Tip : Establish A New History Of Paying Your Bills On Time

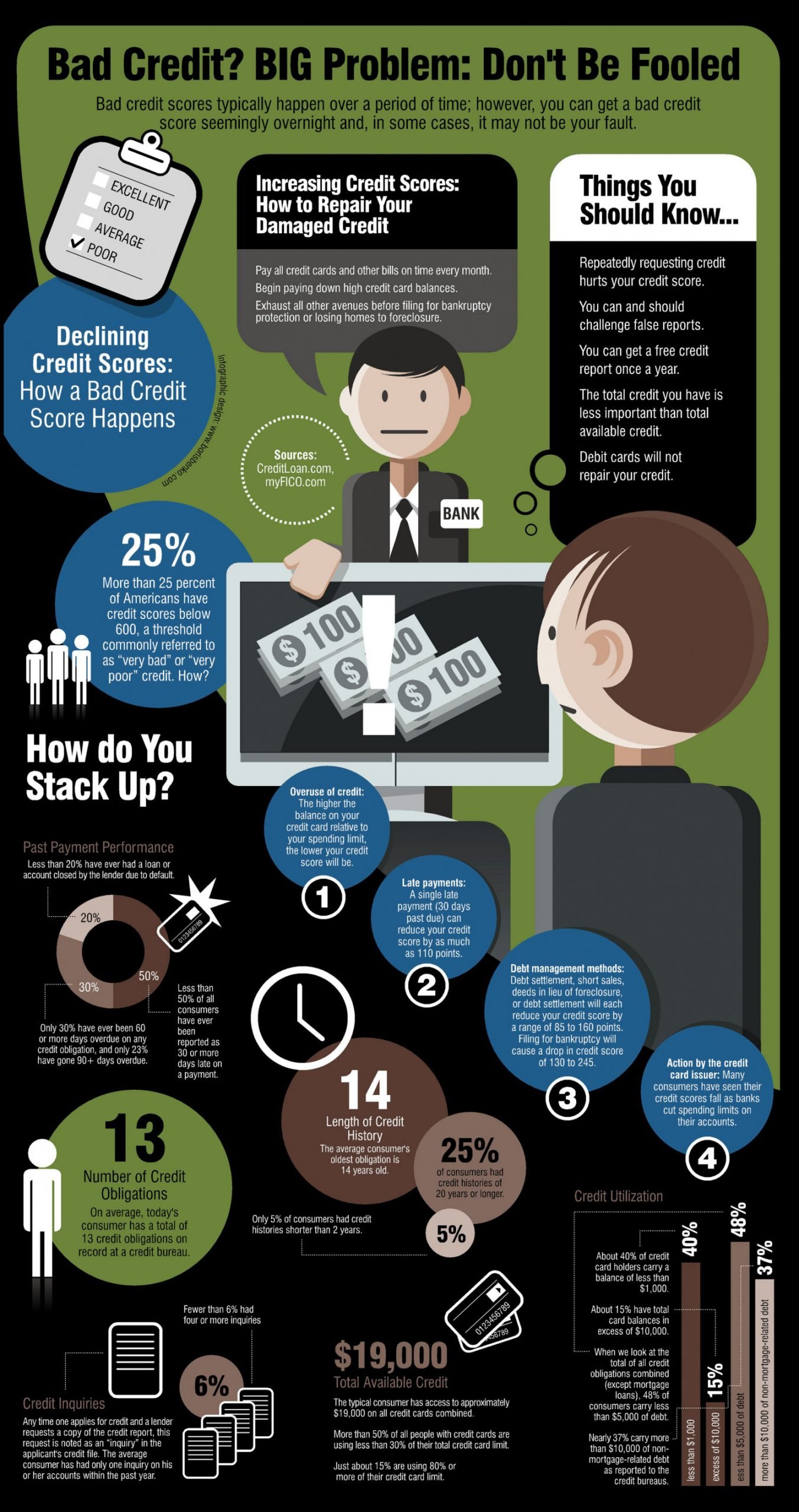

The problem: late or missed payments The biggest hurdle to a strong credit score is a history of late or missed payments. Payment history is important because a single late payment can send your score tumbling by 100 points.

Plus, late or missed payments hang around: They stay on your three credit reportsone each maintained by the national credit bureaus of Experian, Equifax and TransUnionfor seven years.

The fix: Make sure to pay your credit-card bills and loan payments on time each month. Know that there is a bit of a grace period, too. Your creditors cant report your payments as late until at least 30 days past due. So if youre a week late on your credit-card bill, pay it today.

The more months you pay all your bills on time, the greater the impact this will have on your credit score. But you will have to be patient. Depending on how low your credit score is, it can take several months, maybe even a year or more, of on-time payments to significantly improve your credit score.

Can A Credit Repair Specialist Steal Your Identity

Information obtained from you by a credit recovery professional can be used to steal your identity if it falls into the wrong hands. Confidentiality is very important to maintain credit recovery results. Credit recovery professionals must have a system in place to protect the privacy of their customers.

Errors By The Credit Reporting Agency

The credit reporting agency may have reported your information wrongly. For example:

- your name, date of birth or address needs updating

- a debt is listed twice

- the amount of a debt is wrong

To fix this kind of error, contact the credit reporting agency. They may be able to fix it straight away or help you get it changed.

Recommended Reading: Does Affirm Do A Hard Credit Check

An Improved Score Will Lead To Financial Opportunities

Keeping your credit report in positive and accurate shape is something anyone can and should do. Your credit scores speak for you, and you want them to be your numerical cheerleaders! The higher they are, the better the interest rates will be on credit cards and loans.

Odds are, youll be eligible for higher credit limits, a greater variety of rental properties, and wont have to pay extra fees to start up a cellphone or utility contract. They can even result in lower car and life insurance rates. In fact, when your reports are reflecting what they should and your credit scores are in the right place, you can be sure that a business or financial institution will identify you as the attractive credit risk you really are.

Report Credit Repair Fraud

State Attorneys General

Many states also have laws regulating credit repair companies. If you have a problem with a credit repair company, report it to your local consumer affairs office or to your state attorney general .

Federal Trade Commission

You also can file a complaint with the Federal Trade Commission. Although the FTC can’t resolve individual credit disputes, it can take action against a company if there’s a pattern of possible law violations. File your complaint online at ftc.gov/complaint or call 1-877-FTC-HELP.

Recommended Reading: Remove Inquiries Off Credit Report

How Does A Credit Repair Company Work

The role of the credit repair company is to assist you when disputing any incorrect details present on your credit report, including foreclosures, bankruptcies, and late payments. With the help of this company, youre in a position to improve your credit history. As a result, youll be one step towards improving your overall credit rating, hence being guaranteed access to loans. The three steps followed by the credit repair company are

Make The Most Of A Thin Credit File

Having a thin credit file means that you dont have enough credit history on your report to generate a credit score. An estimated 62 million Americans have this problem. Fortunately, there are ways to fatten up a thin credit file and earn a good credit score.

One is Experian Boost. This relatively new program collects financial data that isnt normally in your credit report, such as your banking history and utility payments, and includes that in calculating your Experian FICO credit score. Its free to use and designed for people with limited or no credit who have a positive history of paying their other bills on time.

UltraFICO is similar. This free program uses your banking history to help build a FICO score. Things that can help include having a savings cushion, maintaining a bank account over time, paying your bills through your bank account on time, and avoiding overdrafts.

A third option applies to renters. If you pay rent monthly, there are several services that allow you to get credit for those on-time payments. For example, Rental Kharma and RentTrack will report your rent payments to the credit bureaus on your behalf, which in turn could help your score. Note that reporting rent payments may only affect your VantageScore credit scores, not your FICO score. Some rent-reporting companies charge a fee for this service, so read the details to know what youre getting and possibly purchasing.

Read Also: Getting Married Affect Credit Score

Can You Pay A Company To Fix Your Credit

work mostly by deleting negative information from your credit report, typically errors. But thats only one tiny part of fixing your credit score. And you might be able to dispute errors yourself faster.

So not only are credit repair companies expensive , but you can do it on your own. And if you really need credit help, you can always seek affordable assistance from a nonprofit credit counselor through the National Foundation for Credit Counseling.

How To Manage Multiple Scores

Fix 5If youre seeking a loan, ask the lender which VantageScore or FICO score it uses. Then find out how you perform on that score.

If you can learn the main factors that a score considers, you may be able to boost it, Hardekopf says. For example, you could pay down credit card debt to improve your debt-to-credit ratio, which is likely to improve some scores.

Fix 6Check your credit report, and dispute any errors you find. Obtain your credit report free of charge at AnnualCreditReport.com and read it carefully. All credit scores can benefit from having incorrect negative items removed, Ejaz says.

In CRs recent study, “A Broken System: How The Credit Reporting System Fails Consumers and What to Do About It,” of the 34 percent of volunteers who found errors, 11 percent said they were related to debt they didnt owe or had already paid off, or to payments inaccurately reported as late or missed.

Dispute errors in writing by sending a certified letter with supporting evidence to each of the big three credit bureaus. They have about 30 days to respond.

Read Also: Repo Removal Letter

Follow Healthy Money Habits

Finally, the best way to repair your credit is to continue to follow healthy money habits. After all, slow and steady wins the race.

These little things include making and sticking to a budget each month. What is your total income? What bills do you have to pay? Put these into a spreadsheet to see what you have left over at the end of the month. Once you know how much extra income you have, you can start putting some of that extra in a separate savings account for emergencies. You donât need to cut out every cup of coffee from your spending. But, if you can build up an emergency fund over a few months, youâll have some extra breathing space when an unexpected surprise hits.

Having this emergency fund means that youâll be able to pay for a new car battery outright, without putting it on a credit card. This will help improve your credit utilization ratio, which is an important factor.

Additionally, be diligent about paying your bills on time. If you can, set these payments to automatically withdraw from your account every month. Although paying your utilities on time doesnât usually have a positive impact on your credit, late payments can ding your credit. However, you can ask your landlord to report your on-time monthly rental payments to the credit reporting agencies to establish a history of responsible payments.

If You Find Errors Dispute Them

The next step in credit repair is to dispute incorrect information on your credit report.

Errors arent common, but they happen. Of course, sometimes bad credit is just your fault. You shouldnt try to argue accurate information, but if you do see errorseven small onesits worth cleaning them up. Heres how:

Once you have the copy of your full credit report in hand, check your identity information , and credit history.

Review the list of credit cards, outstanding debts, and major purchases. If you see any mistakes or questionable items, make a copy of the report and highlight the error.

Next, gather any information that you have to back you up, such as bank account statements, and make copies of these as well. This is important! The credit bureaus wont do anything without proof.

Write a letter to the specific credit reporting agency that shows the falsehood, whether it is Experian, Equifax, or TransUnion. Explain the mistake and include a copy of the highlighted report along with your documentation. Although certain bureaus now let you submit disputes online, its not a bad idea to send this letter by certified mail, and keep a copy for yourself. The reporting agency has 30 days from the receipt of your letter to respond. The Federal Trade Commission provides advice on contacting the credit bureaus about discrepancies. Here are the contact numbers and web sites for the three credit bureaus:

- Equifax: 800-685-1111 www.equifax.com

Also Check: When Does Usaa Report To Credit Bureaus

Keep Old Credit Cards Open

You might be tempted to close old when youve paid them off. However, dont be so quick to do so. By keeping them open, you can establish a long credit history, which makes up 15% of your credit score.

There are a few caveats here, though. Your issuer may close your card after a certain period of inactivity and if it charges an annual fee, it might be worth closing.

Assess Your Credit History For Free

You are entitled to receive one free credit report from each of the three major credit reporting bureaus every year. These credit reporting agencies keep detailed records of your credit history. Assessing your credit involves three simple steps:

Also Check: Usaa Check Credit Score

When Do Collection Agencies Get Involved

If an account has a past-due balance of more than 30 days, your creditor may turn your account over to a collection department or agency to seek the funds directly from you. When an account is sold to a collection agency, the account can be noted on your credit reportoften having an enormous negative impact on your credit score.

Collection agencies work to collect funds on amounts due for credit cards, personal loans, auto loans and mortgages. Collection entries will fall off of your report after seven years. If the collection information is incorrectjust like any other erroryou can file a dispute.

Why Should You Never Hire A Credit Repair Company

Why you should NEVER go to a credit repair company. It is important to have a good credit history. Without it, you could be denied loans with low interest rates and lines of credit, work, rent, and even insurance. If your credit report has a history of debt problems or errors, consider using a repair service to “clear” it.

How to get a salvage title clearedIs there any way to get rid of a salvage title? While a salvage vehicle designation can never be completely removed from the vehicle’s name, a rebuilt salvage title or title is issued when the vehicle is fully repaired and undergoes a government inspection. Repair the damage to the vehicle. Keep all receipts for repairs and parts.Is a salvage title Bad?Recycle titles, not all good and not all bad.â¦

Also Check: How Can You Get A Repo Off Your Credit

Is Hiring A Credit Repair Company Really Worth It

Yes, hiring a credit repair company to help you improve your score and rebuild positive credit is worth it. While theres no guarantee, credit repair companies have helped millions of Americans rebuild their credit.

If you have multiple inaccurate and harmful items on your credit report, then hiring a reputable credit repair service is an excellent idea. You get help from an industry expert who knows what it takes to negotiate with creditors and work with credit reporting agencies to dispute incorrect items and boost your credit score.

How To Review Your Credit Report

Review every credit reporting agencys credit report in detail. Each report has the following sections: Credit Summary, Accounts , Inquiries and Negative Information. Reviewing each section can help you understand the source of a poor credit score, and if your report contains legitimate errors.

When you review your credit report, you will need to visit each section, and keep notes about erroneous information. Remember, there are three bureaus, so you need to repeat this process for all three reports.

The next section details what you should should note.

You May Like: Paypal Credit Hard Pull

Ovation Credit Repair Services By Lending Tree

Ovation Credit Services by Lending Tree is one of the most reputable credit repair companies on our list. With Better Business Bureau accreditation since 2004 and an A+ rating, Ovation has rave reviews from former clients. In addition, the credit repair company has helped over 120,000 people build their credit through an education-based approach, teaching better financial and spending habits.

The sign-up process starts with a free consultation to learn which services will work best for your needs. Once you sign up, youll meet your personal case advisor, who will perform an extensive analysis of your credit report and history to build a custom strategy for you. Theyll also dispute and challenge any incorrect items on your account with the three credit bureaus, ultimately improving your credit scores.

Ovation Credit Services offers two credit repair packages: Essentials and Essentials Plus.

Essentials Plan

The Essentials Plus plan includes all the features from the Essentials plan, plus a few extras:

- Unlimited disputes/challenges

- Ovation recommendation letter to creditors

- TransUnion® credit monitoring

Ovation Credit Services is one of the best credit repair companies on our list for many reasons, including its stellar reputation, affordable service plans, money-back guarantee, and education-based approach. We also love that Ovation offers a ton of discounts:

Pinpoint Things To Dispute

The next step by a credit repair company is to go through your reports to check for possible errors and mistakes. This is done to find any misleading information thats negatively affecting your credit score. It usually includes duplicate accounts, expired negative items, and errors in the payment history. Consequently, theyll proceed to have such items removed from your credit report, and the different ways they do this include

- Sending on your behalf cease-and-desist letters to debt collectors

- Requesting the validation of information on your credit report

- Writing letters to contest inaccurate and negative marks

In addition to this, credit repair companies help you pinpoint any errors on your credit reports to help prove your case.

Recommended Reading: Carmax First Time Buyer

How Often Should You Check Your Credit Score

You should check your credit score regularly to check for errors, but make sure that you are doing so through soft inquiries so that your score isnt dinged. Many banks offer free credit monitoring to their customers check with yours to see if you can enroll in their service and get alerts whenever your score changes.

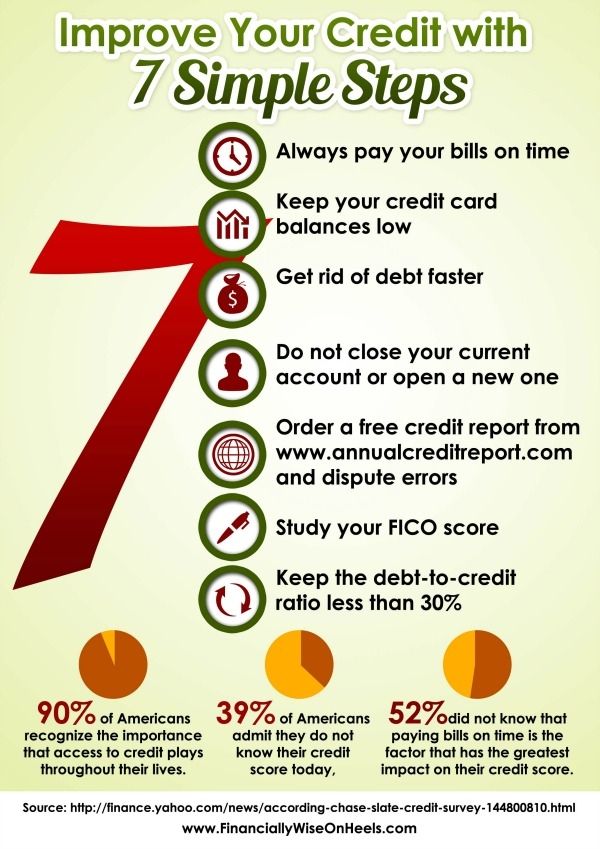

How To Improve Your Credit Score

If your credit score is low, there are steps you can take to help improve it. You can:

- lower your credit card limit

- limit how many applications you make for credit

- pay your rent or mortgage on time

- pay your utility bills on time

- pay your credit card on time each month either pay in full or pay more than the minimum repayment

As you do these things, your credit score will start to improve. So you’ll be more likely to be approved next time you apply for a loan or credit.

If you’re struggling to pay bills and are getting into more debt, talk to a free financial counsellor. They can take you through the options and help you make a plan.

You May Like: Does Carvana Affect Credit Score

I Was Adamant I Didnt Owe A Penny

If a lender keeps chasing you for a missed payment even if youre not responsible for it you could end up with a default being recorded on your report, or even a County Court Judgment.

James Insell received a court claim from debt collection agency Lowell in 2020, after Vodafone continued to demand payment for a mobile phone contract hed been mis-sold in 2017.

I knew I was in the right, he told Which?. I wasnt going to pay anything. So I thought, right, Im going to have to defend myself.

James made the bold decision to issue a counterclaim against Lowell for damages done to his credit score.

In a victory for victims of credit report errors, the judge decided there was no debt owed and Lowell had breached their duty of care to James by reporting the default to CRAs.

Debt collection agencies can use credit reporting as a weapon, says Jamess barrister, Andrew Smith. Youre effectively saying: Pay this, or Im going to tell everyone youre a risk to lenders. In the UK, you could call it demanding money with menaces in Scotland, you could call it extortion.

Vodafone did not respond to a request for comment on this case.

Listen: we dive deeper into the stories of James Gaby and James Insell on the Which? Money Podcast