Do Your Savings Affect Your Credit Score

by Maurie Backman | Published on Oct. 28, 2021

Having money in the bank is important — but will it help boost your credit?

Having a good credit score is important because it can open the door to affordable borrowing opportunities. Say you need money in a pinch and want to apply for a personal loan. The higher your credit score is, the more likely you’ll be to not only get approved for that loan, but to get it at a reasonable interest rate. Similarly, you might see a new offer hit your radar that you’d like to pursue. The stronger your credit score is, the more likely you’ll be to snag it.

The more consistent you are with paying your bills on time and not borrowing more than you can afford, the higher your credit score is likely to be. And building up a healthy savings account balance is certainly a smart financial move to make to support that. But will having a decent chunk of savings impact your credit score? Here’s what you need to know.

What To Expect From Debt Collection

While healthcare providers generally dont have contact with credit bureaus, debt collectors do, which could be bad news for your credit score.

However, theres some good news: Theres a waiting period, or grace period, of 180 days before the major credit bureaus include medical debt on your credit report. Whats more, starting on July 1, 2022, the credit bureaus are increasing this grace period from six months to one year.

The move gives borrowers have more time to work with healthcare and insurance companies to pay their bills before facing negative consequences. Its also common for insurance companies to be slow in making payment arrangements with healthcare providers, leading to errors on medical bills. So this grace period provides time to work things out.

Currently, medical debt can remain on your credit report for up to seven years . Yet this is set to change in July 2022. The three credit bureaus have decided that medical debts that have been paid off or are worth less than $500 wont show up on your credit report.

Good Credit Puts Money In Your Pocket

Good credit management leads to higher credit scores, which in turn lowers your cost to borrow. Living within your means, using debt wisely and paying all billsincluding credit card minimum paymentson time, every time are smart financial moves. They help improve your credit score, reduce the amount you pay for the money you borrow and put more money in your pocket to save and invest.

1 Scores and rates as of January 9, 2015, as reported on myFICO website.

Also Check: When Does Wells Fargo Report To Credit Bureaus

What Is A Credit Rating And How Does A Consumer Proposal Affect My Credit

In Canada, the two major credit reporting agencies are TransUnion and Equifax. Each agency maintains a for you that includes information about your credit behaviour such as your credit applications, your outstanding debt and whether you make your payments on time. Your credit report also includes a rating for each type of credit you use.

- I means installment credit: You make payments on a fixed amount loan, like a car loan, personal loan or student loan.

- O means open-end credit: You can make repeated withdrawals and repayments, like a line of credit.

- R means revolving or recurring credit: You make regular payments and you can borrow up to a credit limit, like a credit card.

- M means a mortgage loan.

Your credit rating for each type of credit will be based on a scale of 1 to 9. For example, R1 is the best possible credit behaviour for revolving credit types, and R9 signifies that your debts are uncollectable or you have filed for bankruptcy. Filing a consumer proposal results in an R7 rating, which means you are making regular payments using a debt management option.

Once your LIT files your consumer proposal with the Office of the Superintendent of Bankruptcy Canada , the OSB will notify the credit reporting agencies of your consumer proposal. The date of the filing will appear in the legal or public records section, and when you complete your obligations under the proposal , that completion date will be updated in your record.

Can Too Much Credit Hurt My Credit Score

No, having too much credit cant hurt your credit score directly. However, the number of credit card accounts you have open can indirectly affect your credit utilization ratio. Whether its on one credit card or collectively across all of your existing credit card accounts, using more than 30% of your total available credit can put a dent in your score.

Remember that opening new lines of credit results in a hard pull on your credit score. Too many of these in a short period of time can put a hurting on your credit score in the short term.

Don’t Miss: Qvc Card Credit Score

What Are The Benefits Of Using Afterpay

There are plenty of benefits for using Afterpay! Here are just a few:

You can enjoy your purchase now and pay it off over four equal instalments, due every two weeks.

There’s no interest or added fees . So, using Afterpay won’t affect your credit score.

It’s easy to use! If you’re shopping online, simply select Afterpay at checkout. In-store, just inform the cashier that you’d like to use Afterpay and provide them with your mobile number.

You can use Afterpay at thousands of popular retailers.

You dont require a credit check to sign up.

How Your Spouses Credit Score Impacts Joint Purchases And Accounts

Couples usually make joint financial decisions together when it comes to big-ticket items like mortgages, car loans, and personal loans. When you co-sign a loan with your partner, both of your credit scores will be weighed to determine the loan amount and interest.

If your partner has a history of missing or defaulting on payments, their credit score could drive down the qualifying loan amount and you may have to pay a higher interest rate on the loan you do receive. You can leave your spouse off a loan application if they have a low credit score, but by doing so and not including both of your incomes on the application, you could miss out on qualifying for the full line of credit that you need.

If one persons income is not sufficient, youll have to factor in both scores, says Megan McCoy, Ph.D., director for the personal financial planning masters program at Kansas State University.

Having everything in your spouses name can also be problematic if you happen to divorce. If your partner defaults on bills and your name is on the account, you could be solely responsible for these debts without the help of your partners income.

Read Also: Does A Repossession Stay On Your Credit

Don’t Miss: What Credit Score You Need For Care Credit

Does Voting Increase Credit Score

While voting in elections doesnt necessarily improve your credit score, being on the electoral register will.

The electoral roll is a list of names and addresses of people who are registered to vote. Being on this register makes it easier for you to borrow money because it helps credit companies confirm your identity.

Lenders can also check that the details that you have provided are accurate and minimise the risk of fraud.

How Long After A Consumer Proposal Can I Get A Credit Card Or Credit In General

As soon as your proposal is approved in court you may apply for a new credit card. There are not many creditors willing to lend to borrowers like you, so tread carefully.When you are rebuilding your credit, the most impactful new credit is going to be a credit card more than a loan by far.In our experience, Capital One is a terrific company for credit rebuilding even if they were included in your consumer proposal!After they approve you, you will be expected to give them a security deposit, which rarely exceeds $300, regardless of the limit.HomeTrust Company offers a credit card secured with a deposit from you. For every dollar you send to them, they will add it to your credit limit.

Don’t Miss: How Can I Raise My Credit Score 50 Points Fast

As You Pay Down Your Mortgage

In the long run, having a mortgage and paying it off as agreed can help you build a stronger credit profile.

A study by LendingTree found that U.S. borrowers saw an average credit score drop of 20.4 points after getting a mortgage. It took an average of 165 days after closing for credit scores to reach their low points, and another 174 to rebound. In total, the decline and rebound averaged 339 daysjust shy of a year.

While your score will likely drop initially, a track record of on-time monthly payments on the sizable loan will help to improve your score and trustworthiness as a borrower.

What Credit Scores Are Used For

Banks, building societies and credit card companies use credit scores to work out how risky it would be to lend money to you. They will analyse your score to decide if:

- you qualify for a product

- what interest rate you will pay

- what credit limit to offer

Your credit score will be checked if you are looking for a mortgage, personal loan, credit card or an overdraft on your current account even a student current account.

Don’t Miss: What Is The Minimum Credit Score For Care Credit

Commit 20% Of Your Income To Savings And Debt Repayment

Use 20% of your after-tax income to put something away for the unexpected, save for the future and pay off debt. Make sure you think of the bigger financial picture that may mean two-stepping between savings and debt repayment to accomplish your most pressing goals.

Many experts recommend you try to build up several months of bare-bones living expenses. We suggest you start with an emergency fund of at least $500 enough to cover small emergencies and repairs and build from there.

You cant get out of debt without a way to avoid more debt every time something unexpected happens. And youll sleep better knowing you have a financial cushion.

Get the easy money first. For most people, that means tax-advantaged accounts such as a 401. If your employer offers a match, contribute at least enough to grab the maximum. It’s free money.

Why do we make capturing an employer match a higher priority than debts? Because you wont get another chance this big at free money, tax breaks and compound interest. Ultimately, you have a better shot at building wealth by getting in the habit of regular long-term savings.

You dont get a second chance at capturing the power of compound interest. Every $1,000 you dont put away when youre in your 20s could be $20,000 less you have at retirement.

If either of the following situations applies to you, investigate options for debt relief, which can include bankruptcy or debt management plans:

WATCH TO LEARN MORE ABOUT BUDGETING

Avoid Carrying A Balance

Whenever possible, avoid carrying a balance. The best way to budget on credit is to pay your statement in full each month to avoid paying interest. This also allows you to maximize your grace period. When large, unexpected costs arise, try to charge them at the beginning or your credit card cycle. This will allow you to extend the due date for the entire 30 day cycle and at least another 21 days between the closing date for your statement and the due date.

Read Also: How To Unlock Your Credit

Monitor Your Credit For Free With Creditwise From Capital One

Thereâs no doubt that marriage is life-changing. But one thing it doesnât change is how important it is to monitor your credit. It will help each of you know where you stand. And you can take steps to improve your credit scores if you need to.

can help with that. You can access your TransUnion credit report and VantageScoreî 3.0 credit score every week and monitor your credit with CreditWise. Itâs free for everyone, not just Capital One customers. And using it wonât hurt your score.

You can also get free copies of your TransUnion, Experian and Equifax credit reports. Visit AnnualCreditReport.com to learn how.

Knowing whatâs in your credit reports and understanding how you can affect each otherâs credit can contribute to a solid financial foundation for your marriage. And that could help you and your loved one have the happily-ever-after you deserve.

Learn more about Capital Oneâs response to COVID-19 and resources available to customers. For information about COVID-19, head over to the Centers for Disease Control and Prevention.

Government and private relief efforts vary by location and may have changed since this article was published. Consult a financial adviser or the relevant government agencies and private lenders for the most current information.

Will A Dro Show Up On Your Credit File

Your DRO will show up on your credit reference file. It can reduce your chances of getting credit from some lenders, as it shows you’ve struggled to keep up repayments before.

You’re not allowed to get credit for £500 or more without telling the lender that you have a DRO. A lender might change their mind about offering you credit, when they see a DRO registered on your credit file.

The note of your DRO stays on your credit file for up to six years after the date the DRO was made. This means it could be some time before you can get credit in the future.

You might also struggle to open a new bank account during the DRO period and for some time after it has ended.

If you need a new home while you’ve got a DRO, you could find that your options are limited. Many private landlords and letting agencies will insist on credit checks when you apply for a tenancy, and because the DRO will show up on your credit report, you may be turned down or charged higher fees.

If you’re not comfortable with how a DRO can affect your credit rating, you might want to think about a different debt solution.

Also Check: Credit Score Usaa

The Average Debtopens In New Window Among American Consumers In 2021 Was $92727 Which Includes Credit Card Balances Student Loans Mortgages And More This Number Can Represent A Large Chunk Of Your Finances So Budgeting Should Be A Priority In Maintaining A Healthy Financial Well

How You Manage Debt Will Impact Your Credit

You may have heard debt being classified as either good debt or bad debt. Typically, when you hear good debt, its in reference to money borrowed at a low, fixed interest rate to purchase assets that may increase in value over time. A mortgage or business loan often fall under this category.

Debts that are labeled bad are the opposite. They tend to be high-interest loans or credit cards used to buy things that are quickly consumed or lose value once purchased.

Ultimately, whether or not you get yourself in over your head with debt is often determined by your behavior in regards to spending and managing money, rather than any one type of debt you incur. A few good rules of thumb to support a healthy credit history and score are:

- Build a budget to pay off debt

- Keep your credit card charges to a minimum

- Pay your credit card balance in full every month

- Make your debt payments on time, all the time

- Do not utilize more than 30% of the credit you are approved for

If you dont establish and stick to an effective money management plan, poor habits will likely impact your credit and may affect your ability to borrow, rent, or even get a job. Sub-par credit will also make any loan that you do get approved for more expensive, as interest rates rise if your credit score is low.

Make Payments on Time

Utilize Credit Responsibly

Budgeting is Your Best Tool to Pay Off Debt

Create Your Budget

Assess What You Owe

Plug in the Numbers

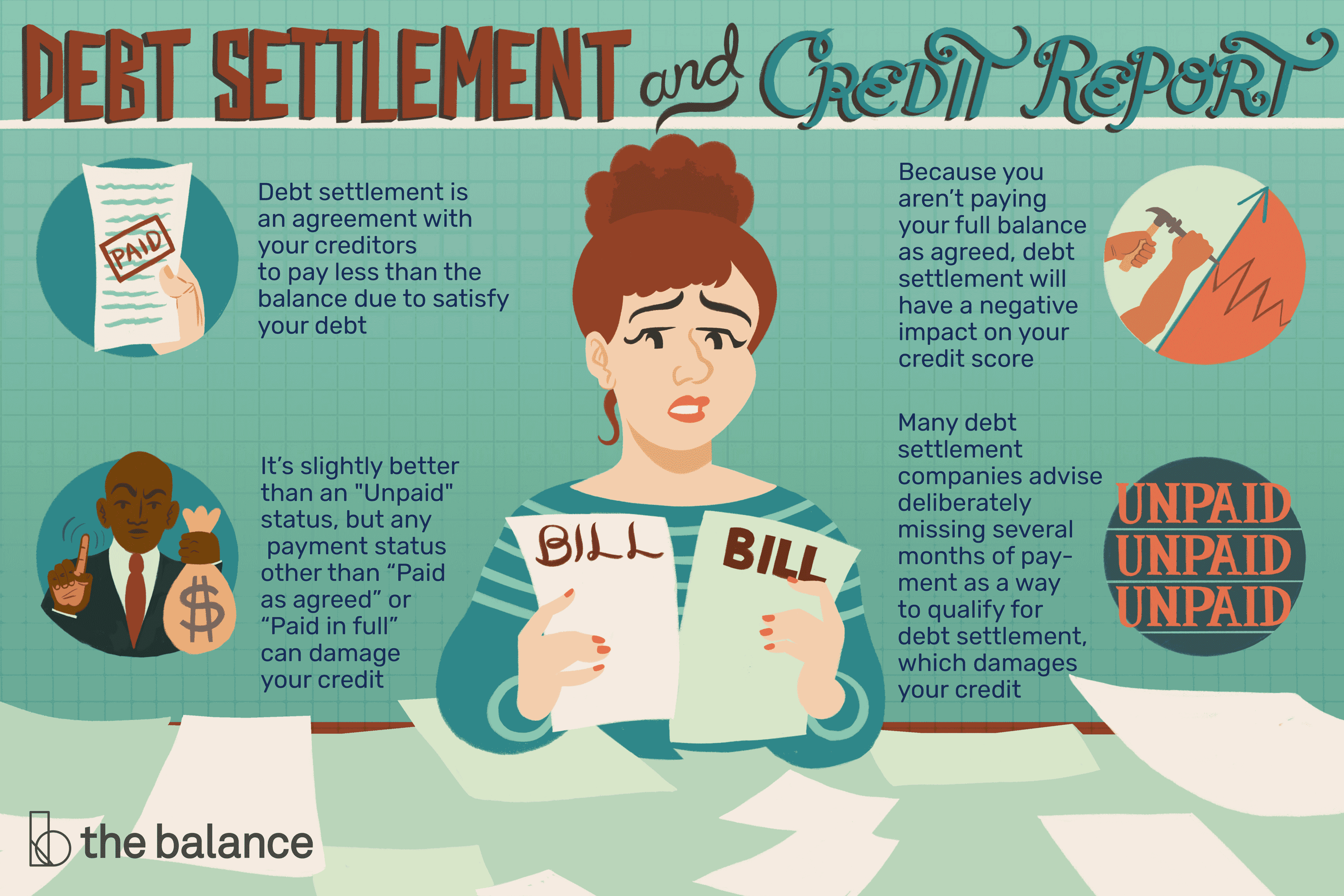

Rebuilding Credit After A Debt Settlement Program

When you finish paying off credit card debt through the program, it remains a part of your credit history for six years. While debt settlement companies help you get out of debt, it can hurt your credit score. Depending on your prior score, your bad credit can be worse off.

However, its better for the creditors to receive compensation partially than not at all. Besides, you can rebuild your credit with proven techniques.

Don’t Miss: Does Uplift Report To Credit Bureaus

Myth #: Each Person Only Has One Credit Score

There are two credit bureaus in Canada: Equifax and TransUnion. Some creditors report to one bureau and not the other, so each bureau may have different information on any one individual. Each bureau also uses their own calculations and algorithms to calculate a credit score. As a result, the same individual may have a different credit score at each credit bureau.

Don’t Run Up High Credit Card Balances

A hard and fast rule to having a solid credit score is maintaining a low . Your CUR is the percentage of your total credit that you’re using. It’s calculated by dividing your total outstanding credit card balance by your total credit limit, then multiplying by 100 to get the percentage.

The higher your credit card balance, the higher your CUR, so it’s crucial to avoid running up excessive card balances. The lower your balances are as compared to your credit limits, the better. Pay off your balance in full each month, and if you can’t afford to do that, keep them below a certain threshold.

“At a minimum, you should strive to keep balancesbelow 30% of the credit limit,” Griffin says. “Any balance can have some effect on scores, but once you cross the 30% threshold, scores begin to drop much faster.”

Griffin warns that those in the habit of revolving large balances on their credit cards month to month are certainly hurting their credit scores without realizing it, even if they never make any late payments on those accounts.

Recommended Reading: How To Remove A Repo From Your Credit