Why Do Credit Scores Matter When Renting

If your credit score is below 620, it can signal to a property owner that youâre a risky renter, and they may deny your application. Your credit score and a performed by the landlord could be what separates you from other applicants. Be upfront and transparent about your credit score, let the landlord know why itâs a lower score and what you are doing to improve it.

What Do Landlords Look For On Your Credit Report

Landlords check your credit for many of the same reasons lenders do: They want to know if you’re likely to pay your bill on time, based on your past history of paying off debt.

In addition to pulling your credit score, landlords may also check your credit report for evictions, bankruptcies, accounts in collections, loan defaults and late payments. Before submitting any rental applications, you’ll want to check your credit report and score. You can do this for free at AnnualCreditReport.com you can also access your Experian credit report and directly through Experian. Looking over your reports and scores will tell you where exactly your credit stands, and will provide clues to what you’ll need to do to increase your scores.

In addition to your credit, landlords may use other types of reports and background checks to screen you as a potential tenant. Tenant screening may also include criminal background checks, a review of your employment history or contacting references. If a landlord has reported your payment history to a credit reporting agency like Experian’s RentBureau, you may have a renter’s credit score that shows whether you’ve paid your rent on time.

Renters in competitive cities like San Francisco, Boston and New York have average credit scores above 700, according to RENTCafé, so you might need to set your sights a little higher if you want to live there.

How A Renter’s Credit Score Might Help

Your renters credit score can help to offset past mistakes you may have made credit-wise.

For example, lets say you left an old medical bill unpaid because you didnt have the cash to cover it. The account was sent to collections and its been sitting on your credit report ever since.

If you have a positive history of paying your rent on time, that could take some of the sting out of the black mark caused by the collection account.

Your lender may look more favorably at your application if youve shown that youre able to keep up with your rent.

A renters credit score could also help with establishing your credit history if you dont have any loans or lines of credit in your name.

If youre fresh out of college, for example, and youre hoping to become a homeowner one day, having a positive renters score could make it easier to qualify for a mortgage down the line.

Recommended Reading: Affirm Cricket

Find No Credit Check Apartment Listings

Look in your local classifieds or on media platforms for apartments that are listed for rent with no credit check required. Also ask friends, relatives and co-workers for their suggestions. If you dont find an apartment with no credit check, consider asking landlords if they might agree to forgo a credit check and rely on a good background check, proof of income and strong references from prior landlords.

Im Having Problems With My Former Landlord Not Updating The Eviction On My Credit Report

Unfortunately, this is something youll need to handle directly with your landlord as neither nor any other service can make them update the information on your account. The best advice we can offer here would be to pay off what remains owed and have them note it as paid in full. This way, they wont continue reporting the debt until it gets to a point where it has been paid off.

You May Like: Free Paydex Score

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

How Do Landlords Use Credit Scores

Landlords, however, are not lenders in the traditional sense. How are you going to use the credit score of prospective tenants to run your rental business?

Landlords use credit scores for the same base reason as lenders: to determine how likely a tenant is to pay their rent in a timely manner. By reviewing a prospective tenants credit report, you can get an idea about how they have handled payments in the past on loans, credit cards, and other things.

You May Like: How Long Is A Repo On Your Credit Report

How To Dispute An Eviction On Credit Report

You can submit a dispute with the credit bureaus if theres some eviction-related information on your credit report that you believe isnt supposed to be mentioned. Youll have to submit a dispute to each credit bureau separately.

To do this, you can send a letter to the respective credit bureaus, including your complete information, proof of your claim, and an explanation of why you believe the information is disputed.

It must include requests to remove the information from your credit records. In addition, submit copies of documents provided by the courtcivil judges expungement records, debt settlement receipts, and eviction suitattached with the letter.

Recommended Reading: Does Opensky Report To Credit Bureaus

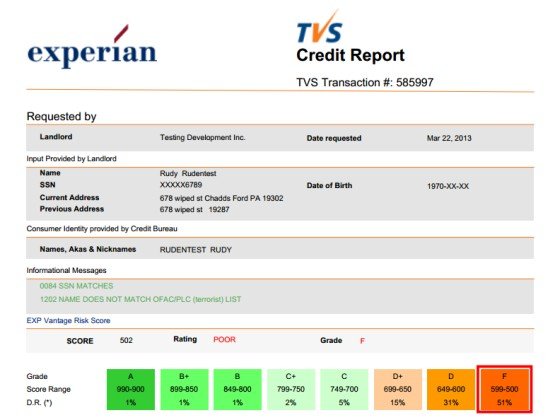

How Do Landlords Check My Credit

There are several ways landlords can check your credit. The National Association of Independent Landlords offers credit checks for a fee, and there are independent screening services that work to pull data from the three major credit bureaus: Equifax, Experian, and TransUnion. Usually, a completed written application is considered permission for landlords to run a credit check, and your application fee includes the cost of this service.

Many people dont realize that a tenant credit check isnt your standard report. Tenant credit reports contain a variety of information that can include:

- Identifying information like social security number, marital status, and date of birth

- Rental history and evictions

- Bankruptcies, tax liens and lawsuits like personal injury claims

- Criminal convictions, sex offender status, OFAC terrorist status

- Late or delinquent payment of rent or bills, including student or car loans

- Debt load, including debt still owed to previous landlords

Don’t Miss: How To Raise Credit Score By 50 Points

How Can I Get An Eviction Off My Record

Removing an eviction from your public record actually isnt that difficult. If you have an eviction record that will show up in your background check, you can petition the court in the county where the case was filed to have the record expunged, or sealed. This typically requires filing a petition with the court and paying a filing fee . Your chances that a judge will agree to expunge a case are higher if the case did not result in an eviction. If you still have an outstanding balance from an eviction case, you should pay the balance before petitioning the court for an expungement.

Do Late Rent Payments Affect Your Credit

On the downside, renting can hurt your credit score in some instances. For example, if you’re late on your rent payments or break your lease, get evicted, or fail to pay any move-out fees, and the landlord reports an unpaid balance to any of the three credit bureaus, that will hurt your credit score. Past-due rental balances can also be sent to a collection agency that could report the account on your credit report.

Your credit report might show an unpaid balance that resulted from an eviction, but the actual eviction would not appear on your credit report. Evictions become a public record in your credit report if your previous landlord sues you, and a judgment is filed against you.

Read Also: Realpage Consumer Dispute

Be Willing To Settle For Less

If you have bad credit, the apartment you want and the apartment you can currently get approved for might be very different. For example, you might have to move to a part of town that you normally wouldnt or live in an apartment thats much smaller and with fewer amenities than youd prefer. But doing so could help you fix your credit and maybe even save some extra money in the process due to cheaper rent.

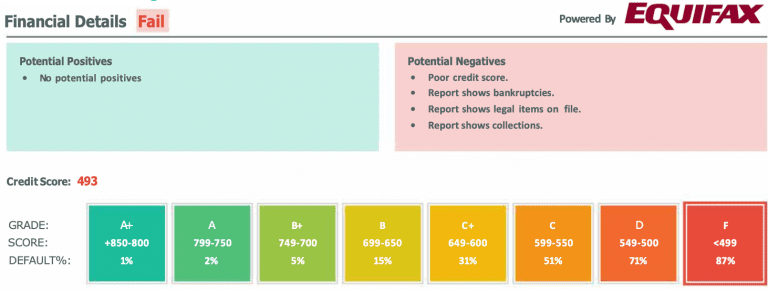

What To Look For In A Credit Report

Here are some key things to look for when evaluating a credit report:

- : Both FICO and Vantage scores range from 300 to 850. A is an indication of an applicants financial health, but its not the whole story. If an applicant has a low score, youll need to read the whole report to understand the reasons behind it.

- Debt Load: A tenant whos burdened with large debts may be unable to keep up with rental payments. Consider the applicants rent-to-income ratio , calculated by dividing monthly rent by monthly gross income. Many landlords follow the so-called 30% rule, whereby a tenants rent should not exceed 30% of their gross income. For example, if a tenants monthly gross income is $6,000, they cant afford more than $1,800 per month in rent.

- Late Payments: If a tenant hasnt paid credit card and other bills on time, theres a good chance they wont pay their rent on time either.

- : A credit report lists hard inquiries by lenders, which indicate the tenant has applied for a loan or credit card. New accounts could add to their debt load.

- Delinquent Rental Payments: An applicant is unlikely to pay rent on time if they failed to pay rent they owed to previous landlords on time.

- Negative Information: Evidence of previous bankruptcies, liens, garnishments, car repossessions, accounts in collection, and similar issues are red flags that indicate the applicant has financial problems.

You May Like: How Long Do Repossessions Stay On Your Credit

What Is An Apartment Credit Check

An apartment credit check shows your credit history. It lists your bank and credit card account balances, as well as any outstanding loans or payments you owe.

Landlords do apartment credit checks to find out if potential renters will pay their rent on time. To make sure you are responsible, landlords use screening tools such as credit reports, which provide your bill-paying history. Landlords need your written permission before running a credit check and will ask you to sign a credit screening document or a rental agreement.

To request a credit report, landlords can go through tenant screening companies, landlord associations or directly to the three major credit bureaus: Equifax, Experian and TransUnion.

These bureaus may report different information, giving a landlord a good overall idea of your creditworthiness and financial position.

You will likely be asked to provide the following information:

- Full legal name

- Current and former addresses from the last two years

- Current and past employment

Landlords may also ask you directly about your credit history. Some charge an application fee that includes the price of running a credit check. The process can take minutes or several days, depending on how the landlord decides to do the apartment credit check.

Why Is A Credit Check Important For Landlords

A credit check is an essential part of the tenant review process. It provides an overview of an individuals financial status, including the amount of debt theyre carrying and their bill-paying history. A credit report is based on the assumption that people whove met their financial obligations in the past will do so in the future.

When landlords use credit information to make rental decisions, they must comply with the Fair Housing Act, a federal law that prohibits discrimination in the sale or rental of housing. Landlords must treat all tenants fairly and cant discriminate based on race, sex, religion, or other factors specified in the law.

While credit checks are useful for assessing applicants rent-paying ability, theyre just one part of the screening process. Landlords should consider using additional screening tools, like background checks and criminal histories.

Also Check: Stoneberry Credit Karma

The Differences In The Bureaus

Conceptualizing the difference in scoring systems at each credit bureau can be difficult without more direct comparisons.

FICO is one type of credit score that provides a credit score based on payment habits and the amount of debt the individual currently has on their credit lines. Experian, Equifax, and TransUnion all use VantageScore credit scores, which use the same factors, but a different formula.

While a FICO score is just a number, the credit reports issued by Experian, Equifax, and TransUnion all include more detailed information as well.

The exact information you get from any report will be dependent on where the report comes from, what credit scoring model is used, and what information you request.

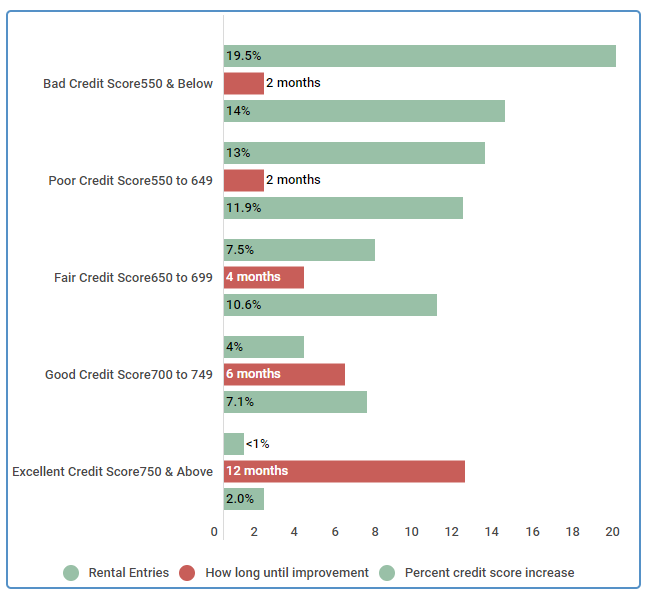

How Rent Reporting Helps Your Credit Score

While there has been some progress in credit reporting of timely rent payments, its not widespread. If you rent from a smaller company or an individual landlord, its less likely that your rent payments will be reported to the credit bureaus.

Even when rent payments are included on your credit report, theyre not guaranteed to help your credit score. According to FICO, only a small number of consumers see a significance effect on their credit scores after having rental added to their credit reports.

Even if rental data doesn’t make a major difference in your credit score, it can help if a landlord manually reviews your credit report looking for positive trade lines.

You May Like: Does Klarna Improve Your Credit Score

A Final Word Of Advice

It can be very discouraging to be rejected from an apartment application. In fact, it can be downright hurtful.

Though it does happen, you shouldnt give up on finding the right apartment for you.

There are rooms and apartments for rent just about everywhere in this city, and if you look long enough, youll find your own perfect home.

What Do Landlords Look For When They Check My Credit

When landlords check your credit, theyre looking for evidence that youll pay your rent on time. The metrics that they use to do this often vary, but theyll pay special attention to your payment historyspecifically, whether you have any derogatory items like late payments, charge-offs, or collection accounts.

Read Also: Remove Inquiries In 24 Hours

Other Variables To Consider

No matter what type of credit score range youre considering, you should look at these other variables in a persons profile before you make a final decision:

- Someone with a low credit score may still be able to make routine payments, in full and on time, if they have a decent, consistent employer. Conversely, even a person with a good credit score may be a risk if they dont have a consistent job or line of income.

- You may also inquire about the prospective tenants history with other renting arrangements. If you can, call their previous landlord and ask what their previous payment history and overall demeanor has been like. You might be surprised at the answer.

- Family status. Its illegal to discriminate tenants based on their family status, but you might be able to gauge a tenants responsibility based on whether theyre living alone or with children.

- Make sure to have a one-on-one conversation with any tenant youre considering accepting. Youll be able to get a feel for the tenants personality and attitude, which may be strong indicators of their responsibility and accountability. Youll also get the chance to ask them specific questions about their pastwhich is a good idea if there are questionable records on their credit report.

What Landlords Look For On Credit Reports

In addition to your credit score, credit reports contain essential information related to your financial habits and history that landlords may review, including:

- Debt to Income Ratio: This metric shows the amount of your monthly pre-tax income that goes toward debt payments.

- : Landlords will look to see whether you are carrying high balances on your credit cards.

- Bankruptcies: If you’ve ever experienced a bankruptcy, it will appear on your credit report. Unfortunately, its very difficult to explain bankruptcy, so it may diminish your chances of renting successfully.

- Rental History: Some landlords and rental property managers will report your rent payments to credit bureaus. You can even request this service online. If you have low-to-no credit, this is a great way to demonstrate that you have a history of paying rent on time.

Don’t Miss: Who Is Syncb Ppc

How To Get A Tenants Credit Score

Landlords who havent used credit scores as a screening factor before or are new to the rental industry might not be sure how to find out this private information about their tenant. Do you simply ask your tenant to tell you their credit score? Can you trust this information?

No that is not the right way to find out a tenants credit score.

Here at RentPrep, we offer two services that provide tenant credit score information. Our credit check is a pass/fail based system that provides you a range to choose from. This does not provide the specific credit score.

We also offer our SmartMove reports for those who would like to see the specific credit score with a full credit report.

If you want to learn more about how credit scores can and should be used during screening, this complete review can help. This will give you insight into different ways to run a credit score, the benefits of each method, and how you should consider this as you move forward with business.