What My Improved Credit Score Allowed Me To Do

In August of 2011, I had to purchase a car so I could switch jobs.

When I filled out the credit application to see if I qualified for lower financing rates, my credit score came back as 731.

In other words, I raised my credit score from 621 to 731 in just five months!

This is a very big deal because, at 621, I would have been denied a loan for the car, or would have had an interest rate that exceeded 9% on the auto loan.

Since I chose to get a secured credit card, I was able to take the car loan on my own and qualify for the low rate of 3.99% financing.

The difference in the loan between the two interest rates would be $750 over the life of the loan, far surpassing the cards annual fee, and the opportunity cost of my secured credit card holding my $1,100 for five months.

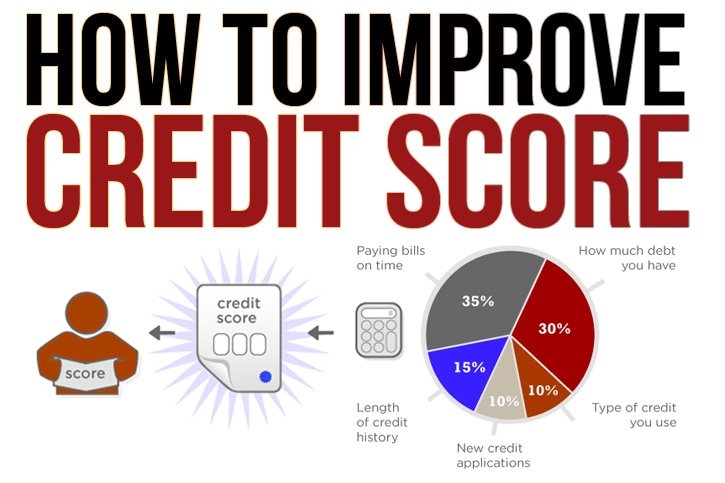

How Your Credit Score Is Calculated

Your FICO credit score is calculated using an algorithm created by FICO.

Payment History 35% Payment history includes on-time payments, late payments, account status, and collection accounts. Late payments negatively affect your score for 36 months.

30% The total amount of debt you have includes car loans, mortgages, credit card balances, and any other loan. Collection accounts that have been charged off arent included.

Length of credit history 15% This includes the average age of your current open accounts. If you have a bunch of accounts you recently opened, it will shorten your average account age and lower your score. Keep revolving accounts such as credit cards and lines of credit open for as long as possible.

New Accounts 10% This is made of credit inquires and recently open credit accounts. The more credit inquires you have in the last 24 months the lower your score will be. The good news is that after 24 months, the inquiry drops off your report and no longer affects your FICO credit score.

10% The different types of credit accounts you have impacted your score. It is not good to have five credit cards open and nothing else. If you have credit cards, student loans, a mortgage, a personal loan, an auto loan, it shows credit mix diversity.

Check Your Credit Report For Errors

One way to quickly increase your credit score is to review your credit report for any errors that could be negatively impacting you. Your score may increase if you are able to dispute them and have them removed.

About 25% of Americans have an error on their credit reports, so it’s important to take the time to review. Some common errors to look out for include fraudulent or duplicated accounts, as well as misreported payments.

“Most of the clients we meet with have not reviewed their report within the past year, and are often surprised by what we find to discuss with them,” says Thomas Nitzsche, a financial educator at MMI.

You can get a free credit report from the three major credit bureaus on a weekly basis by going to AnnualCreditReport.com now through April 2021.

Also Check: Does Opensky Report To Credit Bureaus

Become Someones Authorized User

“Find a relative or friend with good credit who is willing for you to become an authorized user on their card,” said Paul Lightfoot, president of Optima Asset Management.

“Once authorized, their account will show up on your credit report. You are essentially ‘inheriting’ the credit history of that account,” he added. “The other person’s account must have a good history of payments and an excellent balance ratio for this to succeed. This approach is ideal for young adults who do not have a long credit history.”

Boost Credit Score Overnight

Before we get started, its important to understand how long it takes something to affect your credit report. Most lenders and creditors send information to the credit reporting agencies every month. Therefore, its hard to move your score up in a day or two. Boosting your credit score quickly means increasing it over the course of 3-6 months.

Also, you need to be careful about which methods you use to boost your score. Before you use any of these methods, you should make sure that you understand your credit report. Your report will tell you what factors are affecting your score.

For example, if you have a lot of collections entries from the past, but dont carry a credit card balance each month, then taking steps to raise your credit limit wont necessarily boost your score. In fact, taking out new accounts could lower your score from the credit checks.

Its also important to realize that there are lots of scams and illegitimate actors when it comes to credit and lending. Make sure you dont fall for a scam. If someone says they have a way to increase your score quickly in 24-48 hours, you should be very suspicious. After all, if it were that easy to raise your score that fast, then everyone would be doing it. There are no credit secrets or credit hacks that can cause your score to jump overnight.

Read Also: Does Speedy Cash Do Credit Checks

Challenge Late Payments Collections And Charge Offs

I have written many articles about removing late payments, collections, and charge offs, so I dont want to get super specific here.

Instead Ill share an overview and then point you to the articles that will tell you how to execute the techniques.

Basically, in order to remove these negative items, youll need to follow a couple of steps. First, you need to write the original creditor a Goodwill Letter.

This letter will simply explain the situation that led up to the late payment, collection or charge off.

At the end of the letter, youll ask that they consider making a goodwill adjustment and remove the entry from your credit report. Its simple.

What If A Goodwill Letter Doesnt Work?

If the goodwill letter doesnt work, youll need to follow more advanced techniques to get the negative entry removed.

The advanced techniques are outlined in each one of the following articles depending on the type of negative entry:

How Can I Check And Monitor My Credit

You can check your own credit it doesn’t hurt your score and know what the lender is likely to see.

You can get a free credit score from a personal finance website such as NerdWallet, which offers a TransUnion VantageScore 3.0.

It’s important to use the same score every time you check. Doing otherwise is like trying to monitor your weight on different scales or possibly switching between pounds and kilograms. So, pick a score and get a game plan to monitor your credit. Changes measured by one score will likely be reflected in the others.

Remember that, like weight, scores fluctuate. As long as you keep it in a healthy range, those variations wont have an impact on your financial well-being.

Recommended Reading: Aargon Collection Agency Payment

Check And Understand Your Credit Score

Its important to know that not all credit scores are the same, and that they fluctuate from month to month, depending on which credit bureaus lenders use and how often lenders report account activity. So, while you shouldnt worry if you see your scores rise or fall by a few points, you should take note when a big change occurs.

The two main consumer credit scoring models are the FICO Score and VantageScore. Here are the factors that comprise your FICO Score and how much each factor is weighed:

- Payment history

- Amounts owed

- Length of credit history

- New credit

Here are the factors influencing your VantageScore:

- Total credit usage, balance and available credit

- Payment history

- Age of credit history

- New accounts

There are a variety of options for checking your credit score for free.

For example, consumers can get a free FICO Score from the Discover Credit Scorecard even without having a Discover credit card, and a free VantageScore by creating a LendingTree account. American Express and Capital One also offer free credit scores to both card account holders and the general public, though many other card issuers offer free access only to their cardholders.

Here are the tiers that credit scores can fall into, according to FICO:

| FICO Score tiers |

| Poor credit |

Keep Credit Balances Below 30%

Your credit utilization ratio has a pretty sizable impact on your overall credit score. Its best to keep your credit utilization ratio under 30%. For example, if your monthly credit card limit is $1,000, do not use more than $300.

Consider opening another credit card account if you need to use over 30% of your credit every month. Splitting your credit over multiple accounts allows you to stay under the 30% threshold, as long as you pay the balances successfully.

You can also increase your credit limit to increase your utilization. If you spend $500 a month on your credit card and your credit limit is $1,000, your credit utilization would be 50%. If you increase your credit limit to $1,500 but still spend $500, your credit utilization is now 30%.

Simply ask your credit card issuer or other lender for a credit limit increase. They arent required to, so you may get denied if you have a history of poor payment and spending habits. However, if you have been a good borrower, your provider should be willing to increase your credit limit.

You May Like: Credit Score 698

What Goes In To A Credit Score

There are 5 primary factors that influence your credit score. This section will give a brief explanation of each factor.

Length of Credit History

The length of your credit history is surprisingly important to your credit score. Thats because the more credit history you have, the more information credit reporting agencies have to give you a score. Credit scores work differently than other scores. If you open your first credit card and make a payment on time, you dont start with a perfect score. The longer your history, the higher your score will be.

is the second largest factor in your credit score. This looks at how much revolving debt you have available compared to how much youre using. Revolving credit is things that you can use repeatedly, like credit cards or lines of credit. Thats different from loans which you get in a lump sum. Those are known as installment debt.

The less of the credit you utilize, the better your score. If you have a $10,000 limit on your credit card and you use $5,000 of it, then youre using 50% of your credit. The more credit youre using, the greater the risk that youll default on your obligations. Thats because high credit utilization is a strong signal that you are having money problems.

Payment History

New Credit

For example, if you apply for a personal loan with 5 different banks, all of the checks will appear on your credit report. But your credit score will treat these as one credit check, not 5.

Check Your Credit Score

Most humans dont realize their credit score rating till a time comes after they want it.

Dont be such a humans!

Good credit score ratings are your passport to aggressive hobby charges for mortgages, cars, credit score card offers, coverage premiums, and more. Maintaining a excessive credit score rating is really well worth it as it will prevent from the cash youd pay in better hobby charges.

Luckily, its easy to study your credit score rating. I suggest the subsequent companies:

| Company |

|---|

| FREE |

Also Check: Does Paypal Working Capital Report To Credit Bureaus

Why You Should Let Your Kids Get A Secured Credit Card

To all of the parents out there who worry about letting their college kid apply for a credit card, I can tell you it worked for me in five months and will change my financial future for many years to come.

Secured credit cards offer a foolproof way to raise your credit score when it is not possible through a regular bank credit card.

Its a safe way to earn credit if you do not trust your kid to spend responsibly.

The worst that can happen with a secured card is that you cannot pay your bill, your company closes out the account, and they pay off your credit with the money you already have on deposit.

My secured card worked perfectly for me and I have now been accepted for a credit card with a major bank.

If You Have A Credit Card But No Installment Loans

Like the scenario above, adding an installment loan to a credit report that only features credit cards might be a wise move. By opening a new type of account, you may add diversity to your credit report mixture.

Yet opening a traditional installment loan for the sole purpose of improving your credit mixture presents a problem. Unlike credit cards, a traditional installment loan automatically causes you to go into debt.

However, there is a way to add an installment loan to your credit report without taking on debt in the process at least not in the conventional sense. Consider opening a .

With most credit builder loans, the lender will hold your loan proceeds in a Certificate of Deposit or savings account. After you make all of your monthly installments to pay off the loan, youll receive the funds to use as you please. You can then use those funds as you wish, perhaps even to establish an emergency fund to protect your finances and credit in the future.

Also Check: How To Add Utility Bills To Your Credit Report

Become A Credit Card Authorized User

If you’re looking to quickly establish your credit history — and, thus, your credit score — being a could help. In some cases, becoming an authorized user on an older account can also help improve your credit even if you already have a credit history. Not everyone looking at how to build credit fast already has a credit history.

Basically, authorized users are people who are added to someone else’s credit card account. The authorized user gets a card in their name and can make purchases with the account. Unlike the primary cardholder, authorized users are not legally obligated to make payments on the account.

Many credit card issuers will report the credit card account activity to the credit bureaus for both the primary account holder and the authorized user. As the authorized user, your credit score may benefit from both the credit history of the account and the credit limit.

If you’re starting from nothing, this is a great option for how to build credit fast. The important thing to note is that this only works if the credit card account is in good shape. Late payments or high balances can hurt both the primary cardholder and any authorized users.

Request A Credit Limit Increase

Paying down your debt is not the only way to decrease your credit utilization ratio. Another strategy is to increase the credit limit on your credit cards while keeping your balance at or below the same amount.

To request a credit limit increase, contact your card provider. It may run a credit check before approving the limit, which can ding your score by up to five points. Remember to not get greedy with a larger credit limit. If you decide to overuse your new limit, youll defeat the purpose of this strategy.

Don’t Miss: How To Report A Death To Credit Bureaus

Raise Your Credit Limits

If you tend to have problems with overspending, dont try this.

The goal is to raise your credit limit on one or more cards so that your utilization ratio goes down. But again, this works in your favor only if you dont use the newly available credit.

I dont recommend trying this if you have missed payments with the issuer or have a downward-trending score. The issuer could see your request for a credit limit increase as a sign that youre about to have a financial crisis and need the extra credit. Ive actually seen this result in a in credit limits. So be sure your situation looks stable before you ask for an increase.

That said, as long as youve been a great customer and your score is reasonably healthy, this is a good strategy to try.

All you have to do is call your credit card company and ask for an increase to your credit limit. Have an amount in mind before you call. Make that amount a little higher than what you want in case they feel the need to negotiate.

Remember the example in #1? Card A has a $6,000 limit and you have a $2,500 balance on it. Thats a 42% utilization ratio .

If your limit goes up to $8,500, then your new ratio is a more pleasing 29% . The higher the limit, the lower your ratio will be and this helps your score.

Keep Your Balances Low

The sweet spot for credit utilization for credit scoring purposes is 30% or lower. Try to pay down the outstanding balances on your revolving accounts to this percentage. If 30% is a stretch, pay as much as you can to start seeing an increase in your score.

You can also request credit limit increases to reduce this percentage without forking over a wad of cash. But heres the catch you must be disciplined enough not to use the card. Also, know that some credit card issuers perform a credit check to determine if youre eligible for an increase, which could lower your score by a few points.

Don’t Miss: Does Carvana Report To Credit Bureaus