Mistakes On Your Report

Mistakes on credit reports can and do happen, and these can have a negative effect on your credit report.

Some of the most common errors include incorrect names and addresses, but other details such as whether youâre on the electoral roll, your debt levels and account status can have mistakes as well.

If your name or address have errors or if you have used different names/addresses for different accounts, some of your accounts may not appear on your credit report. This may mean you lose out on any positive effects that these accounts may have on your credit score. Make sure you look at the âaccountsâ section of your credit report to check all of your accounts are there and thereâs nothing you donât recognise. If you want to change something that’s not right on your ClearScore credit report , you can raise a dispute.

If you want a cheat sheet of things to check on your credit report, read our guide here.

What’s In My Fico Scores

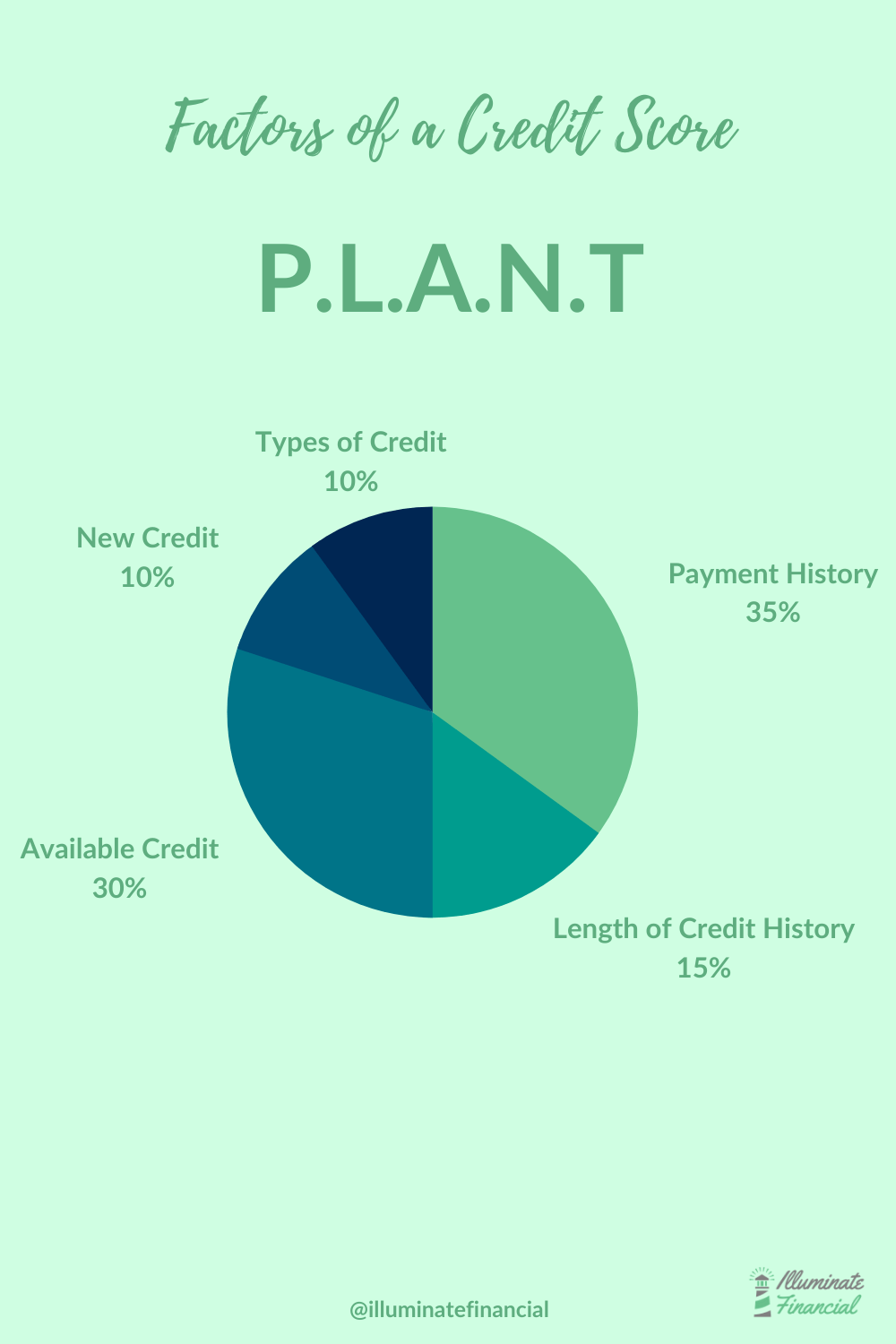

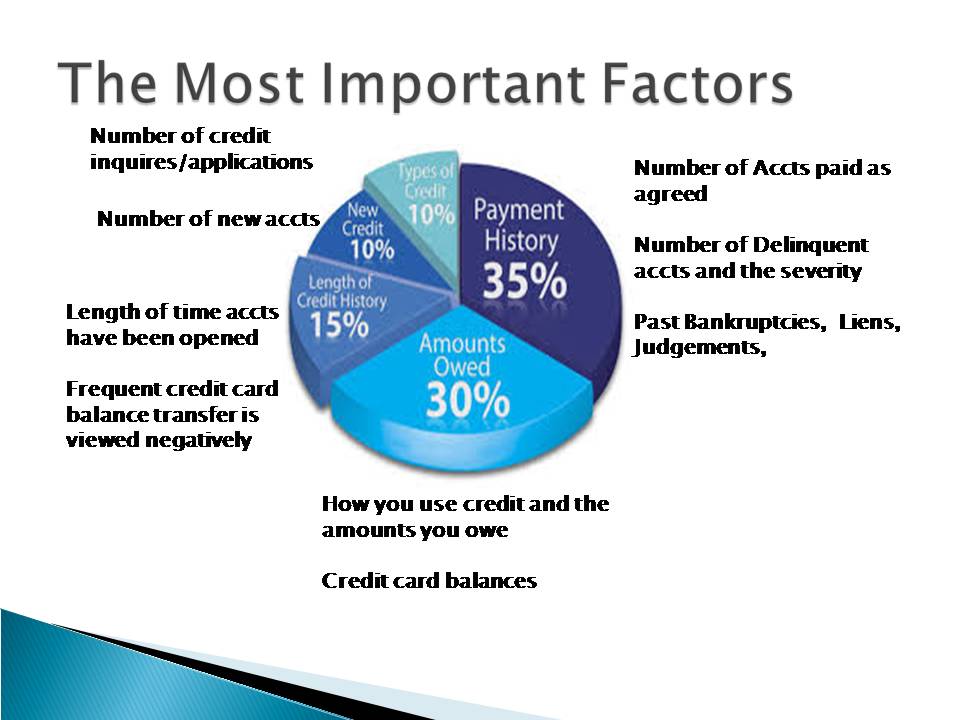

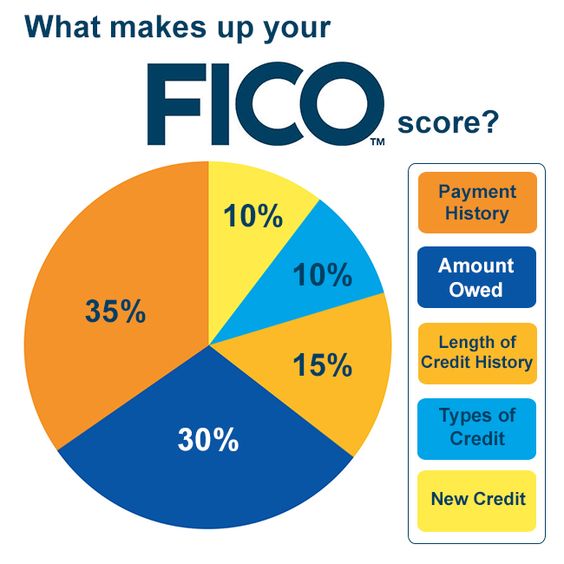

FICO Scores are calculated using many different pieces of credit data in your credit report. This data is grouped into five categories: payment history , amounts owed , length of credit history , new credit and credit mix .

Your FICO Scores consider both positive and negative information in your credit report. The percentages in the chart reflect how important each of the categories is in determining how your FICO Scores are calculated. The importance of these categories may vary from one person to anotherwe’ll cover that in the next section.

If You Have A Goal To Reach A Higher Score Or Just Want To Learn More About Credit Scores In General Its Important To Know What Affects Your Credit Scores And How Your Actions Could Improve Or Hurt Your Credit

Although there are many credit-scoring models, the goal of these formulas is to figure out your credit risk that is, the likelihood of you paying your bill on time, or even at all. And whether youre looking at a FICO® or VantageScore® credit score, your scores are based on the same information: the data in your credit reports.

While various credit-scoring models may treat factors differently, the leading models, FICO® and VantageScore®, place similar relative importance on the following five categories of information. Weve ranked them by which ones are often most important to the average consumer.

Also Check: Increase Fico Score 50 Points

How To Get A Free Annual Credit Report

Your credit score affects your life in many ways. So the only way to improve credit and protect yourself and your money are to stay on top of Big Brother. All three agencies are required by federal law to provide you with a free annual credit report at your request once every 12 months. You also have 60 days to report a free copy if youre denied credit, insurance, or employment based on bad credit. To order, visit annualcreditreport.com or call 1-877-322-8228.

The Age Of Your Accounts

Just like with your address, banks and lenders like to see signs of stability in the age of your credit accounts. So, they like to see that at least one of your credit accounts has been held for several years. Just like your address, this not only proves who you are, but shows youâve been trusted by another lender over a long period of time. Itâs likely to have a positive impact on your credit score if you have an older credit account on there. If your credit accounts are all mostly new this could lower your credit score.

Tip: if you’re going to close any of your credit accounts, try not to close your oldest one. This could cause a drop in your credit score.

Recommended Reading: Navy Federal Credit Score For Auto Loan

What Is A Credit Score

High credit scores signal to lenders that the borrower is likely to repay their loans within the provided terms. The higher your number, the more likely your loan will be approved, as some lenders may have minimum credit score requirements. And the more likely you are to get favourable terms for the loan, including a lower interest rate, than someone with a lower score.

Your credit score may also slightly differ by reporting agency or by the lender, as each will have its own proprietary way of calculating your specific number.

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

Read Also: Report Death To Experian

How Much Of Your Credit Limit Youre Using

Your credit utilisation will have an impact on your credit score. For example, if you use too much of your total available credit or too much of a single line of credit, it could damage your score.

Lenders may also consider this when they’re assessing your creditworthiness and ability to pay back credit. Keeping it under 30% is typically a good strategy.

If your utilisation goes over this level it could be marked as negative factor on your report. Equifax have given the following information as a guide to show how a high credit utilisation might impact your credit score:

-

If you use between 50% – 75% of your total credit limit, this will show up as an âamber flagâ on your credit report, meaning it may have a negative effect on your credit score.

-

If you are using more than 75% of your total credit limit, this will be a âred flagâ on your credit report, and itâs likely to have a more significantly negative effect on your credit score.

This means, ideally, you should think about carefully managing your credit utilisation. So for example, if your total limit is £1000, you might not want to use more than £300. If you have multiple cards or accounts, you might want to share out the amount you’re borrowing across the cards, rather than maxing out one card .

in your ClearScore account.

Other Credit Score Factors You Should Know About

Once youve mastered paying on time and keeping credit utilization low, turn your attention to other credit factors. These also affect your scores, though not nearly as much:

The length of time youve had credit: Longer is better, so keep old accounts open unless there is a compelling reason to close them, such as an annual fee on a card you no longer use. You might be able to help yourself a little in this category by becoming an authorized user on an old account with an excellent payment record.

The kinds of credit you have, or credit mix: It’s best to have a mix of installment accounts those with a set number of equal payments, such as car payments or mortgages and .

The length of time since you’ve applied for new credit: Each application that causes a hard inquiry on your credit may take a few points off your score.

Total balances and debt: Its best if you’re making progress in paying off your debt.

Read Also: 524 Credit Score Credit Card

Your Level Of Debt Matters

Your debt level determines 30% of your credit score. Credit scoring calculations, such as the FICO score, look at a few key factors related to your debt. The amount of overall debt you carry, the ratio of your credit card balances to your credit limit , and the relation of your loan balances to the original loan amount.

As a guideline, you should keep your credit card utilization at 30% or less, meaning only charge up to 30% of any card’s available limit.

Having high balances or too much debt can heavily affect your credit score. The good news is that your credit score can improve quickly as you pay down your balances.

What Is A Credit Card

According to Merriam-Webster, a credit card is a card authorizing purchases on credit. Basically, the credit company gives you a card which you use to buy goods and services. In return, the cardholder pays back the amount of money used during a billing period plus an interest and other charges associated with it. Credit cards come with very high Annual Percentage Rates compared to other forms of loans. Those who cannot pay all money they have used during a billing period they pay high-interest charges. It is important to note that you cannot borrow unlimited money from your credit card company. There is a limit to how much you can borrow and that limit is called a credit line. The credit line is determined based on the credit health of a person applying for it.

You May Like: Realpage Inc Hard Inquiry

How To Check Your Credit Score

Knowing where your credit score stands before applying for a new credit card or loan can help give you insight into which products you may qualify for and what interest rates you can expect.

You can check your credit score in a variety of ways, knowing it wont hurt your credit by doing so. For example, you can request a free copy of your FICO Score every 30 days through Experian. You can also access your free credit score by signing up for LendingTree.

Your bank or credit card issuer may also offer the ability to check your credit score for free. If not, Discover, Capital One, Chase and American Express all offer a free credit score service.

Additionally, the Fair Credit Reporting Act requires each of the three major credit bureaus to provide individuals with free credit reports through AnnualCreditReport.com. Due to the COVID-19 pandemic, the credit bureaus are now allowing you to pull your credit reports weekly until April 2022. Checking your reports regularly can help identify potential fraud and identity theft, as well as legitimate errors that may be dragging your scores down.

What Is A Good Credit Score

A FICO® Score is a three-digit number thats used to determine your creditworthiness in over 90% of lending decisions. It is determined by the information lenders supply to the big three credit bureaus in your credit reports. FICO Scores range from 300 to 850, and while the credit ratings of poor to exceptional vary depending on the credit-scoring model, the ratings determined by FICO are as follows:

| FICO Score ranges | |

|---|---|

| 800-850 | Exceptional |

A good credit score is one that falls anywhere from 670 to 739, while a credit score below 670 may prevent you from obtaining the most desirable interest rates and terms on loans and credit products.

Don’t Miss: Navy Federal Internal Score

Factors That Impact Your Credit Score In Canada

Not all debt is created equal on a credit report. Lenders consider credit rating, payment history, amounts owed, length of credit history, new credit and the types of credit in use before approving an applicant for financing. Effectively managing these 5 factors and understanding how they can impact your credit score will increase your chance of getting approved for financing at the best rate available.

- Save Money

What Affects Credit Score Negatively

Here are the top factors that may negatively affect your credit score:

- Hard Enquiries: Whenever you make a loan application or apply for a new credit card, the bank or lender will source your credit information from a credit agency. This is termed as a hard enquiry or pull enquiry. When you make multiple loans or credit card applications, your credit score could be affected because of such hard enquiries.

- Request for Higher Credit Limit: If you frequently request your lender to increase your credit limit, it can impact your credit score negatively. This is because every such request will lead the bank to ask for a credit report from a credit agency. This, in turn, can hit your credit score.

- New Credit Accounts: If youre constantly opening new credit accounts, it reflects that you are credit hungry and are unable to manage the available credit effectively. This could bring your credit score down as lenders will consider this a negative sign.

Read Also: How To Get A Repossession Removed From Your Credit Report

These Factors Dont Affect Your Score

Eagle-eyed readers will have noticed that so far the credit score overlooks some fairly significant factors. Indeed, your credit score does not take into account your age, marital status, occupation or where you live. Surprisingly, even your salary, assets and child support obligations are not factors that contribute to the score. Lenders may consider these, but the credit score does not apply them to the overall calculation.

What You Can Do

Check your credit score regularly, not only to root out and correct any errors in your report, but also to spot any patterns to address in order to achieve your best possible score. Bear in mind that each credit bureau works differently, so your scores may vary from one to the other. See how ScoreMasterâs range of credit monitoring tools and services can give you the insight you need.

Large Amount Of Existing Debt

Your existing debt can also increase or decrease your credit score. For example, if you are currently paying the EMIs of two to three separate loans, you would have a poor credit score until you manage to repay them successfully. Hence, it is important to ensure that you dont borrow multiple loans at the same time.

Don’t Miss: Ntb/cbna

The 5 Biggest Factors That Affect Your Credit

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

A is a number that lenders use to determine the risk of loaning money to a given borrower.

Here are the five biggest things that affect your score, how they affect your credit, and what it means when you apply for a loan.

Credit Age And History

If youâre very young and just starting out with credit, your score will reflect that. Credit age is about 15 percent of your credit score, and the scoring agencies will consider both the age of your oldest account and the average age of all of your accounts.

For new credit holders, thereâs not much you can do but continue using your credit wisely and wait for your accounts to get older. Closing old accounts, even if you donât use them, will shorten the overall average account age. Opening a new account will do this as well. Keep your accounts as long as it makes sense so that your oldest account can continue boosting your credit score.

Read Also: 728 Fico Score

How Much You Use Credit

Anyone who has a limited credit history may find it hard to borrow money because the lender is not able to determine if the borrower is a good risk. In addition, those customers with frequent and multiple credit applications raise a red flag for lenders because they may be overburdened with too much debt and might struggle with any further credit. Handling credit responsibly will boost your score.

Factors That Dont Affect Your Credit Score

Checking your credit reports

Checking your credit reports will result in a soft inquiry but have no fear soft inquiries have no impact on your credit scores.

In pre-COVID times, you could only check each of your credit reports for free once a year. Beginning in April 2020 however, the three credit bureaus gave people weekly access to monitor their credit reports for free until April 2021. Missed the boat? Well then, weve got some great news theyve just extended it until April 2022!

Learn how to check your free credit reports here.

Using your debit card

Checking and savings accounts arent included in your credit reports only credit accounts like loans and lines of credit are. Using a debit card linked to your bank account wont help you build credit, but it also wont hurt it.

Being denied credit

Some online lenders will only run a hard inquiry on your credit report when you accept a loan or line of credit not when you apply.

Keep in mind, not all lenders operate this way. If you see messages like Check your rate with no impact to your credit score on a lenders website, you should be able to apply without affecting your credit.

Your level of income or changes to it

Believe it or not, how much you take home every month has no effect on your credit. So, whether you just lost a job or scored that big promotion youve been aiming for, youll see no changes to your credit score.

Payments under 30 days past due

Getting married

Also Check: Does Carmax Do Credit Checks

Why Credit Scores Matter

A credit score is a snapshot in time that represents the health of your credit report. It’s designed to predict your repayment behavior, but is not the only factor lenders use when deciding if they will extend credit and at what terms.

The information in the above chart is for general educational purposes only and does not represent score ranges specific to any one credit bureau or credit scoring model.

The loan terms offered to you are tied to how much risk the lender believes they are taking by extending credit to you. Consumers with higher credit scores usually qualify for better loan terms.