Do Insurance Companies Report To The Credit Bureaus

Insurance companies don’t report information about your premium payments or claims to the national credit bureaus. Some insurers use credit checks to help set your premiums, however, and failure to pay insurance bills could lead to negative entries on your credit report. Here’s how it all works.

Contact The Credit Bureaus

Both Equifax Canada and TransUnion Canada have forms for correcting errors and updating information. Fill out the form to correct errors:

Before the credit bureau can change the information on your credit report, it will need to investigate your claim. It will check your claim with the lender that reported the information.

If the lender agrees there is an error, the credit bureau will update your credit report.

If the lender confirms that the information is correct, the credit bureau will leave your report unchanged.

In some provinces, the credit bureau is required to send a revised copy of your credit report to anyone who recently requested it.

How A Credit Score Is Calculated

Its impossible to know exactly how much your credit score will change based on the actions you take. Credit bureaus and lenders dont share the actual formulas they use to calculate credit scores.

Factors that may affect your credit score include:

- how long youve had credit

- how long each credit has been in your report

- if you carry a balance on your credit cards

- if you regularly miss payments

- the amount of your outstanding debts

- being close to, at or above your credit limit

- the number of recent credit applications

- the type of credit youre using

- if your debts have been sent to a collection agency

- any record of insolvency or bankruptcy

Lenders set their own guidelines on the minimum credit score you need for them to lend you money.

If you have a good credit score, you may be able to negotiate lower interest rates. However, when you order your credit score, it may be different from the score produced for a lender. This is because a lender may give more weight to certain information when calculating your credit score.

Recommended Reading: What Is Cbcinnovis On My Credit Report

How Credit Is Reported For Apple Card Account Participants

Participants 18 years or older can opt in to be credit reported and build credit history.6 Participants will be reported to the credit bureaus as Authorized Users, which means they can spend on the account but are not required to make payments.

If you’re added as an Apple Card participant

- If a participant opts in to be credit reported, the Apple Card account will appear on their credit report.

- Participants inherit all positive and negative credit reporting from the account owners Apple Card account.

- The account owners payment history and account age is reported on the participants credit report.

If youre removed as a participant from an Apple Card Family account

- Account owners, the participant themselves, or Goldman Sachs can remove a participant at any time.

- Upon removal, Goldman Sachs will stop reporting the participant on that account to the credit bureaus.

- The participants credit history with Apple Card remains on their credit report unless the account is closed for a specific reason, such as an account owner filing for bankruptcy.

If youre a participant and want to open your own Apple Card account

How Does Paying Off Credit Cards Affect Your Credit Score

The two most important factors that make up about two-thirds of your estimate are your on-time payment and the size of your debt. Using loans is one of the easiest and fastest ways to increase your account. Card issuers report their new balance to the credit bureaus on a monthly basis and change usage immediately.

Also Check: How To Remove Repossession From Credit Report

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Is Self Reporting

Describing it as self reporting is a bit deceiving, because an individual cannot actually contact the credit bureaus directly to report credit information or payments.

Self reporting refers to giving the credit bureaus permission to view your accounts and payment history for things that are not automatically reported. This process still involves the use of some third-party service as individuals themselves cannot report directly.

Before considering self reporting, its important to remember what information is already reported to the bureaus. Loan payments are reported automatically: student loans, auto loans, personal loans, mortgages, and most credit cards.

Recommended Reading: Does Paypal Credit Report To Credit Bureaus

Why You Can Trust Bankrate

At Bankrate, we have a mission to demystify the credit cards industry regardless or where you are in your journey and make it one you can navigate with confidence. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to:

- Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

- Consistently provide up-to-date, reliable market information so you’re well-equipped to make confident decisions.

- Reduce industry jargon so you get the clearest form of information possible, so you can make the right decision for you.

At Bankrate, we focus on the points consumers care about most: rewards, welcome offers and bonuses, APR, and overall customer experience. Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next.

How Do I Fix Mistakes In My Credit Report

- Write a letter. Tell the credit reporting company that you have questions about information in your report.

- Explain which information is wrong and why you think so.

- Say that you want the information corrected or removed from your report.

- Send a copy of your credit report with the wrong information circled.

- Send copies of other papers that help you explain your opinion.

- Send this information Certified Mail. Ask the post office for a return receipt. The receipt is proof that the credit reporting company got your letter.

The credit reporting company must look into your complaint and answer you in writing.

You May Like: Speedy Cash Credit Check

What’s In Your Credit Report

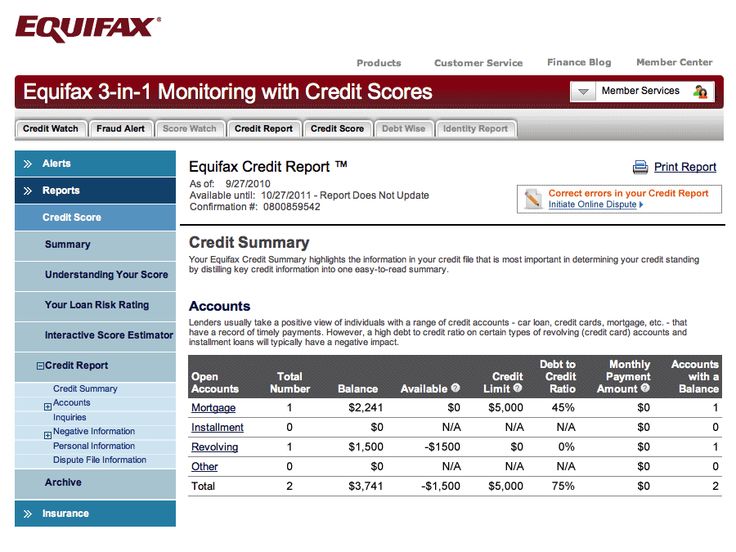

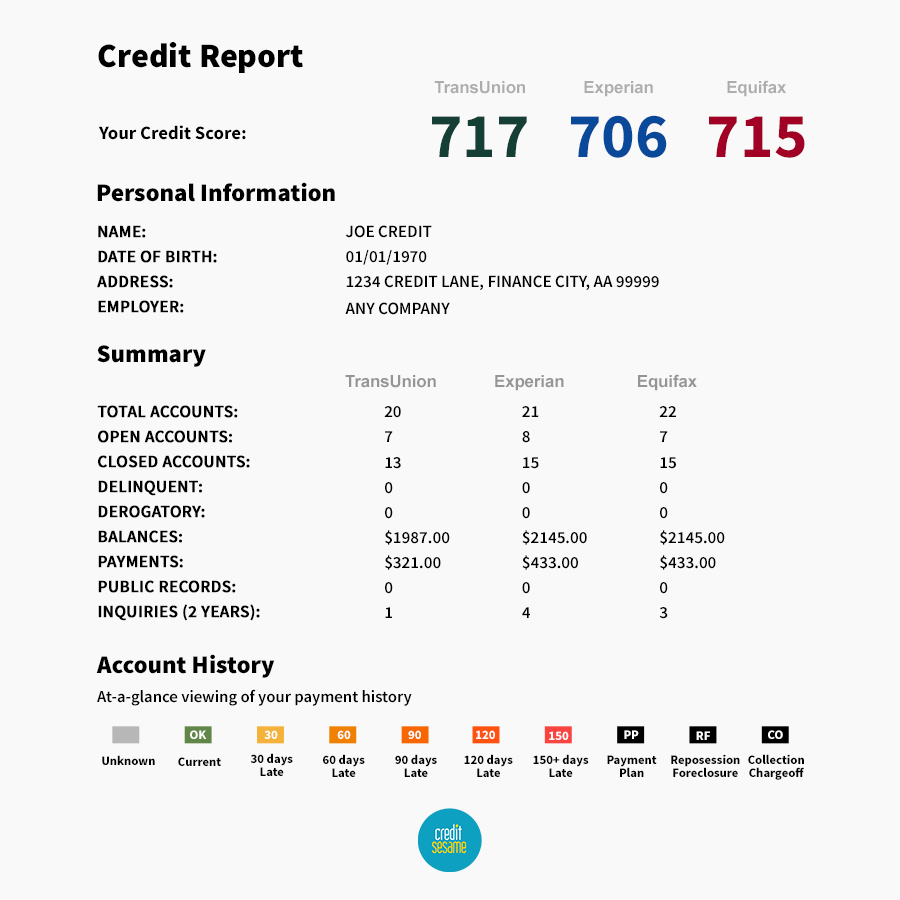

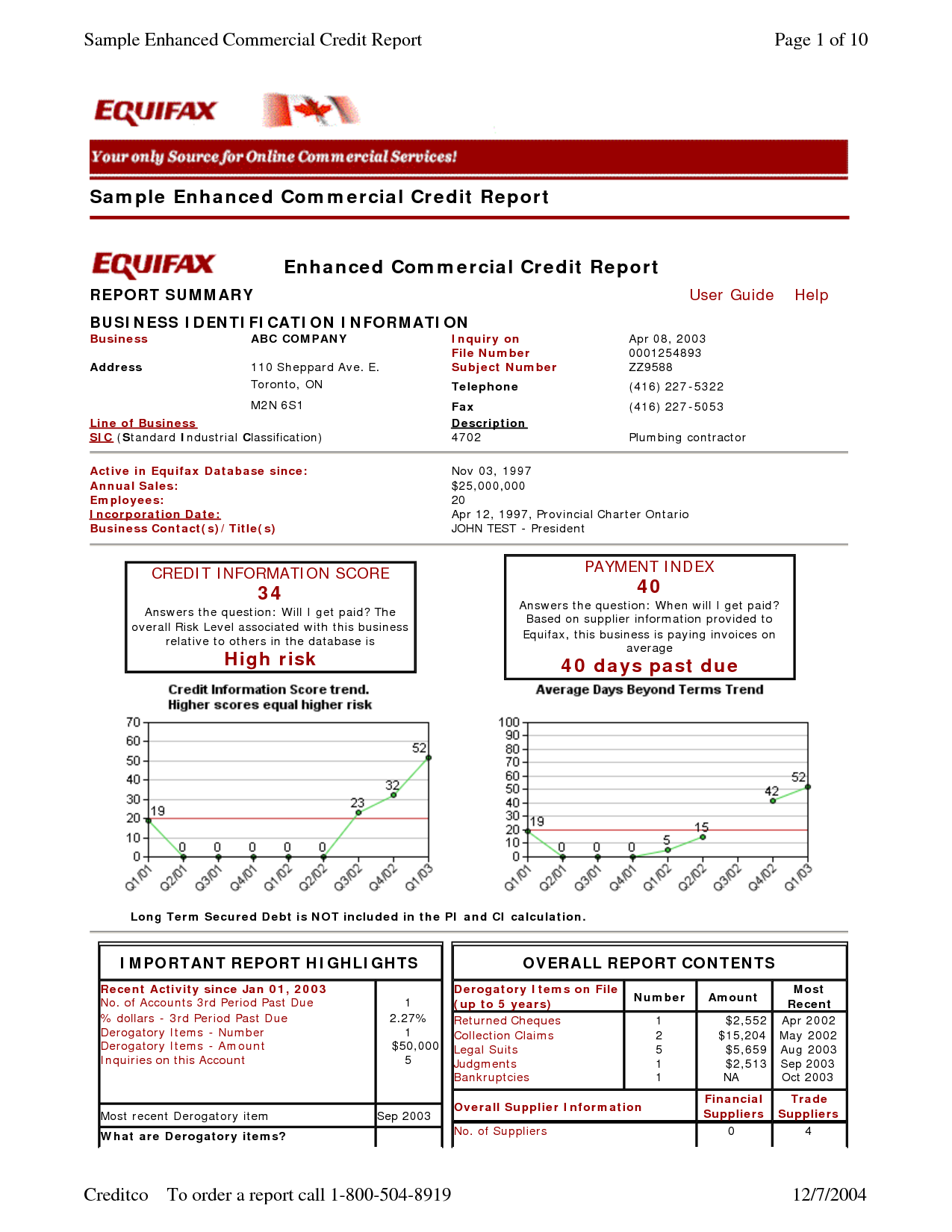

Your credit report contains personal information, credit account history, credit inquiries and public records. This information is reported by your lenders and creditors to the credit bureaus. Much of it is used to calculate your FICO Scores to inform future lenders about your creditworthiness.

Although each of the credit bureausExperian, Equifax and TransUnionformat and report your information differently, all credit reports contain basically the same categories of information.These four categories are: identifying information, credit accounts, credit inquiries and public records.

How Does It Affect Your Credit Utilization

Lets say you buy a big-ticket item using one of your credit cards. You know that the purchase is going to put you over the recommended 30 percent utilization rate, but your plan is to pay the purchase off when you get the bill . So far, so good.

However, if your credit card company, as many do, reports at the close of your billing cycle , your score is going to be negatively affected until you make the payment and it is reported to the bureaus in the next billing cycle. This is because your purchase has affected your credit utilization in a negative way.

Of course, if you stick to your plan, this will be a temporary problem and your score will bounce back once the payment is made and reported. But if you need to access new credit in the meantime, this could be a problem for you.

Even if you dont access new credit, others might look at your credit report while this factor is bringing your score down, like insurance providers or even potential employers or landlords. You have an explanation at the ready, but the chances of them asking and you being able to explain yourself are probably pretty slim.

Also Check: Barclaycard Fico Score Accurate

How Credit Is Reported For Apple Card Account Co

Each co-owner will be reported to credit bureaus as an account owner, so each person is reported in their own name. The shared Apple Card will be reflected on each account owners credit report as a jointly owned account.4 Credit reporting for each co-owner may include both positive and negative payment history on their shared Apple Card, as well as the credit line amount and credit utilization. Each individual’s personal credit history includes information that’s unique to them, so Apple Card usage and payment history can impact each person’s credit score differently.

If you combine your account with an existing Apple Card account owner

- You can only co-own an account with a member of your Family Sharing Group.

- The credit limit for each person will be combined. Both co-owners will see the combined credit limit for the shared account on their credit reports.

- Each co-owner will maintain their pre-merge Apple Card payment history on their individual credit profile.

- Each co-owner will maintain their Apple Card account origination date on their individual credit profile, which can be helpful to maintain the age of their credit history.

- After the accounts have merged, the credit profile for both account owners will include their shared payment and credit activity for Apple Card going forward.

If you want to co-own an Apple Card account with someone who doesnt have an existing Apple Card

If you want to close a co-owned Apple Card account

What Makes Up Your Vantage Score

VantageScore uses the following breakdown:

- Payment history: 41%

- Balance: 6%

- Available credit: 2%

While the formula appears largely similar, with payment history and credit utilization holding the greatest importance, there is a critical distinction in the way the two scores create these metrics.

Whereas FICOs numbers generally represent snapshots, VantageScore uses something called trended credit data. This is just a fancy way of saying they consider the trajectory of a borrowers behavior, rather than scoring based only on the current balance or utilization. The reasoning behind this is twofold: consumers should be rewarded for a history of low credit utilization and healthy account balances, and account holders are more likely to make appropriate payments if they have done so in the past.

A further difference between the two is that a FICO score needs more time to develop, at least initially . A VantageScore, on the other hand, is available to people with a more limited credit history.

But regardless of which score used, the general path to credit success is the same: make regular, on-time and appropriately-sized payments, and keep accounts open for a long time. The formulas for FICO and VantageScore may seem complicated, but earning a good credit score doesnt have to be.

Don’t Miss: What Is Syncb Ntwk On Credit Report

Get Familiar With Your Score

Because credit scores can change so frequently as new data gets added or removed from your credit reports, checking yours daily or weekly isn’t necessary. Free credit monitoring from Experian can alert you to changes in your credit report and scores, so you can more quickly take action if necessary. These regular updates will give you a chance to look over what has been reported recently, see bigger-picture trends and help you understand how your credit habits help shape your credit score.

Increase Your Credit Limit

Raising your credit limit isn’t a particularly daunting task. Although methods vary from issuer to issuer, a few clicks within your account management portal can usually lead you to a limit raise request. You can also typically ask for an increase via phone, or with a written request.

Oftentimes, your issuer will offer a credit increase in exchange for a small piece of information or two. It’s common for issuers to bump the limit for cardholders that update their annual income figure, for instance.

It’s also worth noting that your account needs to be in good standing to get a limit bump. Issuers won’t increase their exposure to you as a lender if you haven’t demonstrated you can pay your statements on time or be disciplined about your spending.

You May Like: Does Zzounds Report To Credit Bureau

What Do The Credit Bureaus Say

As you might expect, the three credit bureaus decline to disclose which card issuers purchase their credit reports. Similarly, the Consumer Data Industry Association, a trade group representing credit bureaus, says it also is unable to shed light on the credit bureaus used by card issuers.

Tip: A hard inquiry lowers your credit score, albeit by a small amount. This is because it can send an uncertain signal to a potential lender. For instance, why did you apply for new credit? Are you going to max out a new credit line? This is why its important to only apply for credit when you need it.

How Do I Improve My Credit

Look at your free credit report. The report will tell you how to improve your credit history. Only you can improve your credit. No one else can fix information in your credit report that is not good, but is correct.

It takes time to improve your credit history. Here are some ways to help rebuild your credit.

- Pay your bills by the date they are due. This is the most important thing you can do.

- Lower the amount you owe, especially on your credit cards. Owing a lot of money hurts your credit history.

- Do not get new credit cards if you do not need them. A lot of new credit hurts your credit history.

- Do not close older credit cards. Having credit for a longer time helps your rating.

After six to nine months of this, check your credit report again. You can use one of your free reports from Annual Credit Report.

Read Also: Does Lending Club Show On Credit Report

Errors On Your Credit Report

If you find errors on your credit report, write a letter disputing the error and include any supporting documentation. Then, send it to:

Find a sample dispute letter and get detailed instructions on how to report errors.

The credit reporting agency and the information provider are liable for correcting your credit report. This includes any inaccuracies or incomplete information. The responsibility to fix any errors falls under the Fair Credit Reporting Act.

If your written dispute does not get the error fixed, you can file a complaint with the Consumer Financial Protection Bureau .

Where Do I Get My Free Credit Report

You can get your free credit report from Annual Credit Report. That is the only free place to get your report. You can get it online: AnnualCreditReport.com, or by phone: 1-877-322-8228.

You get one free report from each credit reporting company every year. That means you get three reports each year.

You May Like: Is 698 A Good Credit Score

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

Why Knowing When Credit Card Companies Report To Credit Bureaus Is Important

Knowing when credit card companies report to credit bureaus can clear up some confusion you may have with your credit reports. Have you ever checked your credit reports and seen a balance, but you know you pay off your card every month in full?

This is likely because credit card companies provide a snapshot of your current balance when they report to the credit bureaus.

So, if youre concerned about how this snapshot of your balance may affect your credit, consider keeping tabs on your spending by your statement closing date. You could also make a payment before your statement closing date, so your balance is lower when its reported. Keeping a low balance can help your credit overall.

Why? Because when it comes to your credit scores, one important factor is your credit utilization.

Recommended Reading: How To Remove Repossession From Credit Report

Request Your Free Medical History Report

You have the right to get one free copy of your medical history report, also known as your MIB consumer file, each year. You can request a copy for:

- Yourself

- Someone else, as a legal guardian

- Someone else, as an agent under power of attorney

You can request a medical history report online from MIB or by phone at 1-866-692-6901.

Not everyone has a medical history report. Even if you currently have an insurance plan, you won’t have a report if:

- You haven’t applied for insurance within the last seven years

- Your insurance policy is through a group or employer policy

- The insurance company isnt a member of MIB

- You didnt give an insurer permission to submit your medical reports to MIB