What Happens If I Miss A Payment

If you miss a payment, well disable your Credit Builder card and ask you to pay your overdue balance. See How and when do I pay off the card? on how to make a payment.

If your balance due isnt paid in full after 30 days, we may report information about your account to the major credit bureaus. Late payments, missed payments, or other defaults on your account may be reflected on your credit report.

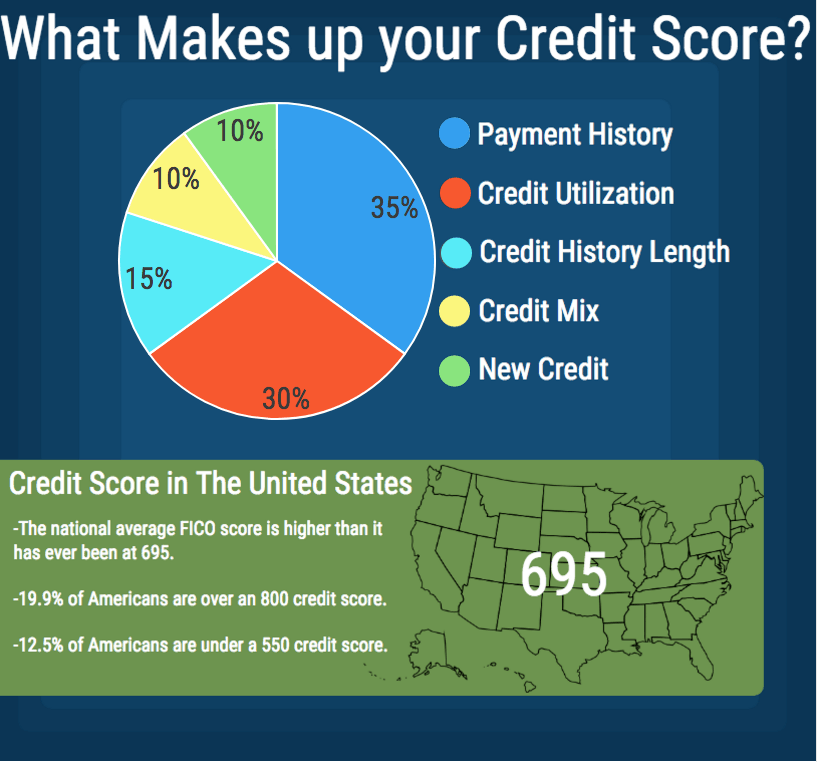

How Is Your Credit Score Calculated

Your credit score could also vary based on which nationwide consumer reporting agency Equifax, TransUnion or Experian provides the data. This is because not all lenders and creditors report to all three agencies. Some report to only one or two, or even none at all. Thanks to all these variables, you have multiple credit reports and credit scores.

Although scoring models vary, they usually consider the following:

Fix Whats Fixable Or At Least Try

Errors on your credit report may hinder progress toward your highest credit score. But you can find these mistakes with a credit report check. If you find any false information in your report, you can try to correct these errors. You can often remedy errors on a credit report with a filed dispute at each of the credit bureaus, Equifax, Experian®, and TransUnion®. Once each bureau validates your claim, they can then remove the false information from your credit report and that can raise your credit score.

So, there are potential methods to help guide you on the path to earning an excellent credit score. Once achieved, staying in that credit echelon could seem like yet another challenge on the horizon. But if you can achieve an excellent credit score, its likely you developed at least some of the best practices for maintaining it as well.

You May Like: How To Check Business Credit Score For Free

Distill Best Practices Into Everyday Habits

To make progress toward credit score perfection, it can help to develop better credit habits. These best practices include paying your bills on time and keeping an eye on your account balances. Lucky for you, Credit Journey could help put these habits into practice. Features like can help raise awareness of your credit status and account changes. This level of keen attention could assist you on the path to earning your best credit score.

Request A Credit Limit Increase

You can directly increase the denominator of your CUR, and thereby lower the ratios value, by increasing your available credit. You can do this without opening a new account if you already have one or more credit cards.

Most credit card companies will seriously evaluate a request for a higher credit limit, but you may have to provide extensive financial information to back your request.

The credit card company may ask for bank statements and tax returns before granting a higher limit. You should expect the creditor to do a hard pull of your credit, which reduces the positive impact of the higher limit, at least in the short run.

Naturally, youll get the biggest CUR improvement by not actually using your additional credit, as explained earlier. A credit card company expects you to use any card it issues to you otherwise, its not worth their effort.

Recommended Reading: Is Your Fico Score Your Credit Score

Dispute Credit Report Errors

A mistake on one of your credit reports could be pulling down your score. Disputing credit report errors can help you quickly improve your credit.

You’re entitled to free reports from each of the three major credit bureaus. Use AnnualCreditReport.com to request them and then check for mistakes, such as payments marked late when you paid on time, someone else’s credit activity mixed with yours, or negative information thats too old to be listed anymore.

Once you’ve identified them, dispute those errors.

Impact: Varies, but could be high if a creditor is reporting that you missed a payment when you didn’t.

Time commitment: Medium to high. It takes some time to request and read your free credit reports, file disputes about errors and track the follow-up. But the process is worthwhile, especially if you’re trying to build your credit ahead of a milestone such as applying for a large loan. If you’re planning to apply for a mortgage, get disputes done with plenty of time to spare.

How fast it could work: Varies. The credit bureaus have 30 days to investigate and respond. Some companies offer to dispute errors and quickly improve your credit, but proceed with caution.

Set Up Automatic Payments

Its easy to forget to pay a bill before the due date. So eliminate the forgetfulness factor by putting your bills on autopay.

Use technology to pay every bill on time, every time, said Bobbi Rebell, a personal finance expert at debt payoff app Tally. We all know that the number one thing to help your credit score is to pay your bills on time, but life happens and things dont always go as planned. It doesnt help that many Americans feel overwhelmed by their credit card balances. If you have credit card debt, take advantage of automation tools to help streamline your financial life.

Also Check: What Credit Score Is Needed To Get A Mortgage

How Long Does It Take To Rebuild Credit

Typically, it takes at least 3-6 months of good credit behavior to see a noticeable change in your credit score. It is difficult to make a change any faster, unless the negative information on your credit report was a minor blip, like being late with bill payments one month.

While it is impossible to put a specific time frame on , it is safe to say the less negative information you have on your report late payments, maxed out credit cards, constant credit applications, bankruptcy, etc. the easier it is to repair your credit score.

It takes more time to repair a bad credit score than it does to build a good one. Mistakes penalize your credit score and can prevent you from being approved for a loan. Though there are lenders that offer loans with bad credit, they end up costing hundreds or thousands of dollars in higher interest rates when borrowing. A poor credit score also can be a roadblock to renting an apartment, setting up utilities, and maybe even getting a job!

You are not going to lose nearly as many points if you are late with one payment as you will if you are delinquent for several months to the point where your account has been turned over to a collection agency. The severity of the second situation is far greater than the first and your score will reflect that.

Here are some time frames for negative information that detracts from your credit score.

Top Ways To Raise Your Credit Score

There are several things you can do in the short-term to try and better your credit score.

Improving your credit utilization will likely have the quickest impact. This could be through paying down debt, upping your credit limit or opening a new credit account. Additionally, there are a couple other things you can do to start your journey to an increased score, including the following:

Also Check: What Impacts Your Credit Score

Pay All Your Bills On Time

On-time payment history is the most important factor when building credit. Your payment history, which is one factor that makes up your FICO score, accounts for 35% of your FICO credit score. This means you should always aim to pay your bills on or before the due date.

Setting up automatic payments is the easiest way to pay bills on time. Youll connect your bank account to the provider, who will automatically charge your account on or before the due date. Creating automatic payments means you wont have to worry about missing a payment, as long as you have enough money in your bank account to cover the bill.

If you choose to not use autopay and realize youve missed a payment, contact the lender or bill provider and rectify it as soon as possible. Only late payments over 30 days are reported to the credit bureaus. The later the payment, the more it will impact your score.

How To Control The Number Of Credit Checks

To control the number of credit checks in your report:

- limit the number of times you apply for credit

- get your quotes from different lenders within a two-week period when shopping around for a car or a mortgage. Your inquiries will be combined and treated as a single inquiry for your credit score.

- apply for credit only when you really need it

Recommended Reading: What Credit Score Do Home Lenders Use

Safe Secure & Trusted By Millions

Your funds are FDIC insured up to $250,000 through The Bancorp Bank or Stride Bank, N.A., Members FDIC and we keep your money safe and secure with periodic security tests of our systems.

- Turn on instant transaction alerts

- Block your card in one tap

- 24/7 live support with a real human

- Secure two-factor and fingerprint authentication

Activating A Credit Card Online

Many issuers may also allow you to activate your card online. Instructions for doing so should be included with your cardeither on the sticker attached to the card or the leaflet information included in the envelope with your card.

Depending on how your specific issuers process works, you may need to provide your card information as well as identifying personal information. Alternatively, the issuer may require you to set up online banking and log into your account before activating. Regardless, prompts should guide you through the process.

Also Check: How To Get My Free Annual Credit Report

Make A Difference As A Business Owner Or Lender

If youre a business owner or lender working with a credit invisible, take a look at other types of data to evaluate the creditworthiness of that consumer.

Perhaps theyve paid back a nontraditional loan, or they own an asset other than a mortgaged home or financed car. If an individual has proved that they are motivated and able to repay loans, they might not actually be a high risk for a loan.

If you collect regular payments directly with consumers, consider if theres a way you can report their payments to credit bureaus, such as through Experian Boost.

These small actions can help connect the dots between responsible consumers and the limited data that filters up to credit bureaus.

Leave Old Accounts Open

Once you finally get rid of student debt or pay off your auto loan, you may be impatient to get any trace of it wiped from your report.

But as long as your payments were timely and complete, those debt records may actually help your credit score. The same is true for your credit card accounts.

An account thats paid in full is a good thing however, closing an account isnt something that consumers should automatically do in the hopes that it will positively impact their credit score, says Nancy Bistritz-Balkan, vice president of communications and consumer education at Equifax. Having an account with a long history and solid track record of paying bills on time, every time, are the types of responsible habits lenders and creditors look for.

Closing a credit card account can actually lower your credit score, as you will now have a lower maximum credit limit. If youre still carrying balances on other cards or loans, your utilization ratio will go up. Youre better off keeping the card with a $0 balance.

Any bad debts that can impact your score negatively are automatically removed over time. According to Ulzheimer, bankruptcies can stay on your credit report for no longer than 10 years, while late payments and delinquencies such as collections, repossessions, foreclosures and settlements stay on your report for seven years.

Don’t Miss: Why Is It Important To Check Your Credit Report

Request A Credit Freeze From The Credit Bureaus

Contacting each credit bureau to request a credit freeze will flag the account and prevent new lines of credit from being opened by identity thieves. It can be done online or over the phone.

If you decide to do it over the phone, its a good idea to ask any questions you may have about the more formal step of informing the credit bureau of the death.

Heres how to contact each credit bureau online to request the credit freeze:

Heres where you can mail the death certificate to each credit bureau:

- Experians Consumer Assistance Center, P.O. Box 4500, Allen, TX 75013. You can also upload the death certificate online.

- TransUnion, P.O. Box 2000, Chester, PA 19016

- Equifax Information Services LLC, P.O. Box 105139, Atlanta, GA 30348-5139

How To Improve Your Credit Score To Land A Mortgage For Your First Home

Wondering how to improve your credit score? Sure, its easy to fall in love with the idea of buying a home. Youve got it all planned out: a five-bedroom home in your favorite neighborhood with a manicured lawn andwhy not?a nice pool.

But if youre going to get a mortgage , youll likely need to improve your , also called a FICO scorea simplified calculation of your history of paying back debts and making regular payments on loans. If youre borrowing money to buy a home, lenders want to know youll pay them back in a timely manner, and a credit score is an easy estimate of those odds.

Heres your crash course on this all-important little number, and how to whip it into the best home-buying shape possible.

Don’t Miss: Is Fico Score Credit Score

Open A New Credit Card

Approach this method with caution. Having your own credit card is an exciting, but equally daunting prospect. There were347 million credit card accounts opened in 2019 alone.

Some people, especially those who are new to handling credit responsibility, can find it difficult to withhold from racking up debt. An excellent strategy for ensuring you dont get carried away is watching your credit utilization, or your credit-to-debt ratio, which can be calculated by dividing how much youve spent by how much youve been given. As a general rule of thumb, it is best to keep this number below 30%.

If your credit score is currently suffering because youre not in a financial position to pay off your debt and lower your credit utilization in the near future, an alternative option could be opening a new credit card. This would give you more credit, and assuming you dont put any more money on the new card, your overall utilization would drop.

Opening a new card might also help you save on fees and interest. Many credit cards charge an annual fee in addition to an Annual Percentage Rate , which is the interest rate youll have to pay on any outstanding debt after each billing cycle. Oftentimes, you can open a new card with a different issuer and bargain for a lower APR, then transfer your balance from one card to another so that youre not racking up interest. Some issuers will promote 0% APR on balance transfers for around 13 months.

Consider Consolidating Your Debts

If you have a number of outstanding debts, it could be to your advantage to take out a debt consolidation loan from a bank or credit union and pay off all of them. Then youll just have one payment to deal with, and if youre able to get a lower interest rate on the loan, youll be in a position to pay down your debt faster. That can improve your credit utilization ratio and, in turn, your credit score.

A similar tactic is to consolidate multiple credit card balances by paying them off with a balance transfer credit card. Such cards often have a promotional period when they charge 0% interest on your balance. But beware of balance transfer fees, which can cost you 3%5% of the amount of your transfer.

Read Also: How To Calculate Credit Score From Report

Can You Raise Your Credit Score By 100 Points In 30 Days

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It may not have been reviewed, approved or otherwise endorsed by the credit card issuer. This site may be compensated through a credit card issuer partnership.

Your credit score affects everything from the interest rate youll pay on an auto loan to whether youll be hired for certain jobs, so its understandable if youre wondering how to raise your credit score quickly.

While there are no shortcuts for building up a solid credit history and score, there are some steps you can take that can provide you with a quick boost in a short amount of time. In fact, some consumers may even see their credit scores rise as much as 100 points in 30 days.

Learn more:

Protect Your Personal Information To Avoid Fraud

Your credit can be affected by identity theft if fraudsters access your personal information to open accounts in your name. To help keep your data safe, use a password manager to create and store unique passwords and avoid making financial transactions on public Wi-Fi networks, which could be vulnerable to hackers.

Don’t Miss: Do Lending Club Loans Go On Your Credit Report

Apply For A Better Credit Card

Youâve managed your bank account responsibly, paid all your bills on time every month and used a credit builder card to build up your credit score. Now, itâs time to start reaping some of the benefits of your hard work.

Once youâve built up your credit score to a certain level, youâll have a greater chance of qualifying for a better . Aside from a lower interest rate and a higher credit limit, a new credit card could also give you the following:

Of course, you still need to approach with caution, as otherwise you may do more harm than good. In particular, you should:

-

Check your eligibility using ClearScoreâs eligibility checker before applying.

-

Avoid making several applications in a short period, as this could negatively affect the credit score youâve worked so hard to build.

-

Try not to use more than 50% of your credit limit and always pay what you owe on time.