Review The Claim Results

Reporting agencies and lenders usually take around 30 days to investigate disputes. Once they make a decision, they must notify you within five days of completing their review. The notice will inform you if the disputed item was found to be inaccurate or not.

If the disputed information was, in fact, inaccurate, the bureau must update or delete the item. They should include a free copy of your file if the dispute results in a change.

If the bureau or lender finds that the disputed information isn’t a mistake, you can file an additional claim. Review your initial claim for any errors and correct those. If possible, you should include additional documents to support your request, which can help the bureau evaluate any information it might have missed the first time around.

Dispute Credit Report Inaccuracies:

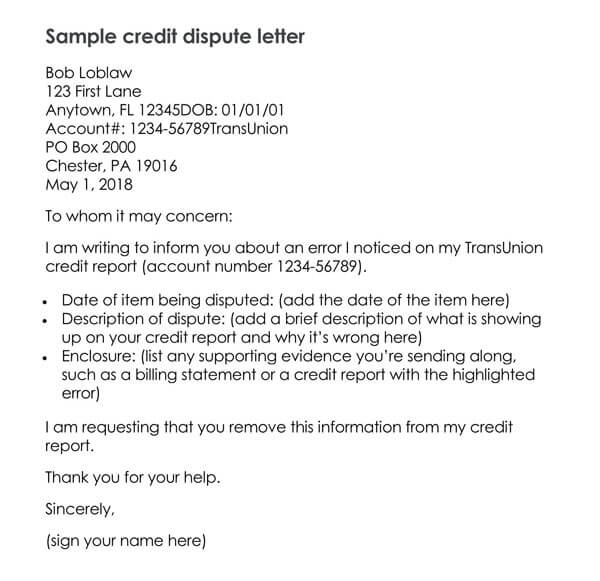

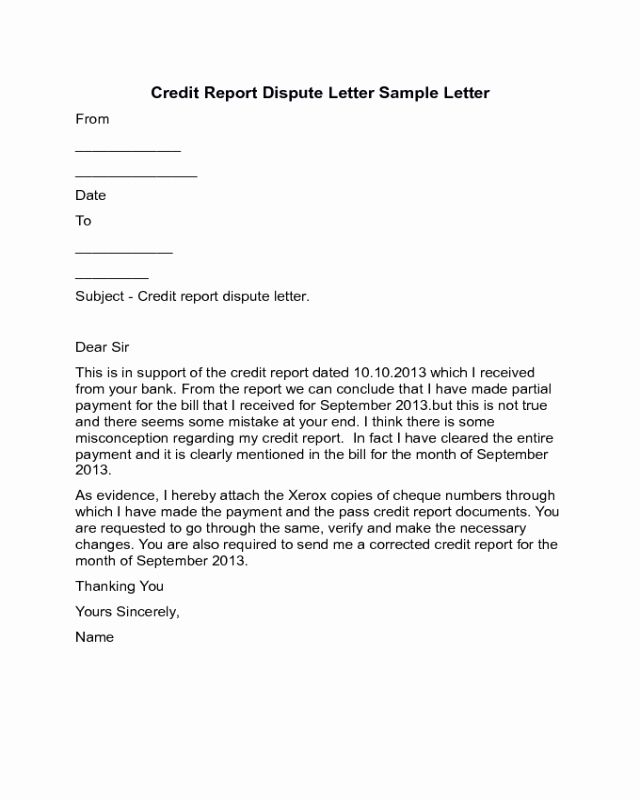

You may write to the credit reporting agencies with the information you have highlighted with a request for correction/deletion depending on your specific dispute. Mailing your letters certified or return receipt is recommended. Sample disputes letters can be found on page 113 of credit.orgs ebook, Consumer Guide to Good Credit, available for in English and Spanish. You may also dispute some items online at www.annualcreditreport.com.

Errors On Credit Reports Could Include

- Identity-related errors such as a misspelled name, wrong phone number or address, or your information incorrectly merged with another persons credit record

- Incorrectly reported accounts, such as a closed account reported as open or an account wrongly reported as delinquent

- Account balance and credit limit errors

- Reinsertion of inaccurate information after its corrected

Read Also: What Does Written Off Mean On Credit Report

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Happens After You Submit Your Dispute

After you’ve submitted a dispute, Experian goes to work to resolve the issue. The data furnisher will be asked to check their records. Then one of three things will happen:

- Incorrect information will be corrected.

- Information that cannot be verified will be updated or deleted.

- Information verified as accurate will remain intact on your credit report.

Don’t Miss: How To Find Out Your Credit Score For Free

Consider Adding An Explanatory Statement To Your Credit Report

You have the right to add an explanatory statement to your credit report. Once you file a statement about the dispute with a credit reporting agency, the agency must include your statement, or a summary of it, in any report that includes the disputed information. If the agency assists you in writing the explanation, it may limit your statement to 100 words. Otherwise, there isnt a specific word limit. But its a good idea to keep the statement very brief. That way, the credit reporting agency is more likely to use your unedited comment.

You May Like: How To See My Credit Score Free

How To Remove Negative Items From Your Credit Report Yourself

First, it’s important to know your rights when it comes to your credit history. Under the Fair Credit Reporting Act , credit bureaus and lenders must ensure that the information they report is accurate and truthful.

This means that, if you find mistakes in your , you have the legal right to dispute them. And, if the bureaus find that the information you disputed doesnt belong in your record or is outdated, they are obligated to remove it.

Common credit report errors include payments mistakenly labeled as late or closed accounts still listed as open. It’s also possible for your report to include information from someone else, possibly someone with a similar name, Social Security number or identifying information.

Bear in mind that correct information cannot be removed from your credit report for at least seven years. So, if your score is low due to down because of accurate negative information, youll need to repair your credit over time by making payments on time and decreasing your overall amount of debt.

Here are some tips to help you repair your credit history:

Also Check: Who Uses Transunion Credit Report

Takeaways: How To Dispute Credit Reports And Win

- Youre entitled to accurate and verifiable information on your credit report

- You can file a dispute with the credit bureaus by phone, mail, or online

- When filing a credit dispute, include as much information as possible to support your claim

- If your dispute is rejected, you can choose to re-dispute the claim with the credit reporting bureaus

Do you have a credit questions for John Ulzheimer? Head over to the and ask away!

Save more, spend smarter, and make your money go further

Common Credit Reporting Errors

When reviewing your reports, some common personal information and account reporting errors include:

- Personal Information reporting errors. Check to see if your name, address, birthdate and Social Security number are correct. If your report contains inaccurate personal information, it could be a sign that your identity has been stolen.

- Accounts that dont belong to you. Its possible that someone with a similar name could have an account accidentally listed on one of your reports. This could also mean that someone has stolen your identity and opened an account in your name.

- Incorrect account status. When reviewing your reports, make sure your account balance, account numbers and credit limits are accurate. Also, double-check that closed accounts arent reported as open.

- Expired debt. Negative remarks, such as collection accounts and late payments, typically remain on your credit reports for up to seven years. In most cases, the negative information automatically falls off of your credit report. If it doesnt, this could mean the time clock on the debt was reset, which may be an error.

- Reinsertion of incorrect information. Incorrect information that was disputed and removed from your credit report in the past can sometimes reappear. This means you will have to redispute the incorrect information with the credit bureaus or the creditor that is providing the information to have it removed again.

Recommended Reading: What Is A Tradeline On A Credit Report

Is It Wrong To Dispute Correct Information

Im not the morality police, and you can do what you want to do, but you do have the right to challenge any information on your report whether its correct or not.

Its your right to have correct and verifiable information on your credit reports. I cant speak for them, but I imagine theyd also want your credit report to be fully accurate and verifiable.

Common Mistakes That Cause Credit Report Errors

To begin, it’s important to know if the person responsible for the error is you. Often, a person may have applied for credit under different names . Make sure you’re consistent and always use the same first name and middle initial, otherwise your report may actually contain information about another person with a similar name. Likewise, apply the same consistency and care with things like your Social Security number and address.

Or it could be a case of what you didn’t put in your report. If you were denied credit because of an “insufficient credit file” or “no credit file,” it may be because your credit file doesn’t reflect all your credit accounts. Though most national department store and all-purpose bank credit card accounts will be included in your file, not all creditors voluntarily supply information to the credit bureaus, nor are they required to report consumer credit information to credit bureaus.

If you find missing accounts, ask your creditors to begin reporting your credit information to credit bureaus, or consider moving your account to a different creditor who does report regularly to credit bureaus.

Other common errors to look for:

You May Like: How Long Before Something Falls Off Your Credit Report

Your Legal Rights To Dispute Credit Reports

Because inaccurate credit reports can potentially harm you financially, its worth knowing all your dispute-related rights under the Fair Credit Reporting Act , the federal statute that regulates credit reporting and safeguards consumers. The law stipulates your right to:

- One free annual credit report that contains all information on file at the time of your request from each of the three credit bureaus.

- Know who received your credit report in the past year .

- Dispute a report with the credit bureau and with the company that furnished the information to the bureau. Both the credit bureau and the information supplier are legally obligated to investigate your dispute.

- Another free credit report should an application for a loan, credit card, etc., be denied because of information in your credit report. Should you choose to dispute the credit report, you must do so within 60 days of that denial.

- Add your own explanatory note to your credit report if your dispute is not resolved to your satisfaction.8

Send Your Dispute To The Credit Bureau

In order to learn how to dispute a credit report and win, youll likely want to include as much information as possible to support your case. That said, youll need to include some items in addition to your dispute claim and your credit report.

Depending on what type of things you want to dispute on your credit report, your case may require different documents. For example, if you are trying to remove a closed account from your score, you might include a record of the closed account with your documents. If you want to dispute a collection amount, you should provide proof of the settled debt or a receipt that shows you made the required payments.

Once you have all of your documents put together, there are a few ways you can approach the dispute process:

- Online: For many, the easiest way to go through the dispute process is by simply uploading your dispute and relative documents online .

- Equifax: 1-866-349-5191

- TransUnion: 1-800-916-8800

Experian

Chester, PA 19016

Recommended Reading: How Do You Dispute Your Credit Report

File A Dispute With Equifax

Once you’ve found an error, you can file a dispute online. There’s a link on the Equifax website to file a dispute, which takes you to the form that you must fill out. You can also call Equifax to initiate a dispute at 866-349-5191 or can mail in forms initiating a dispute to:

Equifax

P.O. Box 740256

Atlanta, GA 30374-0256

You will need to provide specific information to Equifax in order to dispute the error on your report, including your:

- Social security number

- Whether you’ve lived at your current address for at least two years

You’ll need to provide specific details about the information that you’re disputing, such as indicating which account don’t belong on your credit report or what other information is inaccurate.

Types Of Proof To Send With Your Credit Report Dispute

If theres something wrong with your address, name, date of birth, or your Social Security number, youll need to submit proof such as a copy of your drivers license, recent billing statement, or your Social Security card. Proof you paid a charge might include a check copy showing that you paid your bill on time or a recent billing statement showing your credit card limit or balance. Make sure you send a copy of the proof and keep the original documents for your files.

Also Check: How To Fix Negative Accounts On Credit Report

Dispute Your Credit Report

If you discover inaccurate information on your credit report, under the Fair Credit Reporting Act, consumers must dispute inaccurate information directly to the Credit Reporting Agencies. The Credit Reporting Agencies must then notify the Creditors that published the disputed information. Thereafter, The Fair Credit Reporting Act requires that the Credit Reporting Agencies and the Creditor conduct an investigation and provide the consumer with a response to their dispute within 30 days. If you obtain your credit report through , the dispute process may take up to 45 days.

If you are concerned that you have been the victim of identity theft, please notify the credit reporting agencies so that a freeze can be placed on your credit file.

Wait Up To 45 Days For The Credit Bureau Or Furnisher To Investigate And Respond

The credit bureau generally has 30 days after receiving your dispute to investigate and verify information with the furnisher. The credit bureau must also report the results back to you within five days of completing its investigation.

If you dispute the error with the information furnisher, that company must also report the results of its investigation to you. It also typically has 30 days to investigate. But if the furnisher stands by the accuracy of the information it reported, it wont update or remove the error.

One more thing to note is that either the credit bureau or the furnisher may decide that your dispute is frivolous. This generally happens when youve submitted incorrect or incomplete information on the dispute, but can also occur if youve tried to contest the same item multiple times without any new information or if youve attempted to claim that everything on your credit report is incorrect without proof.

If the bureau decides that your dispute is frivolous, it doesnt need to investigate it further as long as it communicates that to you within five days, along with the reasoning for deeming the dispute frivolous. If your original dispute was labeled frivolous, you can try to resubmit a dispute with updated materials.

You May Like: What Is Collections On Credit Report

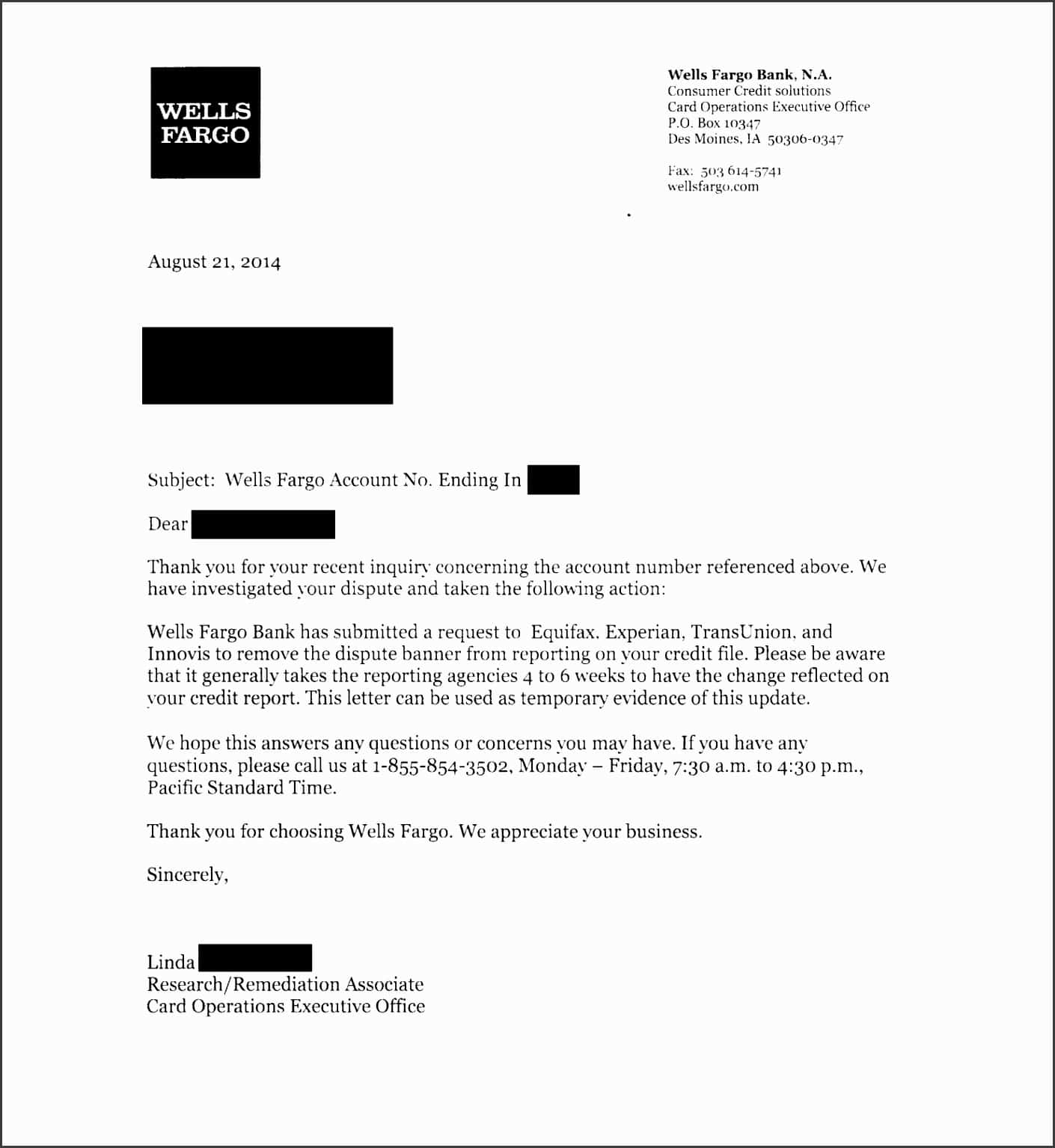

How To Check With The Data Furnisher

When you file a dispute, the Federal Trade Commission suggests also informing the company that provided the data to the credit bureaus, such as a bank, lender or card issuer, in writing. These sources of information are known as furnishers. Notifying the data furnisher may cause them to proactively stop reporting the inaccurate information to the credit bureau, although that’s not guaranteed.

Send the letter to the company using the address it listed on your credit report. If there is no address listed, ask the company for one.

The FTC notes on its website: “If the provider continues to report the item you disputed to a credit reporting company, it must let the credit reporting company know about your dispute. And if you are correct that is, if the information you dispute is found to be inaccurate or incomplete the information provider must tell the credit reporting company to update or delete the item.”

How To Fix Errors On Your Credit Reports And How They Occur

To err may be human, but if that human error negatively affects your credit worthiness, you’re not alone. The number one complaint received by the Consumer Financial Protection Bureau involved incorrect information listed on consumers’ credit reports. Of those complaints, errors on a credit report were at the top of the list.

Worse yet, 26% of participants in a study by the Federal Trade Commission identified at least one error on their credit report that could make them appear riskier to lenders. The potential negative impacts those errors can have on your credit report can be catastrophic on your ability to get loans, new lines of credits, or better lending terms and interest rates.

That’s why staying on top of the content of your credit reports is so important. In this section, we’ll reveal some of the most common mistakes found in credit reports, how to fix them, and what to do if you disagree with any of the information in your report.

Recommended Reading: Does Car Insurance Affect Credit Score

What Usually Happens After You Dispute Something On Your Credit Report

Once you file your dispute, credit reporting agencies must tell information provider about it. Information providers are required to verify the data in questionor, if its found inaccurate, they must inform all three bureaus and have the data corrected or deleted. The credit bureaus sites offer you links to check on the status of a dispute, and FAQs that describe possible outcomes and next steps.

Once a dispute investigation is complete, credit bureaus are required to inform you of the results in writing and provide a new free report if there are changes. Further, the bureau must provide information on the data furnisher involved. Data furnisher is the legal term for any entity that provides information to a credit reporting agency. You can request that the bureau notify anyone who received your report over the last six months.

If you are unsatisfied with the results, you can:

- Refile your dispute, potentially with additional documentation.

- File a statement of dispute, about 100 words, that will be affixed to your file and any future reports. You can ask the bureau to get the statement to entities that recently obtained your report. A fee may be involved.5

What If You Disagree With The Credit Bureau’s Investigation

If you tell the information provider that you dispute an item, a notice of your dispute must be included anytime the information provider reports the item to a credit bureau while that dispute is being investigated.

Finally, if the investigation does not produce the results you feel are correct, and inaccurate information in your credit report is causing you harm, you may consider hiring a lawyer to help resolve your dispute as a last resort.

The secret to success is to be vigilant and tenacious when it comes to reviewing, repairing, and correcting the record regarding your credit reports.

Estimate your FICO Score range

Answer 10 easy questions to get a free estimate of your FICO Score range

Read Also: How Long Does Mortgage Default Stay On Credit Report