Tax Liens And Civil Judgments

In July 2017, changes to public-record reporting requirements were implemented that affected the information sent to consumer credit bureaus, leading them to eliminate many tax liens and civil judgments from consumers credit reports. In response to the changes, tax liens arent weighed as heavily in the latest VantageScore version, VantageScore® 4.0. And they can still have a significant impact on FICO® scoring models.

Can I Trust Credit Karma

Q: Im trying to increase my credit score ahead of applying for a large loan, so Im considering signing up for Credit Karma to track my score. How accurate are the credit scores it shares? Is there anything I need to be aware of before signing up for this service?

A: Credit Karma is a legitimate company however, for a variety of reasons, its scores may vary greatly from the number your lender will share with you when it checks your credit. We have answers to all your questions about Credit Karma.

What is Credit Karma?

How does Credit Karma calculate my score?

How do other lenders calculate my score?

How does Diamond Valley decide if Im eligible for a loan?

Theres Inaccurate Or Outdated Information On Credit Report

If the incorrect account information is more than a month old, this could indicate that your credit report contains inaccurate or outdated information about your credit history.

In this case, we recommend viewing the full credit report in question, reviewing it carefully, and disputing any errors you see directly with the credit bureau.

Also Check: What Does Cls Mean On Experian Credit Report

What To Know About Credit Karma Including Accuracy

Your credit score is one of the most critical pieces of financial information, especially when buying a home.

For a long time now, creditors and lenders have used your credit score to determine whether they would lend to you and what kind of terms they would offer.

Today, your credit score affects even more aspects of your life, possibly even your ability to get a job or successfully rent or purchase a property.

The company has over 100 million members as of 2021, all of which can get their free information from the Credit Karma site.

When buying a home for the first time, it is essential to get your financial house in order far in advance of ever putting down your earnest money with a real estate agency. Credit Karma helps you do just that.

One of the most substantial mistakes first-time homebuyers make is not preparing themselves well enough financially. Credit Karma can be your financial right-hand man in your home buying journey.

Once you are ready to get started, the Credit Karma sign-in will get you on your way. As you would expect, the Credit Karma login is at the top right of the screen.

Lets take a deep dive into what you need to know about Credit Karma and what it offers:

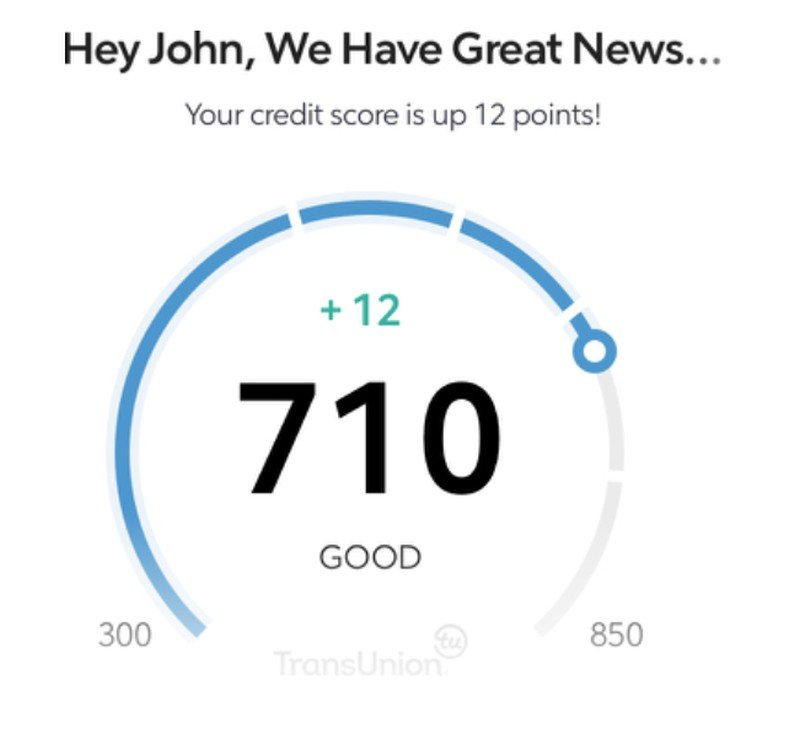

Does Credit Karma Give You An Accurate Credit Score

The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus. This means a couple of things: The scores we provide are actual credit scores pulled from two of the major consumer credit bureaus, not just estimates of your credit rating.

Recommended Reading: Does An Arranged Overdraft Affect Your Credit Rating

Are Credit Karmas Credit Scores Accurate

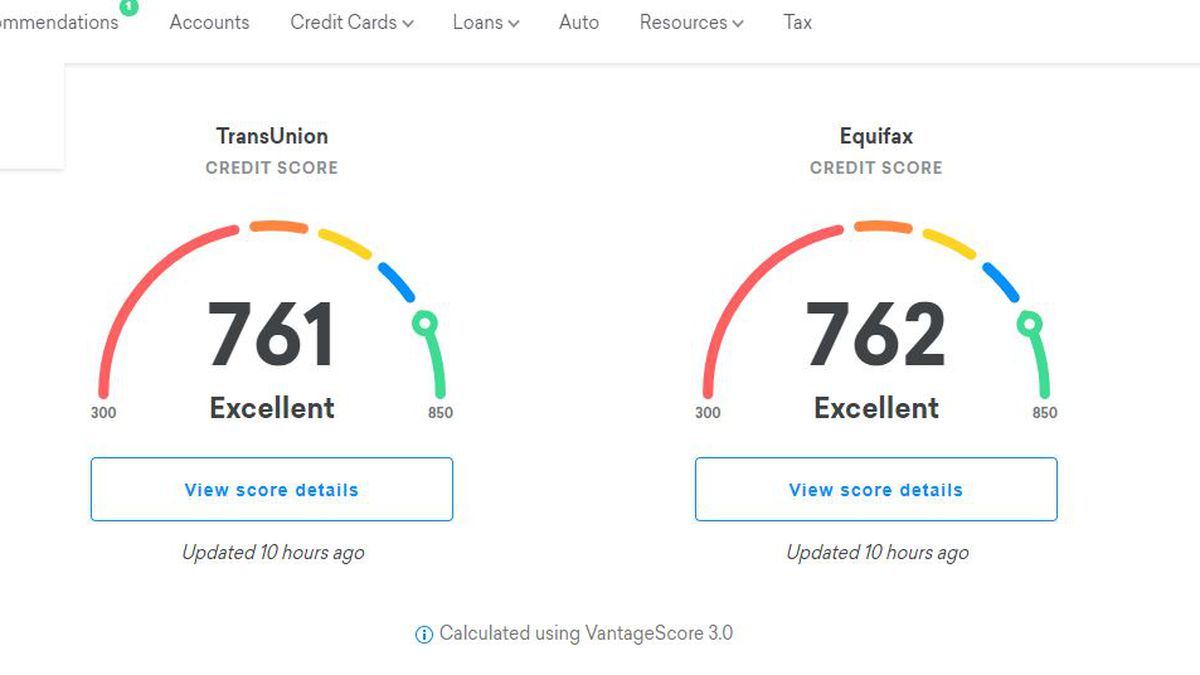

The VantageScore 3.0 credit scores you see on Credit Karma come directly from Equifax and TransUnion, and they should reflect any information reported by those credit bureaus.

Remember that most people have a number of different credit scores. The scores you see on Credit Karma may not be the exact scores a lender uses when considering your application. Rather than focus on your exact scores , consider your scores on Credit Karma a general measure of your credit health.

Is It Possible To Get An 850 Credit Score

Getting an 850 credit score is possible, but uncommon. Only about 1% of all FICO scores in the United States are 850, according to Experian. Those with credit scores of 850 generally have a low credit utilization rate, no late payments on their credit reports and a longer .

But keep in mind that having perfect credit scores isnt necessary. You can still qualify for the best loan rates and terms if your credit scores are considered merely excellent .

Don’t Miss: How To Update Credit Report Information

Is My Actual Credit Score Higher Than Credit Karma

You can find your Equifax and TransUnion VantageScore 3.0 credit scores on Credit Karma.

You have many different credit scores, so some of your credit scores might be higher than the TransUnion and Equifax scores you see on Credit Karma, while others might be lower.

But as long as youre looking at the same version of the same score, the TransUnion and Equifax credit scores you see on Credit Karma should be the same as the Equifax and TransUnion credit scores you find on other websites.

The Dates Of Recent Updates

Lastly, the date on which your lenders send updates to the credit bureaus, as well as the dates on which your score is refreshed, can impact your score temporarily. A credit score, at least for now, is a point-in-time snapshot of your credit risk versus a real-time update.

Generally, lenders send an update with your outstanding balance and updated payment record to the credit bureaus about once every ~30 days. Imagine you do a bunch of holiday shopping one day and nearly max out your credit card, and the next day your lender updates the bureaus with your high balance. Your next credit score update may drop due to higher utilization, even if you paid it off a few days later. Not to worry: this should be resolved with the next update after your balance is paid off.

Additionally, the date your credit score is updated will impact whether or not recently received updates have yet to be factored into your score.

In summary: your score can fluctuate, sometimes significantly depending on your available credit and your balances/outstanding debt at the point in time that updates are sent to the lender. Making multiple payments per month, especially after large purchases, can help reduce these swings.

Now that you understand why its possible to have a large variety of credit scores at once, lets dig into the differences between the main models.

Also Check: How To Get A Credit Report From Credit Karma

Don’t Miss: What Is A Poor Credit Score

Should I Use Credit Karma

Unlike other services that charge between $15-$20 to view your credit score, Credit Karma allows you to check and track your score for free without needing a free trial or a credit card.

Using Credit Karma doesnt affect your score because it performs a soft inquiry on your credit report, which will not be reflected on the report. However, most services will make a hard inquiry on your credit report, which will likely knock off a few points on your credit score.

What Is A Fico Score 8

FICO 8 scores range between 300 and 850. A FICO score of at least 700 is considered a good score. There are also industry-specific versions of credit scores that businesses use. For example, the FICO Bankcard Score 8 is the most widely used score when you apply for a new credit card or a credit-limit increase. 1.

Recommended Reading: How To Get Credit Report From Credit Karma

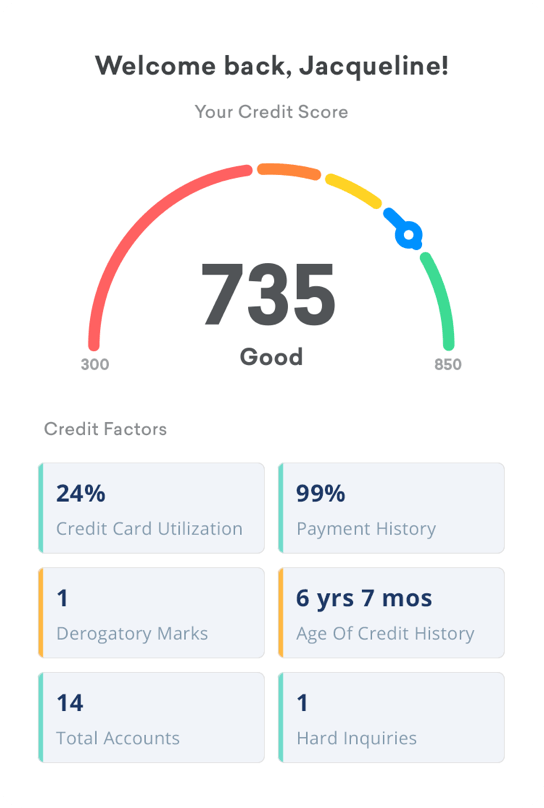

Why You Could Have Different Credit Scores

Its perfectly normal to have different credit scores from different credit bureaus. Here are a few reasons why your credit scores may differ.

- Theres more than one credit scoring model. As noted above, the credit bureaus may use different credit scoring models to calculate your scores. Since different scoring models have different ranges and factor weightings, this often leads to different scores.

- Some lenders may use different types of credit scores for different types of loans. For example, an auto lender may use an auto industry-specific credit score. These scores tend to differ dramatically from standard consumer credit scores.

- Some lenders may only report to one or two credit bureaus. This means a credit-reporting bureau could be missing information that would raise or lower your score.

- Lenders may report updates to the credit bureaus at different times. If one credit bureau has information thats more current than another, your scores might differ between those bureaus.

With all of these factors at play, youll frequently see minor fluctuations and variations across your scores. Instead of focusing on these small shifts, consider your credit scores a gauge of your overall credit health and think about how you can continue to build your credit over time.

Is Credit Karma Score Lower Than Fico

Your FICO score may differ Your score should be within the same range it is everywhere else, including with the major credit bureaus and its many competitors. On the customer review site ConsumerAffairs, some people have reported that their Credit Karma score is quite a bit higher than their FICO scores.

You May Like: How To Read A Credit Report

Why Your Free Credit Scores From Equifax And Transunion May Be Different

You may think that your VantageScore 3.0 credit scores from Equifax and TransUnion should be the same, but thats not always the case.

Remember, VantageScore 3.0 is ultimately just a scoring model. The three-digit number it produces depends largely on the information that lenders report to each credit bureau.

When credit scores that use the same model differ between credit reporting bureaus, its typically because they dont have the same information. Here are a few of the reasons you might see different credit scores.

- Your scores are from different dates. Different bureaus receive information from lenders at different times. If new information is accounted for in one credit score and not the other, the scores may differ.

- Your scores are calculated using different credit reports. Its up to lenders to decide which credit bureaus they report your information two. Some report to all three major credit bureaus, while others report to only one or two. If your Equifax credit report has information that your TransUnion report doesnt , your scores may differ.

- Your credit reports contain incorrect information. Its possible that one or several of your credit reports contain errors. Thats why we recommend regularly checking your credit reports for errors that may affect your scores anddisputing those errors, if need be.

Mixing And Matching Services May Help Cover More Ground

When it comes to checking your credit, there are a lot of ways to go. You can select one service, or pair free services together to access your FICO score from all three major bureaus. However, if you go that route, keep in mind that you wonât have the promised credit protection and monitoring that Experian, TransUnion and Equifax offer.

Disclaimer: The information included in this article, including program features, program fees, and credits available through credit cards to apply to such programs, may change from time-to-time and are presented without warranty. When evaluating offers, please check the credit card providerâs website and review its terms and conditions for the most current offers and information.

Recommended Reading: How To Look Up Credit Score

Heres What You Should Know About The Vantagescore And Fico Credit

The Fair Isaac Corporation introduced the first FICO® scoring model to lenders in 1989. According to the company, FICO® scores are used today by 90% of top lenders to make lending decisions. The VantageScore model wasnt introduced until 2006. It was developed by the three major consumer credit bureaus Equifax, Experian and TransUnion to create a more predictive scoring model that is easy to understand and apply.

Although both models are designed to predict a consumers ability to repay a debt, they do not treat all credit data equally. Lets explore some of the differences between the two models and why they may matter to you.

FICO groups the information into five categories, with each one representing a percentage of your score.

- Payment history: 35%

- Length of credit history: 15%

- New credit: 10%

- 10%

But again, keep in mind that the exact impact a specific category will have on your credit scores can vary depending on your individual credit history and the specific credit-scoring model used.

Why Are My 3 Credit Scores Different

Your score differs based on the information provided to each bureau, explained more next. Information provided to the credit bureaus: The credit bureaus may not receive all of the same information about your credit accounts. Surprisingly, lenders arent required to report to all or any of the three bureaus.

Read Also: What Does Serious Delinquency Mean On Credit Report

You May Like: How Do You Find Out What’s On Your Credit Report

Whats A Credit Inquiry

An inquiry is a request for your credit file. There are two types: hard and soft. Hard inquiries occur when lenders look at your file after you apply for credit. In general, these will affect your credit scores. Soft inquiries are reviews of your file that dont affect your credit scores. Examples of soft inquiries include requesting your own credit reports or lenders looking at them to qualify you for a prescreening offer.

Who Should Use Credit Karma

There are a lot of people who are too scared to use Credit Karma because they do not want to give their personal information. One of the pieces of information you need when signing up on Credit Karma is the Social Security Number. Not everyone is comfortable with giving these details.

However, its a necessary piece of information if you want to track your credit history and score. If you wish to find out your credit score and monitor it in order to know when you can buy a house or a car, then Credit Karma is the way to go.

Even if you dont give your information to Credit Karma, when you want to buy a new home, you will have to give the mortgage lender your Social Security Number. This will allow him/her to check your credit score. But when that happens, there will be a hard inquiry on your credit report, which will bring down your credit score by a bit.

On the other hand, Credit Karma doesnt end up in a hard inquiry on your report. It is only there to gather information and let you monitor your credit.

So, Credit Karma is a good alternative for first-time homebuyers or just anyone who wants to keep an eye on their credit before they borrow a loan or make a great purchase. You should consider this service and sign up in order to monitor your credit score. On top of allowing you to check your score, Credit Karma also lets you learn more about credit scores, what impacts them and how to improve them.

Also Check: Is 689 A Good Credit Score

Experian Vs Credit Karma: Whats The Difference

Experian and Credit Karma are two very different entities. They offer different services, pricing, and even different credit scoring models. Well dive deeper into the differences for each one to help you decide which is better.

The biggest difference between the two is the type of company they are. One is an actual credit bureau and the other just delivers the credit data. This might matter more than you think it does.

Does Credit Karma Use Transunion

Asked by: Granville Glover

The credit scores and credit reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus. They should accurately reflect your credit information as reported by those bureaus but they may not match other reports and scores out there.

Recommended Reading: How To Check My Credit Score With Itin Number

Before We Dive Into How Using Your Credit Card May Affect Your Credit Scores Lets Recap What We Mean When We Talk About Credit Card Utilization

You can figure out your credit utilization rate by dividing your total credit card balances by your total credit card limits. The resulting percentage is a component used by most of the credit scoring models because its often correlated with lending risk.

Most experts recommend keeping your overall credit card utilization below 35%. Lower credit utilization rates suggest to creditors that you can use credit positively without relying too heavily on it, so a low credit utilization rate may be correlated with higher credit scores.

Now that weve defined our terms, lets look more closely at how your credit utilization relates to your credit scores.

Does Credit Karma Give You A True Score

The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus. This means a couple of things: The scores we provide are actual credit scores pulled from two of the major consumer credit bureaus, not just estimates of your credit rating.

Also Check: What Credit Score Do You Need To Refinance Your House

How Does Credit Karma Compare To Actual Credit Scores

A lot of people also wonder how Credit Karma compares to actual credit scores. Well, Credit Karma generates credit reports from two of the three credit report agencies that are at the top. As already mentioned, they create these credit reports through agencies like Equifax and TransUnion. The score reported from these two is very close, and even if the points will be a bit off, they wont be by much.

The only top credit agency that does not report to Credit Karma is Experian. This is basically where the few points that are off are coming from. This relates to the actual credit or FICO score, so that is why it is affected.