How Do Landlords Use Credit Scores

Landlords, however, are not lenders in the traditional sense. How are you going to use the credit score of prospective tenants to run your rental business?

Landlords use credit scores for the same base reason as lenders: to determine how likely a tenant is to pay their rent in a timely manner. By reviewing a prospective tenants credit report, you can get an idea about how they have handled payments in the past on loans, credit cards, and other things.

Why Arent Rental Histories Included In Traditional Fico Scoring Models

The decision to include any piece of credit bureau information in the FICO scoring formula rests on whether the score development process finds such information to be predictive of future risk once vast quantities of it have been studied, Paperno said.

If the information is present, but not predictive , or has simply not been available on a credit report , it’s left out of the formula, Paperno said.

While the FICO scoring models used by most lenders have traditionally ignored rent information even when reflected on a credit report, the latest FICO model FICO 9, released in 2014 incorporates rental data when added to the report being scored, Paperno said.

Who Can See And Use Your Credit Report

Those allowed to see your credit report include:

- banks, credit unions and other financial institutions

- offer you a promotion

- offer you a credit increase

A lender or other organization may ask to check your credit or pull your report”. When they do so, they are asking to access your credit report at the credit bureau. This results in an inquiry in your credit report.

Lenders may be concerned if there are too many credit checks, or inquiries in your credit report.

It can seem like you’re:

- urgently seeking credit

- trying to live beyond your means

Recommended Reading: What Is Syncb Ntwk On Credit Report

A Screening Companys Report About Me Includes Information That Is Wrong How Do I Fix It And Get The Rental I Want

Time is not your friend here. Screening companies have 30 days to reinvestigate after you ask them to and to fix errors. They can certainly do it more quickly, but if it does take a month, the landlord may have given the unit to someone else by then. Still, it may be worth it to you to go through the dispute process with the screening company anyway, because the landlord may have another unit availableor another landlord may use the same screening company.

The process boils down to this: Get the report from the screening company and dispute it.

Do Lenders Report To All Three Bureaus

It is up to the creditor to notify the credit-reporting agency about any borrowing behavior, whether good or bad.

The Fair Credit Reporting Act recommends that lenders report to all bureaus, but this is not mandatory. In fact, some credit unions will only report to one of the four bureaus not to worry, most financial institutions consistently report to the big three.

Another interesting fact is that lenders are not required to report any information to credit bureaus. Its possible to maintain a car or home loan for many years, while no information about it shows on your report. This is unlikely, and it usually gets fixed upon request. If any old accounts are newly factored into your FICO score, keep in mind that it might take six months before your credit rating fully adjusts.

Since lenders are not required to report it, the lack of consistently reported data can become a problem. Innovis tends to get more of the bad information and not so much of the good. Most credit card issuers and loan providers habitually report to the three major credit bureaus, while Innovis gets left out.

Read Also: How To Get Credit Report Without Social Security Number

Obtain A Complete Rental Application And Permission

Before screening you will want the prospective tenant to fill out a rental application. This will give you the information you need to further vet the tenant and complete a tenant background check as well. Once you have accepted the application are move them into the tenant screening phase of the process, you must first receive written person for you to pull a tenant credit check. Most online tenant screening services will facilitate this process for you.

What Is A Good Credit Score For Tenants

Anyone with a credit score over 670 or higher is already at or above the national average for Americans. A good credit scoring for renting is going to be less compared to a good score for buying a home.

So, if your renter has a score of 670 or higher, thats a very good credit score for most rentals. Most landlords are looking for a score somewhere between 600 650 since renters dont have the credit history of making mortgage payments to boost their credit score.

Read Also: How To Remove A Paid Repossession From Your Credit Report

What Can You Do If A Landlord Rejects Your Application

If youâre rejected by a landlord because of your credit history, you should try and find out exactly whatled to this decision. You might be able to get feedback from them, and whether you do or not, you canstillcheck your credit report to get a full picture.

If you know that you have a poor credit history, itâs a good idea to be honest up front. This can savetimeand even help you avoid wasting money, for example, if youâre rejected after paying non-refundableagencyfees. It might be the case that you can still rent the property by paying a larger deposit or using aguarantor.

If you think your credit history is preventing you from being able to rent, you can look at factors thatmight be affecting it. Addressing these issues can help improve your creditworthiness and give apositiveindication to lenders or service providers.

If youâre interested in checking the details of your credit history, you can get online access to yourcredit report with the EquifaxCredit Report & Score, which is free for 30 days and £7.95 monthlythereafter.

Related Articles

How To Run A Tenant Credit Check: A Comprehensive Guide For Landlords

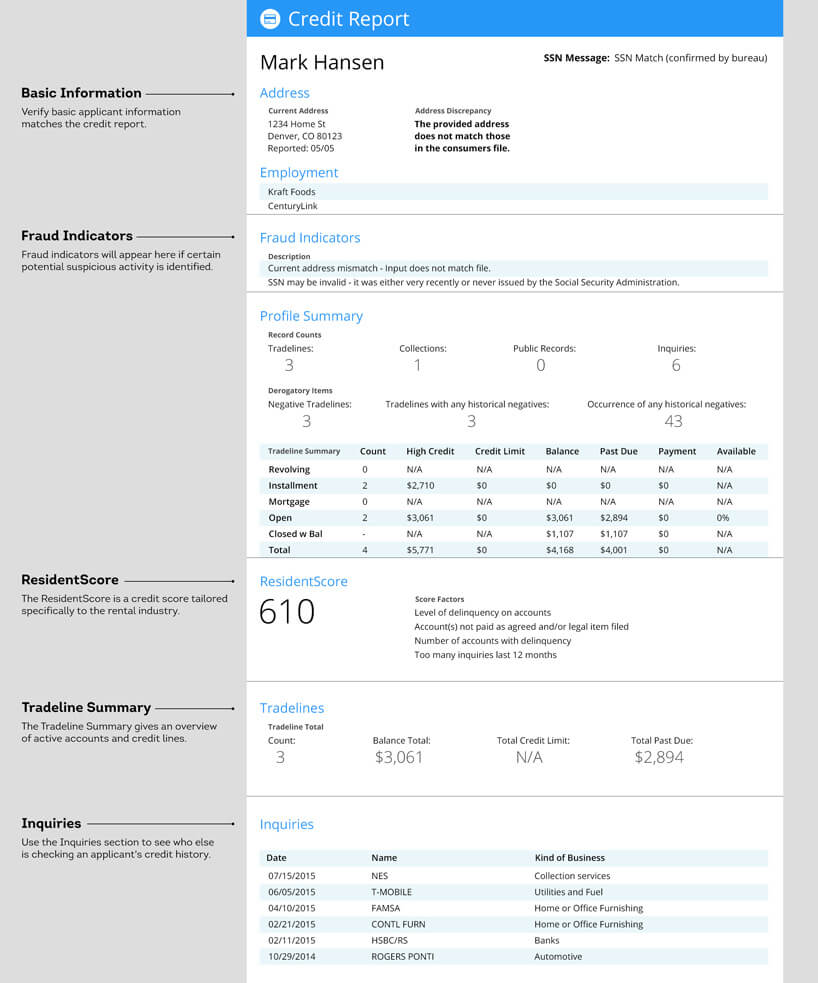

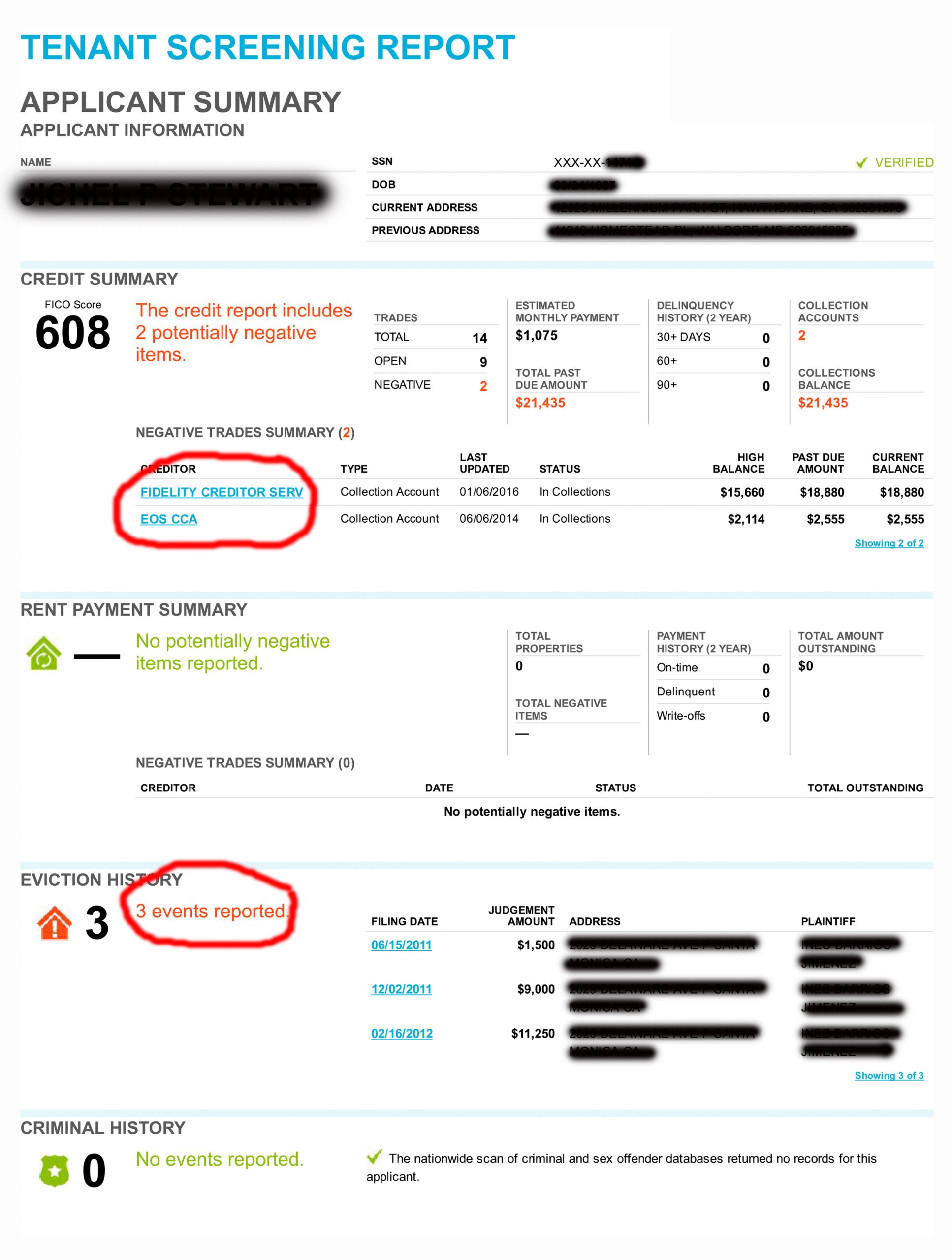

The best way to protect your rental investment property is to perform a tenant credit check on all prospective tenants. Tenant turnover and missed rent payments can be one of the most costly aspects of owning a rental property not to mention eviction proceedings if the tenant continues with non-payment of rent. The best way to cover yourself, and your investment, is to screen your tenants during the application process.

Requesting and analyzing a tenant credit report doesnt have to be a daunting, overwhelming task. The process can be completed entirely online, and with the proper preparation and knowledge base, you will become a pro in no time. We will walk you through the entire process, from how to legally request a credit report, reading and interpreting the report, and accepting and rejecting applications.

Also Check: Unlocking Credit Report

A Good Overall Credit Score

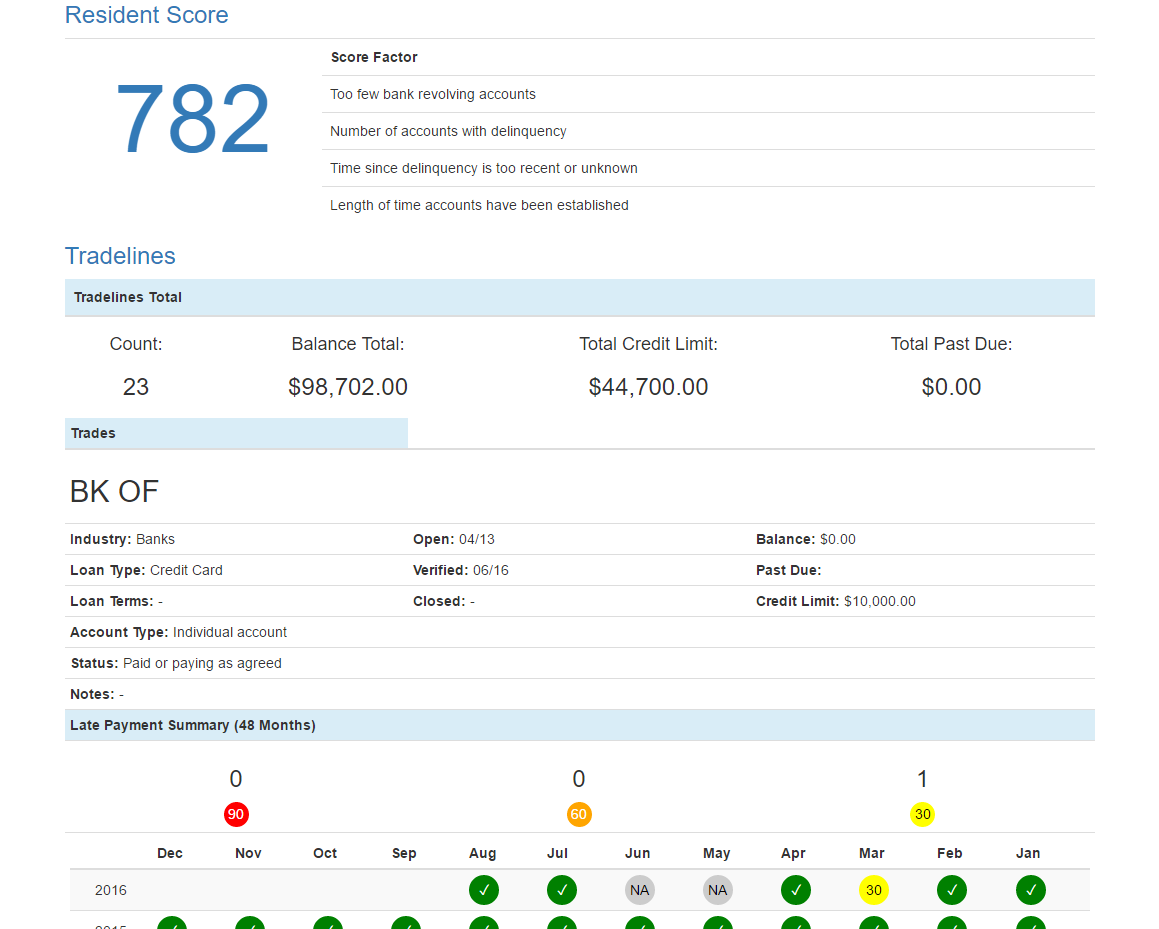

Landlords will focus on your actual credit information, beginning with your FICO Score: A score above 670 usually shows a potential landlord that you have a good credit record, but this number can vary depending on where you live, your income, the monthly rent, and how competitive the local rental market is.

What Landlords Look For On Credit Reports

In addition to your credit score, credit reports contain essential information related to your financial habits and history that landlords may review, including:

- Debt to Income Ratio: This metric shows the amount of your monthly pre-tax income that goes toward debt payments.

- : Landlords will look to see whether you are carrying high balances on your credit cards.

- Bankruptcies: If you’ve ever experienced a bankruptcy, it will appear on your credit report. Unfortunately, its very difficult to explain bankruptcy, so it may diminish your chances of renting successfully.

- Rental History: Some landlords and rental property managers will report your rent payments to credit bureaus. You can even request this service online. If you have low-to-no credit, this is a great way to demonstrate that you have a history of paying rent on time.

Don’t Miss: Does Carvana Report To The Credit Bureaus

What Is A Credit Rating

A credit rating or credit score is basically a tool that lenders and other institutions use to see whether or not you are creditworthy.

In other words, a lender uses your rating to calculate the risk involved with giving you loans, mortgages, or other forms of credit .

Part of the reason your rating is important is because it affects how easily you can access these valuable services in the future. It can also result in smaller credit limits on your bank accounts, a higher interest rate you pay on your loans.

In the UK, a copy of your is held by the three major credit reference agencies . These are:

- Equifax

- Experian

- TransUnion.

Landlords can request public record info about your credit report and rating from the rating credit bureaus listed above.

Here is a video that you might useful.

Here is a link to the original video.

How To Obtain A Tenants Credit Report

Obtaining a credit report for a prospective tenant used to be nearly impossible for individual landlords. For starters, anyone requesting another individuals credit history had to be verified by the credit bureau as a legitimate business with good reasons for pulling reports. These businesses had to maintain proof that they obtained consent from the tenant and had to undergo annual business inspections .

After passing inspection, landlords only option was pulling credit reports by providing an individuals social security number and drivers license number. This pull resulted in a hard inquiry and negatively impacted the tenants credit score.

Fortunately for you, the process is a lot simpler now. Rather than taking tenants personal information and manually entering this into a system, tenants log in to their Avail account to authorize who has access to their credit details. This process results in a soft inquiry, which does not negatively impact their credit score.

You can easily get started screening tenants by using our online rental applications and credit reports.

You May Like: Opensky Credit Card Delivery

How Do Landlords Verify Income And Rental History

One person out of five has an error on their credit report so its a good idea to verify your landlord credit check and make sure your information is accurate. Some ways to do this are:

- An applicants employer will be able to confirm their income and employment status just make sure to get the applicants permission first.

- Contact previous landlords. With an applicants permission, you may call previous landlords to check their rental history.

If any of the information you gather doesnt match the application, talk to the tenant about the discrepancies. If you decide to reject an applicant, be sure to comply with all applicable fair housing laws.

What Credit Score Do You Need To Rent An Apartment

There’s no universal minimum credit score required to rent an apartment. Credit requirements can vary based on the landlord, location and other factors. If you’ve found a listing you like, ask the landlord about their credit expectations before you apply to avoid wasting time and save yourself the application fee, if applicable.

While some landlords prefer renters with good credit, a score in the fair or very poor range won’t necessarily disqualify you from finding an apartment. As you check your FICO® Score, here are some ranges to help you know where you stand:

- Exceptional: 800 to 850

- Fair: 580 to 669

- Very poor: 300 to 579

Good credit or better typically means you manage your credit relationships well, while fair credit may mean that you’ve made one or two credit missteps in the past. If you have very poor credit, it could mean you have some significant negative items on your credit report, which could make it difficult to get an apartment.

Read Also: How To Get Navient Off Credit Report

On Credit Scores And The Fico Scoring Model

The FICO Score helps lenders make accurate, reliable and fast credit risk decisions across the customer lifecycle. The credit risk score rank-orders consumers by how likely they are to pay their credit obligations as agreed. The most widely used, broad-based risk score the FICO Score plays a critical role in billions of decisions each year.

For example, it’s only been within the last five years or so that the most widely used FICO model FICO 8 achieved that distinction. There have been older models, such as the FICO NextGen score, that have never gained a wide following, Paperno said.

Services You Can Use If Your Landlord Does

-

ClearNow: This service debits your rent from your checking or savings account. Theres no cost to tenants, but your landlord must be signed up. If you opt in, payments are reported to Experian via its RentBureau.

-

PayYourRent: Fees are typically paid by management. It reports to all three credit bureaus.

Recommended Reading: How Does Getting Married Affect Credit Score

Which Lenders Use Which Fico Scores

With the exception of the mortgage market, which is heavily regulated, lenders can generally choose which FICO score they use when running a credit check. However, they tend to use certain versions depending on the kind of credit for which youre applying. Heres a look at the most common FICO scores used for each type of credit.

Tips For Improving A Bad Credit Score

If you have time before you need a new apartment, try to work on improving your credit before you start looking at listings. Checking your credit report will give you an idea of which areas you need to address, but here are some specific steps you can take:

- Pay on time. If you have any credit accounts with past-due payments, get caught up as quickly as possible, and make it a goal to make every payment on time going forward.

- Keep credit card balances low. Your credit utilizationyour card balances relative to your total credit limitis an important factor in your credit score, and the lower your balances are, the better. A utilization ratio above 30% will start to hurt your score those with the top credit scores keep their utilization percentage in the low single digits.

- Dispute fraudulent information. In rare cases, a credit report can include information that resulted from fraud. If you find something you don’t recognize, consider disputing it with the credit reporting agencies to have it removed or corrected.

- Avoid new debt. Multiple credit inquiries in a short period can be a sign you’re struggling to manage your budget and leaning on debt to make ends meet. It’s essential to apply for credit only when you need it.

As you take these steps and address other issues you find on your credit report, you may be able to improve your chances of getting the apartment you want.

Recommended Reading: What Credit Score Does Carmax Use

What If My Credit Scores Are Different

Your FICO score will fluctuate, but to what extent will depend on what information your report shows.

The credit score calculation algorithm remains the same, but the specific details that get factored in could weigh differently between bureaus. For example, you could have a much lower FICO score calculation at one of the bureaus if they mistakenly left your oldest account unreported.

You need to know approximately what your credit score is at any given point in time. If you want to be more precise, you can request your credit score from all the credit-reporting agencies. This way, you can determine the lowest and highest score that a lender could see when pulling your credit report.

If you want to keep up with your credit scores all across the board, its a good idea to request it at least once every four months. You would need to get your rating from all of the bureaus every time, though. This is because the score can fluctuate a lot depending on many variables, and watching like a hawk would mean you can see what causes particular score fluctuations.

Is It Hard To Rent A Home With Bad Credit

Maybe. You may have trouble being accepted as a tenant if the credit records that your landlord can access show that you have had instances of bankruptcy or insolvency.

However, you might be able to come to an agreement despite a bad rating from your credit report. For example, you can list a guarantor as a co-signer or agree to pay a larger deposit when you apply.

The exact criteria will depend on the landlord. An important point to remember is that it will be easier to find a compromise when renting privately than through an agency or property office.

You May Like: Does Barclaycard Report To Credit Bureaus

Rejecting A Tenant For Credit Reasons

This requirement to give the reporting agencies information to an applicant is especially important if you decide to reject them because of something that you saw on their credit report.

If you reject someone on the basis of their credit information, you are legally required to tell the tenant what aspect of their credit report caused you to make this decision. Then, you must give them a copy of the report and information about how to contact the bureau who compiled the report.

Why is this the case?

Simply put, it is possible that something is wrong on the tenants credit report or they did not know that something had been reported in a particular place. By disclosing the information that led you to make your decision, you can help ensure that consumers like your tenants retain utmost control over their financial future.

The rental application credit check is not just about what you need from the report but about what is happening with a tenants financial information.