Can You Get A Home Loan With Bad Credit

Its possible to qualify for a mortgage even if your credit score is low. Its more difficult, though. A low credit score shows lenders that you may have a history of running up debt or missing your monthly payments. This makes you a riskier borrower.

To help offset this risk, lenders will typically charge borrowers with bad credit higher interest rates. They might also require that such borrowers come up with larger down payments.

If your credit is bad, be prepared for these financial hits. You can qualify for a mortgage, youll just have to pay more for it.

You Should Have A Decent Income

The new mortgage stress test implemented by the Ministry of Finance at the end of 2016 looks exclusively at income to determine your ability to pay back a mortgage. This test looks at your income and assesses whether or not you could make monthly payments based on their posted rate, which is typically much higher than the interest rate you’d be approved for by your lender. This prevents you from running into trouble if there was ever a significant interest rate hike on your mortgage. There are two ways to get around this. You can increase your income, or save up to make a 20% deposit which allows you to bypass the test. Unfortunately, with housing prices as high as they are in Canada, saving 20% of the purchase price is very difficult.

Your Credit Report Should Reflect A Good Diversity Of Credit Products

When youre successfully managing a credit card, a line of credit and a loan, potential mortgage lenders are going to see someone who will be capable of handling one more payment every month. If all you have is one credit card, even if youve managed it well and kept it in good standing, your credit report is not going to look as good as it could. Lenders may still wonder what sort of risk you pose as a borrower – will you be able to handle multiple credit products or is one your limit? There is no way of them knowing. If you have poor credit, there are still ways to go about diversifying your credit products. Look into secured cards, secured lines of credit and credit building programs. for more info on those.

Read Also: How Does Navy Federal Auto Loan Work

What Credit Score Do You Need To Be Approved For A Mortgage In Canada

When it comes to getting a mortgage, the higher your credit score, the better. A good credit score will ensure that you:

In Canada, . Anything above 650 is considered to be good, which means that your risk for defaulting on your mortgage is low and youre a safe candidate for a loan.

While it will vary from lender to lender, in general, the minimum credit score to be approved for a mortgage is 650. Some lenders may go a little lower, but again, higher is better. A credit score above 700 is considered optimal when applying for a mortgage.

Several factors can impact your credit score, including:

- Payment history. Do you pay your on time?

- . You should use less than 35% of your available credit.

- The longer you have had your credit accounts, the better.

- New credit requests. How recently and often have you applied for new loans or credit cards?

- Types of credit. Having a mix is best, such as a .

If youre unsure of your credit score, you can get it from one of the two credit-reporting agencies in Canada: Equifax Canada or TransUnion. You can request a free copy of your credit score each year .

» MORE:How to check your credit score

The Best Mortgages For Buying A House With Lowcredit

If you have a low credit score, or past red marks on your credit report, the first type of mortgage you should look at is an FHA loan.

FHA loans

FHA loans are mortgages insured bythe Federal Housing Administration. This insurance protects mortgage lenders,making it possible for them to lend to borrowers with lower credit scores andsmall down payments.

In fact, the FHA mortgage programwas specifically designed for credit-challenged home buyers. It allows thelowest credit score of any loan program 500 although you need a 10% downpayment if your score is below 580. Those with a score above 580 onlyneed to put 3.5% down.

Conventional/conforming loans

Conventional loans also allow amodest credit score of 620 with a down payment of just 3%.

However, the cost of privatemortgage insurance can make conventional loans unattractive forlower-credit borrowers with less than 20% down.

Conventional and FHA loans both require mortgage insurance. The difference is that FHA charges the same mortgage insurance premiums for all borrowers, regardless of credit.

Conventional mortgages, on the otherhand, have steeply increased PMI rates for borrowers with low credit and alow down payment. As a result, FHA financing can sometimes be cheaper forborrowers with credit in the low- to mid-600s.

VA loans

For veterans and active-duty service members, a VA mortgage is normally the best bet.

Don’t Miss: Does Kornerstone Credit Report To The Credit Bureaus

What Credit Score Do I Need For A Mortgage

Many or all of the products here are from our partners that pay us a commission. Its how we make money. But our editorial integrity ensures our experts opinions arent influenced by compensation. Terms may apply to offers listed on this page.

In order to get a mortgage, you not only need to be able to document your ability to pay it back, but also show you have a high enough credit score for a mortgage. Mortgage lenders want to see a reasonably good credit history, so let’s look at what credit score you need for a mortgage.

It might be reassuring to know you don’t need an excellent credit score for a mortgage — or even a good score in many cases. In fact, if your employment, assets, and other qualifications can justify the loan. In fact, you might be surprised by the minimum credit score for a home loan.

What Is The Difference Between Pre

Both pre-qualification and pre-approval involve a review of an applicant’s credit report. The difference is the degree of credit review. Pre-qualification involves a quick review of one’s credit and only provides a potential borrower with a general idea of how much mortgage they could qualify for and under what terms. Pre-approval involves a full credit review, while only offered for a limited time window, provides the potential borrower with a solid offer of credit from a lender with which they can use to make good faith offers on homes for sale.

Also Check: Does Qvc Report To Credit Bureaus

Fha Lenders Dont Always Follow Fha Credit Score Minimums

Banks and mortgage companies that offer FHA loans are not required to follow FHA guidelines to the letter.

These are private, for-profit companies that simply approve loans based on guidelines provided by a government agency, namely the Federal Housing Administration, or FHA.

Most if not all lenders across the country impose tougher guidelines for FHA loans than does FHA itself. It doesnt seem to make a lot of sense until you realize that FHA penalizes lenders for approving too many bad FHA loans.

Yes, FHA actually penalizes lenders if they approve borrowers who default months and years later, even if the loan fits perfectly within FHAs published guidelines.

Heres an example.

A borrower applies for a loan and is approved based on FHAs guidelines. Six months later he loses his job and can no longer make his monthly payments. FHA records that bad loan on the lenders record.

Too many bad loans and FHA could revoke the lenders ability to offer FHA loans. That could put some mortgage companies out of business.

Statistically, borrowers with lower credit scores default more often. Thats why most lenders require a higher minimum credit score than does FHA.

Here are credit score minimums as stated by FHA:

Most lenders require a score of at least 620-640. But that number could drop closer to FHAs published minimums because of the new policy.

How To Check Your Credit Score Before You Buy A Home

One way to check your credit score is to request the information from the major credit reporting agencies. By law, credit reporting agencies are required to provide you with a free copy of your credit report once every 12 months.

You can also check your credit score by calling Freedom Mortgage and asking us to prequalify you for a mortgage to buy a house. Prequalification involves a soft credit pull which generally does not have an impact on your credit score. When you give us permission to pull your credit for prequalification, we can often tell you your current credit scores.

Prequalification can also give you an estimate of home prices you can afford, based on an estimate of the amount of a mortgage for which you might get approved.

Read Also: 728 Fico Score

Ways To Help Strengthen Credit Scores To Buy A House

If your credit scores need work before you buy a house, consider these ways to help improve your scores:

- Make on-time payments. FICO and VantageScore both say your track record of making on-time paymentsâyour payment historyâcan be a significant factor in determining your credit rating. You could use email reminders or calendar alerts to remind yourself. And setting up automatic payments can ensure you donât miss a payment due date.

- Pay more than the minimum. Making only your comes with a cost: interest charges. And interest can add up and cost you more money in the long run. Interest can even make it harder to pay off debt. So consider this from the CFPB: âPaying off your balance each month can help you get the best scores.â

- Keep your balances low. The CFPB recommends that you not spend more than 30% of your available credit. A low âa measure of how much of your available credit youâre usingâcould be a sign that youâre using your credit responsibly and not overspending. And that could help you improve your score.

- Apply only for the credit you need. As the CFPB explains, âCredit scoring formulas look at your recent credit activity as a signal of your need for credit. If you apply for a lot of credit over a short period of time, it may appear to lenders that your economic circumstances have changed negatively.â

Mortgage Insurance Savings Tip

If you have a low credit score, it may make more sense to apply for an FHA mortgage. FHA mortgage insurance premiums are not impacted by your credit score. The catch? Theres an extra upfront mortgage insurance premium of 1.75% added to the loan amount to cover the extra risk that FHA lenders take on lower credit score borrowers.

Recommended Reading: Usaa Credit Check And Id Monitor

Minimum Credit Score Needed For An Insured Mortgage

On July 1, 2020, Canada Mortgage and Housing Corporation increased the minimum credit score requirement on insured mortgages from 600 to 680. This represented a significant jump, and the response from industry experts was mixed. Many felt that the new benchmark was too restrictive and would result in too many Canadians not entering the housing market.

CMHC’s minimum score applies to at least one borrower on a mortgage. This makes the situation a bit more flexible for couples, as only one borrower needs to exceed the 680 threshold.

Can You Refinance Your Mortgage With Bad Credit

While it isnt impossible to refinance your home with bad credit, it could be more difficult. Here are some options to consider:

- Contact your current lender. Because youre an existing customer, your current lender might be willing to give you some wiggle room when it comes to credit requirementsespecially if youve been a good customer and made all of your payments on time and in full. However, be sure to also shop around and compare your options from as many other lenders as possible. This way, you can find the most optimal loan for your situation.

- Check the VA refinance program. Servicemembers, veterans and qualifying spouses might be able to refinance through the VA. Keep in mind that while the VA doesnt have a specific minimum credit score, lenders typically require a score of at least 620.

- Consider the FHA refinance programs. Another government-backed option to explore is refinancing through the FHA. The requirements for an FHA refinance are generally much less stringent than other options, and you might be able to qualify with a credit score as low as 500, depending on the program.

- Find a co-signer. Applying with a creditworthy co-signer could make it much easier to qualify for refinancing. A co-signer can be anyone with good creditsuch as a parent, another relative, or a trusted friendwho is willing to share responsibility for the loan. Keep in mind that this means your co-signer will be on the hook if you dont make your payments.

Don’t Miss: Coaf Credit

Learn More About Mortgages In The Uk

How do mortgages work in the UK?

Buying a home or land is expensive. A mortgage is a financial product that helps people purchase their own home or land.This is especially true for a first time buyer, as it might be the only route onto the property ladder.

The minimum credit score for a mortgage

ou can still be approved for a mortgage to buy a property if you have a poor credit score. However, someone with a poor credit score will probably have a higher interest rate than someone whose credit score is good. Buyers with a low credit score may also need to pay a bigger deposit.

fixed term Contract Mortgages

A fixed term contract is a way of describing certain types of employment. If your current employment contract is due to end after a certain period of time, or after a specific piece of work is complete, you are likely on a fixed term contract.

how long does a mortgage application take?

After sending off the final application waiting for the decision can be frustrating. Many prospective homeowners ask how long does it take? but the truth is the mortgage approval process is always different for each customer.

how long does conveyancing take?

The entire conveyancing process will normally take anywhere between 8-12 weeks, however you should be prepared for this to take much longer depending on your circumstances and wider factors. This articles explores what the timescale involves.

Mortgages if You are bankrupt

what stops you getting a mortgage?

IVA Mortgage

There Should Be No Bankruptcies Consumer Proposals Or Excessive Derogatory Items On Your Credit Report

A derogatory item is a late payment, a missed payment, or a payment that was not enough. While you can still get approved for a mortgage with an old bankruptcy, derogatory item, or consumer proposal on your credit report, you will find it much more difficult and the interest rates you have access to wont be very good.

Recommended Reading: Affirm Credit Requirements

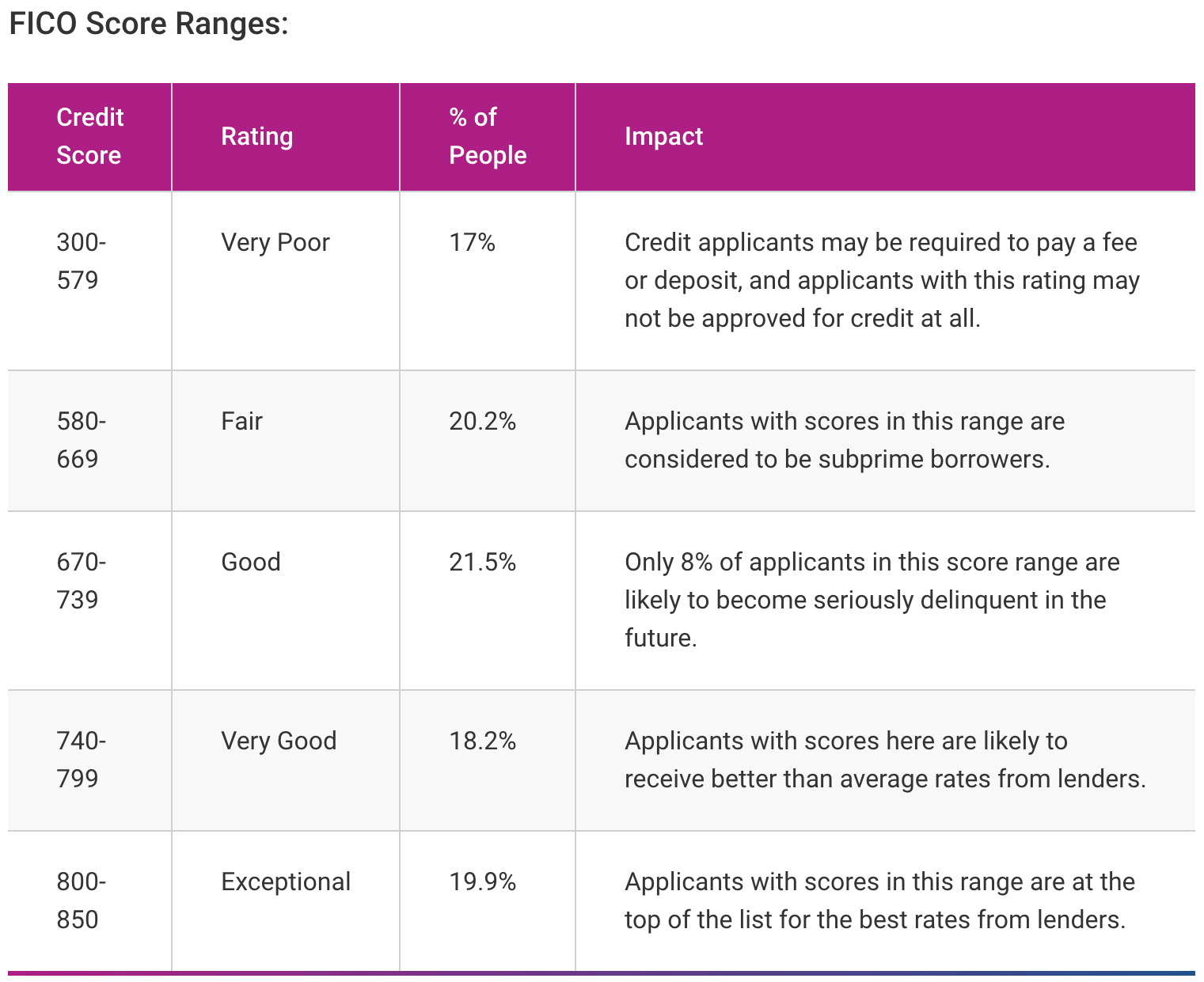

How Your Credit Score Impacts Your Mortgage Prospects

If youre planning to buy a home, your credit score will play a big part in the process. At the start, it will determine which loan options you can even consider as a homebuyer. While some loan types require minimum scores as high as 640 , others go down to 500 .

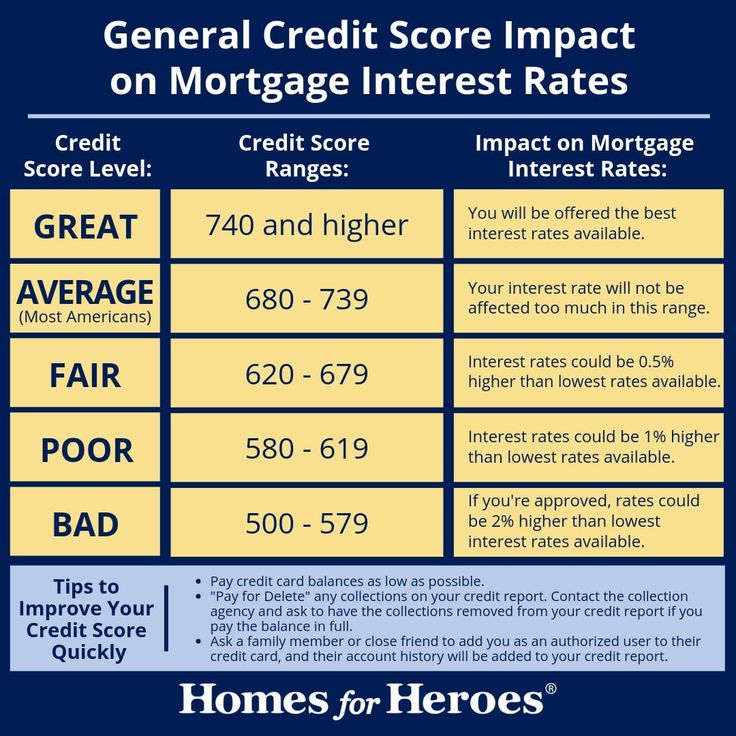

Your credit score will also impact the costs of your loan, because your credit score represents your level of risk to a mortgage lender. A higher score means that you pay your bills on time and can be expected to repay your mortgage just the same. As a result, youll qualify for lower interest rates.

If your score is low, however, that means youre a risky bet for a lender. To compensate for the extra riskthat chance you wont pay your loan or might foreclose on the housetheyll boost the interest rate to protect themselves.

Suppose youre purchasing a $250,000 home in Texas and putting 10% down. In 2019, according to the Consumer Financial Protection Bureau, your interest rates would most likely have looked like this:

| Effect of Credit Score on Loan Rates | |

|---|---|

| 740 to 850 | 3.625% to 4.99% |

The difference in interest paid over the life of the loan could be substantial. On this specific loan amount, just a one-percentage-point difference would equal more than $11,000 less in interest over the first five years and nearly $50,000 less across the 30-year loan term.

Tips To Improve Your Credit Score To Buy A House

If your credit score isnt up to par with what you need to take out a home loan, you should consider taking steps to raise it. This might include paying off outstanding debts, making a plan to get up to speed with your current debts, or partnering with a credit repair firm to remove any discrepancies on your credit report. Take a look at our tips below to learn how you can quickly improve your credit score.

Recommended Reading: How Do I Notify Credit Bureaus Of A Death

Pay It Off And Keep Balances Low

If the available credit on your card isnt very high, this is important to pay attention to. The best way to utilize a credit card is to pay the entire balance off every single month before the date that it is due. All credit cards will give you a grace period by which you need to make the monthly payment.

Theres really no benefit at all in using the grace period to bide your time in making the monthly payment. Interest rates are pretty low currently, and paying your entire monthly balance is a much better approach to credit card statements.