Whats Next: How A Daily Credit Score Helps You Make Financial Progress

Practically speaking, we realize you might not need to check your credit reports every single day. But in some cases like if youre applying for a new account or youre working hard on building credit and want to closely track your progress it can be tough waiting to see a credit score update.

Now that Credit Karma is checking your Equifax and TransUnion credit reports every day for any changes, you can know sooner when either of those scores have changed and possibly get a better understanding of why.

When Does A Late Payment Report As Delinquent

If you are less than 30 days late, you may incur late fees on your account, but it will not show on your credit report. Once a payment is at least 30 days past due, it is reported delinquent and can damage your credit score. Credit-reporting agencies track how many times in the past seven years accounts are reported 30, 60, or 90 days late. To limit damage to your score, work to bring your account current as soon as you can and make all further payments on time.

How To Request A Credit Score Update Through Rapid Rescoring

If youre trying to apply for a loan but your credit score hasnt been updated yet to reflect positive credit moves that youve recently made, you can request an early update. This is known as rapid rescoring.

People usually opt for this when theyre trying to get a very large loan. In most cases, that means a mortgage.

Rapid rescoring can be helpful if your current score is close to your lenders requirements, but doesnt quite meet them.

Don’t Miss: Do You Need A Credit Score To Rent An Apartment

Requesting A Copy Of Your Credit Report

You can also use a free service to do this. Then, really look at your report. See if theres anything wrong with it, like an account in collections that isnt really yours. If you see an error, dispute it with the agency.

If you can prove that the report is wrong, the account will be removed from the report, boosting your score.

How Often Can I Get A Free Report

Federal law gives you the right to get a free copy of your credit report every 12 months. Through December 2022, everyone in the U.S. can get a free credit report each week from all three nationwide credit bureaus at AnnualCreditReport.com.

Also, everyone in the U.S. can get six free credit reports per year through 2026 by visiting the Equifax website or by calling 1-866-349-5191. Thats in addition to the one free Equifax report you can get atAnnualCreditReport.com.

Recommended Reading: Will An Eviction Show Up On My Credit Report

Actions That Damage Your Credit Score

Conversely, your credit score will drop if you:

- Pay a bill more than 30 days late

- Fail to pay a bill so long that its sent to a debt collection agency

- Fail to pay off an auto loan , leading to a repossession

- Use too much of your available credit 2

- Open too many credit cards in a short period

- File for bankruptcy

In general, if you keep a few credit cards open and use them responsibly, your credit score will gradually improve, although it may still fluctuate by a few points in either direction on a regular basis. Fluctuations like this are normal and not a cause for concern.

Major Changes To Your Score Happen For Three Reasons

Your credit score usually only changes by a few points each month. A significant shift in your score typically signals one of three things:

- You Have a Delinquent Payment

Late payments can wreak havoc on your score, especially if the payment is 30 or more days delinquent.

- You’re Using More or Less Credit Than Normal

If you suddenly max out one of your credit cards, your credit utilization ratio may jump and reduce your credit score. On the contrary, if you suddenly pay off one of your credit card balances, your ratio will drop and your score may improve.

- You’ve Settled a Legal Dispute

If you’re involved with a legal dispute around money owed, the judgment can land on your credit report if the judge doesn’t rule in your favor. Negative public records such as bankruptcy filings, tax liens, or civil judgments can drastically drop your credit score and stay on your report for up to 10 years.

If you’re working to improve or repair your credit, focus on making smart financial decisions every month rather than worrying about how often your credit score is updated. Practice responsible credit by making payments on time, spending within your means, and keeping your credit utilization low.

Responsible credit management will be reported to the bureaus and logged on your credit report, which in turn can improve your score in the long run. reports to all three credit bureaus each month to ensure card members always have the most up-to-date information reflected on their credit report.

Don’t Miss: How Much Credit Score To Buy A Car

What Is The Credit Score Update Process

Each month, your creditors provide new information to credit bureaus about your credit usage and financial activities. The credit bureaus take that information and update your credit report, which causes your credit score to update. The information that creditors share with credit bureaus includes:

-

Whether you made on-time payments towards your credit accounts

-

Your current credit balances compared to your credit limits

-

How long your credit accounts have been open

-

Whether youâve opened any new types of credit accounts

-

Whether you applied for any new loans or credit accounts

Whenever information is added to your credit report, it can impact your credit score. This is because the main factors that are used to calculate your credit score are:

How Often Do Credit Scores Update

As soon as credit bureaus receive your information from your creditors, they update your credit report. The information on your credit report influences your credit score. As soon as your credit report is updated, your credit score will change and reflect the new information.

However, if you miss a payment and your creditor reports your payment as more than 30 days late, you might see a drop in your credit score. This late payment will stay on your credit report for seven years and will keep on having a negative effect. Another factor that can cause your credit score to take a significant hit is using more and more of your credit and increasing your . If you suddenly have a spike in credit card debt, you can expect to see a knock in your credit score.

Recommended Reading: How To Update Credit Report Information

What Day Of The Month Does Your Credit Score Update

Again, your credit score could potentially update on any day of the month, and possibly more than once a month. It depends on how many creditors you have and when they report.

In other words: You canât always time your credit card or loan payments to a specific day of the month for maximum impact. What you can do is make sure you donât miss the deadline, since on-time payments make up 35% of your credit score. This way you can avoid having to search for ways on how to remove late payments from a credit report as a penalty.

Make payment in full whenever possible contrary to popular belief, carrying a balance is not good for your score and could eventually get you into a tough situation where you might be going. You should use no more than 30% of your available credit.

Will My Score Go Up Before I Apply For A Loan

Question: I have a credit card that I can pay off in full, but how long after that will my credit score go up? I need to apply for a personal loan for school, but I need my score to go up before I do that. I know it varies by the source, but about how long after I completely pay off my card will my credit score reflect it?

Samantha in Tennessee

A reader asks, I have the money to pay off my credit card now, but am not sure its worth it?

Well, Samantha it is most definitely worth it! When you pay off a credit card, your credit score improves. Why? Because five factors determine your credit score, and one of the biggest is the amount of debt owed. It is 30 percent of your overall score and the biggest chunk is payment history, which is short for I pay my bill on time.

But more important than your credit score going up is that your debts are going down.

The AVERAGE credit card interest rate TODAY hovers around 17 percent. If you put all your money in the stock market obviously a bad idea youd be hard-pressed to earn 17 percent on your investments. But if you pay off a credit card bill that has a monthly balance of $5,000, you could save up to $85 a month.

Thats $1,000 a year! And you dont have to do anything to save that money, other than pay off a debt right now. If you dont think you can afford to do that, call Debt.com today. We know how to make it happen.

You May Like: How To Get Car Repossession Off Credit Report

Also Check: Is 797 A Good Credit Score

Examples Of Rapid Rescores

Use these scenarios to get a sense of when a rapid rescoring is appropriate and how it can benefit your credit score and loan prospects.

Get a rapid rescore after taking steps to improve your score. Lets say that your mortgage broker uses a computer simulator to see that you have an opportunity to improve your credit. If you raise your score by 20 points, youll fall into a category of a borrower that pays a slightly lower interest rate. The simulator says you might accomplish this if you pay down your card balances so that youre using less than 30% of your . Even if you pay off your credit cards every month, your card issuer might take a snapshot when your balance is high, so the credit-scoring model thinks youre maxing out your cards. If youve got the cash available, pay down your debts. Then, use rapid rescoring to submit updated information to the credit bureau and have it pushed to your credit report within a matter of days. When you request a new credit score from that bureau, youre more likely to obtain a higher score and get approved at a lower rate.

The VantageScore and FICO scoring models consider a credit utilization ratio of 30% or less to be ideal.

Read Also: What Is Syncb Ntwk On Credit Report

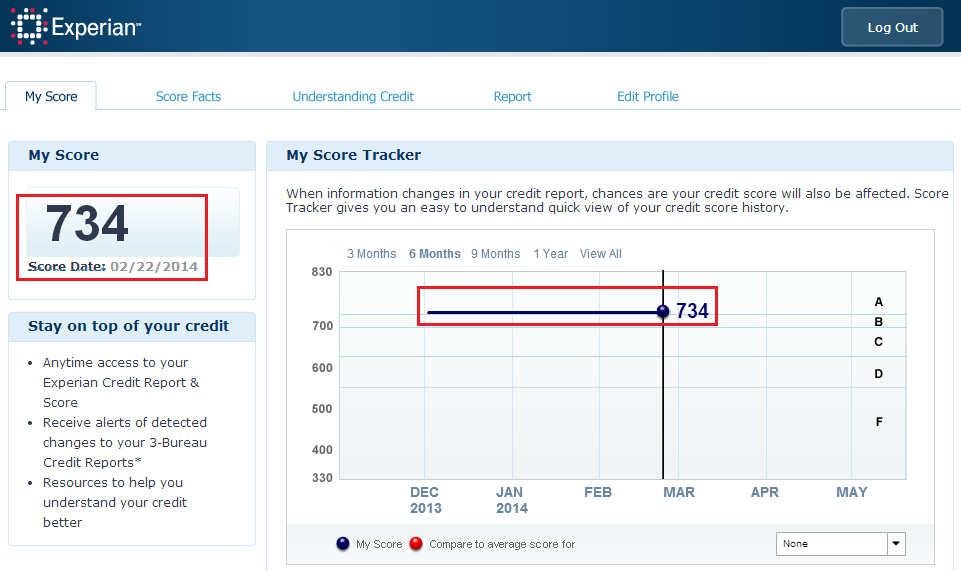

Check Your Credit Report Frequently

Checking your credit scores and credit reports frequently can help you stay on top of your accounts and ensure that the information reported is up to date.

Ordinarily, you are entitled to a free credit report annually from each of the three major credit reporting companies. Through April 2022, Experian, TransUnion and Equifax will offer all U.S. consumers free weekly credit reports through AnnualCreditReport.com to help you protect your financial health during the sudden and unprecedented hardship caused by COVID-19.

You can also request a free and free credit report directly from Experian at any time. When you receive your credit score from Experian, you will also receive a list of the top risk factors currently impacting your score. These factors can help give insight into changes you can make to help improve your credit score going forward.

Thanks for asking.

Jennifer White, Consumer Education Specialist

Join our live video chat every Tuesday and Thursday at 2:30 p.m. ET on Periscope. Rod Griffin, Director of Public Education at Experian, is available to answer your questions live.

Recommended Reading: How To Boost My Credit Score 100 Points Fast

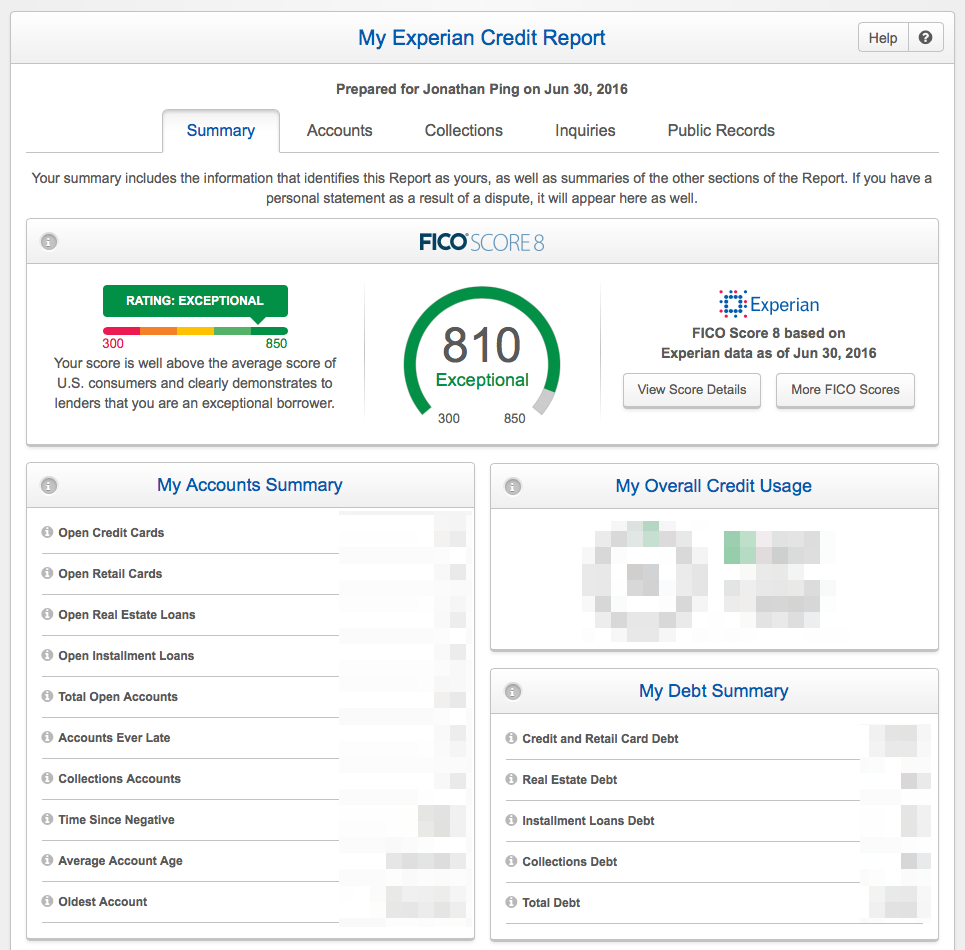

Why Is This Fico Score Different Than Other Scores Ive Seen

While Wells Fargo uses FICO® Score 9 for some credit decisions, there are many different credit scores available to consumers and lenders. FICO® Scores are the credit scores used by most lenders, but different lenders may use different versions of FICO® Scores. Scores are pulled from a specific credit bureau on a certain date and reflect the information at the bureau as of that specific date. The differences in your credit files and the timing may create variations in your FICO® Scores. When reviewing a score, take note of the date, bureau credit file source, version, and range for that particular score.

Why Is There A Gap In My Fico Score History

You may no longer be able to view your FICO® Score history if you stopped your FICO® Score service by opting out and then started it again.

If you don’t see the answers to your questions:

You must be the primary account holder of an eligible Wells Fargo consumer account with a FICO® Score available and enrolled in Wells Fargo Online®. Eligible Wells Fargo consumer accounts include deposit, loan, and credit accounts, but other consumer accounts may also be eligible. Contact Wells Fargo for details. Availability may be affected by your mobile carriers coverage area. Your mobile carrier’s message and data rates may apply.

Please note that the score provided under this service is for educational purposes and may not be the score used by Wells Fargo to make credit decisions. Wells Fargo looks at many factors to determine your credit options therefore, a specific FICO® Score or Wells Fargo credit rating does not guarantee a specific loan rate, approval of a loan, or an upgrade on a credit card.

Wells Fargo and Fair Isaac are not credit repair organizations as defined under federal and state law, including the Credit Repair Organizations Act. Wells Fargo and Fair Isaac do not provide credit repair services or advice or assistance with rebuilding or improving your credit record, credit history, or credit rating.

FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

LRC-1121

You May Like: Do Medical Collections Affect Credit Score

I Opted In But It Says No Score Is Available Why

The most common reasons a score may not be available:

- The credit report may not have enough information to generate a FICO® Score

- The credit bureau wasn’t able to completely match your identity to your Wells Fargo Online® information. To keep your information current, sign on to Wells Fargo Online, visit the Profile and Settings menu, select My Profile and then Update Contact Information. Make sure your email addresses, phone numbers, and mailing addresses are current.

- If you’ve frozen your credit with the credit bureau, you may not immediately receive a credit score. A score should become available for you to view after the next monthly update. Contact Experian® with further questions.

Why Should You Care When Credit Scores Update

You may be wondering why you should care when your credit score gets updated. Its not like it can change that much in a short period of time and its changes dont have a huge impact on you, right?

Besides the fact that its just a good thing to be aware of, just like other aspects of your financial life, theres one situation in which you should pay close attention to when your credit score updates.

It is especially important to be aware of your credit score when you are applying for a major loan. Whether youre applying for a mortgage, car loan, or business loan, your credit score has a massive impact.

Read Also: How To Pull A Free Credit Report

Does A Name Change Affect My Credit History

When you review your credit report using tools like the one from Rocket Homes Real Estate LLC, you might find that your old name will still be there. Thats because lenders can use this information to verify your identity when you decide to apply for loans down the line. It can even alert you to potentially fraudulent activity involving your name.

A name change wont affect your . Dont be concerned your credit history is tied to your Social Security number, which hasnt changed. In other words, if you have an excellent credit score, changing your name shouldnt affect it unless youve done things like make a late payment.

Again, your old name and other identifying information should still be on your credit report to help as further identifying information such as when you apply for a new job.

Dont Miss: When Does Navy Federal Report To Credit Bureau

How Insurers Use Medical History Reports

When you apply for insurance, the insurer may ask for permission to review your medical history report. An insurance company can only access your report if you give them permission. The report contains the information you included in past insurance applications. Insurers read these reports before theyll approve applications for:

You May Like: Does Paypal Credit Report To Credit Bureaus

Also Check: What Is Considered A Very Good Credit Score

Remember When It Comes To Your Credit Scores Updating

- Although updates to your credit score usually occur at least once a month, this frequency could vary depending on your lenders and unique financial situation.

- It’s normal for your credit score to change over time based on your financial behavior.

- It’s up to each individual lender to decide if and when they will report information as well as which of the CRAs they report to, if any.

- Be sure to request a new copy of your credit score in order to see any changes.