Lender With Hundreds Of Mortgage Options

Gustan Cho Associates has a national reputation of being a one-stop mortgage lender due to not only having no lender overlays on government and/or conventional loans but offering dozens of non-QM and alternative loan programs. Any non-QM loan program that is available in the market, we at Gustan Cho Associates have available.

We have dozens of non-QM wholesale lending partners in our network. Gustan Cho Associates will use the middle credit score of the main borrower and NOT the lower middle credit score of the lower credit score borrowers/co-borrowers. There are quick fixes to boost credit scores. Borrowers with lower credit who need help to qualify for a mortgage with bad credit, please contact us at Gustan Cho Associates at 262-716-8151. Or text us for a faster response or email us at gcho@gustancho.com.

How Student Loans Affect Your Credit Score

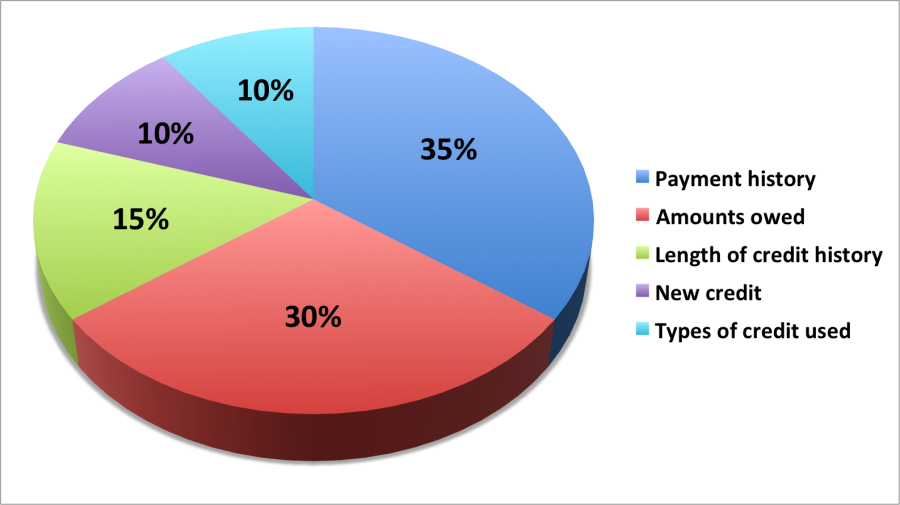

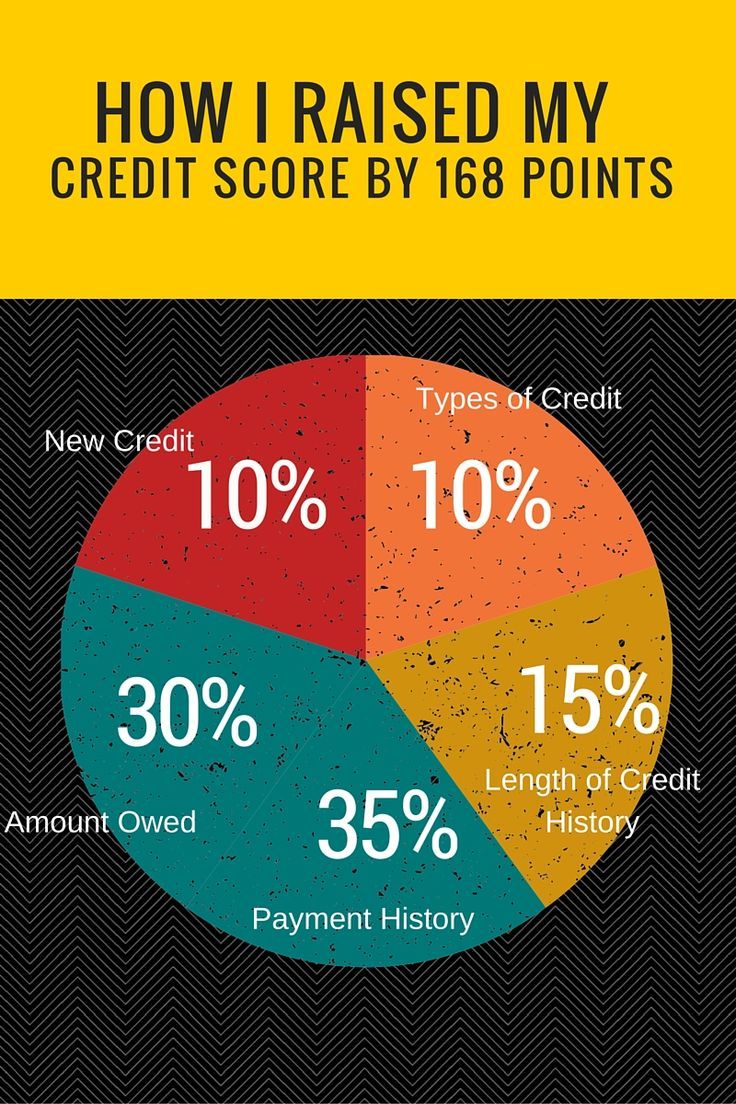

Having student loan debt will affect your credit score, perhaps positively, maybe negatively. If you consistently make your loan payments on time, having student loans can boost your score. Also, remember that FICO likes to see a mix of credit types credit diversity makes up 10% of your score. So, having student loans along with other debts, like a mortgage and credit cards, is a good thing. And the length of your credit history accounts for 15% of your score. If you’ve been paying on a particular student loan account for several years, that will help your score.

But if you pay lateor worse, if you stop making payments altogetheryour credit score will take a significant hit.

What Is A Good Fico Score

A good FICO score lies between 670 and 739, according to the company’s website. FICO says scores between 580 and 669 are considered “fair” and those between 740 and 799 are considered “very good.” Anything above 800 is considered “exceptional.”

According to FICO, the average credit score in 2021 was 716, which falls in the good range.

FICO comes from Fair Isaac Corp., the company that first developed a credit scoring system. It uses data about consumers from the three major credit reporting bureaus: TransUnion, Equifax and Experian.

FICO scores typically express a consumer’s creditworthiness as a number between 300 and 850.

You May Like: Does Checking Your Credit Score Affect Your Credit Rating

Improve Your Credit Score Before Buying A Car

If you check your credit scores and think it might be best to work on your credit before taking out an auto loan, here are some suggestions for improving your credit:

These actions could improve all of your credit scores, which can make it easier to get approved for an auto loan with a favorable rate.

Which Credit Scores Lenders Most Look At

Banks Editorial Team

Banks Editorial Team

How many different credit scores do you have, and what is the most important credit score when you apply for a loan or other type of credit? There are three major consumer credit bureaus whose data is used to generate credit scores. However, because there are many different credit scoring models, you may have dozens of credit scores. Which credit score is most important for a particular lender will vary depending on the type of credit for which youre applying. Heres what you should know about your credit scores.

Read Also: Can Inquiries Be Removed From Credit Report

What’s The Difference Between Base Fico Scores And Industry

Base FICO® Scores, such as FICO Score 8, are designed to predict the likelihood of not paying as agreed in the future on any credit obligation, whether it’s a mortgage, credit card, student loan or other credit product.

Industry-specific FICO® Scores incorporate the predictive power of base FICO Scores while also providing lenders a further-refined credit risk assessment tailored to the type of credit the consumer is seeking. For example, auto lenders and credit card issuers may use a FICO Auto Score or a FICO Bankcard Score, respectively, instead of base FICO Scores.

FICO® Auto Scores and FICO Bankcard Scores have these aspects in common:

- Many lenders may use these scores instead of the base FICO® Score.

- It is up to each lender to determine which credit score they will use and what other financial information they will consider in their credit review process.

- The versions range from 250-900 and higher scores continue to equate to lower risk.

Other Accounts Included In A Credit Report

Your mobile phone and internet provider may report your accounts to your credit bureau. They can appear in your credit report, even though they arent credit accounts.

Your mortgage information and your mortgage payment history may also appear in your credit report. The credit bureaus decides if they use this information when they determine your credit score

A home equity line of credit that is added to your mortgage may be treated as part of your mortgage in your credit report. If your HELOC is a separate account from your mortgage, it is reported separately.

Recommended Reading: When Does A Bankruptcy Leave Credit Report

How To Improve Your Credit Score Before Applying For A Mortgage

If you want to buy a home, one of the best things you can do to make the home buying process easier is to improve your FICO score. Regardless of the credit scoring model that your lender ultimately uses, you can take some basic steps to boost your credit score.

Remember that a lower credit score makes it harder to qualify for a loan and affects the interest rate that the bank or credit union will charge. That means that boosting your credit score can make a mortgage cheaper, making it easier to afford homeownership.

There are five factors that comprise your FICO credit score:

Each step you take to improve your credit score will reduce your mortgage interest rate, making it well worth the effort to improve your credit.

All Major Bureaus Equally Important

The general misconception seems to be that theres one bureau used more than the other two, but this simply isnt the case.

When you apply for any type of credit, whether its an auto loan/lease, credit card, or a mortgage, your credit report and will be pulled.

Lenders may rely on one of the credit bureaus or all three.

Assuming they rely on just one, you wont know who theyre using until your credit is pulled and your score is printed out on a piece of paper staring you dead in the eye.

I suppose if you knew your credit score was low with one of the major credit bureaus, and much better with another, you could ask the car dealership who they use before applying.

But this would be a long shot, and certainly no way to go about getting a loan. Just plain silly really.

In the end, all three bureaus are equally important because you dont know who theyll use, and different creditors use different bureaus.

So you must have a good credit score with all three to ensure there arent any hiccups.

In the case of a mortgage loan, banks and lenders will rely on the mid-score of your three credit scores.

So all three credit bureaus are again equally important, as one bad credit score can weigh down your average.

Don’t Miss: How To Increase Your Credit Score By 100 Points

What Is A Fico Score

Youve probably heard of FICO, but did you know it goes back as far as 1989? At that time, it was referred to as Fair, Isaac, and company.

The FICO score is based on the information in your credit files, provided by the three national credit bureaus. This score is designed to take into account various elements of your financial history.

That said:

No one really knows the exact formula for calculating your FICO score, but there are certain factors that we know impact your score.

Fico Scores Are The Most Widely Used Credit Scoring Model

A Tea Reader: Living Life One Cup at a Time

FICO is perhaps the most recognizable name in . The Fair Isaac Corporation , which developed the FICO algorithm, says its scores are used by 90% of top U.S. lenders in 90% of lending decisions. There are currently several types of FICO scores available. The most widely used model is FICO 8, though the company has also created FICO 9 and FICO 10 Suite, which consists of FICO 10 and FICO 10T. There are also older versions of the score that are still used in specific lending scenarios, such as for mortgages and car loans.

Also Check: How Long For Chapter 7 To Come Off Credit Report

Reasons Why Your Credit Score Might Differ

If your credit score isnt quite adding up across different sources, heres why:

- Most commonly, this will be your FICO or VantageScore 3.0.

- Score version: Each company uses a different base score. For example, the FICO 9 ranges from 300 to 850. This model puts less weight on things like medical debt and doesnt calculate past accounts in collections. However, it does consider rent payments, if reported, in the overall score.

- Industry-specific scores: These scores focus mainly on things like auto score, mortgage score and other installment loans.

- Not every lender reports the same information to every credit bureau. So, your Experian score might differ from your Equifax or TransUnion score.

- Data provided to the credit bureau: Lenders arent legally obligated to report to all three credit bureaus. Some lenders dont report a consumers activity to any bureaus at all.

- Timing: Scores vary from day to day. This depends on whats been reported recently, whats fallen off the report and the age of an account or remark.

- Errors on your credit report: A persons credit score reflects any errors that appear on their report. If an error only appears on one credit bureaus report, then that bureau might give you a lower score. Always dispute any errors as soon as you find them for an accurate score.

How Can You Get Your Experian Credit Scores

![Why Credit Scores Are Important [Infographic] Why Credit Scores Are Important [Infographic]](https://www.knowyourcreditscore.net/wp-content/uploads/why-credit-scores-are-important-infographic-credit-score-credit.jpeg)

If youd still like to access your Experian credit score, you can find it for free in several places.

Experians free CreditWorks Basic service updates your credit score every 30 days. Experian also operates freecreditscore.com, another place where you get your free Experian FICO score once a month.

Some banks and credit card issuers, like Discover, also offer complimentary Experian-based FICO® credit scores.

And if youre willing to pay, Experian and FICO both offer premium services through which you can access your credit scores on a more regular basis. These services offer other benefits, too, such as access to your credit reports and credit- and identity-theft monitoring and support. But we believe strongly that you should never have to pay to access your credit scores or credit reports.

Read Also: Do Late Payments On Closed Accounts Affect Credit Score

Don’t Overthink Your Credit Scores

While your credit scores can be important, there are three reasons that it makes more sense to focus on general healthy credit habits rather than a specific score:

Building a positive credit history can help increase all your credit scores, and you won’t need to worry about which score the lender uses.

What Is A Credit Scoring Model

Scoring calculations are based on payment record, frequency of payments, amount of debts, credit charge-offs and number of credit cards held. A weight is assigned to each factor considered in the models formula, and a credit score is assigned based on the evaluation.

Scores generally range from 300 to 850 .

Lenders use credit scores to help determine the risk involved in making a loan, the terms of the loan and the interest rate. The higher your score, the better the terms of a loan will be for you. There are different credit score models, which emphasize varying factors.

Read Also: How Can You Boost Your Credit Score

How Your Credit Score Affects Your Interest Rates

Knowing your credit score is the first step in getting the best rates on your mortgage. While mortgage interest rates are currently at an all-time low, they drop even lower when your credit score is above 760.

According to FICO, the current interest rate for a 30-year fixed mortgage is 2.377% APR for a 760+ borrower, and 3.966% for a borrower with a score between 620 and 639 .

This 1.589% savings in APR may seem negligible. But it means saving about $260 per month on your mortgage, or $3,120 per year and roughly $93,600 over the lifetime of the loan.

If you currently have a mortgage and are interested in seeing if you can switch to a better rate, look into the pros and cons of refinancing your home.

How Your Credit Score Impacts Your Apr

Your credit score has a major effect on the APR of your loan. The APR of any installment loan, such as a mortgage, reflects the cost of interest expense and fees over the life of the loan. The higher the APR, the more the borrower will have to pay.

If you apply for a $250,000, 30-year mortgage, you can wind up paying wildly different amounts depending on your credit score, as shown below.

Recommended Reading: How To Clean Up Your Credit Report Yourself

Whats A Good Credit Score Range

A good credit range depends on where a score comes from and whoâs judging it. Itâs important to remember that lenders set their own and standards to determine . That means what FICO, VantageScore or anyone else considers good may not all be the same.

However, there are some general guidelines for how being within a score range can impact your choices:

- A poor to fair score means you may find it difficult to qualify for many credit cards or loans. You might need to start with a secured credit card or credit-builder loan to build or rebuild your credit. And if you do qualify for an account, you may have to pay high fees and interest rates if you don’t pay your balance in full each month.

- A fair to good score means you may be able to qualify for more options, but you wonât necessarily receive the best rates or terms. You also might find you can qualify for a traditional unsecured but have a harder time qualifying for a premium card.

- A very good or excellent score means you may be able to qualify for the best products with the lowest-advertised rates. While creditors consider other factors too when determining your eligibility and rates, your credit score probably wonât be holding you back.

Hereâs a closer look at how FICO and VantageScore define their score ranges.

Whatâs a Good FICO Credit Score Range?

Whatâs a Good VantageScore Credit Score Range?

Increase Your Available Credit

Another thing lenders look at when assessing a borrowers creditworthiness is their credit utilization ratio. This ratio compares the borrowers debt, particularly credit card debt, to their overall credit limits.

For example, if you have one credit card with a $2,000 balance and a $4,000 credit limit, your credit utilization would be 50%. Lenders look for borrowers with lower credit utilization because maxing out credit cards can be a sign of default risk.

A credit utilization of 30% is good, but less than 10% is better. So if you have a card with a $1,000 credit limit, to optimize your credit score youll want no more than $100 outstanding on the statement date for the card.

That means that one of the easiest ways to boost your credit score is to decrease your credit utilization ratio. You can do this by paying down debt or increasing your credit limits.

If youve had a credit card for a while and have built a good payment history, most card issuers will be willing to offer a credit limit increase. You can typically request an increase through your online account.

Theres no risk when requesting a credit limit increase. The worst a lender can do is say no, leaving you exactly where you started. In the best-case scenario, youll get a big credit limit increase, dropping your credit utilization ratio and giving your credit score an immediate boost.

Read Also: How To Grow Credit Score

Chase Sapphire Preferred Earning Rate

The Sapphire Preferred is a rewarding card for everyday spending thanks to generous category bonuses. Cardmembers earn 5 points per dollar on travel purchased through Chase Ultimate Rewards®, 3 points per dollar on dining, select streaming services, and online grocery purchases , 2 points per dollar on all other travel purchases and 1 point per dollar on all other purchases. Plus, the card earns 5 points per dollar on Lyft rides through Mar. 31, 2025. While these rates are competitive, it gets better: Youll get a 10% point bonus every account anniversary. So if you charge $20,000 in purchases to your Sapphire Preferred Card in 12 months, youd receive 2,000 bonus points. Its a nice way to get rewarded for purchases that dont earn a category bonus. Youll essentially earn a minimum of 1.1 points per dollar spent.

How Do I Check My Auto Score

You can check your FICO® Auto Score by purchasing your credit reports and scores . However, there are also many ways to check your other credit scores for free.

While each score you receive will depend on the scoring model and the underlying credit report, knowing these other scores can give you a general idea of where you stand before you apply for an auto loan.

Some of the places you can look for a free credit score include:

- Banks and credit unions

- Online financial product comparison sites

- Experian gives you free access to a FICO® Score 8 based on your Experian credit report

- AnnualCreditReport.com offers one free report from each of the credit bureaus each year

Read Also: How To Build Credit Rating Fast Uk