How To Qualify For Carecredit

CareCredit is similar to a credit card in that it is a line of credit, but you can only use it for medical costs. CareCredit can be used for your entire family to help pay out-of-pocket expenses not covered by your health insurance plan. It can also be used to care for your furry family members since it is accepted by many veterinarians and animal hospitals. CareCredit charges no interest on the balance if paid in full within six months, 12 months, 18 months or 24 months, depending on the plan you select. No interest is charged if the minimum monthly payment is made on time. CareCredit is accepted by thousands of physicians and hospitals in the USA.

Signing Up For Carecredit

CareCredit for pets functions like a regular credit card. A pet parent may apply before veterinary care is sought or when the need arises in an emergency situation.

You can get an application from your veterinarian or on theCareCredit website. You may also apply over the phone at 1-800-677-0718.

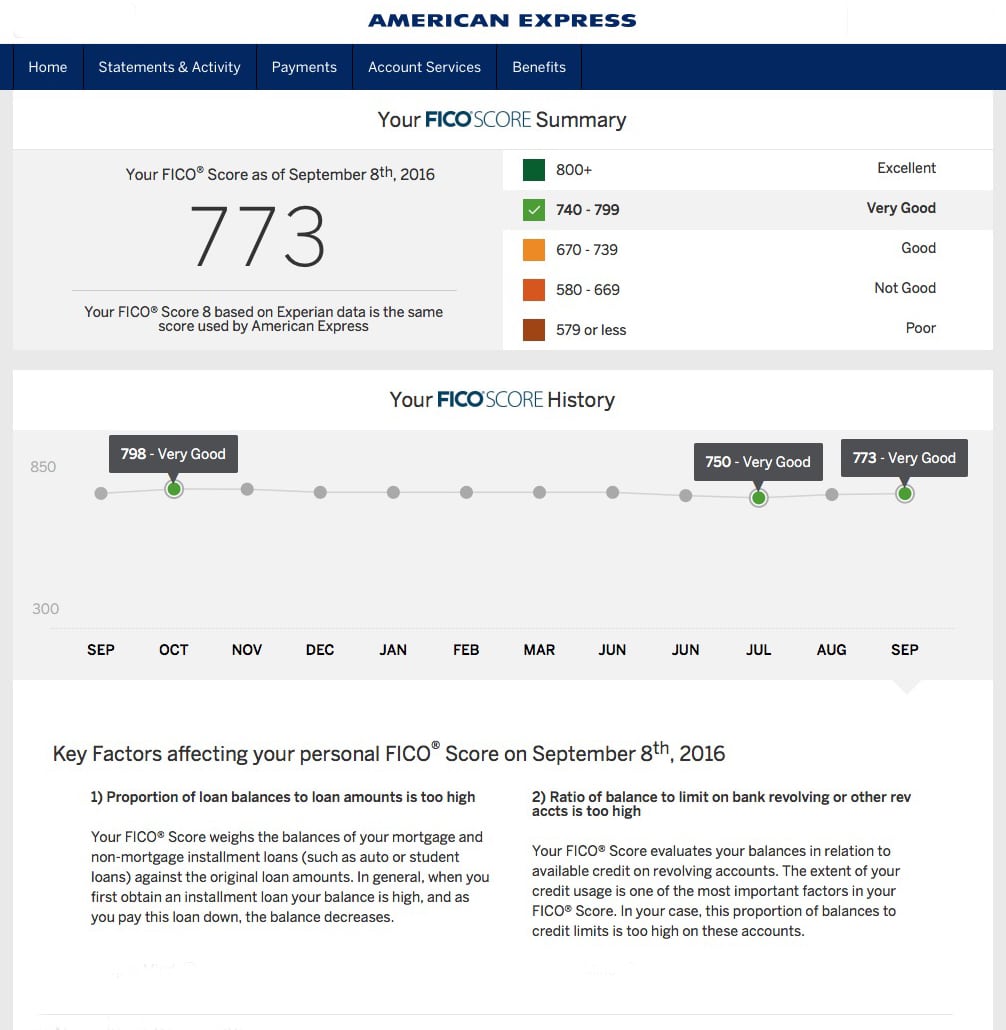

CareCredit will give you a credit limit based on your creditworthiness, determined by your credit score, along with consideration of the estimated purchase amount. You will also need to have your veterinarian or veterinary hospital prepare an estimate of expected costs for you.

The credit period begins when the veterinary office or hospital charges your CareCredit card. Note that CareCredit carries a very high APR of 26.99%. This interest will be charged on the amount you owe starting from the date of purchase if the balance is not paid in full during the grace period. There is a monthly minimum fee that must be paid every month.

There are promotional financing options that are offered for some purchase amounts. CareCredit offers slightly lower annual interest rates to some cardholders for large total expenditures. Purchases of $1,000 or more may be eligible for a 24-month offer with a 14.90% APR, a 36-month offer with a 15.90% APR or a 48-month offer with a 16.90% APR.

Purchases of $2,500 or more may be eligible for a 60-month offer with a 17.90% APR.

Faq Advance Care Card

When you Apply Online, instant credit decisions are available. Certain applications may take 24 to 48 hours. What are the minimum requirements? You must be at

As an alternative to a no-interest period in which interest is silently adding up, CareCredit offers reduced rates of 14.90% for 24, 36 or 48

Recent changes in their credit bureau data or entry errors. this requires less information than the standard CareCredit application.

Hard pull on your credit · Often requires 675 credit score or higher · 26-29% interest rate · If you miss a payment, interest rate can be increased · Early pay-off

Read Also: How To Remove Multiple Late Payments From Credit Report

What Is Syncb And Why Is It Showing Up On My Credit Report

SYNCB stands for Synchrony Bank. This is a financial establishment that provides banking products and services of various kinds including things like savings accounts, IRAs, certificates of deposit, mobile banking solutions and more. For your purposes, Synchrony Bank is the company behind many types of credit cards, including the CareCredit credit cards. Thats why its showing up on your statement and what relationship it has to you vis-a-vis your credit card. You might see this show up on your credit report in a number of ways, including SYNCB, SYNCB/CareCredit or even syncb care credit. Know that if you have a CareCredit card and you see any of these terms on your reports or statements, its simply reflecting you medical credit card issued by Synchrony Bank.

Supercharge Your Future & Credit Score Today

Reclaim your financial freedom and speak with a live credit specialist for your free consultation, right now

Copyright © 2022 Credit Glory LLC. All rights reserved. 1887 Whitney Mesa Dr Ste 2089, Henderson, NV 89014. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. Credit Glory does not provide legal advice and is not a substitute for legal services. If you are dealing with credit and debt issues you should always contact a local attorney for legal advice regardless of your use of any other service. Credit Glory does not guarantee the permanent removal of verifiable tradelines or make promise of any particular outcome whatsoever. Credit Glory requires active participation from its clientele regarding requested documents and information, including investigation results, for the sought-after outcome of a healthy, accurate credit report. Individual results may vary.

Also Check: What Credit Score Do You Need For American Express

If Youre Approved But Your Credit Limit Isnt Enough To Buy A Device With Apple Card Installments

You can apply for Apple Card when you buy a new iPhone, iPad, Mac, or other eligible Apple product with Apple Card Installments. If your application is approved with insufficient credit to cover the cost of the device you want to buy, you can choose a different device thats covered by your credit limit. You can also choose a different payment method or use Apples Trade-in program.

Disadvantages Of Care Credit

The only disadvantage to using it is that you cannot be late with the payments or miss any payments. It does have really high interest rates and late fees that go into effect if you happen to miss a payment.

Our dentist in long island city, highly recommend that you set it to autopay once you receive your first statement. That way you can set it and forget it.

Read Also: Is 750 A Good Credit Score To Buy A House

The Potential Danger Of ‘no Interest’

Lets look at CareCredit, one of the most common medical credit cards. A CareCredit card has a maximum credit limit of $25,000. For charges of $200 or more, CareCredit offers “no-interest” promotional periods of six, 12, 18 and 24 months, depending on the provider. If you pay off your purchase within your promotional period, no interest will be charged. Say you make a $1,000 charge and have a six-month promo period. You could eliminate your debt within that time frame for about $167 a month. For many people, thats much more doable than paying $1,000 at once.

However, CareCredit requires only that you make a minimum payment each month. The minimum may not be enough to eliminate your debt by the end of the no-interest promo period and that’s where you can get into trouble.

Unlike the 0% interest offers on most credit cards, the promotional period on medical credit cards is deferred interest. That means interest starts adding up as soon as you make the purchase. If you pay in full within the promo period, that interest is waived. But if you still have a balance at the end of the promo period, you have to pay all of that retroactive interest. The fine print in the CareCredit brochure states, If the Amount Financed is not paid in full within the promo period, interest will be charged to your account from the purchase date. The purchase interest rate: 26.99%.

What Is Care Credit For Dental Work

Care credit is a third party payment system that allows you to finance dental treatment with certain perks. It works very similar to a credit card except you have options of interest free repayments over how ever many months of your choice. Here are some term length options for repayment with the card.

Any of those term lengths are all interest free but there are certain amount requirements for each length of time.

The one major difference of this card vs a traditional credit card is that you cannot swipe with it as there is no magnetic stripe on the card. In order to use the card, your dentist or healthcare provider needs to manually enter the transaction in at CareCredit‘s website.

You May Like: How To Get Free Credit History Report

Re: How Does Carecredit Affect Credit Score

Thanks everyone!

Im new to rebuilding my credit and Im not familiar to some of these terms. I hadnt heard of the AAoA yet. Like I said, im just starting out and the only card I have is the Secured Capital One card. And Ive only had it for about 6-7 months. If I understand the concept of AAoA from what I just read it seems to be important to have a long average age on your accounts and opening new ones lowers that. So since Ive only had the card 6-7 months its not like Id be loosing much there.

I only have my TU score and its 658 so I think they may approve me..

I was kind of looking as this as a quick way to boost my Utliization Ratio and pay it off right away if possible so it shows sooner than later.

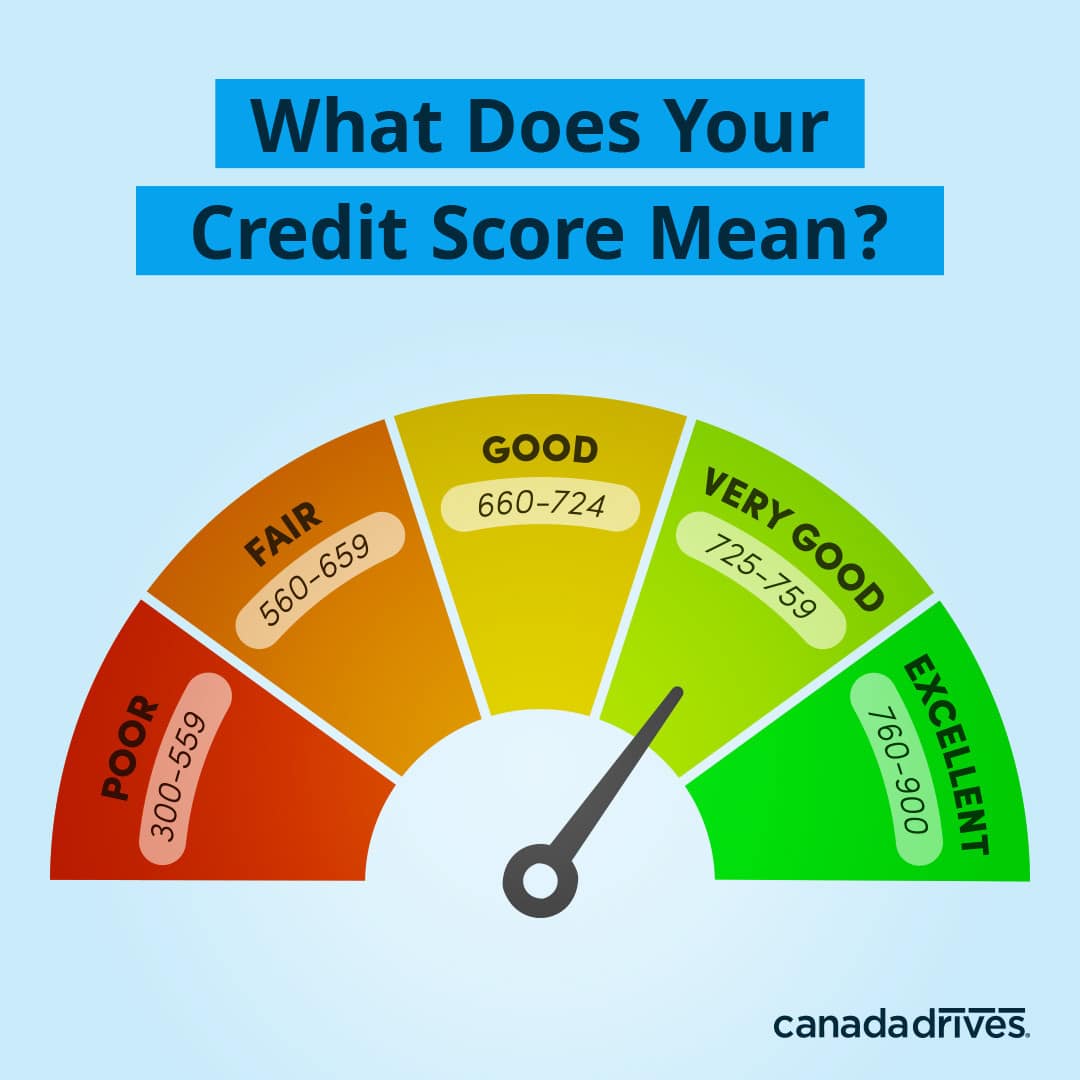

The Magic Number The Best Credit Score For A Car Loan

If you want a cut-off point, a number that serves as a bare minimum, then the number youll want to remember is 630, however, if your score is lower, you may still able to get a loan or simply fill in their information on the right registration form to find out. If your score sits there or higher, youll more than likely qualify for a loan.

But thats just the short answer. You could get approved for a car loan if your credit score is lower , and of course, you can get a loan with great rates with a high score. Remember too, though, that a healthy credit score doesnt even guarantee you a car loan.

For the sake of this topic, take note of the following ranges and how they can impact your application outcome.

Excellent

Reach 760 or above, and youre among the elite, the credit sweetspot. A number of 760 or more shows that you are a very responsible person when it comes to your finances. A lender seeing such a number will trust you more with a loan of any kind. Assuming other aspects of your finances look good, you will also qualify for the lowest rates possible.

Very Good

Youre still sitting pretty in the very good range. You shouldnt have any problems with getting a car loan if your credit score sits here, and lenders will likely take a risk on you with a loan.

Good

Don’t Miss: Do Medical Bills Affect Your Credit Score

Applying Is Fast And Confidential

The application process for CareCredit dental financing is completely confidential and takes less than ten minutes to complete. Over half of our recent applicants have been approved . You can also apply with a co-signer to improve the likelihood of being approved.

Choose your clinic location below to

1. Apply for CareCredit

Apply for CareCredit online now by choosing your clinic location below, or ask your Patient Care Coordinator for more information at your next appointment.

2. Pay Your CareCredit Bill

If you have an existing CareCredit account and would like to pay your CareCredit bill, you can also choose your clinic location below.

Also Check: How To Get A Debt Collection Removed From Credit Report

How To Apply For Carecredit

You can pre-qualify for CareCredit online by using its online service at CareCredit.com/Apply.

If you don’t want to go online, you can apply over the phone using the company’s toll-free number: 1-800-677-0718. There is an automated system available 24/7 or you can apply with a live agent between 9 a.m. and 9 p.m. ET, Monday through Friday.

You can also apply in person at more than 250,000 health care providers and select retail locations that accept CareCredit. CareCredit does not accept applications via fax or email.

Synchrony does not specify how it assesses applications or what the requirements are for their credit cards.

Also Check: How To Up Credit Score

Best Medical Loans For Bad Credit In 2022

Bad-credit borrowers may qualify for medical loans, but interest rates could be high. See your loan options plus other ways to fund medical costs.

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

A medical loan is an unsecured personal loan for planned or emergency medical expenses. The best option for borrowers with fair or bad credit may be personal loans from online lenders that consider factors beyond credit score.

Interest rates on bad-credit medical loans can be high, so before taking one, consider cheaper alternatives like a health care provider payment plan or a loan from a family member.

Here are NerdWallets top picks for lenders that offer medical loans for low-credit borrowers.

A medical loan is an unsecured personal loan for planned or emergency medical expenses. The best option for borrowers with fair or bad credit may be personal loans from online lenders that consider factors beyond credit score.

Interest rates on bad-credit medical loans can be high, so before taking one, consider cheaper alternatives like a health care provider payment plan or a loan from a family member.

Benefits For Providers And Patients

Used wisely, medical credit cards offer benefits to both health care providers and patients.

For providers, the cards enable their patients to get treatment they need without delay. The card issuer pays the charge upfront and assumes all the risk of the borrower not paying, so medical providers dont have to be in the financing or debt collection business.

For patients, paying a little bit each month on a large bill lets them get treatment on a manageable budget as long as they understand how these cards work.

Read Also: Does Target Debit Card Affect Credit Score

Who Is Carecredit Good For

A CareCredit credit card may help you afford a medical procedure not covered by insurance, or pay for a needed surgery.

If youre confident you can pay off your medical bills within CareCredits promotional period, applying may be worth it so that you can stretch out your payments over time. That may help you conserve cash for other uses. But make sure the payments fit into your monthly budget if you dont pay off your full balance before the promotional period ends, you could be looking at hefty interest payments over time once the deferred interest kicks in.

Before you apply for a healthcare credit card, you may want to explore other options. First, see if you can negotiate your medical expenses. Your provider may have a no-interest installment option you dont know about. And if youre truly pressed to pay, see if you might qualify for financial assistance.

How Is Carecredit Different From A Regular Credit Card

CareCredit is a credit card specifically designed for health and wellness needs. You can’t use it anywhere or for anything. Rather, it’s intended to pay for medical expenses at various hospitals, veterinary clinics, dental centers, and private medical practice firms, along with health care-related retailers and pharmacies. According to the company, this amounts to some 250,000 providers in all.

The card’s financing terms tend to be different from those of a regular credit card. Instead of an ongoing, revolving credit line and interest charges, it acts as a short- or long-term loan. Interest accrues retroactively as of the charge date if you don’t pay the full balance by the end of the promotional period.

You May Like: What Can A Landlord See On My Credit Report

The Carecredit Credit Card For Pets: What You Need To Know

What credit score do you need for CareCredit? CareCredit.com doesnt list a minimum credit score to apply. Can you use CareCredit at pet stores? No. CareCredit

Patients now have the ability to see if they prequalify for the CareCredit credit card with no credit score impact. With a real-time prequalification check,

Carecredit Credit Card Review

We publish unbiased reviews our opinions are our own and are not influenced by payments we receive from our advertising partners. Learn about our independent review process and partners in our advertiser disclosure.

The CareCredit Credit Card, issued by Synchrony Bank, is a medical credit card that gives you a way to pay for out-of-pocket health care and medical bills. Whether its to cover a high deductible, an emergency co-pay, or to pay for a necessary or elective procedure, many people often dont have the cash on hand for medical costs. CareCredit, which is offered by many health care providers, lets you spread out payments with deferred interest payments that could prove costly.

Read Also: Does A Mortgage Help Your Credit Score

How To Compare Medical Loans For Bad Credit

Affordable APRs and payments: APR is the total cost of a loan, including interest and fees. It allows you to make an apples-to-apples comparison between loan costs. Look for lenders with rates below 36%, which is the maximum that financial experts agree is affordable.

Funding time: Consider the amount of time it will take to receive funding. Is the medical expense an emergency expense or a procedure planned for the future? Some online lenders approve and disburse loan funds within 24 hours after approval, while others take up to a week.

Customer support: Some lenders provide support through multiple customer contact channels including an app, while others may offer assistance by phone or email only. Consider how you would like to manage your account and the level of customer support you might need.

Other features: Depending on the situation, some lenders provide features like hardship plans or flexible payment options that may help if you hit a financial speed bump. They may also offer free financial education resources.

» COMPARE: See your bad-credit loan options

How Your Initial Credit Limit Is Determined

To determine your initial credit limit, Goldman Sachs uses your income and the minimum payment amounts associated with your existing debt to assess your ability to pay.

In addition, Goldman Sachs uses many of the same factors that are used to assess whether your application is approved or declined, including your credit score and the amount of credit you utilize on your existing credit lines.

Learn how you can request a credit limit increase.

Also Check: Does Moving House Affect Your Credit Rating