How To Improve Your 620 Credit Score

Think of your FICO® Score of 620 as a springboard to higher scores. Raising your credit score is a gradual process, but it’s one you can begin right away.

78% of U.S. consumers’ FICO® Scores are higher than 620.

You share a 620 FICO® Score with tens of thousands of other Americans, but none of them has that score for quite the same reasons you do. For insights into the specific causes of your score, and ideas on how to improve it, get copies of your and check your FICO® Score. Included with the score, you will find score-improvement suggestions based on your unique credit history. If you use those guidelines to adopt better credit habits, your score may begin to increase, bringing better credit opportunities.

Strategies To Build Your Credit In The Long Run

You should also look into methods for building your credit in a sustainable way over time. The methods listed above are great for removing negative marks that are artificially lowering your score, but theres more to achieving a healthy credit score than that.

Try to:

- Use your credit accounts regularly and responsibly to add positive information to your credit reports. If you dont have any credit accounts, you may want to look for ones that are targeted at people who are trying to build credit, such as secured credit cards and . However, your score is good enough that you can also get a normal credit card or loan if you prefer.

- Practice good credit habits in the future. Use your credit in moderation and pay off your credit cards in full each month before your due date.

- Do your best to get out of debt. Theres no easier way to tank your score than to let your debts spiral out of control.

- Add alternative data to your credit report with Experian Boost or a third-party service that reports your rental payments, such as PayYourRent or eCredable.

Boost your credit for FREE with the bills you’re already paying

5.0/5

No credit card required. Results may vary, see website for details.

Boost your credit for FREE with the bills you’re already paying

- Experian Credit Report and FICO® Score updated every 30 days on sign in

- Instantly increase your credit scores for FREE with Experian Boost

- Daily Experian credit monitoring and alerts

Blue Cash Preferred Card From American Express

Earn up to 6% cash back on everyday expenses with the Blue Cash Preferred® Card. Right now, the card offers 6% cash back on groceries and streaming services, 3% cash back on transportation expenses and gas and 1% cash back on other purchases. Along with that, the card has an intro APR of 0% for the first 12 months and users can earn a $300 statement credit if they spend $3,000 in purchases in the first 6 months. After the first year, users must pay an annual fee of $95. To get this credit card, youll need to have a credit score of about 700 or higher.

Also Check: What Is My True Credit Score

Be In It For The Long Haul

Using these strategies will help improve your credit score, but it will take about three to six months to start seeing results. What Can You Do With a 620 Credit Score? This is because missed payments will stay on your credit report for three to five years. Without a successful dispute of a negative item on your report, those blemishes are not easily erased.

Boosting Your Credit Score

If you have bad credit but are a first-time home buyer, start maximizing your score before you begin house hunting. Check your credit score so you know where you stand, review your credit history to make sure its accurate and remember to consistently pay your bills on time. You can check your credit score for free with our tool if youre a current U.S. Bank customer.

When lenders see multiple applications for credit reported in a short period of time, it can discourage them from giving you a loan. So heres a short list of things to try to avoid when applying for a mortgage so that you can keep your options open.

- Avoid opening new credit cards.

- Avoid closing credit cards .

- Avoid applying for new loans.

- Avoid co-signing on any new loans.

Looking for more ways to improve your credit score? Here are some .

You dont have to have a top credit score to get a mortgage, but it will help you compete for the house you want by potentially giving you more financing options. So, take steps to try to boost your credit, avoid applying for credit products at the same time youre house hunting and talk over your options with a mortgage loan officer who can help.

Connect with us to make homeownership a reality.

An experienced mortgage loan officer is just a phone call or email away, with answers for just about any home-buying question.

Recommended Reading: Is 680 A Bad Credit Score

Open A Secured Credit Card

If you dont qualify for unsecured credit cards, then a secured card could be the way to go. Secured credit cards are backed by a cash deposit, so even borrowers with poor credit scores can get one. Through this card, youll be able to improve your credit score by proving your creditworthiness with on-time payments.

Life With A 620 Credit Score

Unless your low credit score is a mistake caused by major errors on your credit report, you might remain in the fair range for at least the next few months.

Until your score improves, avoid taking out any unnecessary loans to ensure that you wont sabotage your progress by accumulating debt that you cant pay off.

Also Check: Where Is My Credit Score On Transunion Credit Report

Can I Get A Personal Loan With Fair Credit

Personal loans for a 600 or 620 credit score or above are certainly possible to get. Many lenders do offer loans to borrowers with fair credit, but there are some things you should know. You may have to pay a higher interest rate than a borrower who has good credit. This will make the cost of your loan higher. You may have to make a complete loan application and provide details of your income, employment, and assets. You may need to secure the loan with an asset you have if you want a lower rate. To determine exactly what you will need to do, you should check offers and get pre-qualified.

Credit Score: Good Or Bad

At a glance

620 is a below-average credit score, but its approaching the good range. Its considered fair by every major credit scoring model. Scores in this range are high enough to get some types of credit, but you wont qualify for the best interest rates. Well explain what financing you can get with a score of 620 and what you can do to improve your credit score.

Get all 3 credit reports and FICO score monitoring, or book a FREE 5-minute credit repair consultation.

Fresh advice you can trust

We promise to always deliver the best financial advice that we can. That’s our first priority, and we take it seriously. Our writers and editors follow strict editorial standards and operate independently from our advertisers and affiliates. Learn more about how we make money.

Read Also: How To Remove A Closed Account From Your Credit Report

Improve Your Payment History

The most effective way to improve your credit score is to establish a positive history of payment.While a credit score is based on several criteria, your payment history is one of the primary factors, accounting for as much 35 percent of your credit score. 620 Credit Score

When you pay consistently and promptly over time, and pay off your balances as soon as possible, your credit score will improve.

Can You Get A Loan With A 620 Credit Score

Youre right on the edge of being approved for several types of loans with a 620 credit score, and for many types, your approval odds are high. However, youll likely face steep APR, deposit requirements and income requirements due to your fair credit score. Heres a closer look at your eligibility for loans and credit cards.

Also Check: How Do You Dispute Hard Inquiries On Your Credit Report

Getting A Credit Account With A 620 Credit Score

With a credit score of 620, youll be able to get a credit card, but you might not have a lot of options other than subprime credit cards, and you wont be able to get rates as good as those offered to people in higher credit score ranges.

The types of credit cards you can get with a credit score of 620 generally fall into two categories:

- Secured credit cards: With these cards, creditors mitigate their risk by requiring you to pay a security deposit, which theyll keep if you default on your debt.

- Unsecured cards with high interest rates: With these, creditors compensate for the lack of a security deposit by charging very high interest rates and additional fees .

Given the choice between those two options, a secured credit card is always your best bet if your main goal is to build your credit. Unsecured subprime credit cards can be dangerous because their high interest rates and fees might jeopardize your finances.

Dont apply for a credit card if you know your credit score doesnt meet the companys requirements. Most applications will trigger a hard inquiry, which will cause your score to temporarily drop. To find out if the card issuer has a minimum credit score, check their website or give them a call.

Takeaway: A 620 credit score is below average, but its not far off from a good credit score.

Additional Credit Scores

How To Improve A 620 Credit Score

Work on removing all negative accounts such as collections, charge-offs, medical bills, bankruptcies, et al.

Remove as many excess hard inquiries as you can. Get your revolving utilization as low as you can . Ensure you have a good credit mix of installment loans and revolving accounts.

Last but not least, make sure you have at least two revolving accounts older than 2 years

We recommend taking a look at Credit Glory. Give them a call

It’s generally much faster if you worked with Credit Glory, and they happen to have incredible customer service.

Read Also: Do Balance Transfers Hurt Your Credit Score

Have Your Rent Payments Reported To The Credit Bureaus

If you dont own a home, but want to demonstrate your ability to make timely payments each month, ask your landlord to report your rent payment history to the three credit bureaus . 620 Credit Score

This may involve an extra fee, but it can have a significant effect on your score. A positive history of making consistent, on-time payments such as rent makes up more than 30 percent of your credit score.

What Credit Card Can I Get With A 620 Credit Score

You might have a hard time getting approved for a credit card with poor credit scores.

The good news is, Credit Karma can help. You can log in to your account to see your personalized Approval Odds for a number of different credit cards. While your Credit Karma Approval Odds arent a guarantee that youll be approved for a particular card, they can help you find a credit card that matches your current credit profile.

Here are some common options you may come across.

You May Like: What Happens To Your Credit Score When You Get Married

A 620 Credit Score Can Be A Sign Of Past Credit Difficulties Or A Lack Of Credit History Whether Youre Looking For A Personal Loan A Mortgage Or A Credit Card Credit Scores In This Range Can Make It Challenging To Get Approved For Unsecured Credit Which Doesnt Require Collateral Or A Security Deposit

| Percentage of generation with 300639 credit scores |

|---|

| Generation |

| 27.3% |

Poor score range identified based on 2021 Credit Karma data.

Your credit scores are numbers calculated by credit bureaus, like FICO and VantageScore. Lenders use scores as at-a-glance information to help decide how risky they think you might be to lend to.

If your credit history includes signs of past credit challenges, such as late or discharged payments or accounts in collections, or little to no credit at all, you may find it more difficult to be approved for new credit. And if you are approved, you may find that approval comes with high rates and fees.

Building your credit scores can help. That said, theres no specific credit score that will guarantee approval or better terms or offers. Not only do you have multiple credit scores that are calculated using data from several possible , but its not always clear which score a lender might choose to check or what its criteria might be for approval.

We recommend thinking of your credit scores as a gauge to help you understand what lenders see when they check your credit. Understanding the factors that go into your scores can help you learn which ones to focus on to improve your overall credit picture in lenders eyes.

Heres what you need to know about building your credit and how to navigate credit applications in the meantime.

| 7.3 |

Ranges identified based on 2021 Credit Karma data.

How To Increase Your Credit Score

Now that you know a little bit more about credit scores, you might be motivated to increase yours. Luckily, there are many ways that you can work to improve your score. Dont be discouraged if youre unable to increase your credit score overnight. It will take some time, but it will happen with intentional steps.

You May Like: How Long Does Information Stay On Credit Report

Also Check: How Long Do Charge Offs Stay On Credit Report

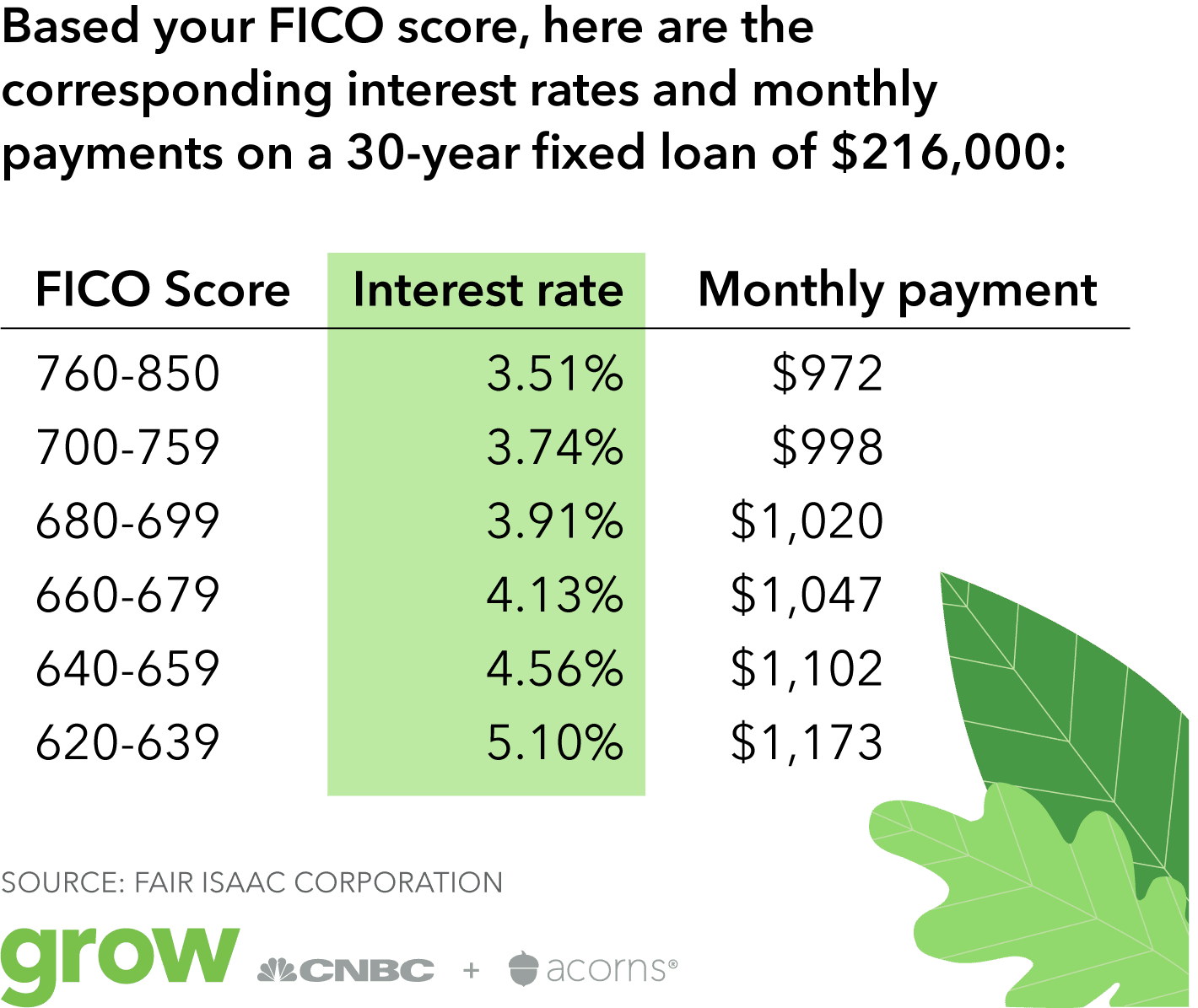

What Credit Score Is Needed To Buy A House In 2022

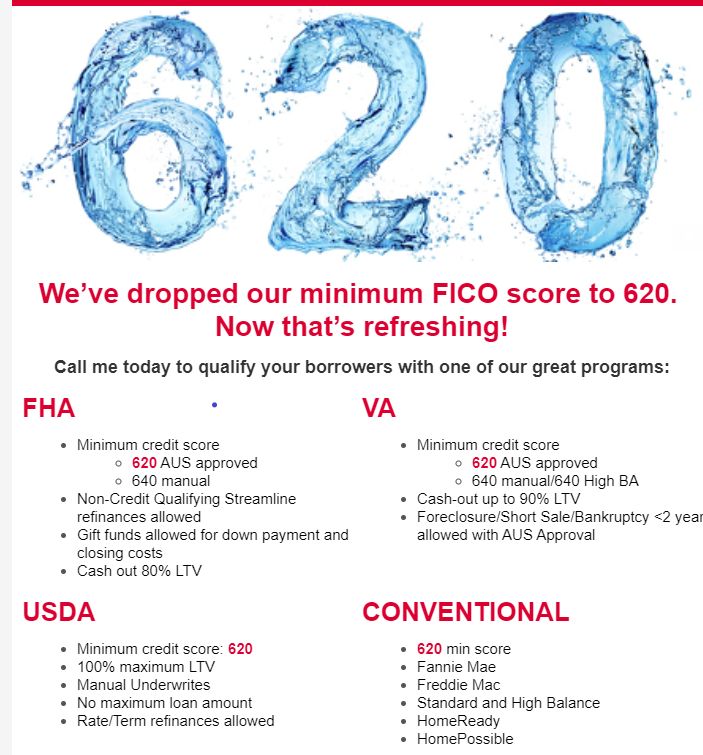

You need at least a 620 credit score to buy a house with a conventional loan in 2022. But, youll find that there are several other loan types that have much lower requirements.

Many first-time home buyers worry that their credit scores are too low to buy a home. First, know that whether your credit score is good or bad is subjective and wont affect your home-buying. Second, mortgage lenders are bound by specific rules which determine what credit scores you need to buy a house, and those rules vary by your loan type.

Conventional loans are the most common loan type. On the credit score scale, which ranges from 350-850, conventional loans require a credit score of at least 620. Other loan types allow for lower credit score minimums, and some mortgage programs have no credit score requirement whatsoever.

Heres what credit score you need to buy a house.

Lower Your Credit Utilization Rate

A high ratio of debt to credit can negatively affect your credit score. You can either pay off this debt or apply for a credit increase to reduce your utilization rate. Another way to do this is by paying your credit cards off early each month so that your posted balance is lower than your spending for the month.

You May Like: What Affects Credit Score Negatively

Is A 620 Credit Score Bad Credit

This is the most commonquestion I get for any credit score, Is it considered bad credit? I have toassume that the definition of bad credit is that you cant get the money youneed at an interest rate you can afford.

The short answer is, yes a 620 credit score is bad credittechnically.

Thats because its under the cutoff for what most banks or credit unions will accept on a loan application. When you are approved for a loan, its going to be for very high interest rates and payments you might not be able to afford.

But instead of thinkingin terms of bad or good credit, try thinking about it in terms of score ranges.A 620 credit score is in the range of Fair in the graphic below, not as badas the many people with a sub-600credit score but still some room for improvement to get better rates.

Your goal here, and this is something well work on later in the article, is to get your score into that next range above a 650 or 670 FICO. Thats going to open up a world of opportunities for loans and financial tools.

How Long Of A Personal Loan Term Can I Get With A 620 Credit Score

While each lender sets their own loan terms, credit score requirements, and loan thresholds, consumers can generally expect to see personal loan offers with repayment terms ranging from between 1-7 years.

Online lenders willing to work with applicants with a 620 credit score include Best Egg, Prosper, Upgrade, Axos Bank, OneMain Financial, and LendingPoint. The average loan term offered by these lenders is 3-5 years, although some longer and shorter loan terms are available. For example, Upgrade offers loan terms of up to 7 years and Axos Bank offers personal loans with repayment periods as short as 1 year. Youll want to shop around and compare loan terms and loan offers from various lenders before deciding to sign on the dotted line. At Acorn Finance, you can check personal loan offers from these top lenders with more, all with no impact on your credit score.

There are advantages and disadvantages to choosing a longer loan term, and the decision is largely up to you. Some consumers prefer shorter loan terms to get out of debt faster and pay less interest, while others like to use a longer repayment period in order to have a smaller monthly payment.

You May Like: Does Credit Karma Lower Score