What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Why Did You Deny My Credit Card Request

TransUnion does not make the decision to grant or deny credit. We supply credit history to entities that evaluate the information when making a decision.

A denial, cancellation or decrease in credit limit may be due to several factors based on creditors’ different lending policies. Only the creditor can inform you of the reason for denial, cancellation or decrease in credit limit. You may wish to contact your creditor for an explanation of the decision.

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Read Also: Credit Report With Itin Number

Your Fico Score May Differ

On the customer review site ConsumerAffairs.com, some people have reported that their Credit Karma score is quite a bit higher than their FICO scores. Whether these posts are reliable is unknown, but it is worth noting.

If your Credit Karma score isn’t accurate, the problem is probably elsewhere. That is, one of the bureaus made an error or omitted information. Or, the information might have been reported to one bureau but not others.

Using Credit Karma won’t hurt your credit score. Your search is a self-initiated inquiry, which is a “soft” credit inquiry, not a “hard” inquiry.

What Is A Credit Report

Your credit report is a record of your credit activity and history. It includes the names of companies that have extended you credit and/or loans, as well as the credit limits, loan amounts and your payment history. You can think of it as your financial resume it tells the story of your financial health to potential lenders.

Recommended Reading: Does Opensky Help Build Credit

Whats On Your Credit Report

Your credit report includes personal information, credit inquiries, open and closed credit accounts, your payment history and public records like bankruptcies, if you have any. All this information is part of your data identity, and you should manage it carefully to make sure youre accurately represented in the credit marketplace.

Lenders often use credit reports to help them decide if theyll approve a credit application. The information helps potential lenders understand your history of managing credit. Its important to remember that credit reporting agencies like TransUnion dont make lending decisions.

How To Read Your Transunion Credit Report

Your credit report contains a history of your interactions with credit facilities over time. It shows your:

- Personal information including current and previous addresses, SIN, name, date of birth, and employers

- History of making payments to settle your debt obligations e.g. credit cards, and how much you owe

- Hard inquiries by lenders for your credit profile

- Court judgements, consumer proposals, liens, collections, bankruptcies, and more

The information recorded on your credit report impacts your credit score and highlights your creditworthiness to potential lenders.

Get more details about the information on your credit report here. You can also learn about how to dispute credit report errors.

Also Check: Does Zzounds Report To Credit Bureau

Does Credit Karma Offer Free Fico Credit Scores

The VantageScore and FICO modelsdiffer in several ways, but that doesnt mean one is better or more accurate than the other. Lenders may rely on different scoring models when evaluating an application, and other considerations can factor in, too.

We recommend looking at your credit scores as a guide to your credit health rather than as a definitive number that determines whether youll be approved or denied for credit.

Vantagescore 30 Credit Score Factors

Different credit scores can have a lot in common under the hood, but each individual scoring modeluses its own combination of factors to determine your score.

Here are the major factors that determine your VantageScore 3.0 credit scores.

Payment history The biggest factor in your scores is your history of paying bills on time. Late or missed payments in your credit history could affect your scores significantly.

Age and type of credit A longer credit history, particularly with the same accounts, shows lenders that youve been able to stick with your accounts over time. Lenders may also consider it a plus if you have a mix of credit accounts with positive use.

Your measures the amount of credit you use relative to the amount available to you. Most experts recommend shooting for a rate below 30%, meaning you use less than 30% of your available credit.

Balances Similar to credit utilization, this factor takes into account your total balances across your accounts but in terms of the dollar amount and not the percentage. If you already owe a fair amount elsewhere, lenders may be less inclined to extend more credit to you.

You May Like: When Does Capital One Report To Credit

American Express Mycredit Guide

Available even if you are not an American Express customer. All for free.

Not a Card Member?

Why MyCredit Guide?

We believe everyone should know their credit score and have the tools to understand it better. That’s why we’re giving you VantageScore® 3.0 by TransUnion, and the key factors that affect your score.

Using MyCredit Guide won’t hurt your credit score.

Use it as often as you like, it wont affect your credit score.

There is no cost to using MyCredit Guide.

We provide a secure login that helps keep your information safe.

MyCredit Guide offers you tools and information to help you take charge of your credit.

In addition to your credit score, get a detailed TransUnion credit report that helps you stay informed.

Alerts

We will let you know if there are any changes to your TransUnion credit report to help detect identity theft. Alerts include address updates, new inquires on your credit report, new accounts opened, and more.

See how different actions like paying down debt or opening a new account, could affect your score.

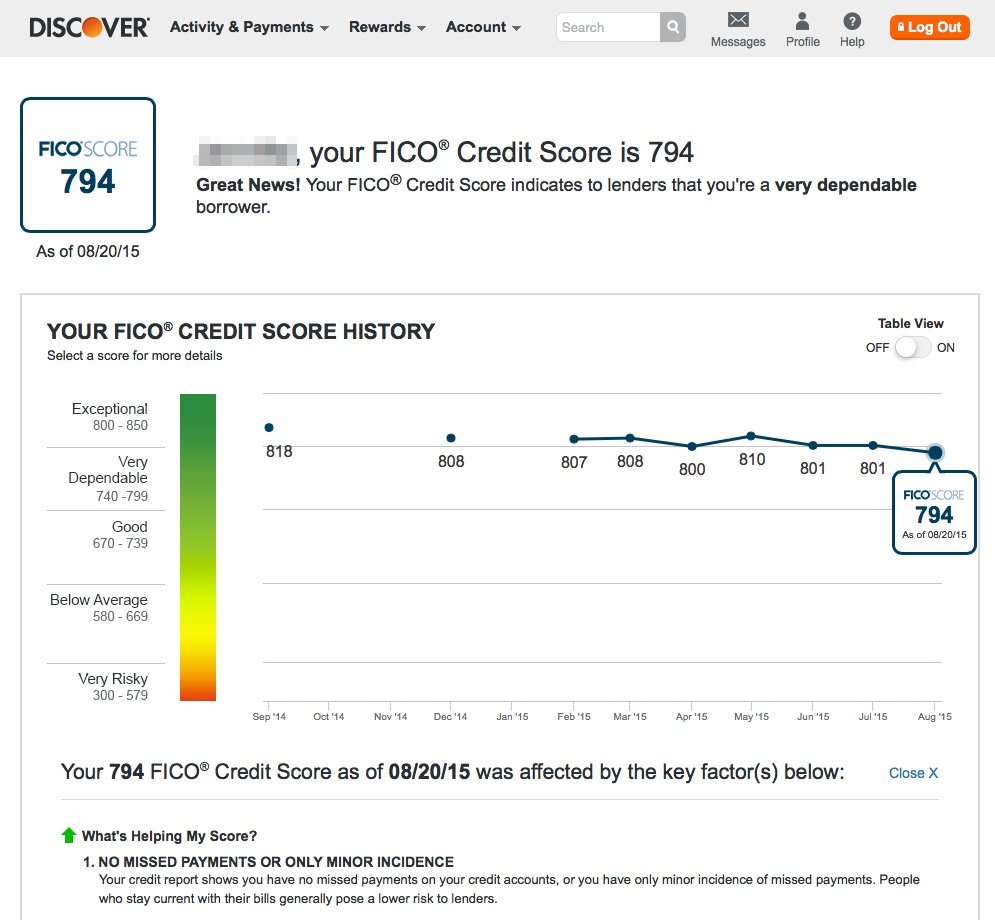

How Often Your Credit Score Updates

Credit scores continually go up and down as information on your gets updated. New balance amounts, bill payments and account openings are only a few factors that appear on your credit report and influence your credit score.

You can generally expect your credit score to update at least once a month, but it can be more frequently if you have multiple financial products. Each time any one of your creditors sends information to any of the three main Experian, Equifax and TransUnion your score may refresh.

That means your creditor may send updated information to Experian today, then Equifax next week, and TransUnion the following, which creates variations in your credit score.

Taking a look at my recent credit score updates through Experian Boost, my score changed four times in October. The fluctuations were due to a new auto loan being reported on my credit report, as well as changes in my credit card balances.

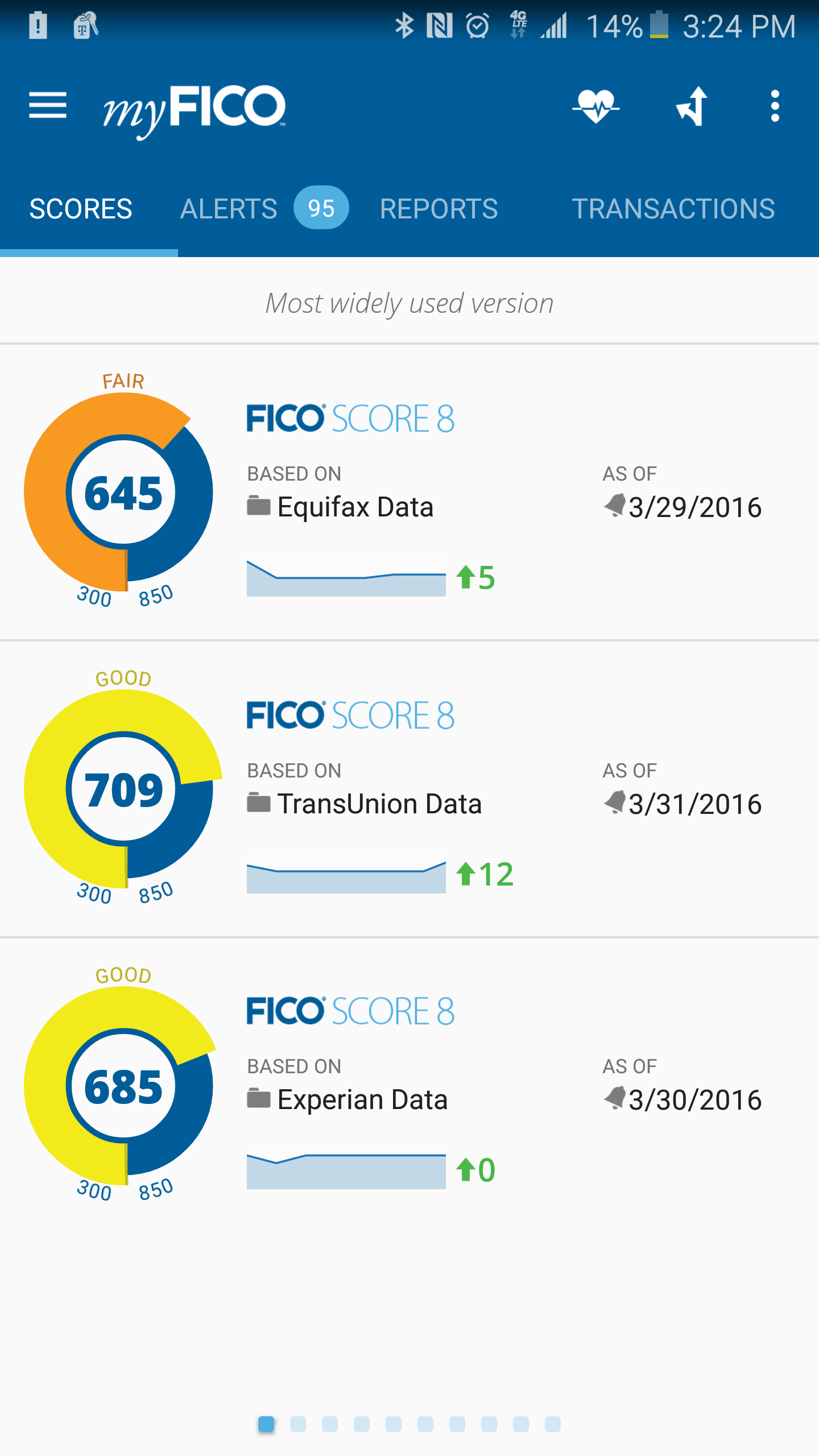

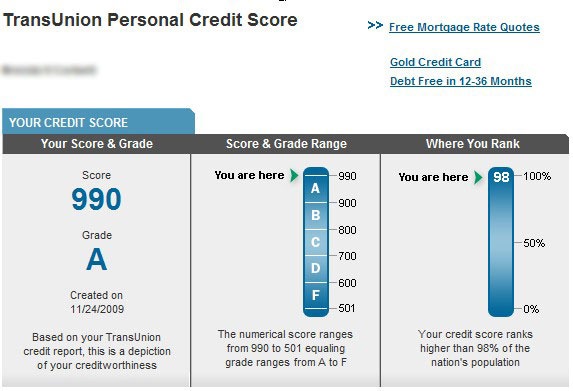

Your credit score may also fluctuate when you check different credit score services that work with different credit bureaus. As stated above, the credit bureaus may receive information at varying times throughout the month, so if you check your scores with Experian and TransUnion today, they may differ if one has info the other doesn’t.

Other reasons for credit score differences include the credit scoring model used and errors on your credit report.

Read Also: Does Paypal Credit Report To Credit Bureaus

You Have Fewer Options For Credit

Without a score, its more difficult but not impossible to get credit.

Lenders like to see that youve borrowed money and paid it back on time in the past, which means you typically need credit to get credit.

If you dont have a credit card, its important to use other forms of credit or loans to show your ability to make on-time payments and manage debt. If you take out a student loan and make regular, on-time payments, this can help build your score.

But if youre not getting approved for other forms of credit, a secured card may be an option. You put down a security deposit to open the account, and your credit limit is typically the amount of your deposit. With responsible credit use, you typically qualify to get your deposit back after a certain period of time.

You could also ask a parent or someone else you trust to add you as an authorized user on one of their credit cards. When youre an authorized user, activity on that card typically appears on your report as if its your own card.

How Does Information Get On My Credit Report And Is It Updated On A Regular Basis

When you have an account with a lender, theyll typically submit account updates to at least one of the three major credit reporting agencies TransUnion, Equifax and Experian. Since lenders dont always report to all three agencies, the information on your credit reports may vary.

Its also important to note that lenders report at different times of the month, so you might see slight differences in your reports, and therefore your credit scores, at any given time.

Recommended Reading: Is 698 A Good Credit Score

When Will My Report Arrive

Depending on how you ordered it, you can get it right away or within 15 days.

- Online at AnnualCreditReport.com youll get access immediately.

- using the Annual Credit Report Request Form itll be processed and mailed to you within 15 days of receipt of your request.

It may take longer to get your report if the credit bureau needs more information to verify your identity.

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

Also Check: Does Speedy Cash Report To Credit Bureaus

How Often Can I Get A Free Report

Federal law gives you the right to get a free copy of your credit report every 12 months. Through the pandemic, everyone in the U.S. can get a free credit report each week from all three national credit bureaus at AnnualCreditReport.com.

Also, everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get at AnnualCreditReport.com.

Where Can I Get My Credit Report

Your credit report is available in a few different places and formats. The federal FACT Act entitles you to one free copy of your credit report from each of the three major credit reporting agencies TransUnion, Equifax and Experian every 12 months. It also entitles you to additional free credit reports if you were recently denied credit, employment or insurance or if youre a victim of fraud, unemployed or on public welfare assistance.

As part of TransUnions commitment to supporting all Americans during and after the COVID-19 health crisis, were pleased to offer you free weekly credit reports through April 20th, 2022 at the same place you would go for your free annual reports: annualcreditreport.com.

Another way to access your credit report information is through a subscription based credit monitoring product such as TransUnion Credit Monitoring. and become a member to get instant online access to your credit report and score with updates available daily. Youll also get interactive tools, key information and alerts to help you understand and stay on top of critical credit report changes and protect your report with just a click.

Also Check: Does Opensky Report To Credit Bureaus

Why Do My Credit Scores Differ Across The Credit Bureaus

Credit scores are a tool commonly used by lenders and other service providers to help assess the risk that their applicants and existing customers won’t fulfill the terms of their loans or contracts. , which are calculated by credit scoring models using the information in your credit reports, are available from a variety of sources, including each of the three national consumer credit bureaus . There are many different credit scoring models available on the market, so your score can vary between lenders depending on which model they choose. It can also vary depending on which credit bureau the information was taken from because of differences in the information being reported to each of your credit reports.

You May Have No Credit Scores Even If You Have Open Accounts

The number of active accounts on your report is a factor in calculating your scores. Most scoring models look for activity within the last two years. If youve had credit in the past but no longer use credit cards, or you have closed accounts on your report, there wont be recent activity to produce a score for you.

And even if you have recent credit activity, you still may not have scores if your lenders dont report to the bureaus. Lenders might only report to one bureau, two bureaus or none at all, but they arent required to report to any of them. If you have an open account that isnt reported to a particular bureau, you wont see it on that bureaus credit report.

If you want to build your credit, before you apply for any type of credit, be sure the card issuer or lender reports to all three major bureaus. If your lenders dont report your on-time payments to all three of these bureaus, potential lenders wont see the healthy credit habits youve established.

Read Also: How To Get Credit Report With Itin Number

Will Checking Your Credit Reports Affect Your Credit Scores

Checking your credit reports from the credit bureaus will not affect your credit scores. When you check your credit report, a “soft” credit inquiry is posted to that report. Soft inquiries, which are different from hard inquiries, do not impact your credit scores.

In fact, the soft inquiries that appear on your credit reports cannot be seen by credit scoring models like FICO® and VantageScore. Even hard inquiries, which can be seen by scoring models, may not have any measurable impact on your credit scores.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. Heres an explanation forhow we make money.

The content on this page is accurate as of the posting date however, some of the offers mentioned may have expired.

Recommended Reading: When Does Citi Card Report To Credit Bureaus

You May Like: Does Titlemax Report To Credit Agencies

Negative Information In A Credit Report

Negative information in a can include public records–tax liens, judgments, bankruptcies–that provide insight into your financial status and obligations. A credit reporting company generally can report most negative information for seven years.

Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Can I Get My Report In Braille Large Print Or Audio Format

Yes, your free annual credit report are available in Braille, large print or audio format. It takes about three weeks to get your credit reports in these formats. If you are deaf or hard of hearing, access the AnnualCreditReport.com TDD service: call 7-1-1 and refer the Relay Operator to 1-800-821-7232. If you are visually impaired, you can ask for your free annual credit reports in Braille, large print, or audio formats.

Recommended Reading: Does Capital One Report Authorized Users To Credit Bureaus

Consumer Statement And Public Notices

This final section of your report will document any consumer proposals, bankruptcies and other judgments against you on your accounts in the past six years. After the time is up, your job is to make sure the debts are removed from your report and you have a clean slate again.

Consumer statements are any messages youd like to convey on your credit report. You could explain why theres a mark on your report. Your explanations could vary: maybe youve been a victim of fraud, you had a family emergency thats caused your payments to go into arrears a few years ago, or youre in the process of correcting an error, for example.

You could even note that youre in a debt repayment plan and getting back on track with your finances to communicate to them that youre a responsible consumer.

Worried about your credit?

Get answers from an expert.

Whether its about keeping, building, or rebuilding your credit, we can help if youre feeling overwhelmed or have questions. One of our professional credit counsellors would be happy to review your financial situation with you and help you find the right solution to overcome your financial challenges. Speaking with our certified counsellors is always free, confidential and without obligation.