Fix Mistakes In Your Credit Report

When you get your credit report, check that:

- all the loans and debts listed are yours

- details such as your name and date of birth are correct

If something is wrong or out of date, contact the credit reporting agency and ask them to fix it. This is a free service.

Some companies may try to charge you to get all negative information removed from your credit report. The only thing they can ask the credit reporting agency to remove is wrong information. And you can do that yourself see .

If there are loans or debts in your report that you know nothing about, it could mean someone has stolen your identity. See identity theft for what to do.

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

How To Raise A Dispute On Your Credit Report

Checking your credit report regularly can help you make sure the information it holds is accurate. If theres incorrect information, you can raise this.;;

To raise a dispute, youll need to contact the CRA directly. Each CRA will have a different method for raising a dispute, but you should be able to contact them online or in writing. Theyll be able to let you know the next steps you need to take.

Don’t Miss: Which Credit Score Matters The Most

Whats In My Credit Report

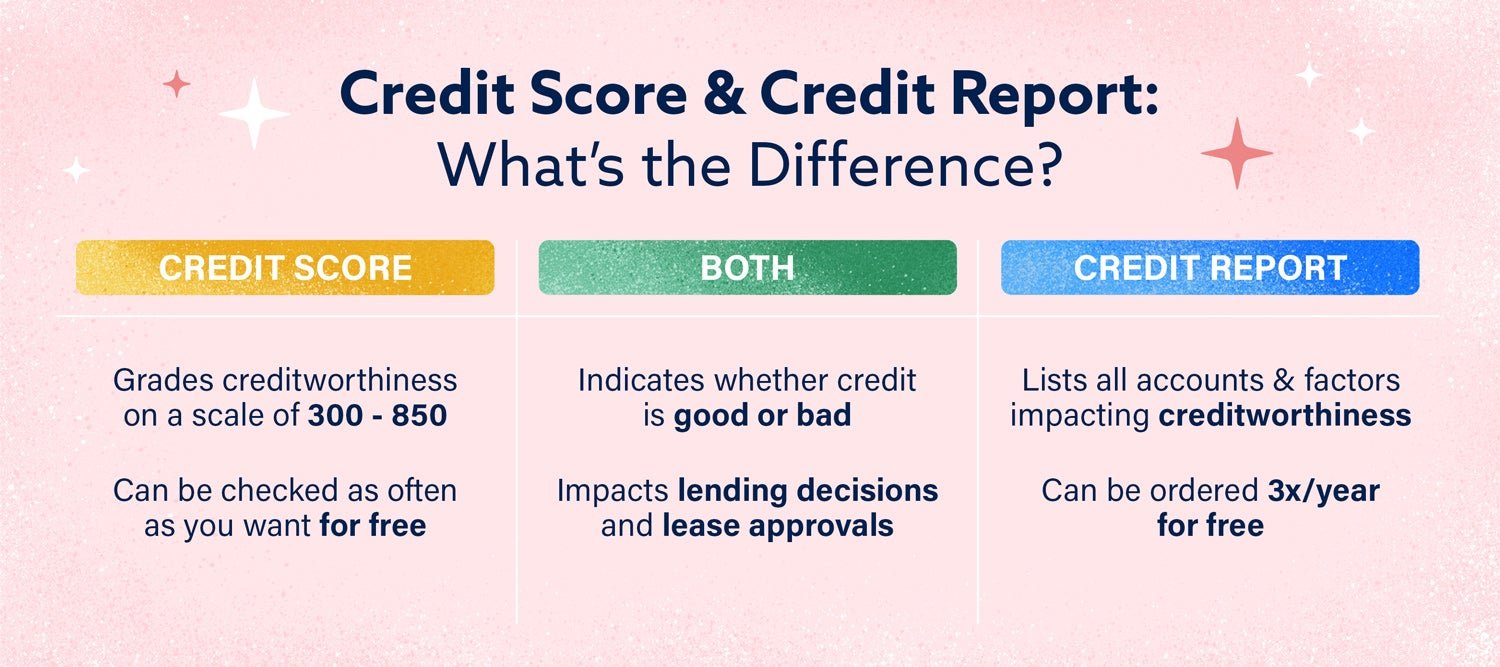

Your credit report is a summary of your credit history. It includes information about you, your financial obligations to creditors, payment history, debts sent to collections, and requests for info from creditors, businesses, or individuals.

Read our blog post to learn how to request a free copy of your credit report.

Information from your credit report is used to determine your credit score. Your credit score, along with the other information in your credit report, informs lenders how likely you are to be a credit risk. Your credit score is usually a three-digit number the higher the number, the better the score.

Does Accessing Your Credit Report Lower Your Score

Checking your own credit report or credit score wont affect it. Its only impacted when lenders do a search on your credit file.

There are two types of searches lenders can do; soft credit checks and hard credit checks.

Soft credit checks generally dont leave a footprint and will often show you the type of rates you could get. Theyre likely to be used by comparison sites and by tools when checking your eligibility for a certain rate or product.

Hard credit checks leave a visible footprint and generally take place when you apply for credit.

Explore more:;Hard vs soft credit checks: what’s the difference?

Also Check: Does Annual Credit Report Affect Score

Prequalify For A Credit Card Without Hurting Your Score

10/09/2021;·What impacts your credit rating. Can get free of charge score, hook up your own profile, and determine whenever you Supercharge it You lack one simple history, or merely one history. Also the three UK financing referral companies , lenders has their particular methods of determining your credit rating. Instantly Increase score…

Other Products & Services:

Chase, JPMorgan, JPMorgan Chase, the JPMorgan Chase logo and the Octagon Symbol are trademarks of JPMorgan Chase Bank, N.A.; JPMorgan Chase Bank, N.A. is a wholly-owned subsidiary of JPMorgan Chase & Co.

Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved.

J.P. Morgan Wealth Management is a business of JPMorgan Chase & Co., which offers investment products and services through J.P. Morgan Securities LLC , a registered broker-dealer and investment advisor, member;FINRA and SIPC. Annuities are made available through Chase Insurance Agency, Inc. , a licensed insurance agency, doing business as Chase Insurance Agency Services, Inc. in Florida. Certain custody and other services are provided by JPMorgan Chase Bank, N.A. . JPMS, CIA and JPMCB are affiliated companies under the common control of JPMorgan Chase & Co. Products not available in all states.

“Chase Private Client” is the brand name for a banking and investment product and service offering, requiring a Chase Private Client Checking account.

Bank deposit accounts, such as checking and savings, may be subject to approval. Deposit products and related services are offered by JPMorgan Chase Bank, N.A. Member FDIC.

Read Also: How Much Does A Hard Inquiry Affect Credit Score

How To Minimize The Effect Of Hard Credit Inquiries

When youre buying a home or car, dont let a fear of racking up multiple hard inquiries stop you from shopping for the lowest interest rates.

FICO gives you a 30-day grace period before certain loan inquiries, like those for mortgage or auto, are reflected in your FICO® credit scores. And FICO may record multiple inquires for the same type of loans as a single inquiry as long as theyre made within a certain window. This window is typically about 14 days.

While some lenders can rely on scoring models that give you more time to shop without incurring an additional hard inquiry, you may want to stick to 14 days to do your comparison shopping, since you likely wont know which scoring model a lender relies on to generate your score.

What Affects My Credit Score

Your score will ultimately be based on how responsibly you use your credit facilities.

For example, you lose 130 points with Experian if you fail to pay a bill on time but will gain 90 points if you use 30% or less of your credit card limit.

Like lenders, each credit reference agency has its own system for assessing your creditworthiness and will take into account different factors when calculating a score.

However, certain things will have a negative impact on your score regardless of the agency – for example, not being on the electoral roll, or making a late payment.

Bear in mind that the timing of entries in your report is more important than the type of activity.

Lenders are most interested in your current financial circumstances, so a missed payment from a few years ago is unlikely to scupper your chances of getting credit.

Also Check: Is 586 A Good Credit Score

What Does A Credit Score Mean

Your credit score is a numerical representation of your credit report that represents your creditworthiness. Scores can also be referred to as credit ratings, and sometimes as a FICO® Credit Score, created by Fair Isaac Corporation, and typically range from 300 to 850.

FICO® Scores are comprised of five components that have associated weights:

- Payment history: 35%

- Length of credit history: 15%

- How many types of credit in use: 10%

- Account inquiries: 10%;

Lenders use your credit score to evaluate your credit risk generally, the higher your credit score, the lower your risk may be to the lender. To learn more, view how your credit score is calculated.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Credit Score plus tools, tips, and much more. Learn how to access your FICO Credit Score.

Is It Worth Paying For A Credit Score

Sites like MyFICO provide access to your FICO credit score when you sign up for a monthly membership. The monthly fee ranges from $19.95 to $39.95 a month. Unlike free credit score sites that only show one score, youll see the FICO scores used by auto lenders, mortgage lenders and other lenders that use industry-specific scoring models.

Access to those scores is typically not worth the monthly fee because theres usually little difference between credit scores. Dont sign up for a paid service if youre worried about your credit score. Instead, use a free monitoring tool, minimize your credit card use and pay all your bills on time. Those strategies will help you improve your score and qualify for lower interest rates.

You May Like: Does Paypal Credit Report To Credit Bureaus

When Does A Credit Check Hurt Your Score

When you check your own credit score, it has no impact because it only counts as a soft inquiry. But when a lender or credit card company pulls your credit score, its a different story.

There are two ways a company can pull your credit information: a soft inquiry and a hard inquiry. A soft inquiry is most often used when a lender wants to preapprove you for a loan or credit card and has no visible impact on your score. Employer credit checks also show up as soft inquiries.

A hard inquiry occurs when youre directly applying for a loan or credit card and will impact your credit score. Landlord credit checks are often considered hard inquiries, too. A hard inquiry will officially stay on your credit report for two years but will only affect your score for one yeartypically between one and five points.

Tips For Improving Your Credit

Checking your credit score regularly is essential if you’re working on building or rebuilding your credit history. As you look for opportunities to improve your credit, here are some tips to help you get started:

- Get caught up on overdue payments, if applicable, and pay all of your debts on time every month going forward.

- Keep your credit card balances lowremember, the key is to keep your utilization rate below 30%, but the lower, the better. If you have high balances, focus on paying them down as quickly as possible.

- Consider asking a family member to add you as an authorized user on their credit card account. Before they submit the request, however, make sure the account has a positive history that can help improve your credit score.

- Avoid applying for new credit unless you need it.

- Get credit for paying your utility and phone billsthese payments typically don’t get reported to the credit bureaus, but with Experian Boost, you can allow Experian to connect your bank accounts and use the data to identify utility and phone payments. Once you verify the accounts, they can be added to your Experian credit file and may help boost your credit score.

As you use these tips and other good credit practices, you’ll be well on your way to a better credit score.

Don’t Miss: Does Having A Overdraft Affect Credit Rating

Hard And Soft Inquiries And How They Affect Your Credit

Credit inquiries, or requests for your credit report information, are classified under soft and hard inquiries. A soft inquiry is any inquiry where your credit is not being reviewed by a potential lender. This can happen when you check your own credit score. Don’t worry — soft inquiries do not hurt your credit score, so check away!

In contrast, a hard inquiry is when your credit is being reviewed because you’ve applied for credit with a potential lender. Hard inquiries make up a small portion of your overall credit score, and they tend to have a minimal, temporary effect. However, if you have a lot of them in a short period of time, it may signal that you are a riskier borrower resulting in a lower credit score.

How To Find The Best Personal Loan Without Damaging Your

28/12/2020;·There are many ways you can check your credit score for free, including accessing your score from one of the three major bureaus Equifax, Experian or TransUnion. Having at least a good of 670 or higher is required to get most cards. Always pay your bills on time. Payment history is an important factor affecting your credit score. Make sure you pay all your bills …

Don’t Miss: How High Can A Credit Score Go

Top Credit Card Wipes Out Interest Into 2023

If you have credit card debt, transferring it to;this top balance transfer card;secures you a 0% intro APR into 2023! Plus, youll pay no annual fee. Those are just a few reasons why our experts rate this card as a top pick to help get control of your debt.;Read The Ascent’s full review;for free and apply in just 2 minutes.

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

Read Also: Which Business Credit Cards Do Not Report Personal Credit

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

How Many Hard Inquiries Is Too Many

The effect of a hard inquiry on your credit scores ultimately depends on your overall credit health. In general, adding one or two hard inquiries to your credit reports could lower your scores by a few points, but its unlikely to have a significant impact.

Having a lot of hard inquiries within a short time frame though will likely have a greater impact on your scores. This is because lenders and in effect, credit-scoring models look at multiple credit applications in a short amount of time as a sign of risk. Though there can be exceptions when youre shopping for specific types of loans, like car loans, student loans or mortgages.

Don’t Miss: Does Zzounds Report To Credit Bureau

Full Lowdown On What Mse Credit Club Offers:

- Our Credit Hit Rate.;This shows your chances of success, as a percentage, of grabbing our top cards and loans.

- Eligibility tool.;It reveals the likelihood of you getting top credit cards or loans .

- Your credit profile explained.;It shows the key factors affecting your score and how to improve them.

Or alternatively…

Experian’s CreditExpert ;free 30-day trial*.;CreditExpert offers new customers a “free 30-day trial, then £14.99 a month” service. It’s different from MSE’s Credit Club in that it gives you real-time access to your credit report . It also offers an eligibility checker. You can only do the free-trial once. To cancel your subscription, log into your account and go to ‘My Subscriptions’.

Experian’s Credit Score ;free subscription to your score.;If you don’t want to pay a subscription to see your credit report, you can sign up for free to see your Experian Credit Score. You won’t have to pay anything, but the information is limited to seeing your credit score, as opposed to credit report. The score updates every 30 days.

What To Remember When You Are Rate Shopping

If you need a loan, do your rate shopping within a focused period such as 30 days. FICO Scores distinguish between a search for a single loan and a search for many new credit lines, in part by the length of time over which the inquiries occur.

When you look for new credit, only apply for and open new credit accounts as needed. And before you apply, it’s good practice to review your credit report and FICO Scores to know where you stand. Viewing our own information will not affect your FICO Scores.

As a general rule, it is OK to apply for credit when needed. Be mindful of this information so you can start the credit-seeking process with more confidence.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

You May Like: How To Get Rid Of Inquiries On Your Credit Report

How To Check Your Credit Score For Free Without Penalty

It’s a myth that checking your own credit score will affect it.

Any time you apply for a loan, or even some bank accounts, the resulting credit check can hurt your overall . But the myth that checking your credit rate or report does the same is just that: a myth.

To better understand how the process works, its important to know the difference between a soft and hard inquiry.