How Do I Build A Good Credit History

A credit reporting agency needs a track record of how youve managed credit before it can calculate a credit score. Typically, six months worth of activity will provide enough information to generate a score. Your score is dynamic and may rise or fall over time, based on how consistently and promptly you pay your bills. Establishing a good credit history takes time. Each creditor has different.requirements for issuing credit. If you are declined credit, contact the lender to determine the reasons why.

You May Like: Carmax Credit Requirements

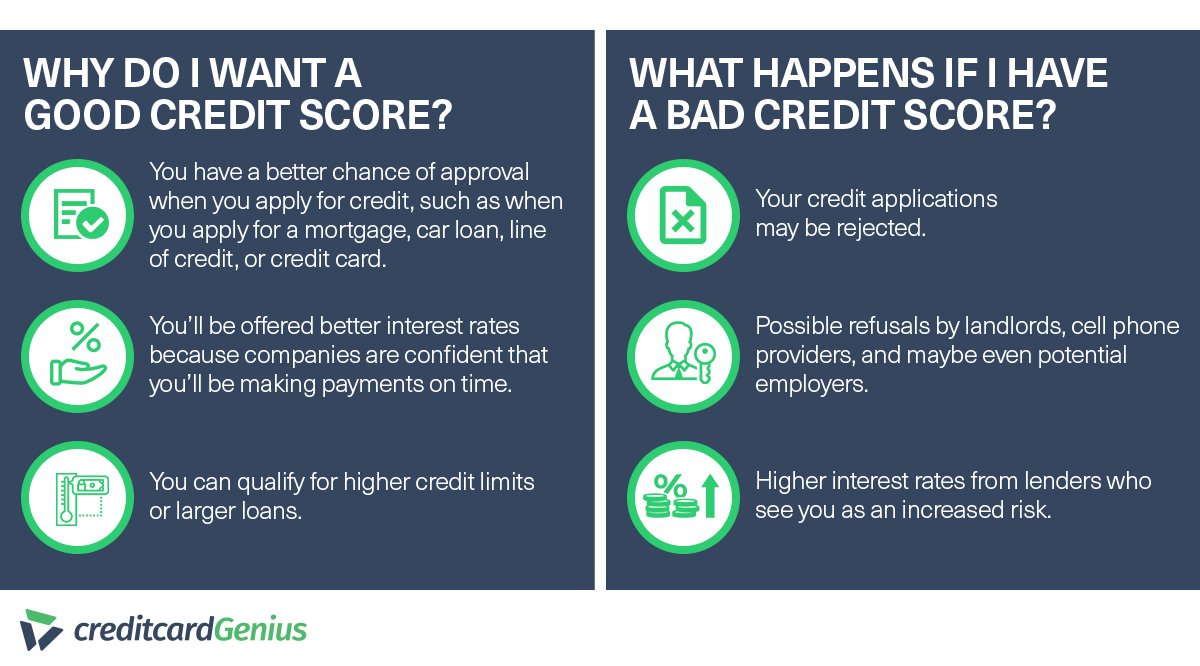

What Are The Benefits Of A Good Credit Score

The benefits of good credit can include everything from lower credit card interest rates to lower car insurance premiums.

Since credit scores are based on information in your credit reports, a higher score is a sign of healthy creditâand that can be the key to enjoying these eight benefits:

1. Get Better Rates on Car Insurance

First up: car insurance. Some insurance companies may use your credit scores to make all kinds of decisions when you apply for coverage.

According to the CFPB, insurance carriers can use your credit reports to help decide whether to approve your application and how much to charge you. Once youâre a customer, they may check your credit to help decide whether to raise your premiums or even deny you the chance to renew your policy.

2. Save on Other Types of Insurance

Companies offering other kinds of insuranceâhome insurance, for exampleâmay also look at your credit history.

Thatâs because insurance companies may want the same information that other lenders look for. That could include your history of on-time bill payments as well as how much debt you owe. What insurance companies learn about your credit may help them determine how much youâll pay in premiums.

3. Qualify for Lower Credit Card Interest

When you apply for a credit card, the card issuer will likely check your credit. If youâre approved, a good credit score may make you eligible for things like a lower annual percentage rate .

4. Get Approved for Higher Credit Limits

How Your Credit Score Impacts Your Financial Future

Many people do not know about the credit scoring systemmuch less their credit scoreuntil they attempt to buy a home, take out a loan to start a business or make a major purchase. A credit score is usually a three-digit number that lenders use to help them decide whether you get a mortgage, a credit card or some other line of credit, and the interest rate you are charged for this credit. The score is a picture of you as a credit risk to the lender at the time of your application.

Each individual has his or her own credit score. If you’re married, both you and your spouse will have an individual score, and if you are co-signers on a loan, both scores will be scrutinized. The riskier you appear to the lender, the less likely you will be to get credit or, if you are approved, the more that credit will cost you. In other words, you will pay more to borrow money.

Scores range from approximately 300 to 850. When it comes to locking in an interest rate, the higher your score, the better the terms of credit you are likely to receive.

Now, you probably are wondering “Where do I stand?” To answer this question, you can request your credit score or free credit report from 322-8228 or www.annualcreditreport.com.

Because different lenders have different criteria for making a loan, where you stand depends on which credit bureau your lender turns to for credit scores.

Read Also: How To Remove Repo From Credit Report

Will Paying The Minimum On My Cards Improve My Credit Score

No. This is a widespread myth. You need to pay at least the minimum payment due on your credit card every month so that your cards have an on-time payment history. You do not have to pay a single cent in interest to improve your credit score. In fact, paying your credit card balances in full every month will have the greatest positive impact on your score, because it will improve your credit utilization percentage.

Get A Handle On Bill Payments

More than 90% of top lenders use FICO credit scores, and theyre determined by five distinct factors:

- Payment history

- Age of credit accounts

- New credit inquiries

As you can see, payment history has the biggest impact on your credit score. That is why, for example, its better to have paid-off debts remain on your record. If you paid your debts responsibly and on time, it works in your favor.

So, a simple way to improve your credit score is to avoid late payments at all costs. Some tips for doing that include:

- Creating a filing system, either paper or digital, for keeping track of monthly bills

- Setting due-date alerts, so you know when a bill is coming up

- Automating bill payments from your bank account

Another option is charging all of your monthly bill payments to a credit card. This strategy assumes that youll pay the balance in full each month to avoid interest charges. Going this route could simplify bill payments and improve your credit score if it results in a history of on-time payments.

Use Your Credit Card to Improve Your Credit Score

Recommended Reading: Raise Credit Score 50 Points In 30 Days

Why Having A Good Credit Score Is Important

It is likely that, like most people, you havent given much thought to your credit score unless you have needed to borrow money or apply for some kind of funding. In everyday life, your credit score is probably not something that has really entered your head, and it certainly wont be something that worries you greatly.

However, it is an important element of your life, and, even if you dont need to borrow any money, your credit score is something that you should take a good look at as, when you do need it, you wont want to find any nasty surprises. Here are just some of the reasons why having a good credit score is important.

Getting A Job

Although prospective employers running credit checks on job applicants is still a rarity, it is becoming more popular, particularly if the job involves handling money or dealing in finances in any way employers want to know they can trust the person they are hiring.

If your credit is bad, it wont always mean that you cant get a job, but it could cause problems in some instances. Therefore, its always a good idea to check your credit score when you are applying for a new job. There might be problems with it that you didnt realize, and you might even want to dispute some of the issues with Equifax. Getting these issues cleared up before you need to apply for a new position is the best course of action. Plus, if you know there is a problem, and you dont dispute it, you can set about getting things right again in your finances.

What Is A Good Score

Typically, the higher the score the better. Each lender decides which credit score range it considers a good or poor credit risk. The lender is your best source of information about how your credit score relates to their final credit decision. Your credit score is only one component of the information that lenders use to evaluate credit risks.

Don’t Miss: How To Report Bad Tenants To Credit Bureaus

Option : Get Instant Access To Your Free Credit Report By Phone

The second fastest way to obtain a free copy of your credit report is to call each of the credit reporting agencies toll free numbers. If you call these numbers, a computer will ask you some questions about your personal information so that it can verify your identity. Then the automated system will mail you a copy of your credit report. It can take up to 3 weeks for your credit report to arrive by mail. You can obtain your free credit report by calling the numbers below:

- TransUnion 1-800-663-9980

Go To Annualcreditreportcom Or Call 1

You can only request your credit report through AnnualCreditReport.com or by calling the verified phone number 1-877-322-8228. If another source claims to have your credit report in exchange for personal information, its probably a fraud.

Requesting your credit report wont negatively affect your credit, but again, youre limited to three reports per 12 months under federal law.

Recommended Reading: Open Sky Not Reporting

Recommended Reading: Can A Closed Account Be Reopened

Do You Know Your Credit Score

Remember that as a business owner, a good credit score will allow you to get better terms of your potential business loan.

So if youve thought long enough, go ahead and apply for a business loan with Camino Financial.

Submitting your application will take only minutes, and it wont affect your credit or lower your credit score. When applying, Camino Financial does a soft pull on your credit that will not affect your credit score.

Ee hope youre well on your way to an excellent credit score and a thriving business!

The Most Important Habit For Achieving A Good Credit Score

If you want to build credit and improve your score so you can experience the benefits of good credit for yourself, McClary says the most important habit is is simple pay your bills on time.

“A history of timely payments is the single biggest factor in determining your credit score according to FICO,” McClary advises. “Bringing past-due accounts up-to-date and keeping them there should be a priority for anyone who has been struggling because of delinquent accounts.”

Read Also: 691 Credit Score Auto Loan

Whats A Good Credit Score

A good credit range depends on where a score comes from and whoâs judging it. And there are different scoring companies, so you can have more than one credit score. As the Consumer Financial Protection Bureau puts it, âBased on your credit reports, you will be given a credit score by the credit-reporting companies. You donât just have one credit scoreâeach company does their own.â

FICO®, which is one credit-scoring company, says scores between 670 and 739 qualify as good. For VantageScore®, another credit-scoring company, scores between 661 and 780 might be considered good. Scores can also be considered very good, excellent and exceptional.

It may also help to know that credit scores are based on information in your . Scores are calculated by credit-scoring companies, like FICO and VantageScore, using complex formulas called scoring models.

Hereâs how FICO and VantageScore define credit score ranges:

Does Getting A New Credit Card Hurt Your Credit

Getting a new credit card can hurt or help your credit, depending on your situation. It can help to increase your credit mix and improve your credit utilization percentage, but it will add a new hard inquiry to your account and make your average credit age youngerboth of which could lower your score. For those in the credit-building stage, adding a new credit card will most likely lower your score in the short term but also lead to a stronger credit score in the long term.

Don’t Miss: How To Get An Eviction Off Your Credit

Check And Monitor Your Credit Reports And Credit Scores

Now that you know why your credit is so important, you can see why itâs a good idea to check and monitor your credit. But how do you do it?

How to Request Free Copies of Your Credit Reports

You can get a free copy of your credit report from each of the three major credit bureausâEquifax, Experian and TransUnionâby visiting AnnualCreditReport.com. Youâll need to provide your:

- Legal name.

- Social Security number.

- Current address.

If youâve moved in the past two years, you may need to include your previous address as well. There may be a limit on how often you can obtain your reportâcheck the site for details.

Once youâve provided the information above, youâll pick which credit reports you want before answering a few additional questions that help verify itâs really you. âThese questions are meant to be hard,â according to AnnualCreditReport.com. âYou may even need your records to answer them. They are used to ensure that nobody but you can get your credit information.â

How to Check Your Credit Scores for FreeâWithout Hurting Your Credit

Keep in mind that your credit scores donât actually appear on your credit reports. So what do you do if you want to check your scores?

Depending on your lender, you may be able to find your scores by checking your statement or by logging in to your account online. You can also get your scores directly from the credit bureaus and credit-scoring companiesâbut you might have to pay for them.

Related Content

Consequences Of Bad Credit And How To Repair Your Credit Score

Experian reports that 11.1% of Americans have a credit score below 550 which is just more than 12 million of us. The exceptional group above 800 numbers 69.3 million. The same number have a good credit score.

So while were generally trending positively, the difference makes a big difference. Someone in the poor credit score category often will pay 50% or more to borrow the same amount of money as someone in the excellent category.

Bar none, credit scores are the most influential factor in getting competitively priced credit, said credit expert John Ulzheimer, a former employee at Equifax. If youve got solid scores 750 or higher lenders will be falling over themselves to offer you great deals on loans and credit card products. If you have lower scores, it means fewer and more expensive options.

Read Also: Cbna Bby Inquiry

Reasons Having A Good Credit Score Is Important

If youre retired, own your own home or just feel you have pretty much bought everything youre ever going to need in life, you may assume that maintaining a good credit score is no longer such a big deal.

Whatdifference does it really make, you ask yourself, if your FICO score is 500 or750? If you dont plan on borrowing or using credit again youve unpluggedand are officially off the grid who cares about a few extra points?

That wouldbe foolhardy thinking. No one can predict the future. Circumstances andsituations change. By letting your good credit erode, youre essentially throwingaway an important financial lifeline.

Lets look at 10reasons why maintaining a good credit score still matters:

Buying a home

Unless you planon paying all cash for your next home, youll need a home loan whose approvaland interest rate will largely be based on your credit score. Even if youreperfectly content with your current living situation, things change. InCalifornia alone in 2019, more than 100,000 residents were displaced bywildfires, meaning they had to find other living arrangements.

Takingout a reverse mortgage

Again, maybeyou hadnt planned on taking out a reverse mortgage loan, but now you have aneed for tax-free cash. Maybe a business opportunity has come your way. Maybeyou want to make some upgrades to your home. And you may have heard that opening a reversemortgage line of credit is an excellent way to help pay for your long-term careone day.

Renting

Buying acar

How Long Does It Take To Raise Your Credit Score

If youre starting from a bad score, it usually takes about six months to one year to build credit to a fair score. The length of time depends on your past credit profile. Negative items like bankruptcy or foreclosures are harder to offset with positive actions. Still, even with one of these remarkably bad items, you can still build credit effectively within 24 months.

Going from bad to excellent may take as little as three to five years. So, even if you have a score thats less than 500 now, with a little work you could achieve a 700 credit score or higher in about 36-60 months. And its worth the effort! A better credit score can save hundreds and even thousands of dollars when paying off loans and credit card balances.

Thank you for submitting your question!

Our financial coaches will review it and reach out to you directly with the answer at the email you provided. If you prefer not to wait, please call to speak with a certified credit counselor for a free consultation.

For immediate assistance, please call:

Don’t Miss: What Credit Report Does Chase Pull

Can You Get A Home Loan With Bad Credit

Its possible to qualify for a mortgage even if your credit score is low. Its more difficult, though. A low credit score shows lenders that you may have a history of running up debt or missing your monthly payments. This makes you a riskier borrower.

To help offset this risk, lenders will typically charge borrowers with bad credit higher interest rates. They might also require that such borrowers come up with larger down payments.

If your credit is bad, be prepared for these financial hits. You can qualify for a mortgage, youll just have to pay more for it.

Key Takeaways: Why Do You Need A Credit Score

Building your credit history is an important step to take in managing your finances. Before you go off to build your credit history and start practicing good credit habits, keep these key takeaways in mind:

- Where can I check my credit report? You can access a free credit report each year via AnnualCreditReport.com, or request your free credit score with Mint today.

- Does a credit report show credit score? Yes, your credit report will feature important metrics regarding your credit history. This can include your credit score, identifying information, payment history, and more.

- Do I need a credit card to establish a credit history? Opening a credit card is a great way to start building your credit, but there are other options that can help you get started. Secured credit cards, store credit cards, credit builder loans, and becoming an authorized user on a relatives account are a few examples to consider.

Also Check: Remove Syncb Ppc From Credit Report