Send A Letter To The Credit Bureau

Once you identify an error on your credit reports, the Consumer Financial Protection Bureau recommends that you contact the credit bureaus that produced the reports with the error. Equifax, Experian and TransUnion, the three major credit bureaus, let you dispute inaccuracies on their respective consumer credit reports online or by mail.

Give your contact information and, in writing, explain what the error is and why its wrong. Youll find sample letters to dispute credit report information with the credit bureau on the CFPB website. Be sure to include supporting documentation, such as a copy of an email verifying the status of the account thats reported incorrectly. The CFPB also recommends that you keep copies of any letters or documentation that you send, and suggests that if you send it by mail, use certified mail with a return receipt.

Items Which Can Be Disputed On A Credit Report

Although the FCRA affords you the right to expect only fair and accurate information to appear on your credit reports, you must be proactive in order to exercise that right. No one is going to check your credit reports for errors and dispute incorrect information for you .

Remember, the FCRA actually gives you the right to dispute any information contained on your credit reports. There are no restrictions in the FCRA which prohibit you from disputing an item. Here are a few examples of the most common types of credit information disputed by consumers.

Hire A Credit Repair Company

If youre looking for the easiest way to fix your credit report, the following three credit repair services earn our top marks based on BBB ratings, industry reputation, and our own reviews.

These services challenge each of three major credit bureaus to verify, correct, or remove negative items on your credit reports.

| $79 | 9.5/10 |

The Fair Credit Reporting Act entitles you to dispute inaccurate items on your credit reports. You can do so through the mail or online at the three credit reporting company websites.

While you can attempt to fix your credit yourself, the process requires effort, patience, organization, and expertise. For what many consumers consider to be a reasonable price, you can hire a credit repair organization to do the work for you.

Some disputes are easy to resolve, such as the removal of outdated information. Other disputes require more work, including submitting evidence to contest items and forcing the bureaus to validate questionable data. The ideal outcome is to remove enough negative items to give your score a boost.

Most credit repair services offer a free consultation to review your credit reports and identify fruitful areas worth challenging. The credit specialist will review with you the different plans the company offers, what services come with each plan, and how much each plan will cost you.

You May Like: Sprint Collections Agency

Wait Up To 45 Days For The Results

After you dispute credit reporting errors with a credit bureau, it typically has 30 days to investigate your claim. It must notify you of the results five days after completing the investigation. However, it can take up to 45 days under the following circumstances:

- Youve submitted a dispute after receiving a free credit report from AnnualCreditReport.com

- During the 30-day investigation window, you submit new materials and documents

Which Credit Report Errors Should You Dispute

The most concerning errors are those that could hurt your scores or suggest identity theft. Those include:

-

Wrong account status .

-

Negative information that’s too old to be reported most derogatory marks on your credit must be removed after seven years.

-

An ex-spouse incorrectly listed on a loan or credit card.

-

Wrong account numbers or accounts that arent yours.

-

Inaccurate credit limits or loan balances.

-

Accounts you don’t recognize.

If you suspect your identity has been stolen, follow the steps to report identity theft.

Recommended Reading: How To Get Charge Offs Removed

How Will Accepted Disputes Affect Your Fico Score

Often your score will improve when errors on your credit report are corrected. In some situations, however, your score may not improve when credit information is corrected or updated. For example:

- It is often thought that closing credit card accounts will improve your score. This is not true. Closing an account will neither remove it from your credit report, nor will it prevent the payment history from continuing to be displayed and considered in the calculation of your FICO Score.

- Removing negative information from your credit report may not have the impact on your FICO Score that you expect. There could be additional negative information remaining that will prevent an immediate increase in your FICO Score.

- FICO Scores only consider credit-related information on your credit report. If you change personal information , the credit information on your report will not be impacted and your FICO Score will probably not change. The FICO Score only considers credit account, collection, and public record information.

It typically takes the credit bureau 30-45 days to respond to your dispute.

Common Credit Reporting Errors

When reviewing your reports, some common personal information and account reporting errors include:

- Personal Information reporting errors. Check to see if your name, address, birthdate and Social Security number are correct. If your report contains inaccurate personal information, it could be a sign that your identity has been stolen.

- Accounts that dont belong to you. Its possible that someone with a similar name could have an account accidentally listed on one of your reports. This could also mean that someone has stolen your identity and opened an account in your name.

- Incorrect account status. When reviewing your reports, make sure your account balance, account numbers and credit limits are accurate. Also, double-check that closed accounts arent reported as open.

- Expired debt. Negative remarks, such as collection accounts and late payments, typically remain on your credit reports for up to seven years. In most cases, the negative information automatically falls off of your credit report. If it doesnt, this could mean the time clock on the debt was reset, which may be an error.

- Reinsertion of incorrect information. Incorrect information that was disputed and removed from your credit report in the past can sometimes reappear. This means you will have to redispute the incorrect information with the credit bureaus or the creditor that is providing the information to have it removed again.

You May Like: Repo Removed From Credit Report

Take Advantage Of Score

The number of accounts and average age of your accounts are both important factors in your credit score, which can leave those with a limited credit history at a disadvantage.

Experian Boost and UltraFICO are programs that allow consumers to boost a thin credit profile with other financial information.

After opting into Experian Boost, you can connect your online banking data and allow the credit bureau to add telecommunications and utility payment histories to your report. UltraFICO allows you to give permission for your banking data, like checking and savings accounts, to be considered alongside your report when calculating your score.

How Long Does Information Stay On Your Reports

The FCRA limits how long a credit reporting agency can report negative items in your credit report. Items that aren’t negative but are neutral or positive can be reported indefinitely. Review the rules below and then check your credit report for negative items that are too old to be reported.

No Negative Credit Reporting If You Make an Agreement Due to Coronavirus

Under the federal Coronavirus Aid, Relief, and Economic Security Act, if you make an agreement with a creditor to defer one or more payments, make a partial payment, forbear any delinquent amounts, modify a loan or contract, or get any other assistance or relief because COVID-19 affected you, the creditor must report the account as current to the credit reporting agencies if you weren’t already delinquent.

Read Also: What Credit Bureau Does Comenity Bank Use

One: Obtain A Recent Copy Of Your Credit Report

In order to dispute an item on your credit report, youll need to prove to the powers that be that your credit report is inaccurate. To do so, youll want to have a copy of your credit report handy. Consumers are entitled to one free credit report each year from each of the three main credit reporting agencies, which you can access through AnnualCreditReport.com. Or if youre a Mint user, you can easily view your credit score in the Mint app whenever you please!

Once youve got your credit report in front of you, pull out that red pen of yours and notate any items on the report that are inaccurate or with which you do not agree.

What Happens When An Item Is Deleted From Your Credit Report

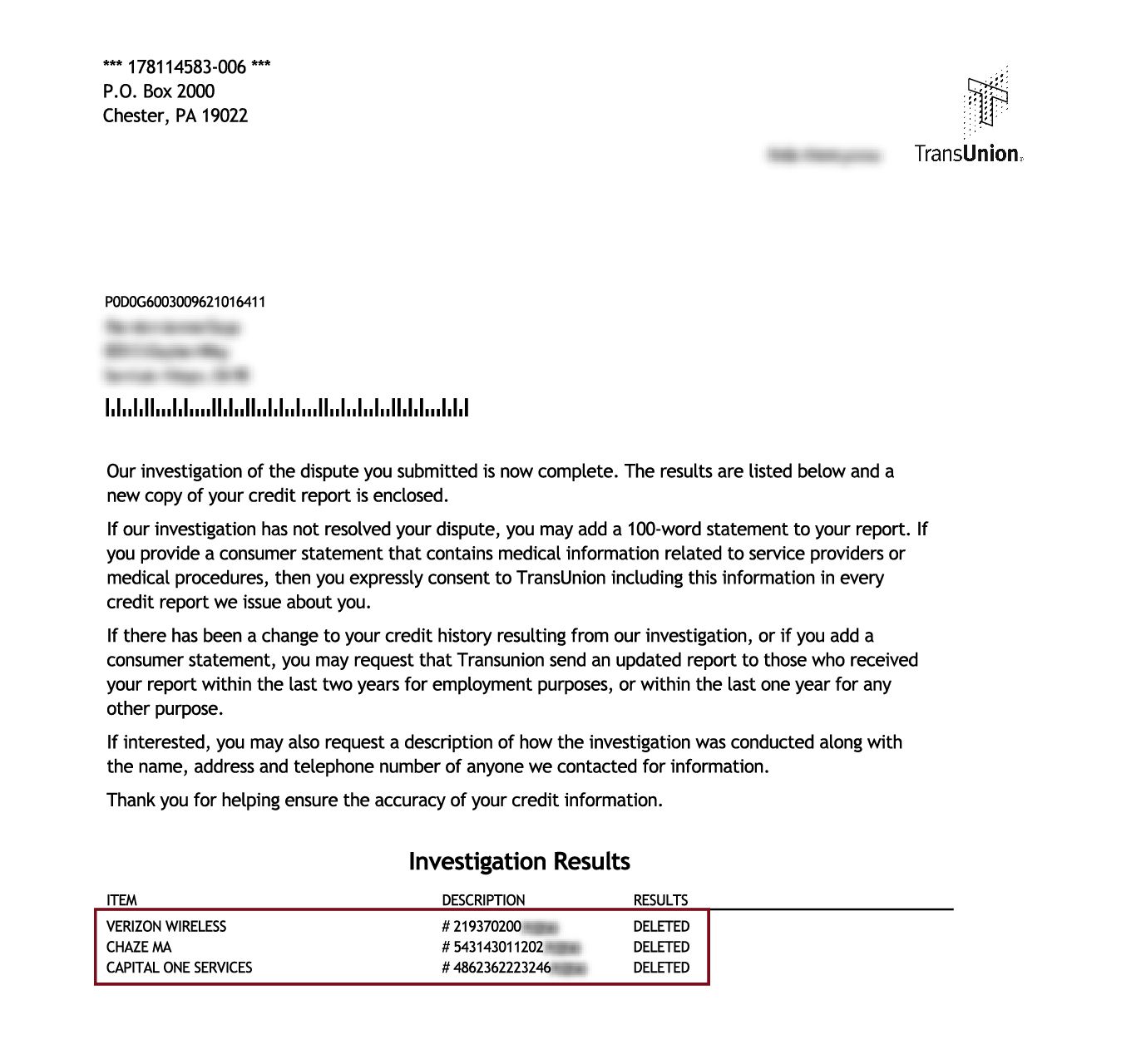

Whenever your credit report is altered because of a dispute lodged by you or a credit repair service, the credit bureau must inform you in writing. You are then entitled to a fresh copy of your credit report from the bureau.

Many credit cards offer free alerts that inform you whenever your credit score changes. Thus, if an item deletion results in a change to your score, your credit card company may be the first to inform you of the good news. You also may get a free fraud alert service.

You should see your credit score improve when negative items are removed from your reports. How much it improves, however, depends on the type of item that is removed and its age.

The credit bureau must send you written results about your dispute, which usually arrive within the initial 30-day window. If the results are favorable, you can instruct the bureau to notify anyone who received your report in the past six months.

Recommended Reading: What Stores Use Comenity Capital Bank

Why Do I Have Different Credit Scores

Credit reporting agencies collect similar information from lenders, but lenders can choose to report to one, two or all three agencies. And agencies may use different scoring models, which may weigh certain information in your reports more heavily than other factors. Thats why information in your credit report can vary, and why your score can too. Use our tool to learn how to read your credit report and better understand your score.

Your score can also change depending on the day lenders provide updated information to each agency. If you check your credit score before the latest data is included in your credit report, you wont see those changes.

Only Apply For Credit You Need

Every time you apply for a new line of credit, a hard inquiry is pulled on your report. This type of inquiry lowers your score temporarily. Applying just to see if you get approved or because you received a pre-qualified offer of credit is not a good idea.

If its a single hard credit pull, the drop will be slight. However, a string of hard inquiries could signal to lenders that you are taking on too much debt. The effects of a hard credit pull on your score, according to a representative of TransUnion, can last up to 12 months.

If you do need to apply for new credit, research your likelihood of approval to ensure youre a good candidate before applying. If possible, get a pre-approval or pre-qualification, as in many instances these result in a soft rather than hard credit pull. Soft pulls dont affect your credit score You dont want to risk lowering your score for a denied application.

You should also refrain from applying for several credit cards within a short time frame, or before taking out a large loan like a mortgage.

When you shop for a mortgage, auto, or personal loan, you can keep hard inquiries to a minimum by making rate comparisons within a short time period. Applications for the same type of loan within a designated time frame will only appear as a single hard inquiry. According to FICO, this span can vary from 14 to 45 days.

Don’t Miss: Can Lexington Law Remove Repossessions

File A Dispute Directly With The Creditor

You can also contact the company that provided the information to the bureau in the first place, such as a bank or credit card issuer. Once it receives a dispute, a lender is also required to investigate and respond to all disputes that might impact your score.

Remember to include as much documentation as possible to support your claim. It’s also helpful to include a copy of your report marking the error.

The address you should mail the letter to is usually listed on your report, under the negative item you’d like to dispute. You can also contact the lender directly to verify the mailing address and the documents you should include.

If the lender finds that it was mistaken or cannot prove that the debt actually belongs to you, it will notify the bureau and ask it to update your file.

Fix Your Credit And Improve Your Credit Score

Here are some tips on how to fix your credit and improve your credit score:

If you need help fixing your credit, contact a non-profit credit counseling service that can help you for little or no cost. You can also check with your employer, credit union, or housing authority to see what no-cost credit counseling programs may be available.

It takes time to build up or fix your credit. Unfortunately, there are a lot of fraudsters preying on consumers who want to fix their credit. Avoid any credit counselor or company that promises quick-fix credit repairs, promises to hide your bad credit history, requires upfront payment, or tells you to dispute accurate credit report information or to give false information to creditors.

Here are some resources to help you find a reputable credit counselor:

- Federal Trade Commissions Choosing a Credit Counselor: How to choose a credit counseling service

- Federal Trade Commissions : How to avoid credit repair scams

- Department of Business Oversights : Common questions about credit counseling services

Don’t Miss: Zzounds Credit Approval

Ask Your Creditors To Verify

You should keep a record of the name of the bank, collection agency, or creditor who has left a negative comment on your credit report. You have the right to demand proof that the debts they are displaying are yours, as well as information on how they computed your overdue balance.

Contact your creditor, who you think has given the inaccurate information directly. This will help to speed up the process. You should also send a copy of the letter and documents to the creditor via registered mail. If you are right, and the creditor responds soon, the negative item can be removed from your credit report shortly.

Check Your Credit Report

You should check your credit report after 30 days. Credit bureaus have to conduct their investigation within the time frame of a month. When the 30 days have passed, you should re-check your credit report to see whether they have removed the negative item. This period of 30 days starts from the time the credit bureau received your letter.

Don’t Miss: Aargon Agency Settlement

How To Dispute An Item On Your Credit Report

Home \ \ How to Dispute an Item on Your Credit Report

Join millions of Canadians who have already trusted Loans Canada

Accurate reporting of your credit information is the number one goal of the two main credit reporting bureaus in Canada, Equifax and TransUnion. Unfortunately, sometimes mistakes are made and inaccurate information is included on your credit report. When this happens, both Equifax and TransUnion are required, by law, to investigate, confirm, or change any information that you dispute.

All consumers and credit users have the right to dispute information that they know is inaccurate. Once a dispute is initiated, the credit reporting bureau must launch an investigation to confirm the validity of the information in question.

Considering a credit monitoring service? Check out this article.

Check For Updates To Your Credit Report

Updates to your affected credit reports may take some time to appear. It can depend on the specific credit bureaus update cycle and when the furnisher sends the new information to the credit bureau.

If the update doesnt appear on your credit reports within several months, contact the credit bureaus and the furnisher to verify its reporting your account information to the bureaus.

Don’t Miss: How Long Does Negative Information Stay On Chexsystems

The Basics Of Disputed Accounts

It will help you to understand some basics of dispute wording:

- How the dispute wording got there.

- How to find disputed accounts.

- How to know when it is it is not necessary to remove dispute wording from an account.

- How to avoid damage your credit scores when removing dispute wording

How the Dispute Wording Got On Your Credit Report

Dispute wording can be put on a credit report account by the creditor, by one of the credit bureaus: Experian, Equifax, or TransUnion, or by both. Understanding that there are two sources of dispute wording guides our strategy for making sure we remove the dispute wording permanently. Your creditors furnish the current data on your accounts to one or more credit bureaus every month. So you will often see creditors referred to data furnishers. They are one in the same.

Dispute Wording Caused by Contact from You to the Creditor

Accounts are put in dispute by when they receive a question or complaint by direct contact from the consumer. Most dispute wording gets on your credit report because of routine, informal contact by the consumer to the creditor. When you notify a creditor, in any manner, that you disagree with any of your account information, the creditor must flag the account as disputed to avoid violation of federal law. Creditors have been sued for failing to mark disputed credit report accounts so they are very sensitive to any communication from you about your account.

Dispute Wording Caused by Contact from You to a Credit Bureau