When Are You Eligible For An Increased Credit Line

There are several opportune times to request a credit line increase. Graduating from school and entering the workforce is a great time to ask your issuer for a higher limit. Getting a pay raise or transitioning to a new, higher-paying job are also signals that you might qualify for additional credit access.

While each lender has specific criteria for granting increases, only established cardholders should expect to receive one. Sensibly, banks will only lend extra money to customers they have reason to trust, and that trust must be built over time.

If youve been approved for a credit increase, you can request another as soon as six months later. If you were denied, youll want to wait until you can demonstrate a pattern of responsible card use. Your odds will go up if you have improved your payment habits or if your credit score has gone up for other reasons.

Covid + Credit: How Will A Lowered Credit Limit Affect My Credit Scores

Learn what a reduced credit limit can mean for your credit utilization rate.

Reading time: 5 minutes

Unemployment, furloughs and pay cuts caused by the Coronavirus/Covid-19 pandemic continue to affect consumers, many of whom are turning to their credit cards and lines of credit to help them pay for basic necessities. Unfortunately, some lenders and creditors are adapting their lending policies and lowering credit limits, leaving borrowers to wonder how those new credit limits will affect their credit scores.

Although some borrowers may be surprised by this action, especially if they have previously paid their bills on time, lenders and creditors can usually adjust credit limits at any time, for any reason, in an effort to mitigate their own risk. Thats why its important to understand how a credit limit decrease may impact your credit scores and what action to take if you believe you have been negatively affected.

What Is A Credit Limit

Your credit limit is the maximum amount you can borrow on a line of credit. For example, with a credit card, you can spend as much or as little as you want, up to your credit limit. The same is true for other loans, such as home equity lines of credit: Your credit limit is a pool of money from which you can draw. Once you use it up, you need to pay down your loan balance if you want to spend from that account anymore.

Alternatively, your lender can raise your credit limit, based on your request or their decision to do so.

Read Also: Comenity Capital Cart

When Should You Say No To A Pre

Of course, there are reasons to say no to a credit increase. If you have credit card debt or a problem controlling your spending, accessing more credit may be a bad idea.

While an increased limit can potentially improve your credit score, its probably better to keep your available credit low to prevent further debt.

Dmitriy Fomichenko President Sense Financial

A credit limit increase can help improve your credit score. Assuming that you keep your spending at the same level, an increase in credit limit will lower your credit utilization and help improve your score.

Keep in mind that if you request a credit limit, your credit card provider will be likely to do a credit check, which can lower your score. However, the impact from such inquiries is usually minor and temporary.

Recommended Reading: Does Capital One Report Authorized Users To Credit Bureaus

How Increasing Your Credit Limit Can Hurt Your Credit Score

Unfortunately, increasing your credit limit doesnt always boost your score. Here are a couple of ways that it could end up damaging your credit:

- You could start spending more: Increasing your credit limit wont benefit your score if you use it as an excuse to start spending more. If you get carried away and rack up too much credit card debt, then your credit utilization rate will stay the same or increase, and your score will suffer.

- Your request might trigger a hard inquiry: If you request a credit limit increase yourself your card issuer may run a credit check. This could trigger a hard inquiry, which can temporarily take a few points off your credit score . 23

Find out if requesting a credit limit increase triggers a hard or soft inquiry

It isnt always easy to tell if your credit card issuer will run a hard credit check on your report when you request a higher credit limit. If youre unsure, its safer to call your card issuer and double-check.

Your Credit Card Offers A Built

Some credit cards, such as those designed for people with fair credit, let you qualify for a credit limit increase if you make a certain number of on-time bill payments. Others will automatically assess your situation after a set period of time to see if you qualify.

The Capital One Platinum Credit Card, for example, will review your credit limit in as little as six months from the time you get the card.

And if you carry the Discover it® Secured Credit Card for at least seven months, Discover will determine if youre eligible to transfer to an unsecured credit card and get your security deposit back.

» MORE:How do credit card issuers determine credit limits?

Don’t Miss: Carecredit Minimum Score

What You Need To Know

- Getting approved for a higher credit limit has some pretty sweet benefits and can set you up for future success

- Depending on your card issuer and request, you could be approved or denied for a credit limit increase immediately or it could take several days to process

- Theres no one-size-fits-all answer to how much of a credit limit increase you should request. It depends on your income, credit score and account history

How A Credit Limit Increase Can Raise Your Credit Score

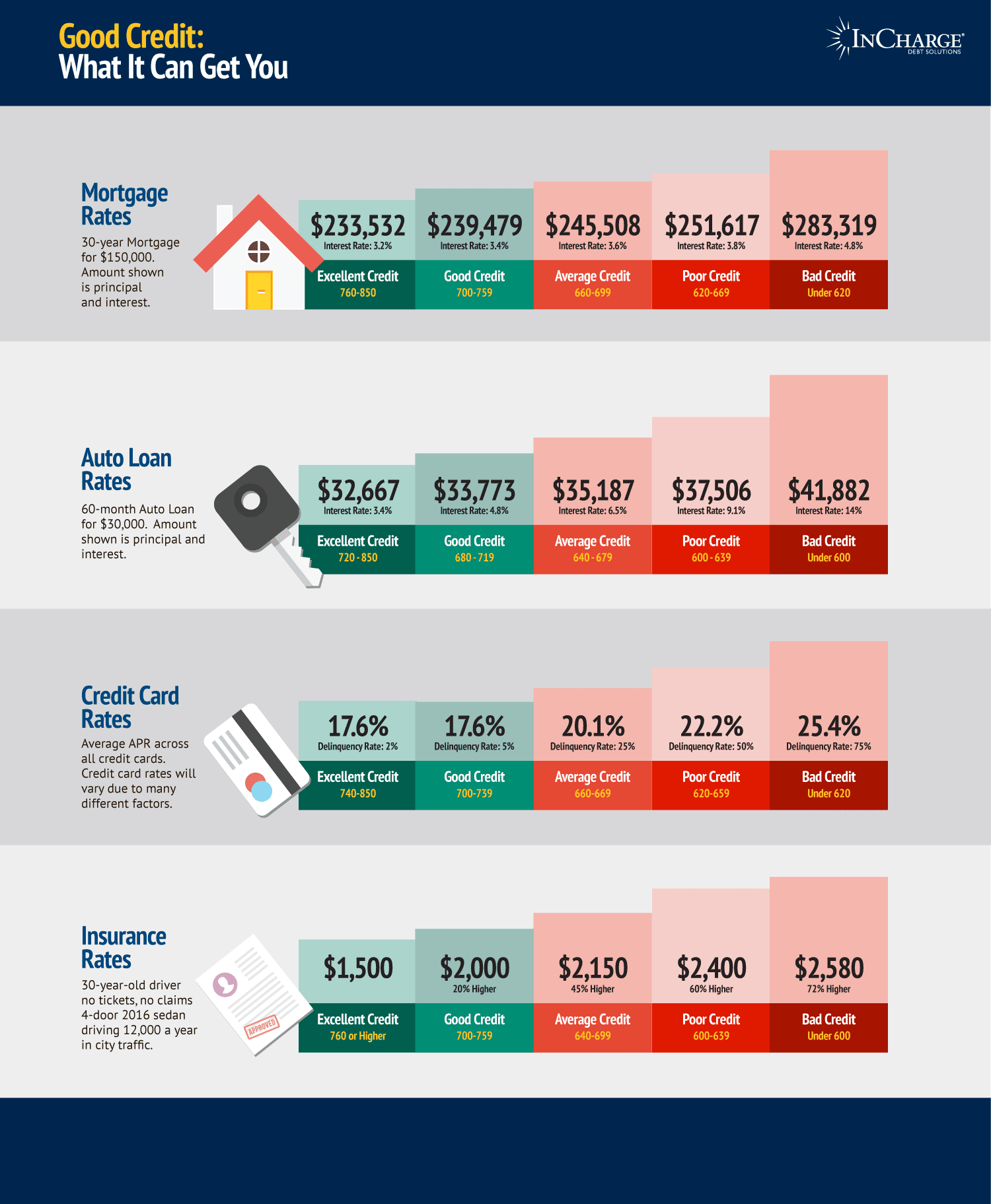

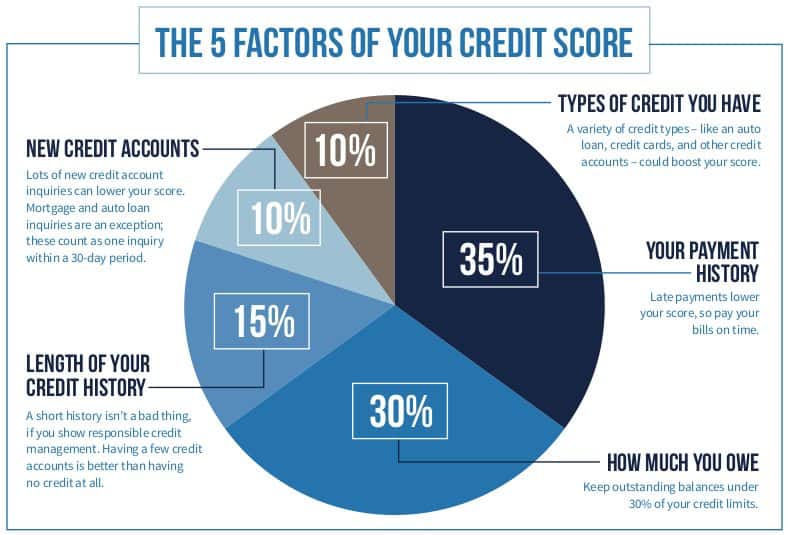

, or amounts owed, is the second biggest factor in your FICO Score. If you increase your credit limit without charging more on your credit card, your credit utilization ratio will go down and your score will go up.

This effect can be almost immediate and, because your credit utilization is such a big part of your credit score, profound, depending on the amount of the credit limit increase.

For instance, lets say you have a credit card with a $1,000 credit limit, and you owe $400 on it. Your credit utilization for that card is 40%, which is not ideal. If you double your available credit, now you are only using 20% of that cards available credit much better for your credit utilization ratio.

However, if you were to request a credit limit increase and only received an additional $200 in credit, your utilization ratio would be 33%. Thats still over 30%, which is the maximum lenders like to see. The credit limit increase would help your credit score, but not as much as that $1,000 credit limit increase would.

If your credit utilization is hovering around 30%, getting a credit limit increase may bump you down to 20% or less, which could raise your credit score.

Remember that its also important to consider the negative ramifications of a credit limit increase before you make a decision that could affect your credit.

You May Like: 820 Fico Score

Heres What Happens When You Try To Spend More Than Your Available Credit:

If you try to make purchases on a card with no available credit, there may be consequences. In most cases, the transaction will simply be denied. Other cards may process it but then hit you with an over-limit fee and maybe even reduce your limit, too. A high penalty interest rate might also apply, perhaps canceling any low introductory APR previously in effect. Over-limit policies vary by issuer, so be sure to review your cards terms and conditions or contact customer service for specifics.

Does Requesting A Credit Increase Impact Credit Score

Requesting a credit increase can impact your credit score, but only if the card issuer pulls your credit file. If the request could affect your credit, the card issuer will let you know, whether you’re making the request over the phone or online.

When a credit card company pulls your credit file, it’s known as a hard credit inquiry. This generally causes a small drop in your credit score. For most consumers, one hard inquiry takes fewer than five points off their FICO® Score, the most widely used type of credit score.

Not every card issuer pulls your credit report when you ask for a credit card limit increase. If yours doesn’t, then your request won’t have any impact on your credit.

Read Also: Sywmc On Credit Report

How To Avoid An Automatic Credit Limit Increase

While some credit card companies might offer an increase in advance, others could increase your credit limit without asking. If you donât like the idea of an automatic increase, you can try and prevent this from happening by simply asking them not to do it. âPut it in writing so that itâs flagged and part of your account,â McClary says. âIâve actually done this myself, and it does work. They don’t want to make you mad, since that’s not a good way to keep a customer.â

If youâve already been given a credit limit increase that you donât want, you can reject it. But McClary warns that doing so could backfire. âIf the increase has already had an impact and been reported on your credit history, lowering it could actually cause your score to go down,â McClary says. However, he adds this should only affect your credit score in the short term and likely wonât have a major impact.

Recommended Reading

Does Requesting A Credit Limit Hurt Your Credit Score

Most of the time, automatic credit limit increases only trigger a soft inquiry, which doesnt affect your score.

However, when you request a credit limit increase, your bank might perform a hard pull, depending on the issuers policies. Normally youll be made aware if thats the case in advance. But if you havent, make sure to ask so you know what to expect.

A hard inquiry can take a few points off your credit score. Luckily, the impact of a single hard pull is rarely significant. While it will stay on your credit report for two years, it will stop affecting your scores in 12 months.

At the same time, multiple hard inquiries can result in a more serious impact and be interpreted by creditors as a move to get access to more funds in a desperate situation.

For this reason, avoid requesting a higher credit line with more than one issuer at the same time. Ideally, you should wait at least six months before requesting more credit.

That said, it can be a good strategy to increase your credit limit every year. This is a positive credit habit that can help you ensure you proactively earn credit points on a regular basis while getting the most out of the cards you have.

If youre denied, dont worry and try again in six months or later. Ask your issuer how you can improve your chances and follow that advice to work on your credit.

Don’t Miss: How To Check Credit Score With Chase

Do Restrict Applications For A Higher Credit Limit

When requesting a higher credit limit, a lender will search your credit history which can leave a mark onyour credit report. A high number of these searches may suggest that you are financially stretched andmay make lenders reluctant to increase your limit.

Making fewer applications overall, as well as limiting them to the card with the most attractive interestrates can help reduce the number of credit checks made in your name, which could limit the possiblenegative impact, and improve the chances of a successful application.

How Does Getting A Credit Limit Increase Affect Your Credit Score

As long as you donât increase your spending by too much and keep making payments on time, your credit score shouldnât be negatively affected by a credit limit increase. And thatâs because a higher credit limit can lower your overall credit utilization ratio.

Credit utilizationâhow much of your available credit youâre usingâis an important factor in determining your credit score. The Consumer Financial Protection Bureau recommends you keep your ratio under 30%. This, along with responsible behaviors like on-time payments, could actually help improve your credit score in the long run.

You May Like: Credit Score Care Credit

Can My Credit Limit Be Reduced

Credit card issuers hold the right to reduce your credit limit at any time by providing little to no notice, irrespective of how well you might have maintained your account. Reports suggest that over 62 million credit card holders had their cards closed or experienced reduced credit limits during the first four months of 2021 because of the threat that issuers perceived from the COVID-19 pandemic.

Youve Used Your Existing Credit Line Responsibly

You use your credit card conservatively, avoiding debt when possible. You pay every credit card bill on time. As a reward, the credit card issuer may automatically grant you a higher credit limit, or invite you to request one. It could be just a small bump, or it may be as much as 30%.

The news may come to you out of nowhere, but its no reason to be concerned. In fact, its a sign youre managing your credit card well. You’ve proved yourself to be a good credit risk to the card issuer.

» MORE:Requesting a credit limit increase? Heres what to expect

Recommended Reading: Does Monroe And Main Report To Credit Bureaus

How To Control The Number Of Credit Checks

To control the number of credit checks in your report:

- limit the number of times you apply for credit

- get your quotes from different lenders within a two-week period when shopping around for a car or a mortgage. Your inquiries will be combined and treated as a single inquiry for your credit score.

- apply for credit only when you really need it

Increasing Your Limit Could:

- Be a factor down the track, as lenders consider your credit limit when you apply for a home loan

- Tempt you to spend more money, which might not be a good idea if you can’t pay it back

- Increase the interest you’re accruing having a higher credit limit makes it easier to overspend and could make it harder to pay off your full balance each month.

Also Check: Credit Score Usaa

Things To Consider When Requesting A Credit Limit Increase

- New credit could cause a temporary drop in your credit score. Although an increase in your credit limit may help your credit score, a lenders hard inquiry will be added to your credit history and could lower your score in the short term. This is especially true if youve applied for credit increases multiple times or with multiple lenders in a relatively short period of time.

- Make sure your new credit balance wont lead you to temptation. When you make a credit limit increase request, be careful to not overspend. Late payments and not keeping your utilization rate low could cause long-term problems.

When Should I Request A Credit Increase

You should ask for a credit limit increase when your card issuer is most likely to approve your request. It may be a good time to ask if the following conditions apply to you:

- Your credit score has increased since you opened the account: Having a good credit score shows that you manage your finances carefully, meaning your creditor is more likely to trust you to repay larger debts.

- You have a history of repaying your balance: Your creditor will look favorably on your request if your credit report shows a spotless payment history and you consistently pay off your credit card balance each month.

- You just received a raise: Getting an increase in your salary improves your debt-to-income ratio, which shows your creditor that you can manage more debt.

- You have fewer expenses: If youve paid off some of your other debts or your outgoing expenses have dropped for some other reason, then this will also reduce your debt-to-income ratio and show your creditor that you can handle having more debt.

You May Like: Does Comenity Bank Report To Credit Bureaus

How To Avoid A Credit Limit Reduction

Usually what goes up must come down, or but that doesnt have to be true in the case of your credit limit. Watch out for these few instances where you may actually see your credit limit be by your lender:

- Inactivity or low credit utilization: Not using enough of your credit limit can result in a reduction.

- Elevated credit utilization: On the other side of the spectrum, using too much of your limit can put you at risk for a reduction. Balance is key.

- Late or missed payments: If you consistently dont pay on time or enough, your lender may restrict your limit.

- Drastic change in buying habits: If you suddenly start dropping thousands of dollars left and right, your lender may reduce your credit limit to mitigate any issues.

Essentially, if your lender believes you arent using the card enough, youre going overboard or youre using it irresponsibly, they can reduce your credit limit. They dont necessarily have to let you know, thoughtheyre only required to notify you if your limit is cut due to a missed payment, if you make only minimum payments on a high balance or if you show another red flag, according to the Fair Credit Reporting Act.

When it comes to avoiding a credit limit reduction and keeping your credit health in top shape, its best to review your credit report regularly to spot any changes and make payments on time, ideally above the minimum amount. To learn more about credit and credit repair services, reach out to our team of credit advisors.