How To Get A Free Copy Of Your Credit Report

Posted in Finance on 2015-06-16by Joan ::

When was the last time you checked your credit report? Many consumers dont know they have the ability to request a free copy of their credit report. In todays blog post, were going to show you how to do this!

In Canada, there are two credit reporting agencies: TransUnion and Equifax. Below are the step-by-step instructions on how to request a free copy of your credit report. It is important to know that there may be a cost for requesting an electronic copy of your credit report or to get access to your credit score. In order to verify your identity, you will need to provide copies of two pieces of I.D. with your request.

How Do You Check Your Credit Report

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

Due to the COVID-19 pandemic, many people are experiencing financial hardships. To remain in control of your finances, you can get free credit reports every week through April 2022.

Request all three reports at once or one at a time. Learn about other situations when you can request a free credit report.

Request Your Free Credit Report:

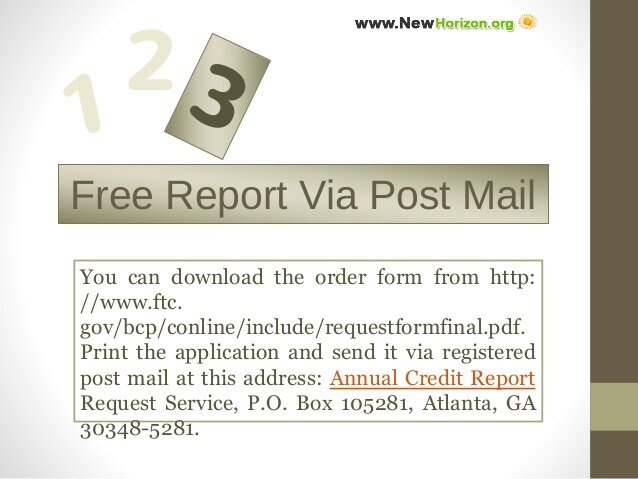

By Mail: Complete the Annual Credit Report Request Form and mail it to:

Annual Credit Report Request Service

PO Box 105281

Atlanta, GA 30348-5281

If Your Request for a Free Credit Report is Denied:

Contact the CRA directly to try to resolve the issue. The CRA should tell you the reason they denied your request and explain what to do next. Often, you will only need to provide information that was missing or incorrect on your application for a free credit report.

If you can’t resolve your dispute with the CRA, contact the Consumer Financial Protection Bureau .

How To Get Your Annual Credit Reports From The Major Credit Bureaus

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Federal law gives you free access to your credit reports from the three major credit bureaus: Equifax, Experian and TransUnion. Using the government-mandated AnnualCreditReport.com website is the quickest way to get them, but you can also request them by phone or mail. Until April 20, 2022, those reports which had been limited to once a year are available weekly to help consumers manage their finances.

Your credit reports are a detailed record of your past use of credit but they do not include your credit score. NerdWallet offers a free credit score and report, updated weekly using TransUnion data. Checking your score does not damage your credit.

Heres how to use AnnualCreditReport.com.

Also Check: Does Kornerstone Credit Report To The Credit Bureaus

What Is Credit Monitoring

Canadas credit bureaus, as well as many credit card issuers and financial institutions, offer credit monitoring services. These services provide you with a notification after certain updates to your credit file, such as a credit inquiry.

You could consider using this service if you think youve been the victim of fraud or if you have been affected by a data breach. This can help you see if somebody is trying to apply for credit in your name.

You usually need to pay for these services.

Which Credit Report Is Most Accurate

No one credit report is innately more accurate than the others. Your TransUnion credit report might contain information that your Equifax credit report doesnt, or vice versa.

This is partly because lenders are not required to report your information to all three credit bureaus. In some cases, they may only report to one bureau and not the others, or they may report information at different times.

In any case, its a good idea to review your credit reports on a regular basis so that you can be sure any discrepancies are minor.

Ready to help your credit go the distance? Log in or create an account to get started.

You May Like: Can Klarna Affect Your Credit Score

Other Free Credit Reports

Under the FCRA you are entitled to a free credit report if a company denies you credit, insurance or employment and you request your report within 60 days of receiving the notice. The notice you receive will give you the contact information of the credit reporting agency. You may also receive a free credit report if you are unemployed and will be looking for a job within 60 days, if you are on welfare, or if you are a victim of identity theft.

Are There Other Ways I Can Get A Free Report

Under federal law, youre entitled to a free credit report if

- you get a notice saying that your application for credit, employment, insurance, or other benefit has been denied or another unfavorable action has been taken against you, based on information in your credit report. Thats known as an adverse action notice. You must ask for your report within 60 days of getting the notice. The notice will give you the name, address, and phone number of the credit bureau, and you can request your free report from them

- youre out of work and plan to look for a job within 60 days

- youre on public assistance, like welfare

- your report is inaccurate because of identity theft or another fraud

- you have a fraud alert in your credit file

If you fall into one of these categories, contact a credit bureau by using the below.

Don’t Miss: Do Landlords Report To Credit Bureaus

What Should You Look For On Your Credit Report

When you receive your reports, check each section carefully and determine whether you believe the information is correct. Your report could alert you to fraudulent activity being carried on in your name by an ID thief or other inaccurate information that could affect your ability to obtain a loan. Your credit reports may include:

- A list of businesses that have given you credit or loans

- The total amount for each loan or credit limit for each credit card

- How often you paid your credit or loans on time, and the amount you paid

- Any missed or late payments as well as bad debts.

Your credit reports may also include:

- A list of businesses that have obtained your credit report within a certain time period

- Your current and former names, address and/or employers

- Any bankruptcies or other public record information.

Be sure to review that all of the above that appear on your credit reports are accurate, and check the accuracy of:

- Your personal information: are there addresses or variations on your name that are wrong?

- Potentially negative entries: are there unpaid debts listed on accounts you never opened?

- Public record information: is this information accurate?

Difference Between Credit Reports And Credit Scores

While your credit score and credit report are related, they’re not the same thing. Your credit score is a single three-digit number that signals your credit health to lenders and creditors. Your credit report doesn’t include your credit score. The report, which includes credit activity, is used to calculate your credit score.

Recommended Reading: How To Remove A Repo From Your Credit

What To Do About Inaccurate Information

- Clearly identify the inaccurate information on your credit report and dispute it, in writing, to both the credit reporting agency that issued the report with inaccurate information and any creditors associated with the information.

- For more information, review the FTCs online Disputing Errors on Credit Reports article.

- If an investigation doesnt resolve your dispute with the credit reporting company, you can ask that a statement of the dispute be included in your file and future reports. If inaccurate information is not removed or reappears, you may wish to consult with a private attorney regarding possible legal actions.

Here is contact information for the three credit reporting agencies and links to their web pages informing consumers how to dispute inaccurate information:

Is Your Account Information Correct

The biggest section of your credit report will detail all of the information about each account. You want to make sure that the payment history is accurate and the account status is up-to-date. Mistakes in this section of your credit report can have a significant negative impact on your credit score.

Its important to note that each account will have an account balance. This may not be on the dot accurate, depending on when that creditor reports information to the credit bureaus. But it should be close. If its not, then you may want to contact the creditor or check your account information online to ensure the balance is accurate.

You May Like: Speedy Cash Extended Payment Plan

How Many Free Credit Reports Can You Get Per Year

The number of credit reports you can get for free depends on where you get them from and whether youve placed a fraud alert on your credit reports.

For example, the Fair Credit Reporting Act entitles you to receive one free credit report from each major credit bureau a year. In most cases, this means you can view all your credit reports for free once per year through AnnualCreditReport.com. However, due to Covid, you can receive free weekly credit reports from all three credit bureaus through AnnualCreditReport.com until April 20, 2022.

In addition, some credit reporting companies and personal finance websites allow you to check one or more of your reports for free. For example, if you sign up for myEquifax, you can get six free Equifax credit reports per year through 2026. Experian also allows you to view your Experian credit report for free 12 times a year.

You can also get an additional free copy of your report from each credit bureau if you suspect fraud and place a fraud alert on your credit reports. To do this, you must contact one of the credit bureaus.

If youve been a victim of identity theft and filed a report, you can get an additional six free credit reports per year, two from each credit bureau.

How To Correct Errors In Your Credit Report

If you see anything you believe is incorrect, contact the credit bureau immediately. You can call the telephone number on the report to speak with someone at the credit bureau. If you find evidence of identity theft, the next steps to take include contacting any creditors involved to close fraudulent accounts and filing a police report. See Identity Theft Victim Checklist, on our web page for more information on what to do.

Don’t Miss: Does Paypal Credit Report To The Credit Bureaus 2019

Is Any Negative Information Listed Accurate

Each report will have a special section that lists items that are considered negative in your credit report. These are things like missed payments, charge-offs, and collection accounts. Make sure all of this information is accurate. Otherwise, you have negative items that are hurting your score.

If a negative item is legitimate, note how old it is. Negative information can only stay in your report a set time, so you want to make sure these items are not outdated.

What Information Do I Have To Give

To keep your account and information secure, the credit bureaus have a process to verify your identity. Be prepared to give your name, address, Social Security number, and date of birth. If youve moved in the last two years, you may have to give your previous address. Theyll ask you some questions that only you would know, like the amount of your monthly mortgage payment. You must answer these questions for each credit bureau, even if youre asking for your credit reports from each credit bureau at the same time. Each credit bureau may ask you for different information because the information each has in your file may come from different sources.

Also Check: Affirm Credit Score Needed

Why Are Credit Reports Important

Credit reports, which include identifying information, such as your name and Social Security number, can also be used to monitor certain kinds of identity theft. By regularly reviewing your credit reports, you can ensure that the information found in them is accurate. If you spot unfamiliar activity on any of your reports, it could be a sign of identity theftthat a criminal has used your personal information to open a credit account or take out a loan in your name.

The negative information in a credit report covers a lot of ground. It can include tax liens, judgments, and bankruptcies obtained from public records. These can give lenders, prospective employers, and others a view of your financial status and obligations.

Generally speaking, a credit reporting agency can report negative information about you for seven yearsbut there are exceptions. For instance, information about a lawsuit or court judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Credit agencies can keep bankruptcies on your report for up to 10 years and unpaid tax liens for 15 years.

Other Situations Where You Are Eligible For A Free Credit Report

If you are a victim of identity theft, you are entitled to place a fraud alert on your file and to receive copies of your credit report from each of the three credit reporting companies free of charge, regardless whether you have previously ordered your free annual reports.

For more information on ID theft, including advice for victims and tips on prevention, review the Attorney Generals Consumer Alerts: Identity Theft Prevention and Identity Theft Recovery.

If a company takes adverse action against you, such as denying an application for credit, insurance, or employment, you are entitled to a free credit report if you ask for it within 60 days of receiving notice of the adverse action. The notice will give you the name, address, and phone number of the credit reporting company to contact.

Recommended Reading: Synchrony Bank Ntwk

Nationwide Consumer Reporting Agencies

The three nationwide consumer credit reporting agencies, also called credit bureaus, are Equifax, Experian and TransUnion. They compile credit histories on consumers. Your credit history contains information from financial institutions, utilities, landlords, insurers, and others. The credit bureaus provide information on you to potential credit granters, insurers, landlords, and employers. You have the right to get a free copy of your credit history in several situations:

You also have the right to a free copy of your report from each of the credit bureaus every year.

How To Order Your Free Annual Reports From Equifax Experian And Transunion

You can order your free annual credit reports through a toll-free phone number, online, or by mailing the Order Form at the end of this Information Sheet.

1-877-322-8228Annual Credit Report Request ServiceP. O. Box 105281Atlanta, GA 30348-5281

You have the option of requesting all three reports at once or staggering them. You could create a no-cost version of a credit-monitoring service. Just order a free report from one credit bureau, then four months later from another, and four months after that from the third bureau. That approach won’t give you a complete picture at any one time. Not all creditors provide information to all the bureaus. Monitoring services from the credit bureaus cost from about $40 to over $100 per year.

Also Check: Does Paypal Credit Show Up On Credit Report

Place A Credit Freeze

Contact each credit reporting agency to place a freeze on your credit report. Each agency accepts freeze requests online, by phone, or by postal mail.

Experian

PO Box 26Pittsburgh, PA 15230-0026

Your credit freeze will go into effect the next business day if you place it online or by phone. If you place the freeze by postal mail, it will be in effect three business days after the credit agency receives your request. A credit freeze does not expire. Unless you lift the credit freeze, it stays in effect.

What Is A Credit Report

Your personal credit report contains details about your financial behavior and identification information. Experian® collects and organizes data about your credit history from your creditor’s and public records. We make your credit report available to current and prospective creditors, employers and others as permitted by law, which may speed up your ability to get credit. Getting a copy of your credit report makes it easy for you to understand what lenders see when they check your credit history. Learn more.

Recommended Reading: Unlocking Credit Report

Beware Of Imposter Sites

The only website you should be using to request a free credit report is annualcreditreport.com.

Unfortunately, some consumers mistakenly visit other websites that show up in online search results. Many of these sites will advertise a free credit report, but later try to upsell you on their paid service or even mislead you into signing up for a subscription.

One example was freecreditreport.com, a website owned by Experian that was forced to settle with the FTC in 2005 for failing to adequately disclose that consumers would be signed up for a $79.95 annual membership. The website still exists and can grant you access to your Experian report for free, but not Equifax or TransUnion. A statement from Experian says freecreditreport.com was created nearly five years before free annual credit reports became required by law and is not represented in any way as a replacement, substitute or alternative to the federally mandated free credit report website.