Why Should You Settle An Account

Its important to remember that having unpaid debts will affect your credit score in a negative way. Creditors will consider you a high-risk borrower, which means these lenders will assume that youre less likely to pay back the amount you borrow from them. Theres a good chance youll end up with a higher interest rate when you obtain the loan too. Lenders use this additional interest to account for the perceived risk of lending to you.

Settled accounts may harm your credit history but their effects are much less averse when compared to listing an unpaid debt on your credit report. Creditors will look at credit reports with settled debts more favorably than those with unpaid debts. Settling an account may lower your credit score in the short term but its negative effect will lessen as time goes by.

Settling an account, paying it in full and closing it may help your credit score. Your payment history on that particular account will still appear on your credit report, which lenders can use as a reference to determine your ability to pay back debts.

How To File A Dispute To Remove Medical Debt From Your Credit Report

Note, under the amended rules, medical debt over $500 that is outstanding for over a year will appear on your report. Once it is paid, however, it will fall off your report.

You can check your credit report and get personalized credit-improvement tips for free here at WalletHub.

How do I remove negative items from my credit report?

You cannot remove a negative items from your credit report unless the information listed is incorrect. If the entry is an error, you can file a dispute with the three major credit bureaus to have it removed, but the information will remain on your report for seven years if it is accurate.read full answer

How To File a Dispute To Remove a negative items From Your Credit Report

If the information is correct and you pay off the outstanding debt, you can then ask the lender via phone or in writing to make a goodwill adjustment, removing the derogatory mark from your credit report. Although the lender is under no legal obligation to do so, goodwill requests are successful in many cases.

How long does a charge-off stay on your credit report?

How to Improve Your Credit Score After a Charge-Off

How Long Should Debt Stay On Your Credit Report

Most debts should come off your credit report within six or seven years. Some debts have a charge-off period of 180 days. This means that even if the debt is supposed to be removed within a certain period of time, such as seven years, the charge-off period of 180 days may be added to that, resulting in a total time of seven years and 180 days before the debt is removed from your credit report.

However, there are some exceptions. For example, a bankruptcy can stay on your credit report for up to 10 years. After filing bankruptcy, you should still always obtain a copy of your credit report. While you will see the bankruptcy listed, you should not see any of the debts that were discharged as part of your case. Still, even with a bankruptcy on your credit report, instilling healthy credit habits will help ensure the black mark on your credit report does not completely decimate your credit score so you can still start rebuilding your credit.

Once you obtain your credit report and see that old debts are still showing even though they should be removed, it is important that you know what steps to take.

Read Also: Can You Have A 900 Credit Score

Write To The Credit Provider

The first thing you should do is write to the credit provider. This is the person who obtained the judgement against you and who you owed money to. You should ask them to confirm, in writing, that you have paid them back. It is important to have this documentation to show that you have fully satisfied the judgement debt.

What Happens To Reporting Of Repayment History Information When You Have A Financial Hardship Arrangement

Your credit report includes your RHI for credit accounts like home loans, personal loans, personal overdrafts and personal credit cards. During a financial hardship arrangement, your RHI will show whether or not you met the requirements of the financial hardship arrangement .

Your credit report will also show that those payment obligations have been impacted by a financial hardship arrangement. This will be shown by a letter code of A or V that will go next to your RHI and will remain on your credit report for 12 months. However, your credit report wont include the reason for the hardship arrangement, or the details of the arrangement.

Visit for more information on financial hardship arrangements.

Also Check: Is 602 A Good Credit Score

How Do I Rebuild My Credit After Collections

Then consider these six basic strategies for rebuilding credit:

What Is A Collection On Your Credit Reports

A collection account is created when a debt youve failed to repay is transferred to a collection agency. Youre still on the hook for paying the debt once its sold, but you typically have to pay the collection agency instead of the original creditor.

Debts arent usually turned over to collections the moment you make a late payment, but the time between your first missed payment and the transfer can vary. It may take several months, it may happen immediately, or it may never happen at all, depending on the creditor.

Once the debt has been turned over to collections, its generally reported to the credit bureaus. Itll then appear on your credit reports and, as a result, damage your until its removed.

Also Check: Syncb Ppc

Also Check: Does Debt Consolidation Hurt Credit Score

Requesting A Goodwill Adjustment For A Missed Payment

If you are a loyal customer with a history of making repayments on time, your lender may consider removing a one-off missed payment from your credit file. To do this, you will have to contact them asking for a “goodwill adjustment”, which will serve to erase the errant missed or late payment. Lenders can be more likely to accept this course of action if you also agree to take steps to avoid missing future payments, perhaps by setting up an automatic monthly direct debit.

Do The Three Credit Reference Agencies Hold Identical Information About Me

No. The information CRAs obtain from public sources, such as electoral register data, bankruptcies and County Court Judgments should be similar, but information supplied by lenders may well be different. Some lenders supply data about their credit accounts to all three CRAs, while others only supply data to one or two agencies.

Recommended Reading: What Is My Real Credit Score

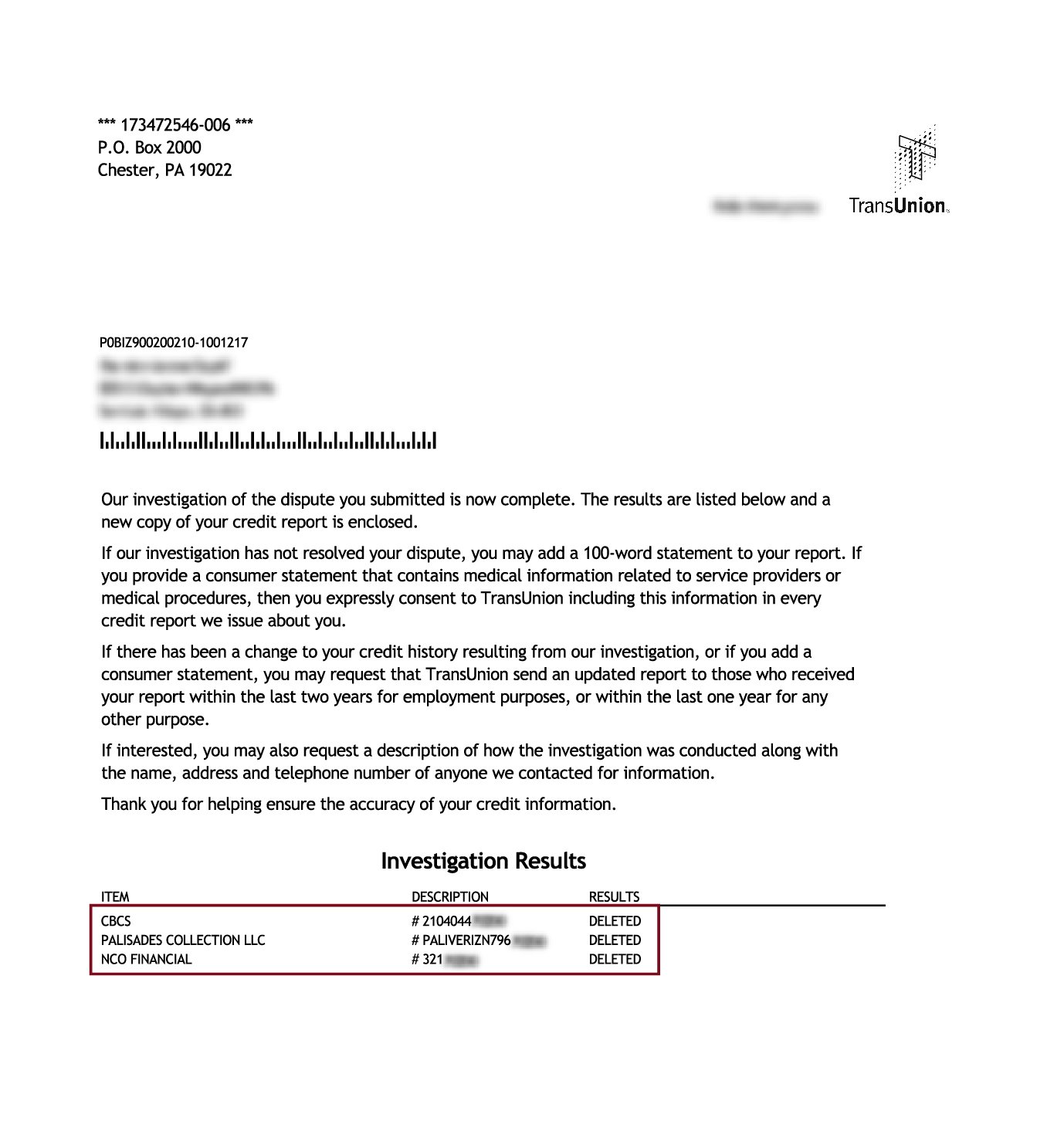

If A Collection Is On Your Report In Error Dispute It

You may have a collections account on your credit report that shouldnt be there. Maybe its too old to still be reported, or the collection itself is incorrect.

Too old to be reported: Delinquent accounts should fall off your credit report seven years after the date they first became and remained delinquent. But that doesnt always happen. For debts that linger longer than they should, file a dispute with any credit bureau that still lists the debt.

If a credit bureau has made a mistake on your report if you dont recognize the account or a paid account shows as unpaid, for example gather documentation supporting your case. Then, file a dispute by using the credit bureau’s online process, by phone or by mail. The bureau has 30 days to respond.

Collection is incorrect: If you think the error is on the part of the debt collector, not the credit bureau, ask the collector to validate the debt to make sure its yours. Note that you have 30 days from the date the collector first contacted you to dispute the validity of the debt. If the collector cant validate, the collection should come off your reports. Follow up to make sure.

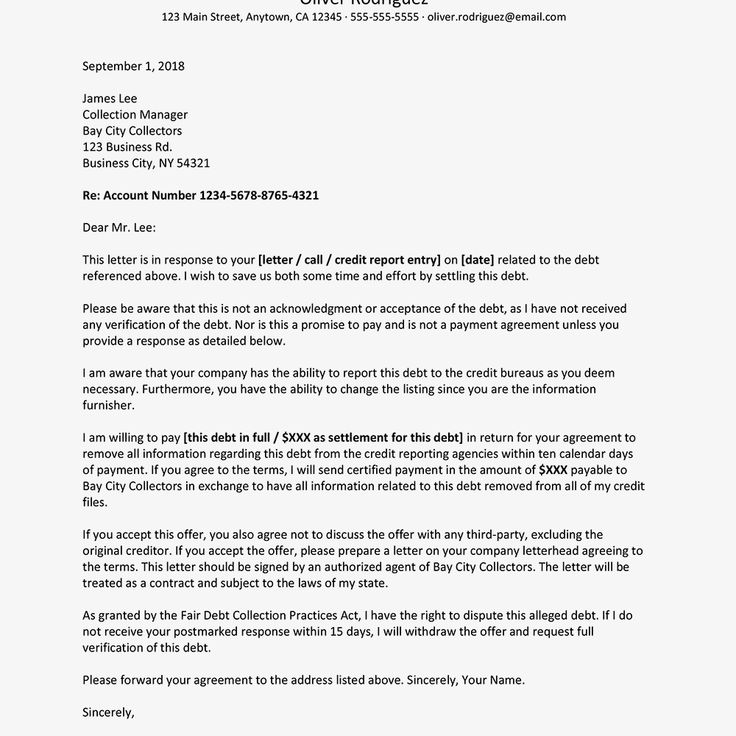

How To Request Pay For Delete

To ask for pay for delete, youll need to send a written letter to the creditor or debt collection agency. A pay for delete letter should include:

- Your name and address

- The creditors or collection agencys name and address

- The name and account number youre referencing

- A written statement saying how much you agree to pay and what you expect in return with regard to the creditor removing negative information

Youre essentially asking the creditor to take back any negative remarks that it may have added to your credit file in connection with late or missed payments or a collection account. By paying some or all of the outstanding balance, youre hoping that the creditor will show goodwill and remove negative information from your credit report for that account.

Also Check: What Credit Score Does Everyone Start With

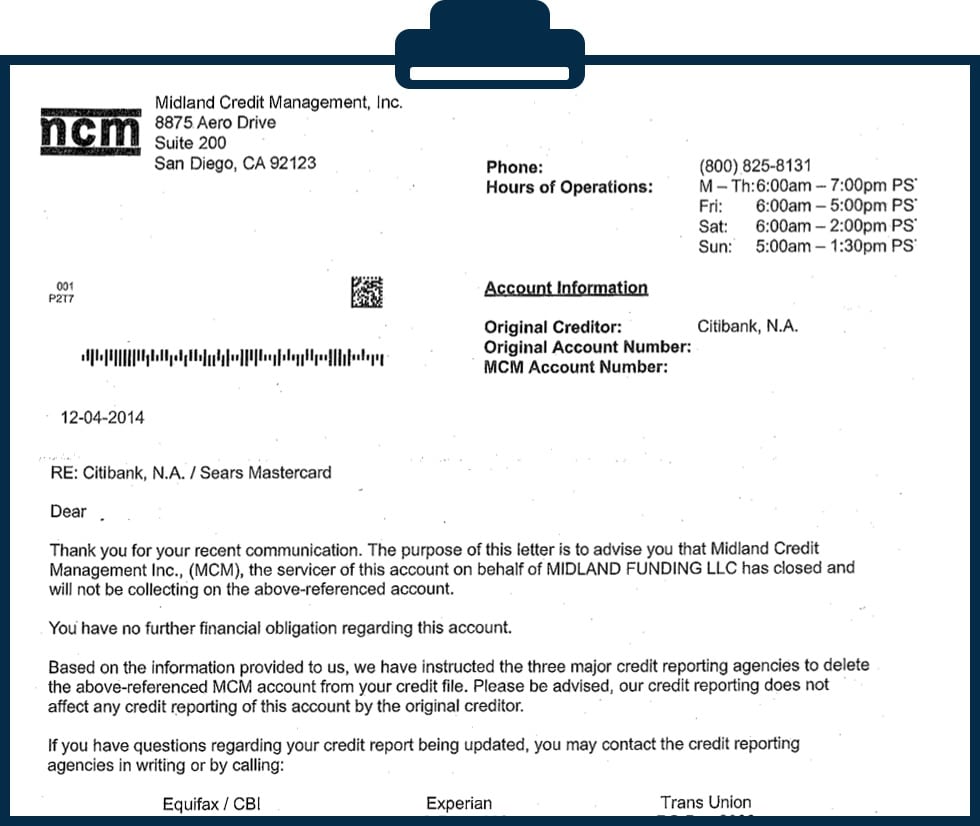

Getting A Satisfied In Full Reporting

If the collection agency agrees to settle for less than you owe, be sure it also agrees to report the debt it holds as “satisfied in full” to the credit bureaus. Get written confirmation from the creditor and the collector. The debt collector’s confirmation should say that it will acknowledge the debt as paid in full when you pay the agreed amount.

Potential Tax Consequences of Settling Debt

The IRS generally considers canceled debt of $600 or more as taxable, and settling debts for less than what’s owed can increase your tax liability depending on your tax bracket and the canceled amount. Consult a tax professional for more information.

If the creditor, or the debt collector if it has the authority, agrees to delete the original account line, get confirmation that it will submit a Universal Data Form to the three major credit reporting agencies deleting the account/tradeline. If the debt collector doesn’t have the authority to act for the original creditor to delete the account information on the original debt, you might need to contact the creditor and the debt collector separately.

Judgments Or Acts Of Bankruptcy

If you dispute a listing that comes from the public record, such as a judgment or act of bankruptcy, you would need to have the public record details changed to have the listing removed from your credit report. Credit reporting agencies get court judgment and bankruptcy information directly from the Courts and the Australian Financial Security Authority records. This might involve having the court judgment set aside.

Recommended Reading: How To Raise Credit Score 100 Points In 30 Days

Check Your Credit Report

Review your credit report and if you find information on it that you think is wrong, you have a right to ask the credit reporting agency or the credit provider to fix it for free.

- If theres a simple error, continue to Step 03 to fix it

- If youre finding it difficult to identify whats wrong, contact us on 1800 007 007 for help

Some things to look out for that could impact your credit health:

- Defaults: these are listed against credit accounts where you have been issued with a Default Notice by the creditor for payments over $150 which are more than 60 days overdue .

- Current credit accounts: details of your current credit accounts, such as loans and utility accounts.

- Repayment History Information: details of whether you have made repayments on time .

Complain To The External Dispute Resolution Scheme

If you are not happy with the outcome of Step 03, ask for details of your credit providers External Dispute Resolution scheme and make a complaint. EDR schemes are free and independent.

The relevant dispute resolution schemes are:

Financial services eg. Loans, credit cards, rental contracts for goods

See our page on Complaints & Disputes to find out more about EDR schemes

You May Like: What Day Does Discover Report To Credit Bureaus

Time Limits/statute Of Limitations

There are time limits for taking most types of courtaction. These time limits are set either in the Statute ofLimitations 1957, as amended, or in specific legislation dealing with thecourt issue involved.

The law in relation to time limits is complex but, in general, the timelimit for taking actions for breach of contract , for debt judgments and for non-payment ofcharges such as rent is 6 years. If your does notstart the court action within 6 years of the debt being due, the action can beheld to be statute-barred by the court. However, you must raise thefact that the creditorâs action is statute barred and win. If you win, thiseffectively means that you cannot be forced by the court to pay the debt eventhough the debt still exists.

If your gets a judgment, then, in general, theyhave 12 years in which to enforcethat judgment.

What Is A Pay

A pay-for-delete letter is when you offer to settle a balance on a negative account in exchange for the debt being deleted from your credit report. The creditor or debt collector is not obligated to agree to your request, but it may be worth sending the request. If youre sending the request to a collection agency, youll need to offer enough for it to be profitable for them to settle. Theres no way to know how much that is, though. If youre close to the seven-year mark for the item to fall off your credit report, it may not be worth sending a pay-for-delete letter.

Read Also: How Often Does Capital One Report To Credit Bureaus

Dispute After 7 Years

According to the Fair Credit Reporting Act , past-due accounts can only remain on your credit report for seven years from the first date of delinquency. Sneaky collectors often try to re-age a debt, making it look like the account became delinquent later than it did. This re-aging keeps the debt on your credit report longer.

What Are Settled Accounts

Asettled account is an account that has been fully paid or closed.

Types of settled accounts can be a loan that was paid in full or a closed credit card account.

Settled accounts can also be known as collection accounts.

These accounts can appear on your credit report for up to 7 and a half years from the date it was paid in full.

If you have any delinquencies or late payments, then the settled account will appear on your credit report for 7 years from your first delinquency or the original delinquency date.

Recommended Reading: When Do Credit Cards Report Late Payments

What Information Can Be Put On My Credit Report

Only certain information can be listed on your credit report. This includes:

- Identification information

- Information about applications you have made for credit

- details of consumer credit accounts that you have

- defaults listings where you owe more than $150 and this is at least 60 days overdue, as long as you have received certain notices

- court judgments if it relates to consumer credit products, such as judgments relating to loans

- bankruptcy and debt agreement information and

- repayment history information .

Our Editorial Review Policy

Our site is committed to publishing independent, accurate content guided by strict editorial guidelines. Before articles and reviews are published on our site, they undergo a thorough review process performed by a team of independent editors and subject-matter experts to ensure the contents accuracy, timeliness, and impartiality. Our editorial team is separate and independent of our sites advertisers, and the opinions they express on our site are their own. To read more about our team members and their editorial backgrounds, please visit our sites About page.

You May Like: What Is My Credit Score Free

What Is Cancellation Of Debt

Debt cancellation happens when a lender forgives or discharges some or all of a debt that you owe. The process typically doesnt affect your credit scoreunless it happens in bankruptcybut it could end up costing you. Debt cancellation typically happens in accordance with a debt forgiveness program.

For example, the U.S. Department of Education offers income-driven repayment plans to federal student loan borrowers. If you get on one of these plans, your repayment term will last 20 or 25 years, after which any remaining debt is forgiven.

With debt cancellation, youre no longer on the hook for the canceled amount, and you dont have to worry about the lender coming after you in the future.

Can I Pay The Original Creditor Instead Of A Collection Agency

It is strongly advised to work closely with your creditor instead of letting matters go unattended by avoiding your creditors calls and emails. Your creditor is only likely to reach out to a debt collection agency if you remain unresponsive for over 180 days. The creditor can either sell your debt to a debt collection agency or file a lawsuit against you.

It is wise to negotiate with your creditor and work towards a settlement that allows you to settle your debt and urge your creditor to forgive a certain amount in light of your financial situation.

Don’t Miss: How To Gain Credit Score