How To Improve Credit Score Where Better Credit Is Due

Having trouble paying your bills on time? Millions of Americans are woefully behind on credit card payments, utility or medical bills, even parking tickets and may not understand the devastating effect on late payments or not paying at all can have on their credit. A study released in late July by the Urban Institute found that 35% of Americans have debt that has gone into collection… Continue Reading

How Much Credit Do You Want

Once you know your credit limit, ask yourself how much credit you want. Increasing your available credit can boost your credit score and improve your purchasing power, so you might be tempted to ask for a large amount of credit at oncebut dont make a request thats so large its likely to be declined. If you have a $5,000 credit limit, its better to request an increase to $6,000 than it is to request an increase to $10,000.

Keep in mind you may not even get to suggest a number. When you apply for a Discover credit limit increase online, for example, Discover will determine how much of a credit line increase to offer you. To give you an idea, you can compare your credit report at the time you were given the original credit limit to your current credit report. Your credit is a major factor in how issuers determine your credit limit when you apply for a card.

How Long Does A Discover Credit Line Increase Take

While there isnt an official statement on how long a Discover credit line increase takes, many credit line increase requests are implemented as soon as the request is approved. In other words, if you request a Discover credit limit increase and get approved, your new credit limit could take effect that same day.

In most cases, a credit line increase request will be accepted or denied within minutes. In some cases, it may take a few days to learn whether or not your credit limit request will be approved .

Recommended Reading: Why Do You Need A Good Credit Score

Why You Should Check Your Credit Scores

Companies use your credit scores to make a number of decisions, including whether to approve you for loan applications, insurance premiums , rental requests and, in some states, even employment applications. How high or low your scores are can influence everything from how much interest youll pay on your next loan to whether you get your dream job or apartment. Thats why its important to know how your scores stack up. And dont worry checking your scores is considered a soft credit inquiry, so your credit wont be affected.

Consider A Balance Transfer

One of the best ways to pay off outstanding credit card balances is through a balance transfer. The balance transfer process allows you to transfer your credit card debt onto a single balance transfer credit card, which can help you consolidate your debt into a single monthly payment. Plus, many of the top balance transfer on balance transfers for up to 18 months, giving you over a year to pay off your transferred balance without added interest.

Read Also: How To Maintain A Good Credit Score

Get Your Free Fico Credit Scores From Discover

Keeping an eye on your credit is important for staying on track financially.

Discover makes it virtually hassle-free to monitor your credit and FICO score each month.

If you have another credit card that offers FICO scores from Equifax or Experian, you can get a more complete picture of your credit score.

If you’re considering opening a Discover credit card account to take advantage of Social Security number alerts, do your research first.

Check the rewards, fees and annual percentage rate to make sure you’re picking a card that best fits your needs and spending habits.

disqus_bY6jsUm3H5

Saturday, 08 Aug 2020 11:09 AM

Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. This compensation may impact how and where products appear on this site . These offers do not represent all account options available.

Editorial Disclosure: This content is not provided or commissioned by the bank advertiser. Opinions expressed here are authorâs alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. This site may be compensated through the bank advertiser Affiliate Program.

Are You A Score Star Test Your Knowledge Of The Fico Score With This Video Quizvideo Quiz

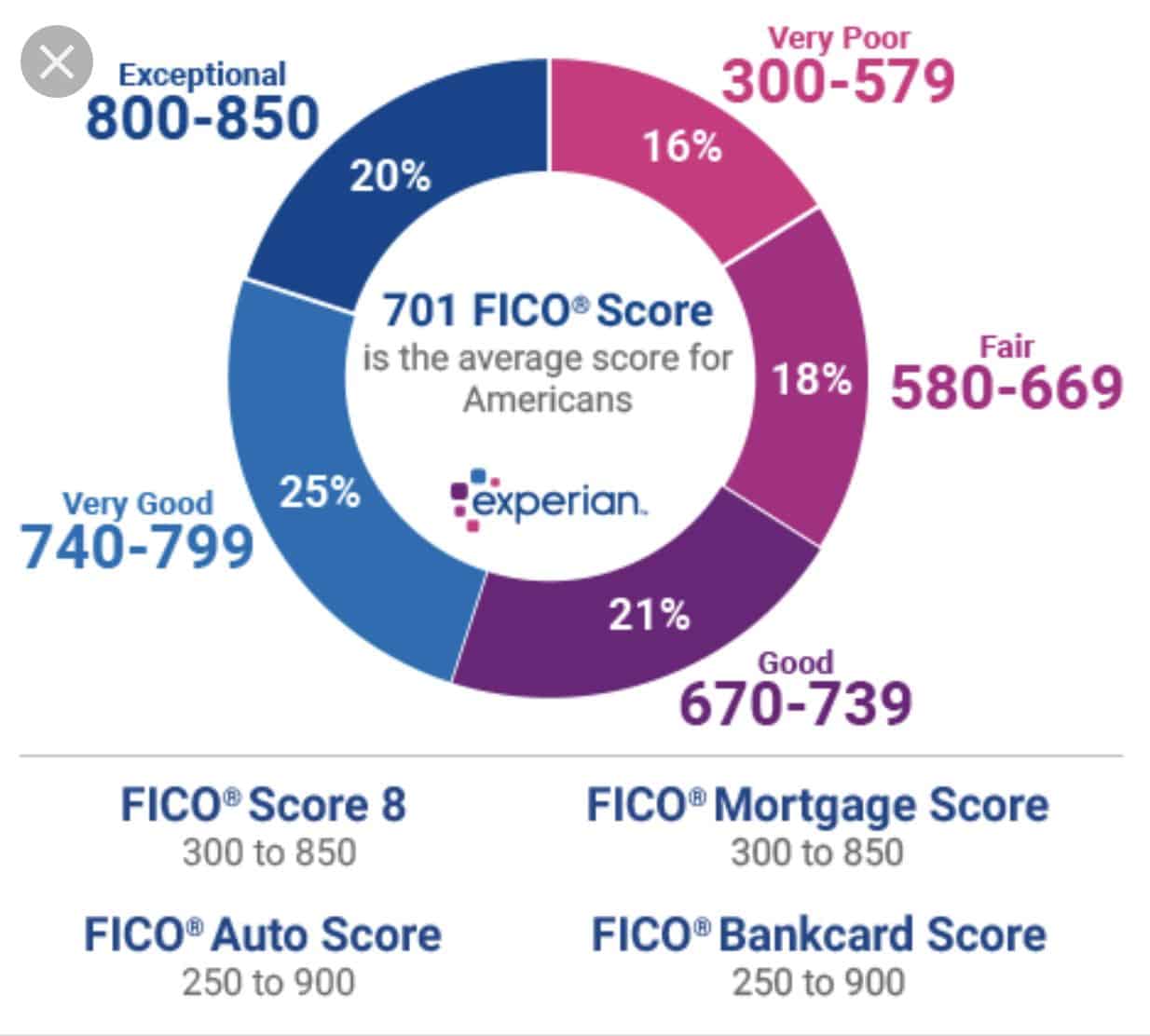

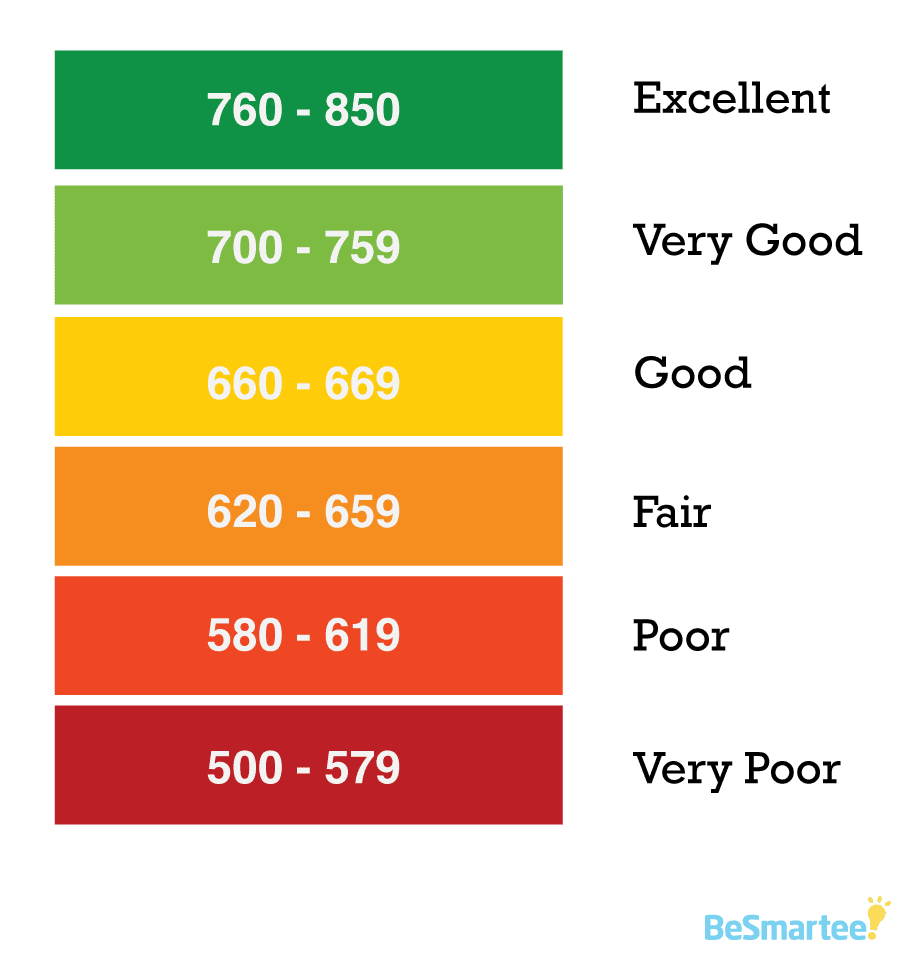

The FICO® Score is a three digit number ranging from 300-850 that summarizes your credit risk, based on a snapshot of your credit report at a particular point in time. It helps lenders predict how likely you are to repay your debts on time. Its important to know and manage your FICO® Score because it affects whether you can get credit and what kind of interest rate you will pay for credit cards, auto loans, mortgages and other kinds of credit. The video quiz below will test your knowledge of the FICO® Score. After viewing the quiz, you can go to www.myfico.com to learn more facts and fallacies about the FICO® Score as well as tips and tricks for maintaining and improving your FICO® Score.

Recommended Reading: How To Improve Your Credit Score

Fico Scores Are Commonly Used By Lenders To Assess Your Credit Risk But Other Credit Scores Can Also Give You A Good Idea Of Where You Stand

In other words, your FICO® scores are just one type of credit score you can get. This is because FICO is a company that creates specific scoring models used to calculate your scores. But there are other companies that use different scoring models to determine your credit scores, too.

VantageScore is an example of one of these companies. Both FICO and VantageScore offer credit-scoring models to evaluate the information in your credit reports and issue a corresponding credit score. These scoring models evaluate many of the same factors when looking at your credit reports and calculating your scores, but they differ very slightly.

Thats why you may see different credit scores depending on which scoring model is used. Your scores can also differ depending on which consumer credit bureau report Equifax, Experian or TransUnion the scoring model pulls your information from.

How To Increase Your Chance Of Approval

Before you apply, check your credit score. There are many ways to check your credit score online for free. In fact, Discover cardholders can use the Discover Credit Scorecard to get a FICO credit score for free.

Once you know your credit score, youll know whether or not its worth applying for the Discover it Cash Back credit card. Remember, Discover is looking for people who have established good credit, so youre going to need a FICO credit score of 670 or higher. If youre using the VantageScore credit scoring system, youll want a score of 700 or higher.

If your credit score isnt quite there yet, its worth taking the time to improve your credit score before applying for the Discover it Cash Back credit card. The best way to improve your credit quickly is by paying off your outstanding balances, which reduces your credit utilization ratio and increases your credit score. Youll also need to make on-time payments on your existing credit cards before you can qualify for the Discover it Cash Back card, so if youre having trouble remembering when your credit card bill is due, consider signing up for to make sure you never miss a deadline.

Also Check: How Much Will Credit Score Increase After Paying Off Collections

How To Check Your Credit Score

At a glance

Checking your credit score is as easy as visiting a free online scoring website, checking your credit account statements, or signing up for a credit monitoring service.

Instantly access your report and discover your credit score from all three credit bureaus.

Fresh advice you can trust

We promise to always deliver the best financial advice that we can. That’s our first priority, and we take it seriously. Our writers and editors follow strict editorial standards and operate independently from our advertisers and affiliates. Learn more about how we make money.

You probably know your credit score can affect your ability to open a credit card or finance large purchases, such as a house or a car. This means that before you can begin shopping around, you need to first know how to check your credit.

Checking your credit score is a little more complicated than just checking your credit report . 1

Well cover all the ways to check your credit score , why it matters where you get your score from, and why checking your credit score is important.

| Anyone |

How To Apply For A Discover Card Credit Line Increase

In some cases, you dont have to do anything to get a credit line increase with Discover. Depending on your creditworthiness and account history with Discover, you may be eligible for an increased credit limit automatically.

If you havent received an automatic credit limit increase yet, you have three options to formally request one.

Don’t Miss: Does Chime Report To Credit Bureaus

Credit Score Fluctuations Throughout The Month

One of the great things about credit scores is that theyre constantly changing. You may see a different score if you check your credit score at different times of the month.

The frequency with which your credit score is updated depends on the number of credit accounts you have. This is because credit scores are based on the information shown on your credit reports, and your creditors wont all necessarily update your credit file at the same time.

While its completely normal for your credit score to change throughout the month, these changes highlight how important it is to use the same website and model version when monitoring your credit.

Will My Fico Credit Score Ever Be Unavailable

- You have mismatched or missing information, like an address change that hasnt been updated with either Discover or TransUnion®.

- Your account status is abandoned, bankrupt, fraud, lost or stolen, closed, revoked or charged off.

- You have a foreign address.

- Your credit history is too new.

- You have opted out.

- Youve had no account activity for 180 days, in which case the score will also be unavailable online or on our mobile app.

Also Check: When Do Defaults Drop Off Credit Report

When Does Discover Report To Credit Bureaus

Like most large financial institutions, Discover seems to report to all three major credit bureaus approximately once per month. This reporting typically occurs around or just after the same time a cardmemberâs monthly billing statement is issued. In some cases, changes to your credit report will appear immediately. In others, changes may take more than a month to appear on a report.

Why We Recommend Secured Credit Cards

Secured credit cards are a great way to build your credit from the ground up or repair a history of bad credit.

Youll still need to apply for one just like a regular card, but the eligibility criteria are a lot more inclusive in most cases.

With responsible use, a good secured credit card will eventually help you graduate to a regular credit card with much better terms.

Recommended Reading: How Long Until Bankruptcy Is Off Credit Report

How To Build Credit With A Secured Card

If you have bad credit you will want to improve it. A secured credit card can help you do that.

Remember two key factors.

- Payment history is the most important part of your credit score. Make your payments on time.

- is also a critical part of your score. This is the percentage of your credit limit that you actually use. Keep your balance below 30% of your credit limit. Lower is better!

Here are some steps that will help.

- Use your card. A dormant card will contribute less to your credit than an active card.

- Pay every bill on time. On-time payments build credit. Late or missed payments kill credit.

- Pay every bill in full. Any balance carried past the due date incurs interest. Thats money out of your pocket.

- Watch your balance. Secured cards often have low credit limits. That makes it easy for your to rise.

Heres a proven way to build credit

Find a recurring monthly bill that you pay anyway, like your Netflix subscription. Make sure its under 30% of your credit limit. Put it on your card and set up an automatic payment from your bank. Your card will be active, the bills will be paid on time, and your credit utilization will stay low. Put the card away and forget about it.

You can even get a second secured card and do the same thing with another bill. If you use no-fee cards it wont cost you a dime, except for the money you deposit, and youll get that back.

Does Checking Your Credit Score Lower It

When a consumer checks their own credit score, it is treated as a soft credit inquiry that is not reflected on their credit report. For that reason, checking your credit score does not lower it. Instead, are based on five major factors: payment history , amount of debt , length of credit history , amount of new credit and credit mix . We recommend you check your credit score at least once a month.

Recommended Reading: When Does Kohls Report To Credit Bureau

Should You Use Discover Credit Scorecard

Discover Credit Scorecard is a great way to keep an eye on your FICO score and the factors that go into determining it. We like Discovers free FICO credit score checker so much that were sorry to see the company make this service available only to its Discover customers. If youre in the market for a new credit card, the free Discover FICO score tool might be enough to make you take a closer look at what this credit card company has to offer.

However, the Discover Card free credit score is not the only free credit check tool available. If you arent a Discover customer and dont plan to become one, take a look at some of the other good free credit score websites instead. Each of these services takes a different value-added approach to free credit monitoring, with extras available, such as personalized credit offers, financial calculators and tools, credit score simulators, and credit repair tools. So check out our picks for the best free credit check sites, and choose one or two that deliver the most value for you.

After all, theyre free! And using them to monitor your credit wont negatively impact your credit score. But because these monitoring tools can help you improve your credit score, theyre definitely worth your time.

For more information on credit scores, check out some of our other resources:

Free Credit Scoring Website

One of the best ways to check your credit score for free is by visiting a free credit scoring website. These websites typically offer access to your credit report, score and/or credit monitoring and are updated anywhere from weekly to monthly. Theres no fee to sign up for basic credit score updates. However, some websites offer more advanced services for a monthly fee.

Also Check: Does Income Affect Credit Score

What’s In It For Discover

There’s no obvious benefit for Discover to offer free FICO credit scores. They don’t collect any fees from consumers in exchange for the scores.

Your personal information could help Discover’s marketing or product development, however.

Discover says:

They never sell personal information to third parties if that’s something you’re worried about.

If your information is used for marketing, you could be on the receiving end of targeted ads. Whether you choose to apply for a Discover credit card or not is entirely up to you.

To be fair, Discover does have some solid credit card offerings.

The Discover it card, for example, might be one you’d consider if you’re looking for a card that offers a high quarterly cash back bonus.

What Else Do I Need To Get Approved For The Discover It Cash Back Card

Theres no guarantee that you will be approved for a credit card, regardless of how high your credit score is. Your credit score is probably the most important factor when considering your credit application. However, Discover also considers other factors such as your income, debt, and any negative items on your credit report.

Recommended Reading: What Does A Credit Report Show

Ive Got My Fico Score Is This What Lenders Will Use

When you hear credit score, you may think of it as a monolithic entityyou have one credit score and thats what lenders use when they are deciding whether to extend credit to you. But the reality is very different.

Youre more likely to have dozens of scores. Why?

It all starts with your credit report. Credit scoring models use the information in your report to generate a 3-digit credit score by using a proprietary algorithm. Basically, the score is a grade of how well youre doing, credit-wise.

Heres where it gets nuts. FICO actually has dozens of credit scores. The three credit bureaus, Equifax, Experian, TransUnion, offer credit scores as well.

A lender may use any one of these scores when making a decision they may use a credit score model but tweak it with some of their own proprietary information some lenders are even building their own scores.

For example, your TransUnion credit score might be 760 but your Discover Scorecard score is 20 points lower. This can be really confusing when youre thinking of applying for credit.

Whats key for you to know is that the scores are all generated from the same underlying information: your credit reports. If you want to see your score improve, focus on the things in your reports that you can positively affect, such as making all of your payments on time and by spending as little of your credit limit as possible .

Answered by Korrena Bailie