What Else Do Lenders Look At When You Apply

As we mentioned, your credit score is not the only factor lenders examine before they approve or decline your application. They also want to see a favourable history of debt management on your part. This means that on top of your credit score, lenders are also going to pull a copy of your to examine your payment record. So, even if your credit score is above the 600 mark, if your lender sees that you have a history of debt and payment problems, it may raise some alarms and cause them to reconsider your level of creditworthiness.

Other aspects that your lender might look at include, but arent limited to:

- Your income

- The amount youre planning to borrow

- Your current debts

- The amortization period

This is where the new stress-test will come into play for all potential borrowers. In order to qualify, youll need to prove to your lender that youll be able to afford your mortgage payments in the years to come.

Theyll also calculate your monthly housing costs, also known as your gross debt service ratio, which includes your:

- Potential mortgage payments

- Potential cost of heating and other utilities

- 50% of condominium fees

This will be followed by an examination of your overall debt load, also known as your total debt service ratio, which includes your:

Can I Pay Someone To Fix My Credit

You cannot buy your way to a good credit score. But if you are willing to go the distance, then you can definitely improve your credit score.

Fixing your credit requires patience and commitment. With the right plan, you will be able to rebuild your credit score and maintain it for the rest of your life. Credit card debt and bad credit will never be a part of your life. Remember, the key to success is a plan.

???? SAFE | SECURE | PRIVACY PROTECTEDLic. #11108 Matrix Mortgage Global

My team and I hope you found this blog useful for home buyers and homeowners in Canada who are looking for the best mortgage when you have a bruised credit. If youre feeling overwhelmed about your finances, please consider talking to a mortgage broker who can help you put together a plan to get back on track. Work with an award-winning mortgage brokerage to make sure you have the largest options available.

What Qualifies As A Good Credit Score

For those who arent as familiar with their credit score, its a three-digit number that encompasses all your credit-related activity into one cumulative average. In Canada, credit scores range anywhere from 300 to 900. The higher your credit score is, the better your chances are of getting approved for various loans and other credit products. Generally speaking, a score of 650 and above is considered good and means that you are a low default risk and a better candidate for lending. A credit score of 750 or higher is deemed excellent.

Loans Canada Lookout

Don’t Miss: Does Rent A Center Report To The Credit Bureau

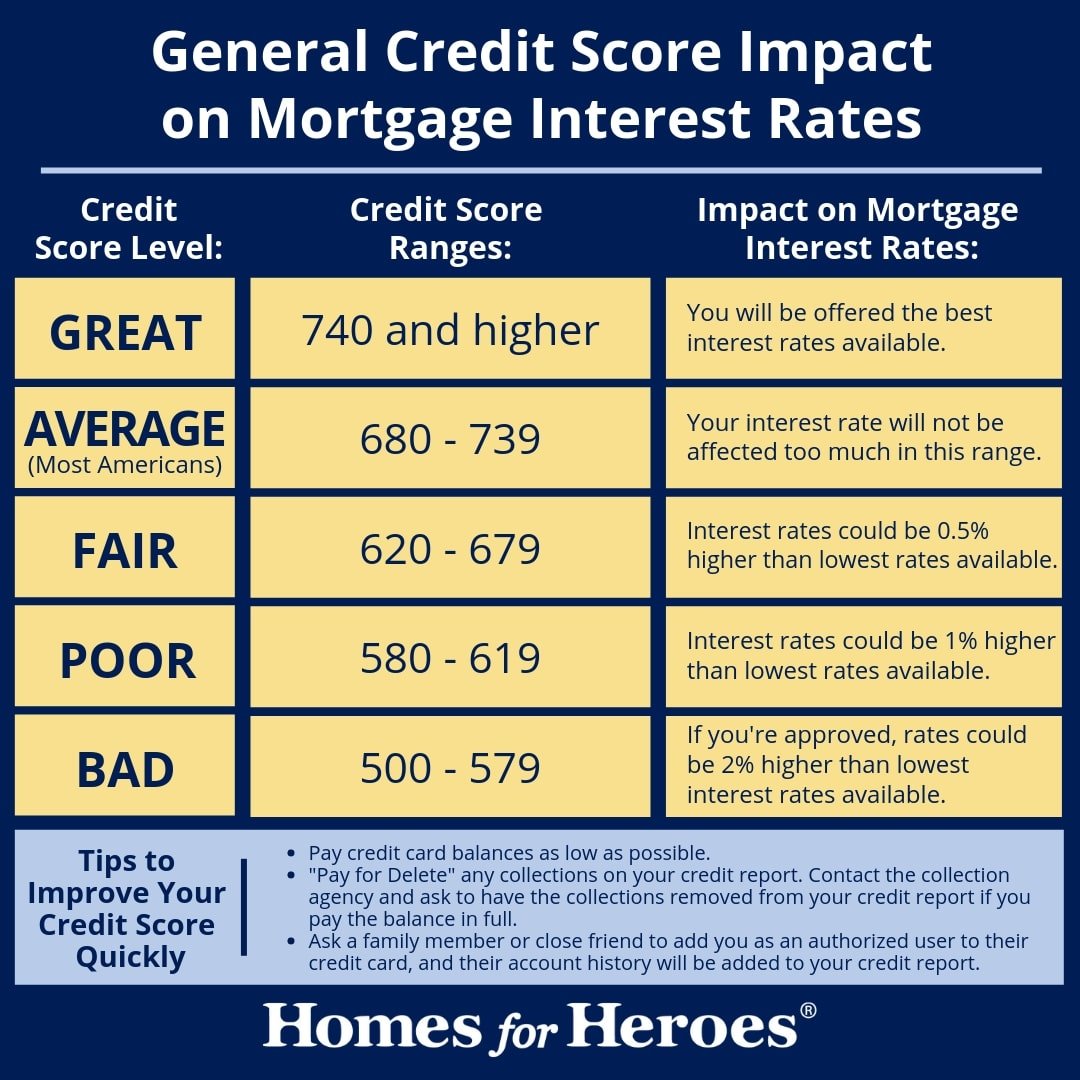

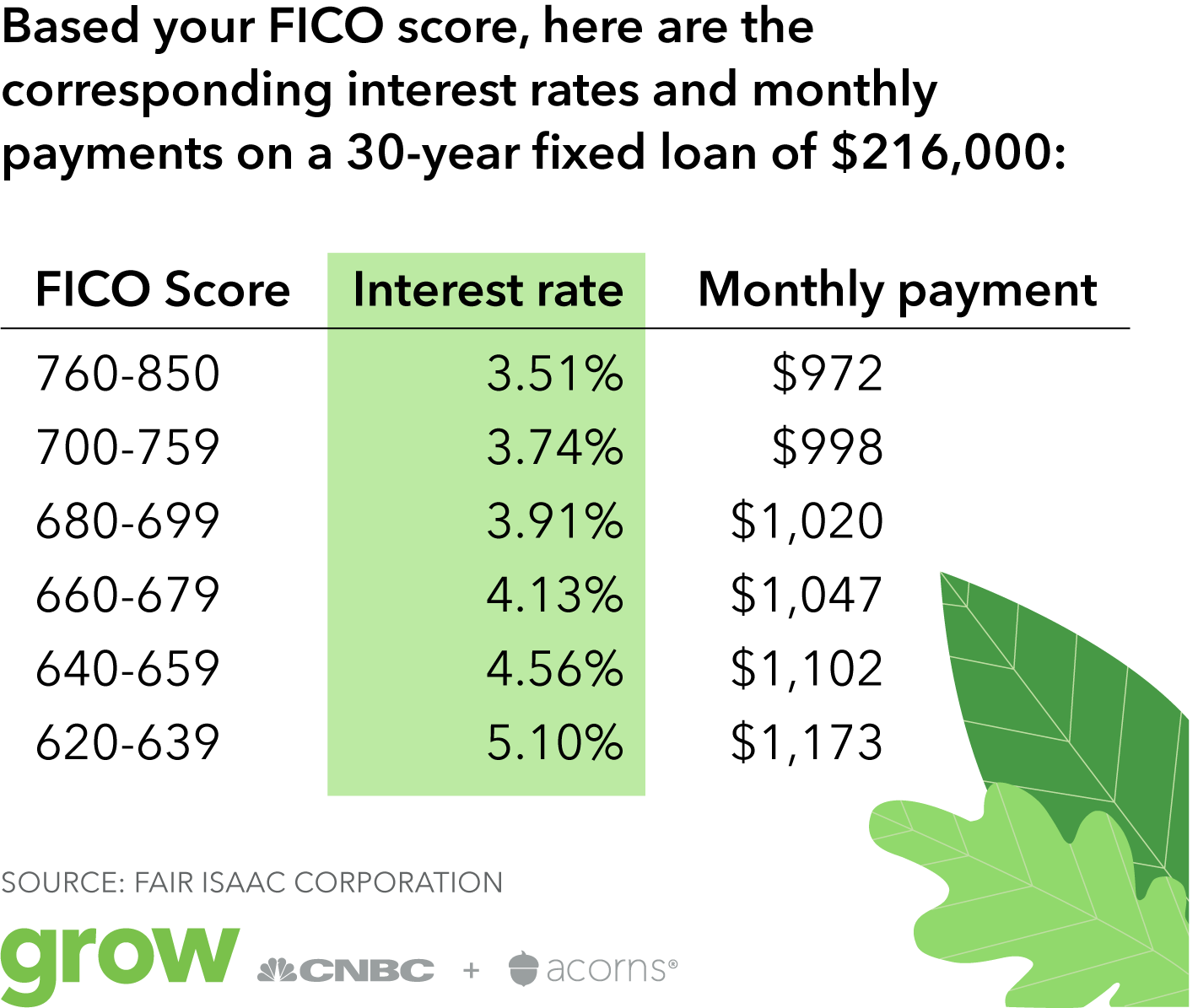

Qualifying For A Lower Mortgage Rate

It may be helpful to improve your credit score before applying for a mortgage so you can qualify for a lower mortgage rate and save tens of thousands of dollars over the life of the mortgage. The money you save on your mortgage is well worth the time and effort to improve your credit score.

If you have a low credit score, review your credit reports to see the items that are affecting your credit score. You can raise your credit score by making timely payments on all your bills, paying down your credit card debt, removing errors from your credit report, and paying off outstanding delinquent balances. In some cases, just a few points can make a big difference in your mortgage rate.

Continue to monitor your credit score in the weeks leading up to your mortgage application to see how your credit score improves.

Strategies To Raise Your Score Above 700

The single biggest element in the calculation of your FICO score is the timely payment of bills. This makes up 35% of your score.

But, with your 700 FICO score, you probably already know that. So lets assume youll continue doing so.

What else can you do? Well, here are some dos and donts:

For more tips, see How to raise your credit score fast.

Read Also: When Does Usaa Report To Credit Bureaus

The Financial Difference Between Two Mortgage Rates

Never settle on the first lender you get a quote from. According to research from the Consumer Financial Protection Bureau, interest rates between mortgage lenders can vary by 0.5% or more for similarly qualified borrowers. To secure the best rate, fees, and terms for your situation, most financial experts recommend comparing at least two to three different quotes.

Here is the difference in dollars between two different mortgage rates on a new purchase with a $300,000 home loan:

| Loan Amount | |

|---|---|

| $120 | $43,383 |

In this example, there is a 0.75% difference between Loan A and Loan B. Loan B costs $120 less per month and a total of $43,383 less in interest over the loans life.

How Your Credit Score Affects Your Mortgage

Your credit score is important because it affects which lender you can get your mortgage from, and what your interest rate on that mortgage will be. Prime lenders, such as major banks, will definitely give you a mortgage if your credit score is above 700, and they will consider applications with credit scores between 600 and 700.

If your score is between 600 and 700, the rest of your application will need to be strong in order to get approved. The lower your score the greater risk you pose to the lender. To compensate for that risk, some lenders, such as trust companies and private lenders, will charge you a higher interest rate. And some lenders wont lend you money at all, if your credit score is too low.

Here is a table showing which lenders you can get a mortgage from in different credit score range scenarios.

| Description |

|---|

Don’t Miss: Is 580 A Bad Credit Score

What Is A Good Credit Score To Buy A House

If only it were that simple. When trying to answer the question, What credit score is needed to buy a house? there is no hard-and-fast-rule. Heres what we can say: if your score is good, lets say higher than a 660, then youll probably qualify. Of course, that assumes youre buying a house you can afford and applying for a mortgage that makes sense for you. Assuming thats all true, and youre within the realm of financial reason, a 660 should be enough to get you a loan.

Anything lower than 660 and all bets are off. Thats not to say that you definitely wont qualify, but the situation will be decidedly murkier. In fact, the term subprime mortgage refers to mortgages made to borrowers with credit scores below 660 . In these cases, lenders rely on other criteria reliable source of income, solid assets to override the low credit score.

If we had to name the absolute lowest credit score to buy a house, it would likely be somewhere around a 500 FICO score. It is very rare for borrowers with that kind of credit history to receive mortgages. So, while it may be technically possible for you to get a loan with a score of, say, 470, you would probably be better off focusing your financial energy on shoring up your credit report first, and then trying to get your loan. In fact, when using SmartAsset tools to answer the question, What credit score is needed to buy a house?, we will tell anyone who has a score below 620 to wait to get a home loan.

Build A Record Of Employment

Youre more attractive to lenders if you can show at least two years of steady employment and earnings, especially from the same employer. Be prepared to show pay stubs from at least the 30-day period prior to when you apply for your mortgage and W-2s from the past two years. If you earn bonuses or commissions, youll need to provide proof of that, as well.

It can be more difficult to qualify if youre self-employed or your pay is coming from multiple part-time jobs, but not impossible. If youre self-employed, you might need to furnish business records, such as P& L statements, in addition to tax returns, to round out your application.

What if youre a graduate just starting your career, or back in the workforce after time away? Lenders can usually verify your employment if you have a formal job offer in hand, so long as the offer includes what youll be paid. The same applies if youre currently employed but have a new job lined up. Lenders can flag your application if youre switching to a completely new industry, however, so keep that in mind if youre making a change.

Gaps in your work history wont necessarily disqualify you, but how long those gaps are matters. If you were unemployed for a relatively short time due to illness, for instance, you might be able to simply explain the gap to your lender. If youve been unemployed for longer, though six months or more it can be tough to get approved.

Read Also: How To Report To A Credit Bureau Landlord

What If You Don’t Have A High Enough Credit Score To Buy A House

Having bad credit or no credit may mean youre unlikely to get a mortgage unless someone you know is willing to help out. Having a co-signer who has a better credit score could help you secure the loan.

Another option would be to have “a friend or more likely a family member purchase the home,” add you to the title and then try to refinance into your name when your credit scores improve sufficiently, according to Ted Rood, a mortgage banker in St. Louis.

If such assistance isnt available to you, your best bet will be waiting and working on your credit.

Curiosity Sorts And Charges

Make sure you examine rates of interest to get essentially the most reasonably priced mortgage potential. The better your credit score rating, the decrease the rate of interest, generally.

Most poor credit mortgage firms embrace mounted rates of interest, which ensures it would keep the identical for the size of your mortgage.

A mortgage with a variable fee will fluctuate and transfer in response to an index fee.

Don’t Miss: What Is Syncb Ntwk On Credit Report

What Is A Good Credit Score

Honestly, what determines a good credit score for a mortgage varies. It really depends on your loan program and financial history. Lenders look at things such as your debt-to-income ratio, W2s, current debts, etc. to calculate your interest rate.

Take a look at some typical FICO score minimums by loan type. Just know that the chart were providing is a reference point. Contact an American Financing mortgage consultant to compare loan programs for your specific situation.

Even Though Rates Are Low Right Now You May Need To Take Steps To Qualify For The Lowest Ones

Good news for potential homebuyers. While mortgage rates have been creeping higher, they’re still at almost record lows. Now, with the May 1 announcement of the Federal Reserve that it will not raise interest rates, mortgage rates are likely to remain the same or even decrease.

At present, interest rates on a 30-year fixed mortgage average around 4.20 percent, according to HSH Associates, a mortgage information website. Fifteen-year fixed mortgages now average about 3.64 percent.

Given concerns about a future recession and international political upheaval, rates may be good for a while.

“Global turmoil is a mortgage shopper’s best friend,” says Keith Gumbinger, a vice president at HSH. “We will have lower fixed and adjustable mortgage rates until the volatility settles.”

But even though rates like these are attractive, banks don’t give them to just anyone looking to buy a home. John Walsh, founder and chairman of Total Mortgage Services, a Milford, Conn.-based mortgage lender, explains that to get the best rates, borrowers need to meet certain criteria, such as having a good credit score.

Here are five situations that could prevent you from getting the best mortgage rate out there right nowand how you can improve your chances.

Also Check: Can You Remove Hard Inquiries Off Your Credit Report

Consider A Shorter Loan Term

When you take out a 15-year fixed-rate mortgage instead of a 30-year fixed-rate mortgage, the interest rate will normally be lower. In mid-September 2020, for example, the 30-year rate was 2.87%, and the 15-year rate was 2.35%.

You also could consider an adjustable-rate mortgage. Its introductory rate may be lower than what you could get on a fixed-rate mortgage. It depends on the market, though: In mid-September, a 5/1 ARM had an interest rate of 2.96%.

Even if you can get a lower rate on an ARM, youre taking a risk. It might be cheaper in the short term, but it could be more expensive in the long term. Why?

- No one knows what interest rates will look like when the ARMs introductory period ends.

- Theres no guarantee youll be able to refinance or sell when the ARMs introductory period ends.

Check Your Credit And Monitor Your Progress

While you’re working your way toward the credit score needed to buy a house, check your progress with a free score some credit cards and many personal finance websites offer them.

Free credit scores often are VantageScores, a competitor to FICO. Either type of score can be used to track your progress they both emphasize the same factors, with slight differences in weighting, so they tend to move in tandem.

Mortgage lenders check older versions of the FICO score . If you want to see where you stand on those so you know exactly what mortgage lenders will see, youll have to purchase a comprehensive FICO report. You can do that at myFICO.com, then cancel the monthly service rather than pay an ongoing fee. Be sure to cancel before the next billing cycle starts the monthly subscription fee will not be prorated.

However, if youre near or in the excellent credit score range on a free score source, you dont need to pay to check your FICO scores. You almost certainly have good enough credit to qualify for the best rates.

About the authors:Bev O’Shea writes about credit for NerdWallet. Her work has appeared in the New York Times, Washington Post, MarketWatch and elsewhere.Read more

Kate Wood writes about mortgages, homebuying and homeownership for NerdWallet. Previously, she covered topics related to homeownership at This Old House magazine.Read more

Also Check: Does Credit Limit Increase Hurt Score

How Much Can I Borrow

Your lender will compare your gross income to your debts to calculate your “debt-to-income” ratios.

- Ideally, the monthly payment on your new mortgage loan should total 28% or less of your monthly income, though some lenders will go as high as 40%.

- Your total monthly debt payments, including your mortgage and payments on student loans, credit cards, or auto loans, should total no more than 36% of your monthly income, though some lenders will go higher.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Does Paypal Credit Build Your Credit

What Is The Difference Between Apr And Interest Rate

The mortgage APR is the interest rate plus the costs of things like discount points and fees. This number is higher than the interest rate and is a more accurate representation of what you’ll actually pay on your mortgage annually.

Why is it important to understand the difference between the interest rate and APR? When you’re shopping around for lenders, you may find that one charges a lower interest rate, so you think that company is the obvious choice. But you might actually find out the APR is higher than what you can get with another lender because it charges hefty fees. In reality, it might not be the best deal.