How To Read Your Cibil Report Or Credit Report

The credit report is a detailed document that highlights your entire credit history and record. It includes your personal information, contact information, employment history, credit limit on various credit cards, credit balances, and dates on which you opened various accounts. This credit report is viewed by various parties or organisations.

Some common parties who may view your credit report are as follows:

- Lenders like banks and non-banking financial companies

- Landlords

Given that it is a comprehensive document with multiple sections, it is important for you to know how to read your credit report. This will help you understand your report better, and even check to see if it does justice to your credit history.

How To Earn A Fair Credit Score:

If you are trying to get your credit score into the “fair” range, pull your credit report and examine your history. If you see missed payments or defaulted loans or lines of credit, do your best to negotiate with the lender directly. You may be able to work out an agreement that allows you to make manageable, on-time payments. Getting back on track with these consistent payments could help improve your credit score over time. As you work through meeting your debt obligations, take care not to close any of your accounts. Open accounts with a long history could be positively contributing to your score and can continue to be used responsibly in the future.

Look at your credit report, create a budget that sets aside money to pay off your debts, and learn more about how credit scores are generated: these are the three fundamental steps in moving your credit score upwards.

How To Improve Your Credit Scores

To improve your credit scores, focus on the underlying factors that affect your scores. At a high level, the basic steps you need to take are fairly straightforward:

- Make at least your minimum payment and make all debt payments on time. Even a single late payment can hurt your credit scores and it’ll stay on your credit report for up to seven years. If you think you may miss a payment, reach out to your creditors as quickly as possible to see if they can work with you or offer hardship options.

- Keep your credit card balances low. Your is an important scoring factor that compares the current balance and credit limit of revolving accounts such as credit cards. Having a low credit utilization rate can help your credit scores. Those with excellent credit scores tend to have an overall utilization rate in the single digits.

- Open accounts that will be reported to the credit bureaus. If you have few credit accounts, make sure those you do open will be added to your credit report. These could be installment accounts, such as student, auto, home or personal loans, or revolving accounts, such as credit cards and lines of credit.

- Only apply for credit when you need it. Applying for a new account can lead to a hard inquiry, which may hurt your credit scores a little. The impact is often minimal, but applying for many different types of loans or credit cards during a short period could lead to a larger score drop.

Also Check: Account Closed Repossession

What Is An Excellent Credit Score

You probably already know that your credit score is a three-digit number based on the information in your credit report, which includes items like your loan payment history and credit card balances. Multiple companies have models that calculate credit scoresFICO and VantageScore, for example, which both operate on a scale from 300 to 850.

Generally speaking, a higher credit score can translate to cost savings, perks and more. Your credit score is a key factor considered by lenders, so a better score can help you get more credit at attractive interest rates . Landlords and employers can also check your credit score as part of their due diligence process. And some of the best reward credit cards are only available to those with the highest scores.

So how high should you aim? Getting a perfect score is extremely difficult, so many credit overachievers strive for a score in the high 700s or 800+. That puts you squarely in the highest range for most credit scoring models .

If youre nowhere close, dont worrythe tips below will still help you improve your credit score over time. You can actually reap many of the benefits listed above with a score thats considered good. But if good doesnt cut it, read on for your roadmap to excellent credit.

Regularly Read Your Reports

Since your credit score is based off of the information in your credit report, take time to review your reports regularly. You want to be sure everything is an accurate, true reflection of your financial story. As you become more comfortable reading and understanding the data in your report, the easier it is to identify which information is potentially causing changes in your credit score.

To help you understand your credit report, weve created an interactive guide that breaks down each section and explains how the information may impact your credit score.

Disclaimer: The information posted to this blog was accurate at the time it was initially published. We do not guarantee the accuracy or completeness of the information provided. The information contained in the TransUnion blog is provided for educational purposes only and does not constitute legal or financial advice. You should consult your own attorney or financial adviser regarding your particular situation. For complete details of any product mentioned, visit transunion.com. This site is governed by the TransUnion Interactive privacy policy located here.

Also Check: Is An 820 Credit Score Good

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

What Is The Difference Between A Fico Score And Other Credit Scores

Only FICO Scores are created by the Fair Isaac Corporation and are used by over 90% of top lenders when making lending decisions.

Why? Because FICO Scores are the industry standard for making accurate and fair decisions about creditworthiness. They help millions of people get the credit they need for a home, a new car, or a special purchase.

You may have seen ads for other credit scores, or likely even purchased them in the past. These other credit scores calculate your scores differently than FICO Scores. So while the other credit scores may seem similar to the FICO Score, they aren’t. Only FICO Scores are used by 90% of the top lenders.

Recommended Reading: Chase Sapphire Preferred Score

What Is Considered A Good Credit Score In 2021

A good credit score is anything in the range of 690-719. With such a credit score, you qualify for lower interest rate loans with more creditors.An excellent credit score is any starting from 720 and higher. That score gives you access to the best credit card deals and the lowest interest rates.

Its actually quite simple, but as some credit score stats show:

4. Four in ten Americans dont know how their credit score is calculated.

Even so, many people assume they know how their creditworthiness is determined. To take the guesswork out of your finances lets look at the factors that determine our credit scores.

Who Creates Your Credit Report And Credit Score

There are two main credit bureaus in Canada:

- Equifax

These are private companies that collect, store and share information about how you use credit.

Equifax and TransUnion only collect information from creditors about your financial experiences in Canada.

Some financial institutions may be willing to recognize a credit history outside Canada if you ask them. This may involve extra steps. For example, you may request a copy of your credit report in the other country and meet with your local branch officer.

Recommended Reading: What Credit Score Does Navy Federal Use For Auto Loans

Monitor Your Credit Report And Score

Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable termsbut checking it further ahead of time gives you the chance to improve your score, and possibly save hundreds or thousands of dollars in interest. Experian offers free credit monitoring for your Experian report, which in addition to a free score and report, includes alerts if there’s a suspicious change in your report.

Keeping track of your score can help you take measures to improve it so you’ll increase your odds of qualifying for a loan, credit card, apartment or insurance policyall while improving your financial health.

What Else Do Lenders Look At When You Apply

As we mentioned, your credit score is not the only factor lenders examine before they approve or decline your application. They also want to see a favourable history of debt management on your part. This means that on top of your credit score, lenders are also going to pull a copy of your to examine your payment record. So, even if your credit score is above the 600 mark, if your lender sees that you have a history of debt and payment problems, it may raise some alarms and cause them to reconsider your level of creditworthiness.

Other aspects that your lender might look at include, but arent limited to:

- Your income

- The amount youre planning to borrow

- Your current debts

- The amortization period

This is where the new stress-test will come into play for all potential borrowers. In order to qualify, youll need to prove to your lender that youll be able to afford your mortgage payments in the years to come.

Theyll also calculate your monthly housing costs, also known as your gross debt service ratio, which includes your:

- Potential mortgage payments

- Potential cost of heating and other utilities

- 50% of condominium fees

This will be followed by an examination of your overall debt load, also known as your total debt service ratio, which includes your:

Also Check: Do Pre Approvals Affect Credit Score

Your Credit Score Can Fluctuate

You may see some short-term movement in your credit score. This happens as information is added or falls off your report, which can happen frequently. Our latestConsumer Pulse revealed one-third of consumers monitor their credit at least weekly. Its encouraging to see people take an active approach to managing their credit health. But when it comes to your credit score, theres no need to obsess over minor, day-to-day changes. Nor is it necessary to achieve a perfect score. Trying to stay within a certain credit range is a smart, less stressful way to monitor your score.

Also, your credit score may not be the only thing a lender looks at when making a lending decision. For example, if you apply for a mortgage, lenders may also verify your income, personal assets and employment history. Because lenders look at multiple factors, its important to strive for overall financial wellness in addition to any credit score goal you may have. Building an emergency savings account and creating a plan to pay down debt, if you have any, will help you be more financially secure and can reflect positively in your credit health.

What Is A Good Credit Score For An Auto Loan

Next to a mortgage, vehicles are often among the most expensive purchases the average adult makes in the United States. According to the Kelley Blue Book, an independent automotive valuation agency, the average price for a light vehicle purchase in the U.S. was $38,940 in May of 2020.

For a significant purchase like a car, having good credit could mean saving thousands when youre financing your purchase.

For example, someone with a FICO score of 620 who is looking to buy a new car is told by the car dealer they could qualify for a 60-month loan for $38,000.

According to the FICO Loan Savings Calculator, your loan in June 2020 would have an APR of 16.714% and your monthly payments would be $939. Over the life of the loan, youd pay an additional $18,315 in interest.

A $942 per month car loan payment is a significant amount, even if you can get approved. So, lets assume you hit the pause button and decide to work on improving your credit before taking out a loan. When you apply again down the line, you learn that youve boosted your score to a 670, which is considered a good credit score by most credit scoring models.

With a 670 credit score, the FICO Loan Calculator now estimates that you might qualify for an APR around 7.89%. Based on that rate, your monthly payment on the same $38,000 auto loan would be $768. You would pay $8,106 in total interest over the life of your loan.

Because you improved your credit score from poor to good, you would save:

Also Check: Derogatory Marks Removed

You’re Not Labeled For Life

There’s lots you can do to make sure you have a good credit score. Most important, make your credit card and loan payments on time. Thirty-five percent of the FICO score is based on your payment history. Check our other tips.

Those with thin or subprime credit histories might consider signing up for one or both of the new credit improvement programs, Experian Boost and the Fair Isaac Corporation’s UltraFICO. Boost, which launched in March, includes utility payments in the score calculation, and UltraFICO, expected to roll out nationally later this year, reviews banking history. For more information, check these new ways to improve your credit score.

Keep in mind that a major downturn in your luck or behavior could drop your credit score by 100 points, but it’s unlikely to dip it into the 300 range.

Indeed, McClary says he’s never actually seen a 300 FICO scoreor an 850 score, for that matter. The lowest score he’s ever seen was 425, he says, and in that case the holder had already been in bankruptcy and was delinquent with several creditors.

“Obsessing over perfecting your score might be a waste of time,” Ross says. “Your efforts should be more focused on maintaining your score within a healthy range.”

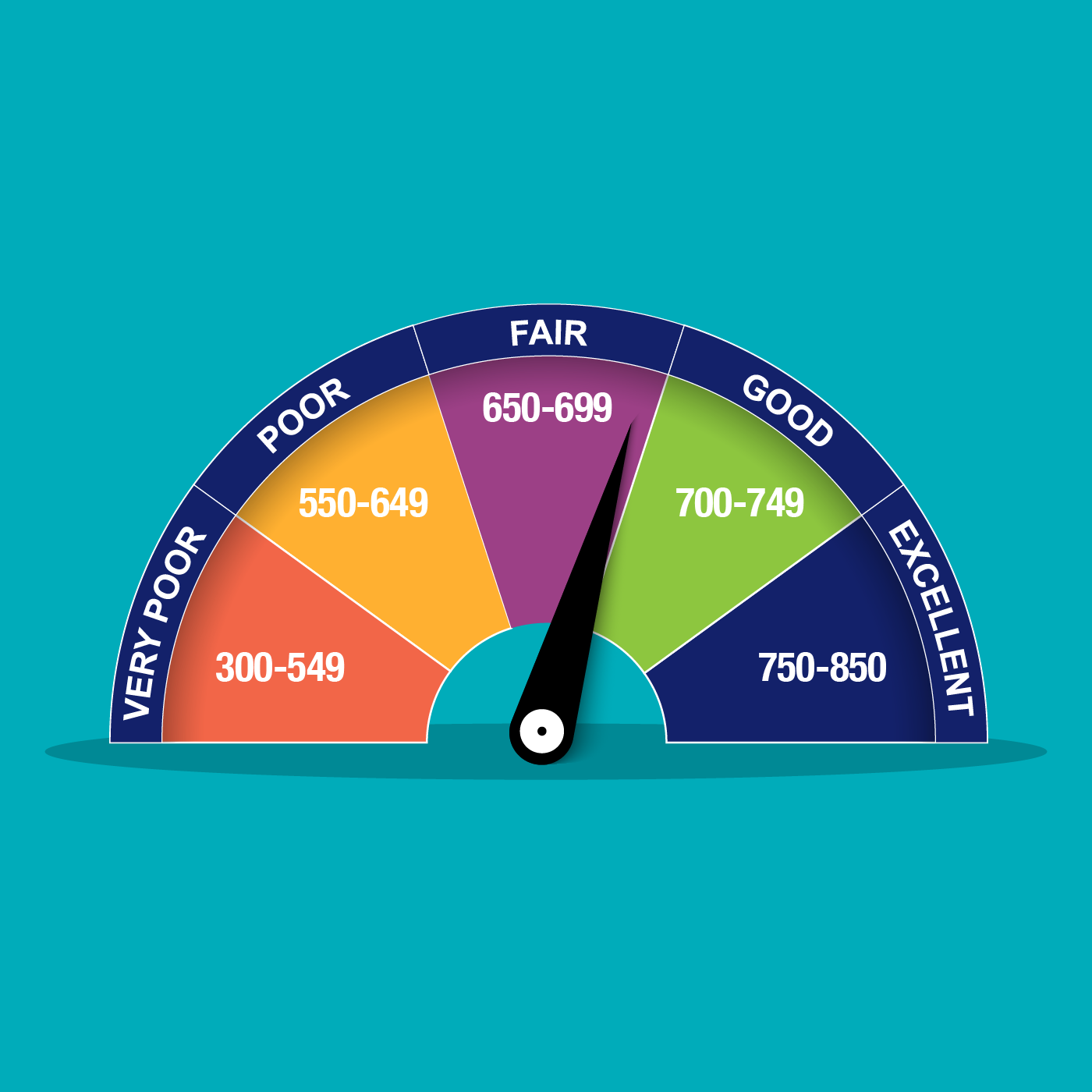

What Is Considered A Good Cibil Score Range

A credit score ranging from 750 to 900 is considered an excellent credit score. Banks, NBFCs and other online lenders prefer candidates who have a credit score in this range. If your credit score is in this range, you will be eligible for most credit products. The following table will help you understand the CIBIL score range and its meaning.

|

Immediate Action Required |

Approval chances are very low |

As the table illustrates, having a credit score of 750 and above is considered to be excellent and it can help in easily availing several credit opportunities.

Also Check: Carmax Finance Rate

Whats Considered A Good Credit Score

If youre trying to build or maintain healthy credit, knowing whats considered a good score can be helpful. A good credit score can help you get approved and lock in better rates for loans and other credit.

Higher is generally better, but its hard to say specifically what a good score is. Whats considered a good score can differ by lender and the type of credit youre applying for. The score you see when you obtain credit monitoring or buy a credit score along with your credit report may not be the score that the lender is using. There are also different scoring models. That said, read on to learn what a good credit score range is when you check your score with TransUnion. Plus, youll find tips on how to maintain healthy credit.

How Your Credit Score Affects Your Car Loan

Your credit score is an important factor in determining your ability to repay debt. But how it affects your auto loan can vary based on the lender you choose and the scoring model or models they use to evaluate your creditworthiness. In general, though, the higher your credit score, the better your chances of scoring a low interest rate and less restrictive loan terms.

For example, if you have a good credit score, you may be able to finance $30,000 for a new vehicle with a 3.99% APR over 60 months. In this scenario, your monthly payment would be $552, and you’d pay $3,120 in interest over the life of the loan.

If you have poor credit and your APR is 15.99% on that same amount, however, your monthly payment would jump to $729, and you’d pay $13,740 in interest over the 60-month term.

In other words, it is possible to get an auto loan regardless of your credit situation, but doing so with poor credit could cost you thousands of dollars, making it less appealing if you don’t need a new car.

One thing to keep in mind, though, is that your credit score isn’t the only factor lenders consider during the application process. They’ll also look at your credit report, your debt-to-income ratio your monthly debt payments relative to your gross monthly incomeyour employment history, and other factors.

If your credit score isn’t in great shape but your financial profile is strong overall, it could potentially improve your chances of getting a lower interest rate.

Read Also: Does Speedy Cash Check Your Credit