Sample Letter To Remove Charge Off From Credit Report

Note: Use this in attempting to negotiate a complete removal or PAID AS AGREED on a debt that states CHARGE OFF or SERIOUSLY PAST DUE on your credit report.

RE: account #

Dear Sir or Madam, After recently reviewing my credit report, I took notice that the above-mentioned account is currently in status. I sincerely would like to take care of this account as soon as possible.

Due to , I unfortunately got behind on my payments and was unable to meet my obligations. However, since then my situation has greatly improved and I am in the position to recompense this debt.

I am willing to pay equalling the amount of provided that the above account is updated on all credit reporting agencies to state: PAID AS AGREED, or completely removed from all credit reporting agencies upon my final payment.

I am not agreeing to an updated credit report that states this account as: PAID CHARGE OFF or the like, as this will not significantly increase my credit score, nor will it reflect my sincere willingness to restore my good name and hopefully, someday, again do business with your company.

Your written response will serve as an agreement to my proposal and I will begin payments. Thank you very much for your valued time.

Best regards,

Negotiate A Payment Plan

Remember that creditors dont want to charge off debts or send them to collections. Thats a complete loss for them. If you give them any hope of collecting they will probably be willing to work with you.

Contact your creditors and offer a payment plan. If you cant manage the full amount, offer a settlement for less. Be honest and offer only what you can afford to pay. There are no guarantees but theres a good chance that creditors will be willing to negotiate.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: Why Is There Aargon Agency On My Credit Report

Should You Pay A Charge Off

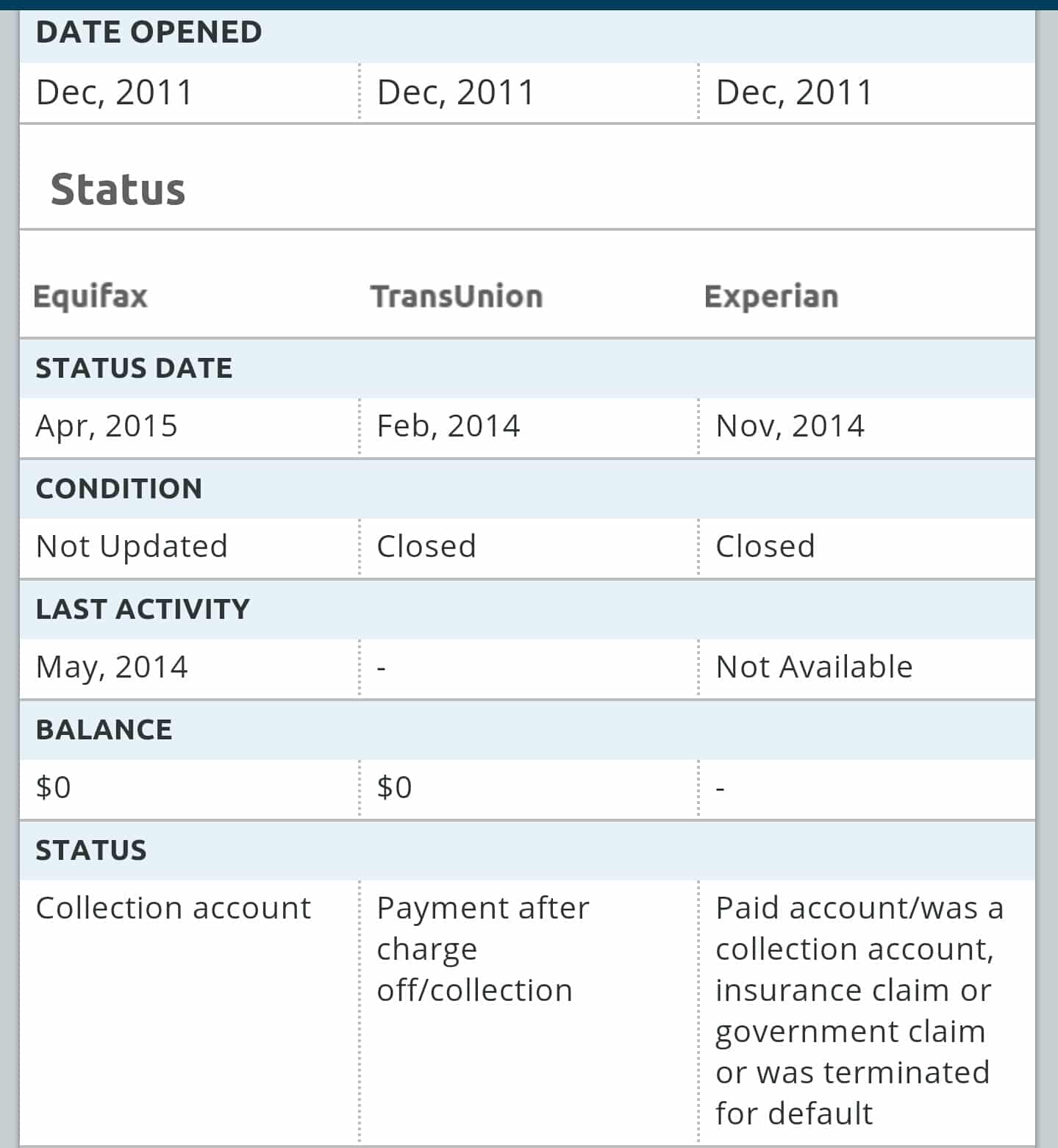

If you want to pay a charge off to improve your credit score, you should be aware that both a paid and unpaid charge off have the same negative impact on your credit score. However, keep in mind that you are legally obligated to pay off your outstanding debts. When future lenders and creditors look at your credit report, they will view paid off charge offs as more favorable than unpaid charge offs, so from that perspective, it does make sense to pay off a charge off. That said, charge offs are highly negative marks that are added to a persons credit report, oftentimes, many lenders will refuse to lend you money if a charge off appears on your credit report. That said, a paid charge off looks better on your credit report than an unpaid one.

How To Remove Charge

The letter you send your creditor to remove your charge-off is called a pay for delete letter or a goodwill letter. Generally, you send a pay for delete letter if you havent paid the debt and a goodwill letter if youve already paid.

When wondering how to remove charge-off from credit report easily, a letter may be your best bet. How you construct your letter can make or break your chances of successfully removing a charge-off from your credit history. In addition to addressing your letter to the right person, remember these tips:

- Avoid blaming the creditor or collector

- Dont make excuses

- Keep it as direct as possible

Keep reading to see a sample letter to remove charge-off from credit report for paid and unpaid balances.

You May Like: What Does Transunion Credit Report Show

Can You Be Sued For A Charge

Selling your debt to a collection agency isnât the only option a creditor has, though. Lenders also can sue you in civil court to get you to pay the balance. Debt collectors can sue you, too, if theyâve purchased your debt from the lender.

You may not face a lawsuit right away: Creditors may wait up to 18 months before filing a case against you. But it can happen in as little as six months, as well.

If you receive a summons to appear in court, you usually will have 30 days to respond. If you donât respond, the court may grant a default judgment in favor of the creditor, allowing them to garnish your wages or bank account.

The good news is that most creditors want to avoid the cost of going to court and can be open to a settlement if you show a willingness to negotiate.

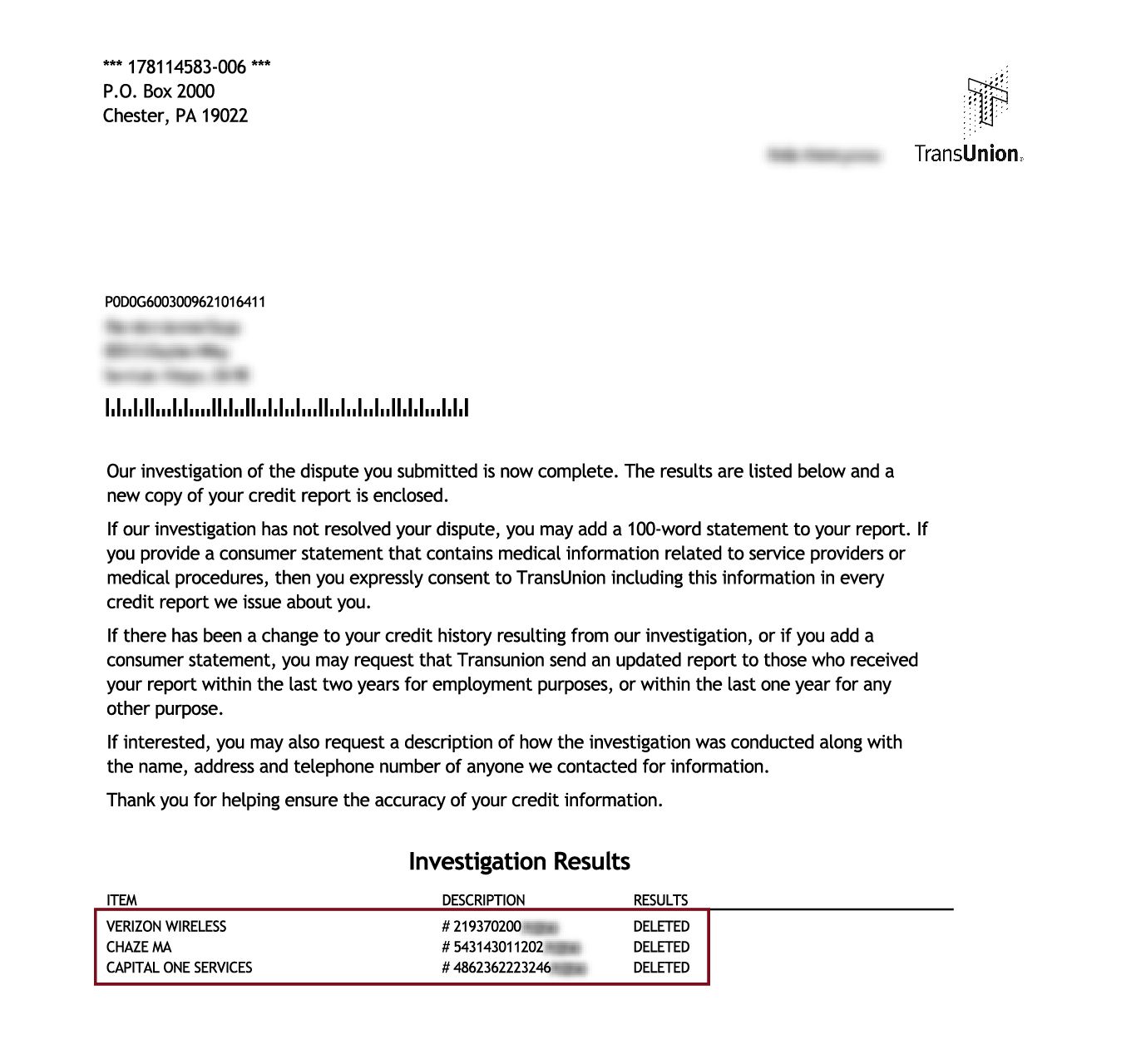

How To Dispute A Charge Off

If your credit report has an inaccurate credit card charge off, you can dispute the claim. In some cases, you may also want to file a claim if the charge-off account still shows delinquent payments after the seven years have passed. If you find yourself in this situation, you are going to want to talk to a credit reporting agency or the collections agency as soon as possible.

Also Check: What Credit Score Do You Need To Buy A House

You May Like: Is 748 A Good Credit Score

Will My Credit Score Improve If I Pay The Charge

Your credit score may improve if you pay the charge-off in full, but it depends on a few factors. For example, if the charge-off is very recent, then paying it off may not have much of an impact on your credit score.

However, if the charge-off is older and you have a good credit history, then paying it off may raise your credit score.

Its important to note that the impact of a charge-off on your credit score will vary from person to person.

Whats The Difference Between Unpaid Vs Paid Collection

If a unpaid debt goes to the debt collection agency, it will appear on your credit report as an unpaid collection. However, if you pay the collection agency, the debt will be shown as a Paid Collection.

While this will look better on a credit report than Unpaid, if your goal is to have a charge off completely removed, consider using the steps outlined above.

Read Also: What Is A Good Business Credit Score

Can Credit Repair Companies Remove Charge

Only the credit bureaus have the power to remove something from your credit report. Not even your creditors have direct access to your credit file.

Reputable credit repair companies can help you exercise your consumer rights. They can also help you prepare and submit disputes.

If you direct a credit repair company to dispute an item on your credit report and your creditor cant verify that its 100% accurate, it must be erased from your report. A charge-off isnt allowed to remain on your report if its incorrect, outdated, or unverifiable.

The FCRA gives you the right to ask the credit bureaus to verify any item on your credit report. You also have the right to manage this dispute process on your own. But if youre busy or overwhelmed by the process, you can hire a professional to deal with the credit bureaus and your creditors on your behalf. You dont have to face credit problems alone.

Will Paying A Charge

Paying a charge-off will not automatically get it removed from your credit report. The status will change to show that it has been paid, but the mark remains on reports for seven years since the first missed payment.

Before you pay a charge-off, you can sometimes make an agreement with the credit issuer that they will remove the charge off in exchange for your payment. If you make this type of agreement, make sure to get it in writing.

Read Also: Does Easy Financial Report To Credit Bureaus

How To Dispute A Charge

The Fair Credit Reporting Act gives you numerous rights when it comes to the information on your credit reports. For example, you have the right to dispute an item on a credit report with which you disagree.

Disputing a charge-off is actually a simple process. The credit bureaus give you three potential ways to submit a dispute: via mail, online, or over the phone.

Can You Dispute A Charge Off On Your Credit Report

Yes, you can dispute a charge off on your credit report, however, the credit reporting bureaus will not remove it unless there is an error in the information report or the charge off does not belong to you. However, a valid charge off cannot be removed from your credit report. It will remain on your credit report for seven years from the date you first missed a payment on your account. After 7 years, the charge off will automatically be removed from your credit report.

Read Also: What Is Credit Score Out Of

Learn More About Credit Scores

If its not clear from everything above your credit score in the U.S. will be an essential part of living in America on a visa. That said, there are lots of other important topics around credit scores that it would be worth it to familiarize yourself with:

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Paid Versus Unpaid Charge

What happens if you pay back your charge-off amount in full? Does it still hurt your credit?

Unfortunately, paying off a charge-off doesnt automatically remove it from your credit history. Lenders will still see a charge-off and may not want to lend you money.

However, a paid designation is added to your credit report if you pay what you owe in full. Some lenders may see a paid charge-off more favorably than an unpaid charge-off.

Also Check: What Does A Good Credit Score Mean

What To Do If You Have A Charged

If one or more accounts you owe ends up being charged off as bad debt, your mailbox may fill up with letters from debt collectors. In the event that you dont believe you owe the debt for any reason or you believe its past the statute of limitations for collections in your state, you can request a debt validation.

Debt validation means the debt collector has to verify that the debt is yours. You can request a debt validation by sending a letter to the collection agency. The Consumer Financial Protection Bureau has a template you can follow. Once you send the request, all collection efforts must temporarily stop until the debt collector is able to respond and validate the debt.

But what if a charged-off account truly belongs to you?

At this point, youll have to decide how you want to handle it. Again, this could mean offering a debt settlement to the creditor or making payments over time. If you believe a charged off debt is close to the statute of limitations in your state, you may choose to do nothing and hope the creditor decides not to file a lawsuit in the meantime.

Talking to a nonprofit credit counselor or debt counselor can help you decide which option to pursue. A can also help you develop a financial plan for avoiding charge-offs in the future. For example, this may include reviewing your budget and spending habits.

How To Get A Charge

Removing a charge-off from your credit report is difficult to do. Once your account hits charge-off status, itll stay on your credit report for seven yearseven if you turn it into a paid charge-off.

The good news is that after seven years the negative information completely disappears from your credit reports, thanks to the Fair Credit Reporting Act.

The best chance you have at getting it erased from your report in the meantime is to dispute it with one of the major credit reporting agencies that reported the inaccurate information.

The only way you can dispute a charge-off with a bureau is if you believe it was reported by mistake. If you initiate a dispute, the credit bureau will be required by law to look into the claim and correct it or remove it if theres an error.

Recommended Reading: Does Missing A Credit Card Payment Affect Your Credit Rating

Offer To Pay The Creditor To Delete The Charge Off

Probably the most effective way to remove a charge off in your credit record is to offer payment to the creditor. Even before payment, try to negotiate and tell them that they have to remove it from your history after your payment. One caveat of this is that once you have paid and the credit report indicates charge off paid, you really cannot do anything. The creditors can no longer remove this from your credit report.

How Many Points Does A Charge

A new charge-off notation might lower your credit score. But its difficult to pinpoint the exact number of points your score might change.

Nothing in credit scoring is worth a set number of points. A collection account, for example, wont drop your credit score 40 points. A credit inquiry wont cost you 10 points. Credit scoring models, like the ones FICO and VantageScore create, evaluate your credit report as a whole to determine your credit risk. Individual credit report entries arent considered in a vacuum by themselves.

Its also worth noting that a charge-off is typically added to your credit reports after a string of late payments. By the time your account is six months past due, you may already have six rolling late payments on your credit reports. Payment history is worth about 35% of your FICO Score. So, those late payments are already hurting your numbers. Adding a charge-off into the mix might not cause much additional damage if your scores are already in rough shape.

Recommended Reading: How To Put A Credit Freeze On Your Credit Report

How To Improve Your Credit Score

If a charge off cannot be removed from your record, the best way to improve your score is to pay your loans full and on time. Never miss any payment date to gain the trust of creditors and lenders again.

As you may know, your lousy record could last for seven years, but after this, the good points in your rating will be the only ones left. This means that you should no longer add to your bad record. Just let the bad one get erased by time.

If The Debt Is Accurate And Unpaid Try Paying It Off

A valid charge-off account that remains on your credit report can result in a bad credit score. A paid charge-off wont have as much of a negative impact. And some credit scoring models, like VantageScore, dont penalize a consumer’s score as much for older or paid-off charge-off accounts.

You can pay the full balance all at once or in installments. Another option would be to settle for a lower amount. Paying the account in full looks better on your credit report than settling, but doing something about a charge-off is better than keeping an unpaid charge-off on your credit.

Also Check: Will Paying Off My Credit Card Increase My Credit Score

Have A Professional Remove The Charge

If youd rather have a professional work on your credit, you might want to read about Lexington Law or we might suggest you visit their website here > >

But you can get a free consultation to find out how a company can help restore your credit.

Even if you pay several hundred dollars to a credit repair company like Credit Saint, Sky Blue, or Lexington Law, you can save even more by getting lower interest rates and building a more stable personal finance life.

If you have delinquent payments, nonpayments, or charge-offs that are inaccurate, credit repair experts will be able to help.

Ask Lexington Law for Help

What Is The Best Way To Remove Charge

Getting a charge-off removed from your credit report can make the difference between qualifying for a loan for a house or car. Future lenders want to see that you pay off your debts. This is where hiring a credit repair company can really make a difference.

They help clients remove charge-offs on their credit reports by disputing errors with the credit bureaus on their behalf. This means you dont have to contact any of the credit bureaus or collection agencies yourself directly.

If you arent sure where to start regarding disputing charge-offs on your credit reports, talk to one of their credit repair professionals and get your questions answered. You can do it on your own, but youre likely to have more success by enlisting professional help.

They offer a no-obligation consultation to explain what they can do to help in your particular situation.

Read Also: How To Build Up Credit Rating Fast