Your Habit Can Make Good Credit Score

Having a good credit score is the best way to save money on your mortgage, car loan, credit cards, and other interest rates. But how do you get there? All it takes is responsible financial choices with money, credit, and debt to achieve that. it may sound hard, but if you consistently follow the habits listed, then you can get your credit score up. It is important to understand these habits that will not only improve your finances but also increase your credit score over time.

The Importance Of Knowing Your Score

As we mentioned above, you shouldn’t go through life without knowing your credit score. This number is updated regularly. It goes up or down usually every month, but it may even be changed more frequently based on who’s reporting.

Knowing your score means you’re more likely to make better decisions about your finances. Having a lower score may make you more cautious about applying for new credit as there’s a good chance you’ll be denied. If you have a lot of inquiries and very few accounts, your score drops, and lenders may refuse to grant you a new account. On the other hand, knowing you have a higher credit score makes you a more attractive applicant to .

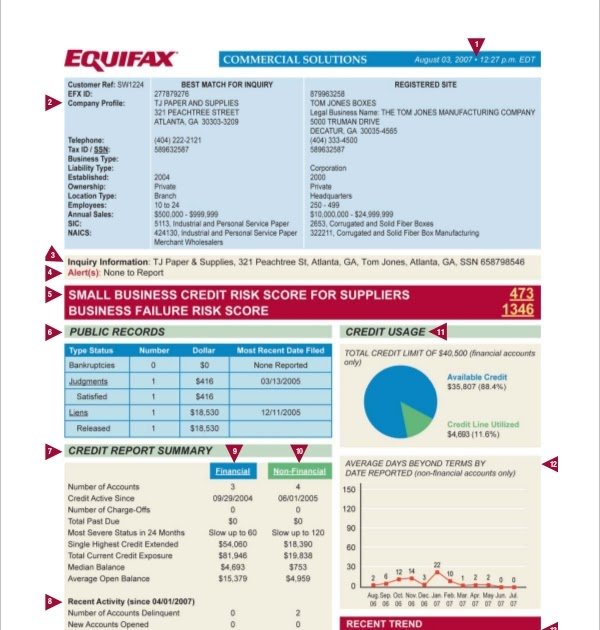

Keep in mind that checking your credit score isn’t the same as checking your . Your credit report provides a detailed history of your financial life, including any accounts you have, how often you’ve paid them on time, any delinquencies, bankruptcy reports, flags and messages, write-offs, and inquiries. The report also includes the dates of any changes to your credit history. You can use this history to account for and report any discrepancies.

You can start by going to the three major credit bureaus, Equifax, Experian, and TransUnion first by logging on to AnnualCreditReport.com to check your report for free. Each agency gives you access to your report once every 12 months. You’ll have to pay them if you want your credit score. But why pay when you can get your score for free?

What Is The Most Accurate Credit Score

Although there are many different scores and scoring models, there is a light at the end of this confusing tunnel.

Among all the credit score models, the FICO credit score is used by more than 90% of major U.S. lenders.

You might have a different score calculated by a different scoring model with a different provider.

However, it’s very likely that the lender or creditor will use the FICO score to determine if they’ll approve your application for a new line of credit.

Because of this, you might want to keep your eye on your FICO score, rather than many of the others that are available, simply because this is the number the lenders care about most. A FICO score ranges from 300 to 850 .

You May Like: Does Opensky Report To Credit Bureaus

Home Trust Secured Visa*

You might be new to Canada, have a problematic credit history, or are just starting out on your own financially. There are many reasons why you might need to build or rebuild your creditbut whatever the case, youll want to take steps towards achieving a healthy credit score. Thats where the no-fee Home Trust Secured Visa can come in. Unlike with conventional credit cards, its easy to be approved for a secured cardyou just need to be a resident of Canada and have a deposit. The Home Trust Secured Visa tops our list for its low minimum deposit and $0 annual fee. With this card, building your credit score is simple and affordable.

- Annual fee: $0

What To Do When You Cant Make A Payment On Time

If you find you cant make a payment, it is better to make a partial payment at least. It will still hurt your score, but not as much when you skip a payment altogether. Just dont just skip a payment. Call your lender or service provider and let them know you will have difficulty making your monthly payment. See if you can have the due date extended or the late fees waived. If you are out of a job and tight on fiscal resources, see if you can work out a new payment plan. Make every effort to pay your lenders on time, every time. Otherwise, your credit score will be hurt every time you miss a payment. Note that all overdue payments can eventually wind up on your credit report if they go into a default status or are passed along to a collection agency.

Also Check: Syncb/ppc On Credit Report

Full Credit Report Services

Remember

You can apply for your credit record as often as you like without harming your chances of getting credit.

You can get free 30-day trials of more comprehensive credit checking services from Experian and Equifax. These include your full credit report.

However, you normally have to give your credit or debit card details when you sign up to the free trial. Money will be taken from your account unless you cancel in time.

Why Your Credit Score Changed

Your credit score can change for many reasons, and it’s not uncommon for scores to move up or down throughout the month as new information gets added to your credit reports.

You may be able to point to a specific event that leads to a score change. For example, a late payment or new collection account will likely lower your credit score. Conversely, paying down a high credit card balance and lowering your utilization rate may increase your score.

But some actions might have an impact on your credit scores that you didn’t expect. Paying off a loan, for example, might lead to a drop in your scores, even though it’s a positive action in terms of responsible money management. This could be because it was the only open installment account you had on your credit report or the only loan with a low balance. After paying off the loan, you may be left without a mix of open installment and revolving accounts, or with only high-balance loans.

Perhaps you decide to stop using your credit cards after paying off the balances. Avoiding debt is a good idea, but lack of activity in your accounts could lead to a lower score. You may want to use a card for a small monthly subscription and then pay off the balance in full each month to maintain your account’s activity and build its on-time payment history.

You May Like: Does Paypal Credit Report To Credit Bureaus

Submit Your Request By Phone:

To request your credit report free of charge by phone, use our Interactive Voice Response system: . Interactive Voice Response is an automated tool that gathers the required information to process your request through voice response or key pad selection. It is important to note that when requesting your free credit report by phone, you will be required to enter your Social Insurance Number . If you do not wish to provide your S.I.N., you will need to select a different option to submit your request such as mail or in person. If/when you complete the identity validation process, your credit report will be sent to your home address via Canada Post within 5-10 days.

Do Not Close Old Accounts

A considerable part of the scoring is calculated in regard to your history of credit. Attention is given to well-seasoned accounts that have been open and in good standing longer. Any credit account older than 2 to 4 years is a huge boost to your credit score. Be choosy about what kind of credit you apply for and keep it open for as long as possible, and dont close your oldest line of credit unless you absolutely have to.

Read Also: How Accurate Is Creditwise Credit Score

How To Get Excellent Credit: 5 Expert Tips

1. Always pay on time. Always.

Payment history heavily influences your credit score. In fact, it is the most influential factor for FICO and VantageScore.1 To stay on top of your payments, set up a calendar reminder or enroll in automatic payments. The on-time payment goal applies to all your bills, including utilities, rent and cell phone service.

What if you were late on a payment a few years ago? While late or missed payments can stay on your credit report for seven years, the impact on your credit score decreases over time. Most negative items have little impact on your score after two years2 so be patient, keep making timely payments, and youll soon be on your way to an excellent credit score.

2. Optimize your credit utilization ratio.

is another key piece of your credit score puzzle. Credit utilization measures the balances you owe on your credit cards relative to your cards credit limits. Its calculated on an overall basis .

The general rule of thumb with credit utilization is to stay below 30%.3 This applies to each individual card and your total credit utilization ratio. Strategies for improving your credit utilization ratio focus on reducing the numerator and managing the denominator .

Try one of these techniques to improve your credit utilization ratio:

3. Regularly monitor your credit scores for inaccuracies.

4. Be strategic about taking on new debt and closing accounts.

5. Consider your credit mix.

What Makes Up My Credit Score

Your credit score is broadly based on your past and current credit behavior. The factors that make up your credit score are

Repayment History : Prompt repayment on your past and existing credit products is the key to a good credit score.

Positive Credit Accounts : A credit score calculation takes into account your credit accounts and if they are positive or negative .

This ratio takes into account your spending on credit card to the overall credit limit on your credit card. A high ratio negatively affects your credit score.

There are two types of credit, secured and unsecured. A judicious mix of both is one of the factors beneficial for your credit account.

Hard Inquiries : These inquiries get created each time you apply for credit. Many hard inquiries over a short period of time is not good.

A long history of responsible behavior with credit is appreciated and contributes towards a good credit score.

Read Also: Does Paypal Working Capital Report To Credit Bureaus

Should I Get A Loan Or A Credit Card

If you need cash, a credit card or personal loan will work for you. They both deliver the money you need relatively quickly. Unfortunately, choosing between a credit card and a personal loan is not always easy. While a credit card is usually more suitable for short-term debt, a personal loan is usually ideal for people who need more time to pay.

What Information Do I Have To Give

To keep your account and information secure, the credit bureaus have a process to verify your identity. Be prepared to give your name, address, Social Security number, and date of birth. If youve moved in the last two years, you may have to give your previous address. Theyll ask you some questions that only you would know, like the amount of your monthly mortgage payment. You must answer these questions for each credit bureau, even if youre asking for your credit reports from each credit bureau at the same time. Each credit bureau may ask you for different information because the information each has in your file may come from different sources.

Don’t Miss: Syncb/ppc

How To Check Your Credit Report

Have you ever wondered how a bank or other lender decides whether to give you credit? One of the tools they use is your credit report. This tells them about your credit history and helps them assess how much of a risk lending to you will be, depending on the quality of your credit score.

Whats in this guide

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Lenders Look At More Than Just Your Credit Score

Banks and Non-Banking Financial Institutions are becoming better at finding out about the borrowers ability to repay a loan. They dont just see if you have a good credit rating. They will look at your debt portfolio to have an understanding of what kind of a borrower you are. They will look at your payments history to arrive at a lending decision. One thing is that if you have missed just a couple of payments, it could cause your credit score to drop drastically. Lenders know that. Hence, they carefully look at your payment history and if you have defaulted on your payment, then how many times and how late you have defaulted.

If you have bad credit, it will help if you can show that you have re-established your creditworthiness. If there was an event that caused the bad credit, then you can even try requesting a meeting with the lender to discuss your option. You can say there were hardships and provide documentation that you have since recovered from the financial hardship.

Lenders will also look at your current debt. If you dont have much debt, then this could become a strong factor in your loan application as lenders will view you favorably if you have a low debt-to-income ratio. Lenders will also want to see a recent solid repayment history with no late payments or collection accounts in the past 12 months. A low debt-to-income ratio and solid employment history is a winner in the eyes of the lender.

How Can I Build My Credit Score

The two biggest factors in your credit score are paying on time and managing how much of your credit limits you’re using. Thats why they come first in this list of tips:Pay all your bills, not just credit cards, on time. Late payments and accounts charged off or sent to collections will hurt your score.Use no more than 30% of your credit limit on any card less, if possible. The best scores go to people using 10% or less of their credit limits.Keep accounts open and active when possible that gives you a longer payment history and can help your “credit utilization,” or how much of your limits you’re using.Avoid opening too many new accounts at once. New accounts lower your average account age and each application causes a small ding to your score. We recommend spacing credit applications about 6 months apart.Check your credit reports and dispute errors.

You May Like: What Card Is Syncb/ppc

Over 1 Million Canadians Trust Borrowell

Courtney M.

Love this! I was a little skeptical at first but it tells you who you still owe and how much. Currently using this to view my credit and pay off what I owe.

Andrea B.

I have been using Borrowell for over a year now and I am a happy customer. I get the real deal on my credit and good advice also!

Ashvin G.

Excellent service. Recommend to understand your finance and banking accounts, debt control, loan utilization to build a good credit score for lending purpose.

What Are The Largest Credit Card Companies

- Visa 336M cardholders. Visa is the largest payment network with over 40 million merchants.

- Mastercard 231M cardholder. As the second largest credit card network in the United States, Mastercard offers benefits such as easy bill payment and data protection with chip technology.

- Citibank 95M cardholder.

Don’t Miss: Is Creditwise Good

Can I Buy A Copy Of My Report

Yes, if you dont qualify for a free report a credit bureau may charge you a reasonable amount for a copy of your report. To buy a copy of your report, contact:

- TransUnion: 1-800-916-8800 transunion.com

But before you buy, always check to see if you can get a copy for free from AnnualCreditReport.com.

Federal law says who can get your credit report. If youre applying for a loan, credit card, insurance, car lease, or an apartment, those businesses can order a copy of your report, which helps in making credit decisions. A current or prospective employer can get a copy of your credit report but only if you agree to it in writing.

Balance Transfer Credit Cards

Once you accumulate a debt load on an existing credit card, the interest will compoundrapidly. Your best bet is to transfer the debt to a balance transfer credit card, which lets you move debt from a high-interest card to one with a lower rate. These cards often offer promotional interest rates for a specific period0% interest for the first 10 months, for examplewhich can buy you time to pay down your balance with little or no interest. Sometimes, even the regular interest rate on a balance transfer card is lower than usual.

Also Check: Does Balance Transfers Affect Your Credit Score

What To Do If You Don’t Have A Credit Score

For FICO® Scores, you need:

- An account that’s at least six months old

- An account that has been active in the past six months

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren’t scorable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a or secured credit card, or becoming an .