Make Sure Your Credit Reports Are Accurate

The three leading credit reporting agenciesExperian, TransUnion and Equifaxcollect your credit information from companies where you have open accounts. These can include banks, , retailers, auto and mortgage lenders and even utility companies. And while they work to collect accurate information, they dont always hit the mark. An FTC study found that 26% of participants had a potentially material error in one of their credit reports.

The first step when looking to improve your credit score is to ensure that all accounts and negative marks on your report are actually yours. The agencies are required by federal law to provide your credit report for free once every 12 months and do so through AnnualCreditReport.com .

Request your reports and make sure everything is accurate. If something is amiss, you can file a dispute with the reporting agency and the bank or lender associated with the incorrect information.

How Do I Ask For An Increase

Submit a request through Online Banking Customer Services: look for Request a credit limit increase listed under Banking Services. You can also request a credit limit increase over the phone by calling the customer service number on the back of your card to inquire about increasing your credit limit. You may be able to complete the request over the phone, or you may be asked to go to your branch.

Set Up Autopay Or Calendar Reminders

If you struggle to remember to pay your bills each month , there’s an easy fix: autopay. If you’re not sure you’ll be able to pay your bill in full, you can set it so you just pay the minimum. And the same goes with your utilities: Most major providers will let you set up autopay that withdraws automatically each month from your checking or savings account . In the case of student loan companies, some give you a discount on your interest rate if you set up autopay.

If you don’t want to use autopay, another easy option is setting up a payment reminder. Many banks and card issuers will let you schedule reminders through their websites, including sending you email reminders or push notifications . You can also set up Google or Outlook calendar invites or make a note of the due date on a physical calendar. It doesn’t really matter what notification system you use so long as you pay on time.

The sooner you start paying on time, the sooner your score will begin to improve. And just as a bit of motivation, older credit penalties, such as late payments, matter less as time passes. So start now and stay consistent.

You May Like: Does Applying For A Loan Hurt Your Credit Score

Don’t ‘spend’ Your Applications Too Often

Every time you apply for a credit product , it adds a footprint to your file for a year.

Too many, especially in a short space of time, can trigger rejections as it makes it look like you’re desperate for credit. Therefore, space out applications if you can and don’t do them frivolously.

In fact it’s almost worth thinking about applications as ‘spending’. Is it really worth spending an application on what you’re doing, or could you save it for something else?

So if you fancy a cashback credit card and have no other credit you need to apply for in the next six months or so, great, spend your application. But if you’re just about to apply for a mortgage, wait until after you’ve done that. Prioritising is important.

For the same reason, if you apply for a cheap credit card and don’t get the credit limit you need, don’t automatically apply for another one. Read the;Low Credit Limit;guide for more information.

Sign Up For Credit Monitoring

One of the best ways to maintain a good credit score is by monitoring it consistently. You can do this by signing up for a free or paid credit monitoring service. These services monitor changes in your credit report and send you regular updates.

Plus, the right credit monitoring service can help spot instances of fraud sooner. Monitoring your credit is the best way to proactively maintain a good credit rating.;;;;

Recommended Reading: How To Get My Free Credit Score

Become An Authorized User On Someone Elses Account

If youre new to credit and cant qualify for your own credit card, becoming an on someone elses account can be a great way to get started. But its a double-edged sword: If the person who owns the account has healthy credit, it can help you establish a positive credit history over the long run. On the other hand, if they miss payments or carry high credit card balances, that could also reflect poorly on you. Thats why its important to pick someone you trust who has a longer credit history and higher credit scores than you do, and who overall has a positive credit history.

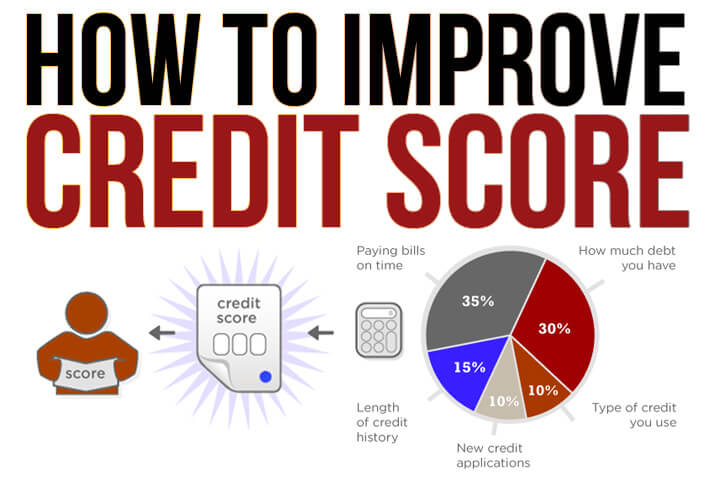

Pay Attention To Credit Utilization

Your credit utilization rate is the amount of revolving credit youre using divided by the amount of revolving credit you have available. It makes up 30% of your credit score and is often the most overlooked method of improving your score. ;For most people, revolving credit just means credit cards, but it includes personal and home equity lines of credit as well. A good credit utilization rate never exceeds 30%. So, if you have a credit limit of $5,000, you should never use more than $1,500.

Also Check: Does Opensky Report To Credit Bureaus

Check Your Credit Report

To get a better understanding of your credit picture and what lenders can see, check your credit report and learn more about how to read your Experian credit report. It’s also a good idea to order your free credit score from Experian. With it, you’ll receive a list of the risk factors that are most impacting your scores so you can make changes that will help your scores improve.

If you find information that is incorrect, you can file a dispute with the credit reporting agency on whose report you found it. You should also contact the lender that is reporting the incorrect information directly and ask them to correct their records.

Keep A Diverse Mix Of Credit

Keeping different types of credit accounts also factors into your credit score, making up 10% of it.

A lack of credit mix wont necessarily negatively impact your credit score, but the more variety you have, the better itll look to lenders. Dont go and open different accounts right now just to improve your credit mix, but do consider doing simple things like opening a new credit card if you dont have one, or shopping around for lenders when its time to buy a new car.

Don’t Miss: Does Checking Your Credit Score Affect Your Credit Rating

Money Moves You Should Be Making Right Now

If youre trying to increase substantially to accomplish a goal, youre really going to have to have as much lead time as possible, said Thomas Nitzsche, director of media and brand at Money Management International, a nonprofit financial counseling and education provider that advises people on how to legally and ethically improve their credit score on their own.

If you have fair credit and youre trying to improve the number for a house purchase, for instance, youll want to start working on it at least a year in advance, he explained to TMRW.

But even though that sounds like a long time away, you can start doing things right now to bump that number up. Below, see seven things you should do and not do to help improve your credit score:

If You’ve Split Up Ensure You Financially De

If you split up with someone you’ve had joint finances with , once your finances are no longer linked, write to the credit reference agencies and ask for a notice of disassociation. You can also call up or find the forms online.

This will stop their credit history affecting yours in the future. However, the agencies say they can’t do this if you still have a joint account open with the ex. The account’ll need to be closed or transferred to an individual account before you can do it. For example, a joint loan would have to be paid off before a notice be given.

Tip Email

Don’t Miss: How To Remove Items From Your Credit Report Yourself

Keep Credit Card Balances Low

If you want to maintain a healthy credit score, its important to keep your credit utilization ratio low. At the very least, your credit utilization ratio should be below 30%, but between 2% and 9% will help you optimize your score..;

You can calculate this number by dividing your total debt by your total available credit. For instance, if you owe $6,000 in debt but have $30,000 in available credit, your credit utilization ratio is 20%.;

One easy way to lower your credit utilization ratio is to request an increase in your credit card limits. Increasing your limits will automatically improve your credit utilization ratio, assuming you dont add more debt.;

This can be a better approach than applying for a new credit card account since the credit inquiry will likely lower your score by a few points.;

Debt Settlement Vs Debt Consolidation

An important point to note is that debt consolidation loans dont erase the original debt. Instead, they simply transfer a consumer’s loans;to a different lender or type of loan. For actual debt relief or for those who don’t qualify for loans, it may be best to look into a debt settlement rather than, or in conjunction with, a debt consolidation loan.

Debt settlement aims to reduce a consumer’s obligations rather than the number of creditors. Consumers can work with debt-relief organizations or services. These organizations do not make actual loans but try to renegotiate the borrowers current debts with;creditors.

To consolidate debts and save money, youll need good credit to qualify for a competitive interest rate.

Consolidating Debt

You May Like: How To Check Credit Score For Free

You Don’t Have A Uniform Credit Rating

There’s no such thing as a credit blacklist. This is a myth. In the UK, there’s no uniform credit rating or score, and there’s no blacklist of banned people.

Each lender scores you differently and secretly.

This means just because one lender has rejected you, it doesn’t automatically mean others will. Though after a rejection, it’s always important to;check your credit file for errors;before applying again.

Of course, if you’ve got a poor credit history, or had problems, it can feel like you’re blacklisted. Credit scoring is intuitive would you lend to someone with a history of not repaying? However, on occasion there are firms that specialise in lending to those who have had past problems though they then charge a whacking rate.

The tools that lenders use to decide aren’t universal either. As well as your credit file, they also look at application information and any past dealings they’ve had with you, and use the three sources of information to build up a picture of you.

Leave Old Accounts Open

Once you finally get rid of student debt or pay off your auto loan, you may be impatient to get any trace of it wiped from your report.

But as long as your payments were timely and complete, those debt records may actually help your credit score. The same is true for your credit card accounts.

An account thats paid in full is a good thing; however, closing an account isnt something that consumers should automatically do in the hopes that it will positively impact their credit score, says Nancy Bistritz-Balkan, vice president of communications and consumer education at Equifax. Having an account with a long history and solid track record of paying bills on time, every time, are the types of responsible habits lenders and creditors look for.

Closing a credit card account can actually lower your credit score, as you will now have a lower maximum credit limit. If youre still carrying balances on other cards or loans, your utilization ratio will go up. Youre better off keeping the card with a $0 balance.

Any bad debts that can impact your score negatively are automatically removed over time. According to Ulzheimer, bankruptcies can stay on your credit report no longer than 10 years, while late payments and delinquencies such as collections, repossessions, foreclosures and settlements stay on your report for seven years.

You May Like: How To Remove From Credit Report

Keep Credit Utilization Low

Your credit usage, or the balance you carry against the total limit of all your , could also negatively impact your score. Also referred to as a credit utilization ratio, your credit usage is expressed as a percentage. To calculate this number, take the total amount on the balance of your credit cards and divide it by your total credit limit.

For instance, if youre carrying a balance of $2,000 on all your cards and the total limit on all your cards is $20,000, your credit utilization is 10%.

The higher your credit utilization is, the more youll be seen as a risk to lenders because theyll think youre too reliant on debt. This also means a higher percentage is more likely to negatively impact your score.

Start Working Towards A 700+ Credit Score

If you want to buy a house, car, or make any other important purchase, it pays to have good credit. But what if you have damaging errors on your report, keeping your scores down? Credit help might be a good option to consider.

If youre not sure where to start, Lexington Law might be able to help. Theyre leaders in credit help and know the laws and steps you need to take to work towards improving your credit.

Get started with their free credit report consultation, and theyll provide you with a free credit score, a credit report summary, and recommendations on how to work to improve your credit. If you find its right for you, pricing starts at just $89.85 per month and you could start your journey to improving your credit.

You May Like: What Is A Good Credit Score Number

Get A Copy Of Your Credit Reports

Before you can figure out how to increase your credit score, you have to know what score you’re starting from. Since your credit score is based on the information in your , the first place you should go to improve your credit score is your credit report.

A credit report is a record of your repayment history, debt, and credit management. It may also contain information about your accounts that have gone to collections and any repossessions or bankruptcies.

Order copies of your credit reports from each of the three major to identify the accounts that need work. You can get free copies of your credit reports every 12 months from each of the major bureaus through AnnualCreditReport.com.

Tips That Can Help Raise Your Credit Scores

Because , building credit takes time. Depending on your individual situation, there may be ways to raise your scores quickly like paying down all your debt in a very short span of time. But if youre starting out with bad credit, even a drastic measure like that may not have the immediate effect youre looking for. No matter what, the most impactful thing you can do for your credit is to create some consistent habits. Here are some tips that can help you raise your credit scores over time.

Read Also: How To Report A Death To Credit Bureaus

Check Your Credit Score For Free

Knowing where you stand and watching your progress can be important. With Experian, you can check your FICO® Score for free. Your account gives you a breakdown of which factors are impacting your score the most, so you can take a focused approach to improving your score. Your credit score will also automatically be tracked and updated each month.

Use This Site To See Whats Holding You Back From An 800+ Credit Score

Imagine having an 800+ credit score. A score that’s nearly perfect. A score that lets you get any loan or credit card you want. A score that gets harsh debt collectors off your back so that you’re never harassed on the phone again.

We know it sounds like a dream. But the one thing keeping many people from their best credit score is not having access to the most up-to-date version of their credit scores possible. In fact, many credit scores arent totally accurate. And without accuracy, how can you work towards a score that opens up opportunities for the best credit cards, loans, and interest rates?

gives you access to the most reliable and accurate version of your credit scores today. They deep-scan all three major credit bureaus to bring you the most trustworthy report, so you can know exactly what you need to do next. The best part? Using it will not affect your credit.

Recommended Reading: Which Credit Score Matters The Most

Raise Your Fico Score Instantly Its This Easy

For the first time ever, get credit for your Netflix®, Huluâ¢, Disney+â¢, HBOâ¢, phone and utility billsâonly with Experian Boost.

- 1Connect the bank account you use to pay your bills. Your information remains private.Connect

- 2Choose and verify the positive payment history you want added to your credit file.Verify

- 3See your boost results instantly.Boost

Connect the bank account you use to pay your bills. Your information remains private.

Choose and verify the positive payment history you want added to your credit file.

See your boost results instantly.