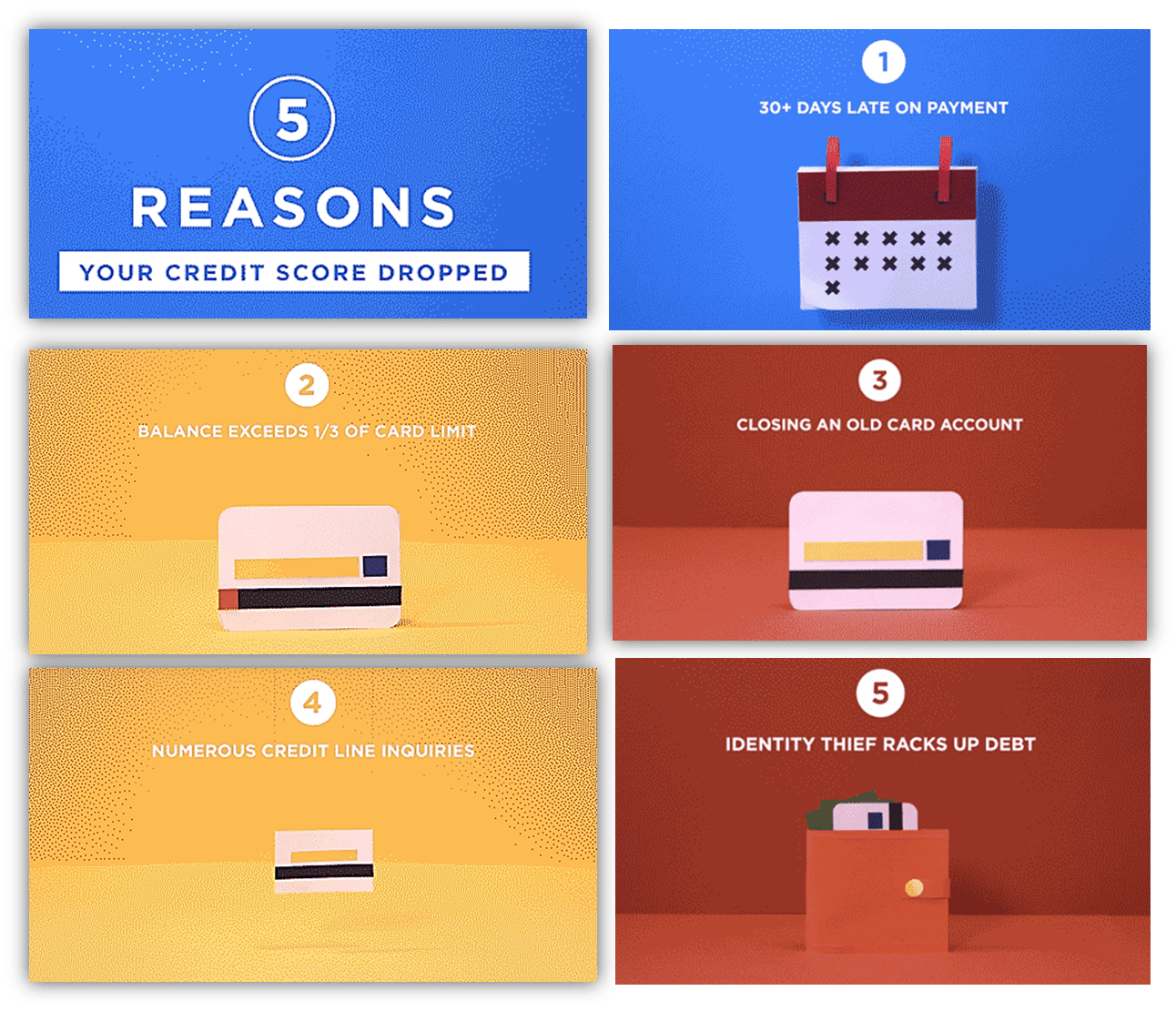

Can A Credit Score Drop Even If Nothing Changed On My Credit Report

It can sometimes seem like your credit score fluctuates up or down even if you seemingly havent done anything to influence it.

Sometimes your score does change based on factors out of your control. For example, there are different scoring models for calculating your credit score based on your financial information. It is common to see differences in scores from one model to the next.

However, if you see a big drop in your score, it is usually triggered by something specific. Most times your behaviour influences your score in ways that may not be obvious.

Below are some common reasons why your credit score may go down when nothing has changed. This will give you an indication of what to look for on your credit report.

Full Credit Report Services

Remember

You can apply for your credit record as often as you like without harming your chances of getting credit.

You can get free 30-day trials of more comprehensive credit checking services from Experian and Equifax. These include your full credit report.

However, you normally have to give your credit or debit card details when you sign up to the free trial. Money will be taken from your account unless you cancel in time.

Recommended Reading: How To Boost Credit Score 100 Points Fast

What Are No Credit Check Apartments

No credit check apartments are apartment units that dont require a credit check as part of the rental process.

This is a shift from the traditional rental process, where landlords perform a credit check during the tenant screening process.

In theory, any apartment could be a no credit check apartment. However, finding an upscale or luxury no credit check apartment unit is almost impossible. These apartments are usually rented out by landlords in search of eager renters.

For prospective renters, there are several risks involved.

Its important to be critical and wary of no credit check apartments. Usually, landlords choose to forego a credit check because they are desperately looking for tenants to fill the space.

In some cases, no credit check apartments may be undesirable, your landlord may be unprofessional, or you may be the

So what is the point of

The tenant screening processs primary goal is to vet prospective tenants to ensure they will fulfill the duties of a good tenant.

A huge part of this screening process is determining whether a tenant is likely to pay on time and in full. Landlords rely on credit checks as a determining factor.

Rather, they provide information about whether you have a history of paying your debts on time and managing your finances responsibly. They will show any outstanding debts, your credit scores from major bureaus, and any loans you may have taken out.

Your Credit Score Will Affect Your Interest Rate

This is an oft-asked question by first time homebuyers what is a good credit score to buy a house? Well, just having a good credit score doesnt mean you will get approved. And just having a bad credit score doesnt mean you will get rejected. It all depends on your payment history. Getting approved for a home loan with a great credit score does not mean you are going to get a great deal. Your credit score will affect the interest rate you get. Poor credit score often leads to higher interest rates and increased closing costs leading to a higher monthly payment. Naturally, the higher your credit score the lower your interest rate will be. You will also get more favorable terms and conditions.

Read Also: When Can Bankruptcy Be Removed From Credit Report

Should I Check My Own Credit Score

Yes, you should check your credit score regularly. At the very least, you should check it once a year to ensure that your personal information and account information are correct and you havent fallen victim to identity theft.

You should also check your credit status a few months before you apply for a new line of credit, like a mortgage, auto loan, or credit card. Doing so will help you determine if you need to fix your credit before submitting a credit application.

If youve been managing your credit responsibly and notice a sudden and significant drop in your credit score, you should immediately check your credit report and dispute any inaccurate items that you find.

A recent Consumer Reports study shows that its not uncommon to find inaccurate information on your credit reports. In fact, 34% of the participants claimed that they have found at least one error on their credit reports. 4

Knowing Where You Stand Is Easier Than You Think

Katie Miller is a consumer financial services expert. She worked for almost two decades as an executive, leading multi-billion dollar mortgage, credit card, and savings portfolios with operations worldwide and a unique focus on the consumer. Her mortgage expertise was honed post-2008 crisis as she implemented the significant changes resulting from Dodd-Frank required regulations.

Over the course of your financial life, your will be checked often as banks and lenders evaluate whether or not to lend you money or extend credit. Financial institutions prefer to lend to borrowers with good credit . Finding out your score can be quick and easy, and it wont hurt your rating.

Don’t Miss: How To Get My Credit Score To 700

How To Check Your Credit Score For Free Without Penalty

It’s a myth that checking your own credit score will affect it.

Any time you apply for a loan, or even some bank accounts, the resulting credit check can hurt your overall . But the myth that checking your credit rate or report does the same is just that: a myth.

To better understand how the process works, its important to know the difference between a soft and hard inquiry.

How To Control The Number Of Credit Checks

To control the number of credit checks in your report:

- limit the number of times you apply for credit

- get your quotes from different lenders within a two-week period when shopping around for a car or a mortgage. Your inquiries will be combined and treated as a single inquiry for your credit score.

- apply for credit only when you really need it

Read Also: Why Is There Aargon Agency On My Credit Report

Read Also: How To Get Rid Of Closed Accounts On Credit Report

Do Credit Checks Lower My Credit Score

Not every credit check will lower your credit score. Whether it will affect your score or not depends on why your score is being checked and whos doing the checking.

There are two types of credit checks:

- Soft inquiries: These are credit checks that are unrelated to you applying for credit. For instance, if you check your own credit, or if a creditor does so without getting your approval because theyre considering preapproving you for a credit card, itll be a soft inquiry. Soft inquiries dont affect your credit score.

- Hard inquiries: On the other hand, when you actively apply for credit or loans, your lender will run a different type of credit check on you called a hard inquiry. Hard inquiries usually knock a few points off your credit score.

People and companies need permission to check your credit

The Fair Credit Reporting Act regulates credit reporting and strictly prohibits the general public, including employers or landlords, from pulling your credit history without written permission. Businesses that wish to run a credit check on you without asking you first need a legitimate purpose to do so, such as preapproving you for a credit card. 1

What Can Lower Your Credit Score

While checking your own credit score won’t change it, there are plenty of other things that can affect your credit score negatively. Here’s a quick breakdown of each factor that influences your FICO® Score:

Because there are so many variables that go into calculating your credit score, it’s impossible to determine exactly how much damage a negative item may cause to your score. But if you notice your credit score drop and are wondering why, look at these areas to find the likely reason.

Read Also: How Can You Clean Up Your Credit Report

Hard Credit Check Will Impact Credit Rating

Hard credit checks can have an impact on your and score. The hard credit check vs soft credit check distinction lies in the inquirys purpose. For hard checks, the purpose is always to evaluate a credit application you started, whether thats for a credit card, car loan, mortgage, or other credit product. Just one inquiry usually wont have a big impact on your credit rating. However, if you apply for a bunch of new unsecured loans or credit cards at once, then the multiple hard inquiries will signal to lenders that you might be under financial pressure, thus having a greater impact on your rating.

An important exception to the negative impact of multiple hard credit checks is when youre shopping around for the best mortgage and car loan rates. Because this suggests that youre doing your due diligence, all the hard credit checks for a mortgage or car loan are counted as just one credit check so long as they are all done within a specific time frame. This time frame is described by Equifax as ranging from 14 â 45 days. To stay on the safe side, try to have all hard credit checks done within 2 weeks of each other. Also remember that this does not apply to credit card applications.

Late Credit Card Payment

How much a late installment may influence your credit score can rely upon a few different aspects. With regards to your credit score, for instance, a late installment will be assessed depending on how late the payment is, and the recurrence of late payments.

Each credit reporting organization has its own model for assessing your data and allotting you a credit score accordingly, so your credit score will differ between different credit rating organization.

However, the longer an installment goes unpaid, and the more repeated the behavior is, the more damaging it is on your credit score. For example, a payment that is ninety days late can have a more negative impact on your credit scorethan a payment that is just thirty days late. Besides, the more recent the late payment, the more negative of an impact it could have on your overall credit score.

Also, one late payment could have a damaging impact on your credit score, particularly if it is high. If your score is already low, one late payment wont hurt it as much but still does some critical damage. For instance, if you have a credit score of 800, and you make one 30-day late payment on your credit card, it can lead to credit score drop of as much as 90 to 100 points. For a consumer who has never missed a payment on any credit account, this can be very damaging indeed.

You May Like: Is 783 A Good Credit Score

How To Monitor Your Credit Without Hurting Your Credit Score

by Elizabeth Aldrich |Updated Dec. 13, 2021 – First published on March 13, 2019

Image source: Getty Images

Keeping an eye on your credit score can help you better understand what financial actions directly affect your credit, but will it decrease your credit score?

When was the last time you checked your credit? If it’s been longer than a few months, you might want to consider giving it a peek. If it’s been longer than a year, it’s time to change the way you monitor your credit.

Keeping an eye on your credit score helps you understand exactly how your financial actions affect your credit. It also allows you to respond to any sudden drops in your score and know when you’ve achieved excellent credit and might qualify for better interest rates or credit card offers. Ultimately, understanding how your credit score moves over time gives you control of your financial well-being. But it’s important to make sure you keep track of your credit score without harming it.

Have A Diverse Credit Portfolio

Its helpful to have at least one installment loan and one revolving credit account to maintain a good .

That being said, you should only apply for new credit when you need it, instead of for the sole purpose of boosting your credit mix. As you know, every credit account you apply for will incur a hard inquiry on your credit report, and while you dont need to worry about one or two inquiries, having significantly more can be a cause for concern.

Takeaway: Checking your own credit score wont lower it, but if your lender checks your credit, it might

- Checking your own credit score is considered a soft inquiry, which doesnt hurt your credit score.

- However, when a lender runs a credit check because you applied for credit, its considered a hard inquiry, which will hurt your score.

- A hard inquiry generally will only lower your credit score a little, but you should still avoid getting multiple inquiries in a short period of time.

- You should check your credit report regularly to manage your finances and to detect any errors in need of disputing.

- You can monitor your credit score for free through many websites. Doing so wont hurt your credit score.

Article Sources

Don’t Miss: Does Increasing Your Credit Limit Affect Your Credit Score