How Long Does Negative Information Normally Stay On Your Credit Report

If you dont take any steps to remove it, negative information usually stays on your credit report for 7 years, although there are exceptions.

The table below shows how long before different entries and accounts are removed from your credit reports.

Amount of Time Negative Information Can Remain on Your Credit Report

| Negative Item |

|---|

Fair Credit Reporting Act, Equifax, and TransUnion.

Its possible to get any of the items listed above removed from your credit report. To do so, youll need to get the cooperation of either the credit bureaus that produce your reports or the company that provided the information .

As mentioned, you can do this on your own, without hiring outside help. In fact, if you do hire a credit repair company, theyll follow the exact same process that youll use yourself.

Well explain the primary methods you can use to remove negative information below.

Its impossible to erase bad credit overnight

Be patientfixing your credit can be a long process. Even if you manage to convince your creditors or the credit reporting agencies to wipe your credit history clean, itll take time for them to update your records . If repairing your credit ends up requiring multiple rounds of negotiation, it could take even longer.

Hire A Credit Repair Company

If youre looking for the easiest way to fix your credit report, the following three credit repair services earn our top marks based on BBB ratings, industry reputation, and our own reviews.

These services challenge each of three major credit bureaus to verify, correct, or remove negative items on your credit reports.

| $79 | 9.5/10 |

The Fair Credit Reporting Act entitles you to dispute inaccurate items on your credit reports. You can do so through the mail or online at the three credit reporting company websites.

While you can attempt to fix your credit yourself, the process requires effort, patience, organization, and expertise. For what many consumers consider to be a reasonable price, you can hire a credit repair organization to do the work for you.

Some disputes are easy to resolve, such as the removal of outdated information. Other disputes require more work, including submitting evidence to contest items and forcing the bureaus to validate questionable data. The ideal outcome is to remove enough negative items to give your score a boost.

Most credit repair services offer a free consultation to review your credit reports and identify fruitful areas worth challenging. The credit specialist will review with you the different plans the company offers, what services come with each plan, and how much each plan will cost you.

Request A Pay For Delete Arrangement

If you have unpaid charge-offs or collections, you can offer to pay the unpaid debt in exchange for deletion from your credit report. You can even negotiate with them to pay a lesser amount than what you originally owed. In fact, some collection agencies will settle delinquent accounts for far less than whats owed.

But before moving forward, you want to make sure that youre negotiating with the right collection agency. If the debt has bounced from place to place, you may have a better shot at having the item deleted by filing a dispute. This forces the collection agency to prove that the debt actually belongs to you.

Otherwise, make your offer in writing to the collection agency and await approval before remitting payment.

They may counteroffer with a higher amount, but you have the option to keep negotiating until you reach the sweet spot. Once both parties agree on an acceptable number, the debt collector will remove the item once the balance is paid in full.

Quick note: You must do this in writing so youll have proof that they agreed to the arrangement in the event the negative item is not removed once youve satisfied your end of the agreement.

Still no luck?

Don’t Miss: Is 813 A Good Credit Score

Dispute With The Business That Reported To The Credit Bureau

Now, you can completely bypass the credit bureau and dispute directly with the business that reported the error to the credit bureau, e.g., the credit card issuer, bank, or debt collector. You can make the dispute in writing, and the business is required to do an investigation just like the credit bureau.

When the business determines that theres indeed an error on your credit report, they must notify all the credit bureaus of that error so your credit reports can be corrected.

Add More Positive Data To Your Credit Report

Whether your file is thin or fat, adding positive trade lines will always help your score. Negative information counts for less and less each month as it ages until it disappears altogether in seven years. But around year two, most negative items have lost their big impact.

To rebuild your credit faster than just waiting for time to heal your wounds, try adding new accounts. Easy adds include gas and retail cards, secured credit cards, passbook loans and installment loans on small furniture purchases.

Adding positive information to your file will speed your score recovery by balancing or offsetting negative data quickly. Using programs like Experian Boost and UltraFICO can also be helpful in getting approved when you decide to apply for new credit.

Of course, be sure to make those new payments on time, every time, and youll be in the good credit column before you know it.

Remember to keep track of your score!

Also Check: Do Payday Loans Show On Your Credit Report

Don’t Miss: What Is The Highest Credit Score A Person Can Have

Send A Request For Goodwill Deletion

Writing a goodwill letter can be a viable option for people who are otherwise in good standing with creditors. If you’ve taken steps to pay down your overall debt and have been paying your monthly bills on time, you might be able to convince your creditor to forgive the late payment.

While there’s no guarantee that the creditor will delete the derogatory information, this strategy does get results for some. Goodwill letters are most successful for one-off problems, such as a single missed payment. However, they are not effective for debtors with a history of late payments, defaults or collections.

When writing the letter:

- Take responsibility for the issue that lead to the derogatory mark

- Explain why you didn’t pay the account

- If you can, point out good payment history before the incident

What If They Dont Comply

If the CRA does not comply, then your next move is to send an intent to file a complaint with the CFPB .

If the first 2 letters do not get the errors removed, then its in your best interest to let the CRA know that you intend to do next.

Heres an example letter:

Full Name

City, State, Zip Code

Dear Sir or Madam/To Whom It May Concern,

Please be advised that if the items are not deleted I will be filing a complaint with the CFPB .

On I requested that inaccurate/erroneous items that were illegally being reported to my credit file with your agency be deleted. You refused to do so and claimed to have verified these items.

On I requested, as required by FCRA 611 , that you provide me with a complete copy of the information that you used to investigate the matter. You failed to provide me with that information and again failed to delete the items.

Federal Law requires you to respond within 15 days. It has been over . Failure to comply with Federal Regulations by Credit Reporting Agencies will be investigated by the FTC and/or the CFPB.

These negative items have caused financial and emotional stress. Your blatant disregard of the law forces me to fully exercise my rights and file a formal complaint with the Consumer Financial Protection Bureau. Please be advised that I will file this complaint if these inaccurate items are not removed immediately.

1. Cell Phone, Account # 1234562. Cable Bill, Account #6543213. Credit Card, Chargeoff, Account # 00120034

Sincerely,

You May Like: Does American Express Report To Credit Bureaus

Is It Better To Pay Off Collections Or Wait

From the viewpoint of repairing your credit score, its better to pay off a collection sooner rather than later, assuming you can afford to do so. However, a paid collection will only help your credit score if the collector agrees to remove the item from your credit report. Short of that, paying off a collection may have no effect on your credit score.

As explained above, you may have bargaining leverage with a debt collection agency. This manifests when you submit a pay for delete letter that offers to pay the debt in return for removing the collection item from your credit report. Your offer may be for the full amount owed, but you can request a partial write-down of the balance due.

For example, suppose you had a $10,000 credit card balance and were unable to make payments. Eventually, the card issuer wrote off your account and sold it to a debt collection agency for 20 cents on the dollar. The issuer collected $2,000, which means the collection agency must collect at least that much just to break even.

The fact that your original debt was $10,000 may be less important to the collector than to the credit card issuer. If the collector were to collect, say, $4,000 on the old debt, it would rack up a gross profit of 100%. Therefore, the collector may be willing to accept a pay to delete deal.

That is, a higher score will improve your access to credit and lower the amount of interest youll be charged. A higher credit limit will reduce your credit utilization ratio.

What Happens When An Item Is Deleted From Your Credit Report

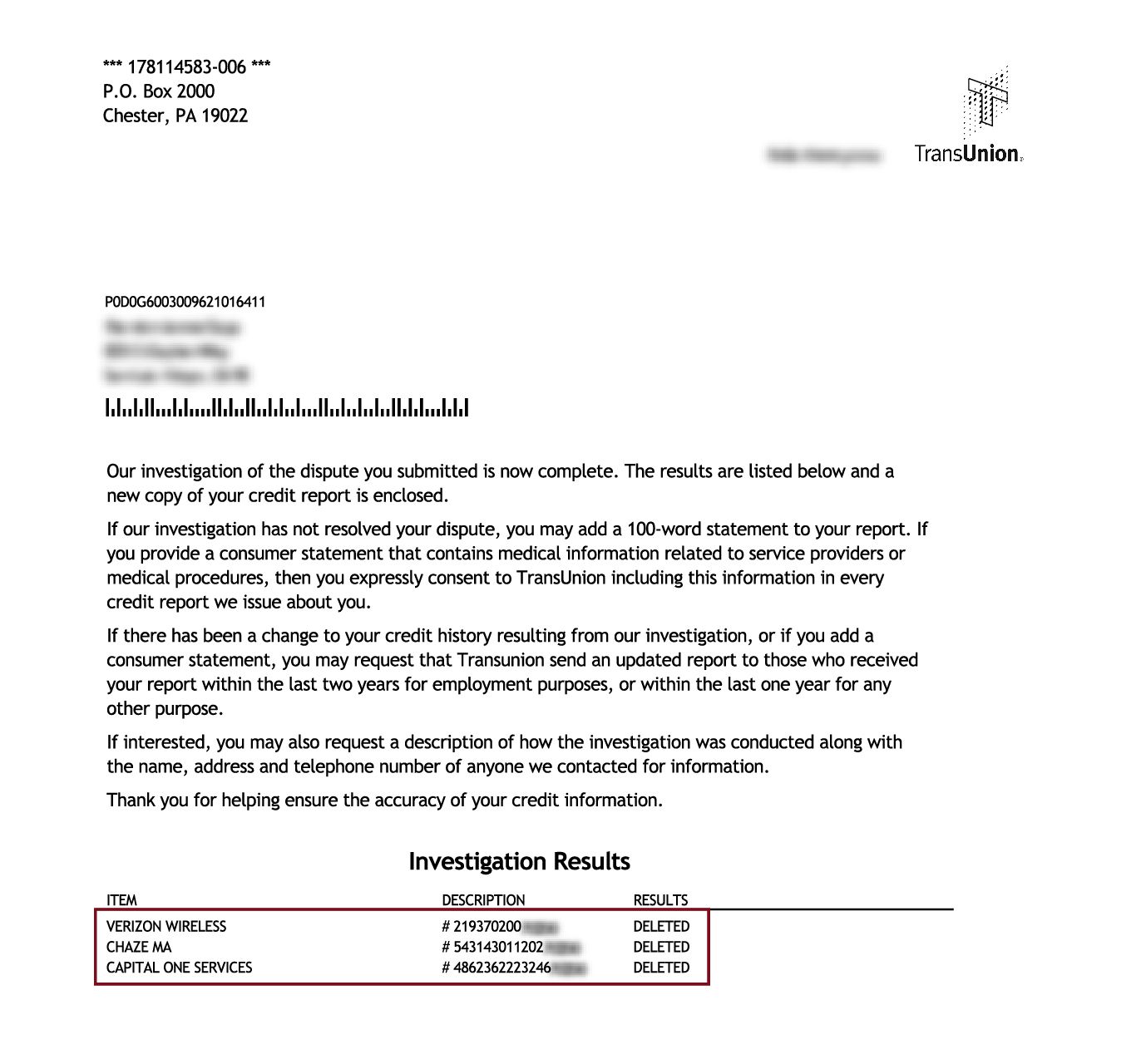

Whenever your credit report is altered because of a dispute lodged by you or a credit repair service, the credit bureau must inform you in writing. You are then entitled to a fresh copy of your credit report from the bureau.

Many credit cards offer free alerts that inform you whenever your credit score changes. Thus, if an item deletion results in a change to your score, your credit card company may be the first to inform you of the good news. You also may get a free fraud alert service.

You should see your credit score improve when negative items are removed from your reports. How much it improves, however, depends on the type of item that is removed and its age.

The credit bureau must send you written results about your dispute, which usually arrive within the initial 30-day window. If the results are favorable, you can instruct the bureau to notify anyone who received your report in the past six months.

Also Check: How Often Can You Get A Free Credit Report

Submit Dispute Letters To The Credit Bureaus

Before trying anything else, we recommend writing a dispute letter to each of the three major credit bureaus reporting the negative item. Creditors are mandated by federal law, the Fair Credit Reporting Act , to report accurate information about each account.

If the credit bureau cant verify their entries with the proper documentation when a dispute is filed, which is not uncommon, they must remove the negative item from your credit report.

You can dispute items on your credit report by phone, online, or mail. But disputing credit report errors by snail mail is the most effective method for several reasons.

The three credit bureaus have 30 days to investigate and respond to your dispute. However, you may sometimes receive a letter from the actual creditor requesting that you provide additional documentation so they can properly investigate the claim. This is a common stall tactic, and youre not obligated to respond.

Paying To Remove Negative Credit Info Is Possible But May Not Succeed

A bad credit score can work against you in more ways than one. When you have poor credit, getting approved for new loans or lines of credit may be difficult. If you qualify, then you may end up paying a higher interest rate to borrow. A low credit score can also result in having to pay higher security deposits for utility or cellphone services.

In those scenarios, you may consider a tactic known as pay for delete, in which you pay to have negative information removed from your credit report. While it may sound tempting, its not necessarily a quick fix for better credit.

Also Check: What Does Fixed Rate Mean On Credit Report

Writing Your Credit Dispute Letter

Now that you have your freshly pulled credit report in front of you score and all its time to look for the items listed on the report.

Youre going to need to write letters to each bureau that lists problematic items. So, if all 3 bureaus show issues you want to resolve, then you need to write to each one, individually.

The best advice that I can give you is to hand write these letters so that it looks personal, and not like every other downloaded template that these bureaus see each and every day.

They receive thousands of these each day, so if you think that the template will slip by without a thought, youre probably wrong.

eOSCAR: The credit bureaus use an automated dispute processing system called eOSCAR. This system scans each letter utilizing OCR scanning technology.

From their website:

So, what does this all mean? It basically means that you cant simply send in the same letter everyone else is sending and expect different results .

Lets construct a sample letter that you can use to dispute the credit report errors on your report.

Full Name

Now, continue reading this before sending them out!

Benefits Of A Debt Validation Letter

Recommended Reading: How To Get Rid Of Inquiries On Your Credit Report

Write A Goodwill Letter Asking The Creditor To Remove The Negative Item

If a creditor reports negative information and that information is legitimate, you wont have a basis to challenge it.

But another strategy is to write a goodwill letter. Thats where you politely request the creditor to remove the negative information.

This strategy will work best on accounts when the negative items are either old, insubstantial, or infrequent.

It can also be effective if you are a current customer in good standing. The creditor may agree to remove the negative item in the spirit of retaining your business.

For example, lets say you had a 60-day late payment reported two years ago. Its a legitimate entry, so you wont be able to dispute it successfully. If you had an otherwise good credit relationship with the creditor for the past five years, you can write a goodwill letter asking them to remove the single late payment based on the otherwise outstanding credit history you have with that the company.

However, you should be aware that it will be much more difficult and probably impossible to have more substantial negative information removed. For example, if youve had three 60-day and a 90-day late payment within the past two years, the creditor will be unlikely to remove the information.

The 5 Categories Your Credit Score Is Composed Of

- Payment history

If you make payments on time, keep your credit usage below 30% , have a good balance of different kinds of debt , you should be on your way to having a great credit score.

At the same time, a factor that can negatively affect your credit score, although not as much, is having a short credit history. For example, someone with more than 20 years of credit history will have a better score than a young college student who recently started using credit.

Luckily, having a low credit score does not mean you will not be approved for a loan until it goes back up. Somelenders provide information on the average score applicants need to qualify for a loan. It is recommended that you speak with your preferred lender so you are clear on the requirements for obtaining a loan with a low credit score.

Having negative impacts on your credit score can make most financial goals an uphill battle. Most negative impacts stay on your report for up to seven years, which can hurt your chances of obtaining new credit during those years. In addition, having a low credit score could translate into getting a higher interest rate on your home mortgage loan which means having to pay about $100,000 more in interest during the life of that loan.

Recommended Reading: What Is A Remark On Credit Report

Plan Before Shopping For A Loan

Before shopping for a loan, its always smart to proactively plan your finances.

First, learn whether the type of credit youre applying for can have its hard inquiries treated as a single inquiry. If so, determine the applicable timeframe. Then you can plan your shopping period accordingly.

Second, you may also want to check your credit reports before getting quotes to understand what information is reported. Find out how to request a free credit report from Equifax.

If youre worried about the effect that multiple hard inquiries may have on your credit reports, it may be tempting to accept an offer early rather than allow multiple hard inquiries on your credit. However, consider your individual situation carefully before cutting your shopping period short. In many cases, the impact hard inquiries have on your credit scores from shopping around will likely be minimal compared to the long-term benefits of finding a loan with a lower interest rate. The more informed you are about what happens when you apply for a loan, the better you can prepare for the process before you start shopping.

Read Also: Does Afterpay Report To Credit