What Factors Affect Your Credit Score

Your credit score is comprised of five factors: payment history, amounts owed, length of credit history, new credit, and credit mix. When youre in the average credit score range, your credit score can be affected by any of these five factors. In fact, your payment history may not even be a major issue. Even though your payment history is flawless, your credit score can still fall below 700 if you owe too much on your credit cards, or if you have too much new credit.

Mortgage Loans That Allow A 600 Credit Score

Programs for borrowers buying a house with a 600 credit score include:

Good Credit Score For Mortgages

A good credit score for a home loan is one that will qualify you for the lowest interest rates possible. Different financial institutions will have varying credit score range cut-offs for different APRs. The Federal Deposit Insurance Corporation showed how credit score ranges can affect a sample $250k/30 year mortgage. A good score for a mortgage in this example would fall between 700 and 759.

|

FICO Score |

|

|---|---|

| $1,491 | $286,760 |

Mortgage companies use different credit score models to determine your rates FICO Score 2, FICO Score 4 and FICO score 5. For the most part, these models are powered by similar factors including payment history, length of credit history, and your current debt obligations.

Most lenders will not provide a mortgage to homebuyer whose credit score is below 620. The only exceptions are FHA loans which are insured by the Federal Housing Administration. If the borrower defaults on a loan of this type, the government protects the borrower against the damages. Note that people whose credit score ranges between 500 and 579 typically need to make a down payment of at least 10%.

Individuals with good credit scores can also qualify for FHA loans if they wish to lower their interest rates.

Also Check: Does Capital One Report Authorized Users To Credit Bureaus

What Information Credit Scores Do Not Consider

FICO® and VantageScore do not consider the following information when calculating credit scores:

- Your race, color, religion, national origin, sex or marital status.

- Your age.

- Your salary, occupation, title, employer, date employed or employment history.

- Where you live.

- Soft inquiries. Soft inquiries are usually initiated by others, like companies making promotional offers of credit or your lender conducting periodic reviews of your existing credit accounts. Soft inquiries also occur when you check your own credit report or when you use from companies like Experian. These inquiries do not impact your credit scores.

Compare More Recommended Credit Card

Is your credit score not 650, 660, 670, 680, or 690? Find more top credit cards for your credit score range:

Note: According to our research, these credit cards offer the best chance of approval for applicants with credit scores of 650, 651, 652, 653, 654, 655, 656, 657, 658, 659, 660, 661, 662, 663, 664, 665, 666, 667, 668, 669, 670, 671, 672, 673, 674, 675, 676, 677, 678, 679, 680, 681, 682, 683, 684, 685, 686, 687, 688, 689, 690, 691, 692, 693, 694, 695, 696, 697, 698 and 699. This does not mean guaranteed approval as credit decisions take into factors other than FICO score.

Petal credit cards are issued by WebBank, Member FDIC.

Recommended Reading: When Does Opensky Report To Credit

How Your Credit Scores Are Set

Canadian credit scores are officially calculated by two major credit bureaus: Equifax and TransUnion.

They use the information in your credit file to calculate your scores. Factors that are used to calculate your scores include your payment history, how much debt you have and how long youve been using credit.

Pro Tip: You can view sample credit scores summaries from each bureau to get a sense of what to expect.

What Is A Good Credit Score

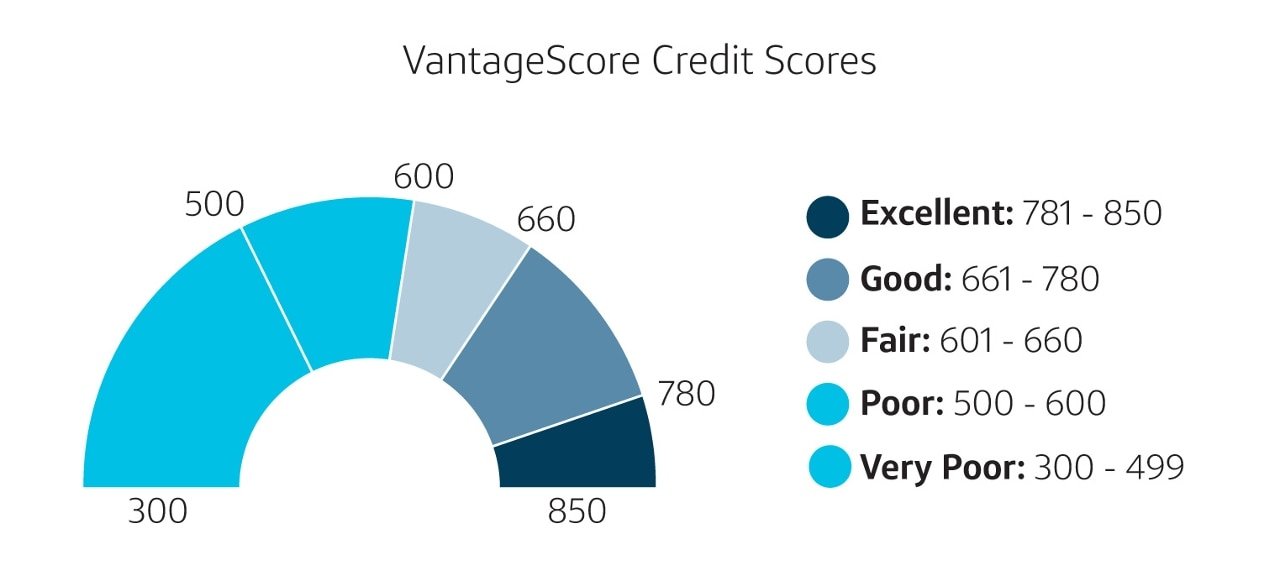

- Good: 661 to 780

- Excellent: 781 to 850

If your lender is pulling your score from Experian, they will see your FICO credit score. You would need to score between 670 and 739 to have a good credit score.

If the lender is checking your VantageScore with TransUnion, you need to rate between 661 and 780.

Unfortunately, there is no way to predict which credit scoring model your lender will see. Lenders request your information from one of the three , and they don’t always use the same one every time.

You May Like: Bp Visa Syncb Pay Bill

Key Things That You Must Know About Credit Score

If you are new to the concept of credit or CIBIL score, you may have several questions about how it works, what impacts credit score, etc. Here are some of the additional aspects you must know about credit score.

1. You can check your credit score and get a credit report for free

Most credit bureaus and third-party websites provide credit scores for free. You can sign up with them and check your credit score for free at any time. It is good to check your credit score frequently to keep a close watch on your credit health. While checking your credit report, you can look for any errors and get them resolved by raising a dispute with the credit bureaus.

2. Not everyone has a credit score

A credit score is available only after an individual takes some form of credit from banks, NBFCs or online lenders. This can include credit card, personal loan, home loan, two-wheeler loans, loan against property, gold loan, car loan, etc. If you have never borrowed before, you would not have any credit score.

3. Factors that Make your Credit Score

If you are wondering how a credit score is calculated, you must know that it is based on factors such as your repayment history, credit utilisation ratio, credit age, credit mix and number of hard enquiries, etc. You will have a good credit score if you have a good combination of all of these factors.

4. It takes time to build an excellent credit score

5. Poor credit score can be improved

6. Checking your own credit score doesnt hurt it

Conventional Loans: Minimum Credit Score 620

Non-government conventional mortgage loans charge higherinterest rates and fees forborrowers with lowcredit scores.

Fannie Mae and Freddie Mac, the agencies thatadminister most of the conventional loans in the U.S., charge loan-level priceadjustments, or LLPAs.

These fees are based on two loan factors:

- Loan-to-value: the ratio between the loan amount and home value

As LTV rises and credit score falls, the fee goes up.

For instance, a borrower with 20% down and a 700credit score will pay 1.25% of the loan amount in LLPAs.

An applicant with a 640 score and 10% downwill be charged a fee of 2.75%.

Thesefees translate to higher interest rates for borrowers. That means lower-creditscore applicants will have higher monthly payments and pay more interest overthe life of the loan.

The majority of lenders will require homeowners tohave a minimum credit score of 620 in order to qualify for a conventional loan.

But although conventional loans are available tolower-credit applicants, their fees often means FHA loans end up being cheaperfor borrowers with bad credit scores.

Also Check: Speedy Cash Repayment Plan

What To Do If You Don’t Have A Credit Score

For FICO® Scores, you need:

- An account that’s at least six months old

- An account that has been active in the past six months

VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren’t scorable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a or secured credit card, or becoming an .

See If You Qualify For A Mortgage With 600 Credit

To recap, a 600 credit score is high enough to qualify for a few different types of home loan.

But credit isnt the only thing that matters.

Before approving you to buy a house, a lender also needs to verify your employment status, income, and debts.

So the best way to find out whether you can buy a house with 600 credit is to check in with a few lenders.

Applying with a lender is usually free, and it will give you a concrete idea of whether you qualify and how much home you can afford.

Popular Articles

Step by Step Guide

Don’t Miss: Speedy Cash Loan Extension

Tip : Limit New Credit Applications

Each time you apply for credit, an inquiry appears on your credit report, regardless of whether you’re approved or denied. This can temporarily lower your credit score by roughly five points, though it will bounce back in a few months. While one credit inquiry isn’t likely to hurt your score, it can add up if you apply for multiple cards within a short period of time.

If you want a new card, but you’re not sure you’ll qualify, you can submit a pre-qualification form online. You can submit as many pre-qualification forms as you want, as they won’t impact your credit score.

For anyone looking to open a new card to take advantage of a sign-on bonus, make sure you space out your applications for new cards. There’s arguably no such thing as too many credit cards, but it’s not wise to apply for several cards within a short period of time it sends a message to issuers that you might be a credit risk.

Moving Past A Fair Credit Score

While everyone with a FICO® Score of 600 gets there by his or her own unique path, people with scores in the Fair range often have experienced credit-management challenges.

The credit reports of 39% of Americans with a FICO® Score of 600 include late payments of 30 days past due.

Credit reports of individuals with Fair credit cores in the Fair range often list late payments and collections accounts, which indicate a creditor has given up trying to recover an unpaid debt and sold the obligation to a third-party collections agent.

Some people with FICO® Scores in the Fair category may even have major negative events on their credit reports, such as foreclosures or bankruptciesevents that severely lower scores. Full recovery from these setbacks can take up to 10 years, but you can take steps now to get your score moving in the right direction.

Studying the report that accompanies your FICO® Score can help you identify the events that lowered your score. If you correct the behaviors that led to those events, work steadily to improve your credit, you can lay the groundwork to build up a better credit score.

Read Also: Check Credit Score Without Social Security Number

How Bad Credit Can Affect You

Everyoneâs situation is different, but you can see how bad credit scores might affect you when you look at some of the places in life where credit can come into play and where higher scores might help:

- With some improvement of your credit score, you might increase your chance of qualifying for cards with no fees and higher credit limits.

- Loans and mortgages: A higher credit score could help you get approved for auto loans, mortgages and other types of loans.

- Interest rates: Interest is the price you pay for borrowing money. In many cases, a higher credit score could help with getting better interest terms.

- Rental applications: When you apply for a lease, your potential landlord could look at your credit to decide about leasing to you.

- Employment applications: Potential employers sometimes pull credit reports during a background check. But they have to get permission from you first.

- Insurance premiums: In some states, your credit history could influence the cost of things like car insurance.

- Deposits: A stronger credit score might allow you to skip security deposits to set up service with utility companies and cellphone providers.

Thatâs just a quick look at the importance of credit. If youâre not satisfied with your credit scores, there are steps you can take to improve them.

Your Credit Scores Are An Important Aspect Of Your Financial Profile

They may be used to determine some of the most important financial factors in your life, such as whether or not youll be able to lease a vehicle, qualify for a mortgage or even land that cool new job.

And considering 71 percent of Canadian families carry debt in some form , good credit health should be a part of your current and future plans.

High, low, positive, negative theres more to your scores than you might think. And depending on where your numbers fall, your lending and credit options will vary. So what is a good credit score? What about a great one? Lets take a look at the numbers.

Read Also: Ccb/mprcc On Credit Report

What An Excellent/exceptional Credit Score Means For You:

Borrowers with exceptional credit are likely to gain approval for almost any credit card. People with excellent/exceptional credit scores are typically offered lower interest rates. Similar to “exceptional/excellent” a “very good” credit score could earn you similar interest rates and easy approvals on most kinds of credit cards.

Why Your Credit Score Changed

Your credit score can change for many reasons, and it’s not uncommon for scores to move up or down throughout the month as new information gets added to your credit reports.

You may be able to point to a specific event that leads to a score change. For example, a late payment or new collection account will likely lower your credit score. Conversely, paying down a high credit card balance and lowering your utilization rate may increase your score.

But some actions might have an impact on your credit scores that you didn’t expect. Paying off a loan, for example, might lead to a drop in your scores, even though it’s a positive action in terms of responsible money management. This could be because it was the only open installment account you had on your credit report or the only loan with a low balance. After paying off the loan, you may be left without a mix of open installment and revolving accounts, or with only high-balance loans.

Perhaps you decide to stop using your credit cards after paying off the balances. Avoiding debt is a good idea, but lack of activity in your accounts could lead to a lower score. You may want to use a card for a small monthly subscription and then pay off the balance in full each month to maintain your account’s activity and build its on-time payment history.

You May Like: How To Get Credit Report With Itin Number

Is Your Credit Score Average For Your Age

Given that younger borrowers may not have a long history of credit to drive their credit score up, it shouldn’t be surprising that average credit scores for American borrowers improve throughout their lifetime. As borrowers mature, they also become more aware of the factors that drive credit score improvement and are motivated to increase their scores to allow home purchases and other large investments that require loans or lines of credit.

Go Slow Applying For New Credit

Weve already touched on this factor, but its worth reminding you that lenders dont like seeing applicants applying for multiple lines credit. It could be an indication youre having budget problems, and looking to solve them by obtaining additional credit. You should apply for no more than one or two new lines of credit per year.

Don’t Miss: What Is Syncb Ppc On My Credit Report