How New Credit Scoring Models Minimize Collection Damage

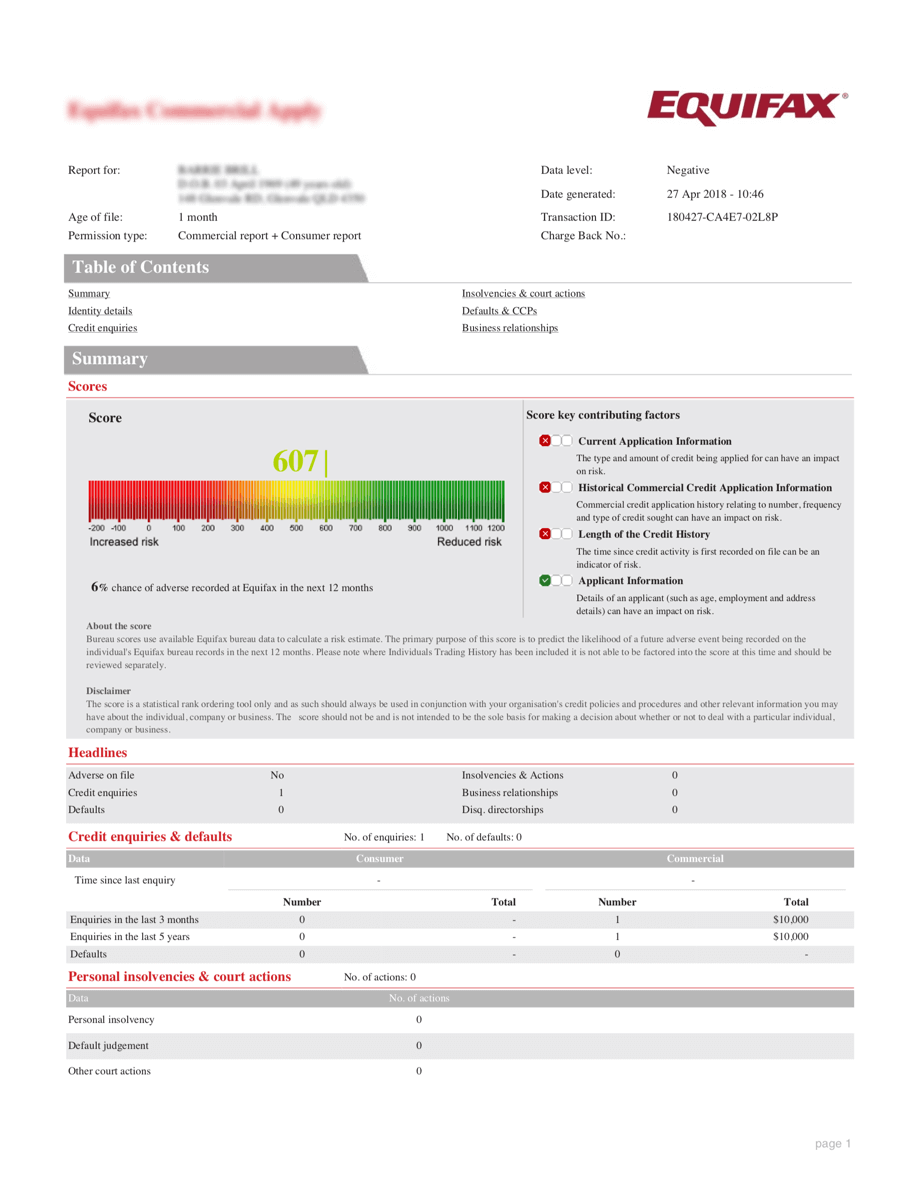

Its important to note that just because something gets noted on your credit report, this doesnt mean it will affect your . In addition, some factors affect your score more than others, and collection accounts are beginning to affect your score less and less.

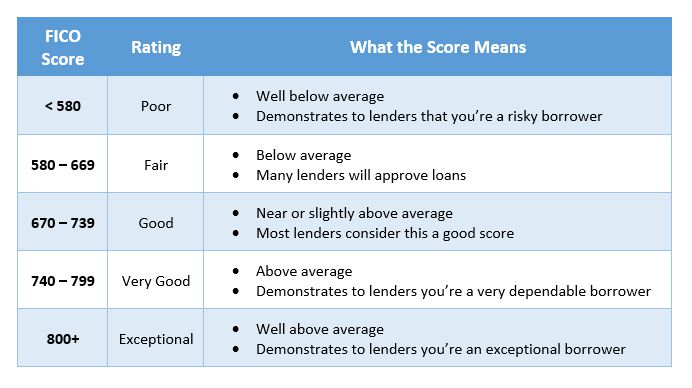

New credit scoring models, such as FICO 9 and VantageScore 4.0 do not give the same weight to medical collections as they give to other types of collection accounts. Essentially, this acknowledges that medical collections arent necessarily a sign that someone is irresponsible with credit, which is what your credit score is supposed to indicate. Additionally, FICO 9 also completely ignores any collection accounts that are under $100. Theyre not factored into your score calculation.

Be aware that these newer scoring models are not yet as widely used by lenders as previous models. Currently, FICO 8 is the most widely used scoring model in lending decisions. But eventually, most lenders will transition to the newer model, which will be good for consumers.

Is your credit rating holding you back? Learn how to fix it.

Can Paying Off Collections Raise Your Credit Score

In the past, paid collections on your credit report were treated the same way as unpaid collections. However, FICO has updated its credit scoring to ignore paid collection accounts. Similarly, VantageScore has recently updated its algorithm to ignore paid collections of all types.

With these new updates to the credit scoring models, paying off a collection does now help your credit score. However, since it takes time for new credit scoring models to be rolled out in financial institutions, it may take time for you to see a result when applying for credit.

Your Complete Guide To Dealing With Collections And Charge

There are five categories of information that make up your FICO® Score. None is more important than your payment history, which accounts for 35% of the total. The most obvious piece of this category is whether you pay your bills on time or not, and for people with strong credit histories, it usually ends there.

On the other hand, if you’re one of the millions of Americans without a spotless credit history, some other things could be weighing down your in the payment history category. Two big ones are collection accounts and charge-offs. These can be score-killers and can linger on your credit for years, especially if you don’t know how to deal with them.

With that in mind, here’s a guide to dealing with collections and charge-offs on your credit. To be clear, these aren’t easy to get rid of, but they’re definitely worth confronting head-on. With smart planning you can put yourself in a position to deal with them wisely and help accelerate your credit-repair process.

Don’t Miss: What Does Debt Consolidation Do To Your Credit Score

Does Paying Off Collections Improve Your Credit Score

Unfortunately, paying off a collection wont necessarily improve your credit score right away. Why?

As we said, with all FICO scores except FICO 9 , both paid and unpaid collections are considered to be major derogatories on your credit report. Since a paid collection is still a major derogatory mark, paying off your collection likely wont help your credit score if the scoring model used is FICO 8 or earlier.

On the other hand, since FICO 9, VantageScore 3.0, and VantageScore 4.0 ignore paid collection accounts, your score should rebound after paying off a collection with these credit scoring models.

Ways To Get A Paid Collection Account Off Your Credit Report

A paid collection account will not disappear from your credit history just because youâve paid it off. It will stay there until the statute of limitations has passed, which is at least seven years in most cases. You cannot have it removed by contacting the credit bureaus and requesting it be removed. They will keep that item on your credit report until the statute of limitations has passed, but they are required to remove it once this period of time has elapsed. If the statute of limitations has passed and the account is still on your report, you can then call the credit bureaus and tell them to remove it.

You can proactively ask a creditor to remove a paid account from your credit report. You can make this request as a negotiating incentive before paying the account or you can ask your creditor for a goodwill deletion after paying your account. Both options are explored below.

Read Also: How To Get Charge Offs Removed From Your Credit Report

Do All Collection Accounts Appear On Credit Reports

Yes, all collection accountswhether paid or unpaidcan show up on your credit report. Debts are usually sent to collections if they go unpaid for a long period of time. They show up on your credit report as a new collection account, not as the original credit account.

This means that you can have different negative items associated with the same unpaid debt, but theyll all be removed from your credit report 7 years after your missed payment.

How To Get A Closed Account Off Your Credit Report

Many people close credit accounts they no longer want, thinking that doing so removes the account from their credit report. The Fair Credit Report Actthe law that guides credit reportingallows credit bureaus to include all accurate and timely information on your credit report. Information can only be removed from your credit report if it’s inaccurate or outdated, or the creditor agrees to remove it.

Don’t Miss: A Credit Score Is Based In Part On Brainly

What To Know About Debt Sold To Collection Agencies

Reading time: 4 minutes

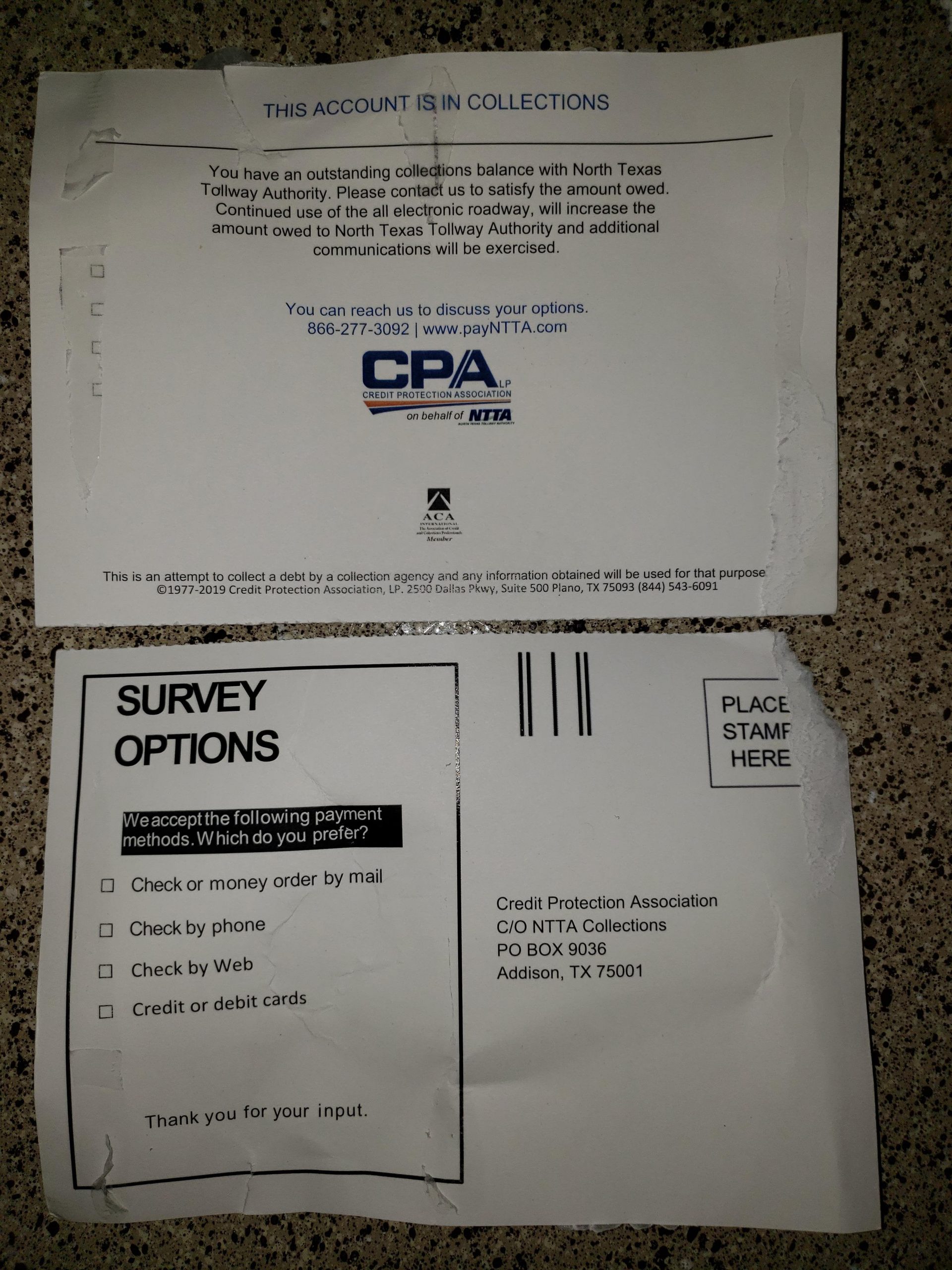

Maybe youve recently faced a serious financial hurdle and missed making payments against a credit card balance. Or maybe youre a few months behind on your utility bills. At first, youll find yourself answering phone calls from your creditors trying to get you to pay. Eventually it might take three months or up to six the phone goes quiet, and you think theyve given up.

Unfortunately, its more likely that the debt has been sold to a collection agency, and you can be assured that theyll try their best to collect. The creditor may have given up, but the collection agency wont thats how debt collectors make their money.

In addition to being a tremendous hassle, being pursued by a collection agency will likely have a negative impact on your credit reports. Read on to learn how debts are sold to third parties, what to do when a collection agency is trying to get you to pay and how to resolve the issue.

How To Dispute A Collection On Your Credit Report

If a collection on your credit report is inaccurate or a duplicate collection account, you can dispute the collection account on your credit report. This doesnt necessarily guarantee that the collection will be removed from your credit report, though, because the account could be updated with the correct information rather than removed.

The Federal Trade Commission provides a guide to disputing errors on credit reports as well as a sample FCRA dispute letter. Alternatively, some consumers may prefer to hire a to assist with disputing inaccurate information.

Recommended Reading: Is 721 A Good Credit Score

Does Deleting A Tradeline Mean The Account Is Wiped From Credit Report

A collections agency wrote:

Within approximately 30 days of your final payment successfully posting, we will request that the three major credit reporting agencies delete our tradeline related to your account from your credit bureau report.

Does this mean the debt will be removed from my report? The statement came on a bill from the agency. Should I go ahead and pay or request a pay for delete letter in writing? Should it be on the original company’s letterhead or is the collection agency fine?

- 1How do you think that a “pay-for-delete” letter would be different from this written statement that says when your payment posts, they delete?

Yes. That’s great! It will be deleted from all 3 credit bureaus. That letter is good enough.

After you pay your last payment, call the company and let them know they are supposed to remove the account from your reports now

Then check your 3 reports about 45 days after you speak with them. If for some reason it still shows on a report, create a dispute on the account and upload that letter to the credit bureau.

It is usually really hard to get them to remove it from your report but you lucked out.

Is The Debt Time

Finally, take note that if your debt is time-barred meaning the statute of limitations has passed. In this case, your debt collector may no longer have the right to sue you and win a judgment. But in some states the clock can restart if you make a written acknowledgement of the debt or make a payment toward it.

You May Like: How Long Does Foreclosure Stay On Credit Report

Communicate Your Situation To The Agency And If Applicable The Creditor

The creditor has hired the agency to collect the money from you, so direct contact with the creditor may not be possible.

The ideal is to pay off your debt in full, but if that isnt possible, you may be able to work out a repayment plan, such as manageable monthly payments, so that the collector doesnt take you to court or sell your debt to another collections agency.

Remember that the creditors goal is simply to get their money back. They may be willing to alter the terms and conditions of the lending agreement to help you return the amount you owe.

Dispute Inaccurate Or Incomplete Collection Accounts

If you have inaccurate or incomplete collection accounts on your credit report, the Fair Credit Reporting Act gives you the power to dispute this information directly with the credit bureaus or creditor. You can send a dispute using the dispute form on each credit bureaus website. The Federal Trade Commission has sample dispute letters on its website if you need help crafting one.

After you submit your dispute, a credit reporting company has 30 days to investigate your claim. If the credit bureau finds the provided information correct, the collection account will be removed from your report. However, if it finds that the company reporting the information was correct, the collection account will stay on your report for up to seven years.

Also Check: How Often Does Merrick Bank Report Credit Bureau

Final Thoughts On Collection Accounts On Your Credit

Restoring your credit score to good health after youve had accounts in collections requires a lot of time and effort. But with dedication and responsible management of your finances, its possible to rebuild credit. Our top tips for when you find yourself in a bad credit situation are:

- Pay or settle any outstanding debts that have moved to collections

- Check your credit score and read your credit reports regularly

- Keep on top of your expenses going forward

- Think about hiring the services of a reputable credit repair agency.

Negative Accounts Stay On Your Credit Report For 7 Years

Although few Americans have likely read it, they owe some thanks to the Fair Credit Reporting Act . Responsible for regulating the collection, dissemination, and use of consumer information, the FCRA is responsible for, among other things, keeping your credit information in the right hands.

The Fair Credit Reporting Act dictates how long negative accounts can remain on your credit report.

Another important section of the FCRA is the portion that addresses the length of time harmful information can stay on your credit report. Specifically, most types of negative accounts can stay on your report for up to seven years from the initial date of delinquency.

This means any charge offs and the hefty credit score dips that accompany them will remain a thorn in the side of your attempts to get credit for the better part of a decade. Whats more, paying off the debt will not automatically remove the charge off from your account. Instead, it is designated a paid charge off, which has less impact on your report but still isnt looked on very favorably by future lenders.

Read Also: Does Opening A New Credit Card Affect Credit Score

How A Closed Account Might Affect Your Credit

The effect of account closure on your credit depends on multiple factors, including the amount of available credit youre using, the length of your credit history, the status of the closed account and the accounts that are still open.

Here are a few things to watch out for when an account is closed.

What To Do When You Cant Pay Back A Debt

You should do everything within your power to avoid letting a debt go unpaid. Otherwise youll risk significant damage to your credit scores and a major blemish on your credit reports for years to come.

However, if youre facing a financial challenge, such as extreme medical debt or an abrupt loss of income, and find that you cant pay the debt, that doesnt automatically mean the collection agency has a right to take everything you own. In the worst-case scenario, the agency will try to garnish your wages or seize your property. These extreme actions are only possible, however, if the contract you signed with the original creditor and state law allow for them.

The federal Fair Debt Collection Practices Act regulates the means and tactics that debt collectors may use to entice consumers to pay. Its important to know what kind of conduct is allowed, so you can report and avoid debt collectors who violate the law.

For example, collection agencies cannot misrepresent themselves, the amount you owe or the actions they plan to take to get you to pay. There are limitations to the collectors ability to seek remediation through the courts, as well as how they may add collection fees.

The best thing to do if you are ultimately unable to pay your debt is to seek legal help. If you have multiple accounts in collections and the totals are well beyond your ability to create a realistic payment arrangement, you should consult with a bankruptcy attorney to discuss your options.

Recommended Reading: Can Delinquency Be Removed From Credit Report

What Is A Charge

Charge-offs tend to be worse than collections from a credit repair standpoint for one simple reason. You generally have far less negotiating power when it comes to getting them removed.

A charge-off occurs when you fail to make the payments on a debt for a prolonged amount of time and the creditor gives up. The creditor then writes off the debt as a loss. This generally happens after about six months or so of non-payment, but it varies among creditors. After your debt is charged off, the creditor can continue to try to collect the debt, or they may decide to sue you for it. In many cases, the creditor will sell your debt to a third-party collection agency.

If The Collection Has Been Paid Send A Goodwill Letter To The Agency

Even if the collection has been paid, the unpaid collection and the record of collection activity can stay on your credit report and have a negative impact for up to 7 years. Some lenders will consider this derogatory information based on the credit scoring models they use or in their underwriting process, which could negatively affect your borrowing applications.

Even with a valid, paid collection account, theres still a chance you can get it removed, and some FICO score and Vantage score models will ignore a collection thats marked as paid. You can write a letter asking the creditor or collector to remove this information as a goodwill deletion. Your goodwill letter doesnt need to have a lot of information or details. Simply identify the debt, and point out that it has been paid and that youd like them to remove it.

The debt collector is not obligated to remove factual, verified information from your credit report, although some will as a courtesy. If this method works, be sure to get written communication from the agency saying they have notified to remove any reference to the delinquent account from your history. This way, you can present this to the credit bureaus in case the agency doesnt push the update to all CRAs.

Read Also: How To Add A Tradeline To Credit Report

How Do You Get A Collection Removed From Your Credit Reports

Lets begin with the honest truth. If theres an accurate collection account on your credit reports, odds are slim youll be able to get it removed before its been there the maximum allotted time seven years from the date of the original delinquency.

Typically, the only way to remove a collection account from your credit reports is by disputing it. But if the collection is legitimate, even if its paid, itll likely only be removed once the credit bureaus are required to do so by law.

Even so, there are a few steps you can take to try to get it removed faster. But be aware: theyre unlikely to work:

- Check all of your credit reports to see where the negative item appears.

- Determine whether the account is legitimate if its not, you might be able to get it removed from your reports.

- Choose your plan of action. You have three choices dispute the account , contact the collection agency for a goodwill adjustment , or simply wait for the account to be removed from your reports in due time.

- Acknowledge that you may not be able to remove a legitimate collection from your credit reports.

Should You Pay The Debt Collector Or The Original Creditor

If you already have an account in collections, meaning the original creditor has already closed your account and transferred it to another owner, you should not pay the lender that the loan was originally from. The debt now belongs to someone else, so it would be pointless to pay the original creditor.

Don’t Miss: How To Analyze A Credit Report