How Long Does Information Stay On Your Credit Report

The length of time that information stays on your credit report depends on the type of information. Here’s a brief list of items and how long they will stay on a credit report.

- Inquiries remain two years from the date of the inquiry. However, the impact of inquiries on credit scores diminishes rapidly. The impact to scores starts to fade after a few months. While the inquiries will still show in the report, FICO® excludes inquiries from the score calculation after 12 months.

- Late payments remain seven years from the original delinquency date of the debt.

- Collection accounts remain for seven years from the original delinquency date of the original account. They are treated as a continuation of the original debt.

- Bankruptcy can remain on your credit report for up to 10 years, depending on the chapter filed.

The Fair Credit Reporting Act specifies how long information can remain on a credit report. You can find a more comprehensive list of timeframes and explanations of them by learning more about when negative information is removed from a credit report. You can also learn about how long some of the most common types of information remain on your credit report.

Check out the scope to hear answers to all the questions asked:

Do you have questions about credit?

What to Look for When You Review Your Credit Report

Resources

Get the Free Experian app:

Types Of Negative Information On Credit Reports

Common types of negative information can include late payments, bankruptcies, charge-offs and hard inquiries.;

The good news? Negative entries donât stay on your credit reports forever. Thatâs helpful to know since your credit profile can influence your chances of qualifying for loans and credit cards. Your credit can also play a role in decisions made by insurance companies, landlords, utilities providers and employers.

Now letâs take a look at different types of negative information.;

Late Payments

Late payments may be another source of negative information on your credit reports.;

According to Experian®, one of the three major credit bureaus, âPayment history is the most important ingredient in credit scoring, and even one missed payment can have a negative impact on your score.â

Here are a few key things to know about late payments:;

- They could stay on your credit reports for up to seven years.;

- They could stay on your credit reports even after you pay the past-due amount you owe.

- Depending on the scoring model, older negative information may count less than more recent information. And negative information with smaller dollar amounts could count less than negative information with larger amounts.;

Keep in mind that negative information like late credit card payments could come with other consequences, including late fees and interest rate increases. Thatâs one more reason for avoiding late payment fees on your credit cards and other accounts if you can.

The Warning Signs Of Identity Theft

Watch for these indicators and act quickly.;They could be signs that youre a victim of identity theft.

These are common warning signs according to the Federal Trade Commission:

- Withdrawals from your bank account you didnt make

- You dont receive bills or other mail

- Debt collectors call about accounts you didnt open

- You receive tax documents in your name that are unfamiliar

- An unusual drop in your credit score

Over half of consumers will experience identity theft each year, with an IDShield plan an Identity Theft Specialist will spend an unlimited amount of time and money restoring your identity.

You May Like: Why Is There Aargon Agency On My Credit Report

Getting A Copy Of Your Report

To get a copy of your credit report, youll need to contact the credit reporting bodies:

Your credit report changes over time and the CRBs will have the most up-to-date information. Youre entitled to one free copy from each CRB every year.

The Bank can only provide you a copy of the credit report we obtained at the time of your most recent application. This may not show changes in your credit report since you last applied for credit with us.

View a Sample Credit Report from CreditSmart

How Long Do Collections Stay On Your Credit Reports

The short answer: Accounts in collection generally remain on your credit reports for seven years, plus 180 days from whenever the account first became past due.

The long answer: Once the original creditor determines your debt is delinquent and sells it to a collection agency, the collection account can be reported as a separate account on your credit reports.

Assuming the collection information is accurate, the collection account can stay on your reports for up to seven years plus 180 days from the date the account first became past due.

Confused? Lets look at an example:

- Your account becomes late on

- After 180 days of nonpayment, your creditor charges it off on

- The original delinquency date is Jan. 1, 2018, but the account appeared on your credit report 180 days after that date. So the account should fall off your credit report by

Read Also: What Credit Score Does Carmax Use

Will Making Payments Change The Timeline Or Keep A Collection From Falling Off Your Credit Reports

In general, making payments on a debt in collection should not affect the time it stays on your credit reports.

As the Consumer Financial Protection Bureau notes, however, in some states a partial payment can restart the time period for how long the negative information appears on your credit reports.

A partial payment can also restart the statute of limitations, or period of legal liability, for the debt. If the debt is still within the statute of limitations, a debt collection agency may choose to sue you for your unpaid debt. Each state has its own statute of limitations that determines how much time a debt collection agency has to take legal action, but for many states it ranges from three to six years.

If you do pay off an account in collections, the collection agency may be able to contact the credit bureaus and remove the collection account from your credit reports before the seven-year mark.

You may have to do some extra pushing to make this happen.

Before paying off an account in collection, get on the phone with an agent from the debt collection agency and confirm that the agency will update your credit reports. If the agent cant or wont agree to remove the paid account from your credit reports, ask if the account can be updated as paid as agreed upon once your payment/s are received.

How Long Can A Company Keep Negative Information On Your Credit Report

A credit reporting company generally can report most negative information for seven years. Information about a lawsuit or a judgment against you can be reported for seven years or until the statute of limitations runs out, whichever is longer. Bankruptcies can be kept on your report for up to 10 years, and unpaid tax liens for 15 years.

Recommended Reading: Does Carmax Accept Bad Credit

Become An Authorized User On A Credit Card

If you dont want to take out a secured credit card, you can ask a family member or friend who has good credit to add you as an on one of their credit cards. You may see an increase in your credit score if the issuer reports the cards positive payment history to the three main credit bureaus. However, your score could take a dip if the primary cardholder makes a late payment or maxes out their credit limit.

How Long Does Positive Information Stay On My Credit Report

The good news is that positive information can stay on your credit report indefinitely.;Active credit accounts that are paid on time remain on your credit report as long as the account is open and the lender is reporting it. On the flip side, closed accounts that were paid on time stay on your credit report for up to ten years from the date the lender reported it as closed to the credit bureau.

This means that positive credit behavior can continue to pay dividends for years to come. A couple tips to stay on track:

- Paying your bills on time, every time, can lay the foundation for a strong credit profile for years to come.

- Optimize your try to keep it under 30%. If you can, pay more than the monthly minimum to decrease your credit card balances or refinance high interest-rate credit cards with a;personal loan that has more beneficial terms.

- Monitor your credit score and overall credit profile. With free credit monitoring and educational tools like Upgrades theres no excuse to not know your credit score!

You May Like: What Credit Report Does Comenity Bank Pull

Do You Have To Do Anything

Once the credit reporting time limit has elapsed, the outdated information should automatically drop from your credit report. You don’t have to do anything to prompt the to update your credit report.

However, if there’s an error with the reporting date, you will have to use the process to have the error corrected so that the information falls off your credit report at the correct time. Send copies of all the evidence you have supporting your claim to help prove your case.

You can complain to the Consumer Financial Protection Bureau if the credit bureau and information furnisher continue violating your rights by listing inaccurate information on your credit report. The CFPB can help facilitate a resolution or seek punitive action against companies who repeatedly violate the law.

Can You Remove Collections Accounts From Your Credit Report

You can’t get a correctly reported collection account removed from your credit report early.

Even if you pay off the debt, the collection account will stay on your credit report for up to seven years. The timeline depends on when your debt first went delinquent, not whether you still owe the money.

However, if you notice an error with the collection account, you can file a dispute with each of the credit bureaus to have the account corrected or removed from your credit reports.

For example, if the collection agency doesn’t send an update to the credit bureaus once you’ve paid off or settled the account, you may want to file a dispute.

If a collection account is removed from your credit reports early, the original account and late payments that led to the collection activity can remain. Those can continue to impact your credit, and the late payments will remain on your report for seven years from the date of first delinquency.

Also Check: Does Paypal Credit Report To Credit Bureaus

How To Remove Negative Information From Your Credit Report

As long as the information is accurate and verifiable, the credit reporting agencies will maintain it for the aforementioned timeframes. If, however, you have information on your report that you believe is incorrect, whether it’s positive or negative, then you have the right to dispute the information and have it corrected or removed from your credit reports.

The most efficient way to file a dispute is to contact the credit reporting agencies directly. And while Equifax and TransUnion have their own processes for consumers to dispute their credit reports, Experian makes available three dispute methods: You can do it over the telephone, via U.S. mail or online.

How Long Does Negative Information Remain On Your Credit Reports

The length of time negative information is allowed to remain on your credit reports is largely defined by the FCRA. Unlike positive information, almost all negative information eventually must be removed from your credit reports. However, not all negative information has the same timeline for removal.

For example, late payments are allowed to remain on a credit report for as long as seven years from the date of their occurrence. This includes any notation that one or more of your accounts was 30, 60, 90, 120, 150 or 180-plus days past due. These are the only late payments that can appear on your credit reports.

Charge-offs, accounts in collections, repossessions, foreclosures and settlements all indicate that you’ve defaulted on an account. In every one of these scenarios, the credit reporting agencies are allowed to report them for no longer than seven years from the original delinquency date that led to their default.

Bankruptcies are another example of negative information that can appear on your credit reports. There are two main types of bankruptcies consumers can file: Chapter 7 and Chapter 13.

Read Also: How To Report A Delinquent Tenant To The Credit Bureaus

Lawsuit Or Judgment: Seven Years

Both paid and unpaid civil judgments used to remain on your credit report for seven years from the filing date in most cases. By April 2018, however, all three major credit agencies, Equifax, Experian, and TransUnion, had removed all civil judgments from credit reports.

Limit the damage: Check your credit report to make sure the public records section does not contain information about civil judgments, and if it does appear, ask to have it removed. Also, be sure to protect your assets.

Missed Student Loan Payments

Some student loan accounts that become delinquent can stay on your credit report for more than seven years. For example, if you go into default on a Stafford Loan or a PLUS loan, that negative information can be reported for seven years after the U.S. Department of Education takes over your loan from a guarantee agency. This usually only occurs if you havent made payments in years. So, in effect, that negative credit history could be shadowing you for a decade or so. In fact, overdue Perkins Loans will stay on your credit report indefinitely until they are paid off in full.

Don’t Miss: Is 586 A Good Credit Score

What Happens To Your Credit Score When Derogatory Marks Fall Off Your Report

Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment, at which point your credit scores may start rising. But if you are otherwise using credit responsibly, your score may rebound to its starting point within three months to six years.

If a negative item on your credit report is older than seven years, you can dispute the information with the credit bureau and ask to have it deleted from your credit report.

What Are Other Ways To Improve Your Credit Score

You can build healthy credit over time by starting with these steps:

- Make on-time payments. This is one of the most important factors that impacts your credit scores. If you think you cant afford a payment, reach out to the lender right away. It may be willing to work out a payment plan and keep your account in good standing.

- Check your credit reports. This will help you understand and track your overall financial health. Also look for errors, such as incorrect credit card balances, trade lines that arent yours and accounts that are incorrectly marked as delinquent.

- Dispute and fix errors. About 20 percent of consumers have an error on at least one credit report, according to a Federal Trade Commission study. Getting an error removed may help your credit score improve.

- Consider a debt consolidation loan. A debt consolidation loan unites all your debts into a single balance, often at a lower interest rate that can save you money. A debt consolidation calculator can help you evaluate whether this type of loan is right for you, as debt consolidation can temporarily hurt your credit.

Sign up for a Bankrate account to analyze your debt and get custom product recommendations.

Recommended Reading: Paypal Credit Soft Pull

How Long Does Information Stay On My Credit Report In 2021

Rachel Surman

â¢7 min read

Article Contents

We get asked this question all the time: âHow long does information stay on my credit report?â

Itâs an understandable question, considering how important credit is to almost all of your financial decisions. Your credit report includes financial information about your credit history. Lenders report your bill payments to Canada’s credit bureaus, who update your credit report on a monthly basis. Missed or late payments are also reported, and this negative information is added to your credit report. Every time your credit report is updated, your credit score is likely to change as well.

You might be concerned about how long information stays on your report and how it will affect your credit score. You might wonder if lenders will see this information when they review your loan application, or if negative information on your credit report will impact your ability to find a rental apartment .

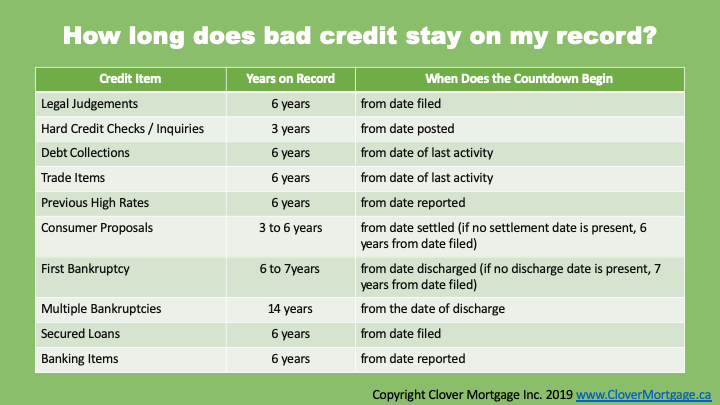

If youâre wondering when something will come off of your report, there are set time frames for items like bankruptcies and collections that Equifax has put in place. In general, most negative information is deleted from your file 6 years from the date of last activity.

Want to see your Equifax Credit Report?

Positive Information From Accounts In Good Standing

Your credit report will always show any open loans and lines of credit, which is good news for your credit score. As long as you keep your accounts in good standing, this positive information will boost your credit score throughout the lives of the accounts. To help keep your accounts in good standing, we recommend that you check out our guide on tips for never missing a due date.

Once you close an account that was in good standing, it will remain on your credit report for 10 years. While it may be frustrating to see an account that benefits your credit score disappear, you can easily balance out the credit score impact by having more than one credit account. You can read more about the benefits of multiple credit cards in our guide about how many credit cards you should have.

Read Also: How To Remove Car Repossession From Credit Report