The Importance Of Knowing Your Score

As we mentioned above, you shouldn’t go through life without knowing your credit score. This number is updated regularly. It goes up or down usually every month, but it may even be changed more frequently based on who’s reporting.

Knowing your score means you’re more likely to make better decisions about your finances. Having a lower score may make you more cautious about applying for new credit as there’s a good chance you’ll be denied. If you have a lot of inquiries and very few accounts, your score drops, and lenders may refuse to grant you a new account. On the other hand, knowing you have a higher credit score makes you a more attractive applicant to .

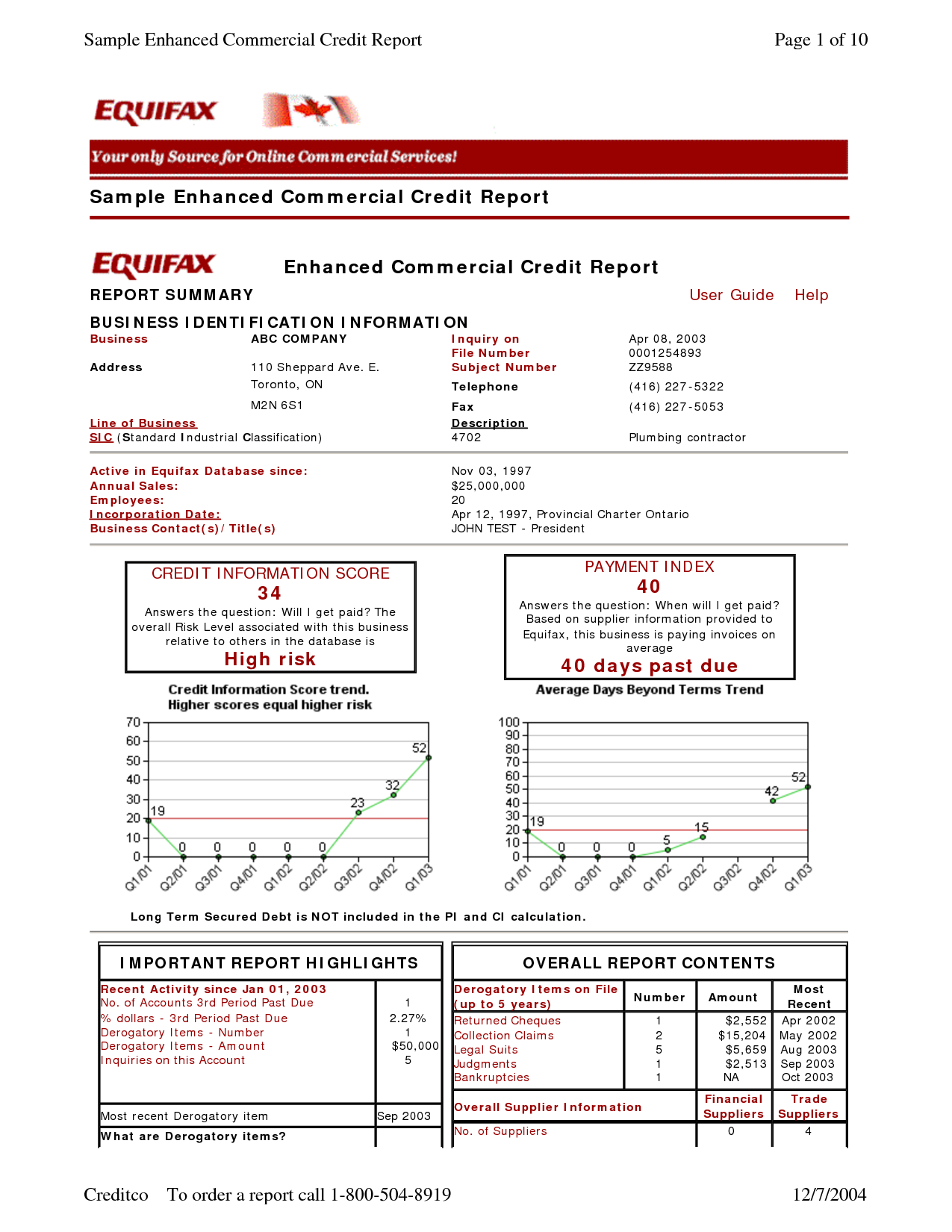

Keep in mind that checking your credit score isn’t the same as checking your . Your credit report provides a detailed history of your financial life, including any accounts you have, how often you’ve paid them on time, any delinquencies, bankruptcy reports, flags and messages, write-offs, and inquiries. The report also includes the dates of any changes to your credit history. You can use this history to account for and report any discrepancies.

You can start by going to the three major credit bureaus, Equifax, Experian, and TransUnion first by logging on to AnnualCreditReport.com to check your report for free. Each agency gives you access to your report once every 12 months. You’ll have to pay them if you want your credit score. But why pay when you can get your score for free?

Decide How Many Reports You Want To Review

Select whether you want to receive a report from Equifax, Experian, TransUnion, or all three. The bureaus are given information about our credit-card histories from creditors, but they don’t all have the same information, which can lead to slight variation in the credit history recorded by each.

It’s best practice to review all three over the course of the year you can even set calendar reminders to request one every four months. However, if you’re preparing to buy a house or make another big purchase that requires a credit check, you may want to request all three reports at once to review for accuracy, since you don’t know which bureau the lender will pull from.

By Step Instructions To Obtain Your Free Credit Reports

1. Go to www.annualcreditreport.com. Make sure you are trying to get a “report” not a “score”. The report is free however the “score” is not.

2. Select your state and then click REQUEST REPORT.

3. Fill in your personal information .

- If you have not lived at your current address for at least 2 years, you will also need to include your previous address.

4. Click CONTINUE.

5. Select each of the three different credit reporting companies .

6. Click NEXT.

7. Click NEXT to continue. You will be transferred to the Equifax website.

- When you are finished at the Equifax website, click on Return to AnnualCreditReport.com located in the menu bar at the top of the screen.

EQUIFAX WEBSITE INSTRUCTIONS

8. Enter the last 4 digits of your social security number.

9. Click on .

10. Answer the security questions which are based on information in your file.

11. Click on .

12. Click on the Get Started link.

13. Print and Save Report.

14. To save your credit report as a PDF, click on Save as PDF. Save to your hard drive or disk. To print your report, click Print Report.

NOTE: When you view your credit report, make sure that you save and print it BEFORE you close the credit report window or continue to the next page/segment/step. If you close the window before printing, you cannot view it again for free.

15. Once you have saved and/or printed your Equifax credit report, click on Return to AnnualCreditReport.com at the top of the screen.

17. Select your state and then click REQUEST REPORT.

Recommended Reading: Check Credit Score Usaa

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

What Affects My Credit Score

Your score will ultimately be based on how responsibly you use your credit facilities.

For example, you lose 130 points with Experian if you fail to pay a bill on time but will gain 90 points if you use 30% or less of your credit card limit.

Like lenders, each credit reference agency has its own system for assessing your creditworthiness and will take into account different factors when calculating a score.

However, certain things will have a negative impact on your score regardless of the agency – for example, not being on the electoral roll, or making a late payment.

Bear in mind that the timing of entries in your report is more important than the type of activity.

Lenders are most interested in your current financial circumstances, so a missed payment from a few years ago is unlikely to scupper your chances of getting credit.

Also Check: Coaf On My Credit Report

What Are The Benefits Of A Good Credit Score

Here are some of the advantages of having a good credit score:

- It helps in accelerating the loan-approval process.

- It enables you to negotiate better terms and conditions, for instance, a lower rate of interest. An interest rate that is reduced by just 0.5% can translate into a substantial amount of savings.

- It reduces the possibility of loan or credit card rejection.

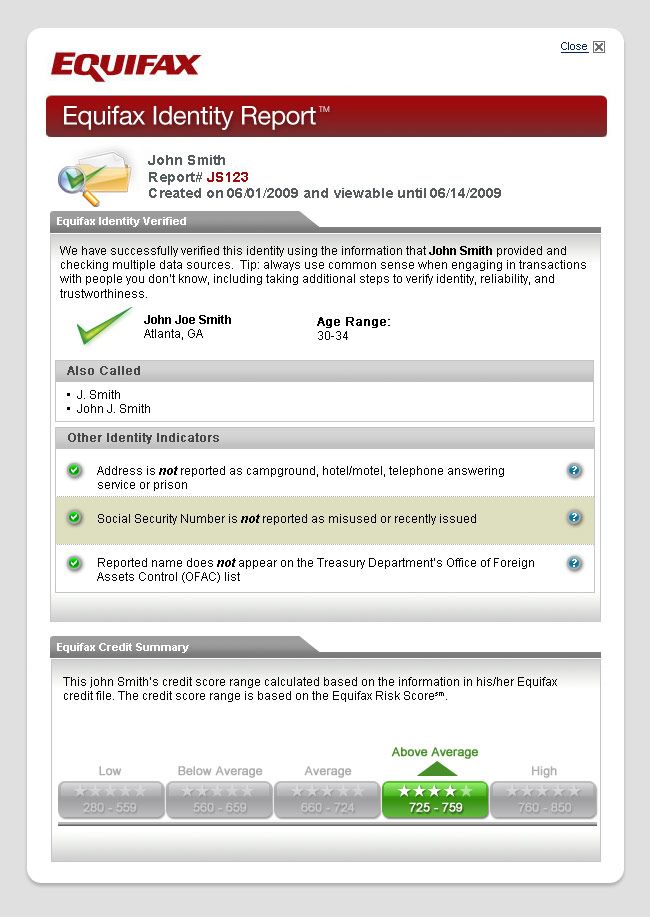

How Is The Equifax Score Calculated

An Equifax score is calculated based on several factors, your repayment history being one of the most important.

Member banks and non-banking financial companies provide Equifax with information on every customers credit activity including payments on their loans and credit cards, their credit limit, the age and number of their credit accounts and the status of these accounts, among other data. The bureau then uses sophisticated mathematical algorithms to calculate the individuals credit score.

Don’t Miss: What Is Syncb/ppc

Submit Your Request By Mail:

First, you’ll need to download and complete the Canadian Credit Report Request Form.

Second, you must provide a photocopy of two pieces of valid, non-expired Canadian Government-issued identification. At least one of the two IDs must include your current home address. Examples of acceptable documentation include:

- Driver’s license

- Birth certificate

- Certificate of Indian Status

In order to protect your personal information, we will validate your identity before mailing your credit report to your confirmed home address. If your address is not up-to-date on either identification, you must also provide additional documentation that shows your current home address . Your copy should show the date of the document, the sender, your name, address and your account number.

- Documents must be less than 90 days old

- We recommend you blackout any transactional details.

- If you provide a credit card statement or copy of your credit card as proof, please ensure to blackout your CVV.

While providing your Social Insurance Number is optional, it helps us avoid delays and confusion in case another individual’s identifying information is similar to your own. If you provide your S.I.N., we will cross-reference it with our records to ensure that we disclose the correct information to you. We will not use it for any other purpose or share it with any third party.

As a last step, you will need to submit your completed form and proof of identity

Kindly allow 5 – 10 days for delivery.

Which Credit Report Is Most Accurate

No one credit report is innately more accurate than the others. Your TransUnion credit report might contain information that your Equifax credit report doesnt, or vice versa.

This is partly because lenders are not required to report your information to all three credit bureaus. In some cases, they may only report to one bureau and not the others, or they may report information at different times.

In any case, its a good idea to review your credit reports on a regular basis so that you can be sure any discrepancies are minor.

Ready to help your credit go the distance? Log in or create an account to get started.

You May Like: Affirm Credit Score Approval

What’s A Good Credit Score In Canada

A good credit score in Canada is any score between 713 and 900. Credit scores in Canada range between 300 and 900. There are five distinct categories that your credit score could fall into, ranging from poor to excellent. Having a good credit score can help you qualify for financial products at lower interest rates. Not sure where you stand? Check your credit score with Borrowell!

Go To Annualcreditreportcom Or Call 1

You can only request your credit report through AnnualCreditReport.com or by calling the verified phone number 1-877-322-8228. If another source claims to have your credit report in exchange for personal information, it’s probably a fraud.

Requesting your credit report won’t negatively affect your credit, but again, you’re limited to three reports per 12 months under federal law.

You May Like: Usaa Fico Score

How To Check Your Credit Score In Canada

With Borrowell, you can get your credit score in Canada for free! Signing up takes less than 3 minutes, and no credit card is required. Once you’ve signed up for Borrowell, you can download your Equifax credit report for free AND check your credit score at any time without hurting it. Plus, you’ll receive weekly updates on how your score has changed. Stay on top of your credit health with Borrowell.

Request Credit Reports & Answer Any Security Questions

After you fill out the form, you can request your credit reports from the three major credit bureaus. Youll likely be asked to answer some security questions to verify your identity. For example, you may be asked when you were born or information about past accounts you may have owned. In addition, you may be asked to provide your phone number to receive a one-time password.

You May Like: Syncb Ppc Card

Generate Your Credit Report Online

You can save reports to your desktop or print them out so youll have access later.

If you need to request a report or reports by mail, send a request form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

Your report or reports should be sent within 15 business days.

You can also get your credit reports by calling 877-322-8228. Visually impaired consumers can also call this number to request audio, large-print or Braille reports.

Submit Your Request And Review Your Report

The site will produce your credit report within a few seconds. If you request your report over the phone, it will be sent by mail and could take up to 15 days to arrive.

The report is separated into five sections:

- Personal information: Your name, past and current addresses, year of birth, and phone numbers.

- Accounts: This is where you’ll find the entire history of every line of credit you have or have had in the past the current balance, date opened, status of the account, highest balance, minimum payment, credit limit, etc.

- Public records: If you have been involved in legal matters, filed for bankruptcy, or experienced a tax lien, it will be listed here.

- Hard inquiries: If you have applied for a new credit card or loan in the last two years, the name of the lender will appear here with the date of the inquiry and the date it is set to expire.

- Soft inquiries: If an employer, landlord, insurance company, or credit-card lender has ever made a soft inquiry into your credit, it will appear here. Soft inquiries don’t affect your credit score and thus aren’t disputable.

Recommended Reading: Centurylink Credit Check

How To Get A Free Credit Report

Order a copy of your credit report from both Equifax Canada and TransUnion Canada. Each credit bureau may have different information about how you have used credit in the past. Ordering your own credit report has no effect on your credit score.

Equifax Canada refers to your credit report as credit file disclosure.

TransUnion Canada refers to your credit report as consumer disclosure.

How Do I Order My Free Annual Credit Reports

The three national credit bureaus have a centralized website, toll-free telephone number, and mailing address so you can order your free annual reports in one place. Do not contact the three national credit bureaus individually. These are the only ways to order your free credit reports:

- complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

P.O. Box 105281

Atlanta, GA 30348-5281

Also Check: Carmax Finance Rate

How Do I Get A Copy Of My Credit Reports

You are entitled to a free credit report every 12 months from each of the three major consumer reporting companies . You can request a copy from AnnualCreditReport.com.

You can request and review your free report through one of the following ways:

- Mail: Download and complete the Annual Credit Report Request form. Mail the completed form to:

Annual Credit Report Request ServiceP.O. Box 105281Atlanta, GA 30348-5281

You can request all three reports at once or you can order one report at a time. By requesting the reports separately you can monitor your credit report throughout the year. Once youve received your annual free credit report, you can still request additional reports. By law, a credit reporting company can charge no more than $13.00 for a credit report.

You are also eligible for reports fromspecialty consumer reporting companies. We put together a list of several of these companies so you can see which ones might be important to you. You have to request the reports individually from each of these companies. Many of the companies in this list will provide a report for free every 12 months. Other companies may charge you a fee for your report.

You can get additional free reports if any of the following apply to you:

What Is A Credit Report

Your personal credit report contains details about your financial behavior and identification information. Experian® collects and organizes data about your credit history from your creditor’s and public records. We make your credit report available to current and prospective creditors, employers and others as permitted by law, which may speed up your ability to get credit. Getting a copy of your credit report makes it easy for you to understand what lenders see when they check your credit history. Learn more.

Read Also: Affirm Credit Score Needed For Approval

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Why You Could Have Different Credit Reports From Different Bureaus

The credit bureaus can only report on the information thats provided to them. Since lenders are not required to report to all three major credit bureaus, you might find information about certain accounts on one credit report, but not others.

Even when lenders do report information to all three major bureaus, they may report that information at different times. Given all the credit information included in a typical credit report, its perfectly normal to observe some minor differences between your credit reports.

Mistakes do happen from time to time. If you think your credit reports are different due to legitimate errors, you can dispute those errors with each credit bureau.

Recommended Reading: Freeannualcreditreport Com Official Site

How To Get A Free Equifax Credit Score And Report In Canada

In this article, I will show you two ways to get your Equifax credit score for free!

Your credit score and report provide an assessment of your creditworthiness and combined, they can impact your ability to apply for credit.

Equifax and TransUnion are the two main credit bureaus in Canada. These two companies use information collected from various financial institutions to compute your credit score.

The details of the data they receive from banks are compiled in whats generally referred to as a credit report.

If you want to request your credit score and report from Equifax, a $23.95 fee applies. They also sell monthly credit monitoring products that range from $16.95 to $29.95 every month.

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

Also Check: Zebit Reviews Bbb

Are There Other Ways I Can Get A Free Report

Under federal law, youre entitled to a free credit report if

- you get a notice saying that your application for credit, employment, insurance, or other benefit has been denied or another unfavorable action has been taken against you, based on information in your credit report. Thats known as an adverse action notice. You must ask for your report within 60 days of getting the notice. The notice will give you the name, address, and phone number of the credit bureau, and you can request your free report from them

- youre out of work and plan to look for a job within 60 days

- youre on public assistance, like welfare

- your report is inaccurate because of identity theft or another fraud

- you have a fraud alert in your credit file

If you fall into one of these categories, contact a credit bureau by using the below.