Amazon Shop Cards Are The Best For Establishing Credit

Any credit card can help you develop credit if you use it wisely and make your monthly payments on time. You may have to look at other possibilities if your credit score isnt high enough to qualify for a specific credit card.

Because they have fewer restrictions than many other credit cards, store cards tend to be easier to qualify for. In other words, Amazon store cards are a better option for developing credit than Amazon Visa cards because you dont need an exceptional or decent credit score to get approved.

A FICO score of at least 580 is usually sufficient for obtaining a retail credit card if you have only fair credit. At least a 670 FICO Score is required to be eligible for one of the Amazon Rewards Visa cards.

Why Should I Check My Credit Score And Credit Report

It will help you to ensure that your credit score and credit report is accurate and up to date. This will allow you to check the likelihood of being accepted for credit in the future.

Another reason for you to check your credit score is to know if it dips, or if credit agencies have made an error while calculating your score. This will help you make timely amends.

What Credit Score Do You Need For Amazon Rewards Card

As a traditional credit card, youll likely need a of at least 660 to be approved for the Amazon.ca Rewards Mastercard. Note that your credit score takes a hit of 10 points when you apply.

Besides the credit score, you only need to be a resident of Canada and the age of majority in the province or territory where you live. Getting approved is easy, so it could be handy for people who are looking to maximize their rewards.

You May Like: Is 733 A Good Credit Score

Alternate Pick: Ink Business Preferred Credit Card

The Ink Business Preferred® Credit Card may be a solid alternative to the Amazon Business American Express Card*, offering a strong rewards rate on areas many businesses are likely to find appealing. Earn 3 points per dollar on the first $150,000 spent on travel and select business categories each account anniversary year. Earn 1 point per dollar on all other purchases. It also comes with an annual fee of $95 but that may be balanced out by the flexibility of your earnings.

Rewards earned are Chase Ultimate Rewards points which can be redeemed for cash back at 1 cent per point or redeemed for 25% more value when used to book travel through the Chase Travel Center. You can also use your rewards to , but that yields a lesser value of around 0.8 cents per point.

Is The Card For You

This card makes absolute sense for you if you are an Amazon Prime Member and/or Whole Foods enthusiast. While other cards such as the Discover it or Chase Freedom may offer cash back category bonuses on groceries or quarterly bonuses on Amazon purchases, its hard to find a card that offers a higher return rate on both.

Chances are that if you shop Amazon frequently, you already pay the $119 Amazon Prime membership fee so the card effectively has no annual fee. That said, dont hold a balance on this card as it charges a higher interest rate than many other cards available. If you do need to carry a balance on your card, consider a card thats best for 0% APReither on purchases or on balance transfers. As long as you pay your bill in full every month, you will come out ahead with the Amazon Prime Rewards card.

To view rates and fees of the Blue Cash Preferred® Card from American Express, please visitthis page.

To view rates and fees of the American Express® Gold Card, please visitthis page.

Read Also: Paypal Credit Hard Pull

Don’t Miss: How To Know Credit Score

What Are The Benefits Of A Credit Card For Amazon

Ideally the credit card you use for your Amazon and/or Whole Foods spending will earn a high rewards rate, helping you save money on every purchase. Additional perks could include shopping protections like extended warranties, purchase protections and theft protections. Your goal in choosing a credit card for Amazon is to find the card that offers the best combination of rewards and other perks for your particular circumstances.

Also Check: When Does Your Credit Score Update

What Is Store Cards And Credit Cards

In order to have a better sense of how each card is categorized, its vital to know if its a closed-loop or open loop.

Closed-loop cards, such as the Amazon Retail Card and Amazon Prime Store Card, are what most store cards are. You cant use a closed-loop card outside of the business where its affiliated, thus you cant use it at any other place. Both of these cards are exclusively accepted at Amazon.

Because they may be used everywhere Visa is accepted, the Amazon Rewards Visa Signature Card and the Amazon Prime Rewards Visa Signature Card are termed open-loop cards. In other words, you can use them to buy things from Amazon, but you can also use them at any other shop .

Recommended Reading: When Does My Credit Score Update

Can I Get Amazon Credit Card With Bad Credit

Yes, you can get the Amazon.com Secured Credit Card with no credit. This card is designed as a credit building tool with a $0 annual fee that also accepts applicants with bad credit and reports payment history to major credit bureaus. … And the Amazon.com Store Card requires a credit score of 640, at a minimum.

This Credit Card Is Right For You If:

Truth be told, the Amazon Rewards Visa Signature Card serves a small niche. Its great for consumers who want to earn more at Amazon, Whole Foods, and this cards other bonus categories, but who dont want to pay for an Amazon Prime membership.

On the other hand, if youre one of the many people who already have an Amazon Prime membership, youll qualify for the , which is a better card overall.

You May Like: What’s Your Credit Score

What Are The Benefits Of Having An Amazon Credit Card

Amazon credit cards come with several cardholder benefits, including:

- The potential to earn rewards up to 5% cash back on all Amazon Rewards Visa Card purchases and all Amazon Store Card purchases with an Amazon Prime account

- 0% promotional financing for qualifying purchases with the Amazon Store Card

If You Count Yourself As A Loyal Amazon Customer You Might Be Able To Earn A Nice Chunk Of Your Spending Back Or Even Finance Your Purchases With One Of The Amazon Credit Cards

There are four to choose from, so how do you pick which one is right for you? Here are a few questions to ask.

- What type of Amazon shopper are you ?

- Do you want the option to finance a large Amazon purchase or not? Well guide you through your four choices in this Amazon credit card review so that you can make the best decision for yourself.

- Are you a frequent Whole Foods shopper? As of October 2020, eligible Prime members will earn 5% back on Whole Foods Market purchases when using the Amazon Prime Rewards Visa Signature Card. Cardholders who arent eligible Prime members will now earn 3% back on Whole Foods Market purchases when using the Amazon Rewards Visa Signature Card.

Don’t Miss: What Credit Score Is Needed For A Personal Loan

How To Get A Credit Report

A credit report collects information about your financial history and current credit status. It includes details about the accounts you have open, the amounts you owe, and the terms of those loans.

You can get your free credit report online annually at AnnualCreditReport.com or through one of their partner agencies. is also an excellent source of free credit score reports. Additionally, you’re entitled to one free credit report from any credit bureau.

Once you have your report, use it to improve your score by checking for incorrect information and correcting any mistakes that may be on your record. You can also use it to understand better how secure your current debt positions are and make informed decisions about future financial commitments.

Your credit score also affects the interest rates lenders offer you when you’re looking to borrow money. Lenders may be more willing to offer you a good interest rate if they know that your credit score is in good shape.

So, keep track of your scores and make necessary changes so that you always have the best chance of getting approved for a loan or other financial product on Amazon.

How Amazon Prime Rewards Visa Signature Card Compares To Other Cards

Although this card did not make it to our list of top-rated cash back credit cards for 2022, it is still a good option and able to match up with other cash back cards because of its zero annual and international transaction fees, as well as its high cash back rates, especially for purchases made on Amazon and Whole Foods. Ultimately, how this card compares with other cards depends on what you are looking for in a card and your use for it.

Below we feature a head-to-head comparison between Amazon Prime Rewards Visa Signature Card and another cash back credit card that is also backed by Chase.

Quick Comparison of Amazon Prime Rewards Visa Signature Card

Amazon Prime Rewards Visa Signature Card

- Cash Back Rate: 1%-5%

- 5% on purchases at Amazon and Whole Foods

- 3% on restaurants, gas stations and drugstore purchases

- 1% on all other purchases

Chase Freedom Unlimited

- Cash Back Rate: 1.5%-5%

- 5% on travel purchased through Chase Ultimate Rewards

- 3% on dining at restaurants, including takeout and delivery

- 3% on drugstore purchases

- 1.5% on all other purchases

Also Check: Does Paying Off Credit Cards Help Credit Score

Another Amazon Credit Card Worth Considering

If you don’t shop online enough to make an worth your while, you may want to think about signing up for the instead especially since new cardholders can receive a $50 Amazon.com gift card upon approval as a welcome bonus.

Note that this no-annual fee credit card does offer a lower rewards rate than the Prime Rewards card, but you’ll still earn 3% back for shopping at Amazon.com and Whole Foods Market as well as 2% back for spending at restaurants, gas stations and drugstores and 1% back for all other purchases.

To get approved for this card, you’ll need to have a good credit score of at least 670, though having a higher one certainly won’t hurt your chances.

How The Amazon Store Card Works

The Amazon Store Card works just like any other credit card, as you can use it to purchase items online and in physical stores. Also, you can use it to pay your bills and other expenses.

However, there are several differences between the Amazon Rewards Visa Signature Card and store cards. First is that store cards are not used in whole foods markets.

Also, after opening an Amazon store card, you receive a $60 gift card, unlike when opening an Amazon Prime Visa card, where you receive a $200 gift card from Amazon. Finally, the Amazon store card reward program isnt as robust as the Amazon Rewards Visa Signature card program. Nevertheless, store cards offer introductory perks for new card holders.

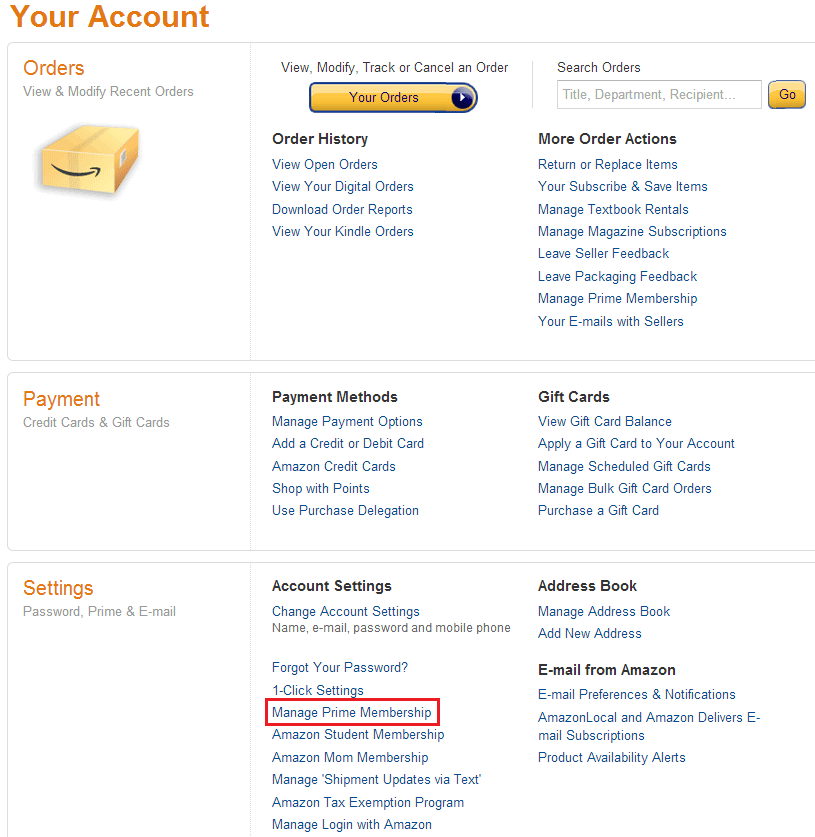

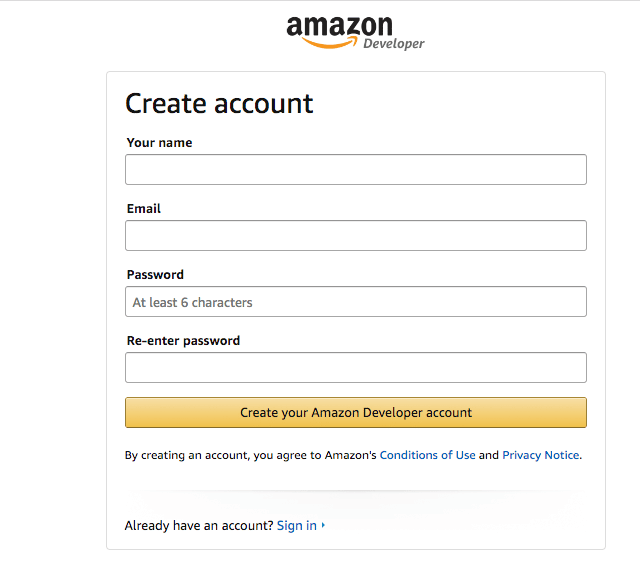

To get started, go to and sign up for a store card. Once you have created your account, you can select your required credit score.

The credit limit of Amazon store cards is $400, but the average is about $1500 or more. Some reports show an initial credit limit of $150.

To keep your account safe and secure, Amazon requires you to maintain a minimum spending limit and monthly billing cycle. In addition, the company will monitor your account closely for any unusual transactions or patterns that may indicate trouble. If there are any problems, youll get a notification immediately to take appropriate action.

Don’t Miss: How Do You Freeze Your Credit Report

Amazon And Amazon Prime Store Cards

If you don’t want or don’t qualify for either of the Amazon Rewards Signature Visa cards, the Amazon or Prime store cards may be a viable option for saving money on your Amazon purchases. Amazon store cards are not accepted at Whole Foods markets, unlike the Amazon Prime Rewards Signature Visa and the Amazon Rewards Signature Visa.

When you are approved for an Amazon store card, you receive a $60 gift card from Amazon, which is a bit less than the $200 gift card you receive for opening an Amazon Prime Visa card. The Amazon store card’s reward program is not as robust as its Visa Rewards Signature Visa card, but it does offer introductory financing opportunities for new cardholders.

Does Amazoncom Give 5% Cash Back

Just shopping at Amazon.com will not automatically snag you 5% cash back on your purchase. The best way to earn 5% back when shopping with Amazon is to use a credit card that offers 5% back. Here are a few of the best options:

- Amazon Prime Visa Signature: 5% cash back in rewards at Amazon.com and Whole Foods Market with an eligible Prime membership, 2% cash back at restaurants, gas stations and drugstores and 1% on all other purchases.

- Chase Freedom Flex: If Amazon is a quarterly bonus category, then the card will earn 5% cash back on up to $1,500 in categories that rotate quarterly , 5% on travel purchased through Chase Ultimate Rewards®, 3% on dining and drugstores and 1% on all other purchases.

- Discover it Cash Back: If Amazon is a quarterly bonus category, then the card will earn 5% cash back on everyday purchases at different places each quarter up to a quarterly maximum of $1,500 in spending when activated. Plus, earn unlimited 1% cash back on all other purchases automatically.

You May Like: How To Dispute A Credit Report And Win

Similar To Other Amazon Cards

The Amazon Store Credit Builder Card offers similar benefits to the Amazon store card, however, there are a few significant differences you need to know. This is not an ordinary store card and is a Credit Builder Card.

Since this is a subprime financial product, the 28% interest rate is higher than average cards. The cardholder must make an upfront deposit equal to the credit limit. You should, therefore, use this card to become eligible for better Amazon cards.

These strict limits can work in your favor if you have a bad credit rating, including developing responsible borrowing habits. Also, timely payments can help you to make a positive impression on lenders.

Also, building a strong credit history with an improved score will increase others confidence in your ability to pay back loans. You can prove your creditworthiness by using this card wisely, and lenders may increase your credit limit .

Do You Run A Sole Proprietorship

As a sole proprietor, there’s a good chance your business doesn’t have credit. In that case, the Amazon Prime Visa card is probably best for you. Eligibility is based on your personal credit, not your business credit. And without a large team, you don’t have to worry about granting other people access to cards.

Recommended Reading: Is 810 A Good Credit Score

Other Things You Need For The Amazoncom Credit Card:

You should note that while your credit score is an important factor, there are plenty of other things that will impact your chances of being approved for the Amazon.com Credit Card, too. Some other key criteria include your income, existing debt load, number of open accounts, recent credit inquiries, employment status and housing status.read full answer

Since all these criteria are taken into consideration, you might be able to get approved with a slightly lower credit score. But its best to wait to apply until you meet the Amazon.com Credit Card credit score requirement. You can check your credit score for free on WalletHub.

Is The Amazon Business Prime American Express Card Right For You

The Amazon Business Prime American Express Card is a great choice for Prime or Business Prime customers who already shop Amazon.com and its eligible properties frequently. The option for an interest-free period, in particular, is a welcome one if your business is stretched thin a few months out of the year.

To view rates and fees of the Amazon Business American Express Card, see this page.To view rates and fees of the Amazon Business Prime American Express Card, see this page.To view rates and fees of the American Express Blue Business Cash Card, see this page.To view rates and fees of The Blue Business® Plus Credit Card from American Express, see this page.

Information related to the Amazon Prime Rewards Visa Signature Card has been collected by NerdWallet and has not been reviewed or provided by the issuer of this card.

Read Also: How To Check Your Credit Score Without Hurting It

How Do I Find My Amazon Credit Card Number

You can manage your Amazon Prime Rewards Visa Card or Amazon Rewards Visa Card account online with Chase by logging in at Chase. Your full credit card number can be found on the front of the hard plastic or metal card that is mailed to you within 7 to 10 business days after approval. If you dont have your full credit card number, please call Chase. For bank contact information, see Customer Service for Financial Institutions.

To access and manage your online Amazon Store Card or Amazon Secured Card account, visit Synchrony Bank.To create an account, youll need your full credit card number, which can be found on the front of the hard plastic card that is mailed to you within 7 to 10 business days after approval. If you dont have your full credit card number, please call Synchrony Bank. For bank contact information, see Customer Service for Financial Institutions.