How To Improve Your Credit Score

No matter what your history looks like, its always possible to start improving your credit score. By paying your bills on time, paying off debt, and working to get your balances low relative to your overall credit limit, you can increase your score and establish a positive credit history.

Some of those negative marks may stick around for a while, but their impact decreases over time. And in the meantime, those positive habits will help you build a more stable financial foundation.

Supercharge Your Future & Credit Score Today

Reclaim your financial freedom and speak with a live credit specialist for your free consultation, right now

Copyright © 2022 Credit Glory LLC. All rights reserved. 1887 Whitney Mesa Dr Ste 2089, Henderson, NV 89014. FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries. Credit Glory does not provide legal advice and is not a substitute for legal services. If you are dealing with credit and debt issues you should always contact a local attorney for legal advice regardless of your use of any other service. Credit Glory does not guarantee the permanent removal of verifiable tradelines or make promise of any particular outcome whatsoever. Credit Glory requires active participation from its clientele regarding requested documents and information, including investigation results, for the sought-after outcome of a healthy, accurate credit report. Individual results may vary.

There Are Other Ways To Improve Your Credit Score

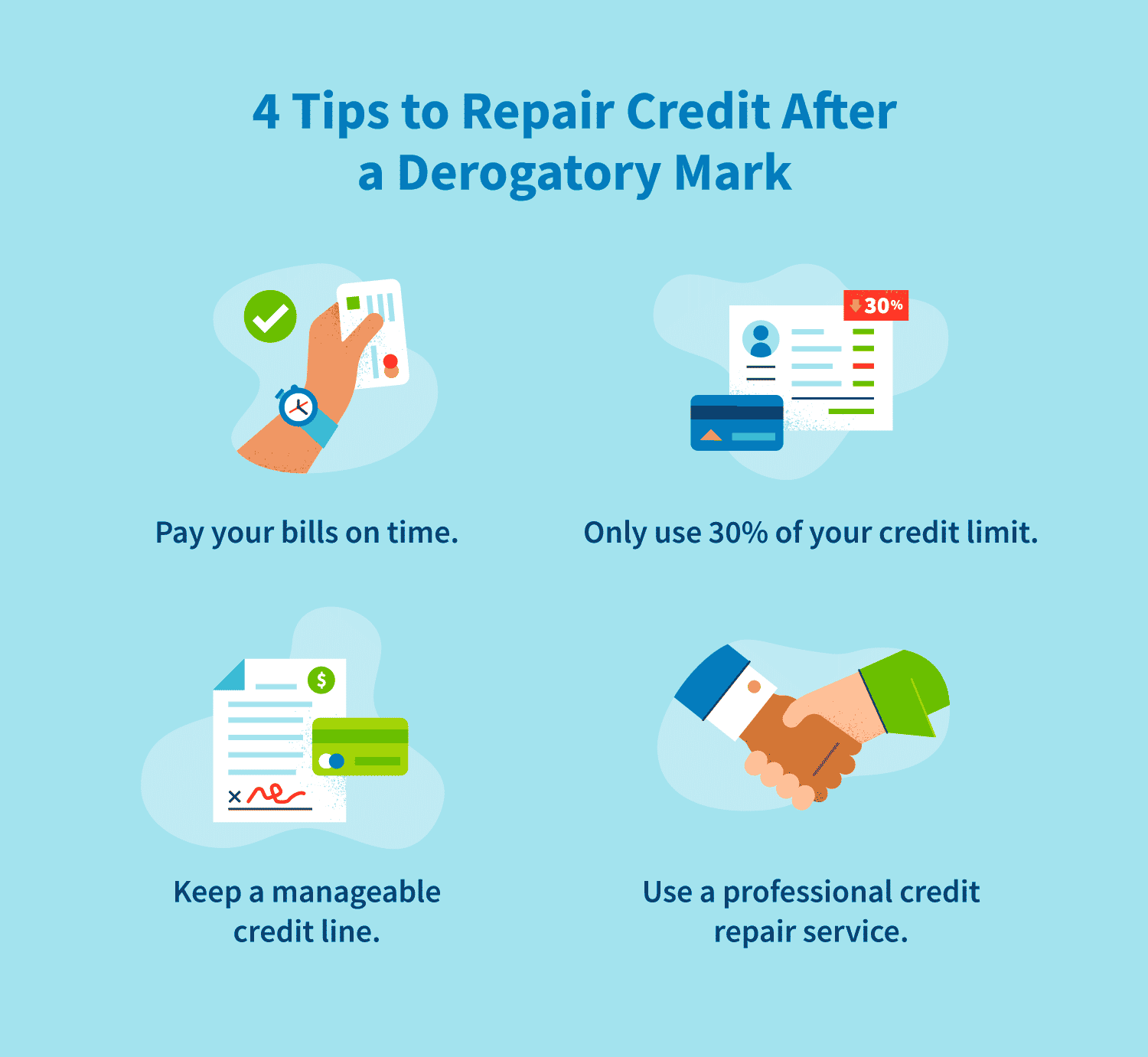

Maybe you have a derogatory mark thats legitimate but dragging your credit score down. If you cant fix the derogatory mark, look for other ways to improve your credit score:

- Work to resolve outstanding debt problems. If you have a debt in collections or are behind on payments, try to quickly resolve those issues by negotiating a settlement or payment plan. The longer the issues go unaddressed, the more severe the derogatory marks will be.

- Make payments on time, every time. Youll build a positive payment history with each month that passes and start to counterbalance negative marks.

- Pay down high credit card balances. One factor that affects your credit score is your credit utilization ratio or how high your credit card or line of credit balance is compared to your credit limit. The lower, the better, so if you make extra payments to lower your balance, it could give your credit score a boost.

- Open a secured credit card. A derogatory mark will lower your credit score and make it harder to qualify for a credit card. However, you could qualify for a secured credit card. You put down a cash deposit on the card and get a tool to build a positive payment history and improve your credit.

Dealing with derogatory credit can be discouraging. It might take time and patience to see progress. But by learning more about your credit score, youre taking steps in the right direction.

Read Also: What Is The Top Credit Score Possible

What Should You Not Say To Debt Collectors

3 Things You Should NEVER Say To A Debt Collector

- Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. …

- Never Admit That The Debt Is Yours. Even if the debt is yours, don’t admit that to the debt collector. …

- Never Provide Bank Account Information.

How To Remove Negative Items Related To Identity Theft

If you believe youve been a victim of identity fraud, you should first file a dispute with the Federal Trade Commission online at IdentityTheft.gov or by phone at 1-877-438-4338. You should also file a police report.

After you report the incident, make sure to take the following steps:

- Request a copy of your credit report through AnnualCreditReport.com

- Look out for unauthorized transactions or new accounts that dont belong to you

- Contact the credit bureaus through phone or mail to dispute any credit information that doesnt belong to you

- Place a security freeze and fraud alert on your credit report

- Contact creditors to close compromised accounts

- Consider subscribing to an identity theft protection or credit monitoring service

Also Check: How Long Are Hard Inquiries On Credit Report

Should I Pay Off Closed Derogatory Accounts

In a word, yes. You borrowed the money, bought the item, used it, etc, so you owe the money and should pay it back.

However, you need to know WHO to pay. If the derogatory account is closed by the lender, they have probably sold it to a collection agency.

That means sending money to the original lender will do no good because you now owe the collection agency.

And, like it or not, collection agencies can play hardball. They may even sue you, although each state has a statute of limitations for the length of time in which you can be sued for the debt).

So yes, you may have gone through a rough financial situation and not paid your debts. But if you can, the best thing to do is to pay off closed derogatory accounts once you are able.

Write A Pay For Delete Letter

A pay for delete letter is asking the creditor to remove the negative mark in exchange for paying the balance you owe.

Keep in mind that removing an accurately reported item may be in violation of a creditorâs agreement with credit bureaus, which can be seen as unethical. Because of this, a pay for delete letter may not work.

But if you can get a negative item removed using this method â ensure that you get the agreement in writing before paying â your score will improve.

Also Check: Will Paying Off Collections Help My Credit Score

How To Deal With Derogatory Marks

You cant deal with a derogatory mark if you dont know about it, so Bruce McClary, spokesman at the National Foundation for Credit Counseling, recommends checking your credit reports at least once a month. Having a Credit Karma account can help you notice and dispute incorrect derogatory marks and generally keep tabs on your Equifax and TransUnion credit reports for free.

Here are steps you can take if you have a derogatory mark on your credit reports.

Should You Write A Letter Explaining Derogatory Items On Your Credit Report

You may need to write a letter explaining derogatory items on your credit report when you apply for a mortgage.

A letter of explanation is a letter that you write to a lender explaining the reason for negative marks on your credit report. This may be required by your lender when you apply for a mortgage, particularly when applying for a home loan that is subsidized by the government, such as an FHA loan or VA loan.

Your mortgage lender needs to be certain that you will be able to pay off your home loan. They will want to understand the circumstances of any derogatory items on your credit report in order to determine whether you have learned from your mistakes and taken steps to improve your situation or whether you may still be at risk of defaulting on a loan in the future.

A good letter of explanation should be truthful, clear, and detailed. If there were extenuating circumstances that led to you becoming behind on your bills, explain what happened and how you resolved the problem. As with a credit report dispute, be sure to include any documentation that supports your story along with your letter of explanation. Try looking up sample letters of explanation online if you need help.

Read Also: Does Afterpay Show On Credit Report

Dispute Credit Report Errors

Keep up to date on your credit status by ordering a free credit report at annualcreditreport.com. Check it thoroughly to see if you notice anything that appears suspicious, such as a delinquent charge you donât recall making on your credit card.

You can dispute any errors you find by mailing a letter to the credit reporting agency. Include your contact information and identify the specific nature of the error. Include copies of paperwork, such as signed receipts, that document your case, as well as dates, amounts, and other relevant information. State your reason for disputing the item and the information you want to have corrected.

The reporting agencies must investigate your dispute and forward your documents to the company that reported the information. If you are found to be in the right, that company will have to contact all the credit reporting agencies with the correct information so it can be updated.

Send A Request For Goodwill Deletion

Writing a goodwill letter can be a viable option for people who are otherwise in good standing with creditors. If you’ve taken steps to pay down your overall debt and have been paying your monthly bills on time, you might be able to convince your creditor to forgive the late payment.

While there’s no guarantee that the creditor will delete the derogatory information, this strategy does get results for some. Goodwill letters are most successful for one-off problems, such as a single missed payment. However, they are not effective for debtors with a history of late payments, defaults or collections.

When writing the letter:

- Take responsibility for the issue that lead to the derogatory mark

- Explain why you didn’t pay the account

- If you can, point out good payment history before the incident

Also Check: Does Apple Card Pull Credit Report

Submit A Dispute To The Credit Bureau

The Fair Credit Reporting Act is a Federal law that defines the type of information that can be listed on your credit report and for how long . The FCRA says that you have the right to an accurate credit report and because of that provision, you can dispute errors with the credit bureau.

are easiest when made online or via mail. To make a dispute online, you must have recently ordered a copy of your credit report. You can submit a dispute with the credit bureau who provided the credit report.

To dispute via mail, write a letter describing the credit report and submit copies of any proof you have. The credit bureau investigates your dispute with the business that provided the information and removes the entry if they find that is indeed an error.

How Many Points Will My Credit Score Go Up When A Derogatory Mark Is Removed

Wow, so you have either paid off a bad debt or it has been long enough for it to finally fall off your credit history. Either way, I bet you are feeling a big relief!

And, now youre wondering, How many points will my credit score go up when a derogatory mark is removed? There is no one size fits all concrete answer. When a derogatory mark is removed, credit scores can increase in a range anywhere from barely noticeable up to 150 points.

So now you are wondering if there is a point to paying off your derogatory accounts. Keep reading because Ill cover that below. Ill also talk a little more about how much your score will increase if you pay off collections accounts.

Im also going to explain how to remove negative information from your credit. And, finally, Ill give you some information to help you decide if you should pay off closed derogatory accounts.

Lets start with improving your credit score by paying off derogatory accounts.

Also Check: What Credit Score Do Most Lenders Use

Learn What Derogatory Marks Are Their Causes And How To Rebuild Credit After Getting One

You may or may not have heard of derogatory marks in your credit reports. So, what are they? A derogatory mark or remark in your credit report is a negative item, such as a late payment or foreclosure. If a derogatory mark is listed in your credit reports, it can hurt your and may affect your chances of qualifying for things like credit cards, loans and mortgages. While most derogatory marks can stay on your credit reports for up to seven to 10 years, depending on the type of mark, their impact generally diminishes over time.

Consistent responsible credit usage, such as on-time payments, could help you rebuild your credit, though. You can also review your credit reports for errors and dispute any incorrectly reported derogatory marks, which might improve your credit. Read on for more information about what derogatory marks are and how to rebuild credit after receiving one.

Work With A Credit Counseling Agency

Several non-profit credit counseling organizations, like the National Foundation for Credit Counseling , can help dispute inaccurate information on your record.

The NFCC can provide financial counseling, help review your credit history and help you organize your budget or place you in a debt management plan free of charge. It also offers counseling for homeownership, bankruptcy and foreclosure prevention.

As always, be wary of companies that overpromise, make claims that are too good to be true and ask for payment before rendering services.

When looking for a legitimate credit counselor, the FTC advises consumers to check if they have any complaints with:

- Your states Attorney General

Read Also: Does Affirm Go On Your Credit Report

Getting A Professional To Help With Disputes

If you can spare the relatively low cost of hiring a credit repair company to help with your disputes, it may be a worthwhile expense.

A quality credit repair firm typically has a decade or more of experience handling derogatory mark disputes. They know the law inside and out so that they can take the best possible approach at disputing each item.

We recommend Lexington Law Firm. They have lawyers and paralegals on staff to help you. You can read our full review of them here. Beyond the technical expertise, a credit repair company also saves you the time and aggravation it takes to oversee disputes, especially if you have several.

Whatis A Derogatory Mark

Your credit report is a record of your reported credit behavior both negative and positive. A negative entry on your report, such as a seriously delinquent payment, is considered a derogatory mark. Each derogatory mark you receive can lower your credit score some more than others.

When lenders view your credit report and see a derogatory mark, they may view you as more of a lending risk. The riskier you appear as a borrower, the more likely it may be that you could receive unfavorable terms, such as high interest and fees. Or you may be denied a financial product altogether.

Also Check: Does Afterpay Affect Your Credit Score

What’s Worse Delinquent Or Derogatory

“Derogatory” is the term used to describe negative information that is more than 180 days late. Accounts that are less than 180 days late are referred to as “delinquent.” … Both delinquent accounts and derogatory accounts will lower credit scores and hurt your ability to qualify for credit or other services.

Do I Have Derogatory Marks On My Credit Report

You might already have some idea that you have derogatory credit. For instance, you might be aware that you missed a payment or declared bankruptcy recently.

Or perhaps you applied for a credit product or loan and were rejected. If so, dont let it slide. Contact the lender and ask why you were denied. The lender is required under the Equal Credit Opportunity Act to tell you the specific reasons it deemed you non-creditworthy, according to the Consumer Financial Protection Bureau .

Many lenders will send this information to you as a matter of course. If a lender doesnt, request it within 60 days of rejection. The reasons can alert you to derogatory marks on your credit.

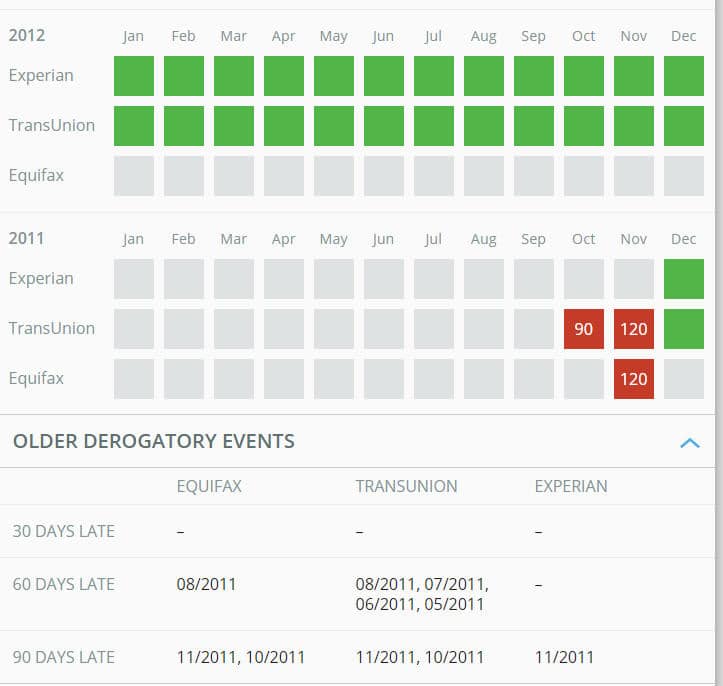

To know for sure if you have derogatory credit, however, youll need to review your credit reports from all three major credit-reporting agencies: Equifax, TransUnion and Experian.

Request free copies of your credit reports on AnnualCreditReport.com, the only website for free credit reports authorized by the Federal Trade Commission .

Once you get your free annual credit reports, review them for derogatory marks. You might find a summary of derogatory credit marks. Equifax, for example, has a section listing negative information on its credit reports. Other credit reports might list derogatory marks next to the relevant accounts.

Check both places for derogatory marks and compare credit reports to ensure the information matches up.

Read Also: Is 690 A Good Credit Score

How To Dispute Inaccurate Information

The last thing you want is for inaccurate information to hurt your credit score. Thats why its so important to regularly check your credit report and dispute anything that looks wrong.

You can on disputing credit report errors, but its typically a simple process that can be completed online. Below is the website and other contact information for each of the major credit bureaus.

How To Rebuild Your Score After A Derogatory Item

Making efforts to improve your credit standing after a derogatory mark could increase your score. Use the following tips to rebuild your score:

- Make payments on time: Payments determine credit scores and making payments before the due date can give you better financial standing.

- Keep credit balance below 30 % limit: Another major influence on scores is credit utilization. This refers to how much your credit is available for use.

- Use credit builder tools: Utilize tools such as credit builder and share-backed loans to get your credit score up.

You May Like: How Often Does Capital One Report To Credit Bureaus

File A Dispute Directly With The Creditor

You can also contact the company that provided the information to the bureau in the first place, such as a bank or credit card issuer. Lenders are required to investigate and respond to all disputes.

Remember to include as much documentation as possible to support your claim. Including a copy of your report marking the error is also helpful.

The address you should mail the letter to is usually listed on your report, under the negative item you’d like to dispute. You can also contact the lender directly to verify the mailing address and the documents you should include.

If the lender finds that it was mistaken or cannot prove that the debt actually belongs to you, it will notify the bureau and ask it to update your file.