A Credit Report Is Divided Into Several Parts:

A credit score is a three-digit numeric summary of your credit history, which ranges between 300 and 900. It is calculated using details from the account and the enquiry section of your Credit Report. Your credit score is considered during credit approval because it is calculated according to algorithms that combine your credit behaviour and your account information to determine your eligibility. If your score meets the lenders eligibility criteria, then they will offer you credit at favourable terms. Here you can have a look at the different credit score range and its meaning.

Also Check: Affirm Delinquent Loan

What Is A Credit Grantor

The credit grantor is another term used to describe your or the company that has granted some form of credit to you.

As your credit grantor, the credit card issuer can make a lot of decisions about your account as outlined in your credit card agreement. They can raise or lower your credit limit and your interest rate. They can charge fees to your account for certain transactions, and they can charge fees as a penalty if youre late with a payment. However, your credit grantor can also close your credit card account, sometimes without warning.

What Should You Not Say To Debt Collectors

3 Things You Should NEVER Say To A Debt Collector

- Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. …

- Never Admit That The Debt Is Yours. Even if the debt is yours, don’t admit that to the debt collector. …

- Never Provide Bank Account Information.

Read Also: How Fast Can Credit Score Go Up

Where Can I Find Out More About Credit Credit Reports And Scores Repairing My Credit Scores And Protecting Myself Against Credit Fraud And Identify Theft

The Federal Trade Commissions website and the Consumer Financial Protection Bureaus website offer helpful information about credit and other related topics.

Federal Trade Commission Articles:

What should I do if I think someone is using my personal information?

Visit identityTheft.gov to report identity theft and get a personal recovery plan that will:

- Walk you through each recovery step

- Pre-fill letters and forms for you to send to businesses, debt collectors, and others

- Track your progress and adapts to your changing situation.

Is it safe to provide my Social Security Number to AnnualCreditReport.com?

Yes. The sites security protocols and measures protect the personal information you provide. You must enter your Social Security Number to receive a free credit report through AnnualCreditReport.com.

Can I use my Individual Taxpayer Identification Number to get my free annual credit reports?

Not if you use the AnnualCreditReport.com site. We believe your Social Security Number is the most secure number to use, so our site accepts only that number.

However, since the ITIN has a similar format, you can use your ITIN if you submit your request to one of the three nationwide consumer credit reporting companies by mail. Once the company receives your request, they will verify your identity using their own procedures.

How can I submit a suggestion or comment about the Annual Credit Report Request Service or this website?

Read Also: How To Report To Credit Bureaus On Tenants

Follow Up On The Dispute

You may have to provide additional information or proof to refute something on your credit report. Be sure to respond to any inquiries by the specified time.

Removing a derogatory mark from your credit report helps repair your credit. Youll also want to improve your credit by doing things like lowering your

If youre unable to remove a derogatory mark from your credit report, youll need to wait until it rolls off of your report, usually within seven to 10 years. In the meantime, you can learn how to rebuild your credit and improve your creditworthiness.

You May Like: How Much Does A Credit Check Affect Your Score

How Long Can A Derogatory Mark Impact My Credit Scores

Derogatory marks can remain on your credit for up to seven to 10 years or more, depending on what type it is. However, your scores can start improving before that if you take steps to make your credit healthy over time. That can include making at least the minimum payment on time and keeping your balances low.

You May Like: Does Klarna Raise Credit Score

Common Reasons That Remarks Are Added To Credit Accounts

A remark might be added to an acount on your credit report if you:

- Settled a debt for less money than you owed

- Rehabilitated a student loan in default

- Negotiated with your creditor to remove the negative payment history on a credit account

- Informed your creditor that your payment on an account was affected by extreme circumstances, such as a natural disaster

- Filed a report that the account was compromised by hackers or identity thieves

- Disputed the accuracy of the information being reported

Don’t Miss: How Long Is Chapter 13 On Your Credit Report

You Filed A Credit Dispute That Was Later Resolved

As mentioned, a statement of dispute may be added if you formally dispute an account with your creditor, a debt collector contacting you, or the credit bureaus.

If your creditor is the one that added the dispute to your credit report, then theyll probably remove it once they consider the dispute to be resolved. 4 Credit disputes generally last no more than 3045 days because this is how much time the credit bureaus are legally given to conduct their investigation. 5

If your creditor removes the dispute remark from your account but youre unsatisfied with the results of the bureaus investigation, then you can dispute the account again or have a consumer dispute statement reinserted onto your credit reports.

Note that if youre the one who added the dispute remark, then itll only be removed once youve asked the credit bureau to do so. Only remarks added by your creditors can be removed without your say-so.

What Does A Remark Mean On Credit Reports

A remark is a note of the balance. Suppose you dispute your account or settle it for less than the amount owed with the charge of an account. Or rehab a student loan to get rid of any previous adverse payment history and make the account current. Remarks can be either positive or negative, based upon the events.

Recommended Reading: Is 757 A Good Credit Score

How To Deal With Derogatory Marks

You cant deal with a derogatory mark if you dont know about it, so Bruce McClary, spokesman at the National Foundation for Credit Counseling, recommends checking your credit reports at least once a month. Having a Credit Karma account can help you notice and dispute incorrect derogatory marks and generally keep tabs on your Equifax and TransUnion credit reports for free.

Here are steps you can take if you have a derogatory mark on your credit reports.

How To Read Credit Report Codes

Youll find a variety of different codes on your credit reports. Each major credit bureau has its own codes though, so dont assume a code used by one bureau means the same thing on another bureaus report.

Each bureau offers a guide explaining the codes youll see on that particular bureaus report. Heres where you can access those guides.

Also Check: How To Take Freeze Off Credit Report

Re: What Does Remark Added To Your Account Mean And Why Did It Drop My Credit Score

@Jdwinn7 wrote:

I have been working on rebuilding my credit in order to buy a house later this year. A few weeks ago, I sent a goodwill letter to Capital One asking if they could remove a few late payments I accrued during a time of financial hardship. They responded a few days ago and told me no. Yesterday, I noticed my credit score dropped 19 points. When I looked on Credit Karma to find out why, it said Capital One added missed payments and then removed missed payments. It also said that remarks have been added to my account by Capital One. I called Capital One and talked to three different people and no one could tell me what happened. I plan on reaching out to TransUnion tomorrow to try to see if they can help.

My question is what does “remarks added to your account” mean? Also, what do I need to do to correct this problem?

You would need to pull a new report to see the remarks if you cannot access it thrkugh your CMS. The remarks are right in the account under “remarks”. Most often at the bottom of the account info, but possibly above the payment history.

I would go to annual credit report and pull a report for free . This is free to do so weekly thru 4/2021.

There is a way to get a free report every 24 hours from TU for free, but you cannot have any open disputes. The report is similar to Annual Credit Report.

220 | EQ 550 | TU 498 | EX 505 721 | EQ | TU | EX 670 TU EX

Do I Have Derogatory Marks On My Credit Report

You might already have some idea that you have derogatory credit. For instance, you might be aware that you missed a payment or declared bankruptcy recently.

Or perhaps you applied for a credit product or loan and were rejected. If so, dont let it slide. Contact the lender and ask why you were denied. The lender is required under the Equal Credit Opportunity Act to tell you the specific reasons it deemed you non-creditworthy, according to the Consumer Financial Protection Bureau .

Many lenders will send this information to you as a matter of course. If a lender doesnt, request it within 60 days of rejection. The reasons can alert you to derogatory marks on your credit.

To know for sure if you have derogatory credit, however, youll need to review your credit reports from all three major credit-reporting agencies: Equifax, TransUnion and Experian.

Request free copies of your credit reports on AnnualCreditReport.com, the only website for free credit reports authorized by the Federal Trade Commission .

Once you get your free annual credit reports, review them for derogatory marks. You might find a summary of derogatory credit marks. Equifax, for example, has a section listing negative information on its credit reports. Other credit reports might list derogatory marks next to the relevant accounts.

Check both places for derogatory marks and compare credit reports to ensure the information matches up.

Read Also: What Credit Score Do You Need To Get An Apartment

How To Remove Credit Remarks Available On The Credit Report

Borrowers grow anxious when they seederogatory credit marks on credit reports. But theres no need to be concerned. Obtaining a credit report from each of the bureaus is the greatest way to work on credit remarks. After that, emphasise the credit reports good parts. If you discover any errors on your credit report, contact the credit reporting agencies to file a dispute. Never forget to include supporting documentation if the credit report contains incorrect information. If the credit remarks are real, you might write the agency a goodwill letter from a different perspective.

Nowâs the right time to secure a safe education loan! Fill the form in this blog TODAY!

Checking Your Nationwide Specialty Credit Reports

Several nationwide specialty credit reporting agencies also exist. These agencies keep records on particular types of transactions, like tenant histories, insurance claims, medical records or payments, employment histories, and check writing histories. These agencies must give you a free report every twelve months if you request it. To get a specialty credit report, youll have to contact each agency individually.

How to Stop Getting Prescreened Credit Card and Insurance Offers

Under the FCRA, credit reporting agencies are allowed to include your name on lists that creditors and insurers use to make offers to you, even though you didnt initiate the process. ). The FCRA also provides you the right to opt out of receiving these offers , which prevents the agencies from providing yourcredit file informationfor these offers. ). You can opt out for five years or permanently.

Read Also: What Does Natural Disaster Mean On Credit Report

How Do You Get Rid Of Credit Reports That Are Closed And Charged Off On Your Credit Reports

Closed accounts cannot be removed, but after some time, theyll disappear. Accounts charged off may get paid for and will be reflected as being paid. Many people believe that an account charged off means you are no longer owed the amount and are excused. That isnt the situation. Rather it indicates that they have given up and arent actively seeking to get the money back. However, this does not mean that they cant reopen accounts or transfer them to a collection firm that will attempt to recover the debt. Its not identical to an account that is part of the bankruptcy discharge.

Your Payment Status Changed

Your lender may have added a remark to your credit report if you previously approached them, told them you were having trouble paying, and asked for special accommodations .

If you recently began making your usual payments again, then its likely that your creditor removed the remark from your account.

Here are examples of payment changes that can appear as a remark on your account: 23

- Reduced payment

You May Like: Is 741 A Good Credit Score

Negative Credit Report Entries That Impact Your Score The Most

Most accurate negative items stay in your file for around seven years. Fortunately, their impact diminishes as time goes by, even if they are still listed on the report.

For example, a collection from a few years ago will carry less weight than a recent one especially if there arent any new negative items in your history. Improving your debt management after receiving a derogatory mark can show lenders youre unlikely to repeat the issue and help increase your score.

These are the most common items that can lower your credit score:

Multiple hard inquiries

Multiple hard credit checks over a short amount of time are a red flag for lenders, as it tells them that you are applying for credit too often and, potentially, being denied.

However, there are some exceptions to this. For example, if youre looking to buy a home and want to compare interest rates between several lenders, you can. FICO and VantageScore, the two most commonly used credit scoring models, give consumers a window of around 14 to 45 to compare rates this is known as rate shopping. All credit inquiries done between this period of time will show up on your file as one item.

Delinquency

Foreclosure

Foreclosure can also cause a credit score to drop substantially. According to FICO, a score can drop up to 100 points from a foreclosure, depending on the consumers starting score. Foreclosures stay on your record for seven years.

Charge-offs

Collections

How Do Errors Impact Your Credit Score

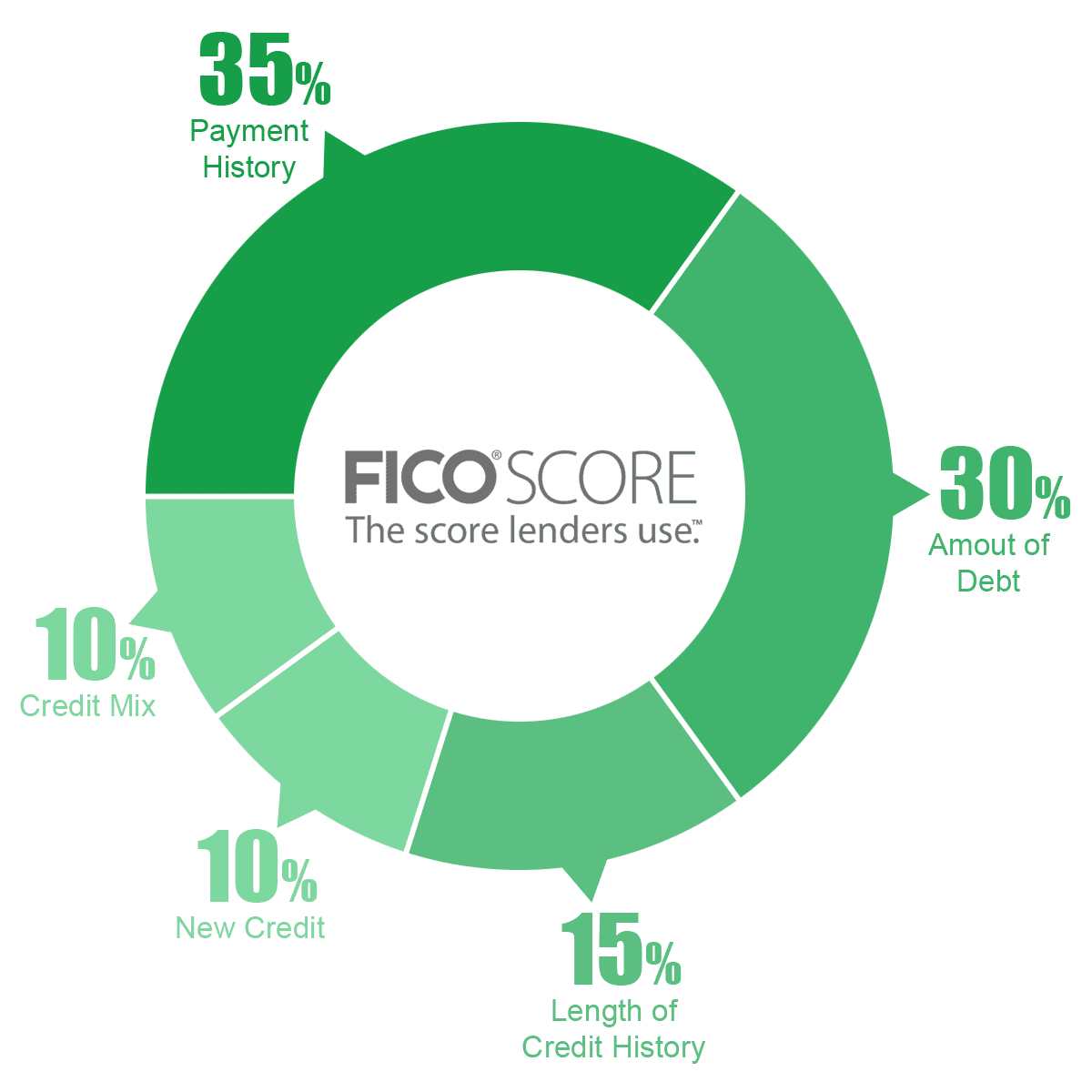

Your is calculated using different models such as VantageScore and FICO, the two most widely used credit-scoring models. Each model has its proprietary metrics and criteria. However, both use data from the major credit reporting agencies to generate your score.

Both scoring models also consider similar factors when calculating your score. These include your total credit usage and length of credit history, for example. But your payment history is the most important factor when determining your credit score.

Your payment history alone makes up around 35% of your FICO score and 42% of your VantageScore 4.0. Since payment history is so significant, a single inaccurate late payment could impact your score considerably. According to FICO, if your report has a 90-day missed payment, your score could drop by as much as 180 points.

Also Check: How To Remove Closed Accounts From Your Credit Report

How To Access Your Report

You can request a free copy of your credit report from each of three major credit reporting agencies Equifax®, Experian®, and TransUnion® once each year at AnnualCreditReport.com or call toll-free 1-877-322-8228. Youre also entitled to see your credit report within 60 days of being denied credit, or if you are on welfare, unemployed, or your report is inaccurate.

Its a good idea to request a credit report from each of the three credit reporting agencies and to review them carefully, as each one may contain inconsistent information or inaccuracies. If you spot an error, request a dispute form from the agency within 30 days of receiving your report.

Read Also: What Credit Bureau Does Comenity Bank Use

Can You Erase Bad Credit Overnight

The short answer is no. Fixing bad credit is a time-consuming process that often takes months. It involves contacting credit agencies and lenders to dispute inaccurate information, and they can take up to 30 days to respond to your request. They may also ask for more documentation to validate your dispute, further prolonging the process. Additionally, note that accurate negative items cannot be deleted from your report and will remain on your record for at least seven years.

Recommended Reading: How Long Bankruptcy Stay On Credit Report

How To Remove Negative Items From Your Credit Report Yourself

First, it’s important to know your rights when it comes to your credit history. Under the Fair Credit Reporting Act , credit bureaus and lenders must ensure that the information they report is accurate and truthful.

This means that, if you find mistakes in your , you have the legal right to dispute them. And, if the bureaus find that the information you disputed doesnt belong in your record or is outdated, they are obligated to remove it.

Common credit report errors include payments mistakenly labeled as late or closed accounts still listed as open. It’s also possible for your report to include information from someone else, possibly someone with a similar name, Social Security number or identifying information.

Bear in mind that correct information cannot be removed from your credit report for at least seven years. So, if your score is low due to down because of accurate negative information, youll need to repair your credit over time by making payments on time and decreasing your overall amount of debt.

Here are some tips to help you repair your credit history: