Updates To Your Credit Limit And Balance Affect Your Utilization

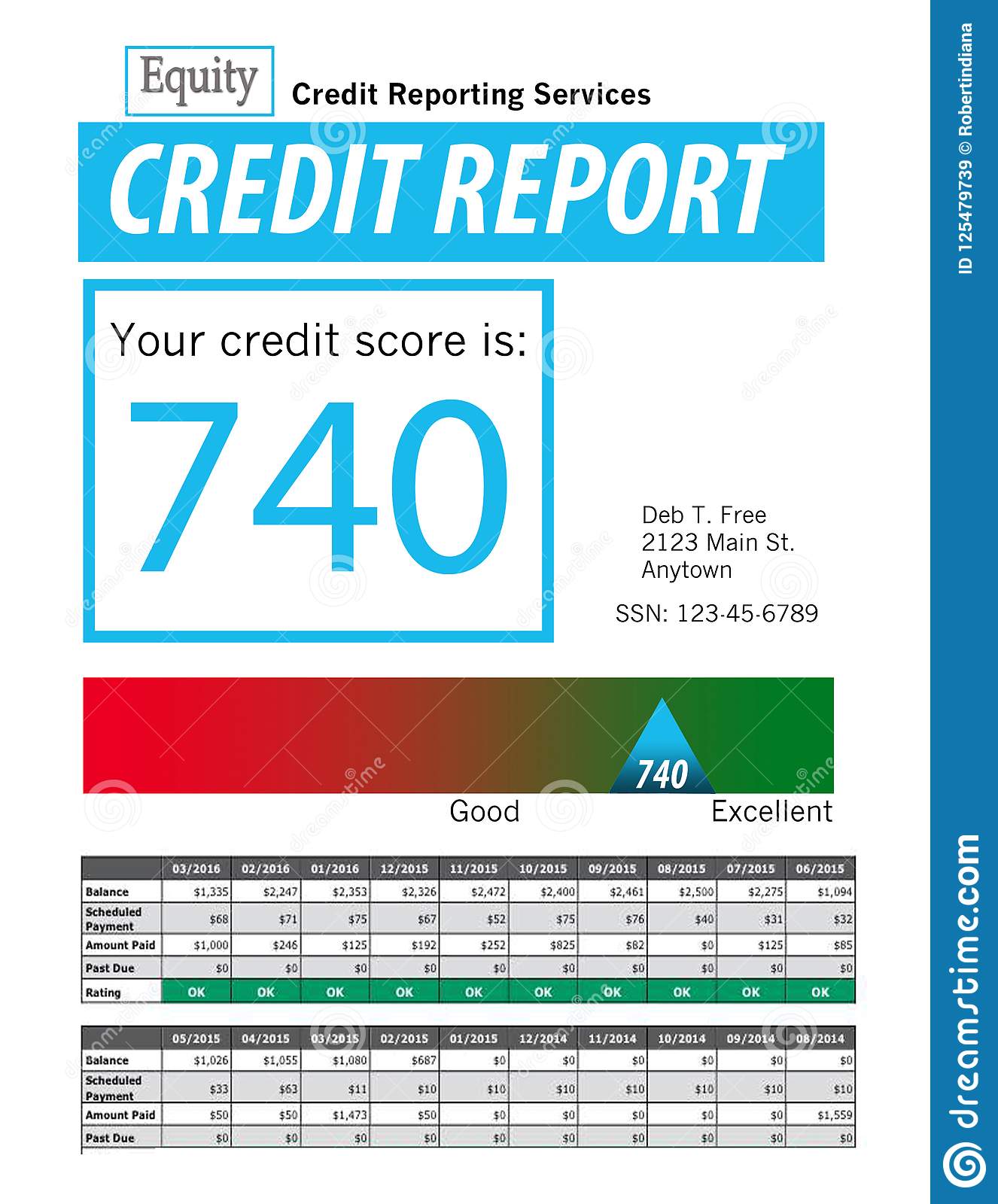

A major factor in determining your credit score is your credit utilization ratio. This ratio compares your credit card balances to your total available credit. The lower your credit utilization, the more free credit you have and the better it is for your score.

For example, if you have two cards, one with a balance of $200 and a limit of $500 and another with a balance of $100 and a limit of $1,000, your total credit card debt is $300. Your total credit card limit is $1,500.

That makes your credit utilization ratio $300 / $1,500 = 20%.

Lenders see high credit utilization as a high-risk behavior. To ensure your credit utilization ratio remains a positive force for your credit score, try to keep it under 30%.

Knowing when your card issuers update the credit bureaus can be very important if youre trying to manage your credit utilization.

Paying down your card balance before the issuer reports means theyll report a lower balance. This keeps your utilization down and your credit score high. Which can have a big impact on your credit score as you work toward your financial goals.

You Ask Equifax Answers: How Often Do Credit Card Companies Report To The Credit Bureaus

Reading time: 3 minutes

Question: How often do credit card companies report to the nationwide credit bureaus?

Answer:

As with many areas of personal finance, the answer to this question depends heavily on the credit card you use and your unique financial situation reporting times vary from card to card.

If a creditor decides to report to one of the nationwide , there are guidelines that they must follow. They should report monthly, preferably on the billing cycle date. For credit card companies, this is usually the day that they issue your charges for the most recent billing cycle, also known as your statement date. For most companies, these dates are spread throughout the month so that they don’t have to produce every customer’s statement on the same day.

For example, if a credit card company has 25 billing cycles, they could send 25 files to the nationwide credit bureaus each month. Smaller companies may only send one file a month that contains all accounts in their portfolio but only includes data as of the statement date. Some credit card companies will report your information in the middle of the month, while others do their reporting at the end of the month. Ultimately, however, there’s no set day, time and frequency credit card companies have to report, as long as they meet the general guidelines.

Your Statement Closing Date

Now lets talk about how this relates to the date that Capital One reports to the major credit bureaus. As we mentioned, the balance on your statement closing date is what Capital One reports as your balance to the three credit bureaus.

Because your balance on your statement closing date is the last date of your billing cycle, its often the highest your balance is all month. Even if you pay off your full balance before your payment due date, its still the statement closing balance thats reported to the credit bureaus.

The balance on your statement closing date is then used by credit bureaus to calculate your credit utilization. So if youve used a large percentage of your credit limit that month, your credit reports will show a high credit utilization, even if you dont plan to carry a balance.

This timing is especially problematic for people who use their credit card for all of their expenses throughout the month and then pay it off in full. Even though youre using your credit card responsibly, your credit score wont reflect as much.

Recommended Reading: Does Credit Line Increase Affect Credit Score

Check For Errors And Fix Them

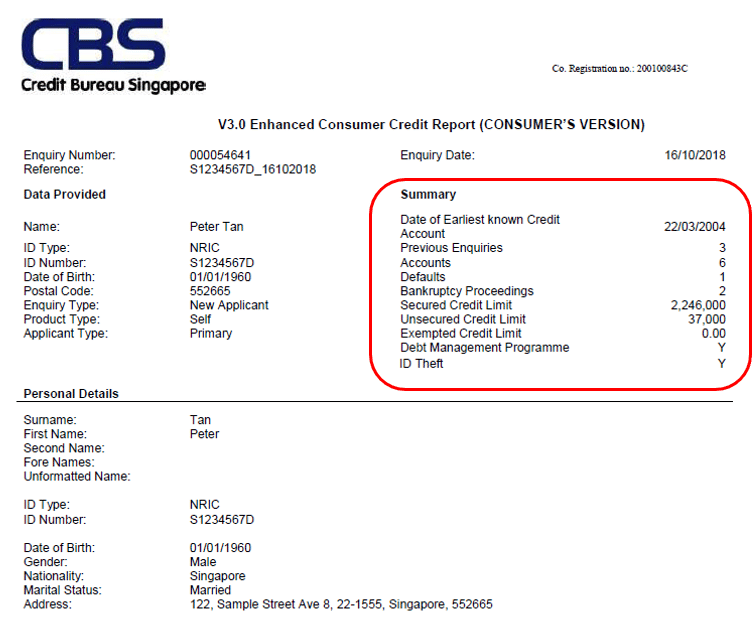

You should review your credit report carefully to ensure it contains no incorrect information. Are you missing any information about yourself? Are there any payments that should not have been missed?

You may suffer a credit penalty if you commit one of these errors. You can dispute any errors on your credit report by following the instructions provided by the credit bureaus at the end of each report.

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Don’t Miss: How To Get Student Loans Off Credit Report

Why Should You Pay Your Balance In Time

Those factors include payment history, credit utilization, the length of your credit history, credit mixes, and new lines of credit.

Payment history accounts for the most significant portion of your score at 35 percent. Paying off your credit card balance in full and avoiding late payments over an extended period helps you avoid interest fees and late penalties, thereby helping you maintain a healthy credit score.

Why Does It Take So Long For My Chase Credit Card Account Activity To Appear On My Credit Report

Like all credit card issuers, Chase reports your account activity to the credit bureaus once a month. So, if you opened a new account or made a significant purchase in January, you wouldnt see that activity reflected on your credit report until February.

You can check your monthly Chase statement for the date of when we last reported to one of the three major credit bureaus .

We continuously report within 30 days of closing out each month. If you want to know which bureau we reported last, contact us here and ask our customer service team, who ll be able to tell you more about how this works.

You May Like: What Companies Use Transunion Credit Report

Effectively Monitor Transactions With Payment Analytics

Payment Analytics is an easy-to-use, web-enabled tool that lets you monitor adherence to commercial card payment policies. It also provides the necessary audit functionality to mitigate your control-related risk. Using customizable rule templates, organizations can automatically review all card transactions and flag suspected card misuse and out-of-policy spending.

With Payment Analytics you can:

- Automatically monitor 100% of card transactions and flag suspected card misuse or out-of-policy spending

- Streamline your audit process and gain greater spend visibility and control with less effort

- Get up and running quickly and easily with our simple web-based interface no hardware, software or extensive training required

- Access your commercial transaction data online, anywhere, anytime

| Reasons we can share your personal information | Does Elan Financial Services share? | Can you limit this sharing? |

|---|---|---|

| For our everyday business purposessuch as to process your transactions, maintain your account, respond to court orders and legal investigations, or report to credit bureaus | Yes |

Why Knowing When Credit Card Companies Report To Credit Bureaus Is Important

Knowing when credit card companies report to credit bureaus can clear up some confusion you may have with your credit reports. Have you ever checked your credit reports and seen a balance, but you know you pay off your card every month in full?

This is likely because credit card companies provide a snapshot of your current balance when they report to the credit bureaus.

So, if youre concerned about how this snapshot of your balance may affect your credit, consider keeping tabs on your spending by your statement closing date. You could also make a payment before your statement closing date, so your balance is lower when its reported. Keeping a low balance can help your credit overall.

Why? Because when it comes to your credit scores, one important factor is your credit utilization.

Recommended Reading: Does Flexshopper Report To Credit Bureau

Keep Unused Credit Cards Open

You might be tempted to close a credit card or a credit account if you havent used it. The burden of carrying a card and paying the fees if you arent using it does not sound economically viable, so you must be tempted to close the card.

However, we dont believe this is a good step for your credit rating. Your credit rating is calculated through many factors, including how much credit you utilize.

To put it right, credit usage plays an important role in deciding the figure for your score. Almost 1/3rd of your credit score is dependent on your utilization ratio. You should utilize at most 15% of the credit available to you, nothing more, nothing less.

You need to realize that your credit usage ratio is one of your best chances of improving your credit score, and youre doing no good to yourself by reducing credit limits or credit cards.

The more credit cards and limits you have, the better your chances are.

Pay Your Credit Card At The Right Time

If youre using a credit card to build credit, you can help your progress by paying your credit card bill at the right time every month. Paying according to your issuers credit reporting schedule can improve two important factors in your credit score:

- Payment history: The payment history on your credit report is the single most important metric in your credit score. Always pay your credit card bills on time to maintain a sparkling payment history. If your card issuer reports your payments, making one before the date that they report will ensure your responsible borrowing is reflected in your credit report.

- : Your is how much of your credit youre using at a given time. To keep a low rate , you need to have a low credit card balance reported each month. If your card is maxed out when your issuer reports your balance, your credit utilization rate will be higher, but if you pay down your balance by the day they report , your credit utilization rate will be lower, which is good for your score.

Paying your credit card bill before the reporting date likely means paying your bill long before the due date. Not only can this benefit your credit score, but it helps ensure that youll pay your balance off on time and avoid late fees and penalty APR.

Takeaways: Most major credit card companies report to credit bureaus every month.

Kari Dearie

Don’t Miss: How Long Does It Take To Build A Credit Score

When Does Capital One Report Credit Utilization To Bureaus

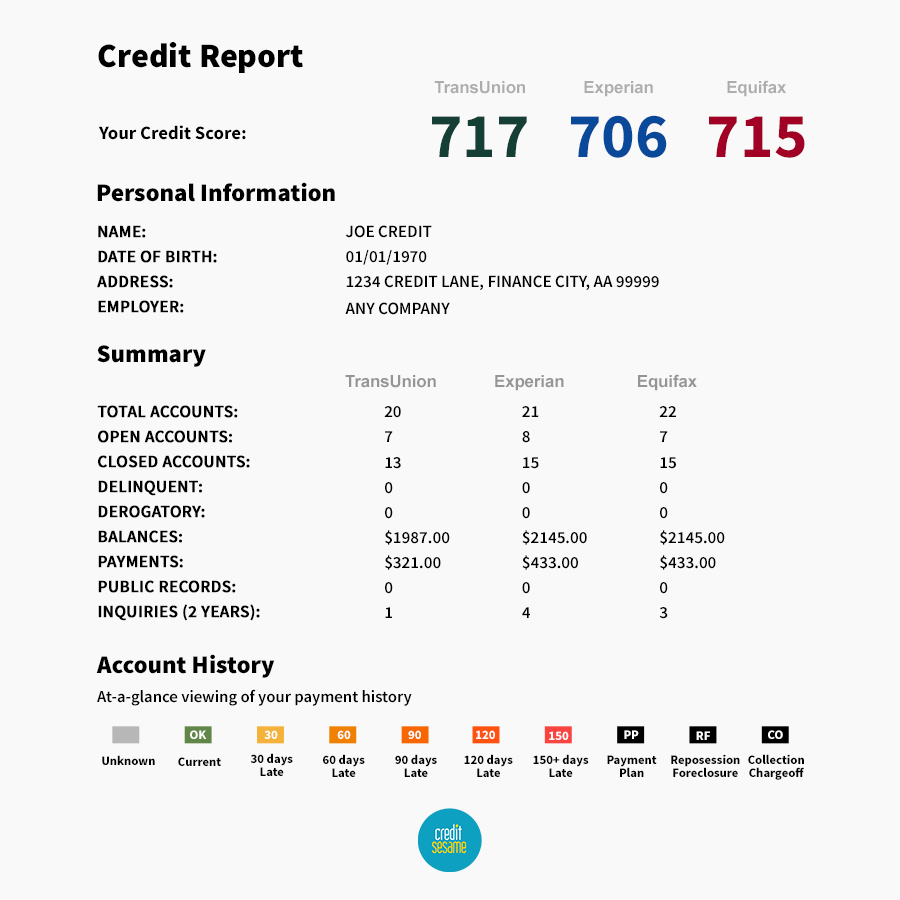

The three biggest consumer national credit bureaus — Experian, TransUnion, and Equifax — don’t calculate your credit score from thin air. To do that, each credit bureau needs data. And one source of that data is your creditors.

If you’re a Capital One credit card holder, you might be wondering when this creditor sends your data to the credit reporting agencies.

To understand when Capital One reports credit utilization to the bureaus, we’ll:

- Discuss what the issuer reports

- Look at the hows, whens, and whys of issuer reporting

- Explore what’s important about your payment history and your credit utilization — and what you can do to improve them

Jump To

What Credit Bureau Does Chase Use

The credit bureau Chase uses isnt essential to most consumers. What is the importance of knowing which credit bureau a given bank uses?

Application for a series of cards at one time does not matter at all, but it can determine whether your application is approved or not.

Chase cards are available in different states, each with a different credit bureau usage profile. One Chase card in California may use Experian, while another may use TransUnion. The credit bureau profiles Chase uses arent disclosed to the public. The validity of such a question is therefore questionable.

Experian, TransUnion, and Equifax are three credit bureaus that issue credit cards that provide credit history reports. Depending on its choice, the card issuer will perform a hard inquiry on your credit report.

Also Check: Does Simm Associates Report To Credit Bureaus

Consumer Protections On Credit Reports

The Fair Credit Reporting Act is a federal law that promotes the accuracy, fairness, and privacy of information maintained by credit bureaus. Consumer protections under the FCRA include:

- Anyone who uses a credit report or another type of consumer report to deny your application for credit, insurance, or employment â or to take another adverse action against you â must tell you, and must give you the name, address, and phone number of the agency that provided the information.

- You may request and obtain all the information about you maintained by a credit bureau. You are entitled to a free file disclosure:

- Once every 12 months

- If a person or business has taken adverse action against you because of information in your credit report

- If you are the victim of identity theft and place a fraud alert in your file

- If your file contains inaccurate information as a result of fraud

- If you are on public assistance or

- If you are unemployed but expect to apply for employment within 60 days.

How Long Does It Take For A New Card To Show Up

Your new credit card will not show up in your account immediately. The new card will probably show up in around 30 to 60 days.

The exact time frame is based on your billing period and the specific dates. You can contact your credit bureau and devise a remediation plan if the card doesnt show in your credit report.

Recommended Reading: How Long To Get A Credit Score

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report Is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

Be Careful With Store Credit Cards

Many department stores are notorious for selling you credit cards you might not need. These departmental credit cards can only work in specific stores but as actual credit cards.

If you happen to have any balance on these credit cards, you need to make sure that you get it addressed. The store card is just like any other credit card, so you shouldnt ignore the balance on it.

Also Check: How Much Does Overdraft Affect Credit Rating

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Become Authorized User On Someone Elses Card

Now, were letting you into a massive trade secret, which isnt yet followed by many for improving their credit score.

You can build your credit score perfectly by becoming an authorized user on someone elses card.

You can talk to friends and family about this opportunity and can share their cards to become authorized users on their cards.

Your credit scores will get intertwined together by becoming an authorized user on someone elses card.

Hence, if you have a slightly poor credit score, it will get entangled with that of another person and will improve significantly.

This can help you improve your credit score on an almost immediate basis. You can take short-term advantage of a friend or familys credit history to improve your score.

You May Like: How To Read A Credit Report From Experian

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 530086Atlanta, GA 30353-0086

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

How Often Do Credit Reports And Scores Get Updated

The next logical question is, when your credit card issuer sends the information to a credit bureau, when does it appear on your credit report?

Generally, you can count on your information to be added to your credit report as soon as the bureau receives it. According to TransUnion, when the credit bureaus receive information regarding your accounts, they typically add it to your credit report right away.

Your credit scores are calculated based on the data in your report every time a creditor requests them. However, you probably shouldnt expect any dramatic changes every time your credit issuer reports your most recent payment. Building credit can be a lengthy process that requires patience, but if you pay on time every time, youll see the results.

Your credit score isnt guaranteed to change with every timely payment.

Brian Martucci, credit expert at Money Crashers

Credit scores update when the information used to calculate them changes enough to produce a different result, Brian Martucci, credit expert at Money Crashers, explains. In other words, your credit score isnt guaranteed to change with every timely payment.

That might not be the case with late payments. Whenever a delinquency appears on your credit file, it can significantly hurt your credit. The longer the debt goes unpaid, the more damage it can do to your scores.

See related: How long does a late payment stay on your credit report?

Recommended Reading: Do Utility Bills Affect Credit Score