Can I Use Carecredit To Pay Insurance Premiums

You can use CareCredit to cover high deductibles, co-pays, co-insurance, and to pay for treatments and procedures not covered by insurance.

Can my wife use my CareCredit card? Once you have CareCredit you can use it over and over for you, your family, and even your pets without reapplying, as long as you have available credit.

What credit score is needed for medical financing?

The company typically funds personal loans for medical expenses in one to two business days. You must have at least a 600 credit score to apply for a personal loan from Upstart.

Can you use CareCredit more than once? CareCredit helps you pay for out-of-pocket healthcare expenses for you, your family, and even your pets! Once you are approved, you can use it again and again* to help manage health, wellness and beauty costs not covered by insurance.

Dont forget to share this post !

Build Your Credit To Open More Options

In the era of smartphones and social media, every John and Jane on the street has a camera in their pockets and theyre not afraid to use them. Each embarrassing social stumble, short-sighted fashion choice, and inebriated mistake can live on forever on the world wide web.

Fortunately, the consumer credit world is a little more forgiving than your Facebook friends, and your financial mistakes will likely be forgiven years before you live down that publicly-posted reality show application video. In fact, negative marks on your credit report can only remain for seven years , after which time they no longer haunt your every credit application.

In the meantime, the absolute best thing you can do is to continue to pay down any existing debt and always pay on time. As your credit score improves so, too, will your credit options. With hard work and patience, you may one day find it easy to qualify for just about any credit card for excellent credit that catches your eye.

What Else Do I Need To Get Approved For Synchrony Bank Credit Card

Theres no guarantee that you will be approved for a credit card, regardless of how high your credit score is. Your credit score is probably the most important factor when considering your credit application. However, Synchrony Bank also considers other factors such as your income, debt, and any negative items on your credit report.

Read Also: Is 794 A Good Credit Score

Which Bank Will Issue A Credit Card Easily

Many subprime credit card companies and banks are willing to issue cards to applicants who have poor credit, including:

- PREMIER Bankcard

- Discover

- Wells Fargo

Note that some secured cards from big banks require an applicant to have at least fair credit for approval.

And then there are big banks that do not issue credit to subprime applicants, including:

- American Express

- Chase Bank

So while you may not get approved for a fancy card with Chase Ultimate Rewards Points or American Express Membership Rewards just yet, the easiest credit cards to get can help you improve your credit over time so you eventually qualify for a more prestigious card.

Linking Paypal Credit And Paypal

How do I link my PayPal Credit account to my account with PayPal?

Linking your account is easy. You can link your PayPal Credit account to an existing account with PayPal if you have one. Don’t have an account with PayPal? Signing up for PayPal is free.

Why should I link my PayPal Credit account to my account with PayPal?

What if my account with PayPal is blocked or closed?

Recommended Reading: Does Balance Transfer Affect Credit Score

What Do Credit Card Users Say

Melinda Opperman, president and chief relationship officer at Credit.org, a nonprofit agency that provides credit counseling and related services, says her organizations review of online forums and discussion boards indicates American Express, Discover and U.S. Bank rely mostly or solely on Experian, whereas Barclays and Goldman Sachs depend primarily or only on TransUnion.

Heres how the credit-reporting landscape looks for other card issuers, according to Credit.org:

- Bank of America: Experian or TransUnion

- Capital One: Equifax, Experian and TransUnion

- Chase: Equifax, Experian and TransUnion

- Citi: Equifax and Experian

- Wells Fargo: Equifax, Experian and TransUnion

Opperman warned that this information only represents a quick survey of what users report. So it could differ from what you experience when applying for a credit card.

Nonetheless, visiting online credit card forums and discussion boards can give you a sense of which credit bureau will help decide the fate of your application.

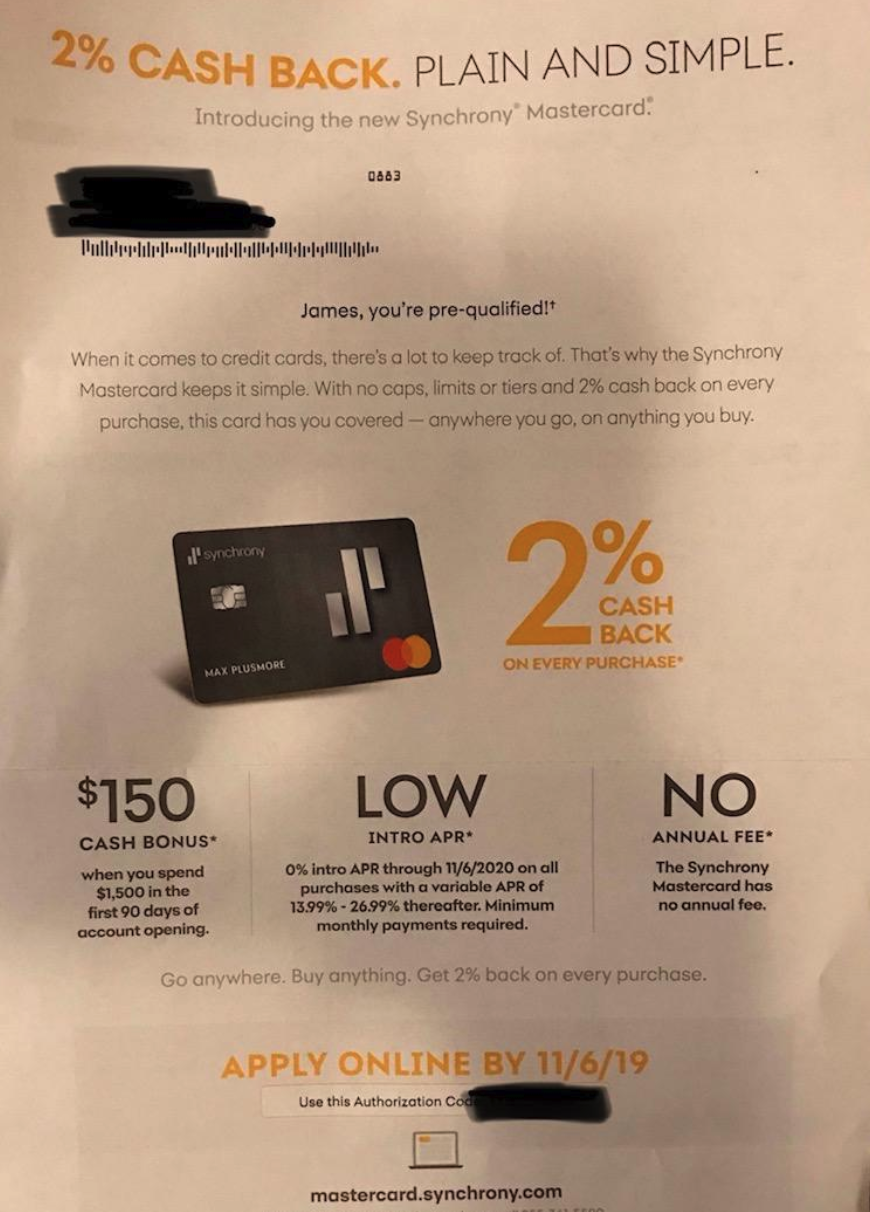

Which Credit Cards Are Offered By Synchrony Bank

Synchrony offers countless credit cards for national stores in just about every type of category. To get an idea of which you might be interested in, check out this comprehensive list.

Youll find tons of specialty stores, as well as some surprising major retailers. In addition, some of the best credit cards have 0% interest rates for up to 18 months. In total, there are nearly 200 credit cards issued by Synchrony. Some are backed by Visa or MasterCard and can be used anywhere, while others may only be used in the actual store.

You May Like:

You May Like: How Long Does A Hard Inquiry Last On Credit Report

What Bank Issues Home Depot Credit Card

For the first six months after making a purchase of $299 or more with the Home Depot Consumer Credit Card, which is provided by Citi, there is no interest charged. During some limited-time promotional periods, you might be eligible to make certain bigger purchases without incurring any interest charges for up to twenty-four months.

Youve Got Some Closed Accounts

Your PayPal Credit or Bill Me Later account will show on your credit report as either active or closed. Regardless of how old the accounts were, if they were closed before Synchrony Bank took over, they were likely being reported for the first time.

If your PayPal Credit was active and in good standingâas in, you didnât owe any moneyâand now itâs suddenly closed, this could be the work of Synchrony Bank. Now that SYNCB owns the accounts, they can not only raise and lower your credit lines, but they can also close your account for inactivity.

If you havenât used your account for a year or more, the creditors wonât make any money off your transaction fees. Thatâs why theyâll close your account due to inactivity. Itâs also the most common reason for closed accounts. Either way, itâll affect your credit score, and if you want your account reopened, youâll need to contact them right away.

Once again, if you see an account that you donât recognize, whether itâs active or closed, youâll want to contact SYNCB and follow the steps above for reporting fraudulent activity.

Recommended Reading: Does Car Insurance Go On Your Credit Report

Raise Your Credit Limits

Another thing that lenders look at is the percentage of your credit limits that youre using. If youre maxing out your credit cards, lenders are likely to think youre in dire financial straits.

If youre barely using any of your available credit, you can probably handle some additional debt.

You can usually request credit limit increases on your existing credit cards through the lenders online portal.

Increasing your credit limits will reduce your credit utilization, boosting your score.

Discount Tire Store Credit Card

The Discount Tire/Americas Tire credit card provides a no-interest promo for your first purchase. The promotional no-interest timeframe can be 6 months, 9 months, or 12 months.

To qualify for 6 months of no interest, your purchase must be between $199 and $999.99. To qualify for 9 months of no interest, your purchase must be between $1,000 and $1,499.99. Finally, purchases of $1,500 or more qualify for a no-interest 12 months.

Also Check: How To Print Credit Report From Credit Karma

How We Picked These Cards

To pick the best Synchrony Bank credit cards, we evaluated dozens of the retail cards Synchrony Bank offers. Then, we picked cards that stood out from the pack in one way or another.

We also wanted to make sure our picks were relevant to your daily life. Synchrony Bank offers credit cards from many different retailers, but its not always clear how the card could benefit the average consumer. We focused on cards that could offer serious value for either major purchases or purchases you might make on a regular basis.

What Makes A Credit Card Easy To Get

Secured cards are the easiest category of credit to be approved for because of their required security deposit. The deposit protects the card issuer if you miss a payment.

Some secured cards can be obtained without a credit check, providing nearly instant approval for anyone who meets the basic eligibility criteria. Two secured cards that dont run a credit check include the Secured Sable ONE Credit Card and OpenSky® Secured Visa® Credit Card.

Sable is a cash rewards credit card, which means eligible purchases earn cash back rewards, and it also offers one of the lowest APRs of any credit card.

This is in stark contrast to unsecured cards for bad credit, which are not only harder to get approved for, but they charge excessive fees and offer few perks you wont see any balance transfer or intro APR deals with these cards.

You May Like: How Long Do Credit Applications Stay On Your Credit Report

Is Credit Karma A Reliable Credit Score

Sams Club Synchrony Bank Store Card

Unlike the amazon card, a Sams Club store card works like a regular credit card. You can use it anywhere. So you get the ease of credit score approval that come with store cards and the flexibility that comes with normal credit cards. Other perks of this card include cash back on certain, qualifying purchases like gas, dining out, and travel.

Recommended Reading: Is 757 A Good Credit Score

What Bank Is Sams Club Credit Card

Synchrony Bank, which holds a license from Mastercard International Incorporated, is the financial institution that is responsible for issuing Sams Club Mastercards. The word Mastercard is a registered trademark, and Mastercard International Incorporated has the rights to the circled logo as a trademark as well.

Why Does Synchrony Lower Credit Limits

It’s likely that Synchrony Bank lowered your credit limit because your recent credit history showed that you were a higher-risk customer than you had been in the past. … If you’d like to get your limit raised, aim to improve your credit utilization and work on making minimum payments on-time every month.

You May Like: What Is The Minimum Credit Score To Buy A Car

Send A Dispute Letter

If you see an item listed under SYNCB/NTWRK on your credit report that you suspect is a mistake, then you can dispute it by sending a dispute letter to SYNCB/NTWRK and/or the credit bureaus.

Send your letter to SYNCB/NTWRK if you believe the error originated with them . Send it to the credit bureaus if you believe they made the mistake .

Either way, its usually a good idea to send copies of the letter to both parties . They may contact each other as they investigate the matter, and its important to make sure everybody has received the relevant information.

Use this to file a dispute directly with one of the credit bureaus. Mistakes in your personal information , as well as credit accounts that you don’t recognize, should usually be disputed with the bureaus. Often they’re the result of the bureau confusing you for someone else.

Use this to file a dispute with a creditor or debt collector. If you recognize a credit account but it’s listed with the wrong balance or incorrect status , the error may have originated with your data furnisher.

How Many Credit Cards Is Too Many

In general, if you have one or two credit cards on hand, youre good to go. But if you pay off your bill in full every month, never use more than 30% of the credit you receive, and make informed choices, then its not necessarily bad to have a lot of credit cards, especially if they provide a diverse array of benefits.

Donât Miss: Annual Credit Report Itin

Read Also: How Fast Does Credit Score Go Up

Youre An Authorized User On Someone Elses Syncb/ntwrk Credit Account

SYNCB/NTWRK can show up on your credit report if someone else added you as an to their own SYNCB/NTWRK credit account.

You might have been named as an authorized user by your:

- Spouse

- Friend

- Business partner

If someone designated you as an authorized user on their SYNCB/NTWRK credit account, their activities on the account could affect your credit score. 3

If the primary cardholder is a responsible person and a reliable borrower, being an authorized user on their account will probably improve your credit score by helping you build a positive payment history. On the other hand, you might see a small drop in your credit score if the primary cardholder neglects their payments or cancels their account with unpaid debt.

Similarly, your use of someone elses credit will affect their credit score, so take care when acting as an authorized user.

Synchrony Bank Doesnt Have The Name Recognition Of Some Other Banks But It Issues The Store Credit Cards For Many Popular Retailers

And while these cards are often known for their discounts and rewards programs, as retail cards they can also be some of the easiest cards to be approved for on the market.

This list shows our top picks of the best Synchrony Bank credit cards. They may be worth a look, based on your shopping habits and needs.

| Card |

|---|

You May Like: Can You Remove Hard Inquiries Off Your Credit Report

Read Also: How Long Are Late Payments On Credit Report

How Does This Impact My Credit Score

The SYNCB/PPC, SYNCB credit card, and any other SYNCB partnership counts as a line of credit in the eyes of the credit bureaus. That means any hard inquiries, credit misuse, and other activity will affect both your utilization and credit score.

In general, each new hard inquiry will lower your credit score up to five points. Of course, if you have multiple hard inquiries pulled, that number becomes compounded, lowering your score by the tens and maybe even twenties. Multiple hard inquiries also look bad to credit issuers, which will make it challenging to obtain a new credit card in the near future at a competitive interest rate.

Having closed accounts, on the other hand, affects your credit utilization rate. Closed accounts show that you have less credit. So, if you still owe any debts, having less credit causes your utilization rates to increase. This also has a negative impact on your credit score since it shows that you’re nearly reaching your credit limits with your current lenders.

Your closed accounts will still contribute to your length of credit history. However, it can take up to 10 years for closed accounts to be cleared from your credit report, granted they remain in good standingâi.e., you continue to pay off your debts on time and avoid late payments.

Removing Syncb From Your Credit Report

Theres no reason an application for a credit card should hold you back from getting approved for a competitive mortgage, student loan, or any other line of credit.

Though one credit card application wont likely destroy your credit, it can have an effect on your score for up to two years.

If SYNCB, Paypal, or one of its other partners has popped up on your report and lowered your score, consider disputing your debt or hiring a credit repair company to improve your score.

If youre looking for a place to start, the credit repair companies below provide excellent services.

They have a proven track record of success, with countless reviews from satisfied customers with soaring credit scores:

You May Like: How To Get Hospital Bills Off My Credit Report

What Are Credit Reports And How Do They Work

Your credit report tells your financial story to lenders, and it allows them to make informed decisions about your creditworthiness.

Your credit report is like a report card that grades how well you manage your financial obligations, says Bruce McClary, vice president of communications for the National Foundation for Credit Counseling.

There are three credit bureaus that publish these reports: Experian, TransUnion, and Equifax. These bureaus report information from your lenders such as payment history, balanced owed, and whether youre paying on time. If you pay your bills on time and keep your balances low, youll have a higher score. Conversely, if you miss payments regularly, youll have a lower credit score.

Potential lenders use one or multiple reports to verify your information. Theyll also use this information to determine if youre eligible for financing and if you are what your terms should be. Therefore, monitoring your credit reports is an essential way to stay on top of the information presented to prospective lenders.

Is Synchrony Bank Owned By Amazon

This is because General Electric Capital initially ran Synchrony Bank as a subsidiary once it was established in 2003. Even though it is now a retail bank, they dont talk about their past very often. It was expected to have an initial public offering in 2014 on the NYSE under the ticker symbol SYF for a total of $2.88 billion.

Read Also: Does Chase Credit Journey Affect Credit Score