Mistake On Your Credit Reports

So far weve assumed that your credit scores dropped because of accurate information on your credit reports. But what if thats not the case?

Lenders can make mistakes too. Thats why its important to check your credit reports to keep an eye out for errors. The CFPB says that credit report inaccuracies are one of the most common issues it deals with each day.

If you find a mistake on your credit reports, you have the right to dispute it with the credit bureaus and with the reporting lender. Companies are required to investigate the dispute free of charge and promptly correct errors that are confirmed.

How Does A Short Sale Impact Your Credit

A short sale will blow a hole in your credit score, dropping it as much as 100-150 points, depending on where you started. The higher your credit score, the more you will fall.

Rod Griffin, Director of Public Education for Experian, one of the three major credit reporting bureaus in the U.S., said: Short sales, are among the worst things that can happen to your credit score.

The specific amount your score drops depends on your credit history, the scoring system being used and what the lenders criteria are, Griffin added, but it definitely will have a very serious negative effect.

typically range from 300 to 850. If your score is in the 750-800 range, it could easily drop 150 points in a short sale, maybe even more. If you have an average or even good credit score , you could lose 100 points after a short sale and fall into what lenders call subprime category.

Why is this important? A lower score can make borrowing more difficult, if not impossible. Even if you are still eligible for credit or loans, your interest rate will climb as your credit score drops.

How Much Will Credit Inquiries Affect My Score

The impact from applying for credit will vary from person to person based on their unique credit histories. In general, credit inquiries have a small impact on your FICO Scores. For most people, one additional credit inquiry will take less than five points off their FICO Scores.

For perspective, the full range for FICO Scores is 300-850. Inquiries can have a greater impact if you have few accounts or a short credit history. Large numbers of inquiries also mean greater risk. Statistically, people with six inquiries or more on their credit reports can be up to eight times more likely to declare bankruptcy than people with no inquiries on their reports. While inquiries often can play a part in assessing risk, they play a minor part are only 10% of what makes up a FICO Score. Much more important factors for your scores are how timely you pay your bills and your overall debt burden as indicated on your credit report.

Also Check: How To Unlock My Experian Credit Report

One Of Your Credit Limits Was Lowered

A lower credit limit has the same impact as charging an expensive item. If you have a balance on a credit card with a low credit limit, your goes up, and your credit score goes down. You may not have control over whether your credit card issuer reduces your credit limit, but if this happens, paying down your balance can improve your credit utilization and your credit score.

Minimum Credit Score By Mortgage Loan Type

The minimum credit score you need to qualify for a mortgage in 2021 depends on the type of mortgage youre trying to obtain. Scores differ whether youre applying for a loan insured by the Federal Housing Administration, better known as an FHA loan one insured by the U.S. Department of Veterans Affairs, known as a VA loan or a conventional mortgage loan from a private lender:

|

Type of loan |

|

|

FHA loan requiring 3.5% down payment |

|

|

FHA loan requiring 10% down payment |

500 – Quicken Loans® requires a minimum score of 580 for an FHA loan. |

|

VA loan |

Also Check: Syncb Toys R Us

What If You Dont Have Any Credit At All

Building credit from scratch is challenging, but it can be done. Adding a co-signer to the mortgage loan application works for people with no credit as well as for those with poor credit. Another option is to start using a credit card responsibly.

Start off with a secured card and make your monthly payment in full each month to build credit. Or ask a close relative if you can be added as an authorized user on one of their credit cards.

You can agree not to spend anything . This simple step will add that credit cards entire length of use to your own credit report.

You can also show your lender that youve regularly paid other bills on time, like your cell phone, utilities, or rent. Another method is to make a bigger down payment to compensate for your lack of credit. Talk to your lender to see what else you can provide to make the loan work.

Where Does My Credit Score Come From

A credit report is a written history ofall creditor accounts which belong, or have belonged, to a person in theirlifetime.

are a compilation of information from credit bureaus, which are companies to which creditors report borrower payment history on a regular basis.

In the mortgage space, there are three main credit bureaus Experian, Equifax, and TransUnion. Each bureau uses the information availableto it to assess your individual credit score.

Your credit score is a numerical value that sums up theinformation on your credit reports. The higher your creditscore, the more likely you are to make payments. Thats why lenders rewardborrowers with good credit scores by approving them for larger loan amounts andlower interest rates.

The algorithm which uses your credit report to determine yourcredit score is cloaked we dont know how each line item affects the finalscore. However, we do know that your payment history is the single biggestfactor in determining your credit score.

This is why first-time home buyers rarely have credit scores that are excellent. Theres just not enough history of managing credit and making payments to make that kind of determination.

Read Also: Credit Check Without Ssn

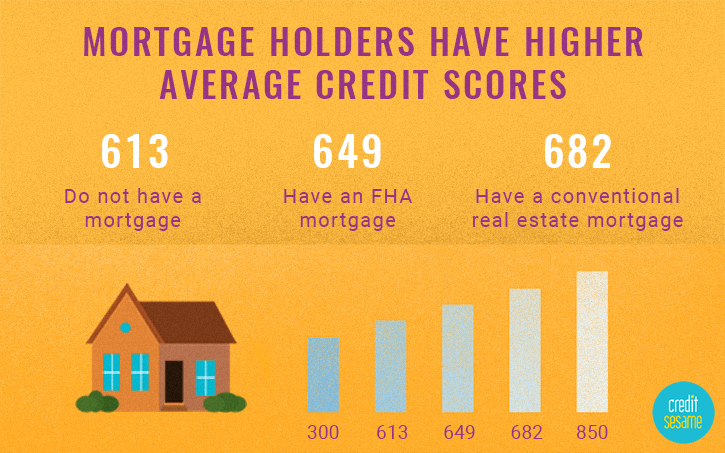

What Is A Good Credit Score For Getting A Home Loan

To qualify, youll need at least the minimum credit score to buy a house, which ranges from about 500 680, depending on the mortgage program. But a higher credit score can boost your chances of qualifying for a mortgage because it shows the lender youre likely to repay your loan on time.

During the application process, lenders commonly check the borrowers FICO® credit score, which grades consumers on a scale of 300 850, with 850 being the highest score possible. The best credit score to buy a house is 760 or higher. According to FICO® data, borrowers with a credit score in this range tend to get the best interest rates on a home loan.

Youve Recently Opened Or Applied For Multiple Lines Of Credit

When you open several credit accounts in a short period of time, you represent more of a risk to lenders. For this reason, your credit scores may drop if youve had several hard credit inquiries placed on your credit reports recently.

Its important to point out that checking or monitoring your credit with tools like Credit Karma doesnt affect your scores because it only results in a soft credit inquiry.

If youre rate shopping, FICO® recommends that you do so in a short period of time. For example, if youre shopping for a mortgage or auto loan within a 30-day period, the credit bureaus will typically group the inquiries together. But if youre considering applying for a credit card, keep in mind that youll get a ding on your credit reports for each credit card you apply for, no matter how close those hard inquiries are over a matter of days. So be sure to only apply for credit cards that you truly need.

Don’t Miss: Syncb Ppc Closed

Your Last Collection Dropped Off Your Credit Report

When calculating credit scores, credit scoring models place people in different buckets, known as scorecards. Your credit profile is compared to other people in your scorecard to come up with your credit score. While you may have been at the top of one scorecard with the collection on your credit report, you may fall to the bottom of a different scorecard if any negative information falls off your credit report.

This type of credit score drop is outside of your control. Fortunately, as long as you keep paying your bills on time and keep your debt low, your credit score will improve.

Do Credit Inquiries Affect My Fico Score

FICO’s research shows that opening several credit accounts in a short period of time represents greater credit risk. When the information on your credit report indicates that you have been applying for multiple new credit lines in a short period of time , your FICO Scores can be lower as a result. Although FICO Scores only consider inquiries from the last 12 months, inquiries remain on your credit report for two years.

If you apply for several credit cards within a short period of time, multiple inquiries will appear on your report. Looking for new credit can equate with higher risk, but most are not affected by multiple inquiries from auto, mortgage or student loan lenders within a short period of time. Typically, these are treated as a single inquiry and will have little impact on your credit scores.

Read Also: Can Public Records Be Removed From Credit Report

Personal Loan Rates Are Reasonable

Take a look at the chart below of rates for personal loans and credit cards. Its clear that getting a personal loan is much cheaper.

For a personal loan, take a look at Credible, my favorite online lending market place where pre-qualified lenders compete for your business. You can get real quotes for free in a matter of minutes.

If you can borrow at a reasonable rate, it may be better than going through a foreclosure or short-sale. Let me explain more below.

Does Paying Off Collections Improve Your Credit Score

Paying off an account in collections may or may not help your credit score. The impact depends on a variety of factors, including the credit-scoring model being used. Older credit-scoring models will reflect that a collection account has been paid and now has zero balance, which can positively impact your score, says Block. Newer credit-scoring models, however, will ignore the zero-balance status on a collections account.

The total number of accounts you have in collections also factors into your credit score. If the collection event is recent and is the only one of its kind, then it may be advantageous to your score to resolve it, says John Cabell, director of banking and payments intelligence for J.D. Power. However, if you have many debts in collections, then you may not see much improvement. Conversely, if the collection event is several years old, it may not actually be playing much of a role in your credit score anymore anyway.

Read Also: Does Paypal Credit Report To Credit Bureaus

You Made An Expensive Purchase

Another important factor in your credit score is the amount of available credit you’re using, or your credit utilization ratio. It comes as a surprise to many people but, if you make a big purchase on your credit card one month, you could see a credit score drop even if you pay the balance in full on your due date.

This happens because credit card issuers typically report the as of the last day of the billing cycle. The balance on your credit card statement is often the balance that appears on your credit report.

It’s relatively easy to correct the impact of a high balance. Simply pay down the balance promptly, avoid making other credit card purchases, and wait for the updated balance to show on your credit report. This will help you recover the lost credit score points.

When Will My Mortgage Company Start Reporting Late Payments

Your mortgage holder will begin negative reporting to the credit bureaus the first time you are 30 days late with your mortgage payment. Therefore, before your foreclosure even begins, you will have negative marks on your credit, bringing your score down.

Most banks wait until you are 90 days behind in your payments to begin foreclosure proceedings, which often take two or three months to complete. By the time your foreclosure is actually finalized, you will find that your credit score is reflecting six months of missed payments this can take your score down by up to 200 points.

Depending on whether you live in a recourse or non-recourse state, you could be held liable for the difference between what the bank gets for the property in foreclosure and what you owe in mortgage. This is called the deficiency.

If you are in a recourse state, the bank has the right to go after your other assets to make up the difference. If you cannot pay the difference between what you owe and the sales price , you might have to file for bankruptcy which is extraordinary painful on your finances, mental health, and ultimately happiness.

Also Check: Does Paypal Credit Report To Credit Bureaus

Your Unpaid Account Was Sent To Collection

To protect your credit score, it’s important for you to pay all of your accounts, not just your credit cards and loans. If you fall behind on the payments on your non-credit accounts , the defaulted balance could be sent to a collection agency and included on your credit report. Once a collection shows up on your credit report, it will almost certainly cause a drop in your credit score.

Change In Credit Utilization Rate

Your is another important factor in determining credit scores. VantageScore says that its extremely influential, and FICO® says that it accounts for 30% of your overall score.

If you spent more than usual last month , it will increase your credit utilization rate. How far will your scores drop because of it? The effect will vary, depending on how much your ratio of credit used versus available credit went up. To keep your credit scores steady, the Consumer Financial Protection Bureau, or CFPB, recommends that consumers keep their credit utilization rate below 30%.

Imagine that you have a $10,000 credit limit, of which you typically only use $1,500 . If your spending one month increases to $2,500, your utilization ratio will still be solid overall at 25%. But if your spending suddenly increased to $5,000 , your scores could start showing a decline.

Also Check: Does Removing An Authorized User Hurt Credit

What You Can Do To Raise Your Credit Score Faster After Taking Out A Mortgage

If youve been approved for a mortgage, first congratulate yourself not only are you about to embark on the exciting ride of home ownership, but you have shown that your financial history is commendable, given how hard it is to qualify for a mortgage in the first place.

But clean credit is important, and you might be itching to get to the up side of the mortgage credit score swing, especially if you are hoping to make another purchase, like a vehicle, or want to take out another credit card. The potential lender will be checking your credit, and even though your credit score took a slight ding for all the right reasons, nevertheless, that is the number they are considering as they assess your interest rate.

Fortunately there are some things you can avoid to help your credit score recover more quickly.

The list of donts includes:

Hoe Benvloed Krediettelling Die Koop Van ‘n Huis

Krediettellings het ‘n direkte impak op verbandrentekoerse. n Verskil van net 100 punte kan jou duisende kos of spaar. Sonder ‘n hoë krediettelling sal jy nie kwalifiseer vir die beste verbandkoerse wat beskikbaar is nie, wat kan beteken dat jy uiteindelik meer geld oor die termyn van jou verband sal betaal.

Read Also: Speedy Cash Repayment Plan

How A Mortgage Affects Your Credit

Know the fundamentals. Your measures your ability to pay back debts. You only earn so much money so keeping your amount of debt in good proportion to your income is essential. This is called your debt-to-income ratio.

Keeping it no higher than 36% is considered optimum with no more than 28% going to your mortgage. If you know you will purchase a home in the near future, dont take on other debt obligations. Keep your debt-to-income ratio low.

However, do continue to build your . A little credit is better than no credit as far as your credit score is concerned. And of course, paying your mortgage on time is good for your credit history.

The Initial Credit Score Hit

Immediately following getting a new mortgage, expect your credit to suffer. Your credit score is a numerical representation of your ability to pay back a debt obligation. When you take on the largest loan that most consumers will ever have, your score goes down until you prove that you have the ability to pay back the loanand that you will actually make the payments you promised.

Because of this temporary lowering of your score, you may find it difficult to get other loans or get a loan with the credit terms you would expect. Plan to wait at least six months before applying for any loan of significant size.

A mortgage is the pinnacle of consumer credit, where, if you can qualify for a mortgage youre considered a trustworthy borrower.

Recommended Reading: How To Get Repossession Off Credit