Its Never A Good Feeling To See That Your Credit Scores Have Dropped Since You Last Checked But Being Able To Quickly Identify The Cause Can Help You Take The Right Steps To Get Them Back On Track

Credit scores can drop due to a variety of reasons, including late or missed payments, changes to your credit utilization rate, a change in your credit mix, closing older accounts , or applying for new credit accounts. And dont forget that credit report inaccuracies due to mistakes or identity theft can also cause a dip.

Lets look at the nine main reasons why your credit scores might have dropped, and how you can address each of them.

You’ve Experienced A Major Event Such As Foreclosure Or Bankruptcy

The late payments that often lead up to a bankruptcy or foreclosure harm your credit scoresand the events themselves can make matters worse.

Bankruptcy is a legal process initiated by borrowers looking to get relief from debt payments, and it’s the most harmful single event to a consumer’s credit. Foreclosure is when your mortgage lender takes possession of your house, often following four consecutive months of missed payments, and is second only to bankruptcy in terms of credit harm.

In addition to damaging your credit score, either event can disqualify you from certain types of borrowing in the future. A mortgage lender may be unlikely to take you on as a borrower if you have a foreclosure in your past, for instance. A legitimate foreclosure mark on your credit report will stay there for seven years.

The amount of time a bankruptcy stays on a credit report depends on the type of bankruptcy filed. Chapter 7 bankruptcy, for instance, appears on your report for 10 years from the date you filed, while Chapter 13 bankruptcy appears for seven years.

Why Is My Credit Score Going Down Even Though I Pay On Time

Your credit score can go down for a variety of reasons even though youre making all of your payments on time. Here are some things that can cause your credit score to go down even though youre making all of your payments on time: increased in credit usage, application for a credit card or loan, closure of an account, or a derogatory item being added to your credit report.

You May Like: How To Check Credit Score On Chase

Have I Recently Paid Back A Loan

It may sound strange but sometimes your credit score may drop after you have paid back a loan.

This is because paying back a loan may affect your credit mix. Your credit mix is a combination of the different types of accounts in your credit report. Your credit score is higher when you have a range of different accounts . This is because having a range of different accounts shows that you can handle different types of debt.

While this may cause a dip in your credit score, it is important to pay back your loans on time to maintain a great credit score. Failing to pay back a loan can make your credit score drop significantly. Credit reports can still have strong scores with a smaller credit range.

Should You Worry About Changes In Your Credit Score

Changes in your credit score are completely normal, so theres no need to worry about small fluctuations! That being said, its good to check your credit report at least once a month so you can monitor these changes when they occur.

You may want to take note of large changes in your score as they could be an indication that something bigger is happening for example, if you have unauthorized accounts opened in your name, or youve been a victim of identity theft.

Dont Miss: What Is Syncb Ntwk On Credit Report

Recommended Reading: Check Credit Score Without Social Security Number

Whats In Your Credit Score

The credit score offered by Discover to its cardholders is the most widely used credit score, the FICO score. Here are the components FICO says go into that credit score:

- Payment history: 35 percent. Simply whether youve paid your bills on time.

- Level of debt: 30 percent. How much debt you have, how much youve borrowed relative to your limits, and a few other factors.

- Length of credit history: 15 percent. How long your accounts have been established

- Types of credit: 10 percent. The mix of credit you have, including revolving accounts, installment loans, mortgage loans, etc.

- Recent inquiries: 10 percent. Opening several accounts, which require inquiries, within a short period of time can lower your score.

Keep in mind that your credit score is based on your credit history, so anytime something changes in your history, your score can change as well. Youre entitled to one free credit report annually from each of the big three credit reporting agencies by visiting AnnualCreditReport.com.

Why Did My Credit Score Drop 9 Possible Reasons

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhereâs how we make money.

When your credit score takes an unexpected turn downward, you may feel angry or frustrated. Credit scores do fluctuate, and a couple of points up or down is not a big deal but a downward trend or a big drop is.

Heres a list of things that might be behind your credit score drop, and tips for fixing them:

You May Like: What Day Does Opensky Report To Credit Bureaus

Negative Impacts To Your Credit Score

- Missed payments: This can be everything from loans to bill payments.

- Defaulting on payments: A default is where a payment over $125 is overdue by more than 30 days and the lender has tried to recover the money. This stays on your credit record even if you repay the amount in full.

- Insolvency: Filing for one of the three types of insolvency â debt repayment plan , no-asset procedure or bankruptcy.

- Applying for too much credit: Applying for multiple sources of credit in a short space of time, eg applying for four credit cards in three months.

- Multiple credit checks: Many agencies/organisations checking your credit score shows you may be seeking more loans or credit than you can afford.

- Shifting debt from one credit card to another.

- Debt collections: You owe money and your debt has been passed on to a debt collector.

- Hardship applications: If you applied for hardship with a previous loan, eg repayment holiday.

- Payday loan and quick finance applications: With their high interest rates, other lenders may consider these a last resort.

- No credit: Having no credit history means there’s no way for future lenders to see if you are a risk or not. This can have the same negative impact as having bad credit.

Age Of Accounts In Your Credit History

As your credit file and accounts age, your score can improve. FICO looks not only at your oldest account, but also at the average age of your accounts. While this factor may not have a significant affect in any given month, it can cause scores to increase when accounts cross an age threshold that FICO finds significiant.

You May Like: Syncb/ppc Closed Account

How To Make Your Credit Score Go Up

Financial institutions consider a score below 549 points a bad credit score. In practice, people with scores like this will get rejected every time they apply for a loan.

Anything from 550 to 619 will get you to the poor credit score list. This might get you qualified for a credit however, since you represent a high credit risk, the lender is likely to give you very unfavorable terms. If you still decide to go with this option, be sure to check out the credit cards for a low credit score.

If you recognize yourself in one of these two groups or you keep on wondering Why did my credit score drop?, here are some steps that can help you improve your current position:

Pay your bills on time.

The tried and true way of earning extra points. Weve already mentioned that credit history is the most important factor lenders consider when deciding whether or not to give you a credit. As the late payments will leave a mark on your credit report for seven long years, try to manage your payments in a timely manner.

Make frequent payments.

If you have the possibility to make a few smaller deposits throughout the month, you can slightly improve your credit situation. The goal is to lower your credit utilization ratio so that your credit score can go up.

Increase your credit limit.

Dispute any credit report mistakes.

Further Reading

Sometimes your credit score can change even though you didnt take any particular action, or at least you werent aware of it at the moment.

Review Your Credit Reports

To improve your credit, it helps to know what might be working in your favor . Thats where checking your credit history comes in.

Pull a copy of your from each of the three major national credit bureaus: Equifax, Experian, and TransUnion. You can do that for free once a year through the official AnnualCreditReport.com website. Then, review each report to see whats helping or hurting your score.

Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal inquiries for new credit. Late or missed payments, high credit card balances, collections, and judgments are major credit score detractors.

You May Like: Credit Score To Get Chase Sapphire Reserve

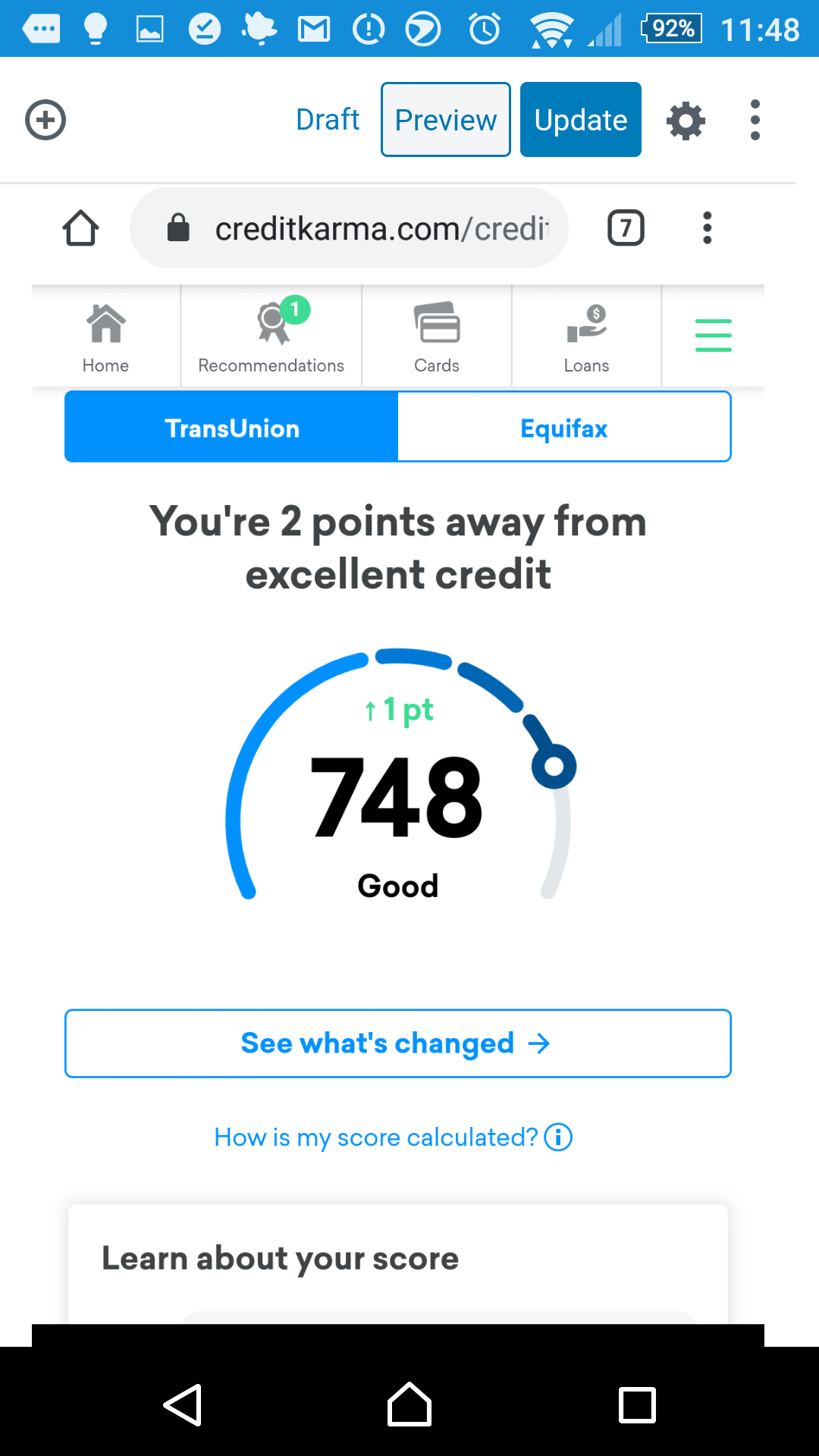

Should I Be Worried If My Experian Equifax Or Transunion Credit Score Has Changed

It stands to reason that if your Experian, Equifax or TransUnion score has dropped by a large number of points, it’s worth taking the time to find out whether your report information is accurate. Errors can then be immediately reported.

On the other hand, if the number of points you’ve dropped is minimal, it’s often best to see whether your score goes up or down in points over the next few months. If your points go down, this may indicate a downward trend has begun. On the other hand, if your points increase, this suggests you’re back on an even keel.

Monitor Score Changes With Creditwise From Capital One

Staying on top of the information in your credit report can help alert you to potential problems. But waitâdoesnât checking your credit report hurt your credit score?

Thankfully, thatâs a myth. The Consumer Financial Protection Bureau confirms that requesting your credit report wonât hurt your credit score.

You could use a credit monitoring tool like . CreditWise is free and available to everyoneânot just Capital One customers.

With CreditWise, you can access your free TransUnion® credit reports and weekly VantageScore® 3.0 credit score anytime, without hurting your score. You can even see the potential impacts of financial decisions on your credit score before you make them with the CreditWise Simulator.

You can also get free copies of your credit reports from all three major credit bureausâEquifax®, Experian® and TransUnion. Just call 877-322-8228 or visit AnnualCreditReport.com to learn how.

Don’t Miss: How Often Does Bank Of America Report To Credit Bureaus

Can A Credit Score Drop For No Reason

Sometimes a credit score can go down for seemingly no reason at all. However, theres always an explanation behind a credit score decrease even if its hard to find or understand.

Credit scores used by lenders in the United States have to comply with a law known as the Equal Credit Opportunity Act . Per the ECOA, credit scoring systems must be empirically derived plus demonstrably and statistically sound. In plain terms, this means that credit scores have to be built using accepted scientific methods and they have to work.

If something causes one of your credit scores to drop, legally there has to be a reason . Remember, a lower credit score means your credit report now represents a higher risk to lenders. In other words, the odds of you becoming 90 days or more late on a credit obligation in the next 24 months have increased.

Below is a list of some unusual reasons your credit score might have decreased.

Read Also: Does Paypal Credit Report To Credit Bureaus

How Can You Improve Your Credit Score

You can improve your credit score by performing the following actions:

- Pay all of your credit cards and loans on time

- Pay all of your other bills on time

- Dont apply for too many credit cards or loan within a short period of time

- Keep old accounts open

- Reduce the balances on your credit cards and loans

- Check your credit report & dispute any inaccuracies that you find

You May Like: Usaa Credit Monitoring Service

Add Utility And Phone Payments To Your Credit Report

Typically, payments such as utility and cellphone bills wont be reported to the credit bureaus, unless you default on them. However, Experian offers a free online tool called Experian Boost, aimed at helping those with low credit scores or thin credit files build credit history. With it, you may be able to get credit for paying your utilities and phone bill even your Netflix subscription on time.

Note that using Experian Boost will improve your credit score generated from Experian data. However, if a lender is looking at your score generated from Equifax or TransUnion data, the additional sources of payment history wont be taken into account.

There are also services that allow rent payments to be reported to one or more of the credit bureaus, but they may charge a fee. For example, RentReporters feeds your rental history to TransUnion and Equifax however, theres a $94.95 setup fee and a $9.95 monthly fee.

How much will this action impact your credit score?

The average consumer saw their FICO Score 8 increase by 12 points using Experian Boost, according to Experian.

When it comes to getting your rent reported, some RentReporters customers have seen their credit scores improve by 35 to 50 points in as few as 10 days, according to the company.

How Often Should You Check Your Credit Score

You should check your credit score regularly to check for errors, but make sure that you are doing so through soft inquiries so that your score isnt dinged. Many banks offer free credit monitoring to their customers check with yours to see if you can enroll in their service and get alerts whenever your score changes.

Recommended Reading: How To Dispute Repossession On Credit Report

The Amount Of Credit Youre Using Has Changed

Your credit utilization ratio the percent of available credit youre actually using has a major impact on your score. So, your score may drop if you put a big purchase on a credit card. And you may see a bump in your score when you pay down debt or spend less than usual.

Plus, timing matters in terms of when your score is calculated. Even if you cover your balances each month, your score can look lower if you check it before you actually pay the bill when youre using more credit. Even after youve paid the bill, there may be a timing gap in which you may not see your score change automatically.

Read Also: Synchrony Bank Ppc

Will Closing A Credit Card Account Impact My Fico Score

It is possible that closing a credit account may have a negative impact depending on a few factors. FICO® Scores may consider your credit utilization rate, which looks at your total used credit in relation to your total available credit. Essentially, it measures how much of your available credit you are actually using. The more of your credit that you use, the higher your utilization rate and high credit utilization rates may negatively impact your FICO® Score. Before you close any credit card account, Wells Fargo recommends that you should first consider whether you really need to close the account or if your real intention is just to stop using that credit card. If you really just want to stop using that card, it may make sense if you stop using the card and put it somewhere for safe keeping in case of an emergency. Its also important to note that length of your credit history accounts for 15% of your FICO® Score calculation. Therefore, having credit card accounts that are open and in good standing for a long time may affect your FICO® Score.

You May Like: Realpage Credit Inquiry

Should You Worry About Changes To Your Credit Score

Changes in your credit score are completely normal. Theres no need to worry about small fluctuations.

That being said, its good to check your credit report at least once a month so you can monitor these changes when they occur. Remember, a changing score means changing information. If you see a big change in your credit score, make sure you know what triggered it.

You Missed A Credit Card Payment

Because your payment history is the most important factor that determines your credit score , missing a credit card payment will have an immediate negative effect on your score. Needless to say, lenders and issuers care a lot about whether you’ve paid your past credit accounts on time because they indicate your risk.

According to FICO data, a 30-day missed payment can drop a fair credit score anywhere from 17 to 37 points and a very good or excellent credit score to drop 63 to 83 points. But a longer, 90-day missed payment drops the same fair score 27 to 47 points and drops the excellent score as much as 113 to 133 points. In other words, the higher your credit score, the greater the negative effect will be.

How quickly your score bounces back after a missed payment varies depending on your credit history and your payment behavior after you miss a payment. If you jump back on track quickly after, it’s likely your score will start improving along with your good payment history. A history of on-time payments is vital to a good credit score, and it’s even better if you can pay them in full.

Don’t Miss: Navy Auto Loans