How To Build Up Your Credit Score

Your FICO® Score is solid, and you have reasonably good odds of qualifying for a wide variety of loans. But if you can improve your credit score and eventually reach the Very Good or Exceptional credit-score ranges, you may become eligible for better interest rates that can save you thousands of dollars in interest over the life of your loans. Here are few steps you can take to begin boosting your credit scores.

Consider credit score monitoring. Continually tracking your FICO® Score can provide good reinforcement for your score-building efforts. Marking steady upward progress is good incentive to maintain healthy credit habits. And monitoring will also alert you to any sudden credit-score drops, which may be a sign of unauthorized activity on your credit accounts.

Avoid high credit utilization rates. High , or debt usage. The FICO® scoring system bases about 30% of your credit score on this measurementthe percentage of your available credit limit represented by your outstanding payment balances. Try to keep your utilization across all your accounts below about 30% to avoid lowering your score.

Consumers with good credit scores have an average of 4.6 credit card accounts.

Can I Get A Car / Auto Loan W/ A 733 Credit Score

Trying to qualify for an auto loan with a 733 credit score is relatively cheap. There isn’t as much risk for a car lender . Taking out an auto loan out with a 733 credit score, shouldn’t be very difficult.

It gets even better.

You can improve your loan terms with a few simple steps to repair your credit.

An ideal option at this stage is reaching out to a credit repair company to evaluate your score and see how they can increase it.

How To Improve Your 733 Credit Score

A FICO® Score of 733 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 733 FICO® Score is on the lower end of the Good range, you’ll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range .

53% of consumers have FICO® Scores lower than 733.

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, you’ll receive information about ways you can boost your score, based on specific information in your credit file. You’ll find some good general score-improvement tips here.

Don’t Miss: Syncb/ppc On Credit Report

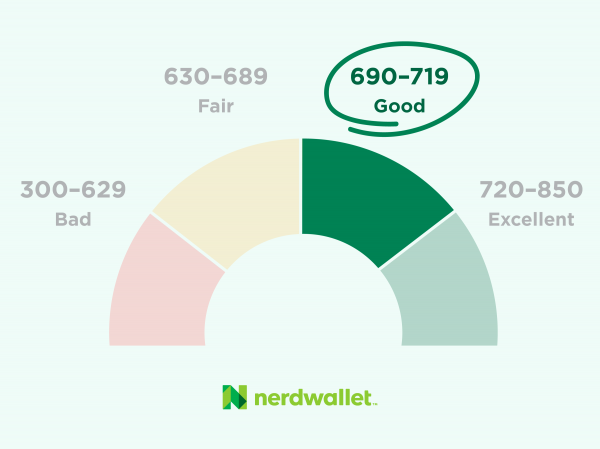

Breakdown Of A Credit Score Rating

So far, this article has only discussed two of the credit score groups which you could move into Good credit score group and Excellent credit score group but there are a range of others that you could fall into if you do not manage your debts very well. These are fair, poor and bad.

A fair credit score would fall into the 650 699 range, if you fall into this bracket it means that you have likely missed a small number of payments on a debt. In general, around 15% of people fall into this category. A poor score means that you have missed several payments over an extended period or have missed a payment on multiple occasions. In can also mean you have a lot of debt at present and would be unlikely to be able to repay any further loans, about 20% of people have this rating.

At the bottom of the scale is a bad score, here you are likely to have had a legal judgment registered against you or in a worst-case scenario been declared bankrupt at some point. The main factor driving you credit score is how well you have managed to make repayments and as shown above these drive your credit rating which is especially true in this case. If you are in this bracket you are in the 8% of the borrowing population.

Have A Credit History

You not only want a good record of paying your bills and credit cards on time, but you also want a long history of doing so. The older your credit accounts are, the better your credit score will be. You want to have credit accounts that have been open for 10 years or more.

Length of credit history accounts for 15% of a credit score, and closing old accounts can affect your credit score, Ross says.

Also Check: What Is Coaf On Credit Report

What Is A Good Credit Score And Tips To Maintain It

Get answers to commonly asked questions related to the credit score and credit reports

If you are wondering what exactly constitutes a good credit score and how it is calculated, we have all the details for you. Read on to find out everything about a good credit score and the various benefits it offers.

About Good Credit Score

How To Fix A 733 Credit Score

In summary your credit score determines your ability to borrow. Its important that you manage it. If you have 733 credit score then your focus should be on driving it higher. To do this follow these simple tips:

- Pay down your debt If you have debts but also have savings then you need to ask yourself do you need all that cash in the short term? Could it be used better if it was spent on paying down debt? This would be an excellent use of your funds in a low interest rate environment and would have the beneficial affect of moving your 733 credit score even higher.

- Get a credit report Like everything else in life mistakes can happen in any area and that includes the record of your debt repayments. Its possible to get a credit report to see if all the information that lenders have on you is correct. If it is not and there are records which indicate that you missed a payment which you never missed, or you applied for finance at an institution you have never even heard of then you need to correct that. Correcting those errors will also drive that score towards excellent.

- Avoid short term debt Before you take on short term debt do a simple mental exercise. Consider an item you wish to buy, look at the price, now ask yourself what the real price is if you use short term finance given the high interest rates that can apply. In some cases, this can mean that the item will cost you twice as much as the list price. At that price is it still something that you wish to buy?

Read Also: Does Qvc Do A Credit Check

Whats A Good Credit Score Range

A good credit range depends on where a score comes from and whoâs judging it. Itâs important to remember that lenders set their own and standards to determine creditworthiness. That means what FICO, VantageScore or anyone else considers good may not all be the same.

Keep that in mind as you read what might be considered a good credit score range.

Whatâs a Good FICO Credit Score Range?

When it comes to âwhatâs good,â FICO says scores between 670 and 739 qualify. Scores in that range, it adds, are near or slightly above the U.S. average.

Whatâs a Good VantageScore Credit Score Range?

When it comes to VantageScore, scores between 661 and 780 might be considered good.

If I Have A 733 Credit Score What Interest Rate Will I Get On My Car Loan

Iâve been struggling to find a job in my career field thatâs close to me, so I think Iâm going to have to commute. I have some money saved up for a car loan, but Iâm not sure what to expect in terms of interest. Will a 733 credit score get me a good loan?

definitely qualify for at least one car loan3.64%very close to the very good range

- Paying any overdue debts

- Reducing the amount of credit youâre using

- Making all payments in full and on time

Read Also: Does Carvana Report To Credit Bureaus

Whats A Good Credit Score

So, what is a good credit score, anyway? Lets start at the beginning.

According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

Is 733 A Good Credit Score

Are you wondering if a 733 credit score is good?

Many people are curious about what their credit scores mean and how to improve them. In this article, well tell you everything you need to know about your 733 credit score and why it matters.

If you want to get approved for the best rates on loans from a financial institution, then having a high credit score is essential. Our goal is to provide information that helps consumers make smart financial decisions when it comes time to buy something like a house or car with financing attached.

The higher your score , the lower interest rates lenders will offer on mortgages, auto loans, and other types of credit debt they may extend to borrowers who have poor or no credit history at all.

Its important not only because these rates can be hundreds of dollars less per month but also because they could save thousands over the life of the loan itself. That means getting an excellent rate could save someone tens of thousands in interest payments over time which would otherwise go towards paying off their debts rather than building wealth through savings accounts or investments like stocks and bonds.

In this article, Well break down the FICO credit score range, factors that impact your credit, what a 733 credit score will get approved for, and finally, what you can do to improve your score.

You May Like: How Do Credit Scores Work When You Get Married

What To Do Before Applying For A Credit Card If Your Fico Score Is 700 To 749

Even if youve been in the 700 to 749 credit score range for a long time, never assume thats still the case. Credit scores are a moving target! The score you have today will be different a month from now, and again a year from now.

For that reason, there are a few steps you should take before you even make application for a credit card.

Can I Get A Personal Loan Or Credit Card W/ A 733 Credit Score

Like home and car loans, a personal loan and credit card isn’t very difficult to get with a 733 credit score.

You donât need to apply for a secured card with Discover or Capital One, who may make you pay $500-$1000 just for a deposit.

You can get even better terms on your personal loan or credit card by repairing your credit and waiting a few short months until your score improves.

A 733 score means you likely have a few-no negative items on your report. Removing any outstanding negative items is usually the quickest way to fixing your report.

We recommend speaking with a friendly credit repair expert online to help guide you through this process. Your consultation is completely free, no-pressure, and will set you on the right path toward boosting your score.

Also Check: Eos Cca Pay For Delete

Fico Score Vs Credit Score

You may find dozens of credit scoring models, each with its own algorithm to determine your credit score. Common credit scoring models include:

-

FICO Score

-

TransRisk

-

Insurance Score

Most lenders use FICO Scores to determine if you qualify for a loan or .

The FICO Score model has more than 30 variations, including multiple base FICO Scores and industry-specific scores. Still, 90% of companies use the FICO Score 8 model when qualifying someone for a loan or credit card.

Because of its widespread use, the term “credit score” generally refers to your FICO Score 8.

Credit Score Is It Good Or Bad How To Improve Your 733 Fico Score

Before you can do anything to increase your 733 credit score, you need to identify what part of it needs to be improved, plain and simple. And in order to identify what needs to be improved, you should probably be aware of all the things that count and dont count towards your score.

Read Also: What Credit Score Does Comenity Bank Use

+ Credit Scores By Income

700+ Credit Scores by Income

People who make at least $50,000 per year are significantly more likely to have a credit score of at least 700. And people who pull in $75,000 to $99,999 per year are in the sweet spot for a score that begins with a 7 or an 8. But note that it is possible to get into the 700-plus club if you earn less or wind up with a way lower score even if you make a lot more. Its all about spending within your means.

How To Find The Best Credit Cards If Your Fico Score Is 700 To 749

If youre in this credit score range, the best credit cards arent hard to find. Nearly all types of cards will be available to you.

At this credit score range, it will be less a matter of finding cards you qualify for, and more about selecting the ones you like best.

Whats more, traditional factors, like annual fee and interest rate become less important. Credit cards in the 700 to 749 range offer the kinds of perks that can actually enable you to come out ahead in using the card. That is, the rewards and benefits will be higher than the annual fee, and even the interest expense if you make a habit of not carrying an outstanding balance.

This guide will offer nine different credit cards if your FICO Score is 700 to 749. You can simply choose the card that offer the best combination of rewards and benefits for you.

Read Also: Paypal Credit Reporting To Credit Bureaus 2019

How To Check Your Credit History

You have the right to obtain your Credit Information Report in order to determine your current credit score. A score will be mentioned in your CIR. You can access your Credit Information Report on the CIBIL website. You will be required to fill in some cursory details like your name, ID details, date of birth, contact details, phone numbers, etc. Post that you will be asked to make payment towards your CIR which will come to approximately Rs.470 .

What Is A Good Fico Score

A good FICO score lies between 670 and 739, according to the company’s website. FICO says scores between 580 and 669 are considered “fair” and those between 740 and 799 are considered “very good.” Anything above 800 is considered “exceptional.”

According to FICO, the average credit score in 2021 was 716, which falls in the good range.

FICO comes from Fair Isaac Corp., the company that first developed a credit scoring system. It uses data about consumers from the three major credit reporting bureaus: TransUnion, Equifax and Experian.

FICO scores typically express a consumer’s creditworthiness as a number between 300 and 850.

Recommended Reading: How To Remove A Repossession From Your Credit Report

Why Do Banks Check Your Credit Score Before Issuing A Credit Card

Banks can analyse your record of late payments and defaults by checking your credit score. Additionally, banks can view a record of any loans or credit cards that you currently hold. Banks also use CIBIL score to gauge your diligence towards paying credit card bill.s Furthermore, banks use CIBIL scores to check the number of credit card and loan applications made by you.

Bank oftentimes reject a loan or credit card application due to bad credit history. In fact, having no credit history is also considered poor credit history.

How To Maintain Your Credit Score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. Thats the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 Thats because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

Legal

Don’t Miss: Usaa Free Credit Report

How To Get A 733 Credit Score

While theres no exact formula to achieve a specific score, you can aim to get within a general score range. Even taking the different credit scores and definitions of good credit into account, there are general principles that can help you build and maintain healthy credit. Sticking to these principles over time can raise your scores, making you a better credit risk in lenders eyes.

Here are some actionable tips to help you stay on top of the important factors that can affect your credit.