Should You Remove Closed Accounts From Your Credit Report

You should attempt to remove closed accounts that contain inaccurate information or negativeitems that are eligible for removal. Otherwise, there is generally no need to remove closed accounts from your credit report. Inaccurate information could be pulling down your credit score and should be addressed, but older accounts with a good history may be helping your score.

Even after closing an accountlike a personal loan or credit cardthe information related to your balances and payment history stays on your for many years. In fact, both accounts closed in good standing and negative items or collection accounts may remain on your credit report for seven to 10 years.

Your credit score is calculated based on five main factors: payment history , credit utilization , length of credit history , different types of credit and new credit .

Because a credit report includes both open and closed accounts, some of these credit factors can be affected by a closed account being removed from your report. For example, if you made payments on a personal loan for a number of years and that account is removed from your report, yourlength of credit history could decrease.

Having a closed account removed from your report may not affect your score, but in many cases, it is wise to leave accounts in good standing on your report, as they could have a positive impact overall.

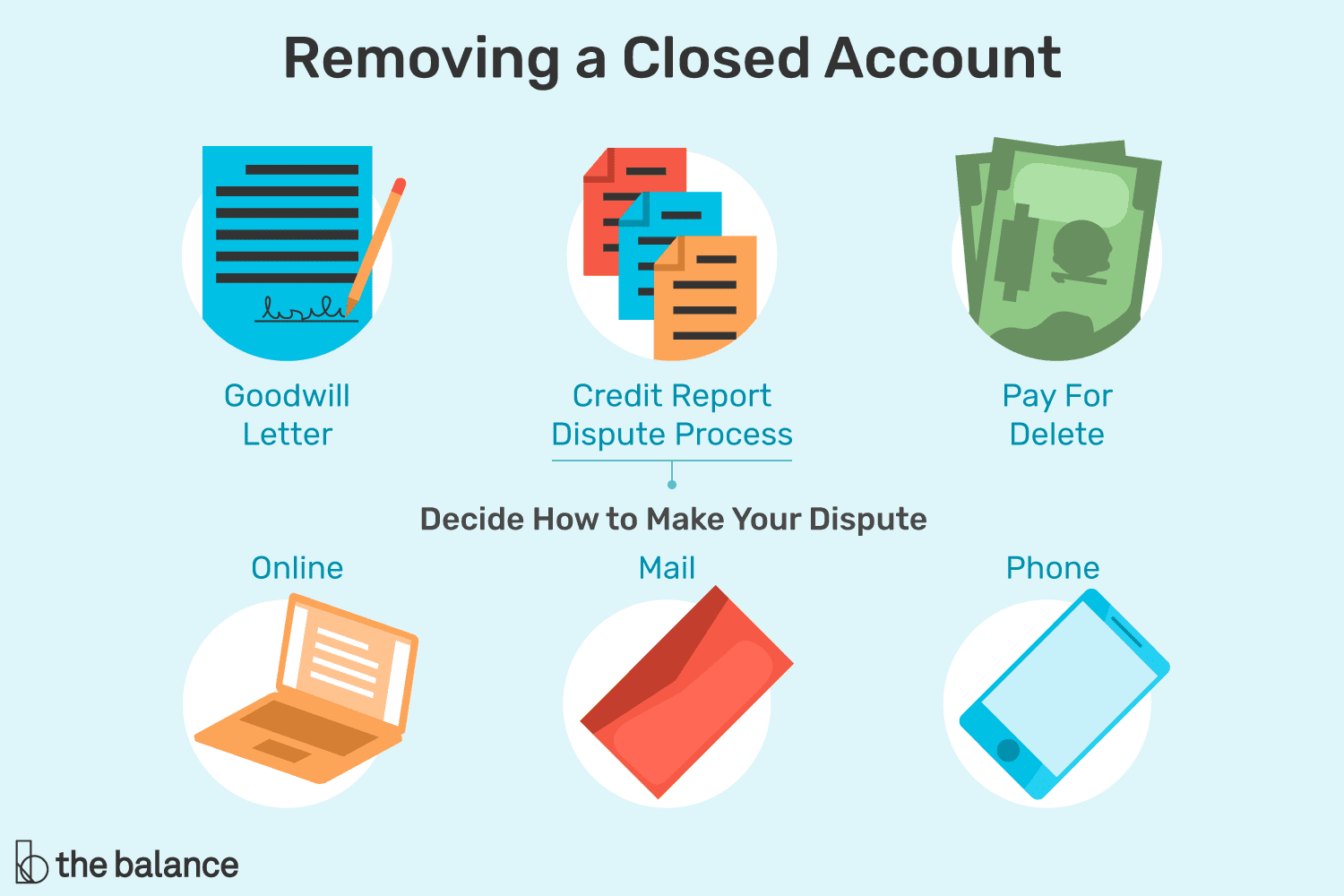

Read on to learn how to get rid of closed accounts from your credit report.

What Is The Difference Between Derogatory And Delinquent

Derogatory remarks are worse than delinquent accounts foryour credit. Delinquent means youre simply late on the account but stillexpect to pay it off. Derogatory means youve stopped paying and will likelydefault.

The technical difference is usually 180 days. Accounts willbe marked delinquent until youre 180 days late on the payment but will switchto derogatory after that point.

Monitor Your Credit For Free

Regularly monitoring your credit reports for changes can help you stay on top of new information as it is reported and can also help detect potential credit fraud or identity theft sooner. Experian’s free credit monitoring can help by automatically alerting you to important or potentially suspicious changes. Whether it’s a late payment, a balance increase or a collection account, keeping a close watch can help you keep your credit scores in great shape and help you protect yourself from potential fraud.

You May Like: Unlock My Experian Account

How Do You Dispute An Accurately Reported Late Payment

If you really did make a late payment, theres still a chance you can have it removed from your credit reports. This might be a slim chance, but its worth trying because late payments can potentially have such a significant impact on your credit.

For these methods, youll just be contacting the lender or creditor, rather than the credit bureaus. Youre basically just pleading your case and asking it to forgive the late payment its under no obligation to actually do so. If the lender decides to report the account as current instead of delinquent as a result, this is typically known as a goodwill adjustment.

This might work if you have an otherwise excellent payment history with that lender, and have been a responsible customer except for this mistake. If there was a technical error that prevented you from paying on time, like an issue with the payment system, that could work in your favor. Or, if there was some major life event that prevented you from paying by the due date, your card issuer may be sympathetic to that as well.

If you havent been a very good customer, however, and have a history of late payments and other negative marks, you probably wont have much success with a goodwill adjustment. But it might still worth a shot, depending on your situation. It wont cost you anything to try but some time.

There are only two steps in this process:

Insider tip

Closed Accounts And Credit Utilization

Use our tradeline calculator to calculate your credit utilization ratios.

Now that you know what a closed account is and why an account may be closed, you may be wondering what a closed account on your credit report means for your credit.

The main impact of closing an account on your credit is the effect on your utilization ratio. By closing an account, you are reducing your total available credit limit, which could increase your overall utilization ratio if you have balances remaining on your other accounts.

Therefore, if you have balances on any of your other cards, you probably dont want to close an account that is helping to keep your overall utilization down, as well as improving your ratio of low-utilization to high-utilization accounts.

On the other hand, if you pay down all your other credit cards to 0% utilization, you can safely close an account without impacting your credit utilization.

Try using our tradeline calculator to calculate your individual and overall credit utilization ratios and see how closing one of your accounts could affect your utilization rate.

Recommended Reading: What Company Is Syncb Ppc

Avoid The Following Strategies

While the following methods can be tempting options when trying to repair your credit, they can often cause more harm than good. Stay away from the following:

Closing a line of credit that is already behind on payments

Closing a card thats behind on payments doesn’t eliminate the debt. In fact, it can lower your credit score by increasing your debt-to-credit ratio, also known as credit utilization percentage. This ratio represents the amount of credit you’re currently using divided by the total amount of credit you have available.

For example, if you have two credit cards, each with a maximum credit limit of $5,000, your total available credit is $10,000. Owing $3,000 on one card and $2,000 on the other would mean you’re using 50% of your total available credit.

To improve your credit score, experts recommend keeping your credit utilization under 30%. Following the example mentioned above, that would mean using only $3,000 or less per cycle.

If you close one of your credit cards instead of paying it, you’ll have less available credit. Creditors evaluate your debt-to-credit ratio when you apply for new cards or loans. If your ratio is over that threshold, they might classify you as a high-risk borrower, offer you less attractive interest rates or even deny you credit altogether.

Filing for bankruptcy

There are two types of bankruptcies available for individuals: Chapter 7 and Chapter 13. A third type, Chapter 11, is meant for businesses.

How Long Do Closed Accounts Stay On My Credit Report

When you close an account, it may not be removed from your credit report immediately. This is true whether the closed account is a credit card or an installment loan. Closed accounts stay on your report for different amounts of time depending on whether they had positive or negative history. An account that was in good standing with a history of on-time payments when you closed it will stay on your credit report for up to 10 years. This generally helps your credit score. Accounts with adverse information may stay on your credit report for up to seven years.

Recommended Reading: What Credit Score Does Comenity Bank Use

Dispute With The Business That Reported To The Credit Bureau

Now, you can completely bypass the credit bureau and dispute directly with the business that reported the error to the credit bureau, e.g., the credit card issuer, bank, or debt collector. You can make the dispute in writing, and the business is required to do an investigation just like the credit bureau.

When the business determines that theres indeed an error on your credit report, they must notify all the credit bureaus of that error so your credit reports can be corrected.

It’s Possible To Negotiate A Pay

Your is important for buying a home, getting a car loan in your name, or just opening a credit card account. A significant part of your score is based on how you manage payments for loans, credit cards, and other types of credit. Having an account fall delinquent can lead to a charge-off, which can cost you major credit score points.

Negative information, including charge-offs, can remain on your credit history for up to seven years. But it may be possible to remove a charge-off from your credit sooner than that so you can begin rebuilding your credit score.

Also Check: When Does Self Lender Report To Credit Bureaus

Use The Advanced Method To Dispute The Charge

If you dont have the money to pay the balance in full, or if you cant get the original creditor to remove the charge-off from your credit report, its time to dispute the negative entry using a more advanced method. To dispute the entry youll first need a copy of your current credit report. Because of the coronavirus pandemic, you can get a free copy of your credit report each week instead of just once a year. Visit annualcreditreport.com to get a free credit report from TransUnion, Experian, and Equifax.

When you have your credit reports in hand, find the charge-off entry and look at every detail to ensure everything is completely accurate. The key here is to be very specific. If anything is inaccurate you have the right to dispute the entire entry.

Here are a few details that you should be verifying are accurate:

- Account Number

- Borrower Names

- Balance

If you find any information that isnt correct, write a letter to each of the three credit bureaus listing the inaccurate information and stating youve found incorrect information that needs to be corrected or removed. If the credit reporting agencies cant verify the entry, theyll have to correct or remove the charge-off in compliance with the Fair Credit Reporting Act. Sometimes the information simply cant be verified and the entry will be removed. Do note however, that if the charge-off is reported accurately, disputing it will not help.

Sample Letter To Remove A Charge

Note: Use this in attempting to negotiate a complete removal or PAID AS AGREED on a debt that states CHARGE-OFF or SERIOUSLY PAST DUE on your credit report.

RE: account #

Dear Sir or Madam, After recently reviewing my credit report, I took notice that the above-mentioned account is currently in status. I sincerely would like to take care of this account as soon as possible.

Due to , I unfortunately got behind on my payments and was unable to meet my obligations. However, since then my situation has greatly improved and I am in the position to recompense this debt.

I am willing to pay equalling the amount of provided that the above account is updated on all credit reporting agencies to state: PAID AS AGREED, or completely removed from all credit reporting agencies upon my final payment.

I am not agreeing to an updated credit report that states this account as: PAID CHARGE-OFF or the like, as this will not significantly increase my credit score, nor will it reflect my sincere willingness to restore my good name and hopefully, someday, again do business with your company.

Your written response will serve as an agreement to my proposal and I will begin payments. Thank you very much for your valued time.

Best regards,

You May Like: 671 Credit Score Good

Rebuilding Your Credit Rating

Since the charged-off account will still show up on your credit report, it will continue to impair your credit score. But the good news is that as charge-offs and other negative information ages, its overall impact can lessen.

In the meantime, you can work on rebuilding a positive credit history by doing things like paying your bills on time, keeping your low, and limiting how often you apply for new credit.

Sample Letter: Credit Bureau Late Payment Dispute Request

You can use this sample letter to dispute information in your credit report. Just insert the appropriate information, like your name and address, the credit bureau name and address, and specific details in the body of the letter. If youre disputing more than one item, youll need to adjust the language to refer to multiple accounts.

Only include copies of documents, not the originals. If you choose to provide a copy of your credit report, circle the delinquent account in question.

Send your dispute request by certified mail, with a return receipt requested, so youll be sure that they receive it.

Enclosures:

Also Check: Experian Temporary Unlock

What Will Help Improve Your Credit Score

- Your Payment History: Delinquencies and missed payments hurt your credit score more than most other factors. In fact, the FICO scoring model ranks payment history as most important in your credit profile.

- Your Credit Utilization Ratio: If youre using a lot of your available credit on your credit cards, expect your credit score to suffer. For best results, pay down your credit card balances to 25%. Never exceed 30% of your available credit lines. Often, keeping an account or two open after youve paid them off can decrease your credit utilization ratio and increase your score.

- Other Factors: Keeping a mix of different types of credit a student loan, a couple credit cards, a car loan, and a mortgage, for example will help your credit score some. Limiting new credit applications can help, too.

Developing these good habits will help a lot, but lets be clear: a major negative entry like bankruptcy, foreclosure, or repossession on your credit file will cause bad credit.

The good news: Even if you cant get them removed using the four strategies I outlined above, these negative items on your credit report hurt your score less and less as they age.

So by making good credit decisions now, youre adding positive information to your credit history thats newer than your negative information.

Your good decisions will help your score eventually!

Remove Original Nelnet Closed Loan Off Credit Report

I have 2 Nelnet loans now closed from 2014. They are due to drop off my credit in January of 2022. I have read and heard that its possible to call the credit bueros and have them removed early. Is this true? Anyone have success with this?

wrote:

I have 2 Nelnet loans now closed from 2014. They are due to drop off my credit in January of 2022. I have read and heard that its possible to call the credit bueros and have them removed early. Is this true? Anyone have success with this?

I take it these are defaulted/negative lines? If you have lates, they’ll come off, but the account could stay longer.TU will grant early exclusions at 6 months .

Experian just builds a 3 month EE into their reporting now, so you shouldn’t need to do anything.

EQ would only grant 1 month, sometimes it ends badly, so I recommend riding it out with EQ.

F8 EQ:EX:TU:Accounts: Reporting:

Recommended Reading: How To Remove Public Records From Credit Report

The Late Payment Occurred More Than Seven Years Ago

If a late payment is correctly reported, it should fall off your credit reports after seven years.

Lets say youve missed a payment by 30 days, then 60 days and then 90 days. Even though this one late account can lead to multiple negative marks on your credit reports, the original delinquency is the one that starts the clock. That means the entire sequence should disappear seven years from the first date the payment was late.

If you see a late payment thats more than seven years old, it could be a mistake, and you may want to dispute it.

Do Closed Accounts With Balances Affect Credit Score

Yes, they do. They increase your, which is the revolving credit you used versus the revolving credit available to you. When your account is closed but it still has a balance, it increases the credit you used but decreases the available credit. Remember, the credit utilization ratio accounts for 30% of your credit score.

Recommended Reading: Carmax Finance Rate

Pay For A Credit Monitoring Service

TransUnion, one of the major credit bureaus, offers a that requires a fee. I have used this service myself.

You can find a lot of other fee-based credit monitoring systems out there.

So why would you pay for credit monitoring when you can get it free?

Paid services have more elaborate tools, but they also have ways to help you recover from identity theft rather than simply detect it.

A Credit Report Is Complex Yet Simple

Your credit report changes every month. All your lenders add and subtract information. Your report from each credit bureau is different from the other two bureaus files on you.

Then, all this data gets distilled into a three-digit number that most lenders equate with your identity. Its easy to see why credit is so confusing and frustrating.

But heres a simpler way to look at it: To get rid of your bad credit, you can:

- Remove Negative Information

- Add Positive Information

- Be Patient

Ultimately, thats how you play this game. This post has been about removing negative information because doing this can increase your score quickly.

But adding positive information is just as important. You can add positive data by making on-time payments, keeping your credit card balances paid down and applying for new credit only when you feel certain youll get approved.

Over time youll start seeing your credit score climb.

Don’t Miss: Thd/cbna On Credit Report

Check The Validity Of The Collection Account

When you examine your credit report for inaccurate information, ask yourself whether each debt is yours and whether each debt amount has been correctly reported. A recent report from the Bureau of Justice Statistics states that 17.7 million people in the United States, 16 and older, are victims of identity theft annually.

The Federal Trade Commission reports that imposter scams and identity theft are the two biggest categories of fraud. The first thing you should do when youâre contacted by a collector seeking your money is to check the validity of the account. But do it fast. The Fair Debt Collection Practices Act only gives you 30 days from the first contact to confirm the validity of the debt. A debt collector must stop collection activity for 30 days if they get a request to validate an account. Keep in mind that one original creditor account can pass through the hands of different collection agencies and debt buyers, so you could have an âinitial contactâ from different agencies for the same debt.

If you want to request validation of new debt, send a letter to the collection agency with the account information and tell them that you dispute the validity of the debt. Ask them to provide information to verify the original account and the debt amount, and make sure to request contact information regarding the original creditor.