How To Get A Free Credit Report

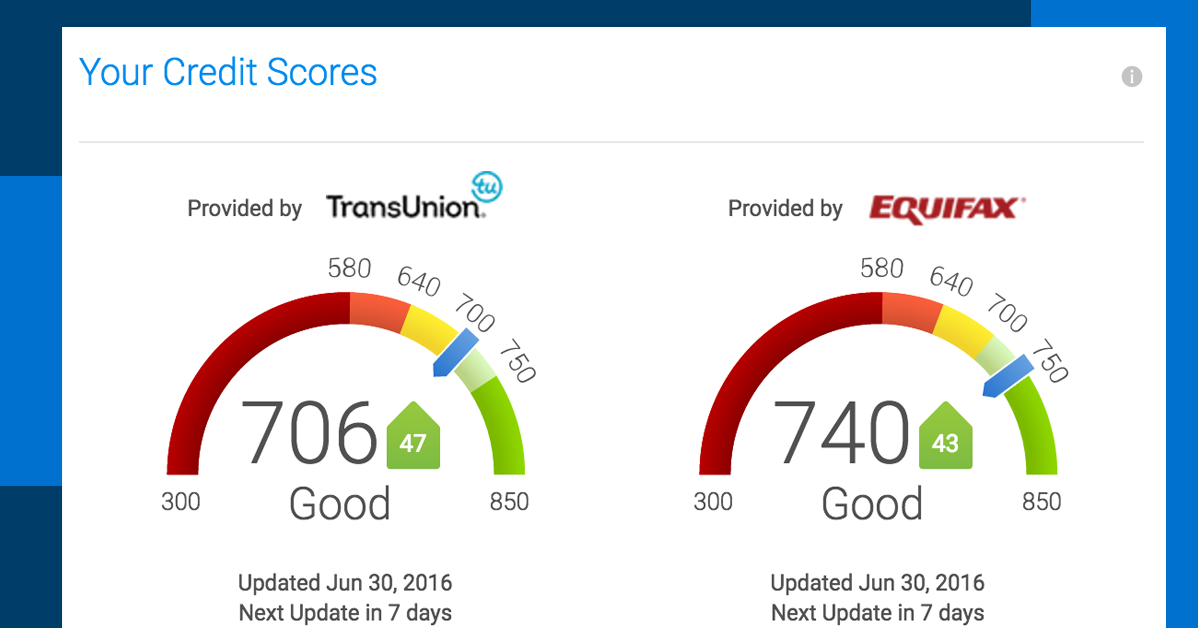

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Why Is It Important To Check My Credit Report

Its important to check your credit report because credit reporting mistakes happen. They can be the result of a creditor reporting inaccurate information or a sign of identity theft. If the error lowers your , it can decrease your approval odds when applying for a loan and it could prevent you from securing the best rate.

Don’t Miss: Itin Credit Score

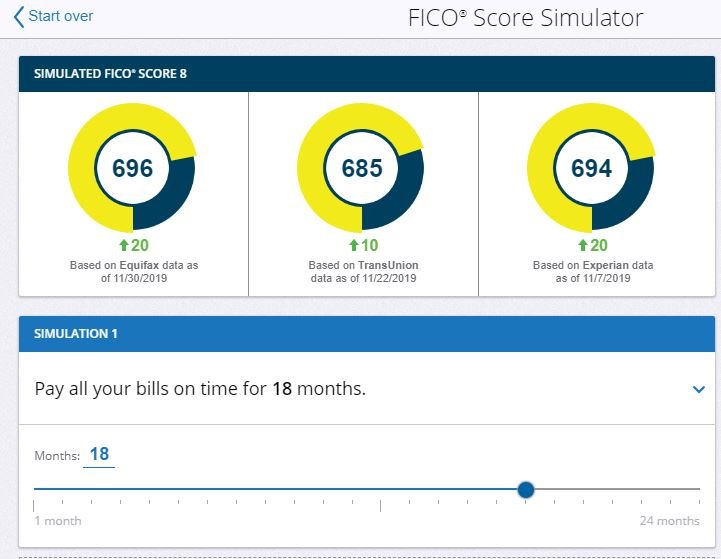

Ways To Increase Your Fico Score

It takes time to boost your FICO Score. Here are a few ways to get started.

- Pay your bills on time. Delinquent payments can lower your credit score. Be diligent and set reminders to pay bills on time. Remember payment history is one of the most important factors in determining your FICO Score.

- Use credit responsibly. If you have credit cards, be careful not to rack up debt that might be hard to pay down. Remember, your FICO Score reflects not only your amount of debt, but also how it compares as a percentage of your available credit. Its a good idea to pay your credit card debt in full, on time, every time.

- Avoid applying for too many lines of credit within a short time. Creditors may think you need money if you make a lot of credit applications. Also, you credit score may drop if a lot of lenders check your credit report.

- Check your credit reports regularly. Your credit reports may contain inaccurate information. If you see errors, dispute them right away.

- Avoid closing credit accounts. Lowering the amount of credit you have available could also lower your credit score. Even so, you may want to consider closing accounts you seldom use that have an annual fee.

You can help raise your credit score by practicing responsible financial habits. That way, when you get your FICO Score for free, you might be pleasantly surprised.

Get LifeLock Identity Theft Protection 30 DAYS FREE*

Start your protection now. It only takes minutes to enroll.

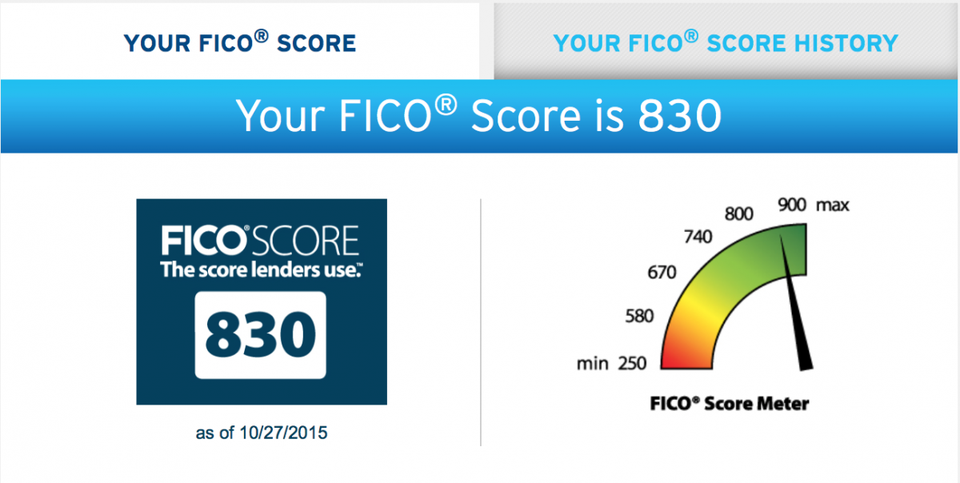

We Want To Help You Build Great Credit So We Offer Fico Scores For Free For Our Primary Cardholders

Your FICO® Score is calculated from the details in your credit report, including your credit history and record of past payments. The score is made available to lenders, landlords and others to assess if youre a financial risk. Its important to pay bills on time and in full to maintain a great credit score, as this can affect your ability to secure a loan or even rent an apartment. Using this feature isnt reported to the credit bureaus and wont affect your score.

Recommended Reading: What Credit Score Is Needed For Carecredit

Experian Is Nothing But A Fraud

Experience still has me down 109 points while Trans Union and Equifax has me at 109 points they seem to not be reporting the correct information when I try to dispute they tell me they cannot dispute. They Luer me into applying for credit cards they said I would be a perfect match for an order to have open trade lines to increase my credit score then upon getting denied because of experience low credit score which Trans Union and Equifax have me 109 points on my credit score, I was promised that those credit card applications would not be hard inquiries but again that was a lie and they continue to show them as hard inquiries on my Experian credit report which brought my credit score down five points which I am trying to dispute and they have a number it says you can dispute hard inquiries but upon calling they had me on hold for over 30 minutes while they were investigating it then transfer me to someone new who didnt know anything about why I was on hold and told me that they cannot dispute hard inquiries I have to call the creditor which is a load of crap!!! Shame on you Experian!!!!!!

The Bottom Line: Knowledge Equals Power

Having your score readily available gives you more power over your financial life. Your credit report is made up of all kinds of sensitive information that can have a powerful impact on your finances, and greatly impact your credit score. Its important to check that the data is correct and up to date, and most major issuers now make this free and easy to do.

Read Also: How To Unlock My Experian Account

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

How Is A Business Credit Score Calculated

A business credit score considers many of the same factors as a personal credit score, such as payment history and amount of debt used. However business credit scores use different scoring models.

For two main types of business credit scores, Dun & Bradstreet PAYDEX Score and Experian Intelliscore Plus, scores range from 1 to 100, and the closer to 100, the better. Consumer FICO scores, on the other hand, are ranked 300 to 850, with 800 and above being consider excellent credit.

Business credit scoring models weigh different factors when calculating scores, but you can anticipate that your payment history, age of accounts and amount of debt will be considered. If you carry a balance on The Blue Business® Plus Credit Card from American Express, that will be factored into your business credit score. And if you miss a payment on your Ink Business Cash® Credit Card, that can negatively impact your score.

You May Like: Carmax Credit Score Requirements

Im 40 And Just Decided To Finally Decide To Work In My Credit

Im a 40 year old male and never really worried about credit. I guess cause of growing up with parents they were in the real-estate business and also the vp of my fathers trucking business at 18 I always paid for everything with cash or just wrote a check on the company. Well do to a one of our drivers of my dads trucking business having a horrible fatal accident in my fathers truck it caused a snow ball effect and my father not only lost hi trucking business with 4 6 axel dump trucks he also lost 7 apartment buildings my home and his and my moms. So to make a long story short I was homeless out of a job and lost. I never new much about credit and how it worked. Well over the past 4 months I been checking my credit and trying to build credit. This app has helped me tremendously along with the other 2 bureaus. I was shocked to find out the wrong info on my report also to find out that someone got cell phones cable and other items in my name. Filing a dispute is easy and being able to check my report everyday and getting the alerts is good. I got my very first credit card and my credit went from a 412 to a 617 since using this app and working with the bureaus I know its not that high but watching it climb gives me something to watch for. Thanks a lot for all the help. Great app

Why Does Your Credit Score Matter

Having a good or bad credit score can affect more areas of your life than you might think. First off, your credit score will determine whether youre able to obtain a loan as well as the interest rates youll pay on those loans. Bad credit means youll pay more interest over the life of any loans you take out. It also affects premiums for auto and homeowners coverage. When you have a low score it can also keep you from getting, a car, a home, and even landing a job, so its important to stay on top of your score and do what you can to get to and maintain a good credit score.

Recommended Reading: Can A Repossession Be Removed

Can You Check Your Fico Score Without Hurting Credit

Because a free FICO Score typically comes from a credit card company, before issuing you their credit card and free FICO Score, they will likely perform a hard credit check which ultimately will lower your credit score. Instead, you can use a paid service like Experian Boost. Youll have access to your Experian credit report and FICO Score without hurting your credit because they only perform a soft credit inquiry.

Is Your Fico Score Really Free

There is a multitude of websites that claim to offer your credit score at no cost, but in most cases, theyre not actually free. When you sign up for these supposedly free credit scores, some websites will enroll you into a credit monitoring service that charges a monthly fee without any warning to you.

Another common issue with providers advertising free credit scores is while they may provide you a monthly update of your credit score for free, they may also make you apply for a credit card with high interest rates and costly monthly fees.

Also Check: Free Karmascore

Is My Fico Score The Same As My Credit Score

Your FICO Score and credit score are both ways to determine your creditworthiness and the likelihood that you will fall 90 days behind on a bill within the next 24 months. FICO offers a specific brand of credit score that many lenders use when determining how much risk theyre taking by giving you a loan or credit card. Some lenders choose to make their scoring models or will use competitors credit scores.

FICO Scores are determined using complex algorithms based on information in your credit report from the three major credit bureaus: Experian, TransUnion, and Equifax. Periodically FICO also releases new versions of its scores or creates different versions to work with each credit bureaus database, so you can have multiple FICO Scores.

FICO credit scores range from 300 to 850 and group consumers by credit scoring ranges. For example, 800 to 850 is considered exceptional, while anything below 670 is considered poor. Each scoring model FICO uses takes a unique approach and may result in a different score depending on the bureaus theyre working with.

How Often Does Your Credit Score Change

Your credit score takes time to build up, but you may also notice a score decrease and increase overnight. As you make consistent on-time payments on loans, pay off debt and increase your credit age, your score will go up. However, if you miss a loan payment, utilize too much of your credit line, or a hard credit check is performed your score will decrease. Thats why its a good idea to monitor your credit to notice any changes in your score and make sure theyre accurate.

When you have a from MoneyLion youll have access to their credit monitoring tool, youll get updates about changes to your score and advice on how you can improve your credit score! Well even let you know the key factors you should focus on to increase your score even more.

Recommended Reading: Uplift Pulls Which Credit Bureau

What Is A Bad Vantagescore

The VantageScore is another popular type of credit score, and this scores newest models also assign credit scores from 300 to 850. However, the range of scores are slightly different than the FICO scoring model. As you can see below, there are more ranges to be aware of, and good credit requires a slightly lower threshold. In the meantime, fair credit requires a slightly higher score.

- Excellent: 781 to 850

- Poor: 500 to 600

- Very Poor: 300 to 499

The newer VantageScore models also break down the bad credit score range into poor and very poor categories. Either way, consumers should strive for a VantageScore thats considered good or better.

The Importance Of Knowing Your Score

As we mentioned above, you shouldn’t go through life without knowing your credit score. This number is updated regularly. It goes up or down usually every month, but it may even be changed more frequently based on who’s reporting.

Knowing your score means you’re more likely to make better decisions about your finances. Having a lower score may make you more cautious about applying for new credit as there’s a good chance you’ll be denied. If you have a lot of inquiries and very few accounts, your score drops, and lenders may refuse to grant you a new account. On the other hand, knowing you have a higher credit score makes you a more attractive applicant to .

Keep in mind that checking your credit score isn’t the same as checking your . Your credit report provides a detailed history of your financial life, including any accounts you have, how often you’ve paid them on time, any delinquencies, bankruptcy reports, flags and messages, write-offs, and inquiries. The report also includes the dates of any changes to your credit history. You can use this history to account for and report any discrepancies.

You can start by going to the three major credit bureaus, Equifax, Experian, and TransUnion first by logging on to AnnualCreditReport.com to check your report for free. Each agency gives you access to your report once every 12 months. You’ll have to pay them if you want your credit score. But why pay when you can get your score for free?

Don’t Miss: How Often Does Discover Report To Credit Bureaus

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Why Should You Check Your Score

Knowing your FICO score has a number of benefits. First, most lenders in the United States use FICO scores when deciding whether to extend credit. With access to a score based on the same models that bankers and card issuers use, youll have a better sense of where you stand in their eyes.

Also, if youre working to improve your credit, checking your FICO score every month is a great way to gauge your progress. Its gratifying to see that your hard work is paying off. On the flip side, itll be easier to spot credit mistakes when you make them and adjust your habits accordingly.

Finally, keeping an eye on your FICO score is a good way to spot trouble. Your FICO score is determined by the information on your credit report. If you fall victim to identity theft or a credit reporting error, this will likely show up in your FICO score. Although it will still be beneficial to check your three credit reports at least once per year which you can also do for free at AnnualCreditReport.com seeing your FICO score every month is a good early warning system if things start going off the rails.

NerdWallet, too, offers a free credit report.

Recommended Reading: How To Remove Serious Delinquency From Credit Report

Enter Your Personal Information

Once youre on the correct website, click on the button near the top of the page or bottom left that says, Request your free credit reports. Afterward, click on the button with the same words below the line that reads, Fill out a form. Finally, complete the form by entering your name, birthdate, current address and Social Security number .

If you havent lived at your current address for at least two years, youll have to enter your previous address, too.

Get Your Credit Score

A lender will use your credit score to determine if they will lend you money and how much interest they will charge you to borrow it. Your credit score is a number calculated from the information in your credit report. It shows the risk you represent to a lender compared to other consumers.

Knowing your credit score before a major purchase, such as a car or a home, may help you to negotiate lower interest rates.

You usually need to pay a fee when you order your credit score online from the two credit bureaus.

Some companies offer to provide your credit score for free. Others may ask you to sign up for a paid service to see your score.

Make sure you do your research before providing a company with your information. Carefully read the terms of use and privacy policy to know how your personal information will be used and stored. For example, find out if your information will be sold to a third party. This could result in you receiving unexpected offers for products and services. Fraudsters may also offer free credit scores in an attempt to get you to share your personal and financial information.

Always check to see if a website is secured before providing any of your personal information. A secured website will start with https instead of http.

Read Also: Does Affirm Accept Itin Number