Need A Little Extra Help

A free credit score is great tool for understanding, tracking, and building your credit. If you want even more insight into your credit, check out ExtraCredit. For $24.99 a month, you can see 28 of your FICO scores from all three major credit bureaus. In addition to your credit scores, ExtraCredit offers opportunities to add your rent and utilities to your credit reports to add more to your credit profile, cashback rewards when youre approved for certain offers, exclusive discounts, $1 million identity theft coverage, and more. Check out ExtraCredit today.

Whats A Conditionally Free Credit Score

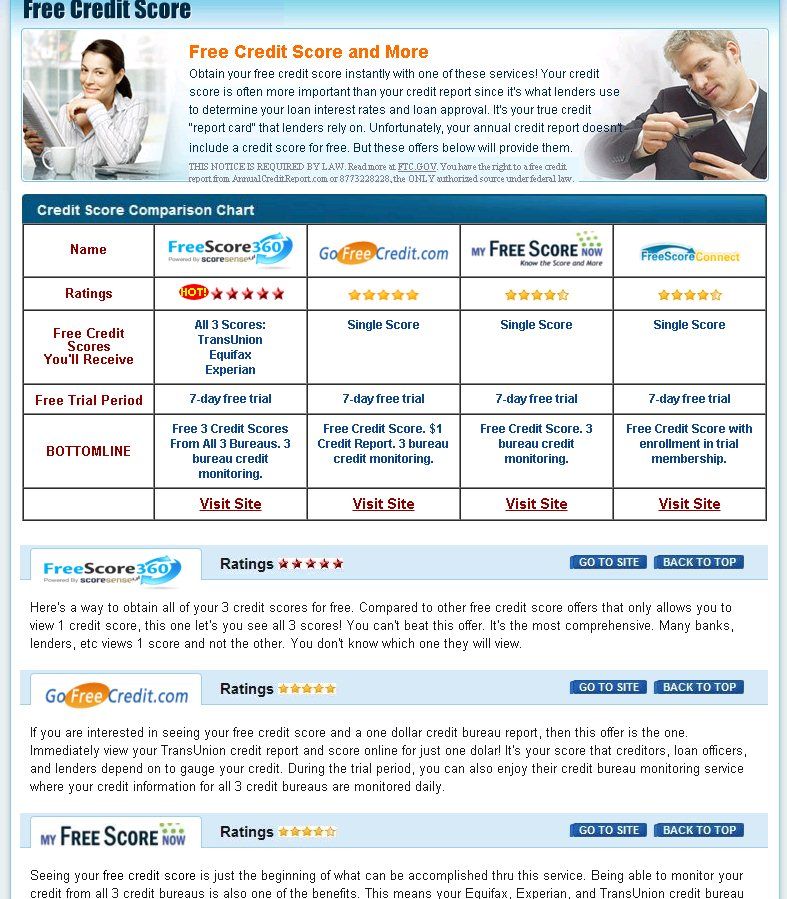

When it comes to accessing your credit scores, it may help to understand the difference between free and conditionally free. If a website or app requires you to input your credit card information at any point, you are not getting a truly free credit score but are instead getting a conditionally free score.

For example, some websites may offer you a free or inexpensive trial of a credit monitoring service. In exchange for signing up for the trial offer, you may be offered a copy of your credit report and what appears to be a free credit score. These websites will ask you for your credit card information.

When you sign up for one of these conditionally free credit services you must proactively cancel the service before the free trial period expires. If you fail or forget to cancel, you will be charged a monthly fee in perpetuity until you do cancel. Fees for monthly credit monitoring services generally run about $20 per month but can be considerably more expensive.

Access More Than Your Score

Not only do you get to see your credit score, but youll also be able to see your credit report card. In a nutshell, it’ll grade you on the five factors that play into your creditpayment history, credit utilization, credit age, new credit inquiries and account mix. Your credit report card gives you snapshot of each new late payment, current credit utilization, new and old hard credit inquiries and how many types of each account you have. Plus, you can check out how your credit score compares to the US average and the averages for your state and age group.

You May Like: What Kind Of Credit Score To Buy A House

How Does A Credit Score Work

Your credit score is a number related to your credit history. If your credit score is high, your credit is good. If your credit score is low, your credit is bad.

There are different credit scores. Each credit reporting company creates a credit score. Other companies create scores, too. The range is different, but it usually goes from about 300 to 850 .

It costs money to look at your credit score. Sometimes a company might say the score is free. But usually there is a cost.

What Is A Credit Score

A credit score is a three-digit number, typically ranging from 300 to 850, that is the result of an analysis of your credit file. That magic number tells lenders your potential credit risk and ability to repay loans. Credit scores consider various factors, such as payment history and length of credit history, from your current and past credit accounts .

Credit score ranges vary based on the model used and the credit bureau that pulls the score. The ratings typically include bad/poor, fair/average, good and excellent/exceptional. The rating you receive depends on the you have. Below, you can check which rating you fall into, using estimates from Experian.

| Rating |

|---|

| 800-850 |

Read Also: How Does A Personal Loan Affect Credit Score

Medical Id Reports And Scams

Use your medical history report to detect medical ID theft. You may have experienced medical iD theft it if there is a report in your name, but you haven’t applied for insurance in the last seven years. Another sign of medical ID theft is if your report includes medical conditions that you don’t have.

Blue Cash Everyday Card From American Express

Annual Fee

RewardsYes

Rewards: The Blue Cash Everyday Card from American Express focuses its rewards on basic spending categories. You get 3% cash back at US supermarkets up to $6000 per year, 1% after you pass the $6000 mark. You also get 3% cash back at US gas stations and at select department stores, and 1% on all other purchases.

Intro Offer: Theres a 0% intro APR on purchases for 15 months after you open the account. After that, the APR is from 16.99% to 27.99%.

The downside: the minimum credit score is 700, so youll need to be in the upper half of the good range.

RewardsNo

Balance transfer cards are a popular way to consolidate credit card debt. If youre looking for a card for this purpose, the BankAmericard Credit Card will be a strong contender.

The card has no annual fee, and theres no penalty APR: if you make a late payment you wont lose the 0% intro APR. You even have free FICO score access, and theres a range of security features.

The regular APR is from 14.99% to 24.99%, and the minimum credit score is 690.

Intro Offer: Theres a 0% intro APR for 21 billing cycles for both purchases and balance transfers made in the first 60 days, giving you plenty of time to pay off those transferred balances. You will pay a 3% fee for each balance you transfer.

The downside: you wont be able to transfer a balance from another Bank of America card.

The Chase Sapphire Preferred Card is a top pick for an all-around travel card.

You May Like: Does Xfinity Report To Credit Bureaus

Is It Safe To Check My Credit Score For Free

Checking your free credit scores on Credit Karma wont affect your credit, and any attempts to monitor your credit with Credit Karma will not appear on your credit reports.

If you want to learn more about how Credit Karma collects and uses your data, take a look at our privacy policy.

You can also read Credit Karmas security practices to learn more about Credit Karmas commitment to securing your data and personal information as if it were our own.

Ready to help your credit go the distance? Log in or create an account to get started.

Why Is My Credit Report Important

Businesses look at your credit report when you apply for:

- loans from a bank

If you apply for one of these, the business wants to know if you pay your bills. The business also wants to know if you owe money to someone else. The business uses the information in your credit report to decide whether to give you a loan, a credit card, a job, or insurance.

Also Check: Will Settling A Charge Off Raise Credit Score

The Importance Of Checking Your Credit Score

Regularly checking your credit score is important because it:

Helps you better understand your financial situation. Without knowing your credit score, its impossible to fully understand your financial circumstances. Having a comprehensive understanding of your score can help you decide whether its a good time to buy a home, apply for an auto loan or make other large purchases.

Makes it easier to improve your score and qualify for better rates. By understanding your score and how it was calculated, you can take strategic steps to improve your credit score over time, or build it for the first time. In fact, many scoring websites let users simulate changes to their score based on various factors like on-time payments, extra payments and new credit applications.

Lets you compare financial products based on eligibility requirements. Knowing your credit score can give you an idea of whether youre likely to qualifyand whether its worth applying. Whats more, lenders typically offer a personal loan prequalification process that lets prospective borrowers see what kind of interest rate they might qualify for based on income and creditworthiness.

May include red flags of fraud. Regularly checking your credit score makes it easier to spot out-of-the-ordinary activity that could indicate fraud. By recognizing a large and unexpected increase in your credit usage soon after it happens, you can file a dispute and get your credit back on track more quickly.

How Is A Business Credit Score Calculated

A business credit score considers many of the same factors as a personal credit score, such as payment history and amount of debt used. However business credit scores use different scoring models.

For two main types of business credit scores, Dun & Bradstreet PAYDEX Score and Experian Intelliscore Plus, scores range from 1 to 100, and the closer to 100, the better. Consumer FICO scores, on the other hand, are ranked 300 to 850, with 800 and above being consider excellent credit.

Business credit scoring models weigh different factors when calculating scores, but you can anticipate that your payment history, age of accounts and amount of debt will be considered. If you carry a balance on The Blue Business® Plus Credit Card from American Express, that will be factored into your business credit score. And if you miss a payment on your Ink Business Cash® Credit Card, that can negatively impact your score.

Don’t Miss: What Credit Score Do You Need For A Mortgage

Get Your Credit Score And Report For Free

If you’ve ever applied for credit or a loan, there will be a credit report about you.

You have a right to get a copy of your credit report for free every 3 months. It’s worth getting a copy at least once a year.

Your credit report also includes a credit rating. This is the ‘band’ your credit score sits in .

How Do I Fix Mistakes In My Credit Report

- Write a letter. Tell the credit reporting company that you have questions about information in your report.

- Explain which information is wrong and why you think so.

- Say that you want the information corrected or removed from your report.

- Send a copy of your credit report with the wrong information circled.

- Send copies of other papers that help you explain your opinion.

- Send this information Certified Mail. Ask the post office for a return receipt. The receipt is proof that the credit reporting company got your letter.

The credit reporting company must look into your complaint and answer you in writing.

You May Like: Is 668 A Good Credit Score

Whats The Best Site To Get A Free Credit Report

The best site for free credit reports depends on what you need.

If you want to take a look at your credit reports from Equifax and TransUnion, you can do so on Credit Karma.

The Fair Credit Reporting Act entitles you to one free copy of your credit report from each of the three major consumer credit bureaus every 12 months. You can order them online at annualcreditreport.com.

How Do I Get Credit

Do you want to build your credit history? You will need to pay bills that are included in a credit report.

- Sometimes, utility companies put information into a credit report. Do you have utility bills in your name? That can help build credit.

- Many credit cards put information into credit reports.

- Sometimes, you can get a store credit card that can help build credit.

- A secured credit card also can help you build your credit.

Also Check: How To Add Utilities To Credit Report

Why Do I Have A Credit Report

Businesses want to know about you before they lend you money. Would you want to lend money to someone who pays bills on time? Or to someone who always pays late?

Businesses look at your credit report to learn about you. They decide if they want to lend you money, or give you a credit card. Sometimes, employers look at your credit report when you apply for a job. Cell phone companies and insurance companies look at your credit report, too.

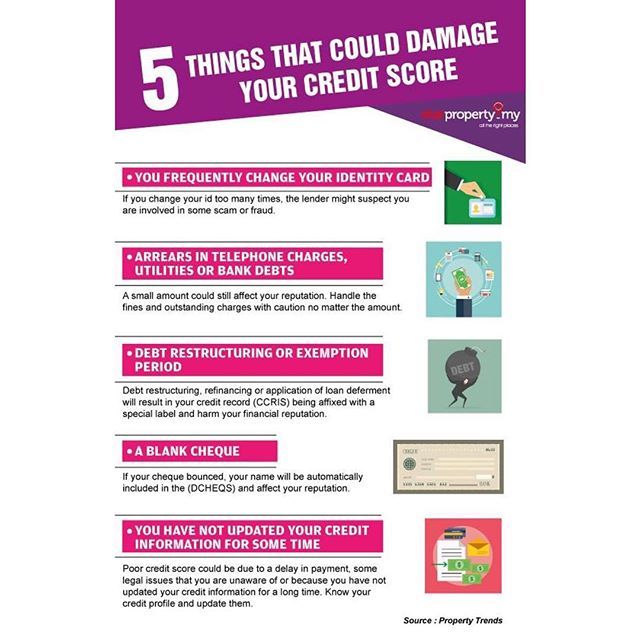

What Doesn’t Impact Your Credit Score

There are many common misconceptions about what does affect your credit score. “Consumers sometimes focus on things that simply don’t matter to their scores. The most common is information about your wealth,” says Ulzheimer.

“Income, balances in retirement accounts, equity in your home, net worth … anything that defines how much money you have or how much you’re worth are not considered by your credit scores.”

Other factors that don’t affect your credit score include race, religion, nationality, gender, marital status, age, political affiliation, education, occupation, job title, employer, employment history, where you live or your total assets.

Learn more: Can employers see your credit score? How to prepare for what they actually see when they run a credit check

Recommended Reading: When Does Bankruptcy Fall Off Credit Report

Does Credit Karma Offer Free Fico Credit Scores

The VantageScore and FICO modelsdiffer in several ways, but that doesnt mean one is better or more accurate than the other. Lenders may rely on different scoring models when evaluating an application, and other considerations can factor in, too.

We recommend looking at your credit scores as a guide to your credit health rather than as a definitive number that determines whether youll be approved or denied for credit.

What Do Lenders See On Your Credit Report

What you see on your credit reports may be slightly different from the things lenders who are reviewing your credit might see. But generally, if a lender is reviewing your credit, they might see your:

- Personal information, such as your name, current address and previous addresses.

- Credit and loan accounts, including information about your payment history.

- Employment history.

Read Also: How To Clear A Judgement On Your Credit Report

What Can Lenders See On Your Credit Report

Your creditreport provides a detailed summary of your credit history. It includes your personal information and lists details on your past and current credit accounts. It also documents each time you or a lender requests your credit report, as well as instances where your accounts have been passed on to a collection agency. Financial issues that are part of the public record, such as bankruptcies and foreclosures, are included, too.

How To Improve Your Credit Score

If your score is not where you want it to be, for whatever reason, there are concrete steps you can take to make it better. I have written extensively on this topic and am in the process of revising my book, Credit Repair Kit For Dummies. For those who cant wait until December when the fifth edition comes out, you can get a copy of the fourth edition on Amazon for cheap!

Here are some tips on how to improve your credit score:

- First and foremost, pay all of your bills on time, as agreed, each and every month. Good payment history is crucial to having a good score and accounts for 35 percent of your FICO score.

- Watch how much of your credit you are using on your credit cards and try to keep it below 25 percent of your total credit available. Your credit utilization ratio reflects how much you owe and accounts for 30 percent of your FICO score.

- Only apply for new credit when you need to and when you are fairly certain you will be accepted. New credit accounts for 10 percent of your FICO score.

- If you only have a wallet full of credit cards with no car loans or mortgages your score will suffer somewhat, so look into ways to obtain whichever kind of debt you dont have in order to improve your credit mix. Credit mix is good for 10 percent of your FICO score.

- To get the last big factor in your score in shape you need only sit back and wait . That factor is length of credit history, weighing in at 15 percent. The longer you show good credit habits, the more points you get.

Read Also: How To Find Out Your Credit Score For Free

Why You Should Check Your Credit Score

Its always good to brush up on the benefits of checking your credit score. And in short, checking your credit is important because it:

- Gives you a good sense of your financial fitness, providing a numerical grade for the contents of your credit reports

- Helps you get the best possible credit card and loan terms, and reduces the likelihood of rejection

- Makes comparing financial products easier, as most offers list a minimum level of credit needed to qualify and

- Tells you how closely you need to review your credit reports. A score that is much lower than youd expect is an obvious red flag, perhaps indicating potential fraud.

- Has no effect on your credit score. Checking your credit score creates a soft inquiry, which does not impact your credit score, so you can check your score as often as you want.

Finally, its important to remember that virtually everyone has room for credit-score improvement. And a better credit score could be worth thousands of dollars per year. Plus, tending to your score doesnt have to cost you a dime or much time. So check out our handy to get started. And if youd like advice tailored to your specific situation, sign up for a free WalletHub account to get your personalized credit analysis. Thats just another reason why you should check your credit score on WalletHub.

Capital One Savorone Rewards Credit Card

Annual Fee

RewardsYes

Heres one for the foodies: the Capital One SavorOne Cash Rewards Credit Card. Theres no annual fee or international transaction fee.

Rewards: Here are the rewards:

- Unlimited 3% cash back on dining, entertainment, groceries, and popular streaming services.

- 1% cash back on other purchases.

- One-time $200 cash bonus if you spend $500 on purchases in the first 3 months.

Intro Offer: Theres a 0% intro APR on purchases for 15 months and a 17.99% 27.99% APR after that.

The downside: youll probably need a credit score over 700 to qualify. If you have defaults, bankruptcies, or very late payments on your record you may not be approved.

Capital One also offers the Savor Rewards from Capital One card, which has a higher introductory bonus and higher rewards. Theres no 0% intro APR, though, and youll have to eat out a lot for the extra rewards to be worth the $95 annual fee.

The Citi Custom Cash Card offers a uniquely flexible rewards program with no annual fee.

Rewards: The card breaks your spending into categories: restaurants, gas stations, groceries, selected travel & transit, drugstores, home improvement stores, fitness, and live entertainment. Youll get 5% cash back on your highest spending category in each billing cycle, up to $500. Youll get 1% cash back on purchases in that category over $500 and on all other purchases. You dont have to select a category: the card adjusts to your spending.

Read Also: How To Remove Names From Credit Report