How Do I Use Credit Karma Coupons

To use a Credit Karma coupon, copy the related promo code to your clipboard and apply it while checking out. Some Credit Karma coupons only apply to specific products, so make sure all the items in your cart qualify before submitting your order. If there’s a brick-and-mortar store in your area, you may be able to use a printable coupon there as well. Get Credit Karma coupons.

Work With The Right Mortgage Company

One of the most significant decisions when purchasing a home for the first time will be picking the right lender. Numerous homebuyers dont put in enough effort to choose the right mortgage company.

The mistake that is often made is just focusing on the interest rate offered and not the loans total cost.

Lenders can make a particular loan product look enticing by the advertised rate they are offering. Sometimes the cost, however, when compared to other loan programs, is not the best.

At the initial stages of procuring financing, make sure you ask the lenders lots of questions. Getting the answers you desire will go a long way towards being happy in the long term.

As a first-timer, there are a plethora of exceptional first-time buyer loan products available to choose from. Whether you are looking for a low or no down payment loan, youll have plenty of outstanding choices.

Just as essential as finding the right fit with a mortgage company is finding a real estate agent you find dependable and trustworthy.

An excellent agent can be a valuable resource in finding a loan specialist. It is one of the many services a real estate agent provides to their buyer clients.

Use The Card Responsibly

A credit card can be a powerful tool when used responsibly. Weyman offers several tips on how to use your credit card responsibly.

- Pay your balance on time and in full every single month. One way to do this is to set calendar reminders.

- Never think of your credit card balance as extra money. You should treat it similar to your debit card or cash.

- Dont chase after rewards by making purchases you normally wouldnt. Ask yourself before every purchase if this is something you would buy anyway if there were no rewards involved.

Also Check: Does Opensky Report To Credit Bureaus

Your Credit Health Report

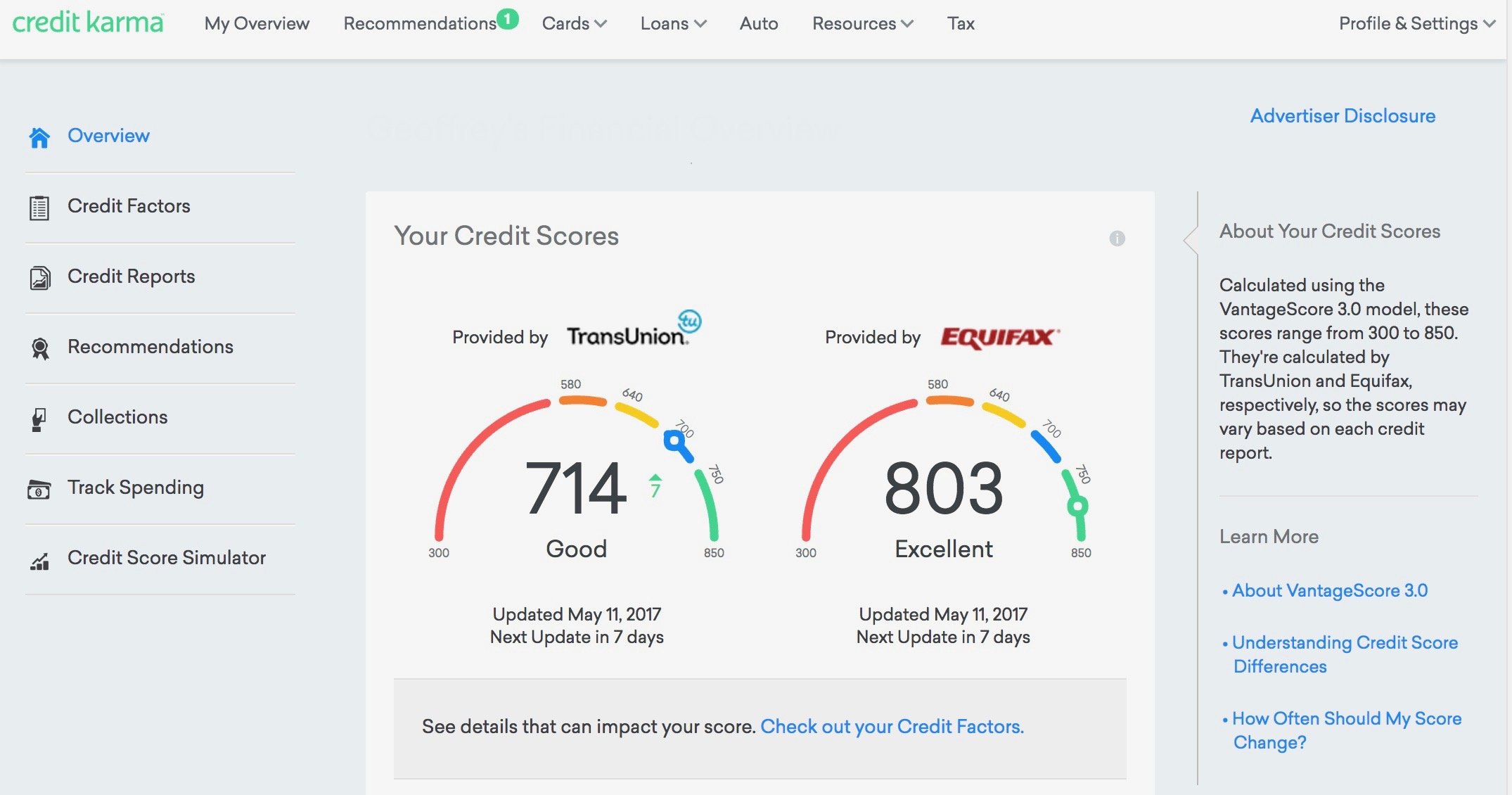

Ready to dig into your credit? From the dashboard, click your TransUnion score to view your TransUnion credit health report or your Equifax score to view your Equifax credit health report. Your creditors may report to all the credit bureaus or just one, so the reports you see may be identical or have slight differences.

On your Credit Health Report page, youll notice a graph depicting the changes in your credit score over time.

Below the graph are two important tabs Credit Factors & Credit Report. Heres what you should know about them.

Next Steps: How Can I Keep Medical Collections From Ever Appearing On My Credit Report

These tips could help you keep medical bills off your consumer credit reports.

Read Also: Affirm Virtual Card Walmart

The Apps Spread Your Data Around

Where does all that data go?

TransUnion says it sells your data to third-party companies. Only California residents can opt out, by selecting a Do Not Sell My Personal Information option. The privacy policies for the other four companies state that while they dont sell the information, they can use it to market products or services to users.

To track exactly where the data goes, CR staff members were able to observe . Fitzgerald and his team noted that not all companies on the receiving end were listed in the apps privacy policy disclosures.

The common practice of sharing data this way in its own right raises privacy concerns. But credit apps escalate the problem, Fitzgerald says, due to the quantity of the information they gather, the amount of time over which they gather it, and the length of time that they retain it. This data, whether sold or simply shared, could, in theory, be used for a broad range of uses, he says.

This highlights a fundamental problem with the apps tested for this research: It is impossible for an average person to get a clear sense of where all this data is sent and how it is used.

Why Are My Credit Scores From Credit Karma Different From Scores I Got Somewhere Else

We pull your VantageScore 3.0 credit scores directly from TransUnion and Equifax. There are a few reasons why you might get different credit scores from each of the three major credit bureaus.

One big reason why you may have different scores is that the three credit bureaus may have differing information about you.

Here are three reasons why that may be the case:

Recommended Reading: Zebit Report To Credit Bureau

How To Get A Copy Of Your Credit Report From All Three Major Credit Bureaus

You can order one free copy annually of your credit report from Equifax, Experian and TransUnion by requesting it online with each bureau. Or get your hands on all three reports at once by ordering them at AnnualCreditReport.com.

Youre also entitled to a free copy of your credit report from a credit bureau that provided a report to a creditor that declined your credit application.

How To Read Credit Report Codes

Youll find a variety of different codes on your credit reports. Each major credit bureau has its own codes though, so dont assume a code used by one bureau means the same thing on another bureaus report.

Each bureau offers a guide explaining the codes youll see on that particular bureaus report. Heres where you can access those guides.

You May Like: Does Qvc Report To Credit Bureaus

What Is Considered A Good Credit Score In Canada

A credit score is a 3-digit number between 300 and 900 that is reflective of how good or bad you are with debt. The credit score you obtain from the two major credit bureaus in Canada may be slightly different, however, they can generally be ranked as:

800 900 Excellent600 649 Fair300 599 Poor

Based on the numbers above, a good credit score is technically any score over 650. The higher your credit score, the better your chances at snagging a competitive interest rate when you want to borrow money.

To arrive at your score, credit bureaus take the following into consideration:

- Your loan repayment history

- Length of your credit history

- New credit inquiries on your account

- Your credit mix

Credit Karma provides a credit score that is obtained from TransUnion. If you also want to see your Equifax credit score, you can obtain it for free through Borrowell.

You can also obtain your credit score directly from the credit bureaus, but this service comes at a cost.

Learn about how your Canadian credit score is calculated.

How Accurate Is Credit Karma

Is Credit Karma Accurate? A common question from people who are using the free credit monitoring service. In this article we will dive into everything you need to know about Credit Karmaâs accuracy, how often Credit Karma updates, how the service works, as well as what to be aware of:

Many people looking to buy a home will need to know their credit score and how accurate is Credit Karma? is one of the more common questions we receive.

Below we will give you an in-depth overview of what is, how accurate Credit Karma is and how often Credit Karma updates.

Lets dive in so we can understand how accurate Credit Karma is:

Read Also: How Can You Get A Repo Off Your Credit

Why Credit Scores Can Vary

- Information may be incorrect on a credit report. If information is wrong on your credit report, it will affect your score. Fortunately, you can dispute inaccurate information using the . Getting incorrect information fixed on any credit report is vital, especially if you purchase a home shortly. You can learn how to dispute errors in a credit report in this helpful article from Norton.

- Some lenders do not report to all three major credit report companies. If a lender does not report to a credit report company, that companys score for you will be different from the score you have at a credit report company with that lenders info.

- Scoring models differ among credit reporting companies. Each credit reporting company has its own scoring model the model they use to weigh the importance of different aspects of your credit. Since they use different models, they can come up with different scores using the same information. You will notice that all credit agencies have slightly different scores.

So, hopefully, you now have a better understanding of Credit Karma accuracy.

How To Print Credit Report From Credit Karma App

With that done the app itself came alive and it s superb giving the cleanest and clearest overview of all your credit contracts and allow an in depth look into the various parts of. 4 easy steps to download the free credit karma credit reports equifax and transunion using actual screenshots.

Freecreditscore Com Credit Karma Credit Report Monitoring Credit

Don’t Miss: Experian Boost Paypal

Best For Credit Monitoring: Credit Karma

Youll have access to your credit report information along with an explanation of the factors that are currently contributing to your credit score. Credit Karma also uses your free credit report information to show credit card and loan offers that you may qualify for based on your credit standing. You dont have to take advantage of these offers if youre not on the market for a new credit card or loan product.

Why Your Free Credit Scores From Equifax And Transunion May Be Different

You may think that your VantageScore 3.0 credit scores from Equifax and TransUnion should be the same, but thats not always the case.

Remember, VantageScore 3.0 is ultimately just a scoring model. The three-digit number it produces depends largely on the information that lenders report to each credit bureau.

When credit scores that use the same model differ between credit reporting bureaus, its typically because they dont have the same information. Here are a few of the reasons you might see different credit scores.

- Your scores are from different dates. Different bureaus receive information from lenders at different times. If new information is accounted for in one credit score and not the other, the scores may differ.

- Your scores are calculated using different credit reports. Its up to lenders to decide which credit bureaus they report your information two. Some report to all three major credit bureaus, while others report to only one or two. If your Equifax credit report has information that your TransUnion report doesnt , your scores may differ.

- Your credit reports contain incorrect information. Its possible that one or several of your credit reports contain errors. Thats why we recommend regularly checking your credit reports for errors that may affect your scores anddisputing those errors, if need be.

Recommended Reading: How To Print My Credit Report Credit Karma

How To Improve My Credit Score

As a small business owner, you know how important it is to have a healthy credit scoreit can help you get great loans to grow and thrivebut you also know getting there is not that easy.

Or is it?

While improving your credit score is not a quick process, its not that complicated. There are some things you can d0:

- Get a secured credit card

- Purchase electronics with installment payments

- Consolidate credit card debt into an installment loan

- Never exceed 30% of credit capacity

- Pay off credit card balances each month

These are just some easy ideas that can help you on your journey. But the most important thing is that you know that youll get an excellent credit score if you work hard at it. The credit score is not a mythical thing thats hard to understand its quite easy once you get the gist of it. If you want to improve your credit knowledge, why not visit our ?

Tips To Increase Your Credit Score

Now that you understand the importance of credit scores in purchasing a home, its time to improve them. So, what are the best ways to go about getting your credit score to increase quickly? Here are some sound tips for upping your credit score:

It would help if you strived to get your credit score above 740, especially when buying a home will be in your financial future. A credit score above 740 is considered very good. Lenders see borrowers above this amount as being dependable. Get your score above 800, and you will be regarded as one of the cremes of the crop. You will be considered a minimal risk to mortgage lenders.

Read Also: Comenitycapital/mprcc

How Does Credit Karma Canada Work

I signed up for Credit Karma in order to test the Canadian service. The signup took less than one minute. The system asked for some information, like my address, and social insurance number, and then asked some personal validating questions.

You can signup for here.

Within seconds after signing up, and logging in, Credit Karma provided me with my credit score.

Credit Karma grabs the score from TransUnion, and although the score wasnt that different from the $150 paid yearly service that I subscribe to from Equifax Canada, there was an approximate difference of 50 points between my Equifax and Credit Karma score. Im not sure how they validate these differences, because it appears that they both provide data and pull the reports from the same places. Also, its important to keep in mind that Equifax charges me for the report, whereas Credit Karma provided the report to me for free.

Equifax Canada does offer a credit monitoring service, which is something that I use as a form of personal credit insurance. Any time a credit report is pulled on my name, or, any changes are made to my report or history, I receive an email, I log into Equifax Canadas website, and I can monitor the changes and reports immediately.

Frankly, I actually like the Credit Karma reporting screen better than Equifaxs screen. The layout of Equifax is old and outdated and is in desperate need of a refresh. It looks like it was designed in the late 90s.

A Credit Karma Account Has Security Measures

For example, you can get a texted code to verify your identity with two-factor authentication if you plan on logging in from different devices.

You will be able to turn credit and identity monitoring on or off. You will also be able to request email notifications for changes to your credit score, special promotions, etc. Having these options comes in handy, especially if there is suspicious activity.

If you need to reach Credit Karma by phone, you can do so by calling their phone number at1-888-909-8872. They are available to answer your calls from 8 a.m. to 11 p.m. Eastern time.

Using their toll-free number will be how you reach Credit Karma customer service.

Also Check: Bpvisa Syncb

Telling Credit Karma About Your Loans

Before you can use Credit Karmaâs tools, you need to enter information about any loans you have beyond credit cards. If you have an auto loan, for example, you provide details about the year, make, model, and current mileage of your vehicle. The site creates a page for that vehicle that displays its current estimated value, as well as links to insurance and loan refinance options. You can also search for a new car and sell or trade your existing one. Credit Karma partners with Carvana for that last capability.

Home loans work similarly. If you supply information about any mortgages youâve taken out, youll see your estimated home value and loan balance. If Credit Karma thinks you could get a better deal, it displays refinancing opportunities that might be attractive. Due to low interest rates, mortgage lenders are apparently swamped right now. You can turn on the new Refinance rate tracker and get notifications when Credit Karma finds a better rate. Similar tools are available for personal loans.

Two years ago, Credit Karma introduced what it calls a High-Yield Savings Account called Credit Karma Money. Of course, in these days of almost nonexistent interest rates, that yield amounted to 0.13% APY on the day I checked it. The account has no fees, and there is no minimum to open it. You can link one external account to your Credit Karma savings account by providing your online banking username and password.

Donât Miss: Les Schwab Credit Score Requirements