Avoid The Following Strategies

While the following methods can be tempting options when trying to repair your credit, they can often cause more harm than good. Stay away from the following:

Closing a line of credit that is already behind on payments

Closing a card thats behind on payments doesn’t eliminate the debt. In fact, it can lower your credit score by increasing your debt-to-credit ratio, also known as credit utilization percentage. This ratio represents the amount of credit you’re currently using divided by the total amount of credit you have available.

For example, if you have two credit cards, each with a maximum credit limit of $5,000, your total available credit is $10,000. Owing $3,000 on one card and $2,000 on the other would mean you’re using 50% of your total available credit.

To improve your credit score, experts recommend keeping your credit utilization under 30%. Following the example mentioned above, that would mean using only $3,000 or less per cycle.

If you close one of your credit cards instead of paying it, you’ll have less available credit. Creditors evaluate your debt-to-credit ratio when you apply for new cards or loans. If your ratio is over that threshold, they might classify you as a high-risk borrower, offer you less attractive interest rates or even deny you credit altogether.

Filing for bankruptcy

There are two types of bankruptcies available for individuals: Chapter 7 and Chapter 13. A third type, Chapter 11, is meant for businesses.

Getting Collectors To Remove Negative Information

Because creditors are not required to report information to a credit reporting agency, when you negotiate a debt settlement, ask to have any negative information about the debt removed from your credit files. The collection agency might tell you that they can’t make that decisiononly the original creditor can remove the information. Ask for the name and phone number of the person with the original creditor who has the authority to make this decision.

How Can I Remove Late Payments From My Credit Report

Late payments can stay on your credit reports for up to seven years. If you believe a late payment is being reported in error, you can dispute the information with Experian. You can also contact the original creditor directly to voice your concern and ask them to investigate. If they determine they reported the late payment by mistake, they can contact the credit reporting companies to have it removed.

Also Check: Open Sky Loans

Send Letters To The Credit Bureaus

If the debt really is too old to be reported, its time to write to the credit bureau to request its removal. When you dispute an old debt, the bureau will open an investigation and ask the creditor reporting it to verify the debt. If it cant, the debt has to come off your report.

The Fair Credit Reporting Act requires credit bureaus to correct or delete any information that cant be verified or that is incorrect or incomplete, typically within 30 days. Otherwise, they are in violation and you are within your rights to file a lawsuit, as well as file a complaint with the Consumer Financial Protection Bureau.

Make sure to craft a case so strong that the creditor will have to acknowledge that its correct or present tangible evidence to the contrary. Include copies of anything that supports your claim, such as copies of court filings that show the correct date for a judgment or bankruptcy or a letter from your original creditor showing when the account became delinquent.

If a collection agency is reporting an account as a different debt, include any paperwork showing that the two accounts are really the same debt.

Send this letter certified with a return receipt requested so that you can prove when it was sent and that it was received.

Why this is important: If you can prove that the debt is older than legally allowed to show on your credit report, the bureau can remove it.

Dont Miss: How To Get Credit Report With Itin Number

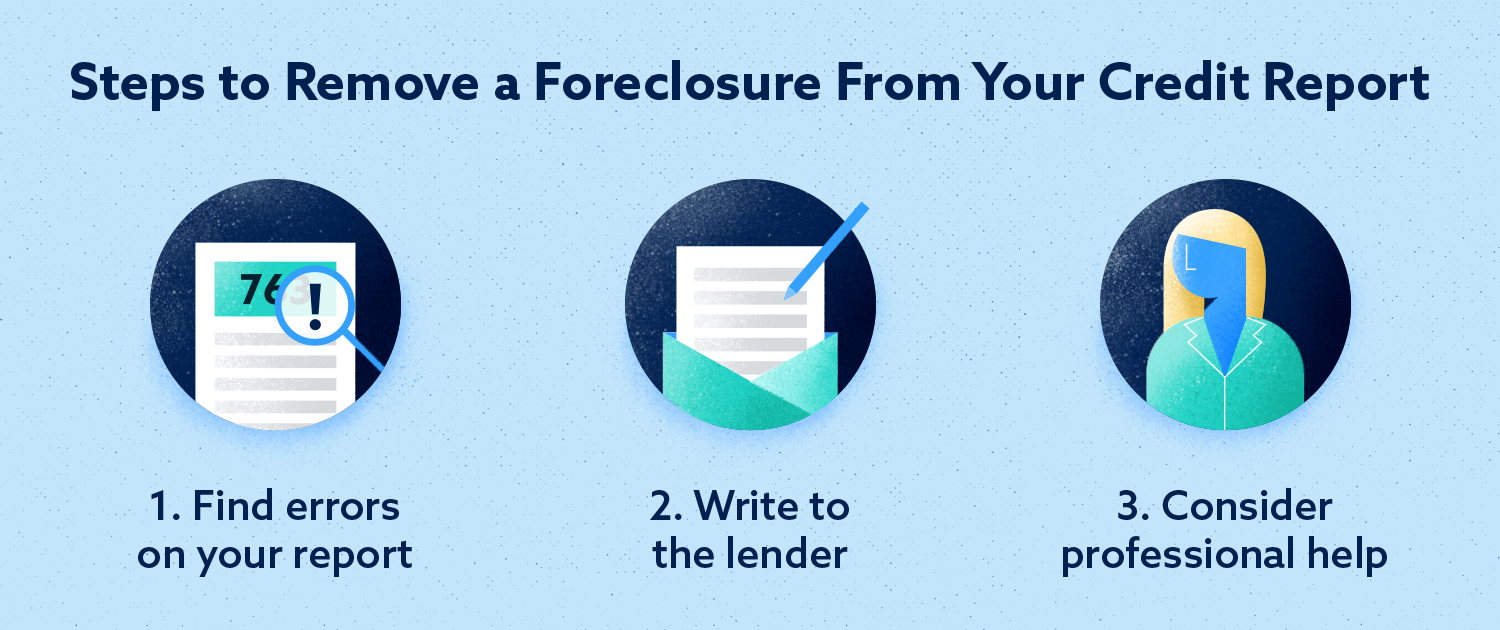

File A Dispute With The Credit Reporting Agency

Once you have your report, make sure to look through each account and see if there are creditors you dont recognize. Its also important to check whether older derogatory items are still being reported.

If you do find errors in your reports, its time to initiate a dispute directly with the reporting bureau through its website or by mail. This will prompt an investigation on the bureau’s part.

Bear in mind that you have to dispute the entry with each agency to make sure the removal is complete across the board.

How to file a dispute online

Each bureau Equifax, Experian and TransUnion has a section dedicated to walking consumers through the online dispute process. Once you create an account, you can file as many disputes as you need and check their status, for free.

How to file a dispute letter

You can also send a dispute letter to the bureaus, detailing any inaccuracies you’ve found in your credit file. When writing your letter, provide documentation that supports your claim and be precise about the information you are challenging. The Consumer Financial Protection Bureau recommends enclosing a copy of your report with the error circled or highlighted.

Depending on the information being disputed, these are some of the documents you can provide to help aid the investigation:

- Copies of checks

Include this dispute form with your letter.

Recommended Reading: Fedup-4u

Wait For The Late Payment To Age Off Of Your Report

At the end of the day, the only surefire way for a late payment to be removed from your credit report is for it to naturally age off. In essence, all negative items have a specific amount of time they can hang around your credit reports, after which time they have to be removed.

In the case of late payments, that time limit is seven years from the date of delinquency. After the seven years have passed, the late payment should come off of your credit report automatically. If outdated items dont automatically come off of your reports, you can file a DIY dispute with the bureau and have it removed fairly quickly.

You may not need to wait the full seven years to see your credit score recover from a late payment, however. Most, if not all, credit scoring models give more weight to your recent credit behavior and less to older items.

This means that negative items have less impact on your credit score the older they get, with some losing the bulk of their influence well before they age off of your report.

You can further offset the impacts of an aging late payment by ensuring you have a robust recent positive payment history. If your late payment looks more like an aberration than a trend, its impacts on your credit score will be greatly reduced.

Why Do Late Payments Matter

Payment history is one of the key factors that lenders use to gauge your ability to make timely payments, and it is the most weighted factor in your credit report. It accounts for 35% of your FICO credit score.

A late payment impacts your credit score within a month. Even if you have maintained a good credit score, one late payment can bring it down. If you have multiple late payments, the impact will be bigger, and they will affect how your ability to be approved for future loans and credit cards.

Also Check: Les Schwab Credit Score

Use A Free Credit Monitoring Service

Apps such as and will show your VantageScore, which resembles your FICO score, any time you want to see it.

More importantly, you can set these apps to send a notification or a text message anytime someone applies for new credit in your name.

This provides a great first line of defense against identity theft.

A lot of credit card issuers will now show your FICO score on their apps or online platforms.

Discover, for example, offers this service. In this case, a big drop in your FICO could warn you about inaccuracies or fraud.

Getting A Satisfied In Full Reporting

If the collection agency agrees to settle for less than you owe, be sure it also agrees to report the debt it holds as “satisfied in full” to the credit bureaus. Get written confirmation from the creditor and the collector. The debt collector’s confirmation should say that it will acknowledge the debt as paid in full when you pay the agreed amount.

Potential Tax Consequences of Settling Debt

The IRS generally considers canceled debt of $600 or more as taxable, and settling debts for less than what’s owed can increase your tax liability depending on your tax bracket and the canceled amount. Consult a tax professional for more information.

If the creditor, or the debt collector if it has the authority, agrees to delete the original account line, get confirmation that it will submit a Universal Data Form to the three major credit reporting agencies deleting the account/tradeline. If the debt collector doesn’t have the authority to act for the original creditor to delete the account information on the original debt, you might need to contact the creditor and the debt collector separately.

Read Also: Credit Score For Prime Visa

Dispute The Late Payment With The Creditor

Disputing a late payment with the bank or creditor directly is often the most effective. If the late payment is, in fact, an error. You can explain the situation to customer service to investigate. Usually, they will need some time to have a department look into the error and respond.

In most cases, if the error is on the creditors behalf, they will refund the late fee and have the late payment removed from your credit report. However, this is not always the case. If they refuse to remove the late payment, you can move on to the next step.

Hire A Credit Repair Service

Disputing errors can be a time-consuming process, especially if your history has several mistakes or if you were a victim of identity theft. Reputable credit repair companies such as , Lexington Law or Sky Blue may be viable solutions if your file is riddled with inaccuracies.

Credit repair services can help you dispute inaccurate negative information and handle creditor negotiations. However, if you decide to hire a credit repair agency, bear in mind that there are consumer protection laws regulating how they operate and what they can do. The establishes the following regarding credit repair services:

- They cannot provide false or misleading information concerning a persons credit status and identification

- They must provide a detailed description of the services they provide

- They cannot charge for their services until they has been completed

- There must be a written contract detailing the services theyll provide, the time frame in which these services will be provided and the total cost for them

- They cannot promise to remove truthful information from your record before the term set by law

- You have three days in which to review the contract and cancel without penalty

Before signing up with one of these companies, its important to understand what they can and cannot do. For example, any company that promises to remove accurate negative items or create a new credit identity for you is most likely engaging in illegal practices or a scam.

Recommended Reading: How To Remove Inquiries Off Credit Report

How Do You Dispute An Accurately Reported Late Payment

If you really did make a late payment, theres still a chance you can have it removed from your credit reports. This might be a slim chance, but its worth trying because late payments can potentially have such a significant impact on your credit.

For these methods, youll just be contacting the lender or creditor, rather than the credit bureaus. Youre basically just pleading your case and asking it to forgive the late payment its under no obligation to actually do so. If the lender decides to report the account as current instead of delinquent as a result, this is typically known as a goodwill adjustment.

This might work if you have an otherwise excellent payment history with that lender, and have been a responsible customer except for this mistake. If there was a technical error that prevented you from paying on time, like an issue with the payment system, that could work in your favor. Or, if there was some major life event that prevented you from paying by the due date, your card issuer may be sympathetic to that as well.

If you havent been a very good customer, however, and have a history of late payments and other negative marks, you probably wont have much success with a goodwill adjustment. But it might still worth a shot, depending on your situation. It wont cost you anything to try but some time.

There are only two steps in this process:

Insider tip

How Do Credit Scores Work Anyway How To Remove Delinquent Payments From Credit Report

A credit score is a substantial element of your financial life. It plays a crucial function in a lending institutions decision to say yes or no to your loan or charge card application. For example, individuals with credit rating below 640 are typically thought about to be subprime customers.

Lending institutions often charge interest on subprime home mortgages at a rate higher than a traditional home mortgage in order to compensate themselves for handling a high threat borrower. Depending on how low your credit score is, they might likewise require a shorter repayment term or a co-signer.

On the other hand, a credit score of 700 or more is typically considered great and could lead to you receiving a lower rates of interest. On loans like mortgages, a slightly slower rate of interest can end up saving you tens of thousands of dollars over the repayment term!

Scores greater than 800 are thought about exceptional. Its worth keeping in mind that while every lender specifies its own varieties for credit scores, the following FICO score range is often used:

- Excellent: 800 to 850

- Fair: 580 to 669

- Poor: 300 to 579

In brief, your credit score is a mathematical analysis of your credit reliability and straight impacts just how much or how little you may spend for your credit. Your credit score can also figure out the size of a down payment required on items like phones, utilities, or apartment leasings.

Read Also: How To Remove A Paid Repossession From Your Credit Report

How Long Does A Collection Account Stay On A Credit Report

The Fair Credit Reporting Act lays out that the collection has to stay on your credit report for up to seven years from the date of default on the original account. This is to give lenders a clear picture of your financial behaviour so they know the risks of lending you money.

However, on a credit report, a paid collection can still stay on your credit report for up to seven years, regardless of whether the account has a $0 balance.

After seven years, the paid collection will automatically drop off your credit report.

Ask For A Goodwill Deletion

If you have a paid collection listed on your report, you can simply ask the debt collector or original collector to remove the collection. This usually involves sending the debt collector or collection agency a goodwill deletion letter explaining your mistake, asking for its forgiveness and showing them how your payment history has improved.

With this option, theres no guarantee your collection will be removed from your credit report, but its worth a shot. If the account is removed, it may help you qualify for better terms on personal loans, mortgages and credit cards.

Don’t Miss: Removing Hard Inquiries From Credit Report

Try Removing Negative Items That Arent Errors

On the other hand, lets say youve made some mistakes. You couldnt afford to pay your credit card bill. Your student loan payments are sometimes late. Of course, the ultimate solution is to improve your financial habits that much is obvious. In the meantime, though, you still have options for dealing with the negative items on your report.

For late payments, you can draft a goodwill letter, which is sometimes referred to as a goodwill adjustment. If you generally have a good history with a creditor, theyre often willing to forgive a late payment here and there and update your credit report accordingly. Youll want to contact the creditor directly, either with a phone call or a letter. Either way, your request should include:

- A brief rundown of your history with the creditor

- A brief explanation of the financial hardship that led to your late payment

- A request to remove the negative mark from your credit report

Of course, if you have a long history of late payments, thats another story. If you have the money, you might be able to negotiate a payment plan with them that includes paying a large lump sum amount in exchange for removing your negative marks. Griffin recommends calling your creditor to discuss your options, and reminds us that the removal of negative, accurate information is unlikely.

Rod Griffin, Director of Public Education, Experian

Re: Removing History Of Delinquency From Credit Report

Welcome to the forums. If your negatives are over ten years old I am thinking they should have fallen off. Even a Chapter 7 is gone after ten years. Some negatives are gone after seven. I have some 30 day lates due to fall off next year when they are seven.

Have you pulled a recent credit report? That would be a good place to start. Then come back to the forum and lets talk about it.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Also Check: How Does Qvc Payments Work