You Spend Heavily In Specific Everyday Categories

You may pony up for a new MacBook Pro once every few years, but if your everyday spending is focused primarily on a specific area, other cash-back cards may make more sense. Maybe you have a large family and do the bulk of your spending on groceries and gas. The Blue Cash Preferred® Card from American Express earns 6% cash back at U.S. supermarkets, on up to $6,000 a year in spending 6% cash back on select U.S. streaming subscriptions 3% cash back at U.S. gas stations and on transit and 1% cash back on all other purchases. Terms apply . Or perhaps you hit the town regularly? The Capital One SavorOne Cash Rewards Credit Card earns 3% cash back on dining, grocery stores and entertainment, including streaming services, and 1% everywhere else.

Read through Nerdwallet’s full list of best rewards credit cards for more options.

Make All Of Your Required Payments On Time

To complete this step, regularly make on-time payments on your loans and lines of credit to keep your accounts in good standing. This excludes medical debt. It also excludes any payment where you’ve agreed with the lender to suspend all payments for a period of time due to hardship. Your required payments must be reported as paid on your credit report until the date that you complete the program.

To help ensure that you make all of your required payments on time, you can set up autopay. When you don’t make timely minimum payments on credit cards or loans, it can be reported as a negative event to credit bureaus. This puts your account in delinquency and lowers your credit rating.

If you’re a few days late on a required payment, contact your lender immediately to see if making a payment will avoid past due or late credit reporting to the credit bureaus.

Availability And International Expansion

Apple Card is limited to the United States, but in the future, it could be expanding to additional countries much like Apple Pay has expanded, and Apple is already said to be in talks with European regulators about an expansion in Europe. Apple Card will be able to be used worldwide where Mastercard is accepted.

There’s no word on when Apple Card might expand to other countries, but there were signs in 2020 that Apple is working to bring Apple Card to Australia at some point.

Also Check: Speedy Cash Card Balance

When Do Credit Card Issuers Report To Credit Bureaus

It might have been easier if there was an exact day of the month when every credit card issuer reports cardholders data to the credit bureaus. Unfortunately, its a bit more complicated than that.

It would make sense to assume that your credit card activity is reported at the end of each billing cycle. However, according to Experian, every lender reports to the bureaus following its own schedule. Typically, it happens every 30 to 45 days.

This runs counterintuitive to how most people understand credit reporting, says Ty Stewart, CEO at Simple Life Insure. People tend to think of the big three bureaus almost like Big Brother, constantly monitoring your every financial move and immediately aware even when you swipe your card at a nearby Starbucks. This isnt accurate. The three bureaus are completely reliant on reports generated by creditors themselves.

Furthermore, its rare that creditors send out the reports to all three bureaus Experian, Equifax and TransUnion on the same day. That means information on your credit reports regarding your credit card usage can differ, which is one of the reasons why your multiple credit scores dont match.

See related: My credit score is 776 and 815 and 828?

Tip: Late payments only get reported once youre at least 30 days past your due date. This means your late payment wont show up on your credit report unless it has reached a 30-day mark. If it has, you can expect it to appear on your credit report within a month or two.

Why You Might Pass On The Apple Card

The 2% cash back on most purchases matches many of the highest flat-rate cash-back cards on the market. But it comes with a big asterisk, because you must use Apple Pay to get elevated rates. The physical card earns just 1% back on purchases, and that’s just not competitive when the industry standard is at least 1.5%.

Here are some reasons the card may not make sense for you:

Read Also: Dla On Credit Report

Is The Apple Card Right For You

If you already use Apple Pay for the majority of your purchases, the Apple Card might be a good choice for you. If you dont use Apple Pay and dont plan on using Apple Pay in the future, the Apple Card wont be as good of a fit and you might want to consider a different cash back rewards card instead.

Ultimately, the Apple Card is best for people who are excited about using mobile wallets and who already make a lot of purchases with Apple and its selected retailers. However, since the Apple Card accepts applicants with fair credit and gives people who were initially declined the opportunity to improve their credit score and apply again, the Apple Card might also be a good option for people who want to use a credit card to help build their credit.

If you are interested in the Apple Card, apply and see what happens. If your application gets declined, you might be able to use the Path to Apple Card program to reapply successfully in the future. If your application gets accepted, remember to use Apple Pay for as many purchases as possible to maximize your Daily Cash and take advantage of everything the Apple Card has to offer.

The information about the Apple Card has been collected independently by Bankrate.com. The card details have not been reviewed or approved by the card issuer.

Conditions That Might Cause Your Application To Be Declined

When assessing your ability to pay back debt, Goldman Sachs1 looks at multiple conditions before making a decision on your Apple Card application.

If any of the following conditions apply, Goldman Sachs might not be able to approve your Apple Card application.

If you’re behind on debt obligations4 or have previously been behind

- You are currently past due or have recently been past due on a debt obligation.

- Your checking account was closed by a bank .

- You have two or more non-medical debt obligations that are recently past due.

If you have negative public records

- A tax lien was placed on your assets .

- A judgement was passed against you .

- You have had a recent bankruptcy.

- Your property has been recently repossessed.

If you’re heavily in debt or your income is insufficient to make debt payments

- You don’t have sufficient disposable income after you pay existing debt obligations.

- Your debt obligations represent a high percentage of your monthly income .

- You have fully utilized all of your credit card lines in the last three months and have recently opened a significant amount of new credit accounts.

If you frequently apply for credit cards or loans

- You have a high number of recent applications for credit.

If your credit score is low

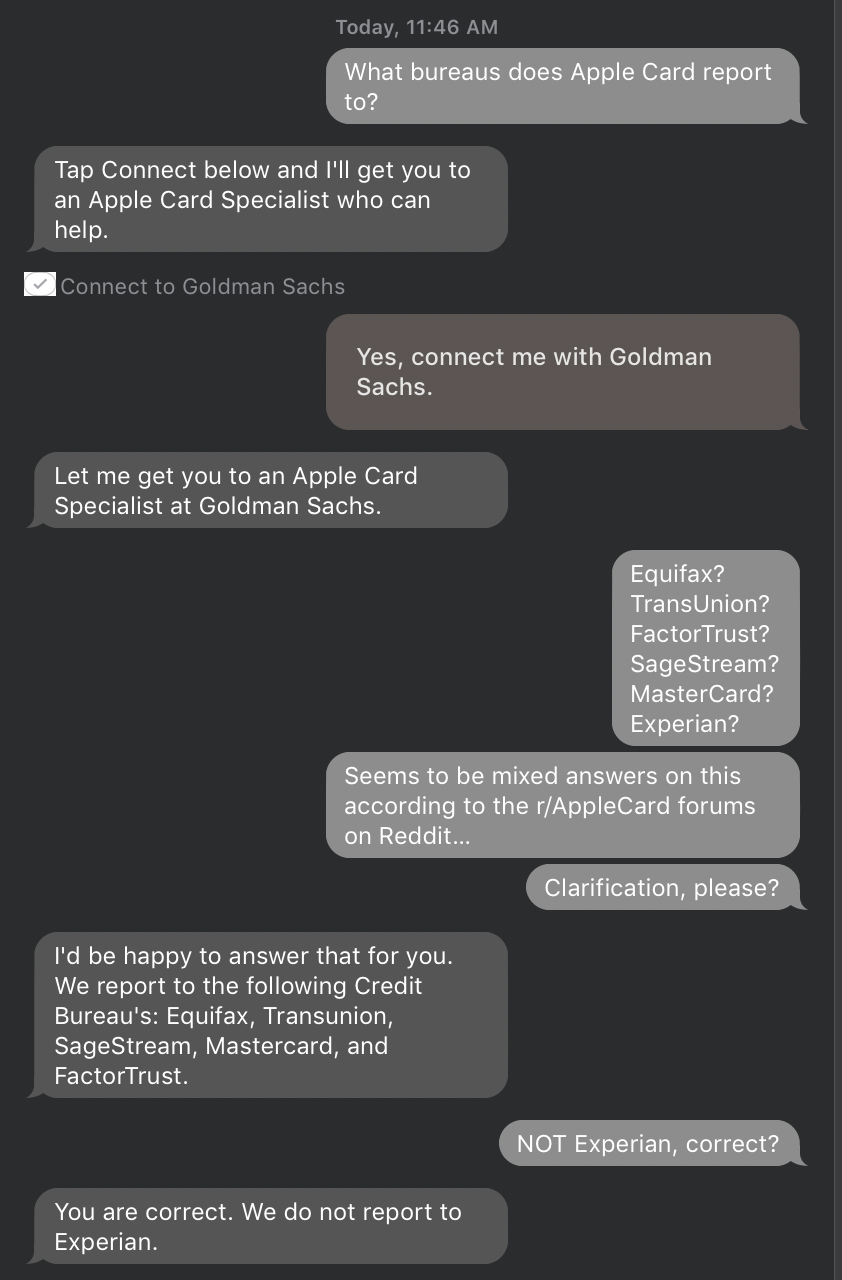

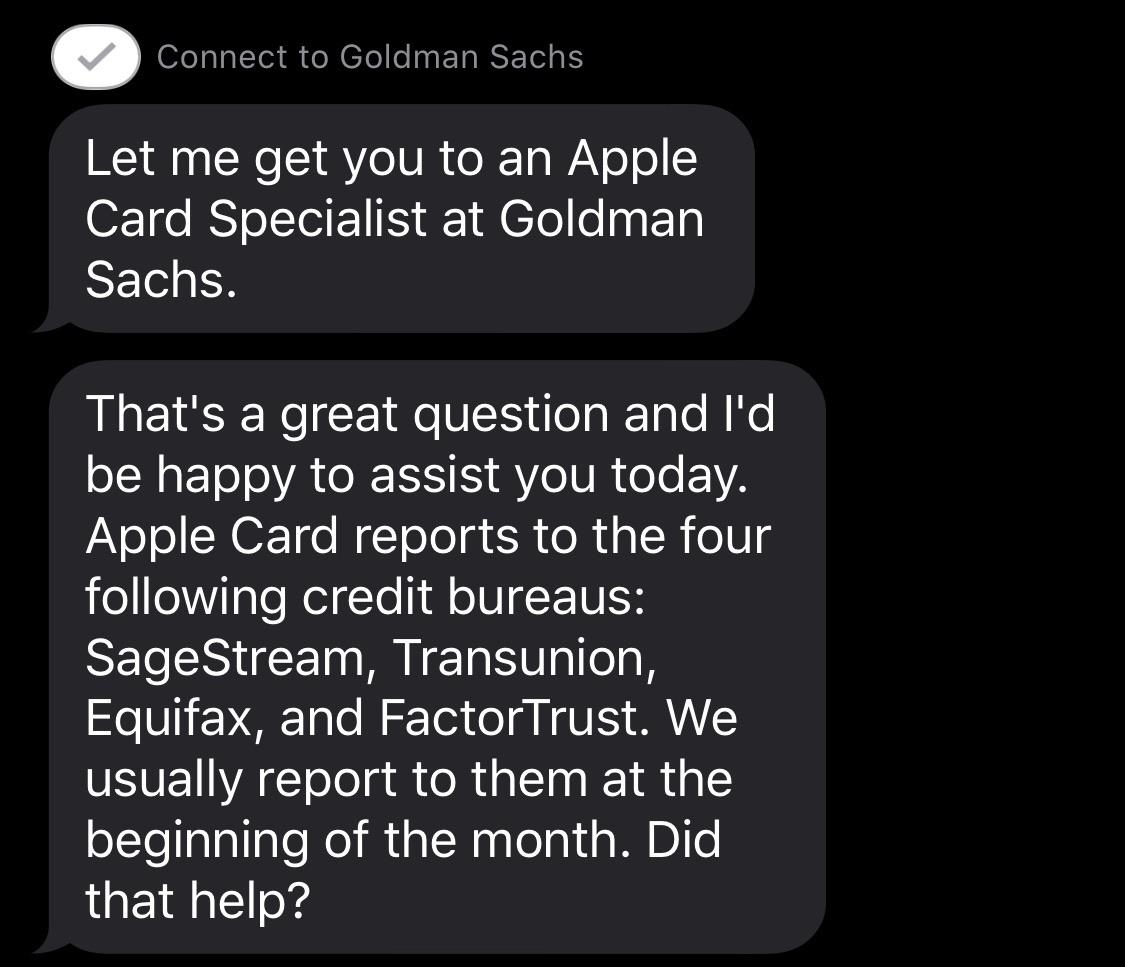

Goldman Sachs uses TransUnion and other credit bureaus to evaluate your Apple Card application. If your credit score is low ,4 Goldman Sachs might not be able to approve your Apple Card application.

Read Also: What Is Thd Cbna On My Credit Report

How To Get The Most Out Of This Card

Use the Apple Card for purchases directly with Apple, including music and apps, and with partner merchants where you can also earn 3% Daily Cash. Also take advantage of Apple Card Monthly Installments to spread the cost of your Apple product purchases over several months , interest-free, and while still getting 3% cash back. Keep in mind that if you buy Apple products through another retailer, even one authorized to sell Apple products, the 3% rate doesnt apply, and neither does the monthly installment plan.

Other than that, use it at retailers that accept Apple Pay, unless you have a rewards card that earns a higher rate at that type of vendor. For example, if you have a card that gives you more than 2 points per $1 spent on entertainment, even if the movie theater you go to accepts Apple Pay, use the other card to buy your tickets.

Maximize rewards by redeeming Daily Cash as a statement credit. Using Daily Cash via Apple Cash means youre not earning rewards on those purchases, when you could get 2% back using Apple Card with Apple Pay.

Why Does This Matter To Consumers

If it were up to a credit card applicant to decide, they obviously would want a card issuer to pull a report that contains the most favorable information most notably their credit score.

However, an applicant has no say in the matter. Therefore, a card issuer could pull your report from Experian, for example, and it shows a credit score of 680, while your Equifax report puts your score at 700 and your TransUnion report puts it at 710.

As such, the Experian report indicating a credit score of 680 might lead to less desirable terms, such as a higher APR for a credit card.

Ted Rossman, industry analyst for CreditCards.com, says which credit bureau is used also might come into play if youve set up a credit freeze with one bureau but not the two others.

Furthermore, he says, one or more credit bureaus might supply inaccurate information such as a late payment on a credit card account when you actually had no late payments that could hinder your ability to get credit.

See related: How to dispute an error in your Experian credit report

You May Like: Can A Closed Account On Credit Report Be Reopened

Apple Card Beginning To Show Up On Equifax Credit Reports

Apple Card is starting to show up on Equifax credit reports, but not yet for all users, according to a Reddit discussion today.

Apple Card info is now being reported to all three major credit bureaus in the United States, with the other two being Experian and TransUnion. As with any credit card, Apple Card usage can positively or negatively one’s credit score based on factors such as payment history, credit utilization, and age of the account.

To apply for an Apple Card, open the Wallet app on an iPhone running iOS 12.4 or later, tap the plus button in the top-right corner, and follow the on-screen steps. The process takes just a few minutes, and if approved, a digital Apple Card will be ready for purchases immediately. A physical, titanium Apple Card can also be requested through the Wallet app for use at retail stores that do not accept contactless payments.

Apple Card’s key features include color-coded spending summaries in the Wallet app, no fees, and up to three percent cashback on purchases, paid out daily.

Does The Apple Card Help You Build Credit

If you use your Apple Card responsibly, it can help you build your credit over time. To improve your credit score with the Apple Card, focus on making regular, on-time payments and try to keep your credit card balance as low as possible. As of this writing, the Apple Card reports credit activity to TransUnion and Equifax two of the three major credit bureaus and Apple may expand reporting to Experian in the future.

Don’t Miss: Dla Meaning Credit Report

About Sharing An Apple Card

If you want to share an Apple Card with trusted family members or friends, set up Apple Card Family and invite friends or family to share your account.

If you dont have an Apple Card, you can apply and if you are approved and accept your offer, you can set up Apple Card Family and invite friends or family.

You can also join a shared Apple Card account by getting an invitation from an account owner to co-own Apple Card. Once you receive the invitation, follow the onscreen instructions.4 You will be prompted to apply for Apple Card.

Re: Apple Card Reporting

When the Apple Card first came out, there was very little reporting and if any it was TU.

Now it looks like Goldman Sachs is reporting to all 3 CRA.

I PIF each month the daily used card but that amount is reported each month along with any installments due.

Even though I PIF, I have a balance showing on my CRAs each month due to a 0% Apple purchase I made ….

Don’t Miss: Can You Dispute A Repossession

What Do Credit Card Users Say

Melinda Opperman, president and chief relationship officer at Credit.org, a nonprofit agency that provides credit counseling and related services, says her organizations review of online forums and discussion boards indicates American Express, Discover and U.S. Bank rely mostly or solely on Experian, whereas Barclays and Goldman Sachs depend primarily or only on TransUnion.

Heres how the credit-reporting landscape looks for other card issuers, according to Credit.org:

- Bank of America: Experian or TransUnion

- Capital One: Equifax, Experian and TransUnion

- Chase: Equifax, Experian and TransUnion

- Citi: Equifax and Experian

- Wells Fargo: Equifax, Experian and TransUnion

Opperman warned that this information only represents a quick survey of what users report. So it could differ from what you experience when applying for one of our best credit cards.

Nonetheless, visiting online credit card forums and discussion boards can give you a sense of which credit bureau will help decide the fate of your application.

Does Applying For Apple Card Affect Your Credit Score

Heads up! We share savvy shopping and personal finance tips to put extra cash in your wallet. iMore may receive a commission from The Points Guy Affiliate Network. Please note that the offers mentioned below are subject to change at any time and some may no longer be available.

Apple Card is poised to become the Apple Music of credit cards for anyone that has an iPhone – the service people sign up for by default since it’s built into the software. While Apple Card does bring solid rewards and impressive money management tools, it will also affect your credit report when you apply for it.

When you apply for a credit card, no matter who the card provider is with, the potential lender will request information from a credit bureau like TransUnion, Equifax, or Experian, to determine your creditworthiness. The request that they submit is results in either a soft or hard inquiry and gets recorded on your credit report.

Apple Card is handling this a little differently than most other credit cards. The industry norm is to record a hard inquiry whether you are approved or declined for a card. Apple and Goldman Sachs are going a different route. You will only be hit with a hard inquiry if you are approved and accept your Apple Card offer. Any other situation will only result in a soft inquiry on your credit. Soft inquiries have no impact on your credit score no matter where they come from or how many you get.

- Payment history: 35%

- Length of credit history: 15%

- New credit: 10%

Don’t Miss: Carmax With Bad Credit

You Crave Instant Gratification

Apple says you can apply for the card through the Wallet app on your iPhone in minutes, and you can begin using it the moment you’re approved. No need to wait seven to 10 business days to get a card in the mail. Similarly, when it comes to earning and redeeming your cash back, rewards are credited daily and can be used more or less immediately. Unlike many other rewards cards, you don’t need to wait until your billing cycle closes.

» MORE:

Setting And Adjusting Your Credit Limit

After Goldman Sachs approves your Apple Card application, they assign your initial credit limit using many of the same factors that go into the approval process, such as your credit score and existing credit. Goldman Sachs also looks at your income and the minimum payments tied to your existing debt. When you share your Apple Card with a CoOwner, our goal is for your combined credit limit to reflect what your credit limits would be individually, added together.8 If youre interested in increasing your credit limit, you can make a request after youve had your Apple Card for as little as four months. Simply call or text, and well connect you with an Apple Card Specialist at Goldman Sachs right away.

Your Credit Limit

Payments History

You May Like: Public Record On Credit

Re: Did Anyone See If Apple Card Reported To Credit Bureaus

Goldman Sachs reports the new account to TransUnion with an HP a few hours after acceptance. Considering that the Apple Card is new nobody has had the luxury of it properly being reported as an account yet since they are not Synchrony Bank. I recommend waiting for a statement to be issued first before looking on if it will show up. The only guarantee is that if you fail to pay on time the the late and collection will definitely show up since Goldman Sach’s wants to be repaid.

How Your Initial Credit Limit Is Determined

To determine your initial credit limit, Goldman Sachs uses your income and the minimum payment amounts associated with your existing debt to assess your ability to pay.

In addition, Goldman Sachs uses many of the same factors that are used to assess whether your application is approved or declined, including your credit score and the amount of credit you utilize on your existing credit lines.

Learn how you can request a credit limit increase.

You May Like: How Do I Report A Tenant To The Credit Bureau

Things To Consider When Sharing An Apple Card Account

Sharing an Apple Card account can have either a positive or negative impact on your credit score. Generally, accounts that have been established for a while, show consistent on-time payments, and have balances below 30% of the total credit limit may result in a positive credit impact. Similarly, sharing an Apple Card with a less reliable cardholder can negatively impact a co-owners or participant’s credit. If the owner misses a payment, or has a very high utilization on their card, credit scores could be negatively affected.