What Has The Most Negative Impact On Your Credit

Just as paying on time can help your credit score, paying bills late can be extremely detrimental to your credit score. Usually, a payment is late after it is 30 days past due. A late payment will stay on your credit report for up to seven years. It will negatively impact your credit score during that time.

The later your payment, the more it can impact your credit score. If you are worried about making a payment on time, the best bet is to contact your creditor or lender immediately and see what options they might offer. Additionally, bankruptcies can cause a huge drop in your credit score depending on the type of bankruptcy, it can stay on your credit report for up to 10 years. Its important to understand all the implications of bankruptcy before you file since the financial and credit implications are far-reaching.

Keeping high balances on your credit cards is also something that will negatively impact your credit score. This is known as high credit utilization. It may lead lenders to determine that you arent able to take on more credit because they see you as a higher risk to default or miss payments.

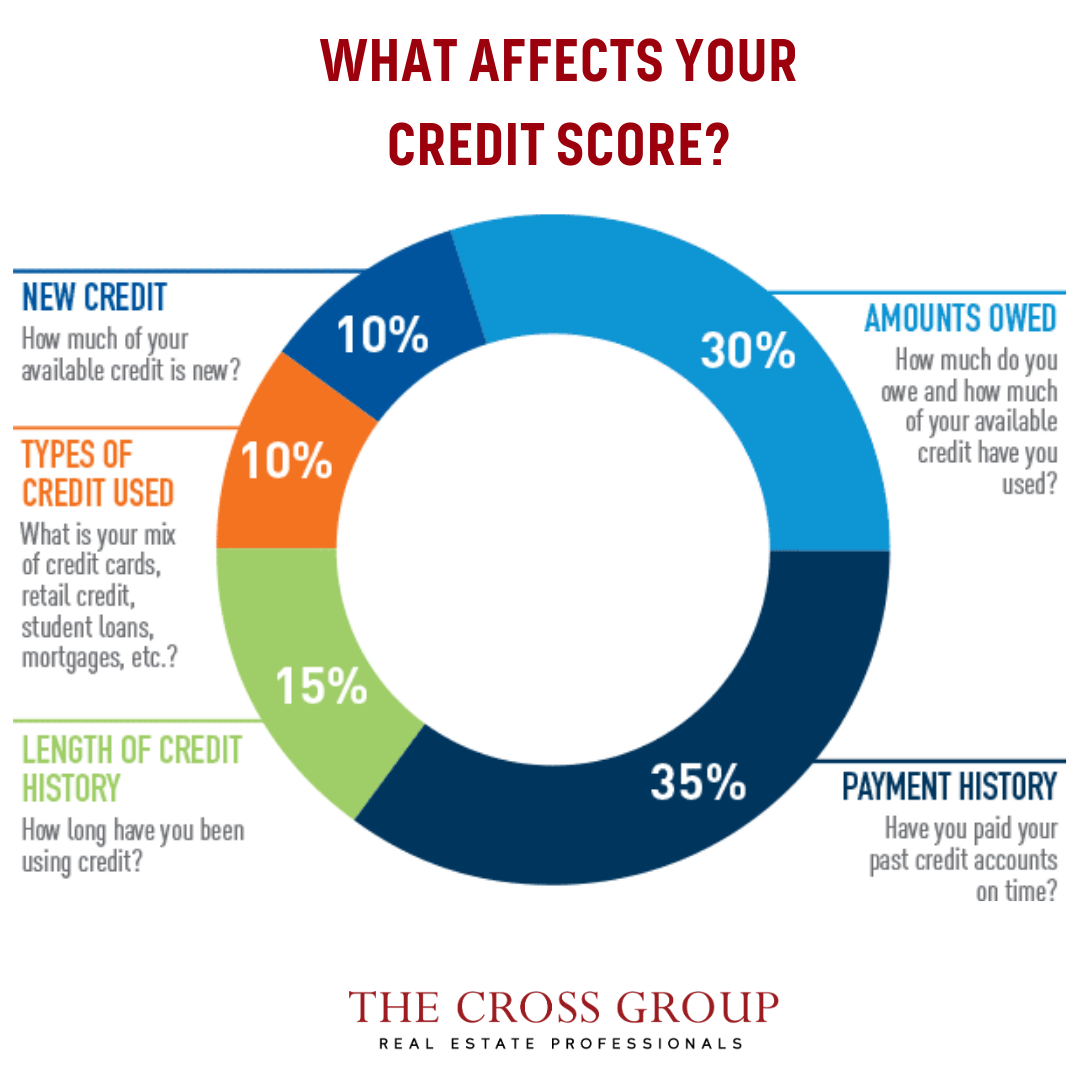

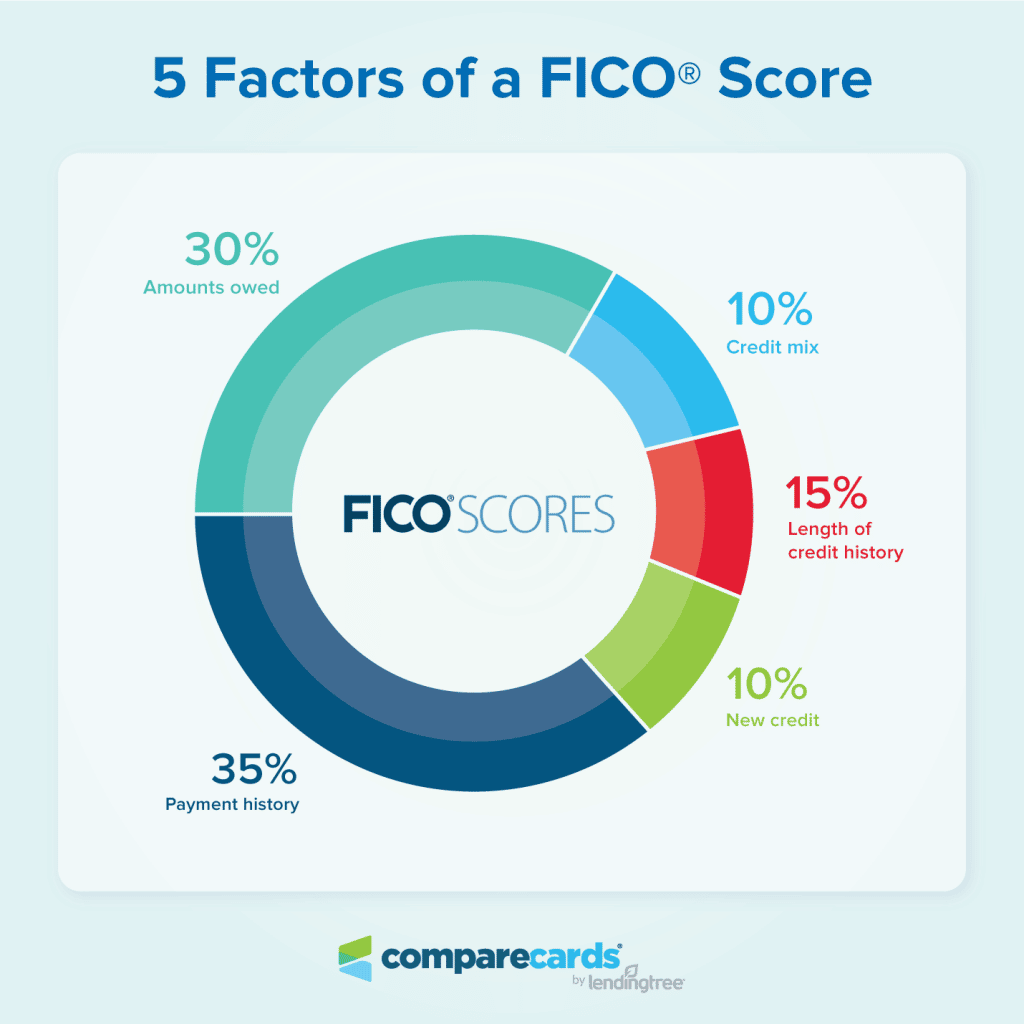

The Five Pieces Of Your Credit Score

Your credit score is based on the following five factors:

Ultimately, one way to potentially improve improve your credit score is to use loans and credit cards responsibly and make prompt payments. The more your credit history shows may be able to responsibly handle credit, the more willing lenders will be to offer you credit at a competitive rate.

Did you know? Wells Fargo offers eligible customers free access to their FICO® Score plus tools, tips, and much more. Learn how to access your FICO Score.

How Influential Are Total Balances And Debt

This is a moderately influential categorynot weighed as heavily as Category #2 and Category #3, and definitely not as much as Category #1.

If you have a substantial amount of debt, theres a greater likelihood that youll be unable to take on new debt. Thats why higher debt negatively affects your credit score.

But large amounts of debt are not always an indicator that repayment is less likelyand thats why this category is not weighed as heavily as the prior categories.

Someone could have a substantial amount of debt to repay, but if that person consistently makes payments on timeand over a moderate span of timeit may suggest that person is quite capable of prompt repayment.

Credit reporting agencies do not take a persons income into account when determining that persons credit score. Someone with a substantial amount of debt might also have a high income, and thus be very capable of making prompt payments. For that reason, too, this category is not weighed as heavily as the prior ones.

Don’t Miss: How Are Account Numbers Displayed In A Credit Report

What Are The Negative Items That Impact Your Credit Score

Banks Editorial Team

Banks Editorial Team

Do you know what the negative items that impact your credit score are? Is a problem with your credit report costing you? It could be, according to credit repair firm Lexington Law. Negative listings on your credit report could prevent you from getting loans or credit cards, or it could mean that you pay higher interest rates to borrow money. Your insurance company could be using information from your credit report to set the price of your premiums.

Other Credit Score Factors You Should Know About

Once youve mastered paying on time and keeping credit utilization low, turn your attention to other credit factors. These also affect your scores, though not nearly as much:

The length of time youve had credit: Longer is better, so keep old accounts open unless there is a compelling reason to close them, such as an annual fee on a card you no longer use. You might be able to help yourself a little in this category by becoming an authorized user on an old account with an excellent payment record.

The kinds of credit you have, or credit mix: It’s best to have a mix of installment accounts those with a set number of equal payments, such as car payments or mortgages and .

The length of time since you’ve applied for new credit: Each application that causes a hard inquiry on your credit may take a few points off your score.

Total balances and debt: Its best if you’re making progress in paying off your debt.

Read Also: How To Get Old Delinquencies Off Credit Report

Why Do Credit Inquiries Matter

When you apply for a credit card, begin shopping for a loan or prepare to take on a new financial responsibility, like renting an apartment, the lenders and companies involved want to know whether youre likely to be a financial risk. By conducting an inquiry into your credit history, these companies are able to assess your level of financial responsibility and the likelihood that you might default on your loan, miss credit card payments or skip out on the rent.

There are two different types of credit inquiries: hard inquiries, which can have a negative effect on your credit score, and soft inquiries, which dont affect your score at all.

S To Take To Improve Your Credit Score

Knowing that credit can impact so many aspects of your life, you may want to take an active approach to monitoring and improving your credit score. Even if youve made mistakes in the past, you can follow these basic credit improvement tips and work your way toward good credit.

Don’t Miss: Why Did My Credit Score Go Up

The Impact Of Negative Items On Your Credit Score

When you fail to make payments on time or have debt settlements or foreclosures on your record, that takes points off your score Fair Isaac calls them damage points. The better your credit score, the more of a hit you take when you incur damage points. That means that one missed payment could drop your score by as much as 110 points, according to credit bureau Equifax. Even a hard inquiry on your report, such as occurs when you apply for new credit, can drop your score 15 points enough to put you down into a lower tier. These are some of the negative items that impact your credit score.

Types Of Accounts That Impact Credit Scores

Typically, credit files contain information about two types of debt: installment loans and revolving credit. Because revolving and installment accounts keep a record of your debt and payment history, they are important for calculating your credit scores.

- Installment credit usually comprises loans where you borrow a fixed amount and agree to make a monthly payment toward the overall balance until the loan is paid off. Student loans, personal loans, and mortgages are examples of installment accounts.

- Revolving credit is typically associated with credit cards but can also include some types of home equity loans. With revolving credit accounts, you have a credit limit and make at least minimum monthly payments according to how much credit you use. Revolving credit can fluctuate and doesn’t typically have a fixed term.

Don’t Miss: How To Get Student Loans Off Credit Report

Length Of Credit History: 15%

Your credit score also takes into account how long you have been using credit. For how many years have you had obligations? How old is your oldest account and what is the average age of all your accounts?

Long is helpful , but a short history can be fine too as long as you’ve made your payments on time and don’t owe too much.

This is why personal finance experts always recommend leaving credit card accounts open, even if you dont use them anymore. The accounts age by itself will help boost your score. Close your oldest account and you could see your overall score decline.

Top 5 Factors That Affect Your Credit Score

Your credit score is the key metric that sums up your credit health, yet many people dont realize they couldve improved their score until they feel like its too late when they learn that they didnt qualify for the loan or are denied other services based on their credit score.

But its never too late understanding the top factors affecting your credit score is one of the first steps that will help you create an actionable plan to maintain or improve your score and unlock more opportunities. To see your individual score and where you stand on each of these factors, check out .

Approximately 220 million consumers have credit files in the United States and around 36 billion pieces of credit data in total are recorded every year thats an average of 15 changes to each consumers credit file every month!1 Monitoring your credit changes is important to maintaining strong credit health or improving it, however, not all of these changes and updates to your credit report affect your credit score equally.

You can have multiple credit scores that are slightly different because there are multiple credit bureaus, different scoring methodologies, and your credit information is often updated at different times. Dont worry about tracking every credit score. Instead, keep track of the bigger picture by understanding the breakdown of factors that impact your credit score and how theyre each generally weighted.

Read Also: How Long To Raise Credit Score 100 Points

Length Of Credit History

In general, having a longer credit history is positive for your FICO Scores, but is not required for a good credit score.

Your FICO Scores take into account:

- How long your credit accounts have been established, including the age of your oldest account, the age of your newest account and an average age of all your accounts

- How long specific credit accounts have been established

- How long it has been since you used certain accounts

Good Credit Puts Money In Your Pocket

Good credit management leads to higher credit scores, which in turn lowers your cost to borrow. Living within your means, using debt wisely and paying all billsincluding credit card minimum paymentson time, every time are smart financial moves. They help improve your credit score, reduce the amount you pay for the money you borrow and put more money in your pocket to save and invest.

1 Scores and rates as of January 9, 2015, as reported on myFICO website.

Recommended Reading: How To Dispute A Charge Off On Credit Report

Types Of Credit On Your Report

Two basic types of credit accounts exist, revolving accounts and installment loans. Having both types of accounts on your credit report is better for your credit score because it indicates you have experience managing various types of credit.

It’s even better if you have loans for different types of assets, such as a car or a home, in addition to credit cards, and maybe a student or personal loan. However, the types of credit only constitute 10% of your credit score, so not having a certain type of credit, such as an installment loan, won’t devastate your score.

The 3 Main Factors Affecting Your Credit Score

You may think that the most important number in your financial life is how much money you make or how much you have in the bank. But a number that actually plays an important role in whether you can borrow money and the interest rate you will pay is your credit score. Unfortunately, there is a lot of misinformation out there about what affects your credit score. Well set the record straight and explain the three main factors affecting your credit score.

Recommended Reading: Do Credit Checks Affect Your Credit Score

What Makes Up Your Credit Score

For example, your bank account balance doesnt appear on your credit report. Neither does your income or your net worth. None of these factors play a role when a scoring model calculates your credit score.

Factors that do impact your FICO Score fall into one of the following five categories.

- Payment History: 35%

- Length of Credit History: 15%

- New Credit: 10%

In each category, a scoring model will ask questions about your credit report. For example, Does the report show any late payments? These questions are known as characteristics in the credit scoring world. The answers to these questions, called variables, determine the number of points you earn. When the scoring software adds all of those points together, you get your credit score.

Related: Understand The 5 Cs Of Credit Before Applying For A Loan

Recent Changes To What Impacts Your Credit

There were some changes to credit reporting and scores over the last couple years that are positive for consumers. These may have positively impacted your credit score. These updates include:

- Tax liens are no longer included on your credit as of April 16, 2018. They dont impact your credit score anymore.

- Medical collections dont impact your credit as much as they previously did.

- A new credit score called the UltraFICOTM Score was introduced in October 2018 by Experian, FICO, and Finicity. This new score will take into account other factors like how you manage your banking accounts. It is supposed to launch in early 2019.

- Experian also announced a new product in December 2018 called Experian Boost, which allows consumers to get credit for on-time mobile phone and utility payments.

You May Like: What’s A Low Credit Score

How Are Credit Scores Created

Our FICO Score vs Credit Score article also explores the five factors of how a credit score is defined, including:

-

Number of Accounts

Lenders and creditors want to know how many types of accounts you have, to determine if youre able to successfully manage said accounts. If you have multiple credit accounts that are maxed out, for example, your credit score will more than likely be affected.

-

Types of Accounts

A credit score takes into consideration the different types of accounts you have in relation to revolving debt and installment loans .

Lenders check to see if youre staying within your credit limit means, which would demonstrate responsible behavior. Your available is the amount of your limit you can still use for purchases.

-

Length of Credit History

The length of your credit history demonstrates how long different accounts have been active. Credit score calculations are indicators of how long your oldest and most recent accounts have been open.

-

Payment History

An individuals payment history reveals a lot about a persons creditworthiness. Such history, for example, may include credit card utilization, retail department store accounts, auto loans, student loans, or mortgages. How long it took you to repay these loans would affect your current credit score.

Also Check: How To Remove Negative Items Off Credit Report

Does Paying Off Credit Card Debt Raise Your Credit Score

You may be able to improve your credit score if you pay off a large chunk of your credit card balances. Even if you don’t reduce your aggregate utilization rate down to less than 30%, getting it down to as close to that as possible will have a positive impact. Any effort to pay off more than the minimum payment on your cards each month might result in an incremental improvement of your credit score as long as you’re doing all the other things that positively impact your score, like paying bills on time.

Read Also: How To Add Positive Accounts To Your Credit Report

Securing Better Interest Rates On Loans And Credit Cards

Banks, lenders and credit card issuers will also check your credit before approving your application. If youre approved, your loan or credit cards interest rate is partially based on your credit score. The higher your score, the more likely you are to get approved and receive a low rate. However, other factors, such as your income, outstanding debt and history with the creditor can also impact your rate.

While many lenders often use specific FICO credit scores, other lenders may use one or several scores. For example, a large lender might review your credit report and then use a proprietary scoring model to create a credit score based on that report. Creditors may use their proprietary scores along with, or instead of, the generic credit scores from FICO or VantageScore.

Reduce Your Credit Utilization Rate

Lowering your utilization rate could be one of the quickest ways to improve your credit scores the lower the better. You can calculate your utilization by dividing your credit card balance by the cards limit. Or, if you have multiple cards, add up the balances and credit limits and then divide the total balance by the total limit.

You could also have high utilization because youre carrying a credit card balance. If you cant afford to pay down the balance right now but you have okay credit, you could try to consolidate your credit card debt with a personal loan. Utilization only looks at revolving debt, so using an installment loan to pay off revolving credit cards can lower your utilization rate.

Don’t Miss: How To Fix Your Credit Score Fast

How Your Credit Score Affects You

Suppose you want to borrow $200,000 in the form of a fixed rate thirty-year mortgage. If your credit score is in the highest category, 760-850, a lender might charge you 3.307 percent interest for the loan.1 This means a monthly payment of $877. If, however, your credit score is in a lower range, 620-639 for example, lenders might charge you 4.869 percent that would result in a $1,061 monthly payment. Although quite respectable, the lower credit score would cost you $184 a month more for your mortgage. Over the life of the loan, you would be paying $66,343 more than if you had the best credit score. Think about what you could do with that extra $184 per month.