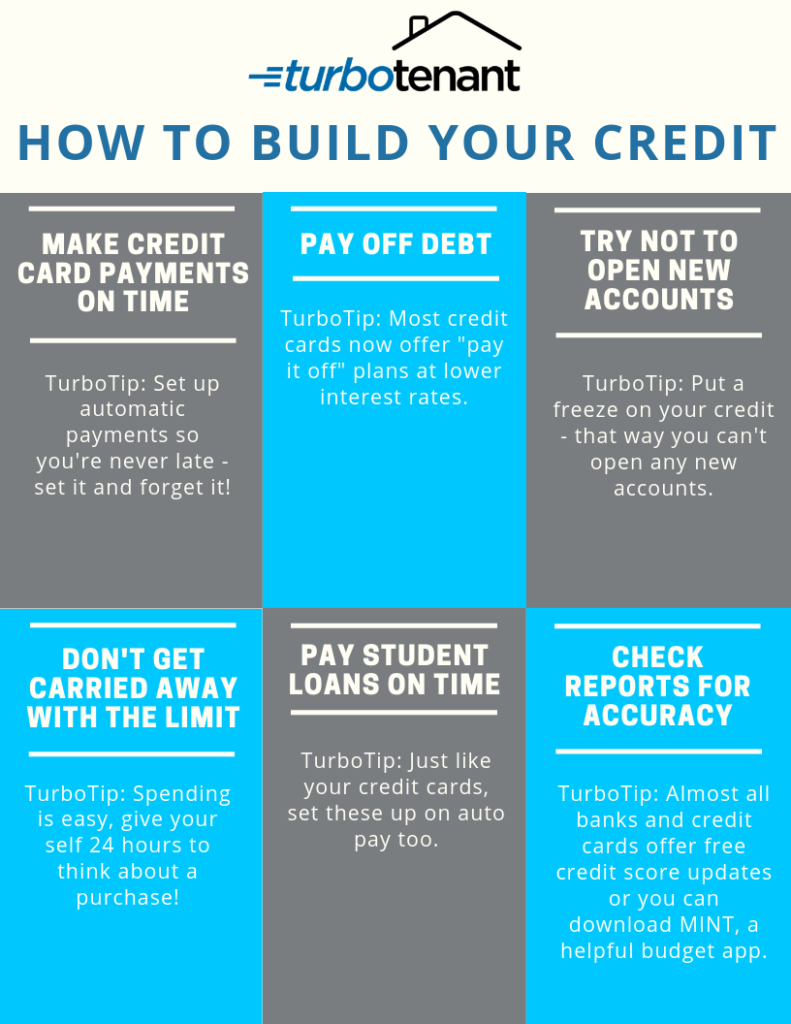

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 530086Atlanta, GA 30353-0086

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

Get Your First Credit Card

If you’ve gotten your feet wet with a secured credit card or retailer card and have proven that you can pay your monthly balance on time, it’s time to take the plunge. Responsible credit card use is one of the quickest and most effective ways to build a solid credit history.

An unsecured credit card is a “revolving” line of credit. This means that the lender sets a credit limit and allows you to continuously borrow and pay back your balance as long as you stay under that limit. Every month, you’re required to make a minimum payment. Any balance that you carry from month to month will be charged interest.

To build healthy credit with a credit card, you must follow one simple rule: Always pay your monthly bill on time . If possible, pay the balance in full every month. If not, at least make the minimum payment.

There are other credit card traps that can affect your credit score. Try not to carry a balance higher than 30 percent of your credit limit . FICO frowns on borrowers who have a high debt-to-credit ratio.

It’s also better to stick with one credit card rather than constantly trading in for a card with a lower interest rate. Fifteen percent of your credit score is based on the length of time you’ve maintained a credit account .

Submit Your Request In Person:

Equifax has four office locations where you can request a free copy of your Equifax credit report in-person and receive a printed copy of your credit report after your identity is confirmed. Copies of the request form you will need to complete are available onsite.

You need to bring with you at least two forms of identification, including 1 photo identification and proof of current address. Also, you must provide the original copies of your chosen identification – photocopies and electronic versions are not accepted at the office. Examples of acceptable documentation include:

- Driver’s License

- Utility Bills

Acceptable Supporting IDs:

- Birth Certificate Issued in Canada

- T4 slip

- Citizenship and Immigration Canada Document IMM1000 or IMM1442

- Social Insurance Number Card issued by Canadian Government

- Certificate of Naturalization

Providing your Social Insurance Number is optional. If you provide your S.I.N., we will cross-reference it with our records to help ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

You May Like: What Is Hard Inquiries On Your Credit Report

Where To Check Your Business Credit Score

Some third-party sites offer companies notifications when their credit scores change at the big agencies. This can be a good option for monitoring your credit score throughout the year. Another option is to check with individual business credit reporting agencies on your own. Its not complicated to do so, but you may have to register directly with the agencies, which include Experian, Dun & Bradstreet and Equifax.

Tip: To maintain your business credit score, you must continue to build healthy financial habits, such as paying your bills and taxes on time. You should also monitor your business credit score for accuracy.

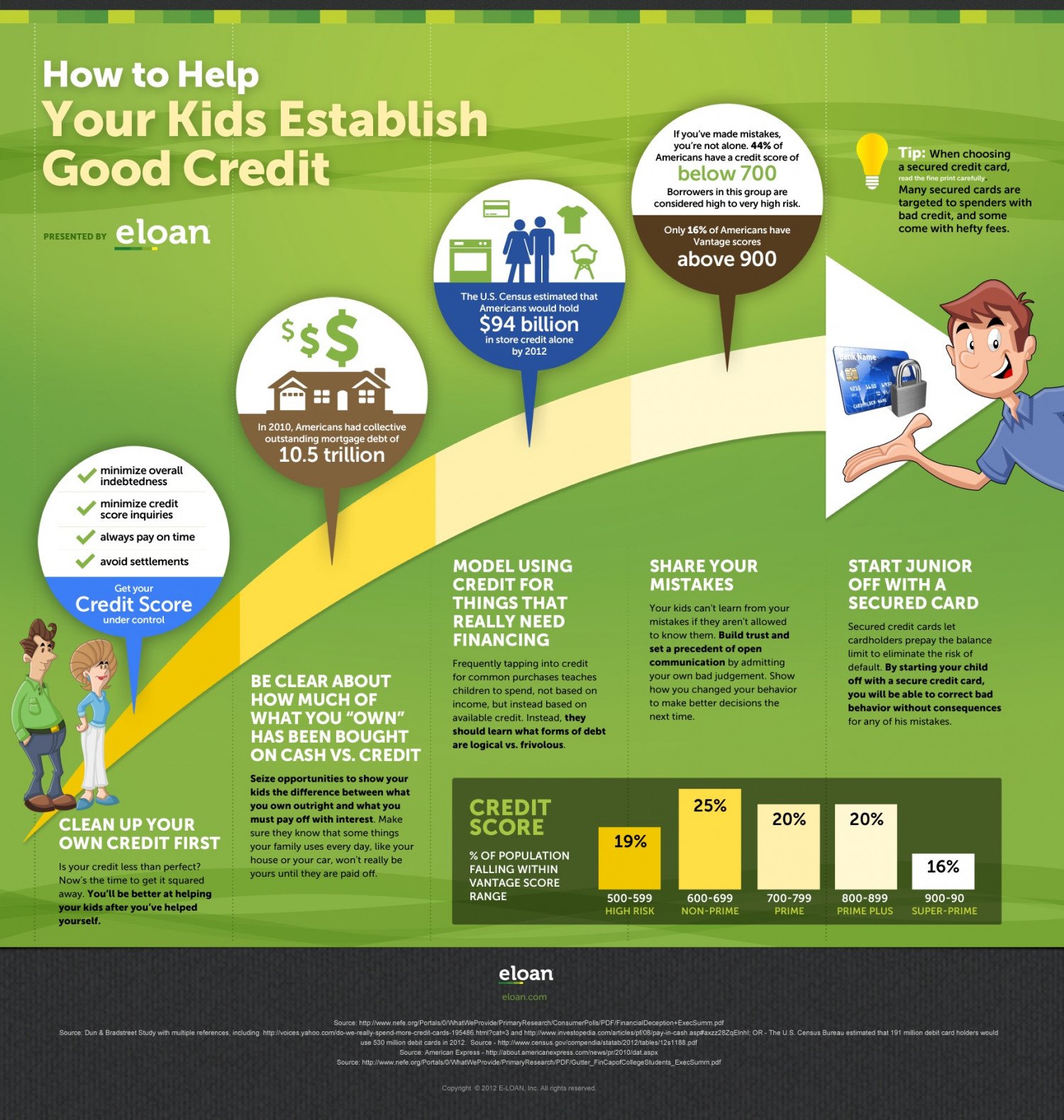

Apply For A Secured Credit Card

Secured credit cards are a great way to build credit if you have none. These cards are typically easier to qualify for if your credit history is poor or non-existent. And you can use a secured card just like a traditional credit card to help you establish good credit, as long as you practice responsible credit behavior.

A secured card is nearly identical to an unsecured card in that you receive a credit limit, can incur interest charges and may even earn rewards. The main difference is you’re required to make a security deposit in order to receive a line of credit. The amount you deposit typically starts at $200 and often becomes your credit limit. So if you make a $200 security deposit, you’ll receive a $200 credit limit.

The Discover it® Secured Credit Card card tops our list for the best secured credit cards by offering cardholders cash back, a generous welcome bonus and no added fees on purchases outside the U.S. all for no annual fee.

Recommended Reading: Will Paying Off My Credit Card Increase My Credit Score

Building Credit May Sound Daunting But It Isnt Hard Once You Know How To Get Started Earning Higher Credit Scores Can Be A Little Trickier But Well Teach You How To Do That As Well

Credit is a cornerstone of financial life in the United States, and if youre starting from scratch, your first step will be establishing your credit history. This means opening or getting added to an account, often a loan or credit card, thats reported to at least one of the major U.S. consumer credit bureaus Equifax, Experian or TransUnion.

The trouble is that many companies want to check your credit before agreeing to give you a loan or credit card, and they may be hesitant if you dont have a . Fortunately, there are several ways around this potential roadblock. Keep reading for some things you can do to start building your credit from scratch.

Pay On Time Monitor And Change Products And Be Patient

Youâll officially begin building credit in the US as soon as you have a credit product that is being reported to the major U.S. credit bureaus. Make your payments on time to demonstrate your creditworthiness and build a good credit history. Rent reporting may also affect your credit score, so making sure your monthly rent payments are on time may be important to establishing a good credit score.

If you have a credit card, aim to generally use it at least once a month to demonstrate that you know how to use credit responsibly over time. Another important factor in your credit score is your credit card utilization: a good rule of thumb is to not use more than 10% of your limit.

Be sure to also check your payment due date so you don’t miss a bill. Many providers will let you set up an automatic recurring payment from your checking account to ensure that you don’t fall behind.

After a few months of on-time payments, you are now logged in the U.S. credit system, which will make it easier for you to get approved for another credit product. This could mean that after a few months of making on-time payments on your secured card, you will become eligible for a credit card that doesnât require a security deposit.

Keep in mind that it can take multiple years to get back to the credit score in the US that you had in your home country. It takes patience and close monitoring to build credit in the U.S.

Don’t Miss: Where Is My Credit Score On Transunion Credit Report

Keep Your Balance Low

An important factor in your credit score is your credit utilization ratio. Your credit utilization ratio, or the amount you owe compared with your credit limit, makes up a portion of your credit score.

Experts suggest keeping your credit utilization ratio below 30 percent. Generally, you should try to keep that figure much lower, closer to 10 percent.

The best thing to do is completely pay off your balance each month. This way you’ll avoid paying interest and keep your utilization down.

Consider Experian Boost Or Ultrafico

When you have no credit history, adding extra accounts can boost your score. You have two options that could help you: Experian Boost and UltraFICO:

- Experian Boost evaluates your utility, streaming and other accounts and adds on-time payments from these accounts to your Experian credit report. If a lender or card company uses another credit bureau, they wont see any of your Experian Boost accounts.

- UltraFICO is a program from FICO that adds information about your bank account balances, cash flow and bank transactions. However, not every lender uses or accepts the UltraFICO score.

You May Like: How To Raise Credit Score In 30 Days

Tip #6 Pay Emis Full And On Time

Periodically, lenders report your credit data to credit bureaus, which is then considered to prepare your credit report and calculate your credit score. The credit bureaus have not revealed the weightage given to different credit parameters, however, the debt repayment history is considered most influential. Therefore, miss or delay in making one or more loan or credit card instalments can harm your credit score drastically. Ensuring full and timely payments will help you build a healthy credit score in no time.

Register Your Business And Get An Ein

To establish a business credit file, youll need to first register your business with your Secretary of State. During this process, you will choose your companys name and business structure .

After registering your business, youll want to request an Employer Identification Number from the IRS. In some ways, an EIN is like a Social Security number for your business. Its a number that the government, business credit reporting agencies and others can use to identify your company.

Registering for an EIN is easy and free. To start the process, simply visit the IRS website to determine if youre eligible and to submit an application.

You May Like: How To Remove Credit Report Freeze

Continue Building Relationships With Vendors

As you build your business, continue establishing and building relationships with vendors, and create contracts for supplies and other business materials. You build credit by paying on time or early with vendors that report to credit agencies. Not all do, and not all vendors report to the same credit agencies. Consider what your business needs, then look up which vendors in that vertical report to credit agencies.

Fix Bad Credit Yourself By Reducing Your Balance And Documented Collections

If you have poor or bad credit, in Canada you can fix your credit score without resorting to bad credit loans, but it can take time – even years. Therefore, we prefer to talk about this process in terms of re-establishing or re-building your credit rather than simply fixing your credit. It is possible to fix your credit score yourself, and fast. One way is to reduce your credit card or line of credit balances below 75% of your limit. You can also get collections removed from your credit report. Learn more.

|

5 Steps to Rebuilding Your Credit Score Here’s an overview of how you can rebuild your credit score. . |

Also Check: Is 733 A Good Credit Score

Everybody Has To Start Somewhere Heres How

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

Credit is one of lifes great catch-22s. Lets say you just graduated from high school and want to get your first credit card. You dutifully fill out the application form and wait for a reply from the issuing bank, only to find out that youve been rejected. Why? You have no .

But how do you establish a credit history? Well, you get a credit card, of course. Its a frustrating conundrum, but luckily, there are a few easy and inexpensive steps you can take to establish your credit history.

Set Up Some Direct Debits

Top tip

Always make sure you have enough money in your bank account to pay any bills being paid by Direct Debit or standing order.

Set up some regular Direct Debit payments to pay bills such as your gas and electricity or your home insurance or mobile phone.

If youre worried there might not be enough money in your account, or your income varies, making manual payments might be the better option.

Read Also: What Is A Good Credit Score

Get Your Credit Score

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

Get A Business Credit Card

Another way to establish business credit is to open a business credit card with a company that reports account activity to the business credit bureaus. If you have a good personal credit score, qualifying for a business credit card may be easy, even as a startup.

Business credit cards can also help you to keep your personal and business expenses separate. And you might be able to find a business credit card that offers the benefit of earning travel rewards or cash back on your companys everyday expenses.

You May Like: Can You Dispute Credit Report

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

How Do I Go About Building My Credit History

If you are new to credit and are trying to build a credit history, it could be daunting to start out. To generate a FICO® Score, you need at least one account opened for six months or more and at least one account that is reporting to the credit bureaus for the last 6 months. Read on to see how you can start building a good credit history.

Read Also: What Is The Best Credit Score

Does Your Child Have A Credit Score

Typically, only people over the age of 18 have a credit score but it is possible for minors to have a credit report. A person under 18 can have a credit report if:

- Their identity was stolen and used to open one or more credit accounts.

- A credit agency erroneously created a credit profile in the minor’s name.

- An adult added the minor as an authorized user or opened a joint account in the minor’s name.

Tips On How To Build Credit Fast

Would you be surprised to learn that you can build credit today quicker than ever before? By becoming an authorized user on anothers existing credit card, you can begin to take control of your credit rating. And you can also leverage the payments youre making monthly from rent to utility bills by getting those details to credit reporting agencies.

To help you build your credit history, well explore how to increase credit scores by opening a line of credit with a secured credit card or a secured loan. So, on to the big question: how can you improve your credit score, quickly? Weve got 14 tips on how to raise your credit score fast that are sure to help.

Read Also: Where To Check Credit Score For Free

What Is A Credit Score

When you apply for credit â whether thatâs a credit card, personal loan, mortgage or anything else â a lender wants to know if you will pay your debt back on time. They do this by taking a look at your credit history.

Your credit score is based on several factors including how quickly you pay back money you have borrowed, if you have any outstanding debt, and whether you have any missed or late payments in your past.

You can find out more by reading our guide to what affects your credit score.

Pay Off Any Existing Debt

To reduce your credit utilization ratio quickly and improve your score, use the debt avalanche or debt snowball method to pay down existing debt:

- With the debt avalanche method, you focus on paying off your highest-interest debt first, followed by the debt with the next highest interest rate, and so on. However, be sure to make the minimum payments on any other cards in the process to avoid any penalties.

- The debt snowball method, on the other hand, focuses on paying off your smallest balances first while still meeting the minimum payment requirements for your other cards. This method is meant to help build momentum as you get a sense of achievement from paying off one card after another.

Recommended Reading: How To Make Your Credit Score Go Up